Professional Documents

Culture Documents

CASE ANALYSIS FOR BIRLA - Global Indian Conglomerate

CASE ANALYSIS FOR BIRLA - Global Indian Conglomerate

Uploaded by

rosemarie tolentinoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CASE ANALYSIS FOR BIRLA - Global Indian Conglomerate

CASE ANALYSIS FOR BIRLA - Global Indian Conglomerate

Uploaded by

rosemarie tolentinoCopyright:

Available Formats

ABOUT:

1) Birla Group had set out a vision “to be a premium global conglomerate with a clear focus on each business

2) US$28 billion conglomerate realising over 50% of its revenues from outside its home market, the group had

been deemed the best employer in India and among the top 20 in Asia by a Wall Street Journal study in 2007.

3) Despite the frenzied strategic refocus from slow-to-medium-growth value companies to high-growth business

sectors, the Birla Group had remained a step behind key rivals Tata Group and Reliance Group in terms of

revenue and market capitalisation.

4) Y2008: to maintain the existing diversity of businesses or to focus on even fewer companies. The Birla Group had

three flagship companies: Grasim Industries, Hindalco Industries and Aditya Birla Nuvo (“AB Nuvo”)

5) Grasim and Hindalco concentrated on commodity businesses and increased vertical integration to reduce

operating costs

6) AB Nuvo was shifting the balance of its portfolio from value companies to growth sectors

7) The Birla Group pursued a dual-track strategy of improving returns for value businesses while using its cash flow

to expand into growth sectors.

8) The Birla Group aimed to mimic the global conglomerate strategy of the likes of General Electric, but it

remained to be seen whether the Birla Group could outpace domestic challengers, to say nothing of competing

internationally.

9) Did the Birla Group have the right mix of businesses and management practices to achieve the goal of local

domination and global relevance?

PESTEL ANALYSIS [Macro-environment]

POLITICAL 1) Federal government’s deficit restricted the amount the government could invest in

education, healthcare and infrastructure.

2) Inherited a colonial-style bureaucracy from the British

3) Reputation for red tape from the days of the “licence raj”

ECONOMIC 1) One of the most attractive of emerging markets, huge consumption potential

2) Low per Capita GDP

SOCIAL 1) 1.1B people, large percentage lived below the poverty line

TECHNOLOGICAL

ENVIRONMENTAL

LEGAL

PORTER’S 5 FORCES [Industry Analysis]

Threat of new entrants

the bigger the limiting factors to entry,

the smaller the threat for existing players

Bargaining power of Suppliers/Inputs

The fewer suppliers, the more a company would depend

on a supplier, supplier has more power

Bargaining power of Buyers/Customers

The customers will have a lot of power when the

demand is low and many alternatives to choose from.

Threat of Substitutes

Companies that produce goods or services for which

there are no close substitutes will have more power

Rivalry among existing competitors

Rivalry is high when there are a lot of competitors that

are roughly equal in size and power.

COMPANY LEVEL

STRENGTH OPPORTUNITY

1) lower average operating costs than their peers

2) strong innovation in most of their business sectors

WEAKNESS THREAT

RECOMMENDATIONS:

You might also like

- Full Download Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions Manual PDF Full ChapterDocument36 pagesFull Download Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions Manual PDF Full Chapteraortitismonist4y0aby100% (20)

- Test Bank For Economics Private and Public Choice 16th Edition William A MceachernDocument13 pagesTest Bank For Economics Private and Public Choice 16th Edition William A Mceachernlindapalmeropagfbxsnr100% (27)

- Solution Manual Global Strategy 2nd Edition PengDocument12 pagesSolution Manual Global Strategy 2nd Edition PengJessica SuryaNo ratings yet

- Industrial Environment: Chapter OutlineDocument13 pagesIndustrial Environment: Chapter OutlineRevti sainNo ratings yet

- STM Unit 2 Second HalfDocument17 pagesSTM Unit 2 Second HalfVickyNo ratings yet

- External Analysis: The Identification of Opportunities and ThreatsDocument28 pagesExternal Analysis: The Identification of Opportunities and ThreatsMaliha Afneen QayyumNo ratings yet

- Charles W. L. Hill / Gareth R. Jones: External Analysis: The Identification of Opportunities and ThreatsDocument25 pagesCharles W. L. Hill / Gareth R. Jones: External Analysis: The Identification of Opportunities and ThreatsNisreen Al-shareNo ratings yet

- FSA Topic 2 NewDocument15 pagesFSA Topic 2 NewKaushali WeerakkodyNo ratings yet

- External Analysis: The Identification of Industry Opportunities and ThreatsDocument29 pagesExternal Analysis: The Identification of Industry Opportunities and ThreatsBISMA SAEEDNo ratings yet

- Solution Manual Strategic Management An Integrated Approach 10th Edition by Charles W. L. HillDocument6 pagesSolution Manual Strategic Management An Integrated Approach 10th Edition by Charles W. L. HillJam PotutanNo ratings yet

- Principles of Management: Nova SBE - Fall 2020 Lecture 10 Thru. To 14 - Strategic AnalysisDocument89 pagesPrinciples of Management: Nova SBE - Fall 2020 Lecture 10 Thru. To 14 - Strategic AnalysisPedro SarmentoNo ratings yet

- Competing Globally EXAM 1 NotesDocument25 pagesCompeting Globally EXAM 1 NotesInesNo ratings yet

- Unit 2Document13 pagesUnit 2hussainnaqvi1194No ratings yet

- External Analysis:: The Identification of Opportunities and ThreatsDocument17 pagesExternal Analysis:: The Identification of Opportunities and ThreatsmutmainnahNo ratings yet

- BPSM Notes Unit 2Document30 pagesBPSM Notes Unit 2Sandip Kumar BhartiNo ratings yet

- External Analysis: Industry Structure, Competitive Forces, and Strategic GroupsDocument44 pagesExternal Analysis: Industry Structure, Competitive Forces, and Strategic GroupsDiadre DachiviantNo ratings yet

- External Analysis:: The Identification of Opportunities and ThreatsDocument19 pagesExternal Analysis:: The Identification of Opportunities and Threats賴佶辰No ratings yet

- Dec 2009Document17 pagesDec 2009Murugesh Kasivel EnjoyNo ratings yet

- Chapter 10 ReportDocument29 pagesChapter 10 ReportMay Jude Dela CruzNo ratings yet

- 4-Mergers & AcquisitionsDocument20 pages4-Mergers & AcquisitionsBhuvanesh JaniNo ratings yet

- Equity - Reading 48Document21 pagesEquity - Reading 48KiraNo ratings yet

- BM461Document11 pagesBM461kamunkiriNo ratings yet

- External Analysis: The Identification of Opportunities and Threats External Analysis: The Identification of Opportunities and ThreatsDocument28 pagesExternal Analysis: The Identification of Opportunities and Threats External Analysis: The Identification of Opportunities and ThreatsTanjil Rabbi BeghNo ratings yet

- Chapter 10Document33 pagesChapter 10kumikooomakiNo ratings yet

- The Rise of Global CorporationDocument33 pagesThe Rise of Global CorporationPhilip John1 Gargar'sNo ratings yet

- Yang He - Strategy NotesDocument11 pagesYang He - Strategy NotesYang HeNo ratings yet

- External Environment CHP # 2Document19 pagesExternal Environment CHP # 2Golam MostofaNo ratings yet

- Chapter 10 Presentation - Beguina, Klarish Jay C. (BSA 2-4)Document19 pagesChapter 10 Presentation - Beguina, Klarish Jay C. (BSA 2-4)Klarish Jay BeguinaNo ratings yet

- ADM650 CHAPTER 2 External AnalysisDocument58 pagesADM650 CHAPTER 2 External AnalysisArya zllkaNo ratings yet

- EM 19-16 InnovationDocument17 pagesEM 19-16 InnovationMikkel GramNo ratings yet

- COMPLETE BUSINESS DOSSIER PRESENTATION MainDocument25 pagesCOMPLETE BUSINESS DOSSIER PRESENTATION MainAyushNo ratings yet

- BM NotesDocument45 pagesBM NotesJessa Mae tapicNo ratings yet

- Man EcoDocument5 pagesMan EcoAlly JeongNo ratings yet

- Unit 2Document6 pagesUnit 2RKR Dairy ProductsNo ratings yet

- The Rise of Corporate Market Power and Its Macroeconomic EffectsDocument22 pagesThe Rise of Corporate Market Power and Its Macroeconomic EffectsAnonymous 0sin2m0TKPNo ratings yet

- Further Topics in Industry and Competitive AnalysisDocument21 pagesFurther Topics in Industry and Competitive AnalysisMaxime MassonNo ratings yet

- Ch-7 & 8. (Krugman) External & Internal Economies of ScaleDocument37 pagesCh-7 & 8. (Krugman) External & Internal Economies of ScaleacNo ratings yet

- Strategy Course Notes PDFDocument27 pagesStrategy Course Notes PDFTodayClass CenterNo ratings yet

- Blue StarDocument48 pagesBlue StarRuchir Shukla0% (1)

- Lesson 4Document12 pagesLesson 4not funny didn't laughNo ratings yet

- Chapter 5 Topicwise Question BankDocument19 pagesChapter 5 Topicwise Question BankVINUS DHANKHARNo ratings yet

- Mergers and AcquisitionsDocument34 pagesMergers and Acquisitionseknath2000No ratings yet

- Theories of International Trade and InvestmentDocument28 pagesTheories of International Trade and InvestmentSushant YattamNo ratings yet

- Economies of Scale & Scope: A Comprehensive AnalysisDocument5 pagesEconomies of Scale & Scope: A Comprehensive AnalysisAarti GuptaNo ratings yet

- SM Group 4Document98 pagesSM Group 4Hoàng VũNo ratings yet

- IBUS 305 Lecture 2 - Managing Industry CompetitionDocument3 pagesIBUS 305 Lecture 2 - Managing Industry Competitionmohit verrmaNo ratings yet

- Chap 3,4Document22 pagesChap 3,4Sadman KabirNo ratings yet

- LAS-No.1 AppliedEcoDocument6 pagesLAS-No.1 AppliedEcoIan Agatha AndresNo ratings yet

- Tows Matrix: Developing StrategiesDocument29 pagesTows Matrix: Developing StrategiesalkalkiaNo ratings yet

- Chapter 03 Evaluating A Company's External EnvironmentDocument32 pagesChapter 03 Evaluating A Company's External EnvironmentKamruzzaman FahimNo ratings yet

- Chapter 7 The Nature of IndustryDocument46 pagesChapter 7 The Nature of Industryphuonganh01062005No ratings yet

- Theories of ManagementDocument10 pagesTheories of ManagementAurelio Espinoza AbalosNo ratings yet

- Fin IndustryDocument10 pagesFin IndustryJudithRavelloNo ratings yet

- Environment AnalysisDocument32 pagesEnvironment Analysisvinay mouryaNo ratings yet

- Internal AnalysisDocument25 pagesInternal AnalysisCyboNo ratings yet

- Market Access-Members of TPPA Obtain Preferred Access To Markets of OthersDocument4 pagesMarket Access-Members of TPPA Obtain Preferred Access To Markets of OthersNurul SyahirahNo ratings yet

- Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualDocument37 pagesStrategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions Manualcameradeaestivalnekwz7100% (32)

- 1 - Strategic Management and Stategic CompetitivenessDocument3 pages1 - Strategic Management and Stategic CompetitivenessStephanie Nicole DiputadoNo ratings yet

- 8871STRATEGIC BUSINESS MANAGEMENT - ND-2022 - Suggested - AnswersDocument13 pages8871STRATEGIC BUSINESS MANAGEMENT - ND-2022 - Suggested - AnswersbanglauserNo ratings yet

- Introduction To Itc Sumit Kundu 123456Document40 pagesIntroduction To Itc Sumit Kundu 123456PREETI GUPTANo ratings yet

- Model Answer: E-Commerce store launch by Unilever in Sri LankaFrom EverandModel Answer: E-Commerce store launch by Unilever in Sri LankaNo ratings yet

- Guide Questions WhatsappDocument1 pageGuide Questions Whatsapprosemarie tolentinoNo ratings yet

- Guide Questions WawaDocument1 pageGuide Questions Wawarosemarie tolentinoNo ratings yet

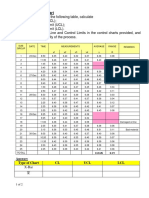

- 5 GT SPC Work Book (Dr2) 30318Document2 pages5 GT SPC Work Book (Dr2) 30318rosemarie tolentinoNo ratings yet

- Financial Analysis Ratios SummaryDocument2 pagesFinancial Analysis Ratios Summaryrosemarie tolentinoNo ratings yet

- Notes Taken During 3 July APQP PPAP ClassDocument2 pagesNotes Taken During 3 July APQP PPAP Classrosemarie tolentinoNo ratings yet

- Order Confirmation-OC3309Document1 pageOrder Confirmation-OC3309Chetan patilNo ratings yet

- Monthly Rubber Bulletin JanDocument2 pagesMonthly Rubber Bulletin Janchamara_No ratings yet

- Behavioural FinanceDocument11 pagesBehavioural Financesambhu_nNo ratings yet

- International Finance - QBDocument5 pagesInternational Finance - QBGeetha aptdcNo ratings yet

- CH IIDocument8 pagesCH IISaso M. KordyNo ratings yet

- Chapter 4: The International Flow of Funds and Exchange RatesDocument26 pagesChapter 4: The International Flow of Funds and Exchange RatesJan Faye Gulla100% (1)

- Ajay 15 GDocument1 pageAjay 15 Gsurendra singh kachhavaNo ratings yet

- Kim Dorothy Borja - 6th. ActivityDocument3 pagesKim Dorothy Borja - 6th. ActivityKIM DOROTHY BORJANo ratings yet

- DAR Officials Alarmed Over Widespread Land Conversion From Agri To IndustrialDocument3 pagesDAR Officials Alarmed Over Widespread Land Conversion From Agri To IndustrialRachelJosefNo ratings yet

- Gann CalculatorDocument10 pagesGann Calculatorshephila567% (3)

- Investment Cases-For Students - Tasks and MaterialsDocument94 pagesInvestment Cases-For Students - Tasks and MaterialsannaNo ratings yet

- ICCO Monthly Cocoa Market Review - April 2018Document2 pagesICCO Monthly Cocoa Market Review - April 2018Marco Sanchez CuevaNo ratings yet

- Small Business in Rural Areas of BangladeshDocument4 pagesSmall Business in Rural Areas of BangladeshTilat RashidNo ratings yet

- Mushak-6 1Document1 pageMushak-6 1md. Billal HosenNo ratings yet

- Getting Interventions Right How South Korea and Taiwan Grew RichDocument54 pagesGetting Interventions Right How South Korea and Taiwan Grew RichmomodedoNo ratings yet

- Weekly Market Report 15-10-2023 (IND)Document8 pagesWeekly Market Report 15-10-2023 (IND)wibage9267No ratings yet

- Lux Islands Resort Company ReviewDocument3 pagesLux Islands Resort Company Reviewदेवीना गिरीNo ratings yet

- GSTCredit Note MN2222306 AA04778Document1 pageGSTCredit Note MN2222306 AA04778Bancy SangmaNo ratings yet

- Prelim Exam - Mac 421Document5 pagesPrelim Exam - Mac 421Ezzz VeriNo ratings yet

- TMBMobile 1661142932267Document5 pagesTMBMobile 1661142932267veerudgNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument13 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVidit LohiaNo ratings yet

- 1501771492306Document23 pages1501771492306Anonymous wl7fgzivPNo ratings yet

- Law of Taxation - 3rd SemDocument3 pagesLaw of Taxation - 3rd SemdeepakNo ratings yet

- Tacn3 - Nhom Fire - Unit 1Document10 pagesTacn3 - Nhom Fire - Unit 1Nguyễn Quốc VươngNo ratings yet

- TLC ColombiaDocument8 pagesTLC Colombiaavillarraga7No ratings yet

- Syrian Petroleum Company (SPC) : DescriptionDocument8 pagesSyrian Petroleum Company (SPC) : DescriptionAiham AltayehNo ratings yet

- 500 QtyDocument1 page500 QtySagar ButaniNo ratings yet

- EIC FrameworkDocument49 pagesEIC FrameworkAnjali MkNo ratings yet

- Top Fertilizers Exports by Country 2020Document8 pagesTop Fertilizers Exports by Country 2020vinit gargNo ratings yet