Professional Documents

Culture Documents

Visa Cards Tariffs For Individua Fc02c120ec

Visa Cards Tariffs For Individua Fc02c120ec

Uploaded by

Mohammed MeeranOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Visa Cards Tariffs For Individua Fc02c120ec

Visa Cards Tariffs For Individua Fc02c120ec

Uploaded by

Mohammed MeeranCopyright:

Available Formats

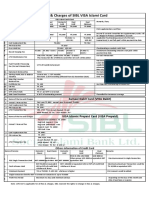

Tariffs on transactions of Visa international payment cards for individuals, applicable in all branches of "DKIB" CJSC

№ TYPES OF TRANSACTIONS Commissions

PRIMARY card SUPPLEMENTARY card 1

1 CARD ISSUANCE, REISSUANCE AND MAINTENANCE

Card issuance (Electron*/Card Plus Classic/Card Plus Gold/Card Plus Platinum)

1.1. free of charge free of charge

(*) - Primary account of new Electron card to be issued can be onli in KGS or USD

1.2. Card reissuance (Electron/Card Plus Classic/Card Plus Gold/Card Plus Platinum) due to:

- expiration date, compromise (by Bank's request) free of charge free of charge

- its loss, damage, compromise (by Customer's request), changing of customer's data to be printed on card KGS 240 KGS 240

1.3. Card PIN-code reissuance free of charge free of charge

1.4. Annual card maintenance fee (Electron/Card Plus Classic/Card Plus Gold/Card Plus Platinum)2

1.4.1. standard conditions

- for the first year free of charge/KGS 700/KGS 1200/free of charge free of charge/KGS 500/KGS 1000/free of charge

- for the second and further years free of charge/KGS 700/KGS 1200/KGS 5000 free of charge/KGS 500/KGS 1000/KGS 2000

1.4.2. for “DKIB” CJSC salary projects' staff

- for the first year free of charge/free of charge/free of charge/- free of charge/KGS 250/KGS 500/-

- for the second and further years free of charge/KGS 700/KGS 1200/- free of charge/KGS 500/KGS 1000/-

1.4.3. for the first and second years for customers of state organizations under salary projects of “DKIB” CJSC

- for the first and second years free of charge/free of charge/free of charge/- free of charge/free of charge/free of charge/-

- for further years free of charge/KGS 700/KGS 1200/- free of charge/KGS 500/KGS 1000/-

1.4.4. for the owners of "Time Deposit +" for the first and further years -/free of charge/free of charge/free of charge not provided

1.5. Сard blocking/unblocking in "DKIB" CJSC free of charge free of charge

1.6. Сard closing in "DKIB" CJSC free of charge free of charge

1.7 Urgent return of card captured by ATM of "DKIB" CJSC, located

- in the branch/outlet /its territory of the Bank • in the same banking date when the card was captured – KGS 500 сомов. In case there is ac confirmation that card capture

was related to ATM failure – free of charge

• not urgent return – free of charge

- in populated area, where branch/utlet is located (out of territory of branch / outlet of the Bank) • during 24 hours* from the moment of its capture by the ATM – KGS 1000, during 48 hours* – KGS 500; in case at the

moment when customer has applied to the Bank the card has been already delivered to the branch/outlet the commission is

not charged.

• not urgent return – free of charge;

(*) - excluding weekends and holidays

1.8. Virtual credit card issuance/reissuance in Internet-Banking, its maintenance free of charge -

1.9. Presenting of photo/video report in from of viewing in "DKIB" CJSC

- from ATMs of "DKIB" CJSC on cards, issued by "DKIB" CJSC KGS 400

- from ATMs of other banks on cards, issued by "DKIB" CJSC other bank's commission plus KGS 400

from ATMs of "DKIB" CJSC on cards, issued by other banks (as a rule is presenting directly to the bank-issuer; as

- exclusion can be provided to the card owner directly by his request in case the bank-issuer is abroad and card KGS 800

owner can be identified by "DKIB" CJSC)

2 CARD TRANSACTIONS VIA DEVICES OF BANKS

2.1. Cash withdrawal:

- via ATMs and cash area POS-terminals of “DKIB” CJSC (except cash withdrawals by Electron card via cash area POS-terminals):

in KGS free of charge

in USD (for credit cards cash withdrawal of USD via ATMs and cash area POS-terminals of “DKIB” CJSC is not

available, but there is possibility to make ATM debit card operations (to withdraw money in USD) using credit 0,4%

card via ATMs of “DKIB” CJSC)

- via other banks' ATMs and cash area POS-terminals 1% (min. KGS 250)

2.2. Cash deposit to the account (account replenishment) via Cash-in ATMs of "DKIB" CJSC (account replenishment can be done using debit card and credit card using as debit card) in:

- national currency (KGS) free

- USD free

Non-cash payments for goods and services via POS-terminals/virtual POS-terminals (Internet) of "DKIB" CJSC

2.3. free of charge (via POS-terminals of other banks settlements are executed via USD, exchange rate difference can appear)

and other banks

2.4. Balance inquiry via ATMs of "DKIB" CJSC network free of charge

2.5. Balance inquiry via ATMs of other banks KGS 60

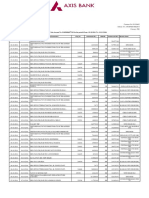

№ TYPES OF TRANSACTIONS Commissions

PRIMARY card SUPPLEMENTARY card 1

2.6. Mini-statement (last 10 transactions) via "DKIB" ATMs (Electron) KGS 5

2.7. Interest accrued for Cash Collateral p.a.(Card Plus Classic/Card Plus Gold) 0%

Monthly interest rate for used credit limit for cash withdrawals (Card Plus Classic/Card Plus Gold/Card Plus

2.8. 2.75%

Platinum)

2.9. For late payment for used credit limit (Card Plus Classic/ Card Plus Gold/Card Plus Platinum):

- Monthly interest rate for used credit limit 2.75%

- Monthly late payment interest rate for used credit limit 2.75%

Total 5.5%

2.10. Monthly interest rate for technical overdraft (Electron) 0%

Providing of receipt's duplicate/details of a on-cash transaction, executed on cards (Electron/ Card Plus Classic/

2.11.

Card Plus Gold/ Card Plus Platinum) via:

- POS-terminals/virtual POS-terminals/ATMs of "DKIB" CJSC KGS 200

- POS-terminals/ATMs of other banks/Internet KGS 500

2.12. Monthly statements (Card Plus Classic/Card Plus Gold/Card Plus Platinum) via e-mail free of charge

3. STANDARD CARD LIMITS IN BANKS' DEVICES

3.1. Daily limits

3.1.1. on debit card (Electron)

- Cash withdrawal via ATMs and cash area POS-terminals of “DKIB” CJSC and other banks KGS 60 000

Non-cash payments for goods and services via POS-terminals/ virtual POS-terminals (Internet) of "DKIB" CJSC

- KGS 250 000

and other banks (for contact and/or contactless payment options)

- Book-to-book money transfer in ATMs of "DKIB" CJSC

between customer's accounts KGS 500 000

to the third parties' accounts KGS 500 000

- Currency exchange in ATMs of "DKIB" CJSC

buy KGS 100 000

sell KGS 100 000

- KGS, USD cash deposit (account replenishment) via Cash-in ATMS KGS 300 000

3.1.2. on debit card (Electron) without PIN-code entering for contactless non-cash payments for goods and services in contactless way via contactless POS-terminals of "DKIB" CJSC and other banks

- by transactions quantity 2 transactions 2 transactions

- by transactions amount KGS 500 KGS 500

3.1.3. on credit cards (Card Plus Classic / Card Plus Gold/ Card Plus Platinum):

Cash withdrawal via ATMs of “DKIB” CJSC and cash area POS-terminals of “DKIB” CJSC and other banks

and/or

- KGS 200 000/KGS 400 000/ KGS 500 000

Non-cash payments for goods and services via POS-terminals/ virtual POS-terminals (Internet) of "DKIB" CJSC

and other banks (for contact payment option)

3.2. Limit per 1 transaction on card (Electron / Card Plus Classic / Card Plus Gold/ Card Plus Platinum) in "DKIB" CJSC devices

3.2.1. Cash withdrawal in ATMs KGS 25 000

4. Credit card collateral conditions

4.1. Standard conditions for Card Plus Classic/ Card Plus Gold

Type of collateral: Credit card limit

4.1.1. Cash collateral is equal to credit card limit plus 10% (salary confirmation for applicant is not applicable) from KGS 5 000/ from KGS 60 000

One Personal Guarantee or Corporate guarantee (salary confirmation for applicant and guarantor should be

4.1.2. KGS 5 000 - KGS 30 000 (up to 70% of net average salary/income for the last 6 months)

provided)

Two Personal Guarantees or Corporate guarantee (salary confirmation for applicant and guarantor should be

4.1.3. KGS 30 001 - KGS 60 000 (up to 70% of net average salary/income for the last 6 months)

provided)

4.1.4. Movable/immovable property or Corporate Guarantee (insurance of immovable property is not required) from KGS 60 001 (up to 70% of net average salary/income for the last 6 months)

4.2. Standard conditions for Card Plus Platinum

Type of collateral:

4.2.1. Cash collateral in amount of KGS 3 500 000 (salary confirmation for applicant is not applicable) from KGS 500 000

4.3. for DKIB salary projects' staff, receiving salary via DKIB during three months and more, and receiving Card Plus Classic and Card Plus Gold:

Type of collateral: Credit card limit

4.3.1. No any collateral 70% from net average salary for the last 3 months (min. limit - from KGS 2 000)

4.4. for DKIB salary projects' staff, receiving salary via DKIB for the period less than three months, and receiving Card Plus Classic and Card Plus Gold:

№ TYPES OF TRANSACTIONS Commissions

PRIMARY card SUPPLEMENTARY card 1

4.4.1. if an employee works in an organization 6 months and more (Organization should present confirmation about it with the amount of official employee's salary)

Credit card limit is 70% from net official salary, presented by the Organization (min. limit - from

No any collateral

KGS 2 000)

4.4.2. if an employee works in an organization less than 6 months (Organization should present confirmation about the amount of official employee's salary)

Credit card limit depends on official salary

Credit card limit, KGS Official employee's salary,KGS

No any collateral 2 000 5 000 - 10 000

2 500 10 001 - 15 000

3 000 15 001 - 20 000

4 000 20 001 and more

4.5. For "Deposit+" owners please see "Tariffs for Deposits for Individuals, applicable in all branches of "DKIB" CJSC" (addendum to GENERAL TERMS AND CONDITIONS, APPLICABLE TO INDIVIDUALS)

5. EMERGENCY SERVICES, PROVIDING ABROAD3: Type of the card Commission, USD

Electron, Card Plus Classic, Card Plus Gold, Card Plus

- Informing about lost/stolen card and its blocking in Visa Exception File USD 35

Platinum

Electron, Card Plus Classic, Card Plus Gold, Card Plus

- Updating data in Visa Exception File (including unblocking of card) USD 3

Platinum

- Emergency cash disbursement:

up to USD 2000 Electron, Card Plus Classic, Card Plus Gold USD 175

up to USD 3000 Card Plus Platinum USD 175

- Emergency card replacement Electron, Card Plus Classic USD 225

Card Plus Gold, Card Plus Platinum USD 250

Electron, Card Plus Classic, Card Plus Gold, Card Plus

- Emergency service request denied or fulfilled by issuer or cancelled USD 50

Platinum

Electron, Card Plus Classic, Card Plus Gold USD 8

- General questions of Visa card holders

Card Plus Platinum USD 7,5

Electron, Card Plus Classic, Card Plus Gold, Card Plus

- Commission of foreign bank for emergency reissued card disbursement USD 25

Platinum

Electron, Card Plus Classic, Card Plus Gold, Card Plus

- Commission for delivery of emergency reissued card to the hotel by courier free of charge

Platinum

Notes:

For one cardholder can be issued maximum: 1) for Electron: two supplementary cards, both of them for the name of third parties (conditios for campus cards issuance also see in the tariffs for "Campus card" project)

1. 2) for Card Plus Classic, Card Plus Gold: three supplementary cards, one card - for the name of cardholder, two cards - for the name of third parties, 3) for Card Plus Platinum: one supplementary card for the name of third parties, 4)

issuance of supplementary credit card (Card Plus Classic, Card Plus Gold) for "Deposit+" owners is not provided

2. Logic of Annual credit card maintenance fee charging (Card Plus Classic/ Card Plus Gold/ Card Plus Platinum):

- for cards, issued till 22/03/2016:

Annual card maintenance fee is charged regardless of whether the card has been used or not, i. e. is calculated starting from card issuance date

- for cards, issued starting from 22/03/2016:

Annual card maintenance fee is charged if the card has been used, i. e. is not calculated from the date of card issuance, but from the date of the first successful financial transaction via the card. Herewith if the term from the date of the first

successful financial transaction till the card expiry date is less than a year, the annual card maintenance fee is calculated based on the actual days remaining before the card expiry date, and then while card reissuance (if it has been expired)

the annual card maintenance fee will be charged from the date of card reissuance. Also in case of cards reissuance for other reasons (including credit card type changing (Card Plus Classic / Card Plus Gold / Card Plus Platinum)) the system

will store data on the first successful transaction of the previous card, and the commission will be charged in spite of card reissuance.

Commissions for emergency services, providing in abroad, settled by Visa company and can be changed in one-way order. These commissions are charged from customer's credit card limit, converting into KGS by NBKR rate on the moment

3.

of conversion.

Funds, deposited for credit card debt repayment till 12.00 p.m., are debited from KGS demand deposit account once a day from 12.00 p. m. till 14.00 p.m., in case funds are deposited after 12.00 p. m.the debt will be repaid on the next bank

4.

day.

5. The Bank has the right to change this conditions and establish special conditions.

6. In case of Bank’s advertising campaign with issuance and/or annual maintenance of card on discount conditions or free of charge, the Bank will apply commissions, stipulated with the campaign and acting on the day of card issuance.

7. All above mentioned commissions do not include taxes. Taxes are taken by the Bank additionally according to the current Tax Code of KR.

If the employee of organization, receiving his salary via DKIB, has received credit card earlier under cash collateral, the Bank can reconsider his credit card limit, that can be given without cash collateral, based on employee salary. In case the

8.

employee resigns from the organization, general conditions should be applied to credit card.

9. Addendum №1 to GENERAL TERMS AND CONDITIONS, APPLICABLE TO INDIVIDUALS (to Section J), of “DKIB” CJSC №21 from 14/04/2014, valid as of 18/07/2016, becomes invalid from the date of entry into force of the current addendum.

You might also like

- Regions Bank StatementDocument2 pagesRegions Bank StatementEduardo Lozano100% (2)

- Digital Banking AnnexureDocument12 pagesDigital Banking AnnexureCypher GamingNo ratings yet

- Fees Charges of SIBL VISA Islami Card-2024Document1 pageFees Charges of SIBL VISA Islami Card-2024tahasheikh822No ratings yet

- Annexure VII Digital BankingDocument14 pagesAnnexure VII Digital BankingSRI HARINo ratings yet

- Changes in Upcoming Schedule of Charges (Jul-Dec-2022)Document1 pageChanges in Upcoming Schedule of Charges (Jul-Dec-2022)Nasir MuhmoodNo ratings yet

- Standard Tariff of Charges1Document9 pagesStandard Tariff of Charges1Ãńmôľ GūpťåNo ratings yet

- Terms & Conditions of Use V6.0Document3 pagesTerms & Conditions of Use V6.0erika985No ratings yet

- SOBC - IB - English Final Jul - Dec 19Document45 pagesSOBC - IB - English Final Jul - Dec 19muhammad ihtishamNo ratings yet

- Schedule of Bank Charges: (Excluding FED)Document58 pagesSchedule of Bank Charges: (Excluding FED)Faisal JavedNo ratings yet

- 021122-Service Charges As On 30.09.2022Document26 pages021122-Service Charges As On 30.09.2022computerdebtaNo ratings yet

- UCO - Debit Card Apply Online Instantly - Official Website of UCO BankDocument14 pagesUCO - Debit Card Apply Online Instantly - Official Website of UCO Bankrolaril797No ratings yet

- Saving OutletsDocument2 pagesSaving OutletsG TechNo ratings yet

- HSBC Select Fees & ChargesDocument2 pagesHSBC Select Fees & Chargesshirin.at70No ratings yet

- Product-Features-and-Applicable - Charges-AL Habib-RDADocument4 pagesProduct-Features-and-Applicable - Charges-AL Habib-RDAmaroof mNo ratings yet

- MITC Document CustomerDocument14 pagesMITC Document CustomerSwapnil PankeNo ratings yet

- Civil Service Exam Part IDocument11 pagesCivil Service Exam Part ILes LhieNo ratings yet

- Handbook On DIGITAL Products 20210815125103Document29 pagesHandbook On DIGITAL Products 20210815125103Neos EonsNo ratings yet

- Handbook On DIGITAL Products 20210818110220Document29 pagesHandbook On DIGITAL Products 20210818110220omvir singhNo ratings yet

- SOC RuPay Select Debit CardDocument4 pagesSOC RuPay Select Debit Cardrichards.prabhu1817No ratings yet

- Digital BankingDocument106 pagesDigital BankingSandeepa ThirthahalliNo ratings yet

- Fees and Charges of SIBL Islami CardDocument1 pageFees and Charges of SIBL Islami CardMd YusufNo ratings yet

- MSC Indonesia Local Charges Update - June 2023Document9 pagesMSC Indonesia Local Charges Update - June 2023Edy LasmanaNo ratings yet

- DownloadDocument2 pagesDownloadishubhamthakerNo ratings yet

- HDFC Savings AC Fees and ChargesDocument2 pagesHDFC Savings AC Fees and ChargesSampada SawantNo ratings yet

- Í N Zcè Yalung Ma - Âluzâââââââ C Ç4) $83, Î Mrs. Ma. Luz Cura YalungDocument7 pagesÍ N Zcè Yalung Ma - Âluzâââââââ C Ç4) $83, Î Mrs. Ma. Luz Cura YalungKevin YalungNo ratings yet

- MSC Indonesia Local Charges Updates - 22 February 2024Document10 pagesMSC Indonesia Local Charges Updates - 22 February 2024letandat14122003No ratings yet

- Tariff Layout EnglishDocument23 pagesTariff Layout EnglishALex QxNo ratings yet

- Globe JanDocument7 pagesGlobe Janlocarl000No ratings yet

- Schedule of Charges English From 1st January To 30th June 2020Document47 pagesSchedule of Charges English From 1st January To 30th June 2020Hassan Riaz BajwaNo ratings yet

- English MITCDocument15 pagesEnglish MITCraman kumarNo ratings yet

- MSC Indonesia Local Charges Update - 20 March 2024Document11 pagesMSC Indonesia Local Charges Update - 20 March 2024Hesti PrawatiNo ratings yet

- MITC Document CustomerDocument14 pagesMITC Document CustomerAnkur SarafNo ratings yet

- SUPERCARD Most Important Terms and Conditions (MITC)Document44 pagesSUPERCARD Most Important Terms and Conditions (MITC)Chouhan Akshay SinghNo ratings yet

- Dutch-Bangla Bank Limited: Customer Options FormDocument1 pageDutch-Bangla Bank Limited: Customer Options Formrimon444No ratings yet

- Schedule of Charges Credit CardDocument2 pagesSchedule of Charges Credit Cardnurul000No ratings yet

- Andhra Pragathi Grameena Bank (APGB) DEBIT CARDDocument2 pagesAndhra Pragathi Grameena Bank (APGB) DEBIT CARDHari Sandeep ReddyNo ratings yet

- Service-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Document2 pagesService-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Mukunda MukundaNo ratings yet

- Digital Banking STANDARED TARIFF OF CHARGES 18 09 2023aDocument4 pagesDigital Banking STANDARED TARIFF OF CHARGES 18 09 2023adahalnarayan367No ratings yet

- SOB Indus ProgressDocument2 pagesSOB Indus ProgressAMit PrasadNo ratings yet

- English CCDocument6 pagesEnglish CCdsouzan071No ratings yet

- Í+ (JÇ) È Agura Noelitoââââââââ Â ÇC '55&Î Mr. Noelito Agura: Welcome To The Wonderful World of GlobeDocument5 pagesÍ+ (JÇ) È Agura Noelitoââââââââ Â ÇC '55&Î Mr. Noelito Agura: Welcome To The Wonderful World of GlobenoelitoNo ratings yet

- Domestic Credit Related Service Charges: Head Office, BangaloreDocument27 pagesDomestic Credit Related Service Charges: Head Office, BangaloreAnwesha SinghNo ratings yet

- Super Shakti Savings AccountDocument2 pagesSuper Shakti Savings Accountrcosmic1980No ratings yet

- DBBL Credit Card FeaturesDocument4 pagesDBBL Credit Card FeaturesidiotbokaNo ratings yet

- Roaming Activation FormDocument2 pagesRoaming Activation FormASIF AHMEDNo ratings yet

- Chapter 4-Bank ServicesDocument3 pagesChapter 4-Bank ServicesPháp NguyễnNo ratings yet

- Full StatementDocument2 pagesFull Statementshanvks10No ratings yet

- ABBL SOC Debit Credit CardsDocument3 pagesABBL SOC Debit Credit Cardsalaminshorkar76No ratings yet

- PK 4Document15 pagesPK 4Instagram OfficeNo ratings yet

- Orange Quick Kill Guide Ao 2.21.24 2Document86 pagesOrange Quick Kill Guide Ao 2.21.24 2taguikenzoNo ratings yet

- PNB SofcDocument13 pagesPNB SofcNic PatelNo ratings yet

- FAQ CignalDocument17 pagesFAQ CignalJessa MarNo ratings yet

- Í Oä'Wè Dollete Segundinaââââ F ÇZ) & 3wî Ms. Segundina Flores DolleteDocument7 pagesÍ Oä'Wè Dollete Segundinaââââ F ÇZ) & 3wî Ms. Segundina Flores DolleteMa YeasaNo ratings yet

- Í JP 0È NIETES SATURNINAÂÂÂÂÂ L Çz8!-3hÎ Ms. Saturnina Ligan NietesDocument7 pagesÍ JP 0È NIETES SATURNINAÂÂÂÂÂ L Çz8!-3hÎ Ms. Saturnina Ligan NietesHLeigh Nietes-GabutanNo ratings yet

- BoB - MITC - A4 Booklet - Ver 5.0 - 25JAN23 NewDocument8 pagesBoB - MITC - A4 Booklet - Ver 5.0 - 25JAN23 NewThakur KdNo ratings yet

- Service Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Mukunda MukundaNo ratings yet

- Pubali Bank Visa Credit Card BrochureDocument5 pagesPubali Bank Visa Credit Card Brochuresamin3shohelNo ratings yet

- Standard Tariff WebsiteDocument18 pagesStandard Tariff WebsiteRaghav Kumar PatelNo ratings yet

- PNB-1068 (R1) - Application Form For ATM DEBIT CardsDocument2 pagesPNB-1068 (R1) - Application Form For ATM DEBIT CardsChandan GuptaNo ratings yet

- HSBC Select Fees Charges Dec 2023Document2 pagesHSBC Select Fees Charges Dec 2023mail.bdoaa2022No ratings yet

- Jazz 2 5 1 Chord ProgressionDocument2 pagesJazz 2 5 1 Chord Progressionbforbes82No ratings yet

- The Karur Vysya Bank LimitedDocument11 pagesThe Karur Vysya Bank LimitedmithradharunNo ratings yet

- PendingDocument1 pagePendingPublic FigureNo ratings yet

- aa195180-01cf-49e2-8cde-a985c6db683dDocument102 pagesaa195180-01cf-49e2-8cde-a985c6db683dapi-80471198No ratings yet

- UPSEE - 2014 - Confirmation Page For Application Number - 402733Document2 pagesUPSEE - 2014 - Confirmation Page For Application Number - 402733buddysmbdNo ratings yet

- 2012 Spring Turkey, Javelina, Buffalo and Bear: Hunt Draw InformationDocument32 pages2012 Spring Turkey, Javelina, Buffalo and Bear: Hunt Draw InformationRoeHuntingResourcesNo ratings yet

- Kotak Mahindra BankDocument7 pagesKotak Mahindra BankHarsha VardhanaNo ratings yet

- Customer Dissatisfaction As A Source of Entrepreneurial Opportunity1Document18 pagesCustomer Dissatisfaction As A Source of Entrepreneurial Opportunity1Tarun SethiNo ratings yet

- Scribd - Reviews, Complaints, Customer ClaimsDocument1 pageScribd - Reviews, Complaints, Customer ClaimsMajor JohnNo ratings yet

- 447096602-Preview-Falix-Pdf - BROWN +++Document5 pages447096602-Preview-Falix-Pdf - BROWN +++13KARATNo ratings yet

- Dde General Prospectus 2018-19 FinalDocument80 pagesDde General Prospectus 2018-19 FinalKarthik SNo ratings yet

- AGICL AXIS Bank Statement MO OCT 16 PDFDocument6 pagesAGICL AXIS Bank Statement MO OCT 16 PDFSagar AsatiNo ratings yet

- Fees N Charges CreditcardDocument12 pagesFees N Charges Creditcard郭芷洋No ratings yet

- Plastic MoneyDocument39 pagesPlastic Moneydakshaangel100% (3)

- Review of Related LiteratureDocument2 pagesReview of Related LiteratureKristel BelenNo ratings yet

- Minimum Disclosure of Bank Fees and Charges 2021Document1 pageMinimum Disclosure of Bank Fees and Charges 2021Bahati RaphaelNo ratings yet

- CSX Offer Factsheet en PDFDocument9 pagesCSX Offer Factsheet en PDFKarl LabagalaNo ratings yet

- Saraswat Bank Full & FinalDocument15 pagesSaraswat Bank Full & FinalPratik RevankarNo ratings yet

- Unemployment DetailsDocument24 pagesUnemployment Detailsfreeforlee23No ratings yet

- Citi Simplicity+: Monthly Income RequirementDocument7 pagesCiti Simplicity+: Monthly Income RequirementCarel Faith AndresNo ratings yet

- MINI Card Cardholder AgreementDocument5 pagesMINI Card Cardholder AgreementCloud FarisNo ratings yet

- Document Set (For JESUS HENRIQUE HERNANDEZ ALBORNOZ) - EncryptedDocument9 pagesDocument Set (For JESUS HENRIQUE HERNANDEZ ALBORNOZ) - Encryptedjesushernandez.alNo ratings yet

- Codigo Tipo de Movimiento Tipo de Captura TransaccionDocument24 pagesCodigo Tipo de Movimiento Tipo de Captura Transaccionmisuper teocascontabilidadNo ratings yet

- TD 08 23Document4 pagesTD 08 23Катерина КлыкNo ratings yet

- Current & Recent Credit Card Signup BonusesDocument31 pagesCurrent & Recent Credit Card Signup BonusesRakib SikderNo ratings yet

- Attitude of Customers Towards Plastic MoneyDocument84 pagesAttitude of Customers Towards Plastic MoneyLove Aute50% (2)

- Us 15 Fillmore Crash Pay How To Own and Clone Contactless Payment DevicesDocument60 pagesUs 15 Fillmore Crash Pay How To Own and Clone Contactless Payment Devicescrhistian lennonNo ratings yet

- Unicity Product Price List - 2018 - EnglishDocument3 pagesUnicity Product Price List - 2018 - EnglishamacksoftNo ratings yet

- Refrigerator BillDocument5 pagesRefrigerator BilldharmendraNo ratings yet