Professional Documents

Culture Documents

Customer Journey Map

Customer Journey Map

Uploaded by

Sureeth ThoguluvaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customer Journey Map

Customer Journey Map

Uploaded by

Sureeth ThoguluvaCopyright:

Available Formats

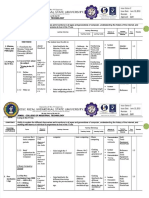

Template

Document an existing experience

Narrow your focus to a specific scenario or process within an existing product TIP

or service. In the Steps row, document the step-by-step process someone As you add steps to the

typically experiences, then add detail to each of the other rows. experience, move each these

“Five Es” the left or right

depending on the scenario

you are documenting.

Customer

experience SCENARIO

Browsing, booking,

journey map attending, and rating a

local city tour

Entice Enter Engage Exit Extend

Use this framework to better How does someone

initially become aware

What do people In the core moments What do people What happens after the

experience as they in the process, what typically experience experience is over?

understand customer needs, of this process? begin the process? happens? as the process finishes?

motivations, and obstacles by

illustrating a key scenario or Customer can be

Steps

process from start to finish. What does the person (or group) Need Loan origination

Knowing the

procedure Customer will register

Customer agree to the

Customer submits

critical information

Borrower qualifcation

information and their Validation

contacted by the loan

processing team Loan approval status

Uploading details Document submission terms and conditions of Agreement

When possible, use this map to typically experience? with their details and

the bank

necessary for banking other details is reviewing the customer contact the

login using their customer can know team collected digitally. application document post-disbursal support support team via

document and summarize The customer Customer reached out

the traditional online Register and

username and

password

about the procedure

traditional channels like

needs loan to and process of Bank will verify the After completing all the

interviews and observations with

channels to know about design

satisfy their needs. applying loan customer documents verifcation process the

the process.

and the system will system will predict the Credit review

email, phone etc

real people rather than relying verify their other

details

eligibility of the loan

approval

on your hunches or assumptions.

Created in partnership with

Interactions Customer refer

their friends and

Search in online

The loan prediction

about the loan

What interactions do they have at

family about the

loan

approval process Bank will ask question Customer will upload system will display the

Customer will get loan Customer will enquire

each step along the way? details and process about the interest rate

Online meeting to and analyze about the the documents in the

loan approval status

clarify doubts system

People: Who do they see or talk to?

involved from the and the repayment fnancial condition of the after completing all the

system details to the bank

customer through the process

Places: Where are they?

loan prediction system

Things: What digital touchpoints or Bank will enquire about

Customer will pay the

physical objects would they use? the purpose of the loan Bank will verify the Customer will sign the interest and repayment

documents of the agreement

customer manually amount after the loan

electronically

approval in specifed

time to the bank

Goals & motivations Superior customer

Providing all the

required details to

experience Document intake is More accurate decision Reducing the number Providing Ratings and Enabling staff to focus

At each step, what is a person’s the customer

entirely digital making of defaulters reviews on high value action

primary goal or motivation? Minimizing the risk Secure data storage

(“Help me...” or “Help me avoid...”)

Difcult to scale to meet

demands

Minimal documentation

Share template feedback Positive moments

What steps does a typical person

Lower cost Super fast and Instant processing of

find enjoyable, productive, fun, covenience for Can easily clarify the Digital solution assist result

motivating, delightful, or exciting? doubts Saves time and money

home. legal process to speed

decision making

Negative moments

Need some What steps does a typical person Prone to errors Lengthy approval

Not providing Unreasonable delays at Costly, manual process Difcult to scale to meet

inspiration? find frustrating, confusing, angering, enough details. times process demands

See a finished version costly, or time-consuming?

of this template to

kickstart your work.

Open example

Areas of opportunity Eliminate

unnecessary 24/7 Availability Add signature

How might we make each step intermediaries Ratings and reviews

better? What ideas do we have? Better customer service electronically on Contacting at anytime

What have others suggested? and security agreement Integrated task in case of any queries

User cconvenience human+machine

You might also like

- Facet5 SuperSkills Developmentguide Final PDFDocument4 pagesFacet5 SuperSkills Developmentguide Final PDFMihai Iulian LucaNo ratings yet

- GENUS Clock Gating Timing CheckDocument17 pagesGENUS Clock Gating Timing Checkwasimhassan100% (1)

- Certified Ethical Hacker Exam PDFDocument253 pagesCertified Ethical Hacker Exam PDFsdbvjasbNo ratings yet

- Customer Journey MapDocument2 pagesCustomer Journey MapSureeth Thoguluva100% (1)

- Advanced 80m-ARDF Receiver: - Version 4 Nick Roethe, DF1FODocument22 pagesAdvanced 80m-ARDF Receiver: - Version 4 Nick Roethe, DF1FOPalade LiviuNo ratings yet

- DDG Interviews PDFDocument1 pageDDG Interviews PDFram179No ratings yet

- Community ToolboxDocument16 pagesCommunity ToolboxAleksandar PokrajacNo ratings yet

- Copia de Folleto Tríptico Festival Del Desierto Moderno Vintage Degradado Morado Naranja AmarilloDocument2 pagesCopia de Folleto Tríptico Festival Del Desierto Moderno Vintage Degradado Morado Naranja AmarilloJulián CHNo ratings yet

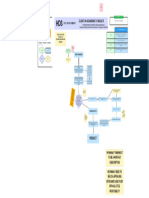

- Flowchart For CategoriesDocument2 pagesFlowchart For Categoriessauvik ghoshNo ratings yet

- Venmo 3.0Document1 pageVenmo 3.0Prinz UtyNo ratings yet

- Assignment 2Document2 pagesAssignment 2Will KurlinkusNo ratings yet

- Electronic ZenDocument354 pagesElectronic ZenyumboNo ratings yet

- Assoc CopyPro Workbook ENGDocument90 pagesAssoc CopyPro Workbook ENGjonathanharripersadNo ratings yet

- A Digitally Guided Companion To The Indianapolis Zoo - PresentationDocument25 pagesA Digitally Guided Companion To The Indianapolis Zoo - PresentationSteven EntezariNo ratings yet

- Servo U 4.0 Brochure en Non UsDocument12 pagesServo U 4.0 Brochure en Non UsKatlheen KrautzNo ratings yet

- Eapp Q1 Las 2Document3 pagesEapp Q1 Las 2alwayswbelleNo ratings yet

- Park - Guide-Brochure-V1.7-engDocument2 pagesPark - Guide-Brochure-V1.7-engRizalBinTjutAdekNo ratings yet

- Park Guide Brochure V1.3 (ENG) Final FA (Smaller)Document2 pagesPark Guide Brochure V1.3 (ENG) Final FA (Smaller)Vivian SherryNo ratings yet

- DailySocial Mobile App User Experience Survey 2018Document18 pagesDailySocial Mobile App User Experience Survey 2018Umroj AlHabsyiNo ratings yet

- Service Blueprint Template - Sheet 1 - Table 1Document1 pageService Blueprint Template - Sheet 1 - Table 1anthonyNo ratings yet

- Blueprint Design ThinkingDocument1 pageBlueprint Design ThinkingDaniel SegarraNo ratings yet

- GTD Workflow Advanced (Diagrama Do Fluxo de Trabalho - GTD)Document1 pageGTD Workflow Advanced (Diagrama Do Fluxo de Trabalho - GTD)Enoch100% (36)

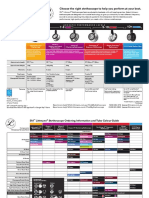

- Littmann ComparisonDocument2 pagesLittmann ComparisonGustavo HahnNo ratings yet

- Living in The It Era SyllabusDocument12 pagesLiving in The It Era Syllabuskwinhie MascardoNo ratings yet

- P9 Elite 20221025Document4 pagesP9 Elite 20221025Chai AlvarezNo ratings yet

- 2 Orgleadershipbehavior BDposters 2018Document1 page2 Orgleadershipbehavior BDposters 2018Anna GorakNo ratings yet

- Mountings Design Foot Scan: Technical InnovationDocument8 pagesMountings Design Foot Scan: Technical InnovationAdnan4466No ratings yet

- Layers of UxDocument2 pagesLayers of UxSaakshi DixitNo ratings yet

- Affinity Publisher Shortcuts Windows PDFDocument3 pagesAffinity Publisher Shortcuts Windows PDFjmaster54No ratings yet

- PDF Epx 4440hd CompressDocument6 pagesPDF Epx 4440hd CompressCovadonga VeracruzNo ratings yet

- Smart But Omnipotent: VINNO Technology (Suzhou) Co,. LTDDocument8 pagesSmart But Omnipotent: VINNO Technology (Suzhou) Co,. LTDdevNo ratings yet

- Lec 6 Sys ArchetypesDocument50 pagesLec 6 Sys ArchetypesJonathan Wee Cheng YangNo ratings yet

- Simon Harrison - On The Management of KnowledgeDocument6 pagesSimon Harrison - On The Management of KnowledgeJuliet AquinoNo ratings yet

- Empathy Map - 2023-10-18 - 15-24-32Document1 pageEmpathy Map - 2023-10-18 - 15-24-32GameboySmitNo ratings yet

- Desain Tanpa JudulDocument1 pageDesain Tanpa Judulsetingakun8No ratings yet

- Client ON-BOARDDocument1 pageClient ON-BOARDrealxpmythNo ratings yet

- 06 Process Analysis MethodsDocument19 pages06 Process Analysis MethodsTaufik NurkalihNo ratings yet

- Servo-U 4.2 Product Brochure-En-Non UsDocument7 pagesServo-U 4.2 Product Brochure-En-Non Usmd edaNo ratings yet

- Instruction Set ReviewDocument3 pagesInstruction Set ReviewWill KurlinkusNo ratings yet

- Beyond 2D, Depth Added Panorama: PromedusDocument4 pagesBeyond 2D, Depth Added Panorama: PromedusBartłomiej GinterNo ratings yet

- Vinno A5 BrochureDocument6 pagesVinno A5 Brochurekhaled twakolNo ratings yet

- CG/VFX Production TheoryDocument15 pagesCG/VFX Production TheoryCarlos JoséNo ratings yet

- So Chesther, 4th Submission Presentation Arcds02 (1) - CommentsDocument16 pagesSo Chesther, 4th Submission Presentation Arcds02 (1) - CommentsCHESTHER ALLEN SONo ratings yet

- Seven PillarsDocument2 pagesSeven PillarsparkmeNo ratings yet

- Four Knowings FrameworkDocument1 pageFour Knowings FrameworkTuan ThaiNo ratings yet

- NIC AI Based Chatbot (Vani)Document2 pagesNIC AI Based Chatbot (Vani)Hitesh KumarNo ratings yet

- Board GameDocument2 pagesBoard GamenishaNo ratings yet

- This Poster at WWW - Yourbias.isDocument1 pageThis Poster at WWW - Yourbias.isAstekMadden100% (1)

- Marketing Research Assignment: Course Guide: Prof. Anubhav MishraDocument8 pagesMarketing Research Assignment: Course Guide: Prof. Anubhav Mishrasauvik ghoshNo ratings yet

- FIRE3 Materials Handbook FFDocument19 pagesFIRE3 Materials Handbook FFMohamed SahraouiNo ratings yet

- System Thinking ChartDocument1 pageSystem Thinking ChartNova AndrianaNo ratings yet

- Visual Ergonomics at Work and Leisure: Paying It ForwardDocument2 pagesVisual Ergonomics at Work and Leisure: Paying It ForwardDiego A Echavarría ANo ratings yet

- Study Card 1 - Descriptive Process Modeling ElementsDocument1 pageStudy Card 1 - Descriptive Process Modeling Elementskob47542No ratings yet

- Plantilla Customer Journey MapDocument1 pagePlantilla Customer Journey MapPaula CostaNo ratings yet

- Boyds Ooda LoopDocument7 pagesBoyds Ooda Loopms msNo ratings yet

- Spexoverview 2Document1 pageSpexoverview 2api-242146325No ratings yet

- Welcome Ebook ENG FEB.-17 2022Document20 pagesWelcome Ebook ENG FEB.-17 2022André AmorimNo ratings yet

- Slua 144Document6 pagesSlua 144saoNo ratings yet

- Customer Request FormDocument2 pagesCustomer Request FormJ ANo ratings yet

- Internship Report On Project Management System of Portonics LimitedDocument42 pagesInternship Report On Project Management System of Portonics LimitedSudeep AmbawatNo ratings yet

- Canon Mp250 Error CodeDocument3 pagesCanon Mp250 Error CodeKiantri AndaNo ratings yet

- MML CommandsDocument375 pagesMML CommandsMarlon DutraNo ratings yet

- Modern 15 A5M (20230418)Document15 pagesModern 15 A5M (20230418)Hà Thị Thanh HuyềnNo ratings yet

- Beginner and Aspiring Quant - Algo Trader - Elite TraderDocument6 pagesBeginner and Aspiring Quant - Algo Trader - Elite TraderClifford DmelloNo ratings yet

- b0700tl BDocument100 pagesb0700tl BDemetri M. Scythe100% (2)

- Brochure Dresser Micro Corrector IMCW2 Brochure NGS - MI - .0007aDocument4 pagesBrochure Dresser Micro Corrector IMCW2 Brochure NGS - MI - .0007arahman ariwibowoNo ratings yet

- Ontracks SSRS BrochureDocument2 pagesOntracks SSRS BrochureNutrióloga Alma ReyesNo ratings yet

- E Book Drones in Mining and AggregatesDocument23 pagesE Book Drones in Mining and Aggregatesrizqi auliaNo ratings yet

- Foxpro Ar4 Operating Instructions: FeaturesDocument4 pagesFoxpro Ar4 Operating Instructions: FeaturesFructuoso Garcia ZuazuaNo ratings yet

- Ecr # 3 Remote Io PanelDocument41 pagesEcr # 3 Remote Io PanelRakesh Karan SinghNo ratings yet

- SYBMS Sem IV Information Technology in Business Management IIDocument22 pagesSYBMS Sem IV Information Technology in Business Management IIDWITI RavariyaNo ratings yet

- IET Lucknow Placement Brochure Nilabh EE05Document12 pagesIET Lucknow Placement Brochure Nilabh EE05nilabhkrNo ratings yet

- TS19340CS14 B1705Document9 pagesTS19340CS14 B1705Ludo BagmanNo ratings yet

- Adobe Acrobat XI Pro 10116 Multilingual Crack Serial Key PDFDocument4 pagesAdobe Acrobat XI Pro 10116 Multilingual Crack Serial Key PDFNicoleNo ratings yet

- Intelidrive Lite FPC 2014-12 CplefpcDocument2 pagesIntelidrive Lite FPC 2014-12 CplefpcalstomNo ratings yet

- SLHT Math9 Q3 Wk5bDocument5 pagesSLHT Math9 Q3 Wk5bErica BecariNo ratings yet

- First LectureDocument38 pagesFirst LectureAhmadnur JulNo ratings yet

- Control SystemsDocument161 pagesControl SystemsDr. Gollapalli NareshNo ratings yet

- Spirit LifeDocument243 pagesSpirit LifenorthernautumnNo ratings yet

- Surjeet Singh: ProfessionalDocument3 pagesSurjeet Singh: ProfessionalGracefulldudeNo ratings yet

- HARQDocument9 pagesHARQmoqcuhlxqxklntbfexNo ratings yet

- 200 Cat ElectricDocument212 pages200 Cat ElectricDan DiazNo ratings yet

- Democratizing Security With ReconmapDocument9 pagesDemocratizing Security With ReconmapSantiago LizardoNo ratings yet

- NatronDocument640 pagesNatronbladimirNo ratings yet