Professional Documents

Culture Documents

My1099 Notice703

My1099 Notice703

Uploaded by

Selina WalkerCopyright:

Available Formats

You might also like

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument2 pagesW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceJunk BoxNo ratings yet

- Screenshot 2022-04-15 at 9.52.17 PMDocument13 pagesScreenshot 2022-04-15 at 9.52.17 PMMalachov Andrew100% (1)

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This Packagetarles666No ratings yet

- Pyw221uc InstrDocument1 pagePyw221uc InstrMaddieNo ratings yet

- Notice To Employee Instructions For Employee: WWW - SSA.govDocument1 pageNotice To Employee Instructions For Employee: WWW - SSA.govPiyush AgrawalNo ratings yet

- Tracey Jordan 833 Kensington Manor DR CALERA AL 35040Document2 pagesTracey Jordan 833 Kensington Manor DR CALERA AL 35040Tracey JNo ratings yet

- De 4Document4 pagesDe 4fschalkNo ratings yet

- California DE-4Document4 pagesCalifornia DE-4Tuğrul SarıkayaNo ratings yet

- Notice To Employee Instructions For Employee: (Continued From The Back of Copy B.)Document1 pageNotice To Employee Instructions For Employee: (Continued From The Back of Copy B.)redditor1276No ratings yet

- W2 InstructionsDocument3 pagesW2 Instructionswarriorsinrecoveryalex.rNo ratings yet

- Generic Form Preview DocumentDocument4 pagesGeneric Form Preview Documentelena.69.mxNo ratings yet

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This PackageBill ChenNo ratings yet

- State Tax FormDocument2 pagesState Tax FormRon SchingsNo ratings yet

- Form W-4 (2013) : Employee's Withholding Allowance CertificateDocument2 pagesForm W-4 (2013) : Employee's Withholding Allowance Certificateapi-20374706No ratings yet

- Emp WitholdingDocument4 pagesEmp WitholdingJohn A MerlinoNo ratings yet

- Alberta 2024Document2 pagesAlberta 2024jennamthoNo ratings yet

- Form 107Document1 pageForm 107api-509940248No ratings yet

- Td1on Fill 22eDocument2 pagesTd1on Fill 22eOluwafeyikemi olusogaNo ratings yet

- Webcam For AdultDocument2 pagesWebcam For AdultDixieojmwwNo ratings yet

- Form W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordsDocument1 pageForm W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordssageNo ratings yet

- Form W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordsDocument1 pageForm W-2 Wage and Tax Statement 2020 Copy C, For Employee's Recordsbassomassi sanogoNo ratings yet

- 2019 W-2 Gregorio MartinezDocument2 pages2019 W-2 Gregorio Martinezporhj perraNo ratings yet

- Tax Return 2021Document4 pagesTax Return 2021Adam Clifton100% (4)

- STF 2023-03-20 1679339081483Document4 pagesSTF 2023-03-20 1679339081483ayogboloNo ratings yet

- fw4 PDFDocument2 pagesfw4 PDFbikash PrajapatiNo ratings yet

- US Internal Revenue Service: F1040es - 2001Document7 pagesUS Internal Revenue Service: F1040es - 2001IRSNo ratings yet

- US Internal Revenue Service: fw4 - 2000Document2 pagesUS Internal Revenue Service: fw4 - 2000IRSNo ratings yet

- YAMIDocument12 pagesYAMIStephany PolancoNo ratings yet

- US Internal Revenue Service: I1040sse - 2006Document4 pagesUS Internal Revenue Service: I1040sse - 2006IRSNo ratings yet

- 2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxDocument6 pages2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxJames D. SassNo ratings yet

- Tax Form 2016Document2 pagesTax Form 2016Sharkman1234566100% (1)

- Shit PDFDocument2 pagesShit PDFlysprr0% (1)

- F 1040 EsDocument12 pagesF 1040 EsHyun SeonNo ratings yet

- Sasumbatomlin19 IL 1040XsgsgfgDocument4 pagesSasumbatomlin19 IL 1040Xsgsgfgdanherman341No ratings yet

- Dustincates2021 TaxesDocument15 pagesDustincates2021 TaxesIllest Alive20650% (2)

- Ca De-4Document4 pagesCa De-4Kevin Marcos FelicianoNo ratings yet

- US Internal Revenue Service: I1040sse - 2001Document4 pagesUS Internal Revenue Service: I1040sse - 2001IRSNo ratings yet

- 2011 Instructions For Schedule SE (Form 1040) Self-Employment TaxDocument5 pages2011 Instructions For Schedule SE (Form 1040) Self-Employment Tax5sfsfdNo ratings yet

- US Internal Revenue Service: fw4 - 2002Document2 pagesUS Internal Revenue Service: fw4 - 2002IRSNo ratings yet

- US Internal Revenue Service: fw4s07 AccessibleDocument2 pagesUS Internal Revenue Service: fw4s07 AccessibleIRSNo ratings yet

- US Internal Revenue Service: fw4p - 1994Document3 pagesUS Internal Revenue Service: fw4p - 1994IRSNo ratings yet

- US Internal Revenue Service: fw4p - 1996Document3 pagesUS Internal Revenue Service: fw4p - 1996IRSNo ratings yet

- Caution - Guidance For Use of The 2009 Form 1040-ES, Estimated Tax For IndividualsDocument8 pagesCaution - Guidance For Use of The 2009 Form 1040-ES, Estimated Tax For Individualsezra242No ratings yet

- US Internal Revenue Service: fw4p - 1993Document3 pagesUS Internal Revenue Service: fw4p - 1993IRSNo ratings yet

- 2022 Ontario Personal Tax Credits Return - Ivano Volpe PDFDocument2 pages2022 Ontario Personal Tax Credits Return - Ivano Volpe PDFLISA VOLPENo ratings yet

- W4 SheetDocument2 pagesW4 Sheetnaru_vNo ratings yet

- US Internal Revenue Service: fw4p - 1995Document3 pagesUS Internal Revenue Service: fw4p - 1995IRSNo ratings yet

- Form W-2 Wage and Tax Statement 2019 Copy C, For Employee's RecordsDocument1 pageForm W-2 Wage and Tax Statement 2019 Copy C, For Employee's RecordsMandy StokesNo ratings yet

- Electronic Filing Instructions For Your 2013 Federal Tax ReturnDocument22 pagesElectronic Filing Instructions For Your 2013 Federal Tax Returnshawntaeadams04No ratings yet

- Tax Impact of Job LossDocument7 pagesTax Impact of Job LossbullyrayNo ratings yet

- US Internal Revenue Service: fw4p - 2003Document4 pagesUS Internal Revenue Service: fw4p - 2003IRSNo ratings yet

- 2024iaw-4 (44019) 0Document4 pages2024iaw-4 (44019) 0ahmedzahi964No ratings yet

- TD1 2023 - BCDocument2 pagesTD1 2023 - BCਸੁਖਮਨਪ੍ਰੀਤ ਕੌਰ ਢਿੱਲੋਂNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesFrom EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNo ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- Apy Chart PDFDocument1 pageApy Chart PDFSHUBHAJIT NANDINo ratings yet

- Chapter 2 ANNUITIESDocument21 pagesChapter 2 ANNUITIESCarl Omar GobangcoNo ratings yet

- C.A. 578Document35 pagesC.A. 578John Mark MarzanNo ratings yet

- BDO Cyprus Tax Facts 2021 FinalDocument27 pagesBDO Cyprus Tax Facts 2021 FinalLeon GribanovNo ratings yet

- Corporate Governance FrameworkDocument24 pagesCorporate Governance FrameworkAghora Kali Peetham DeccanNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- 53a Guide For Orsted EnglishDocument8 pages53a Guide For Orsted EnglishsriramaeroNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- Statement of Financial AffairsDocument12 pagesStatement of Financial Affairsyw79gy8gs9No ratings yet

- Invoice: Angela Shackleford 2600 Poplar Ave Memphis TN 38112 (901) 247-4674Document65 pagesInvoice: Angela Shackleford 2600 Poplar Ave Memphis TN 38112 (901) 247-4674Blake Weber100% (1)

- Acca Strategic Business Reporting (International) Mock Examination 4Document22 pagesAcca Strategic Business Reporting (International) Mock Examination 4Asad MuhammadNo ratings yet

- Detailed Advertisement of Various GR B & C 2023Document47 pagesDetailed Advertisement of Various GR B & C 2023Migflats FlatsNo ratings yet

- Labour Ministry Guidelines of Scholarhsips SchemesDocument4 pagesLabour Ministry Guidelines of Scholarhsips SchemesPranitNo ratings yet

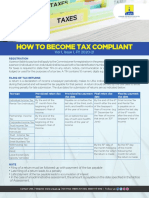

- How To Become Tax CompliantDocument1 pageHow To Become Tax CompliantNGANJANI WALTERNo ratings yet

- PF1 Chapter 3 SlidesDocument98 pagesPF1 Chapter 3 SlidesNamie NamieNo ratings yet

- Credit Process Leaflet v2Document2 pagesCredit Process Leaflet v2Shann KerrNo ratings yet

- Chapter-3: Inter-Temporal Tax Planning Using Alternative Tax Vehicles Constant Tax RateDocument3 pagesChapter-3: Inter-Temporal Tax Planning Using Alternative Tax Vehicles Constant Tax RatetanvirNo ratings yet

- Report On New Economic InitiativeDocument3 pagesReport On New Economic InitiativeAkshat BhatlaNo ratings yet

- Lesson Plan Planet - Paycheck - LP - 2 (1) .13.1Document15 pagesLesson Plan Planet - Paycheck - LP - 2 (1) .13.1Dayton Rogalski [Legacy HS]No ratings yet

- Jotun A S FS 2022Document3 pagesJotun A S FS 2022Info Riskma SolutionsNo ratings yet

- Paper Code 138Document23 pagesPaper Code 138Jaganmohan Medisetty100% (1)

- Cajiuat vs. MathayDocument3 pagesCajiuat vs. MathaySkychordNo ratings yet

- Basics of Business Insurance - NotesDocument41 pagesBasics of Business Insurance - Notesjeganrajraj100% (1)

- Form 16aaDocument2 pagesForm 16aaJayNo ratings yet

- HR Judicial DecisionsDocument6 pagesHR Judicial DecisionsSebin JamesNo ratings yet

- Chapter - 3 - Assessment of CompaniesDocument58 pagesChapter - 3 - Assessment of CompaniesSumon iqbalNo ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- Saint Columban College College of Busineess Education Pagadian City Income Taxation Midterm ExaminationsDocument1 pageSaint Columban College College of Busineess Education Pagadian City Income Taxation Midterm Examinationscarl fuerzasNo ratings yet

- Calculation of Benefit Value On Pension Fund Using Projected Unit CreditDocument6 pagesCalculation of Benefit Value On Pension Fund Using Projected Unit CreditAprijon AnasNo ratings yet

My1099 Notice703

My1099 Notice703

Uploaded by

Selina WalkerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

My1099 Notice703

My1099 Notice703

Uploaded by

Selina WalkerCopyright:

Available Formats

Department of the Treasury

Notice 703 Internal Revenue Service

(Rev. October 2021)

Read This To See if Your Social Security Benefits May Be Taxable

If your social security and/or SSI taxable for 2021. Fill in lines A • You exclude income from

(supplemental security income) through E. sources outside the United

benefits were your only source of States or foreign housing,

income for 2021, you probably will Do not use the worksheet below income earned by bona fide

not have to file a federal income tax if any of the following apply to you; residents of American Samoa or

return. See IRS Pub. 501, instead, go directly to IRS Pub. 915, Puerto Rico, interest income

Dependents, Standard Deduction, Social Security and Equivalent from series EE or I U.S. savings

and Filing Information, or your tax Railroad Retirement Benefits. bonds issued after 1989, or

return instructions to find out if you • You received Form RRB-1099, employer-provided adoption

have to file a return. Form SSA-1042S, or benefits.

We developed this worksheet for Form RRB-1042S.

you to see if your benefits may be

Note. If you plan to file a joint income tax return, include your spouse's amounts, if any, on lines A, C, and D.

A. Enter the total amount from box 5 of ALL your 2021 Forms SSA-1099.

Include the full amount of any lump-sum benefit payments received in 2021,

for 2021 and earlier years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A.

B. Multiply line A by 50% (0.50). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B.

C. Enter your total income that is taxable (excluding line A), such as pensions, wages, interest,

ordinary dividends, and capital gain distributions. Do not reduce your income by any

deductions, exclusions, or exemptions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C.

D. Enter any tax-exempt interest, such as interest on municipal bonds. . . . . . . . . . . . . . . . . . D.

E. Add lines B, C, and D, and enter the total here. Then, read the information below. . . . . . E.

Part of your social security If none of your benefits are Railroad Retirement Benefits, for

benefits may be taxable if, for 2021, taxable, but you must otherwise file rules on a lump-sum election you

item 1, 2, or 3 below applies to you. a tax return, do the following. can make that may reduce the

amount of your taxable benefits.

1. You were single, a head of • Enter the total amount from

household, or a qualifying widow(er) line A above on Form 1040 or

and line E above is more than 1040-SR, line 6a, and enter -0- Get More Information

$25,000. on Form 1040 or 1040-SR, From the IRS

2. You were married, would file line 6b.

jointly, and line E above is more • If you were married, file If you still have questions about

than $32,000. separately, and lived apart whether your social security benefits

3. You were married, would file from your spouse for all of are taxable, see IRS Pub. 915 or

separately, and line E above is more 2021, enter “D” to the right of your 2021 federal income tax return

than zero (more than $25,000 if you the word “benefits” on instructions, or visit

lived apart from your spouse for all Form 1040 or 1040-SR, line 6a. www.irs.gov/SSB.

of 2021).

Note. If your figures show that part Go to www.irs.gov/Forms to

If your figures show that part of of your benefits may be taxable and view, download, or print all of the

your benefits may be taxable, see you received benefits in 2021 that forms and publications you may

IRS Pub. 915 and Social Security were for a prior year, see IRS Pub. need.

Benefits in your 2021 federal 915, Social Security and Equivalent

income tax return instructions.

Do not return this notice to the SSA or the IRS. Keep it with your records.

IRS.gov Catalog No. 61879N

You might also like

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument2 pagesW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceJunk BoxNo ratings yet

- Screenshot 2022-04-15 at 9.52.17 PMDocument13 pagesScreenshot 2022-04-15 at 9.52.17 PMMalachov Andrew100% (1)

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This Packagetarles666No ratings yet

- Pyw221uc InstrDocument1 pagePyw221uc InstrMaddieNo ratings yet

- Notice To Employee Instructions For Employee: WWW - SSA.govDocument1 pageNotice To Employee Instructions For Employee: WWW - SSA.govPiyush AgrawalNo ratings yet

- Tracey Jordan 833 Kensington Manor DR CALERA AL 35040Document2 pagesTracey Jordan 833 Kensington Manor DR CALERA AL 35040Tracey JNo ratings yet

- De 4Document4 pagesDe 4fschalkNo ratings yet

- California DE-4Document4 pagesCalifornia DE-4Tuğrul SarıkayaNo ratings yet

- Notice To Employee Instructions For Employee: (Continued From The Back of Copy B.)Document1 pageNotice To Employee Instructions For Employee: (Continued From The Back of Copy B.)redditor1276No ratings yet

- W2 InstructionsDocument3 pagesW2 Instructionswarriorsinrecoveryalex.rNo ratings yet

- Generic Form Preview DocumentDocument4 pagesGeneric Form Preview Documentelena.69.mxNo ratings yet

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This PackageBill ChenNo ratings yet

- State Tax FormDocument2 pagesState Tax FormRon SchingsNo ratings yet

- Form W-4 (2013) : Employee's Withholding Allowance CertificateDocument2 pagesForm W-4 (2013) : Employee's Withholding Allowance Certificateapi-20374706No ratings yet

- Emp WitholdingDocument4 pagesEmp WitholdingJohn A MerlinoNo ratings yet

- Alberta 2024Document2 pagesAlberta 2024jennamthoNo ratings yet

- Form 107Document1 pageForm 107api-509940248No ratings yet

- Td1on Fill 22eDocument2 pagesTd1on Fill 22eOluwafeyikemi olusogaNo ratings yet

- Webcam For AdultDocument2 pagesWebcam For AdultDixieojmwwNo ratings yet

- Form W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordsDocument1 pageForm W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordssageNo ratings yet

- Form W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordsDocument1 pageForm W-2 Wage and Tax Statement 2020 Copy C, For Employee's Recordsbassomassi sanogoNo ratings yet

- 2019 W-2 Gregorio MartinezDocument2 pages2019 W-2 Gregorio Martinezporhj perraNo ratings yet

- Tax Return 2021Document4 pagesTax Return 2021Adam Clifton100% (4)

- STF 2023-03-20 1679339081483Document4 pagesSTF 2023-03-20 1679339081483ayogboloNo ratings yet

- fw4 PDFDocument2 pagesfw4 PDFbikash PrajapatiNo ratings yet

- US Internal Revenue Service: F1040es - 2001Document7 pagesUS Internal Revenue Service: F1040es - 2001IRSNo ratings yet

- US Internal Revenue Service: fw4 - 2000Document2 pagesUS Internal Revenue Service: fw4 - 2000IRSNo ratings yet

- YAMIDocument12 pagesYAMIStephany PolancoNo ratings yet

- US Internal Revenue Service: I1040sse - 2006Document4 pagesUS Internal Revenue Service: I1040sse - 2006IRSNo ratings yet

- 2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxDocument6 pages2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxJames D. SassNo ratings yet

- Tax Form 2016Document2 pagesTax Form 2016Sharkman1234566100% (1)

- Shit PDFDocument2 pagesShit PDFlysprr0% (1)

- F 1040 EsDocument12 pagesF 1040 EsHyun SeonNo ratings yet

- Sasumbatomlin19 IL 1040XsgsgfgDocument4 pagesSasumbatomlin19 IL 1040Xsgsgfgdanherman341No ratings yet

- Dustincates2021 TaxesDocument15 pagesDustincates2021 TaxesIllest Alive20650% (2)

- Ca De-4Document4 pagesCa De-4Kevin Marcos FelicianoNo ratings yet

- US Internal Revenue Service: I1040sse - 2001Document4 pagesUS Internal Revenue Service: I1040sse - 2001IRSNo ratings yet

- 2011 Instructions For Schedule SE (Form 1040) Self-Employment TaxDocument5 pages2011 Instructions For Schedule SE (Form 1040) Self-Employment Tax5sfsfdNo ratings yet

- US Internal Revenue Service: fw4 - 2002Document2 pagesUS Internal Revenue Service: fw4 - 2002IRSNo ratings yet

- US Internal Revenue Service: fw4s07 AccessibleDocument2 pagesUS Internal Revenue Service: fw4s07 AccessibleIRSNo ratings yet

- US Internal Revenue Service: fw4p - 1994Document3 pagesUS Internal Revenue Service: fw4p - 1994IRSNo ratings yet

- US Internal Revenue Service: fw4p - 1996Document3 pagesUS Internal Revenue Service: fw4p - 1996IRSNo ratings yet

- Caution - Guidance For Use of The 2009 Form 1040-ES, Estimated Tax For IndividualsDocument8 pagesCaution - Guidance For Use of The 2009 Form 1040-ES, Estimated Tax For Individualsezra242No ratings yet

- US Internal Revenue Service: fw4p - 1993Document3 pagesUS Internal Revenue Service: fw4p - 1993IRSNo ratings yet

- 2022 Ontario Personal Tax Credits Return - Ivano Volpe PDFDocument2 pages2022 Ontario Personal Tax Credits Return - Ivano Volpe PDFLISA VOLPENo ratings yet

- W4 SheetDocument2 pagesW4 Sheetnaru_vNo ratings yet

- US Internal Revenue Service: fw4p - 1995Document3 pagesUS Internal Revenue Service: fw4p - 1995IRSNo ratings yet

- Form W-2 Wage and Tax Statement 2019 Copy C, For Employee's RecordsDocument1 pageForm W-2 Wage and Tax Statement 2019 Copy C, For Employee's RecordsMandy StokesNo ratings yet

- Electronic Filing Instructions For Your 2013 Federal Tax ReturnDocument22 pagesElectronic Filing Instructions For Your 2013 Federal Tax Returnshawntaeadams04No ratings yet

- Tax Impact of Job LossDocument7 pagesTax Impact of Job LossbullyrayNo ratings yet

- US Internal Revenue Service: fw4p - 2003Document4 pagesUS Internal Revenue Service: fw4p - 2003IRSNo ratings yet

- 2024iaw-4 (44019) 0Document4 pages2024iaw-4 (44019) 0ahmedzahi964No ratings yet

- TD1 2023 - BCDocument2 pagesTD1 2023 - BCਸੁਖਮਨਪ੍ਰੀਤ ਕੌਰ ਢਿੱਲੋਂNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesFrom EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNo ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- Apy Chart PDFDocument1 pageApy Chart PDFSHUBHAJIT NANDINo ratings yet

- Chapter 2 ANNUITIESDocument21 pagesChapter 2 ANNUITIESCarl Omar GobangcoNo ratings yet

- C.A. 578Document35 pagesC.A. 578John Mark MarzanNo ratings yet

- BDO Cyprus Tax Facts 2021 FinalDocument27 pagesBDO Cyprus Tax Facts 2021 FinalLeon GribanovNo ratings yet

- Corporate Governance FrameworkDocument24 pagesCorporate Governance FrameworkAghora Kali Peetham DeccanNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- 53a Guide For Orsted EnglishDocument8 pages53a Guide For Orsted EnglishsriramaeroNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- Statement of Financial AffairsDocument12 pagesStatement of Financial Affairsyw79gy8gs9No ratings yet

- Invoice: Angela Shackleford 2600 Poplar Ave Memphis TN 38112 (901) 247-4674Document65 pagesInvoice: Angela Shackleford 2600 Poplar Ave Memphis TN 38112 (901) 247-4674Blake Weber100% (1)

- Acca Strategic Business Reporting (International) Mock Examination 4Document22 pagesAcca Strategic Business Reporting (International) Mock Examination 4Asad MuhammadNo ratings yet

- Detailed Advertisement of Various GR B & C 2023Document47 pagesDetailed Advertisement of Various GR B & C 2023Migflats FlatsNo ratings yet

- Labour Ministry Guidelines of Scholarhsips SchemesDocument4 pagesLabour Ministry Guidelines of Scholarhsips SchemesPranitNo ratings yet

- How To Become Tax CompliantDocument1 pageHow To Become Tax CompliantNGANJANI WALTERNo ratings yet

- PF1 Chapter 3 SlidesDocument98 pagesPF1 Chapter 3 SlidesNamie NamieNo ratings yet

- Credit Process Leaflet v2Document2 pagesCredit Process Leaflet v2Shann KerrNo ratings yet

- Chapter-3: Inter-Temporal Tax Planning Using Alternative Tax Vehicles Constant Tax RateDocument3 pagesChapter-3: Inter-Temporal Tax Planning Using Alternative Tax Vehicles Constant Tax RatetanvirNo ratings yet

- Report On New Economic InitiativeDocument3 pagesReport On New Economic InitiativeAkshat BhatlaNo ratings yet

- Lesson Plan Planet - Paycheck - LP - 2 (1) .13.1Document15 pagesLesson Plan Planet - Paycheck - LP - 2 (1) .13.1Dayton Rogalski [Legacy HS]No ratings yet

- Jotun A S FS 2022Document3 pagesJotun A S FS 2022Info Riskma SolutionsNo ratings yet

- Paper Code 138Document23 pagesPaper Code 138Jaganmohan Medisetty100% (1)

- Cajiuat vs. MathayDocument3 pagesCajiuat vs. MathaySkychordNo ratings yet

- Basics of Business Insurance - NotesDocument41 pagesBasics of Business Insurance - Notesjeganrajraj100% (1)

- Form 16aaDocument2 pagesForm 16aaJayNo ratings yet

- HR Judicial DecisionsDocument6 pagesHR Judicial DecisionsSebin JamesNo ratings yet

- Chapter - 3 - Assessment of CompaniesDocument58 pagesChapter - 3 - Assessment of CompaniesSumon iqbalNo ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- Saint Columban College College of Busineess Education Pagadian City Income Taxation Midterm ExaminationsDocument1 pageSaint Columban College College of Busineess Education Pagadian City Income Taxation Midterm Examinationscarl fuerzasNo ratings yet

- Calculation of Benefit Value On Pension Fund Using Projected Unit CreditDocument6 pagesCalculation of Benefit Value On Pension Fund Using Projected Unit CreditAprijon AnasNo ratings yet