Professional Documents

Culture Documents

Bpi 122480

Bpi 122480

Uploaded by

markhan18Copyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Sample Judicial Affidavit Reissuance SCRBDDocument4 pagesSample Judicial Affidavit Reissuance SCRBDBng Gsn100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Docket ReportDocument5 pagesDocket ReportWSETNo ratings yet

- Ortega v. Valmonte (478 SCRA 247)Document2 pagesOrtega v. Valmonte (478 SCRA 247)markhan18No ratings yet

- Molo V MoloDocument1 pageMolo V MoloporeoticsarmyNo ratings yet

- PNB Vs Ca FullDocument12 pagesPNB Vs Ca Fullmarkhan18No ratings yet

- BRIGHT MARITIME CORPORATION v. RICARDO B. FANTONIALDocument17 pagesBRIGHT MARITIME CORPORATION v. RICARDO B. FANTONIALmarkhan18No ratings yet

- 94 PhilconsatDocument10 pages94 Philconsatmarkhan18No ratings yet

- NITTO ENTERPRISES v. NLRCDocument11 pagesNITTO ENTERPRISES v. NLRCmarkhan18No ratings yet

- FILAMER CHRISTIAN INSTITUTE v. IACDocument6 pagesFILAMER CHRISTIAN INSTITUTE v. IACmarkhan18No ratings yet

- G.R. No. 109114Document3 pagesG.R. No. 109114markhan18No ratings yet

- LEO'S RESTAURANT & BAR CAF&EACUTE v. LAARNE C. BENSINGDocument25 pagesLEO'S RESTAURANT & BAR CAF&EACUTE v. LAARNE C. BENSINGmarkhan18No ratings yet

- NELSON V. BEGINO v. ABS-CBN CORPORATIONDocument16 pagesNELSON V. BEGINO v. ABS-CBN CORPORATIONmarkhan18No ratings yet

- PEOPLE v. CHARLIE BUTIONGDocument15 pagesPEOPLE v. CHARLIE BUTIONGmarkhan18No ratings yet

- Ang Vs Associated BankDocument4 pagesAng Vs Associated Bankmarkhan18No ratings yet

- People v. Antero Gamez y BaltazarDocument9 pagesPeople v. Antero Gamez y Baltazarmarkhan18No ratings yet

- G.R. No. 84484 InsularDocument4 pagesG.R. No. 84484 Insularmarkhan18No ratings yet

- Case Digest: FAR EAST BANK v. Gold Palace Jewellery CoDocument3 pagesCase Digest: FAR EAST BANK v. Gold Palace Jewellery Comarkhan18No ratings yet

- Decided Cases Against JudgesDocument17 pagesDecided Cases Against Judgesraymund lumantaoNo ratings yet

- Ong v. OPDocument14 pagesOng v. OPArnold BagalanteNo ratings yet

- Code of Professional ResponsibilityDocument5 pagesCode of Professional ResponsibilityJackie Canlas100% (1)

- Fortune Tobacco Corporation Vs CIRDocument2 pagesFortune Tobacco Corporation Vs CIRiamchurkyNo ratings yet

- Feature of The Constitution of BangladeshDocument2 pagesFeature of The Constitution of BangladeshMd. Mahbubul Karim86% (14)

- SN - Multiple Choice Test (22 December 2023, 12-14h) Attempt ReviewDocument21 pagesSN - Multiple Choice Test (22 December 2023, 12-14h) Attempt ReviewSuhenja NiranjanNo ratings yet

- Screenshot 2022-08-03 at 12.03.23 PMDocument12 pagesScreenshot 2022-08-03 at 12.03.23 PMAbhishekSaxenaNo ratings yet

- RafananPaolaCCL Room202 Mon&Sat530pmDocument3 pagesRafananPaolaCCL Room202 Mon&Sat530pmMimiNo ratings yet

- Canon 20 CasesDocument35 pagesCanon 20 CasesRia Evita RevitaNo ratings yet

- MMDA v. Viron Transportation Co. Inc., 530 SCRA 341Document21 pagesMMDA v. Viron Transportation Co. Inc., 530 SCRA 341EmNo ratings yet

- 2 People V GuintoDocument2 pages2 People V GuintoAbigail TolabingNo ratings yet

- Lutz v. Araneta, 98 Phil. 148 - Public PurposeDocument1 pageLutz v. Araneta, 98 Phil. 148 - Public PurposeIVYJEAN LAGURANo ratings yet

- Caltex V BD of Assessment Appeals - Case DigestDocument1 pageCaltex V BD of Assessment Appeals - Case DigestAbigail TolabingNo ratings yet

- Unit - 3Document15 pagesUnit - 3inderpreet suman100% (1)

- Appeal Lawyer in MississaugaDocument4 pagesAppeal Lawyer in MississaugaHarinder GahirNo ratings yet

- (2003) 5 SCC 351 (2013) 1 SCC 641 (2018) 16 SCC 413. (2018) 15 SCC 678Document10 pages(2003) 5 SCC 351 (2013) 1 SCC 641 (2018) 16 SCC 413. (2018) 15 SCC 678Kartik SolankiNo ratings yet

- TAGUIGDocument9 pagesTAGUIGKael Echavez OpogNo ratings yet

- FactsDocument10 pagesFactsJayson LanuzaNo ratings yet

- Araneta v. PerezDocument6 pagesAraneta v. PerezMHERITZ LYN LIM MAYOLANo ratings yet

- Constitutional Law The Judiciary NotesDocument6 pagesConstitutional Law The Judiciary NotesZoeNo ratings yet

- Memorandum: Objections On The Draft "Transport of Animals (Amendment) Rules, 2024Document55 pagesMemorandum: Objections On The Draft "Transport of Animals (Amendment) Rules, 2024Naresh KadyanNo ratings yet

- Matabuena v. CervantesDocument2 pagesMatabuena v. CervantesIzia Lopez AniscolNo ratings yet

- CASE No. 236 Emperatriz Labayo-Rowe vs. Republic of The PhilippinesDocument2 pagesCASE No. 236 Emperatriz Labayo-Rowe vs. Republic of The PhilippinesJonel L. SembranaNo ratings yet

- Alfonso v. Land Bank of The Phils. - MendozaDocument1 pageAlfonso v. Land Bank of The Phils. - MendozaDonna Mendoza100% (1)

- Income Tax ProjectDocument17 pagesIncome Tax ProjectRajeev RajNo ratings yet

- G.R. No. L-4043 May 26, 1952 CENON S. CERVANTES, Petitioner, vs. THE AUDITOR GENERAL, Respondent. Facts of The CaseDocument2 pagesG.R. No. L-4043 May 26, 1952 CENON S. CERVANTES, Petitioner, vs. THE AUDITOR GENERAL, Respondent. Facts of The CaseJohñ Lewis FerrerNo ratings yet

- Florida LawsuitDocument18 pagesFlorida LawsuitThe Western JournalNo ratings yet

- Housing Act: Laws of Guyana Cap. 36:20Document77 pagesHousing Act: Laws of Guyana Cap. 36:20Trevor Burnett100% (1)

Bpi 122480

Bpi 122480

Uploaded by

markhan18Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bpi 122480

Bpi 122480

Uploaded by

markhan18Copyright:

Available Formats

BPI FAMILY SAVINGS BANK, INC.

, V

CA G.R. No. 122480, April 12, 2000

Facts: Petitioner bank’s annual corporate income tax return for 1989 showed

that it suffered a loss of P8,286,960, and that it had a total refundable

amount of P297,492 inclusive of P112,491 being claimed as tax refund in the

present case. However, petitioner declared in its 1989 income tax return as a

tax credit in the succeeding taxable year.

On October 11, 1991, petitioner bank filed a written claim for refund of

P112,491 with the BIR alleging that it did not apply the 1989 refundable

amount of P297,492 as tax credit to its 1990 annual corporate income tax

return or either tax liabilities due to business losses it incurred for the same

year. Without waiting for respondent CIR’s action in its claim for refund,

petitioner filed a petition for review with the CTA.

CTA dismissed the petition on the ground that petitioner bank failed to

present as evidence its 1990 annual income tax return to prove that it had

not yet credited the amount of P297,422, inclusive of P112,491 which is the

subject of the present controversy to its 1990 tax liability. Since petitioner

declared in its 1989 income tax return that it would apply the excess

withholding tax as tax credit for the following year, the tax court presumed

that it did so. Petitioner failed to overcome this presumption because it did

not present its 1990 tax return which would have shown that the amount was

not applied as a tax credit. Hence, it was concluded that petition was not

entitled to a tax refund. The CA affirmed said decision of the CTA.

Issue: Whether or not petitioner is entitled to a tax refund of P112,491

representing creditable withholding tax paid for 1989.

Held: The petition is meritorious. As a rule, the factual findings on the

appellate court are binding on the SC. This rule, however, does not apply

where, inter alia, the judgment is premised on a misapprehension of facts or

when the appellate court failed to notice certain relevant facts which if

considered would justify a different conclusion. This case is one such

exception.

Strict procedural rules generally frown up the submission of the return the

trial. R.A. 1125, the law creating the CTA, however, specifically provides the

proceedings before it “shall not be governed strictly by the technical rules of

evidence”. The paramount considerations remains the ascertainment of

truth. Verily, the quest for orderly presentation of issues is not an absolute. It

should not bar courts from considering undisputed facts to arrive at a just

determination of a controversy.

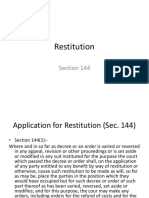

While tax refunds are in the nature of the exceptions and are to the construct

strictissimi juris against the claimant, under the facts of this case, petitioner

has established its claim.

Substantial justice equity, and fair play are on the side of petitioner.

Technicalities and legalisms, however, exalted, should not be misused by the

government to keep money not belonging to it and thereby enrich would be

better by allowing to appeal.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Sample Judicial Affidavit Reissuance SCRBDDocument4 pagesSample Judicial Affidavit Reissuance SCRBDBng Gsn100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Docket ReportDocument5 pagesDocket ReportWSETNo ratings yet

- Ortega v. Valmonte (478 SCRA 247)Document2 pagesOrtega v. Valmonte (478 SCRA 247)markhan18No ratings yet

- Molo V MoloDocument1 pageMolo V MoloporeoticsarmyNo ratings yet

- PNB Vs Ca FullDocument12 pagesPNB Vs Ca Fullmarkhan18No ratings yet

- BRIGHT MARITIME CORPORATION v. RICARDO B. FANTONIALDocument17 pagesBRIGHT MARITIME CORPORATION v. RICARDO B. FANTONIALmarkhan18No ratings yet

- 94 PhilconsatDocument10 pages94 Philconsatmarkhan18No ratings yet

- NITTO ENTERPRISES v. NLRCDocument11 pagesNITTO ENTERPRISES v. NLRCmarkhan18No ratings yet

- FILAMER CHRISTIAN INSTITUTE v. IACDocument6 pagesFILAMER CHRISTIAN INSTITUTE v. IACmarkhan18No ratings yet

- G.R. No. 109114Document3 pagesG.R. No. 109114markhan18No ratings yet

- LEO'S RESTAURANT & BAR CAF&EACUTE v. LAARNE C. BENSINGDocument25 pagesLEO'S RESTAURANT & BAR CAF&EACUTE v. LAARNE C. BENSINGmarkhan18No ratings yet

- NELSON V. BEGINO v. ABS-CBN CORPORATIONDocument16 pagesNELSON V. BEGINO v. ABS-CBN CORPORATIONmarkhan18No ratings yet

- PEOPLE v. CHARLIE BUTIONGDocument15 pagesPEOPLE v. CHARLIE BUTIONGmarkhan18No ratings yet

- Ang Vs Associated BankDocument4 pagesAng Vs Associated Bankmarkhan18No ratings yet

- People v. Antero Gamez y BaltazarDocument9 pagesPeople v. Antero Gamez y Baltazarmarkhan18No ratings yet

- G.R. No. 84484 InsularDocument4 pagesG.R. No. 84484 Insularmarkhan18No ratings yet

- Case Digest: FAR EAST BANK v. Gold Palace Jewellery CoDocument3 pagesCase Digest: FAR EAST BANK v. Gold Palace Jewellery Comarkhan18No ratings yet

- Decided Cases Against JudgesDocument17 pagesDecided Cases Against Judgesraymund lumantaoNo ratings yet

- Ong v. OPDocument14 pagesOng v. OPArnold BagalanteNo ratings yet

- Code of Professional ResponsibilityDocument5 pagesCode of Professional ResponsibilityJackie Canlas100% (1)

- Fortune Tobacco Corporation Vs CIRDocument2 pagesFortune Tobacco Corporation Vs CIRiamchurkyNo ratings yet

- Feature of The Constitution of BangladeshDocument2 pagesFeature of The Constitution of BangladeshMd. Mahbubul Karim86% (14)

- SN - Multiple Choice Test (22 December 2023, 12-14h) Attempt ReviewDocument21 pagesSN - Multiple Choice Test (22 December 2023, 12-14h) Attempt ReviewSuhenja NiranjanNo ratings yet

- Screenshot 2022-08-03 at 12.03.23 PMDocument12 pagesScreenshot 2022-08-03 at 12.03.23 PMAbhishekSaxenaNo ratings yet

- RafananPaolaCCL Room202 Mon&Sat530pmDocument3 pagesRafananPaolaCCL Room202 Mon&Sat530pmMimiNo ratings yet

- Canon 20 CasesDocument35 pagesCanon 20 CasesRia Evita RevitaNo ratings yet

- MMDA v. Viron Transportation Co. Inc., 530 SCRA 341Document21 pagesMMDA v. Viron Transportation Co. Inc., 530 SCRA 341EmNo ratings yet

- 2 People V GuintoDocument2 pages2 People V GuintoAbigail TolabingNo ratings yet

- Lutz v. Araneta, 98 Phil. 148 - Public PurposeDocument1 pageLutz v. Araneta, 98 Phil. 148 - Public PurposeIVYJEAN LAGURANo ratings yet

- Caltex V BD of Assessment Appeals - Case DigestDocument1 pageCaltex V BD of Assessment Appeals - Case DigestAbigail TolabingNo ratings yet

- Unit - 3Document15 pagesUnit - 3inderpreet suman100% (1)

- Appeal Lawyer in MississaugaDocument4 pagesAppeal Lawyer in MississaugaHarinder GahirNo ratings yet

- (2003) 5 SCC 351 (2013) 1 SCC 641 (2018) 16 SCC 413. (2018) 15 SCC 678Document10 pages(2003) 5 SCC 351 (2013) 1 SCC 641 (2018) 16 SCC 413. (2018) 15 SCC 678Kartik SolankiNo ratings yet

- TAGUIGDocument9 pagesTAGUIGKael Echavez OpogNo ratings yet

- FactsDocument10 pagesFactsJayson LanuzaNo ratings yet

- Araneta v. PerezDocument6 pagesAraneta v. PerezMHERITZ LYN LIM MAYOLANo ratings yet

- Constitutional Law The Judiciary NotesDocument6 pagesConstitutional Law The Judiciary NotesZoeNo ratings yet

- Memorandum: Objections On The Draft "Transport of Animals (Amendment) Rules, 2024Document55 pagesMemorandum: Objections On The Draft "Transport of Animals (Amendment) Rules, 2024Naresh KadyanNo ratings yet

- Matabuena v. CervantesDocument2 pagesMatabuena v. CervantesIzia Lopez AniscolNo ratings yet

- CASE No. 236 Emperatriz Labayo-Rowe vs. Republic of The PhilippinesDocument2 pagesCASE No. 236 Emperatriz Labayo-Rowe vs. Republic of The PhilippinesJonel L. SembranaNo ratings yet

- Alfonso v. Land Bank of The Phils. - MendozaDocument1 pageAlfonso v. Land Bank of The Phils. - MendozaDonna Mendoza100% (1)

- Income Tax ProjectDocument17 pagesIncome Tax ProjectRajeev RajNo ratings yet

- G.R. No. L-4043 May 26, 1952 CENON S. CERVANTES, Petitioner, vs. THE AUDITOR GENERAL, Respondent. Facts of The CaseDocument2 pagesG.R. No. L-4043 May 26, 1952 CENON S. CERVANTES, Petitioner, vs. THE AUDITOR GENERAL, Respondent. Facts of The CaseJohñ Lewis FerrerNo ratings yet

- Florida LawsuitDocument18 pagesFlorida LawsuitThe Western JournalNo ratings yet

- Housing Act: Laws of Guyana Cap. 36:20Document77 pagesHousing Act: Laws of Guyana Cap. 36:20Trevor Burnett100% (1)