Professional Documents

Culture Documents

Illustration - Anti-Corruption Series #1 - Managing The Risk of Corruption Overview

Illustration - Anti-Corruption Series #1 - Managing The Risk of Corruption Overview

Uploaded by

Saudi MindOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration - Anti-Corruption Series #1 - Managing The Risk of Corruption Overview

Illustration - Anti-Corruption Series #1 - Managing The Risk of Corruption Overview

Uploaded by

Saudi MindCopyright:

Available Formats

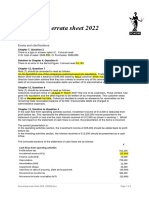

OCEG Anti-Corruption Illustrated Series

Organizations must address global corruption challenges with a comprehensive

and dynamic program. To succeed, the board and management must demonstrate 2 DEVELOP THE PROGRAM PROGRAM OWNERS

and demand an anti-corruption culture. Design a comprehensive and balanced anti-corruption program that AN ANTI-CORRUPTION PROGRAM

corresponds to the risks identified during the assessment process. IS GOOD FOR BUSINESS

Establish policies, procedures and controls in all levels of the business,

Strong anti-corruption programs help

with owners for each. Obtain board and management endorsement

to build a climate of integrity and an

of strategies, short and long term expectations, and

RISK ethical culture across the extended

resources, with ongoing communication of this support. AUDIT

enterprise that drives desired conduct

1 START: ASSESS RISKS CORRUPTION IDENTIFICATION

AND

FINANCE

BUSINESS

COMPLIANCE OPERATIONS

and supports compliance overall.

OTHERS AND LEGAL Compliant companies perform better in

RISKS

Identify corruption risks considering factors

ESTABLISH PROGRAM the marketplace and have a competitive

including nature and location of business

OWNERSHIP AND OVERSIGHT advantage. An effective anti-corruption

activities, third party relationships, methods

OBJECTIVES program enables the company to:

for generating business, and applicable Anti-corruption efforts require coordinated

laws. Evaluate and rank risks based on the action involving many in the C-suite and

organization’s established risk appetite, and managers of operations that present

be prepared to respond to internal and corruption risk. A management commit-

external changes that affect the assessment. tee or internal stakeholder group can

FULFILL LEGAL OBLIGATIONS

ensure that necessary communication AND GUIDANCE

takes place, resources are committed,

REVIEW, REALIGN, • U.S. Foreign Corrupt Practices Act

7 AND REPORT and sufficient support for effective- • U.K. Bribery Act

ness of the program exists.

Take timely corrective and disciplinary action for POLICY DESIGN • U.S. Dodd-Frank and Patriot Acts

violation of the anti-corruption program. • Public Procurement Laws

M&A

Continually evaluate the program and adjust it THIRD PARTY and Regulations

to ensure alignment with changes in risk profile.

RELATIONSHIPS 3 • Guidance from OECD, World Bank,

Keep management and the board informed of PERFORM DUE DILIGENCE and Non-Governmental Organizations

Knowing how and where your vendors, agents and customers operate, and DEFINE AND

program outcomes and needs through regular IMPLEMENT • OCEG GRC Standards

understanding the activities and controls of any planned acquisition, as well as the risks

reporting. Strengthen assurance of program POLICIES • Contractual Obligations

they present, is an essential part of the anti-corruption program. Due diligence should

sufficiency with external review and certification. Write policies that map to

include analyzing whether established steps of an effective program are followed.

regulations, obligations and

P E R AT I O N S / S TA K

business processes. Establish

ESS O EHO

SIN LDE owners responsible to ensure

BU RS

SCREENING K EY continued appropriateness and

6 MONITOR AND EVALUATE AUDITING/ effectiveness. Communicate to

REINFORCE BRAND AND

Track and assess policies and controls for TESTING

ACCOUNTING/ key stakeholders including CORPORATE REPUTATION

effectiveness and performance in various ways: FINANCE

CONTROLS staff, third parties, auditors, • Enhance Brand Credibility

and customers. • Solidify Shareholder Trust

SCREEN SALES/ LOGISTICS/

monitor internal and external information MARKETING DISTRIBUTION/ • Gain Respect in the Marketplace

PURCHASING

and compare vendor, partner and customer

records against trusted data sources for red

flags that indicate issues INVESTIGATIONS

MANUFACTURING

4

BUILD AND

IDENTIFY HOTLINE OPERATE CONTROLS

establish hotline and other open channels for DATA

reporting and resolution of questions and issues Establish procedures and controls to

S

U RE prevent, detect, correct and mitigate ASSURE THE BOTTOM LINE

ED

INVESTIGATE OC • Protect Corporate Assets

PR the risks. Include process, technology,

obtain and assess information about observed PO and Operations

LIC human capital and physical controls.

or suspected misconduct, using appropriate IES • Enable Public Procurement

qualified teams, and considering privilege issues ANALYTICS Establish owners to monitor controls to ensure

effective workflow, continued appropriateness of Lines of Business

ANALYZE design, and operation in business units. Regularly • Enable Operation in

evaluate data to locate concerns and potential problems by document, assess and test controls. Corruption-Prone Countries

applying analytic techniques, tools and reporting capabilities • Prevent Revenue Loss From

Non-Compliance

AUDIT 5 TRAIN AND EDUCATE

provide regular internal audit oversight and inspection of the Develop and deliver training in various forms to raise stakeholder awareness and competence • Avoid or Reduce Fines

anti-corruption program; test and assess controls to determine regarding anti-corruption goals, policies, procedures and controls. Identify role-specific programs and Penalties

if additional or modified action is necessary with desired outcomes and develop content and delivery methods appropriate for each target

contact Scott L. Mitchell smitchell@oceg.org for comments, reprints or licensing requests audience, taking cultural and language issues into account. Assess, certify, and track training results. ©2012 Dachis Group

©2012 OCEG

You might also like

- BR Student Markplan N14Document29 pagesBR Student Markplan N14karlr9No ratings yet

- Iso 45001 ExamDocument15 pagesIso 45001 ExamAhmed NABIL67% (12)

- CFOs Guide To Measuring The Finance FunctionDocument1 pageCFOs Guide To Measuring The Finance FunctionHitesh UppalNo ratings yet

- Planning, Budgeting and Forecasting: An Eye On The FutureDocument24 pagesPlanning, Budgeting and Forecasting: An Eye On The Futurejasondao2015No ratings yet

- Security Management Standard - Physical Asset Protection ANSI - ASIS PAP AMERICAN NATIONAL STANDARD - 1 - 部分1Document20 pagesSecurity Management Standard - Physical Asset Protection ANSI - ASIS PAP AMERICAN NATIONAL STANDARD - 1 - 部分1安靖50% (2)

- R Shachin Shibi - 105 - BDocument3 pagesR Shachin Shibi - 105 - BShachin ShibiNo ratings yet

- 1 Mining Principles: Performance ExpectationsDocument3 pages1 Mining Principles: Performance ExpectationsAngelRojo03No ratings yet

- Lean Self AssessmentDocument1 pageLean Self Assessmentmh70100% (1)

- Chapter6 DevtFrameworkDocument8 pagesChapter6 DevtFrameworknathNo ratings yet

- Cost Audit and Its Excellences What WhyDocument1 pageCost Audit and Its Excellences What WhyJKonsultoresNo ratings yet

- Cost Audit and Its Excellences What Why PDFDocument1 pageCost Audit and Its Excellences What Why PDFFahmida AkhterNo ratings yet

- GRC 16Document6 pagesGRC 16thotaNo ratings yet

- COBIT 5 Poster 2 - What Drives IT Governance PDFDocument1 pageCOBIT 5 Poster 2 - What Drives IT Governance PDFLuis MessiasNo ratings yet

- Forensic Accounting: IntegrationDocument56 pagesForensic Accounting: IntegrationMuhammad Jihaduddin AmriNo ratings yet

- ECA ESG Brochure July2018Document4 pagesECA ESG Brochure July2018Manoj PatelNo ratings yet

- How Align GRC InitiativesDocument1 pageHow Align GRC Initiativesمحمد عبدالعالNo ratings yet

- How Oracle Solutions Help Manage The Smart City: Human ResourcesDocument1 pageHow Oracle Solutions Help Manage The Smart City: Human ResourcesDarlene GanubNo ratings yet

- Sa520 1529989961017Document11 pagesSa520 1529989961017Apeksha ChilwalNo ratings yet

- New Normal - ManufacturingDocument1 pageNew Normal - ManufacturingGolayootNo ratings yet

- ExecutiveBrief - Whitepaper - ISO 45001Document2 pagesExecutiveBrief - Whitepaper - ISO 45001AnitaNo ratings yet

- Capacity Development Agenda: 2022-2024 Provincial Government of Oriental MindoroDocument3 pagesCapacity Development Agenda: 2022-2024 Provincial Government of Oriental MindoroDhon Calda83% (6)

- Value & Opportunity - Accounting TechniciansDocument2 pagesValue & Opportunity - Accounting TechniciansAli AyubNo ratings yet

- Session5 Lekala eDocument27 pagesSession5 Lekala eCiise Cali HaybeNo ratings yet

- How To Make The OHSMS More EffectiveDocument2 pagesHow To Make The OHSMS More EffectiveRafif Utama PutraNo ratings yet

- (PPT) Strategic Analysis of Sana Safinaz Asma Ayub - Academia - EduDocument1 page(PPT) Strategic Analysis of Sana Safinaz Asma Ayub - Academia - Eduyfs945xpjnNo ratings yet

- Performance Measurement Systems For Virtual Enterprise IntegrationDocument13 pagesPerformance Measurement Systems For Virtual Enterprise Integrationsdeshpande87No ratings yet

- The Bank of UgandaDocument1 pageThe Bank of UgandaTimothy KawumaNo ratings yet

- Protecting Farmers - Why Coffee Auction Is A ScamDocument1 pageProtecting Farmers - Why Coffee Auction Is A ScamOlympus MonsNo ratings yet

- COBIT 2019 Governance Management Objectives Practices Activities Nov2018Document350 pagesCOBIT 2019 Governance Management Objectives Practices Activities Nov2018amotavaliNo ratings yet

- K Faid - Master PDVSA - Module 12 - 2009Document49 pagesK Faid - Master PDVSA - Module 12 - 2009Franklin RevillNo ratings yet

- Acfrogcdtxyd2pxju5at Bhuefelguczf1 8kx547l3 Gtczdlqkny9ej0 Ye0f17dznwzi3iblefaqgbd3kvbduseduhsz74gt8t7cxczwq9pzu0pqa3wsfgxkdrm8Document1 pageAcfrogcdtxyd2pxju5at Bhuefelguczf1 8kx547l3 Gtczdlqkny9ej0 Ye0f17dznwzi3iblefaqgbd3kvbduseduhsz74gt8t7cxczwq9pzu0pqa3wsfgxkdrm8r100% (1)

- Strategic Vision: Current Vision Near-Term Vision Future VisionDocument6 pagesStrategic Vision: Current Vision Near-Term Vision Future VisionChandan KumarNo ratings yet

- Introduction To Cost AccountingDocument7 pagesIntroduction To Cost AccountingSeleenaNo ratings yet

- Folleto 5664587d3a3d942Document2 pagesFolleto 5664587d3a3d942LeonelNo ratings yet

- Reliance - IR 2020 (FULL) Single PageDocument4 pagesReliance - IR 2020 (FULL) Single Pagegitanjali srivastavNo ratings yet

- Folle ToDocument2 pagesFolle ToYuliana CamachoNo ratings yet

- Jahanzeeb ALI: About MeDocument1 pageJahanzeeb ALI: About Mehammad.ahmad1854No ratings yet

- ASM Quick Guide BookletDocument32 pagesASM Quick Guide BookletMoatiz RiazNo ratings yet

- PD 25111-2010Document36 pagesPD 25111-2010Beste Ardıç ArslanNo ratings yet

- CG Guidelines For Listed Companies Nov2010Document13 pagesCG Guidelines For Listed Companies Nov2010Raymond ChengNo ratings yet

- Actividad 10, Equpo 1Document7 pagesActividad 10, Equpo 1hwt8w28zwgNo ratings yet

- Nature of Accounting Mind MapDocument12 pagesNature of Accounting Mind MapJared 03No ratings yet

- Agrobank AR2018 PDFDocument297 pagesAgrobank AR2018 PDFarmanNo ratings yet

- M. Wahib 28573 - SMEs Assignment FADocument7 pagesM. Wahib 28573 - SMEs Assignment FAmuhammadwahib594No ratings yet

- Session5 Lekala eDocument27 pagesSession5 Lekala eAbhishek ThakurNo ratings yet

- Managing Innovative Strategic HRM: The Balanced Score Card Performance Management System at ITC HotelsDocument12 pagesManaging Innovative Strategic HRM: The Balanced Score Card Performance Management System at ITC HotelsAbNo ratings yet

- Expect The Unexpected - Managing Your Continuity RiskDocument4 pagesExpect The Unexpected - Managing Your Continuity RiskPatrick OwNo ratings yet

- Tutor ConferenceDocument1 pageTutor ConferencevikkyNo ratings yet

- Employment Pathways: Where Will This Take Me?Document3 pagesEmployment Pathways: Where Will This Take Me?ani gabriela gonzalez gomezNo ratings yet

- ABA ProfileDocument8 pagesABA ProfileSherin MathewsNo ratings yet

- IT Strategic PlanDocument1 pageIT Strategic Plansayee vaitheesvaranNo ratings yet

- 2023 06 ICA Due Diligence Brochure WebDocument4 pages2023 06 ICA Due Diligence Brochure Webq9x6dkc4ypNo ratings yet

- Board of Accountancy: Picpa AncDocument4 pagesBoard of Accountancy: Picpa AncDmc BryanNo ratings yet

- Airasia Annual Report 2017Document231 pagesAirasia Annual Report 2017Tian Xiang100% (1)

- Rep Human2509Document32 pagesRep Human2509Anshul SinghNo ratings yet

- Memberi Energi Tanpa Batas Memberi Energi Tanpa Batas: 6 Esg InsightDocument84 pagesMemberi Energi Tanpa Batas Memberi Energi Tanpa Batas: 6 Esg InsightRomi ArfanNo ratings yet

- Strategic Action Plan For Improving Safety: in Commercial Air TransportDocument11 pagesStrategic Action Plan For Improving Safety: in Commercial Air TransportBitonNo ratings yet

- Description: Tags: FSASA-2BTIGVisionFramework 200608Document1 pageDescription: Tags: FSASA-2BTIGVisionFramework 200608anon-693594No ratings yet

- Complexity ReductionDocument1 pageComplexity ReductionRASHMI RASHMINo ratings yet

- Lesson Four - Corporate GovenaceDocument16 pagesLesson Four - Corporate GovenacemaheeanuNo ratings yet

- Wcms 143383Document9 pagesWcms 143383Mohammed AzawiNo ratings yet

- Practice Bulletin - Assessment of Internal Audit FunctionDocument14 pagesPractice Bulletin - Assessment of Internal Audit FunctionCherylNo ratings yet

- Black Creative Mind Map GraphDocument1 pageBlack Creative Mind Map GraphVan Amiel HerreraNo ratings yet

- Cost Recovery: Turning Your Accounts Payable Department into a Profit CenterFrom EverandCost Recovery: Turning Your Accounts Payable Department into a Profit CenterNo ratings yet

- CCC Guideline - General Requirements - Feb-2022Document8 pagesCCC Guideline - General Requirements - Feb-2022Saudi MindNo ratings yet

- Third Party Cybersecurity Compliance Report TemplateDocument36 pagesThird Party Cybersecurity Compliance Report TemplateSaudi MindNo ratings yet

- Third Party Classification TemplateDocument8 pagesThird Party Classification TemplateSaudi MindNo ratings yet

- DataManagementCaseStudy 210525 124355Document2 pagesDataManagementCaseStudy 210525 124355Saudi MindNo ratings yet

- Cybersecurity Controls Requirements - Dec 2022Document18 pagesCybersecurity Controls Requirements - Dec 2022Saudi MindNo ratings yet

- Finance DPro (FMD Pro) Guide V1.4Document143 pagesFinance DPro (FMD Pro) Guide V1.4Saudi MindNo ratings yet

- Accounting Errata Sheet 2022 291121Document2 pagesAccounting Errata Sheet 2022 291121Saudi MindNo ratings yet

- The Easy Way To Assess GRC CapabilitiesDocument4 pagesThe Easy Way To Assess GRC CapabilitiesSaudi MindNo ratings yet

- Risk Management ManualDocument78 pagesRisk Management ManualSaudi MindNo ratings yet

- Dela Llana VS COA DigestDocument2 pagesDela Llana VS COA DigestNaomi Jean TaotaoNo ratings yet

- Park Rapids Schools FY 23 Signed Final Report and Financial StatementsDocument98 pagesPark Rapids Schools FY 23 Signed Final Report and Financial StatementsShannon GeisenNo ratings yet

- Test Bank For Fundamental Accounting Principles 24th Edition John Wild Ken ShawDocument36 pagesTest Bank For Fundamental Accounting Principles 24th Edition John Wild Ken Shawbethgreennixk57100% (32)

- RED - Audit SamplingDocument10 pagesRED - Audit SamplingClyde RamosNo ratings yet

- LRQA Management System Audit 2010Document10 pagesLRQA Management System Audit 2010ServosteelNo ratings yet

- AAOIFI - Governance Standards 1-13 Including GN For GS 13Document367 pagesAAOIFI - Governance Standards 1-13 Including GN For GS 13Abdul QuderNo ratings yet

- Isa 450Document12 pagesIsa 450Drikita PinhelNo ratings yet

- ISO 22000 Audit ChecklistDocument32 pagesISO 22000 Audit Checklistlouiza100% (3)

- Aamir AssociatesDocument5 pagesAamir AssociateshhaiderNo ratings yet

- Fucking EssayDocument5 pagesFucking EssayNikos SpetsnazNo ratings yet

- Operational Auditing, Tools For Improving Business OutcomesDocument53 pagesOperational Auditing, Tools For Improving Business OutcomessyediitNo ratings yet

- Topic 4 Tutorial SolutionsDocument10 pagesTopic 4 Tutorial SolutionsKitty666No ratings yet

- Asset IntegrityDocument74 pagesAsset IntegrityAhmed Hazem100% (2)

- Astha Bhaiji: 12 (MP Board)Document3 pagesAstha Bhaiji: 12 (MP Board)Divya NinaweNo ratings yet

- 5S Audit Sheet (2015)Document26 pages5S Audit Sheet (2015)Waqar DarNo ratings yet

- Human Resource Management Practices and Their Influence On Service Delivery Among The State Corporations in KenyaDocument15 pagesHuman Resource Management Practices and Their Influence On Service Delivery Among The State Corporations in KenyaIJAR JOURNALNo ratings yet

- Ensuring Compliance To Regularity VFDocument22 pagesEnsuring Compliance To Regularity VFBira myNo ratings yet

- Income Tax - MidhunDocument19 pagesIncome Tax - MidhunmidhunNo ratings yet

- Module 3Document44 pagesModule 3Kenneth PimentelNo ratings yet

- SAP Audit Guide Financial AccoutingDocument12 pagesSAP Audit Guide Financial Accoutingaussiberia1530No ratings yet

- Aoa OpcDocument6 pagesAoa OpcJacinth JoseNo ratings yet

- Iso 9004 2009 Compliance Audit Tool: 7.1 Using A Process ApproachDocument6 pagesIso 9004 2009 Compliance Audit Tool: 7.1 Using A Process ApproachAyman Al-sayyedNo ratings yet

- 1.sanish Resume Latest - FinalDocument4 pages1.sanish Resume Latest - FinalBos BosNo ratings yet

- Cruz, Jasmine Nouvel S. - Bsa Dash 1 PrelimmDocument3 pagesCruz, Jasmine Nouvel S. - Bsa Dash 1 PrelimmJasmine Nouvel Soriaga CruzNo ratings yet

- Training and Development in Pharmaceutical CompanyDocument6 pagesTraining and Development in Pharmaceutical Companyapi-5008825No ratings yet

- Audit Advantage Improving Mission ReadinessDocument8 pagesAudit Advantage Improving Mission ReadinessManuel J VillanuevaNo ratings yet