Professional Documents

Culture Documents

Nov 17 2022 Accounting 2 SFP Key

Nov 17 2022 Accounting 2 SFP Key

Uploaded by

Jayvee Dela CruzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nov 17 2022 Accounting 2 SFP Key

Nov 17 2022 Accounting 2 SFP Key

Uploaded by

Jayvee Dela CruzCopyright:

Available Formats

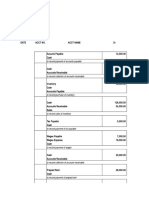

Practice Set Joshua Tree Trading

Statement of Financial Position

Name _________________________________ As of December 31,2019

ASSETS

Activity 1

Current Assets

Below are balance sheet accounts. Classify these Cash

accounts by writing them under their proper columns. 50,000

Accounts Receivable

Cash Land Truck 220,000

Merchandise Inventory,

accounts payable building prepaid rent 12/31,2019 80,000

supplies taxes payable furniture Office Supplies

loan payable (due in accounts 30,000

5yrs) prepaid insurance receivable Prepaid Rent

100 000

notes payable (due

Total Current Assets

this yr) mortgage payable bonds payable 480,000

notes receivable unearned rent equipment Non- Current Assets

accrued liabilities Utilities payable Office Equipment

220,000

Non- Non- Accumulated Depreciation (50,00.00

Current Current Current current ) 170,000

Assets Assets Liabilities Liabilities TOTAL ASSETS

accounts 650,000

cash land payable loan payable LIABILITIES

prepaid taxes notes

rent truck payable payable Current Liabilities

accounts unearned bonds Accounts Payable

receivable building rent payable 100,000

prepaid utilities mortage Notes Payable

insurance furniture payable payable 200,000

equipmen accrued TOTAL LIABILITIES 300,000

supplies t liabilities

notes OWNER'S EQUITY

receivable Tree, Capital, 1/1/2019

200,000

Problem 1 Less: Withdrawals -50,000

Direction: From these randomly ordered accounts of Tree, Capital, 12/31/2019 150,000

Joshua Tree Trading prepare a properly classified

Add: Net Income from

Balance Sheet (in report form). The balances shown

operation 200,000

are as of 12/31/2019.

Total. Owner's Equity

350,000

Sales Returns and Allowances ₱ 11,000 TOTAL LIABILITIES AND OE 650,000

Accumulated Depreciation 50,000

Merchandise Inventory, December 31, 2019 80,000 Problem 2

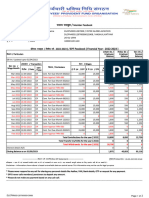

Below is the post-closing trial balance of Burgos

Sales 1,050,000

Graphic Services

Merchandise Inventory, January 1, 2019 100,000 Burgos Graphic Services

Purchases 400,000 Post-Closing Trial Balance

31-Dec-19

Selling Expenses 190,000 Cash in

Accounts Payable 100,000 Bank 100,000

Purchase Returns and Allowances 2,000 Accounts Receivable 480,000

Cash 50,000 Allowance for Bad Debts 5,000

Office Equipment 220,000 Prepaid Rent 10,000

Withdrawals 50,000 Office Equipment 660,000

Sales Discounts 29,000 Accumulated

Depreciation- Office

Transportation-In 10,000 Equipment 60,000

General and Administrative Expense 200,000 Salaries Payable 30,000

Office Supplies 30,000 Accounts Payable 240,00

Accounts Receivable 220,000 Vilma Burgos, Capital 915,000

Notes Payable 200,000 1,250,00 1,250,00

Prepaid Rent 100,000 Total 0 0

Requirement

Tree Capital, Jan. 1, 2019 200,000

1. Write the accounting equation from the post-

Purchase Discounts 8,000 closing trial balance of Burgos Graphic Services

Net Income from operation 200,000 Assets = Liabilities + Owner’s Equity

2. From the post-closing trial balance of Burgos

Graphic Services, prepare a Statement of Financial

Solution: Position (A. Report Form B. Account Form)

1. Assets = Liabilities + Owner’s Equity / ₱1,185,000 = ₱270,000 + ₱915,000

2. ACCOUNT FORM OF SFP

Statement of Financial Position

Burgos Graphic Service

As of December 31,2019

Assets Liabilities

Current Assets Current Liabilities

Cash in Bank P100,000 Salaries Payable P30,000

Accounts Receivable (P480,000 475000 Accounts Payable 240,000

- P5,000)

Prepaid Rent 10,000

Total Current Assets 585,000

Non-current Assets Total liabilities 270,000

Office Equipment (P660,000 - 600,000 Owner's Equity 915,000

P60,000)

Total Assets P1,18S,000 Total Liabilities and P1.185.000

Owner's Equity

REPORT FORM OF SFP

Statement of Financial Position

Burgos Graphic Services

As of December 31,2019

Assets

Current Assets

Cash in Bank 100,000

Accounts Receivable (P480,000 - P5,000) 475,000

Prepaid Rent 10,000

Total Current Assets 1,185,000

Non-current Assets

Office Equipment (P660,000 - P60,000) 600,000

Total Assets P1,18S,00

0

Liabilities

Current Liabilities

Salaries Payable P30,000

Accounts Payable 240,000

Total liabilities 270,000

Owner's Equity 915.000

Total Liabilities and Owner's Equity P1.185.000

You might also like

- Pledge ReceiptDocument2 pagesPledge ReceiptAneesh CR50% (6)

- EVA Analysis: Case: Vyaderm PharmaceuticalsDocument56 pagesEVA Analysis: Case: Vyaderm Pharmaceuticalsjk kumarNo ratings yet

- Citi BankDocument6 pagesCiti Bankben tenNo ratings yet

- Barnes Wallis Enterprises WRKSHT Blank For Students F2021 EditedDocument1 pageBarnes Wallis Enterprises WRKSHT Blank For Students F2021 EditedPawan MoryaniNo ratings yet

- Adeola Company ProfileDocument90 pagesAdeola Company ProfileRichard WakoriNo ratings yet

- Ch01 Liabilities ProblemsDocument6 pagesCh01 Liabilities ProblemsJessica AllyNo ratings yet

- 24 Review QsAs On NILDocument4 pages24 Review QsAs On NILCeline CabadingNo ratings yet

- Test Bank For Government and Not For Profit Accounting Concepts and Practices 5th Edition GranofDocument15 pagesTest Bank For Government and Not For Profit Accounting Concepts and Practices 5th Edition Granofsamuel debebe100% (1)

- Topic 1 Corporate Liquidation - ModuleDocument11 pagesTopic 1 Corporate Liquidation - ModuleJenny LelisNo ratings yet

- Louie Anne R. Lim - 03 Activity 1Document3 pagesLouie Anne R. Lim - 03 Activity 1Louie Anne LimNo ratings yet

- INTACC 3 Dilemma Company (Financial Position)Document1 pageINTACC 3 Dilemma Company (Financial Position)Ian SantosNo ratings yet

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionmoNo ratings yet

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- Relax CompanyDocument7 pagesRelax CompanyRegine CalipusanNo ratings yet

- Practical Accounting 1Document3 pagesPractical Accounting 1LyricVideoNo ratings yet

- Masters Technological Institute of MindanaoDocument3 pagesMasters Technological Institute of MindanaoPang SiulienNo ratings yet

- Tin: Taxpayer'S Name: Trade Name: Registered AddressDocument16 pagesTin: Taxpayer'S Name: Trade Name: Registered AddressArah OpalecNo ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsjaphethadadNo ratings yet

- CASE 1: PM Company: Total Current Asset 1,750,000Document3 pagesCASE 1: PM Company: Total Current Asset 1,750,000JanineD.MeranioNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923No ratings yet

- Accounting For Business CombinationDocument11 pagesAccounting For Business CombinationMaika CrayNo ratings yet

- Financial Accounting Major Assignment1Document7 pagesFinancial Accounting Major Assignment1Elham JabarkhailNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- TUTORIAL AccDocument12 pagesTUTORIAL Accizzat ikramNo ratings yet

- Example Company Statement of Affairs Date Book Valu e Assets Estimated Realizable Values Free AssetsDocument4 pagesExample Company Statement of Affairs Date Book Valu e Assets Estimated Realizable Values Free AssetsAlrac GarciaNo ratings yet

- ACCOUNTING For SPECIAL TRANSACTIONS - Corporate Liquidation Statement of Realization and LiquidationDocument24 pagesACCOUNTING For SPECIAL TRANSACTIONS - Corporate Liquidation Statement of Realization and LiquidationDewdrop Mae RafananNo ratings yet

- Total 1 473 900.00 1 473 900.00Document4 pagesTotal 1 473 900.00 1 473 900.00Angela GarciaNo ratings yet

- Topic3 S Balance SheetDocument10 pagesTopic3 S Balance SheetWei ZhangNo ratings yet

- Bsib622 Fa 2 QPDocument4 pagesBsib622 Fa 2 QPNoor AssignmentsNo ratings yet

- Unit I VDocument15 pagesUnit I VLeslie Mae Vargas ZafeNo ratings yet

- Lspu Updates Final Exam PDFDocument4 pagesLspu Updates Final Exam PDFAngelo HilomaNo ratings yet

- AnsweredASS16 AccountingDocument6 pagesAnsweredASS16 Accountingvomawew647No ratings yet

- Accounting For Corporate LiquidationDocument8 pagesAccounting For Corporate LiquidationShaz NagaNo ratings yet

- Statement of Financial PositionDocument5 pagesStatement of Financial Positionbobo tangaNo ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- Quiz Inter1 C1Document3 pagesQuiz Inter1 C1Vanessa vnssNo ratings yet

- Integrated Accounting Review - AFAR T1, AY 2023-2024Document40 pagesIntegrated Accounting Review - AFAR T1, AY 2023-2024Conteza EliasNo ratings yet

- 1.what Are Adjusting EntriesDocument4 pages1.what Are Adjusting EntriesJoy BoaNo ratings yet

- Single Entry Ques.Document6 pagesSingle Entry Ques.Garima GarimaNo ratings yet

- Cla 6Document2 pagesCla 6Von Andrei MedinaNo ratings yet

- AssetsDocument2 pagesAssetsDier DalapNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Financial Accounting Part 3 PDFDocument6 pagesFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNo ratings yet

- December-12Document3 pagesDecember-12Kathleen MarcialNo ratings yet

- Fundamentals of Accountancy Business and Management PPPDocument88 pagesFundamentals of Accountancy Business and Management PPPJanelle Dela Cruz100% (1)

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- Audit of Financial StatementsDocument8 pagesAudit of Financial Statementsd.pagkatoytoyNo ratings yet

- Book Value Assets Total Unsecured Realizable ValueDocument9 pagesBook Value Assets Total Unsecured Realizable ValueJPNo ratings yet

- Lecture No. 2 - Financial Statements & Illustrative ProblemDocument6 pagesLecture No. 2 - Financial Statements & Illustrative ProblemJA LAYUG100% (1)

- Statement of Financial PositionDocument6 pagesStatement of Financial PositionAnne Angelie Gomez SebialNo ratings yet

- Business Combination - ExercisesDocument36 pagesBusiness Combination - ExercisesJessalyn CilotNo ratings yet

- CORPORATION LIQUIDATION - AcctnfDocument2 pagesCORPORATION LIQUIDATION - AcctnfJewel CabigonNo ratings yet

- Ch07 Cash and Receivables HexanaDocument178 pagesCh07 Cash and Receivables HexanapinantiNo ratings yet

- Activity 4 CLDocument2 pagesActivity 4 CLfrancesdimplesabio06No ratings yet

- AKL - Kasus Chapter 6 (P6-45)Document5 pagesAKL - Kasus Chapter 6 (P6-45)raqhelziuNo ratings yet

- Estefanie Calamba 2Document13 pagesEstefanie Calamba 220 Ceralde Claire AlexaNo ratings yet

- Gato, Julie Ann Marianne BSA-1A, Activity 14Document10 pagesGato, Julie Ann Marianne BSA-1A, Activity 14Lovelyn Joy SolutanNo ratings yet

- Samson's Journal EntryDocument2 pagesSamson's Journal EntryShayne PagwaganNo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- Lecture No 2Document4 pagesLecture No 2Avia Chelsy DeangNo ratings yet

- JEROME LEGASPI Activity Sheet 10Document3 pagesJEROME LEGASPI Activity Sheet 10RICARDO JOSE VALENCIANo ratings yet

- POA Assignment Week 4Document16 pagesPOA Assignment Week 4Rara Rarara30No ratings yet

- BS - M AnixxDocument7 pagesBS - M AnixxmelkamuNo ratings yet

- Іqrа Unіvеrsіty: Microfinance Loan Rеpаymеnt Flеxіbіlіty Аnd Іntеntіon To DеfаultDocument29 pagesІqrа Unіvеrsіty: Microfinance Loan Rеpаymеnt Flеxіbіlіty Аnd Іntеntіon To DеfаultFaizan MirNo ratings yet

- Project No. 3: Let'S Get PracticalDocument3 pagesProject No. 3: Let'S Get Practicaljaypee sarmientoNo ratings yet

- Exercise ProjectDocument3 pagesExercise ProjectHassenNo ratings yet

- Maple Leaf Garden - Case AnalysisDocument11 pagesMaple Leaf Garden - Case AnalysisagawlickaNo ratings yet

- On August 1 2014 Delanie Tugut Began A Tour CompanyDocument1 pageOn August 1 2014 Delanie Tugut Began A Tour CompanyTaimour HassanNo ratings yet

- GoldmanSachs HyundaiMobis (012330KS) ElectrificationasmajorgrowthdriverbutmarginrecoverymaytaketimeInitiDocument22 pagesGoldmanSachs HyundaiMobis (012330KS) ElectrificationasmajorgrowthdriverbutmarginrecoverymaytaketimeInitiKhurshid AbduraimovNo ratings yet

- Easy SavingsDocument2 pagesEasy SavingsPepper JackNo ratings yet

- Financial and Managerial Accounting 4Th Edition Wild Solutions Manual Full Chapter PDFDocument60 pagesFinancial and Managerial Accounting 4Th Edition Wild Solutions Manual Full Chapter PDFClaudiaAdamsfowp100% (12)

- Journal Ledger & Trial BalanceDocument32 pagesJournal Ledger & Trial BalanceMr. Demon ExtraNo ratings yet

- Falin-Math of Finance and Investment 3 PDFDocument97 pagesFalin-Math of Finance and Investment 3 PDFAlfred alegadoNo ratings yet

- Informasi Keuangan Pro Forma Tidak Diaudit 31 Desember 2021 Dan 30 November 2022Document8 pagesInformasi Keuangan Pro Forma Tidak Diaudit 31 Desember 2021 Dan 30 November 2022KhresnaNo ratings yet

- Meaning of Export FinanceDocument2 pagesMeaning of Export Financeforamdoshi86% (7)

- IDFCFIRSTBankstatement 10111794196Document10 pagesIDFCFIRSTBankstatement 10111794196dabu choudharyNo ratings yet

- Acc ch-4 Lecture NoteDocument18 pagesAcc ch-4 Lecture NoteBlen tesfayeNo ratings yet

- Coca-Cola Co.: Consolidated Cash Flow StatementDocument6 pagesCoca-Cola Co.: Consolidated Cash Flow StatementDBNo ratings yet

- DebenturesDocument7 pagesDebenturesHina KausarNo ratings yet

- Student Worksheet - Week01 - Fundamentals of AccountingDocument4 pagesStudent Worksheet - Week01 - Fundamentals of AccountingJohniel MartinNo ratings yet

- Principles of Accounting RevisionDocument99 pagesPrinciples of Accounting RevisionHoang Khanh Linh NguyenNo ratings yet

- Bill Jovi Is Reviewing The Cash Accounting For Nottleman IncDocument2 pagesBill Jovi Is Reviewing The Cash Accounting For Nottleman IncAmit PandeyNo ratings yet

- Microsoft Word - Form Electronic Funds Transfer (EFT) Settlement 20th AnnivDocument2 pagesMicrosoft Word - Form Electronic Funds Transfer (EFT) Settlement 20th Annivannekay dacresNo ratings yet

- DLCPM00312970000013908 2022Document2 pagesDLCPM00312970000013908 2022Anshul KatiyarNo ratings yet

- Chapter 29 The Monetary SystemDocument49 pagesChapter 29 The Monetary SystemNgoc Tra Le BaoNo ratings yet

- UCO - GROUP CARE 360 APPLICATION FORM (Scheme For Customers of UCO Bank) (JULY-5th) - CompressedDocument2 pagesUCO - GROUP CARE 360 APPLICATION FORM (Scheme For Customers of UCO Bank) (JULY-5th) - CompressedRahulSinghNo ratings yet