Professional Documents

Culture Documents

Demas - Kieso CH 13

Demas - Kieso CH 13

Uploaded by

DemastaufiqOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Demas - Kieso CH 13

Demas - Kieso CH 13

Uploaded by

DemastaufiqCopyright:

Available Formats

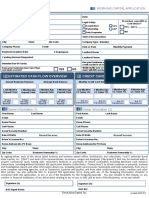

Demas Taufik Suganda_Kieso Ch 13

E13-18

1. Liability for stamp redemptions, 12/31/09.............................. $13,000,000

Cost of redemptions redeemed in 2010.................................. (6,000,000)

7,000,000

Cost of redemptions to be redeemed in 2011 (5,200,000 X

80%)................................................................... 4,160,000

Liability for stamp redemptions, 12/31/10.............................. $11,160,000

2. Total coupons issued ................................................................... $850,000

Redemption rate............................................................................. X 60%

To be redeemed.............................................................................. 510,000

Handling charges ($510,000 X 10%) ........................................ 51,000

Total cost.......................................................................................... $561,000

Total cost.......................................................................................... $561,000

Total payments to retailers......................................................... (330,000)

Liability for unredeemed coupons ........................................... $231,000

3. Boxes ..............................................................................................600,000

Redemption rate.............................................................................X 70%

Total redeemable............................................................................420,000

Coupons to be redeemed (420,000 – 250,000)...................... ………170,000

Cost ($6.50 – $4.00) ....................................................................... X $2.50

Liability for unredeemed coupons ........................................... ……$425,000

ANSWER P 13-1

(a) February 2

Purchases ($70,000 X 98%) ........................................... 68,60

Accounts Payable ................................................. 68,600

February 26

Accounts Payable............................................................. 68,600

Purchase Discounts Lost............................................... 1,400

…………..Cash......................................................................................... 70,000

April 1

Trucks................................................................................... 50,000

…………..Cash........................................................................... 4,000

Notes Payable......................................................... 46,000

August 1

Retained Earnings (Dividends Declared).................. 300,000

Dividends Payable ................................................ 300,000

September 10

Dividends Payable............................................................ 300,000

…………….Cash........................................................................... 300,000

(b) December 31

1. No adjustment necessary

2. Interest Expense ($46,000 X 12% X 9/12)............ 4,140

Interest Payable ..................................................... 4,140

3. No adjustment necessary

Answer P 13-5

a. Cash 1.000.000

Sales 1.000.000

b. Cash 1.000.000

Sales 1.000.000

Warranty Expense 136.000

Warranty Liability 136.000

c. No liability would be disclosed under the cash-basis method relative to future cost due to

warranties on past sales

d. Current Liabilities:

Warranty Liability 68.000

Longterm Liabilities:

Warranty Liability 68.000

e. Warranty Expense 61.300

Parts Inventory 21.400

Accrued Payroll 39.900

f. Warranty Liability 61.300

Parts Inventory 21.400

Accrued payroll 39.900

Answer P13-6

(a) Cash .................................................................................... 294,300

Sales (300 X $900)....................................................................... 270,000

Unearned Warranty Revenue (270 X $90).................................. 24,300

(b) Current Liabilities:

Unearned Warranty Revenue ($24,300/3)............................................... 8,100

(Note: Warranty costs assumed to be incurred equally over the threeyear period)

Non-current Liabilities:

Unearned Warranty Revenue ($24,300 X 2/3)...........................................16,200

(c) Unearned Warranty Revenue...................................... 8,100

Warranty Revenue .................................................... 8,100

Warranty Expense .......................................................... 6,000

Parts Inventory............................................................ 2,000

Accrued Payroll ........................................................... 4,000

(d) Current Liabilities:

Unearned Warranty Revenue ........................... $ 8,100

Non-current Liabilities:

Unearned Warranty Revenue ........................... $ 8,100

Answer P13-8

Inventory of Premium Puppets 60.000

Cash 60.000

Cash 1800.000

Sales 1.800.000

Premium Expense 34.500

Inventory of Premium Puppets 34.500

Premium Expense 23.100

Premium Liability 23.100

Computation: Total coupons issued in 2011 480.000

Total estimated redeemed in 2011 (115.000)

Estimated future redemptions 77.000

Cost of estimated claims outstanding (77.000/5) X 1.50 = 23.100

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Money Send TC28Document9 pagesMoney Send TC28Ahmed AlhunaishieNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Conceptual Framework & Acctg S MQ1-MEXAMDocument22 pagesConceptual Framework & Acctg S MQ1-MEXAMCasey Collera MedianaNo ratings yet

- Demas Taufik - TASK 5Document3 pagesDemas Taufik - TASK 5DemastaufiqNo ratings yet

- Demas Taufik - Task 13Document8 pagesDemas Taufik - Task 13DemastaufiqNo ratings yet

- Homework Audit DemasDocument3 pagesHomework Audit DemasDemastaufiqNo ratings yet

- Grup - Task 4Document6 pagesGrup - Task 4DemastaufiqNo ratings yet

- Uts - Audit 2 Demas 185020307141012Document5 pagesUts - Audit 2 Demas 185020307141012DemastaufiqNo ratings yet

- Demas - Audit - Chapter 12Document9 pagesDemas - Audit - Chapter 12DemastaufiqNo ratings yet

- Demas - Task 5Document5 pagesDemas - Task 5DemastaufiqNo ratings yet

- 139 20210602014221 Kieso Inter Ch20 - IfRS (Pensions)Document47 pages139 20210602014221 Kieso Inter Ch20 - IfRS (Pensions)DemastaufiqNo ratings yet

- Demas - Task 2Document7 pagesDemas - Task 2DemastaufiqNo ratings yet

- Easypaisa Account Transaction Show: 20/06/2021 To 09/09/2021Document1 pageEasypaisa Account Transaction Show: 20/06/2021 To 09/09/2021Shahzad AliNo ratings yet

- Ch02 Foreign Exchange MarketsDocument8 pagesCh02 Foreign Exchange MarketsPaw VerdilloNo ratings yet

- Ali Qamar Shaikh-CVDocument3 pagesAli Qamar Shaikh-CValiqamarshaikhNo ratings yet

- FAR610-Test 1-Mar 2017 - QDocument3 pagesFAR610-Test 1-Mar 2017 - QAmirul AimanNo ratings yet

- The Objectives of Accounts Receivable ManagementDocument14 pagesThe Objectives of Accounts Receivable ManagementAjay Kumar TakiarNo ratings yet

- Sankmobile: Summary of Account BalanceDocument10 pagesSankmobile: Summary of Account BalanceSAMNo ratings yet

- Chapter - 10: Determining Cash Flows For Investment AnalysisDocument15 pagesChapter - 10: Determining Cash Flows For Investment Analysispalak bansalNo ratings yet

- Part 2 A - Investment To A SubsidiaryDocument5 pagesPart 2 A - Investment To A Subsidiarytaniel.dhaverNo ratings yet

- DAC Loan ApplicationDocument1 pageDAC Loan ApplicationDunhamNo ratings yet

- Zenith Doc2Document1 pageZenith Doc2api-3706000100% (2)

- AA 4102 1st Hand OutDocument9 pagesAA 4102 1st Hand OutMana XDNo ratings yet

- NBM PLC ANNUAL REPORT 2022Document101 pagesNBM PLC ANNUAL REPORT 2022Takondwa MsosaNo ratings yet

- Aaconapps2 00-C92pb1aDocument14 pagesAaconapps2 00-C92pb1aJane DizonNo ratings yet

- Chapter 21Document12 pagesChapter 21Mark ArceoNo ratings yet

- K.V.N. Chandra RaoDocument12 pagesK.V.N. Chandra RaoRatanSinghSinghNo ratings yet

- MMW Chapter 1 BonifacioDocument10 pagesMMW Chapter 1 BonifacioAbigail ConstantinoNo ratings yet

- HDFC Bank Was Amongst The First To Receive An PDFDocument83 pagesHDFC Bank Was Amongst The First To Receive An PDFSairam SajaneNo ratings yet

- N.B.: Answer Any Two of The Following Questions. All Parts of Each Question Must Be Answered Consecutively.Document3 pagesN.B.: Answer Any Two of The Following Questions. All Parts of Each Question Must Be Answered Consecutively.Onurup RahmanNo ratings yet

- Introduction Sutex BankDocument14 pagesIntroduction Sutex BankRonakNo ratings yet

- Balance Sheet of Reliance CommunicationsDocument2 pagesBalance Sheet of Reliance Communicationsaman10000No ratings yet

- 10715... Fee ChalanDocument2 pages10715... Fee ChalanMesmerizing PoetryNo ratings yet

- Bonds PayableeeeeDocument48 pagesBonds Payableeeeespur ious100% (2)

- Audit Gen 2021Document2 pagesAudit Gen 2021SUBHENDU KUNDUNo ratings yet

- Topical Depreciation Q 2014-2019Document48 pagesTopical Depreciation Q 2014-2019ibbbi shkhNo ratings yet

- DBG Y9 WT4 GHW4 G LHiDocument5 pagesDBG Y9 WT4 GHW4 G LHiamit06sarkarNo ratings yet

- Indian Financial SystemDocument5 pagesIndian Financial SystemHimaja GharaiNo ratings yet

- Computershare Plan Managers Pty LTD Abn 56 084 591 131 and Cpu Share Plans Pty LTD Abn 20 081 600 875 Financial Services GuideDocument6 pagesComputershare Plan Managers Pty LTD Abn 56 084 591 131 and Cpu Share Plans Pty LTD Abn 20 081 600 875 Financial Services GuideChirag ShahNo ratings yet

- Beneish M-Score - Finbox TemplateDocument6 pagesBeneish M-Score - Finbox Templatemichael odiemboNo ratings yet