Professional Documents

Culture Documents

Factsheet NIFTY AA Category Corporate Bond Indices

Factsheet NIFTY AA Category Corporate Bond Indices

Uploaded by

MURALIHARAN KOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Factsheet NIFTY AA Category Corporate Bond Indices

Factsheet NIFTY AA Category Corporate Bond Indices

Uploaded by

MURALIHARAN KCopyright:

Available Formats

October 2022

NIFTY AA Category Corporate Bond Indices measure the aggregated performance of AA+, AA and AA- rated corporate

bonds across 6 duration buckets (Macaulay Duration). Each index is derived from the underlying AA+, AA and AA- rated

indices of the concerned Macaulay duration bucket. The indices are rebalanced and reconstituted on quarterly basis and issuer

level weights are capped at 10%.

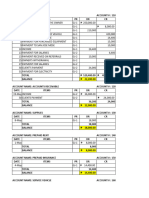

Index Characteristics

Methodology Total Returns

No. of Constituents 14

Launch Date February 09, 2018

Base Date September 03, 2001

Base Value 1000

Calculation Frequency Daily - End of day

Reconstitution Frequency Quarterly

Statistics ( Returns as on Oct 31, 2022 )

Index Name Avg. Avg. Avg. Macaulay Avg. Since

coupon % Yield %* Duration* Maturity* 3M 6M 1 Yr. 3 Yr. Inception

NIFTY AA Category Ultra Short Duration Bond Index 8.61 9.01 0.33 0.33 1.79 3.62 7.02 7.46 8.70

NIFTY AA Category Low Duration Bond Index 8.21 9.21 0.80 0.81 1.45 2.76 6.03 7.77 8.58

NIFTY AA Category Short Duration Bond Index 7.96 9.08 1.93 2.10 1.62 2.40 4.99 8.33 8.61

NIFTY AA Category Medium Duration Bond Index 7.62 9.53 3.49 4.01 1.75 2.61 4.63 8.57 8.51

NIFTY AA Category Medium to Long Duration Bond Index 8.85 9.36 5.54 7.51 2.67 4.69 7.45 10.12 8.63

NIFTY AA Category Long Duration Bond Index 8.16 8.68 8.10 13.39 1.08 0.46 2.10 2.77 7.43

Note: Returns for periods longer than 1 year are annualized

*As on October 31, 2022

NIFTY AA Category Corporate Bond Indices

I

N

D

E

X

V

A

L

V

U

A

E

L

S

U

E

S

Disclaimer: All information contained herewith is provided for reference purpose only. NSE Indices ensures accuracy and reliability of the above information to the best of its endeavors. However,

NSE Indices makes no warranty or representation as to the accuracy, completeness or reliability of any of the information contained herein and disclaim any and all liability whatsoever to any person

for any damage or loss of any nature arising from or as a result of reliance on any of the information provided herein. The information contained in this document is not intended to provide any

professional advice.

Contact us :

Email: indices@nse.co.in | Tel: +91 22 26598386 | Fax: +91 22 26598120

You might also like

- FAC1502 Assignment 4 2023Document193 pagesFAC1502 Assignment 4 2023Haat My Later100% (1)

- Harry BennettDocument1 pageHarry BennettEmannuel Ontario33% (3)

- HERTZ - Memo Group 4Document9 pagesHERTZ - Memo Group 4uygh gNo ratings yet

- SK Investment Group's ProposalDocument31 pagesSK Investment Group's ProposalLansingStateJournalNo ratings yet

- Factsheet NIFTY AA Category Corporate Bond IndicesDocument1 pageFactsheet NIFTY AA Category Corporate Bond IndicesGrimoire HeartsNo ratings yet

- Factsheet NIFTY AAA Corporate Bond IndicesDocument1 pageFactsheet NIFTY AAA Corporate Bond IndicesGrimoire HeartsNo ratings yet

- Kotak Bond Growth Direct: Interest Rate SensitivityDocument1 pageKotak Bond Growth Direct: Interest Rate SensitivityYogi173No ratings yet

- Cambria Emerging Shareholder Yield ETF: Strategy Overview Fund DetailsDocument2 pagesCambria Emerging Shareholder Yield ETF: Strategy Overview Fund DetailsJexNo ratings yet

- ValueResearchFundcard AxisBanking&PSUDebtFund 2019jan03Document4 pagesValueResearchFundcard AxisBanking&PSUDebtFund 2019jan03fukkatNo ratings yet

- Nippon India Low Duration FundDocument1 pageNippon India Low Duration FundYogi173No ratings yet

- QQQ - Empresas Nasdaq - QQQDocument2 pagesQQQ - Empresas Nasdaq - QQQGustavo NuCorNo ratings yet

- Morning Star Report 20190726102150Document1 pageMorning Star Report 20190726102150YumyumNo ratings yet

- QQQ 2Document2 pagesQQQ 2Dominic angelNo ratings yet

- Essel Regular Savings Fund GrowthDocument1 pageEssel Regular Savings Fund GrowthYogi173No ratings yet

- Ind Nifty Divid Opp50Document2 pagesInd Nifty Divid Opp50santosh kumarNo ratings yet

- Value Research Fundcard DSPBlackRock LiquidityFund InstitutionalPlan 2017sep11Document4 pagesValue Research Fundcard DSPBlackRock LiquidityFund InstitutionalPlan 2017sep11Chirag VoraNo ratings yet

- Morning Star Report 20190726102621Document1 pageMorning Star Report 20190726102621YumyumNo ratings yet

- Morning Star Report 20190725103110Document1 pageMorning Star Report 20190725103110SunNo ratings yet

- QQQ - Invesco QQQ ETF Fact SheetDocument2 pagesQQQ - Invesco QQQ ETF Fact SheetnamakerugojoNo ratings yet

- Morning Star Report 20190726102710Document1 pageMorning Star Report 20190726102710YumyumNo ratings yet

- Morning Star Report 20190726102118Document1 pageMorning Star Report 20190726102118YumyumNo ratings yet

- PBW - Invesco WilderHill Clean Energy ETF Fact SheetDocument2 pagesPBW - Invesco WilderHill Clean Energy ETF Fact SheetRahul SalveNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 Indexrahulojha123No ratings yet

- USAA Cornerstone Moderately Aggressive Fund 2022 - 1QDocument2 pagesUSAA Cornerstone Moderately Aggressive Fund 2022 - 1Qag rNo ratings yet

- Benchmark Report For India AIFs 2022Document7 pagesBenchmark Report For India AIFs 2022Apurva ChamariaNo ratings yet

- Kotak Gilt Investment Fund GrowthDocument1 pageKotak Gilt Investment Fund GrowthYogi173No ratings yet

- Morning Star Report 20190726102129Document1 pageMorning Star Report 20190726102129YumyumNo ratings yet

- Fs SP Uk Investment Grade Corporate Bond IndexDocument4 pagesFs SP Uk Investment Grade Corporate Bond IndexAlokNo ratings yet

- Morning Star Report 20171119125636Document2 pagesMorning Star Report 20171119125636wesamNo ratings yet

- Mirae Asset Hybrid Equity Fund - Direct Plan-GrowthDocument1 pageMirae Asset Hybrid Equity Fund - Direct Plan-GrowthnnnNo ratings yet

- ValueResearchFundcard KotakGiltInvestmentRegular 2010nov24Document6 pagesValueResearchFundcard KotakGiltInvestmentRegular 2010nov24zankurNo ratings yet

- Morning Star Report 20190726102105Document1 pageMorning Star Report 20190726102105YumyumNo ratings yet

- Morningstarreport 20230327061731Document1 pageMorningstarreport 20230327061731arian2026No ratings yet

- RWC Global Emerging Equity Fund: 30th June 2020Document2 pagesRWC Global Emerging Equity Fund: 30th June 2020Nat BanyatpiyaphodNo ratings yet

- Morning Star Report 20190725103333Document1 pageMorning Star Report 20190725103333SunNo ratings yet

- Comaparison of HDFC & Sbi - BFDocument5 pagesComaparison of HDFC & Sbi - BFsandeep aryaNo ratings yet

- SFM Q MTP 2 Final May22Document6 pagesSFM Q MTP 2 Final May22Divya AggarwalNo ratings yet

- JS Income FundDocument9 pagesJS Income Fundcoolbouy85No ratings yet

- Vanguard Windsor™ II FundDocument2 pagesVanguard Windsor™ II FundMcnet WideNo ratings yet

- Morning Star Report 20190720091725Document1 pageMorning Star Report 20190720091725SunNo ratings yet

- Schroders: Schroder ISF Global SMLR Coms A Acc USDDocument2 pagesSchroders: Schroder ISF Global SMLR Coms A Acc USDSam AbdurahimNo ratings yet

- Morning Star Report 20190726102604Document1 pageMorning Star Report 20190726102604YumyumNo ratings yet

- CFP SDL UK Buffettology Fund: Factsheet - February 2022Document2 pagesCFP SDL UK Buffettology Fund: Factsheet - February 2022MustafaGhulamNo ratings yet

- QQQM - Invesco NASDAQ 100 ETF Fact SheetDocument2 pagesQQQM - Invesco NASDAQ 100 ETF Fact SheetCitra LiaNo ratings yet

- Wack O Season FINAL Mailing VersionDocument76 pagesWack O Season FINAL Mailing VersionAnonymous Ht0MIJNo ratings yet

- IndiaBulls Fund FactsheetDocument1 pageIndiaBulls Fund Factsheetshivam234agrawalNo ratings yet

- 12-8-2020 TR No End in Sight - FinalDocument93 pages12-8-2020 TR No End in Sight - FinalZerohedge100% (4)

- Ind Nifty 200Document2 pagesInd Nifty 200badasserytechNo ratings yet

- Invesco MSCI Sustainable Future ETF: Growth of $10,000Document3 pagesInvesco MSCI Sustainable Future ETF: Growth of $10,000sarah martinNo ratings yet

- Morningstarreport 20230114061338Document1 pageMorningstarreport 20230114061338hkratheeNo ratings yet

- Nifty FactsheetDocument2 pagesNifty FactsheetTudou patelNo ratings yet

- Morning Star Report 20190726102634Document1 pageMorning Star Report 20190726102634YumyumNo ratings yet

- Franklin India Ultra Short Bond Fund - Super Institutional PlanDocument1 pageFranklin India Ultra Short Bond Fund - Super Institutional PlanTimNo ratings yet

- USAA Precious Metals and Mineral Fund - USAGX - 4Q 2022Document2 pagesUSAA Precious Metals and Mineral Fund - USAGX - 4Q 2022ag rNo ratings yet

- Morning Star Report 20190726102443Document1 pageMorning Star Report 20190726102443YumyumNo ratings yet

- Invesco QQQ Trust: Growth of $10,000Document2 pagesInvesco QQQ Trust: Growth of $10,000TotoNo ratings yet

- HDFC Mutual FUNDDocument22 pagesHDFC Mutual FUNDSushma VegesnaNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexSrikanth VgNo ratings yet

- CFP SDL UK Buffettology Fund: Factsheet - July 2019Document2 pagesCFP SDL UK Buffettology Fund: Factsheet - July 2019sky22blueNo ratings yet

- Axis Bluechip FundDocument1 pageAxis Bluechip Fundarian2026No ratings yet

- Aditya Birla Sun Life Short Term Fund Regular Plan Growth: Interest Rate SensitivityDocument1 pageAditya Birla Sun Life Short Term Fund Regular Plan Growth: Interest Rate SensitivityVijay ChandranNo ratings yet

- Factsheet_Nifty50_ShariahDocument2 pagesFactsheet_Nifty50_ShariahMohammad AleemNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Questions 2016 FRM1 PracticeExamDocument37 pagesQuestions 2016 FRM1 PracticeExamPaul Antonio Rios MurrugarraNo ratings yet

- WSJ 30-09Document45 pagesWSJ 30-09JNo ratings yet

- Real Estate ModelDocument56 pagesReal Estate ModelPrateek Agrawal100% (3)

- Income Tax Rates On IndividualsDocument4 pagesIncome Tax Rates On IndividualsThe man with a Square stacheNo ratings yet

- Act BulletinDocument27 pagesAct BulletinpapergateNo ratings yet

- Formative Assessment On Relative CostDocument8 pagesFormative Assessment On Relative CostChai MarapaoNo ratings yet

- BBMF 3083 Exam Paper September 2019Document6 pagesBBMF 3083 Exam Paper September 2019KAR ENG QUAHNo ratings yet

- XII Economics Guess Paper - 1Document5 pagesXII Economics Guess Paper - 1kawaljeetsingh121666No ratings yet

- Fabm - Q2 - Las-For LearnersDocument113 pagesFabm - Q2 - Las-For LearnersABM-AKRISTINE DELA CRUZNo ratings yet

- Automated System in BankingDocument67 pagesAutomated System in BankingRaj RamNo ratings yet

- 12 Accountancy CBSE Exam Papers 2015 Foreign Set 1Document28 pages12 Accountancy CBSE Exam Papers 2015 Foreign Set 1nayanaNo ratings yet

- Definition of 'Tangible Asset'Document3 pagesDefinition of 'Tangible Asset'coehNo ratings yet

- Ch03-Managing and Pricing Deposit ServicesDocument32 pagesCh03-Managing and Pricing Deposit ServicesVisal ChinNo ratings yet

- Ledger 2Document4 pagesLedger 2Hellarica AnabiezaNo ratings yet

- Chapter 3Document46 pagesChapter 3Leonardo WenceslaoNo ratings yet

- Training Session For AMFI Mutual Fund (Advisor) ModuleDocument143 pagesTraining Session For AMFI Mutual Fund (Advisor) ModulerajivsinghkashyapNo ratings yet

- Tax CalculaterDocument2 pagesTax CalculaterMahimaNo ratings yet

- Promissory NoteDocument4 pagesPromissory Noteheather valenzuela100% (1)

- Sav 1455Document6 pagesSav 1455Michael100% (5)

- Engineering Economy Lecture 6 With SW AsDocument2 pagesEngineering Economy Lecture 6 With SW AsAina MaeNo ratings yet

- Meaning:: Difference Between Equity Shares and Preference SharesDocument7 pagesMeaning:: Difference Between Equity Shares and Preference SharesAnkita ModiNo ratings yet

- S&OP Finance InvolDocument112 pagesS&OP Finance InvolPhantrungsonNo ratings yet

- Examination: Subject CT5 - Contingencies Core TechnicalDocument7 pagesExamination: Subject CT5 - Contingencies Core TechnicalMadonnaNo ratings yet

- FIN B385F Formula Book Unit 1Document3 pagesFIN B385F Formula Book Unit 1Cheng Chi HongNo ratings yet

- The Entrepreneurial ProcessDocument11 pagesThe Entrepreneurial Processainonlela50% (2)

- Fitbase Cancellation FormDocument1 pageFitbase Cancellation FormMarley HarrisNo ratings yet