Professional Documents

Culture Documents

InvoiceReportP1 10368 22 23

InvoiceReportP1 10368 22 23

Uploaded by

Raj kundraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

InvoiceReportP1 10368 22 23

InvoiceReportP1 10368 22 23

Uploaded by

Raj kundraCopyright:

Available Formats

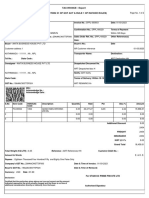

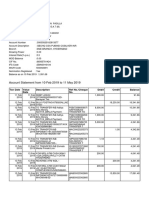

BALAJI EXTRUSIONS AND CABLES PVT. LTD.

Palsana Unit

Factory: Khata 754, Survey no. 313/2/P2 & 314, Village Palsana Pardi, Valsad, Gujarat - 396185

GSTIN: 24AABCB6376Q1Z6 CIN: U31300MH1998PTC113537 PAN: AABCB6376Q TAN: MUMB09923E

Buyer : ESS DEE INDUSTRIES, PUNE,,Gut no. 841 , plot no. C-41 Phase 1 , Consignee: ESS DEE INDUSTRIES, PUNE,,Gut no. 841 , plot no. C-41 Phase 1 ,

Mahalunge,Chakan Industrial area,Khed,PUNE,MAHARASHTRA Mahalunge,Chakan Industrial area,Khed,PUNE,MAHARASHTRA

Buyer GSTIN No : 27ACDPV1267F1ZI Consignee GSTIN No : 27ACDPV1267F1ZI

Buyer State Code : 27 Consignee State Code: 27

HSN CODE Invoice Number : P1-10368-22- Payment Terms: 60 days

PVC Insulated Cable 8544 1990 Invoice Date : 18/11/2022 Freight Terms : Freight Paid

QR SO No : S2211182 No. of packages : 1

a8647b710ef94df80fae3603cc6507702d92aa69d1755c

IRN: a3396254aa8600dfbd PO No : 222320739

Invoice No. : P1-10368-22-23 Page 1 of 1

No. of Total Rate per

Sl No. Item Description Customer Part no Total Assessable Value

Coils Quantity Unit

1 CB FLRY 16/.2MM YELLOW(BLACK) - 1.5 PVC0000235 1 1500.00 3.54 5310.00

2 CB FLRY 16/.2MM BLACK(YELLOW) - 1.5 PVC0000203 1 2000.00 3.54 7080.00

Sub Total : 2 3500.00 12390.00

Date & time of Preparation of Invoice : 3.22 PM 18-Nov-22 IRN Details and QR Code NET SALES 12390

Transport details : Balaji Transport Packaging and Forwarding Charges 0

Mode Of Transport : BY ROAD-GJ-15/AT-8483 Net Sales with P&F 12390

CGST 0.0 % 0

TAX IS PAYABLE ON REVERSE CHARGE : NO IGST 18.0 % 2230

IRN: a8647b710ef94df80fae3603cc6507702d92aa69d1755ca339 SGST 0.0 % 0

6254aa8600dfbd TCS 0.1 % 0

TOTAL INVOICE VALUE IN RUPEES GROSS

14620

Fourteen Thousand Six Hundred and Twenty Rupees TOTAL

Terms : Certified that the particulars given above are true and

1) All payments should be made by A/c payee cheques/bank transfer within the aforesaid payment correct and the amount indicated represents the price

terms. actually charged and there is no additional consideration

2) If payment is not received on due date interest @ 24% per annum shall be charged. flowing directly or indirectly from the buyer.

3) No complaints in respect of material supplied under this invoice will be entertained

unless the same is made in writing within ten days of dispatch.

4) Transactions covered under this Invoice are subject to jurisdiction of mumbai/daman courts.

5) Extra copy not for GST purposes.

Invoice No. : P1-10368-22-23 Page 1 of 1

You might also like

- 3-Month Statement PDFDocument7 pages3-Month Statement PDFConrad Thamsanqa Sqede Mthunzi100% (2)

- Western Union Carding TutorialDocument5 pagesWestern Union Carding TutorialBass12100% (2)

- Lamudi Broker Contract Agreement - Johnson PalmaresDocument6 pagesLamudi Broker Contract Agreement - Johnson PalmaresJonson PalmaresNo ratings yet

- T1D-T178 Pin0000251357 - 1Document1 pageT1D-T178 Pin0000251357 - 1Gangadhar SakthiNo ratings yet

- Kingdee K3-Purchasing, AP and PaymentDocument19 pagesKingdee K3-Purchasing, AP and PaymentClaudia ChongNo ratings yet

- Contracts: Appropriation of Payments.Document8 pagesContracts: Appropriation of Payments.DigvijayNo ratings yet

- InvoiceReportP1 10343 22 23Document1 pageInvoiceReportP1 10343 22 23Raj kundraNo ratings yet

- Party Details:: Description of Goods Code QT Y. Unit List PriceDocument4 pagesParty Details:: Description of Goods Code QT Y. Unit List PriceShadab AhamadNo ratings yet

- INFINITI RETAIL LIMITED (Trading As Cromā) : Tax InvoiceDocument3 pagesINFINITI RETAIL LIMITED (Trading As Cromā) : Tax Invoicemarketbus12No ratings yet

- Samsung Invoice 12357051967-7156716887-27W0I0234223Document1 pageSamsung Invoice 12357051967-7156716887-27W0I0234223BarunMondalNo ratings yet

- Ap Ele 230240Document1 pageAp Ele 230240Mohammad Azhar AliNo ratings yet

- PDFDocument1 pagePDFAjay SakatNo ratings yet

- PDFDocument1 pagePDFAjay SakatNo ratings yet

- TLC Nov22Document1 pageTLC Nov22ABhshekNo ratings yet

- Cremica Food Industries Limited: Tax InvoiceDocument1 pageCremica Food Industries Limited: Tax InvoiceKartik DhimanNo ratings yet

- Invoice CT-2232849Document3 pagesInvoice CT-2232849ABALUNo ratings yet

- Docket ConsignorDocument1 pageDocket ConsignorfloraepoxyNo ratings yet

- Tax Invoice: Tax Amount Amount Rate ValueDocument4 pagesTax Invoice: Tax Amount Amount Rate ValueaaftabganaiNo ratings yet

- InvoiceReportP1 8952 22 23Document1 pageInvoiceReportP1 8952 22 23Raj kundraNo ratings yet

- CCU267960ES BNR T02253 Inv249 20240326152919.146Document2 pagesCCU267960ES BNR T02253 Inv249 20240326152919.146Tapas GhoshNo ratings yet

- A.N Hussunally & Co. f09783Document1 pageA.N Hussunally & Co. f09783abhhijit1170No ratings yet

- Retail Invoice: Meghbela Cable & Broadband Services Pvt. Ltd. (An ISO 9001: 2015 Certified Company)Document2 pagesRetail Invoice: Meghbela Cable & Broadband Services Pvt. Ltd. (An ISO 9001: 2015 Certified Company)riyachoursiabackupNo ratings yet

- OH2GRUKPODocument4 pagesOH2GRUKPO150819850No ratings yet

- Samsung Invoice 11368149082-7136589175-29S1I0155587Document1 pageSamsung Invoice 11368149082-7136589175-29S1I0155587bobbilipooliNo ratings yet

- Tax Invoice ExportDocument2 pagesTax Invoice ExportPrabhatNo ratings yet

- Invoice TG2301395716Document2 pagesInvoice TG2301395716kisanenterprises007No ratings yet

- 1306034446GUR212343254Document2 pages1306034446GUR212343254raom05495No ratings yet

- Indumoti Kumardubi 0950Document3 pagesIndumoti Kumardubi 0950souravsrkNo ratings yet

- Minar Plastic 0105 - 240329 - 151311Document3 pagesMinar Plastic 0105 - 240329 - 151311minarplastic200No ratings yet

- UP0925TS003730 NF1138 30-Apr-2024Document4 pagesUP0925TS003730 NF1138 30-Apr-202418063503196No ratings yet

- 33 AsdDocument1 page33 Asdchennainash5100No ratings yet

- Minar Plastic 0104 - 240329 - 151232Document3 pagesMinar Plastic 0104 - 240329 - 151232minarplastic200No ratings yet

- Sensitivity: LNT Construction Internal UseDocument4 pagesSensitivity: LNT Construction Internal UseSanket KapadnisNo ratings yet

- Lum Inv Lum114 5600026405 SignedDocument2 pagesLum Inv Lum114 5600026405 SignedIrshad BilalNo ratings yet

- WiFi - AdapterDocument1 pageWiFi - AdapterManohar Singh KitawatNo ratings yet

- S7 Inv-2Document5 pagesS7 Inv-2M.TayyabNo ratings yet

- MaheshbiilDocument1 pageMaheshbiilSOURAAVNo ratings yet

- Samsung Invoice 22104070200-7228214173-Z9NJI4028909Document1 pageSamsung Invoice 22104070200-7228214173-Z9NJI4028909f4752gtvccNo ratings yet

- Mat627402plk17953 Manish KindoDocument1 pageMat627402plk17953 Manish Kindoanitamalviya789No ratings yet

- DEPREEDocument1 pageDEPREEAkhil DasNo ratings yet

- Sticker + CableDocument3 pagesSticker + CableRohan DesaiNo ratings yet

- GoldenDocument1 pageGoldenGOLDEN MOTORSNo ratings yet

- Job Card Retail - Tax InvoiceDocument2 pagesJob Card Retail - Tax Invoicegeorgy wilsonNo ratings yet

- Mat568007rka07221 ArchitDocument2 pagesMat568007rka07221 Architanitamalviya789No ratings yet

- Inb002324 006062Document1 pageInb002324 006062Sam PaulNo ratings yet

- AuwmDocument1 pageAuwmNishanthNo ratings yet

- Honda Energhy MeterDocument2 pagesHonda Energhy MeterfinanceabsairtechNo ratings yet

- KA2924TS038432 NF1138 31-Dec-2023Document4 pagesKA2924TS038432 NF1138 31-Dec-202318063503196No ratings yet

- 8018033943Document1 page8018033943AnushaNo ratings yet

- Tax Invoice: GST Invoice No: S12324018292 GST Invoice DT: 30.03.2024Document5 pagesTax Invoice: GST Invoice No: S12324018292 GST Invoice DT: 30.03.2024vishalhardwareandpaintsNo ratings yet

- PF Invoice - OhsDocument1 pagePF Invoice - OhsALOKE GANGULYNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Qusai KHNo ratings yet

- ManojDocument2 pagesManojAditya PandeyNo ratings yet

- VVR Spices GST 22-23-65Document1 pageVVR Spices GST 22-23-65Usha Hasini VelagapudiNo ratings yet

- 142Document1 page142Taranjot SinghNo ratings yet

- Tax Invoice: GSTIN/UIN: 29BISPK3225J1ZT State Name: Karnataka, Code: 29Document1 pageTax Invoice: GSTIN/UIN: 29BISPK3225J1ZT State Name: Karnataka, Code: 29sudheer kulkarniNo ratings yet

- Invoice CT-2236894Document3 pagesInvoice CT-2236894ABALUNo ratings yet

- Tax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPDocument1 pageTax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPAbhijit SarkarNo ratings yet

- PDF FileDocument2 pagesPDF Filearjun duaNo ratings yet

- 9517309706Document2 pages9517309706Doita Dutta ChoudhuryNo ratings yet

- Jac JW 23241548Document3 pagesJac JW 23241548Jugal mahatoNo ratings yet

- Tally Doc 1Document4 pagesTally Doc 1Asok DasNo ratings yet

- Tax Invoice: 827e98c13423a519e7dcDocument2 pagesTax Invoice: 827e98c13423a519e7dctejasviNo ratings yet

- Adobe Scan 7 Mar 2023Document1 pageAdobe Scan 7 Mar 2023Apurva KumarNo ratings yet

- Value for Money in Public–Private Partnerships: An Infrastructure Governance ApproachFrom EverandValue for Money in Public–Private Partnerships: An Infrastructure Governance ApproachNo ratings yet

- PE RO Price Circular Wef 1st Aug 2022Document103 pagesPE RO Price Circular Wef 1st Aug 2022DEEKSHA GUPTANo ratings yet

- Receipt and Payment AccountDocument3 pagesReceipt and Payment AccountAl FahriNo ratings yet

- Desarrollo Guia 10Document16 pagesDesarrollo Guia 10Ibeth DahanaNo ratings yet

- Chapter 10: Auditing Cash and Marketable SecuritiesDocument24 pagesChapter 10: Auditing Cash and Marketable SecuritiesMerliza JusayanNo ratings yet

- Intermediate Accounting Chapter 1 Exercises - ValixDocument46 pagesIntermediate Accounting Chapter 1 Exercises - ValixAbbie ProfugoNo ratings yet

- Evidence 3Document451 pagesEvidence 3Leonor LeonorNo ratings yet

- Payroll AuditDocument12 pagesPayroll AuditmazorodzesNo ratings yet

- The Recovery of Debts Inherent in Cheques Without Cover in Cameroon Via The OHADA Simplified Recovery Procedure and Enforcement MeasuresDocument11 pagesThe Recovery of Debts Inherent in Cheques Without Cover in Cameroon Via The OHADA Simplified Recovery Procedure and Enforcement MeasuresEditor IJTSRDNo ratings yet

- Origin of The Word: Banca, From Old High German Banc, Bank "Bench, Counter". Benches Were Used As Desks orDocument6 pagesOrigin of The Word: Banca, From Old High German Banc, Bank "Bench, Counter". Benches Were Used As Desks orSarvesh JaiswalNo ratings yet

- Epb 7 M ACBZ47 TSCs LDocument8 pagesEpb 7 M ACBZ47 TSCs LSolomon PasulaNo ratings yet

- StatementDocument3 pagesStatementHaris MusakhelNo ratings yet

- DR AlliDocument20 pagesDR AlliDr K. Mamatha Prof & Hod FMTNo ratings yet

- PECO vs. Soriano: Kool Kids 2016 - ALS 2DDocument1 pagePECO vs. Soriano: Kool Kids 2016 - ALS 2DKobe Lawrence VeneracionNo ratings yet

- BPI v. CADocument5 pagesBPI v. CAElizabeth LotillaNo ratings yet

- Jawaban Ud WirastriDocument17 pagesJawaban Ud WirastriDevitaNo ratings yet

- Question Bank 10405Document1,201 pagesQuestion Bank 10405Web SeriesNo ratings yet

- Move 2500Document2 pagesMove 2500Sandro LimaNo ratings yet

- Codigos Object - Types SAP 9Document16 pagesCodigos Object - Types SAP 9Zinkro ClNo ratings yet

- Conclusion and Suggestions: Chapte R-9Document24 pagesConclusion and Suggestions: Chapte R-9Hamdan HassinNo ratings yet

- Brightwell CashPickup 33TF078444391Document2 pagesBrightwell CashPickup 33TF078444391Edz carl AberiaNo ratings yet

- Indian Start-Ups BY ANIKETDocument28 pagesIndian Start-Ups BY ANIKETAniket KarnNo ratings yet

- Citibank IndiaDocument2 pagesCitibank IndiamukeshNo ratings yet

- Javellana vs. MirasolDocument6 pagesJavellana vs. MirasolMj BrionesNo ratings yet

- OblivionDocument25 pagesOblivionDan MichaelNo ratings yet

- LOA Du Hoc Canada Het Bao Nhieu Tien Edutrust - Edu - .VNDocument2 pagesLOA Du Hoc Canada Het Bao Nhieu Tien Edutrust - Edu - .VNAmoure TubeeNo ratings yet