Professional Documents

Culture Documents

PROBLEM 1 and 2

PROBLEM 1 and 2

Uploaded by

Thea Misola0 ratings0% found this document useful (0 votes)

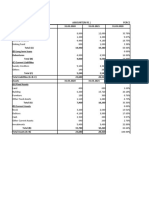

12 views3 pagesThe comparative balance sheet shows ABC Company's assets increased 25% to $1,000 from $800 in 2020 compared to 2019, with current assets up 20% and plant assets up 28%, while total liabilities and shareholder's equity also rose 25% to match the increase in total assets. The percentages of total assets and total liabilities/shareholder's equity remained the same between the two years.

Original Description:

Original Title

PROBLEM 1 and 2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe comparative balance sheet shows ABC Company's assets increased 25% to $1,000 from $800 in 2020 compared to 2019, with current assets up 20% and plant assets up 28%, while total liabilities and shareholder's equity also rose 25% to match the increase in total assets. The percentages of total assets and total liabilities/shareholder's equity remained the same between the two years.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views3 pagesPROBLEM 1 and 2

PROBLEM 1 and 2

Uploaded by

Thea MisolaThe comparative balance sheet shows ABC Company's assets increased 25% to $1,000 from $800 in 2020 compared to 2019, with current assets up 20% and plant assets up 28%, while total liabilities and shareholder's equity also rose 25% to match the increase in total assets. The percentages of total assets and total liabilities/shareholder's equity remained the same between the two years.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

PROBLEM 1.

ABC COMPANY

Comparative Balance Sheet

December 31

ASSETS 2020 2019 Difference Percent

Current Assets 360 300 60 20%

Plant Assets 640 500 140 28%

Total Assets 1,000 800 200 25%

Liabilities and

Stockholder’s

Equity

Current Liabilities 150 120 30 25%

Long Term Debt 240 160 80 50%

Common Stock 350 280 70 25%

Retained Earnings 260 240 20 8%

Total Liabilities 1,000 800 200 25%

and

Shareholder’s

Equity

PROBLEM 1.B

ABC COMPANY

Comparative Balance Sheet

December 31

ASSETS 2020 Percent 2019 Percent

Current Assets 360 36% 60 37.5%

Plant Assets 640 64% 140 62.5%

Total Assets 1,000 100% 200 100%

Liabilities and

Stockholder’s

Equity

Current Liabilities 150 15% 30 15%

Long Term Debt 240 24% 80 20%

Common Stock 350 35% 70 35%

Retained Earnings 260 26% 20 30%

Total Liabilities 1,000 100% 200 100%

and

Shareholder’s

Equity

a. Gross Margin Percentage= Gross Margin/Sales

430,000/1,130,000= 38.05

b. Working Capital= Current Assets- Current Liabilities

620,000-250,000= 370,000

c. Current Ratio= Current Assets/ Current Liabilities

620,000/250,000= 2.48

d. Acid-test Ration= Quick Assets/ Current Liabilities

620,000-140,000/250,000= 1.92

e. Account Receivable Turnover= Sales on Account/ Average Account Receivable

190,000+200,000/2= 195,000

1,130,000//195,000= 5.79

f. Average Collection Period= 365 days/ Account Receivable Turnover

365/ 5.79= 63.04

g. Inventory Turnover= Cost of Goods sold/ Average Inventory

700,000/140,000= 5

h. Average Sale Period= 365 days/ Inventory Turnover

365/ 5= 73

i. Times Interest Earned= Net Operating Income/ Interest Expense

186,000/29,000= 6.41

j. Debt-to-equity Ratio= Liabilities/ Stockholder’s Equity

470,000/930,000= 0.505

You might also like

- Cases Master PDFDocument11 pagesCases Master PDFSam PskovskiNo ratings yet

- Chris Moon - Business Ethics - Facing Up To The Issues (2001, Bloomberg Press) PDFDocument218 pagesChris Moon - Business Ethics - Facing Up To The Issues (2001, Bloomberg Press) PDFCostache Madalina AlexandraNo ratings yet

- Depreciation Method, LecturrequestionsDocument20 pagesDepreciation Method, LecturrequestionsKylie Luigi Leynes BagonNo ratings yet

- Analysis and Interpretation of FS-Part 1Document2 pagesAnalysis and Interpretation of FS-Part 1Rhea RamirezNo ratings yet

- Examination Element of M92 Insurance Business and Finance: The Chartered Insurance InstituteDocument24 pagesExamination Element of M92 Insurance Business and Finance: The Chartered Insurance InstituteApple JuiceNo ratings yet

- Workshop Week 5 SolutionsDocument8 pagesWorkshop Week 5 SolutionsAssessment Help SolutionsNo ratings yet

- Horizontal and Vertical ActivityDocument4 pagesHorizontal and Vertical ActivityKarlla ManalastasNo ratings yet

- YubarajDocument4 pagesYubarajYubraj ThapaNo ratings yet

- Mitchells Balance Sheet: Question 1)Document3 pagesMitchells Balance Sheet: Question 1)Hamna RizwanNo ratings yet

- Current Year Base Year Base Year X 100Document4 pagesCurrent Year Base Year Base Year X 100Kathlyn TajadaNo ratings yet

- Income Statement Company A Percent Company B Percent RevenueDocument4 pagesIncome Statement Company A Percent Company B Percent RevenueLina Levvenia RatanamNo ratings yet

- FSA SolutionsDocument7 pagesFSA SolutionsROHAN DESAINo ratings yet

- Trend AnalysisDocument1 pageTrend Analysisapi-385117572No ratings yet

- Paki Check BiDocument5 pagesPaki Check BiAusan AbdullahNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisEmmanuel PenullarNo ratings yet

- Common-Size Financial StatementsDocument16 pagesCommon-Size Financial StatementsApril IsidroNo ratings yet

- Managerial Finance AssingmentDocument9 pagesManagerial Finance AssingmentEf AtNo ratings yet

- Baker CorporationDocument1 pageBaker CorporationNextdoor CosplayerNo ratings yet

- Financial Ratio Questions 1Document7 pagesFinancial Ratio Questions 1Afnan QusyairiNo ratings yet

- Activity 2Document1 pageActivity 2soleilNo ratings yet

- BFN202 Seminar Questions SET1Document3 pagesBFN202 Seminar Questions SET1baba cacaNo ratings yet

- Tran Thi Thu Nguyet-PA3-HWCHAPTER18Document3 pagesTran Thi Thu Nguyet-PA3-HWCHAPTER18Nguyet Tran Thi ThuNo ratings yet

- Latihan Analisis Horizontal VertikalDocument4 pagesLatihan Analisis Horizontal Vertikaltheresia paulintiaNo ratings yet

- Ratio CourseworkDocument5 pagesRatio CourseworkMarc WrightNo ratings yet

- Statement AnalysisDocument4 pagesStatement AnalysisrameelNo ratings yet

- 2020 Acc 410 Test 1Document8 pages2020 Acc 410 Test 1Kesa Metsi100% (1)

- Questions Financial Statements Financial AnalysisDocument3 pagesQuestions Financial Statements Financial AnalysisBir kişiNo ratings yet

- Ratio and Trend Analysis (FC)Document26 pagesRatio and Trend Analysis (FC)Cindelyn LibodlibodNo ratings yet

- Revised Verti On SFP 2019Document2 pagesRevised Verti On SFP 2019cheesekuhNo ratings yet

- FS Analysis Horizontal Vertical ExerciseDocument5 pagesFS Analysis Horizontal Vertical ExerciseCarla Noreen CasianoNo ratings yet

- Fall FIN 254.10 Mid QuestionsDocument2 pagesFall FIN 254.10 Mid QuestionsShariar NehalNo ratings yet

- Cost of Capital Wacc UpdatedDocument46 pagesCost of Capital Wacc UpdatedDEBAPRIYA SARKARNo ratings yet

- Ec FM Quiz.092023Document3 pagesEc FM Quiz.092023Jenalyn OrtegaNo ratings yet

- Midterm Excel Worksheet - OlivieriDocument14 pagesMidterm Excel Worksheet - OlivieriEmanuele OlivieriNo ratings yet

- FORMAT Complete The BS ISDocument1 pageFORMAT Complete The BS ISAmien MujibNo ratings yet

- ACCN. LOCKDOWN WORKSHEET 2aDocument2 pagesACCN. LOCKDOWN WORKSHEET 2aRyno de BeerNo ratings yet

- FinMan (Common-Size Analysis)Document4 pagesFinMan (Common-Size Analysis)Lorren Graze RamiroNo ratings yet

- Lecture4 - Principles of Finance - Financial Analysis - GARIVERADocument31 pagesLecture4 - Principles of Finance - Financial Analysis - GARIVERArenzen jay medenillaNo ratings yet

- Excel 1 - Common Sized Financial Statements - IrvinDocument2 pagesExcel 1 - Common Sized Financial Statements - Irvinapi-581024555No ratings yet

- Exercise On Csofp - Mixed TartDocument3 pagesExercise On Csofp - Mixed TartNoor ShukirrahNo ratings yet

- Green Manufacturing CompanyDocument3 pagesGreen Manufacturing Companyhyna_khanNo ratings yet

- Learning Activity 3 - Analysis of Financial StatementsDocument3 pagesLearning Activity 3 - Analysis of Financial StatementsAra Joyce PermalinoNo ratings yet

- Managerial Accounting PPDocument42 pagesManagerial Accounting PPSaurav KumarNo ratings yet

- Audit ReportDocument11 pagesAudit ReportAR Shihab ChowdhuryNo ratings yet

- Analysis and Interpretation of Financial Statements PDFDocument11 pagesAnalysis and Interpretation of Financial Statements PDFKudakwashe MujungwaNo ratings yet

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- Api SFPDocument1 pageApi SFPBoston wardNo ratings yet

- Financial Statement Analysis Discussion MaterialDocument3 pagesFinancial Statement Analysis Discussion MaterialMargin Pason RanjoNo ratings yet

- Exercise ProfitabilityDocument2 pagesExercise ProfitabilityPhong Nghiêm TấnNo ratings yet

- Amount (In RS.) PercentagesDocument3 pagesAmount (In RS.) PercentagesROHAN DESAINo ratings yet

- FM Must Do List!! May - 2023 (1) - 230501 - 220727Document86 pagesFM Must Do List!! May - 2023 (1) - 230501 - 220727Regan DcunhaNo ratings yet

- Horizontal Analysis:: James Corporation Comparative Statement of Financial PositionDocument7 pagesHorizontal Analysis:: James Corporation Comparative Statement of Financial PositionJohn Francis IdananNo ratings yet

- Week 6 AssignmentDocument3 pagesWeek 6 AssignmentLovepreet malhiNo ratings yet

- Finman FinalsDocument4 pagesFinman FinalsDianarose RioNo ratings yet

- Horizonatal & Vertical Analysis and RatiosDocument6 pagesHorizonatal & Vertical Analysis and RatiosNicole AlexandraNo ratings yet

- 89 F 4 EfsaDocument3 pages89 F 4 EfsaabhimussoorieNo ratings yet

- 201B 201A Peso Change % ChangeDocument4 pages201B 201A Peso Change % ChangeNin JahNo ratings yet

- C. Net Cash Flow From Operating Activities in 2009: Income Statement 2009Document4 pagesC. Net Cash Flow From Operating Activities in 2009: Income Statement 2009BảoNgọcNo ratings yet

- Management Accounting Problem Unit 2Document7 pagesManagement Accounting Problem Unit 2princeNo ratings yet

- Financial AnalysisDocument4 pagesFinancial AnalysisAira Cane EvangelistaNo ratings yet

- Far670 Tutorial Basis of AnalysisDocument3 pagesFar670 Tutorial Basis of Analysis2020482736No ratings yet

- H and V Anal ExerciseDocument3 pagesH and V Anal ExerciseSummer ClaronNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument9 pagesAnalysis and Interpretation of Financial StatementsMckayla Charmian CasumbalNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Activity 2Document2 pagesActivity 2Thea MisolaNo ratings yet

- Machiavellian PrincipleDocument1 pageMachiavellian PrincipleThea MisolaNo ratings yet

- Differences Between Accounting and Financial ManagementDocument3 pagesDifferences Between Accounting and Financial ManagementThea MisolaNo ratings yet

- Case 1 Group 1Document3 pagesCase 1 Group 1Thea MisolaNo ratings yet

- Chapter 10 PropertyDocument10 pagesChapter 10 Propertymaria isabellaNo ratings yet

- The Objective of General Purpose Financial ReportingDocument86 pagesThe Objective of General Purpose Financial ReportingAlex liaoNo ratings yet

- CH 10 Plant Assets Natural ResourcesDocument59 pagesCH 10 Plant Assets Natural ResourcesJochebed BuriasNo ratings yet

- JAC 12th Accounts Syllabus 2024Document6 pagesJAC 12th Accounts Syllabus 2024ap8204676No ratings yet

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- Solutions Chapter 2Document8 pagesSolutions Chapter 2Vân Anh Đỗ LêNo ratings yet

- MAN1068 Exam Paper 2021-22Document16 pagesMAN1068 Exam Paper 2021-22Praveena RavishankerNo ratings yet

- Chap 3 and 4 - ParcorDocument4 pagesChap 3 and 4 - ParcorAnne Gwynneth RadaNo ratings yet

- Lalit Ji Huf 20Document6 pagesLalit Ji Huf 20sunil jadhavNo ratings yet

- Muzica DescarcataDocument1 pageMuzica DescarcataAndreeaNo ratings yet

- Basics of InvestmentDocument19 pagesBasics of InvestmentJohn DawsonNo ratings yet

- Registered Guidelines On Tariff Determination Under IBR For SESBDocument132 pagesRegistered Guidelines On Tariff Determination Under IBR For SESBSobri Hj IbrahimNo ratings yet

- Short-Term Capital Losses & Long-Term Capital LossesDocument5 pagesShort-Term Capital Losses & Long-Term Capital Lossesramkrishna mahatoNo ratings yet

- Learner's Guide Senior Secondary Course-AccountancyDocument3 pagesLearner's Guide Senior Secondary Course-AccountancyAkshay KumarNo ratings yet

- Autumn 2011 - Midterm Assessment (25089)Document8 pagesAutumn 2011 - Midterm Assessment (25089)Marwa Nabil Shouman0% (1)

- ITC Financial ModelDocument123 pagesITC Financial ModelNareshNo ratings yet

- Intermediate AccountingDocument29 pagesIntermediate AccountingXandra GonzalesNo ratings yet

- Dwnload Full Foundations of Financial Management 16th Edition Block Test Bank PDFDocument35 pagesDwnload Full Foundations of Financial Management 16th Edition Block Test Bank PDFfruitfulbrawnedom7er4100% (13)

- IPCC MTP2 AccountingDocument7 pagesIPCC MTP2 AccountingBalaji SiddhuNo ratings yet

- Assignment On International Accounting StandardsDocument23 pagesAssignment On International Accounting StandardsIstiak HasanNo ratings yet

- Insurance Contracts and Service ConcessionDocument2 pagesInsurance Contracts and Service Concessionss calogsNo ratings yet

- Module 2. Government Chart of Accounts, Accounting and ReportingDocument19 pagesModule 2. Government Chart of Accounts, Accounting and ReportingMa. Leslyn NummilaNo ratings yet

- Principle of AccountingDocument106 pagesPrinciple of AccountingThắng Uông100% (1)

- Leaflet - HDFC Multi-Asset Fund - June 2024Document2 pagesLeaflet - HDFC Multi-Asset Fund - June 2024DeepakNo ratings yet

- Reo Batch 3 May 2022: Auditing TheoryDocument38 pagesReo Batch 3 May 2022: Auditing TheorySova OmenPhoenixNo ratings yet

- Clem Chambers - A Beginner's Guide To Value Investing-ADVFN Books (2013)Document73 pagesClem Chambers - A Beginner's Guide To Value Investing-ADVFN Books (2013)Alonso García MatallanaNo ratings yet