Professional Documents

Culture Documents

File 726201175541 PMBSmoney JULY27

File 726201175541 PMBSmoney JULY27

Uploaded by

Dave VachonCopyright:

Available Formats

You might also like

- FIR Case StudyDocument3 pagesFIR Case StudyTamaraNo ratings yet

- Summer Internship Project Report Axis Bank For Mba StudentDocument79 pagesSummer Internship Project Report Axis Bank For Mba StudentPrem SrivastavaNo ratings yet

- Goldman and The OIS Gold RushDocument0 pagesGoldman and The OIS Gold Rushalexis_miaNo ratings yet

- Pom Inventory ProblemsDocument8 pagesPom Inventory ProblemsSharath Kannan0% (2)

- Challan Form OEC App Fee 500 PDFDocument1 pageChallan Form OEC App Fee 500 PDFsaleem_hazim100% (1)

- PennyMac Mortgage Investment TrustDocument2 pagesPennyMac Mortgage Investment Trustank333No ratings yet

- File 1011201182338 PMBSmoney OCT12Document1 pageFile 1011201182338 PMBSmoney OCT12Dave VachonNo ratings yet

- Letter of CreditDocument8 pagesLetter of CreditswatiraghupatruniNo ratings yet

- PSIfinancialreportrelease 041311Document4 pagesPSIfinancialreportrelease 041311Carrie PowersNo ratings yet

- Feb Hit 36 BvilleDocument1 pageFeb Hit 36 BvillePrice LangNo ratings yet

- Financial News Articles - COMPLETE ARCHIVEDocument319 pagesFinancial News Articles - COMPLETE ARCHIVEKeith KnightNo ratings yet

- Private WealthDocument4 pagesPrivate WealthKunal DesaiNo ratings yet

- Citation: by Joe Bel Bruno "Failed Banks Weighing On FDIC, Amounts Tapped by AgencyDocument10 pagesCitation: by Joe Bel Bruno "Failed Banks Weighing On FDIC, Amounts Tapped by Agencyss041782No ratings yet

- Radar 05 2014 1117 DeepDive Red Tape in OzDocument3 pagesRadar 05 2014 1117 DeepDive Red Tape in OzzeronomicsNo ratings yet

- Michael Sanderson On Equality of Arms in The Law in AustraliaDocument28 pagesMichael Sanderson On Equality of Arms in The Law in AustraliaSenateBriberyInquiryNo ratings yet

- They Thought Their Money Was in High-Interest Accounts-They Got Paid Peanuts - WSJDocument4 pagesThey Thought Their Money Was in High-Interest Accounts-They Got Paid Peanuts - WSJqvrlenarasegtNo ratings yet

- 2012年12月英语六级真题Document15 pages2012年12月英语六级真题六级真题及解析(1990-2022)No ratings yet

- Macquarie Group Announces 501m ProfitDocument4 pagesMacquarie Group Announces 501m Profitapi-239934747No ratings yet

- The Money Laundering Issue in SCBDocument14 pagesThe Money Laundering Issue in SCBaditya saiNo ratings yet

- (15-00293 241-3) Ex C - JPMC-MRS-00005210-11Document4 pages(15-00293 241-3) Ex C - JPMC-MRS-00005210-11larry-612445No ratings yet

- Lloyds Bank Staff Puts Frighteners' On Debtors 12.04.09Document4 pagesLloyds Bank Staff Puts Frighteners' On Debtors 12.04.09Simply Debt SolutionsNo ratings yet

- Markets Hit As Euro Hopes Fade: FSA: Beef Up EU Rules After RBSDocument48 pagesMarkets Hit As Euro Hopes Fade: FSA: Beef Up EU Rules After RBSCity A.M.No ratings yet

- July 12Document64 pagesJuly 12Saifur RahmanNo ratings yet

- 8.3 Risk and TrustDocument16 pages8.3 Risk and TrustShanu JosephNo ratings yet

- The Pensford Letter - 7.2.12Document5 pagesThe Pensford Letter - 7.2.12Pensford FinancialNo ratings yet

- The Pensford Letter - 7.2.12Document5 pagesThe Pensford Letter - 7.2.12Pensford FinancialNo ratings yet

- The Pensford Letter - 7.2.12Document5 pagesThe Pensford Letter - 7.2.12Pensford FinancialNo ratings yet

- Global Financial Crisis During 2008-2010Document12 pagesGlobal Financial Crisis During 2008-2010Mega Pop LockerNo ratings yet

- Jean Ramirez - Inside Job Movie ReviewDocument14 pagesJean Ramirez - Inside Job Movie ReviewJean Paul RamirezNo ratings yet

- Russia'S Revolution: Rate-Riggers To Face Trial in UsaDocument27 pagesRussia'S Revolution: Rate-Riggers To Face Trial in UsaCity A.M.No ratings yet

- Sub Prime Overview For Samir 1 Final 97-2003 FormatDocument10 pagesSub Prime Overview For Samir 1 Final 97-2003 FormatAliasgar SuratwalaNo ratings yet

- FinTech Rising: Navigating the maze of US & EU regulationsFrom EverandFinTech Rising: Navigating the maze of US & EU regulationsRating: 5 out of 5 stars5/5 (1)

- Credit Card Pricing Strategy: Davide Capodici, Brooke Chang, Brian Feldman, Erica GluckDocument75 pagesCredit Card Pricing Strategy: Davide Capodici, Brooke Chang, Brian Feldman, Erica GluckBinay Kumar SinghNo ratings yet

- U.S. Takes Steps To Stem Bank Fallout: Mon 03/13/2023 Page: A1Document4 pagesU.S. Takes Steps To Stem Bank Fallout: Mon 03/13/2023 Page: A1Victor Huaranga CoronadoNo ratings yet

- IceCap February 2011 Global Market OutlookDocument8 pagesIceCap February 2011 Global Market OutlookIceCap Asset ManagementNo ratings yet

- Surge in Liar Loans' From Major Aussie Bank Is Concerning'Document6 pagesSurge in Liar Loans' From Major Aussie Bank Is Concerning'Rajiv RajNo ratings yet

- TrueCredit Education BrochureDocument12 pagesTrueCredit Education BrochureHameed WesabiNo ratings yet

- Hayden Captal APT PresentationDocument34 pagesHayden Captal APT PresentationMarirs LapogajarNo ratings yet

- WallstreetJournalDocument28 pagesWallstreetJournalDeepti AgarwalNo ratings yet

- Inside Job SummaryDocument2 pagesInside Job SummaryAmmar UbaidNo ratings yet

- Stashing Cash: $1.4-Billion Takeover by A U.S. CompanyDocument7 pagesStashing Cash: $1.4-Billion Takeover by A U.S. CompanyStephan FongNo ratings yet

- Home Capital Group Initiating Coverage (HCG-T)Document68 pagesHome Capital Group Initiating Coverage (HCG-T)Zee MaqsoodNo ratings yet

- Accounting Information Systems - Computer FraudDocument84 pagesAccounting Information Systems - Computer FraudDr Rushen SinghNo ratings yet

- 2012 11 13 Cyn Bofa-Ml Slides FinalDocument37 pages2012 11 13 Cyn Bofa-Ml Slides FinalrgosaliaNo ratings yet

- Market Commentary 06-27-11Document3 pagesMarket Commentary 06-27-11monarchadvisorygroupNo ratings yet

- Treasury Scrutinizes Credit Unions - WSJDocument4 pagesTreasury Scrutinizes Credit Unions - WSJdbr trackdNo ratings yet

- Ormalization: ECONOMIC DATA With Impact Positive ImpactsDocument5 pagesOrmalization: ECONOMIC DATA With Impact Positive Impactsfred607No ratings yet

- La Era de La ViolenciaDocument2 pagesLa Era de La ViolenciaAlexis TabaresNo ratings yet

- KPMG Closes The Books On New Century & CountryWideDocument7 pagesKPMG Closes The Books On New Century & CountryWide83jjmackNo ratings yet

- Banking's Next Big BattleDocument8 pagesBanking's Next Big BattleJaskeerat SinghNo ratings yet

- BP Holdings Article Code 85258080768: Feeding FrenzyDocument5 pagesBP Holdings Article Code 85258080768: Feeding Frenzychesleayearly100% (1)

- Another Financial Meltdown Is Closer Than It Appears.: Source: FREDDocument14 pagesAnother Financial Meltdown Is Closer Than It Appears.: Source: FREDVidit HarsulkarNo ratings yet

- Dow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysDocument10 pagesDow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysAlbert L. PeiaNo ratings yet

- Dow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysDocument10 pagesDow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysAlbert L. PeiaNo ratings yet

- Aug 4thDocument15 pagesAug 4thshefalijnNo ratings yet

- Americas Growing Fringe Economy Karger06Document6 pagesAmericas Growing Fringe Economy Karger06Mehdi BoujalalNo ratings yet

- CIT Files BankruptcyDocument2 pagesCIT Files BankruptcyAdam HollierNo ratings yet

- Canadian Banking PDFDocument41 pagesCanadian Banking PDFFuria_hetalNo ratings yet

- Hungry Jack's Vouchers: Your Ticket To Delicious and Affordable Fast FoodDocument13 pagesHungry Jack's Vouchers: Your Ticket To Delicious and Affordable Fast FoodMonibulNo ratings yet

- Cityam 2011-07-05Document28 pagesCityam 2011-07-05City A.M.No ratings yet

- The Plastic Prison: Common Ground Creativity 0 CommentsDocument5 pagesThe Plastic Prison: Common Ground Creativity 0 CommentsSimply Debt SolutionsNo ratings yet

- JPM InitiatingCoverageDocument11 pagesJPM InitiatingCoveragePauline Da CostaNo ratings yet

- BUS 401.3 Movie Assignment On: Inside Job'Document4 pagesBUS 401.3 Movie Assignment On: Inside Job'Nabil HuqNo ratings yet

- Fraud 101: Techniques and Strategies for Understanding FraudFrom EverandFraud 101: Techniques and Strategies for Understanding FraudNo ratings yet

- File 48201260915 PMPQMIBSontario APR9Document1 pageFile 48201260915 PMPQMIBSontario APR9Dave VachonNo ratings yet

- Election Page 2012Document1 pageElection Page 2012Dave VachonNo ratings yet

- Bell 072012 21Document1 pageBell 072012 21Dave VachonNo ratings yet

- File 1011201182338 PMBSmoney OCT12Document1 pageFile 1011201182338 PMBSmoney OCT12Dave VachonNo ratings yet

- Bell 081911 C1Document1 pageBell 081911 C1Dave VachonNo ratings yet

- File 127201250647 PMPQMIBSEnt Jan 28 FIXDocument1 pageFile 127201250647 PMPQMIBSEnt Jan 28 FIXDave VachonNo ratings yet

- ED 8wing Major Troy PaisleyDocument2 pagesED 8wing Major Troy PaisleyDave VachonNo ratings yet

- File 921201165113 PMPQMIent Sept 22 BSDocument1 pageFile 921201165113 PMPQMIent Sept 22 BSDave VachonNo ratings yet

- ED QuinteResidentsRememberDocument3 pagesED QuinteResidentsRememberDave VachonNo ratings yet

- File 722201172918 PMPQMIBSMoney July 23Document1 pageFile 722201172918 PMPQMIBSMoney July 23Dave VachonNo ratings yet

- File 62201155751 PMPQMIjun 4 TdydvdmovieplusDocument1 pageFile 62201155751 PMPQMIjun 4 TdydvdmovieplusDave VachonNo ratings yet

- File 814201121228 PMBSsomalia FULLaug 15Document1 pageFile 814201121228 PMBSsomalia FULLaug 15Dave VachonNo ratings yet

- Traffic Restrictions - June 6 - June 10Document2 pagesTraffic Restrictions - June 6 - June 10Dave VachonNo ratings yet

- File 62201153258 PMPQMIjun 4 Today ENOUGHDocument1 pageFile 62201153258 PMPQMIjun 4 Today ENOUGHDave VachonNo ratings yet

- File 531201181651 PMPQMIBSMoney June 1 FixDocument1 pageFile 531201181651 PMPQMIBSMoney June 1 FixDave VachonNo ratings yet

- File 531201181933 PMBSnhlplayoffs June 1Document1 pageFile 531201181933 PMBSnhlplayoffs June 1Dave VachonNo ratings yet

- File 531201180357 PMBSontario JUN1Document1 pageFile 531201180357 PMBSontario JUN1Dave VachonNo ratings yet

- File5302011101255pmbs Money May 31 Fix Final 02Document1 pageFile5302011101255pmbs Money May 31 Fix Final 02Dave VachonNo ratings yet

- File 530201181927 PMBSontario MAY31Document1 pageFile 530201181927 PMBSontario MAY31Dave VachonNo ratings yet

- Mrs KavitamazumdaraDocument2 pagesMrs KavitamazumdaraMuhammad Asyrofi AnshariNo ratings yet

- LDNDocument2 pagesLDNShaharyar KhanNo ratings yet

- Week 5 Questions - RYDocument6 pagesWeek 5 Questions - RYRishat KayirlyNo ratings yet

- BankingDocument13 pagesBankingPranav SethNo ratings yet

- Rich Dads Guide To Investing With Opm 2019Document5 pagesRich Dads Guide To Investing With Opm 2019Mas Pion ArciereNo ratings yet

- Cma With Cra For Bank ProjectionDocument31 pagesCma With Cra For Bank ProjectionMuthu SundarNo ratings yet

- IBS - MBS - BHIM PNB FAQs - Revised-CompressedDocument13 pagesIBS - MBS - BHIM PNB FAQs - Revised-Compressedemraan KhanNo ratings yet

- Karina's Online Banking Project-1Document46 pagesKarina's Online Banking Project-1KashifNo ratings yet

- Anukrit CVDocument2 pagesAnukrit CVmarkytylerNo ratings yet

- Allied Banking Vs Lim Sio WanDocument3 pagesAllied Banking Vs Lim Sio WanSamantha Ann T. Tirthdas100% (1)

- Anoop Mohanty - Banking System Paradox - 1Document6 pagesAnoop Mohanty - Banking System Paradox - 1AasthaNo ratings yet

- Syllabus of Banking & Insurance LawDocument4 pagesSyllabus of Banking & Insurance LawAkshay DhawanNo ratings yet

- Vol Bills Booked With ProductivityDocument1,013 pagesVol Bills Booked With Productivityshail_juneNo ratings yet

- Fow Spring 2013Document27 pagesFow Spring 2013Arifisal DoankNo ratings yet

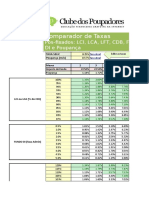

- CP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIDocument5 pagesCP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIeduardolavratiNo ratings yet

- Week 2 Marketing EnvironmentDocument19 pagesWeek 2 Marketing EnvironmentMeghna JainNo ratings yet

- 2 - Bank Contract - Hongda Chem Vzla CADocument12 pages2 - Bank Contract - Hongda Chem Vzla CAjose cordovezNo ratings yet

- 19TH0DEC02016Document2 pages19TH0DEC02016Anonymous Fyi4eNxsNo ratings yet

- Business Application 2018Document2 pagesBusiness Application 2018Janet SimovicNo ratings yet

- Zero Balance Form - SFLBDocument3 pagesZero Balance Form - SFLBroshcrazyNo ratings yet

- Barkatullah Vishwavidyalaya Migration Cert - Format FilledupDocument5 pagesBarkatullah Vishwavidyalaya Migration Cert - Format FilledupRojukurthi SudhakarNo ratings yet

- Cabuhat v. CADocument2 pagesCabuhat v. CALiana AcubaNo ratings yet

- Cape Mob 2014 U1 P1Document7 pagesCape Mob 2014 U1 P1danielle manleyNo ratings yet

- Banking MCQUESTIONSDocument43 pagesBanking MCQUESTIONSparthasarathi_inNo ratings yet

- Lic Nir QuestionaireDocument3 pagesLic Nir Questionaireneville79No ratings yet

File 726201175541 PMBSmoney JULY27

File 726201175541 PMBSmoney JULY27

Uploaded by

Dave VachonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

File 726201175541 PMBSmoney JULY27

File 726201175541 PMBSmoney JULY27

Uploaded by

Dave VachonCopyright:

Available Formats

money

DOLLAR BRITISH EURO S&P/TSX NASDAQ DOW NIKKEI GOLD OIL AECO PRIME

UP 0.37 $1.0607 US UP 0.69 UP 0.94 $1.5475 CDN $1.3684 CDN DOWN 135.39 13,300.60 DOWN 2.84 2,839.96 DOWN 91.50 12,501.30 UP 47.71 10,097.70 UP $4.60 $1,616.60 US UP $0.39 $99.59 US DOWN $0.04 $3.43 UNCHANGED 3%

CURRENCIES

Day over day statistic

Tuesday $0.9428 $0.01210 US DOLLAR YEN Monday $0.9458 $0.01208

Biggest % gains in stocks over $5

1

CARDIOME PHARMA $5.29 +28.40 +16.62

STUDS

Fees bother Canadians

SHARON SINGLETON QMI Agency Canadians are increasingly disgruntled with bank fees and the trouble they have getting their banking problems resolved, according to J.D. Powers annual report on customer satisfaction. On the whole, the 2011 survey found that customer service among the nations lenders has improved. Overall satisfaction came in at 756 on a 1,000-point scale this year, up 26 points from 2010. It was the third consecutive year of improvement. However, fees and problem resolution continue to let the lenders down, the study found. All of the banks, with the exception of Laurentian Bank, saw customer satisfaction over fees deteriorate. That should suggest a strong message to do something about fees, said Lubo Li, senior director of the financial services practice at J.D. Power and Associates in Toronto. Its not that you cant charge fees, its just that they need to be communicated clearly so customers know what they are getting for their money. Just calling something a maintenance fee doesnt cut it, Li said, adding customer satisfaction on bank charges improved when more explanations were given. Its not necessarily that banking fees are rising, though there has been some increase, but that people dont understand what they are being charged for at a time when cash-strapped consumers are making every penny count. Courtney Barber, a St. Johns

BANKING: Customer service improves over last year, but problems remain

businessbriefs

LOONIE CONTINUES RISE

The Canadian dollar rose to its best level in more than threeand-a-half years against the U.S. dollar on Tuesday, as debt fears in the U.S. continued to slam the greenback. The currency climbed as high as $0.9412 to the U.S. dollar, or $1.0625, its strongest level since November 2007. The U.S. dollar fell across the board as a speech by U.S. President Barack Obama gave no sign of a swift breakthrough in deadlocked talks to raise the U.S. debt ceiling. Commodity prices such as oil also rallied on a weaker U.S. dollar, though investors shrugged off fears that a U.S. default would undermine the appetite for riskier assets, while a run of strong earning reports further boosted market sentiment. Shares of Canadian National Railway Co. slid more than 3% Tuesday on concerns of a potential slowdown in global economic growth along with profit-taking after a rally by its stock this year. The slide came a day after CN Rail reported better than expected second-quarter results, despite difficulties including floods in Western Canada, forest fires and mudslides. Although CN did not change its earnings guidance for 2011, it did recognize that there are some macroindicators that suggest that there could be some headwinds leading into the fourth quarter, Raymond James analyst Steve Hansen said. The pace of global growth is probably one thing that is weighing on investors minds, Hansen said. By late morning, CNs stock was down $2.49, or 3.3%, at $72.75 on the TSX. The stock has risen about 13% this year. Reuters

Consumer satisfaction index ranking (based on a 1,000 point scale)

Big Five bank segment TD Canada Trust RBC Royal Bank BMO Bank of Montreal Scotiabank CIBC Presidents Choice Financial Laurentian Bank of Canada Manulife Bank National Bank of Canada Alterna Bank ATB (Alberta Treasrury Branch) HSBC Bank Canada

Source: J.D. Power and Associates

Banking more customer friendly

Midsize segment

2 GLG LIFE TECH $7.79

3 SINO-FOREST CORP. $7.12 +11.95

Biggest % losses in stocks over $5

FINANCIAL 1 WALL$15.01 10.49

DUDS

750.3

Midsize segment average

Big Five segment average

2 GWR GLOBAL WATER $5.40 6.09 3 WESCAST INDUSTRIES $9.95 5.69

Todays big nancial numbers

GO FIGURE

The decline in points that the Conference Board of Canadas monthly measure of consumer condence in July. It was the third straight drop as consumers fretted about job prospects.

1.8

765.3

nine months before discovering the differences. When I no longer qualified for the student account, I assumed the bank would roll my account over into something with similar services, she said. At the very least, I thought I would be contacted with some information on the types of accounts that were available to me. Instead, I was getting ripped off with a per-use fee for my debit transactions an account that was not at all suitable for the type of customer I am. Overall, complaints about

780.5 751.3 741.3 729.2 721.2 786.5 770.3 757.3 747.2 735.2 734.2 710.2

QMI AGENCY

CN SHARES SLIDE

The sale price for a bottle of 1811 Chateau dYquem, the most valuable bottle of white wine ever sold, setting a Guinness World Record. The buyer was a former head sommelier at a top Parisian restaurant.

$121,000

based contract administrator, was one such disgruntled bank customer. When she graduated from university to her first job, her student bank account was switched to a lower-fee account, but with only a handful of free debit transactions, meaning she would pay through the nose once that limit was exceeded. As a student, she had been used to unlimited debit and favoured her card over cash. Not realizing the change, she ended up paying about $90 a month in transaction fees for

banking have declined this year, with the number of customers reporting problems dropping five percentage points to 16%. But for those who did encounter problems, the other main gripe was the inability to get their problems solved with one call. TD topped the survey, with a satisfaction ranking of 780. RBC came in second with 751. CIBC came out bottom among the biggest banks with a customer satisfaction score of 721. sharon.singleton@canoe.ca

TECH SECTOR: Companys stock tumbles 60% since February high

Canadians stand firm with RIM

ALASTAIR SHARP Reuters TORONTO Wall Street and Silicon Valley have issued verdicts on Research In Motion, and they are mostly damning for the BlackBerry maker. Canadians, on the other hand, are eager to give their compatriot the benefit of the doubt. In both the smartphone and tablet computer markets, the momentum belongs to Apple, which edges ever closer to the title of worlds most valuable stock, and Google, its Android software embraced by an army of device makers. By contrast, RIMs shares have fallen 60% from a February peak, hammered by a litany of bad news. The company has missed its own limp quarterly forecasts, suffered crucial delays in bringing advanced smartphones to market and elicited yawns when it launched its long-awaited PlayBook tablet. In the latest sign of decline, RIM said on Monday it will cut 11% of its workforce, even as it rushes to pull off a tricky transition to a new Blackberry operating system. Against that backdrop, there is a discernible gap between Canadian and non-Canadian analysts covering the struggling Ontario-based technology

Men face fines, prison over alleged scam

BRIAN DALY QMI Agency MONTREAL Six men could face fines and two of them could face prison after an allegedly bogus foundation swallowed up $2 million from investors. Quebecs financial watchdog, the AMF, said Tuesday that it has filed 258 charges against the men after 34 investors lost money between 2007 and 2009. The AMF and the Ontario Securities Commission froze the assets of Fer de Lance Foundation following a tip from someone claiming to be a victim. The watchdog alleges money was funnelled to bank accounts in Switzerland and the Turks and Caicos Islands. These are major investments, were talking about investments of $100,000, $300,000 (per person), AMF spokesman Sylvain Theberge told QMI Agency on Tuesday. He said recruiters working for the foundation solicited investors from across Ontario and Quebec. The victims were invited to a lawyers office and allegedly told their money would be securely invested in a trust account. It gave security to the investors because the people thought that in a trust (account), everything was protected, said Theberge. They told them Your capital is 100% guaranteed and we promise you returns that could range from 20% to 300% in very short order. The AMF said the Fer de Lance Foundations true mission is still unclear. Investors were told the entity was created to dedicate all efforts and available means to enhance the well-being of the human race. The AMF is seeking a total of $4.7 million in fines against Paul M. Gelinas, executor of the foundation, and Jean-Pierre Desmarais, a lawyer and legal adviser. Both men could also face prison terms of five years less a day if convicted. Also charged are foundation CEO and chairman George E. Fleury, secretary-treasurer and managing director Michel Hamel, and alleged recruiters Rejean Duguay and Denis Nadeau. Investors have yet to receive compensation, as forensic auditors try to trace the money. First we have to demonstrate that the money thats in the accounts is really the money that belongs to these investors, said Theberge. He adds that some of the victims might live in Ontario. The AMF asked Ontario securities officials to freeze foundation accounts in that province.

CRIME: Quebec watchdog says money funnelled to Caribbean accounts

MORRIS LAMONT QMI Agency Canadian analysts are sticking by Jim Balsillies Research In Motion despite severe losses by the company.

leader. Put simply, Canadians have a lot more time for their national champion. One in five analysts covering RIM currently suggest buying the stock. But the ratio is one in three for Canadian analysts. The pessimism of the big U.S. bulge-bracket firms is really what presumably has driven the stock to the levels that its at, said Paul Taylor, chief investment officer for BMO Harris Private Banking. The Bank of Montreal unit manages $14.5 billion for wealthy Canadians and holds less than $100 million of RIM stock. It irks them to think a Canadian company could possibly have the backbone to compete with the likes of Apple, said Taylor. RIM has long been a source of Canadian pride, a start-up that beat giants like Ericsson and Motorola to make the BlackBerrys secure mobile e-mail an essential tool. Now a global firm with billions in quarterly sales, RIM faces a new generation of users besotted with its touchscreen rivals. Still, Canadian enthusiasm runs deep. A prime example is Scotia Capitals Gus Papageorgiou, who kept an outperform rating on RIM since before the iPhone launched in 2007. Papageorgious price targets since early 2009, on average, were 80% higher than the stocks close that day. To be sure, not everyone agrees its the Canadians who have misjudged RIM. The Canadian investors have far more of a global picture in terms of what is driving RIMs business, said Geoff Blaber, a London-based analyst at CCS Insight. A lot of the U.S. investment analysts can be somewhat focused on what is happening on their doorstep.

Sylvain Theberge, spokesman for Quebecs AMF, says people made investments of up to $300,000 with the Fer de Lance Foundation, which is now under investigation.

Le Journal de Quebec les

Canadians not planning for senility, report finds

The majority of Canadians have no plan in place for someone to take care of their finances if they lose their mental faculties, according to a report. Its a subject many people dont want to even think about, with the majority of Canadians aged 45 and older believing their investment skills will increase as they age, the study by the BMO Retirement Institute found. The BMO Retirement Institute recommends a continuing power of attorney. Its a legal document that gives another person authority to deal with your personal affairs if you lose decision-making capabilities. QMI Agency

SAVINGS: BMO says people dont want to think about disability later in life

Consumers still willing to indulge sweet tooth

NEW YORK Hershey Co. reported higher-than-expected quarterly results and raised its full-year outlook, showing that consumers are willing to pay more to satisfy their sweet tooth even in a weak economy. The worlds largest chocolate maker raised prices to offset soaring costs for commodities such as cocoa and dairy. But those price increases have not dented demand as much as they have in other product categories. Hershey expects 2011 earnings to rise by about 10% and sales to increase by about %6. The company sees full-year earnings of $2.79 to $2.82 per share. Reuters

RESULTS: Hershey raises full-year outlook

Stocks, rates, tools, news, columnists and more just a click away

Your money matters 24/7

VISIT

You might also like

- FIR Case StudyDocument3 pagesFIR Case StudyTamaraNo ratings yet

- Summer Internship Project Report Axis Bank For Mba StudentDocument79 pagesSummer Internship Project Report Axis Bank For Mba StudentPrem SrivastavaNo ratings yet

- Goldman and The OIS Gold RushDocument0 pagesGoldman and The OIS Gold Rushalexis_miaNo ratings yet

- Pom Inventory ProblemsDocument8 pagesPom Inventory ProblemsSharath Kannan0% (2)

- Challan Form OEC App Fee 500 PDFDocument1 pageChallan Form OEC App Fee 500 PDFsaleem_hazim100% (1)

- PennyMac Mortgage Investment TrustDocument2 pagesPennyMac Mortgage Investment Trustank333No ratings yet

- File 1011201182338 PMBSmoney OCT12Document1 pageFile 1011201182338 PMBSmoney OCT12Dave VachonNo ratings yet

- Letter of CreditDocument8 pagesLetter of CreditswatiraghupatruniNo ratings yet

- PSIfinancialreportrelease 041311Document4 pagesPSIfinancialreportrelease 041311Carrie PowersNo ratings yet

- Feb Hit 36 BvilleDocument1 pageFeb Hit 36 BvillePrice LangNo ratings yet

- Financial News Articles - COMPLETE ARCHIVEDocument319 pagesFinancial News Articles - COMPLETE ARCHIVEKeith KnightNo ratings yet

- Private WealthDocument4 pagesPrivate WealthKunal DesaiNo ratings yet

- Citation: by Joe Bel Bruno "Failed Banks Weighing On FDIC, Amounts Tapped by AgencyDocument10 pagesCitation: by Joe Bel Bruno "Failed Banks Weighing On FDIC, Amounts Tapped by Agencyss041782No ratings yet

- Radar 05 2014 1117 DeepDive Red Tape in OzDocument3 pagesRadar 05 2014 1117 DeepDive Red Tape in OzzeronomicsNo ratings yet

- Michael Sanderson On Equality of Arms in The Law in AustraliaDocument28 pagesMichael Sanderson On Equality of Arms in The Law in AustraliaSenateBriberyInquiryNo ratings yet

- They Thought Their Money Was in High-Interest Accounts-They Got Paid Peanuts - WSJDocument4 pagesThey Thought Their Money Was in High-Interest Accounts-They Got Paid Peanuts - WSJqvrlenarasegtNo ratings yet

- 2012年12月英语六级真题Document15 pages2012年12月英语六级真题六级真题及解析(1990-2022)No ratings yet

- Macquarie Group Announces 501m ProfitDocument4 pagesMacquarie Group Announces 501m Profitapi-239934747No ratings yet

- The Money Laundering Issue in SCBDocument14 pagesThe Money Laundering Issue in SCBaditya saiNo ratings yet

- (15-00293 241-3) Ex C - JPMC-MRS-00005210-11Document4 pages(15-00293 241-3) Ex C - JPMC-MRS-00005210-11larry-612445No ratings yet

- Lloyds Bank Staff Puts Frighteners' On Debtors 12.04.09Document4 pagesLloyds Bank Staff Puts Frighteners' On Debtors 12.04.09Simply Debt SolutionsNo ratings yet

- Markets Hit As Euro Hopes Fade: FSA: Beef Up EU Rules After RBSDocument48 pagesMarkets Hit As Euro Hopes Fade: FSA: Beef Up EU Rules After RBSCity A.M.No ratings yet

- July 12Document64 pagesJuly 12Saifur RahmanNo ratings yet

- 8.3 Risk and TrustDocument16 pages8.3 Risk and TrustShanu JosephNo ratings yet

- The Pensford Letter - 7.2.12Document5 pagesThe Pensford Letter - 7.2.12Pensford FinancialNo ratings yet

- The Pensford Letter - 7.2.12Document5 pagesThe Pensford Letter - 7.2.12Pensford FinancialNo ratings yet

- The Pensford Letter - 7.2.12Document5 pagesThe Pensford Letter - 7.2.12Pensford FinancialNo ratings yet

- Global Financial Crisis During 2008-2010Document12 pagesGlobal Financial Crisis During 2008-2010Mega Pop LockerNo ratings yet

- Jean Ramirez - Inside Job Movie ReviewDocument14 pagesJean Ramirez - Inside Job Movie ReviewJean Paul RamirezNo ratings yet

- Russia'S Revolution: Rate-Riggers To Face Trial in UsaDocument27 pagesRussia'S Revolution: Rate-Riggers To Face Trial in UsaCity A.M.No ratings yet

- Sub Prime Overview For Samir 1 Final 97-2003 FormatDocument10 pagesSub Prime Overview For Samir 1 Final 97-2003 FormatAliasgar SuratwalaNo ratings yet

- FinTech Rising: Navigating the maze of US & EU regulationsFrom EverandFinTech Rising: Navigating the maze of US & EU regulationsRating: 5 out of 5 stars5/5 (1)

- Credit Card Pricing Strategy: Davide Capodici, Brooke Chang, Brian Feldman, Erica GluckDocument75 pagesCredit Card Pricing Strategy: Davide Capodici, Brooke Chang, Brian Feldman, Erica GluckBinay Kumar SinghNo ratings yet

- U.S. Takes Steps To Stem Bank Fallout: Mon 03/13/2023 Page: A1Document4 pagesU.S. Takes Steps To Stem Bank Fallout: Mon 03/13/2023 Page: A1Victor Huaranga CoronadoNo ratings yet

- IceCap February 2011 Global Market OutlookDocument8 pagesIceCap February 2011 Global Market OutlookIceCap Asset ManagementNo ratings yet

- Surge in Liar Loans' From Major Aussie Bank Is Concerning'Document6 pagesSurge in Liar Loans' From Major Aussie Bank Is Concerning'Rajiv RajNo ratings yet

- TrueCredit Education BrochureDocument12 pagesTrueCredit Education BrochureHameed WesabiNo ratings yet

- Hayden Captal APT PresentationDocument34 pagesHayden Captal APT PresentationMarirs LapogajarNo ratings yet

- WallstreetJournalDocument28 pagesWallstreetJournalDeepti AgarwalNo ratings yet

- Inside Job SummaryDocument2 pagesInside Job SummaryAmmar UbaidNo ratings yet

- Stashing Cash: $1.4-Billion Takeover by A U.S. CompanyDocument7 pagesStashing Cash: $1.4-Billion Takeover by A U.S. CompanyStephan FongNo ratings yet

- Home Capital Group Initiating Coverage (HCG-T)Document68 pagesHome Capital Group Initiating Coverage (HCG-T)Zee MaqsoodNo ratings yet

- Accounting Information Systems - Computer FraudDocument84 pagesAccounting Information Systems - Computer FraudDr Rushen SinghNo ratings yet

- 2012 11 13 Cyn Bofa-Ml Slides FinalDocument37 pages2012 11 13 Cyn Bofa-Ml Slides FinalrgosaliaNo ratings yet

- Market Commentary 06-27-11Document3 pagesMarket Commentary 06-27-11monarchadvisorygroupNo ratings yet

- Treasury Scrutinizes Credit Unions - WSJDocument4 pagesTreasury Scrutinizes Credit Unions - WSJdbr trackdNo ratings yet

- Ormalization: ECONOMIC DATA With Impact Positive ImpactsDocument5 pagesOrmalization: ECONOMIC DATA With Impact Positive Impactsfred607No ratings yet

- La Era de La ViolenciaDocument2 pagesLa Era de La ViolenciaAlexis TabaresNo ratings yet

- KPMG Closes The Books On New Century & CountryWideDocument7 pagesKPMG Closes The Books On New Century & CountryWide83jjmackNo ratings yet

- Banking's Next Big BattleDocument8 pagesBanking's Next Big BattleJaskeerat SinghNo ratings yet

- BP Holdings Article Code 85258080768: Feeding FrenzyDocument5 pagesBP Holdings Article Code 85258080768: Feeding Frenzychesleayearly100% (1)

- Another Financial Meltdown Is Closer Than It Appears.: Source: FREDDocument14 pagesAnother Financial Meltdown Is Closer Than It Appears.: Source: FREDVidit HarsulkarNo ratings yet

- Dow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysDocument10 pagesDow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysAlbert L. PeiaNo ratings yet

- Dow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysDocument10 pagesDow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysAlbert L. PeiaNo ratings yet

- Aug 4thDocument15 pagesAug 4thshefalijnNo ratings yet

- Americas Growing Fringe Economy Karger06Document6 pagesAmericas Growing Fringe Economy Karger06Mehdi BoujalalNo ratings yet

- CIT Files BankruptcyDocument2 pagesCIT Files BankruptcyAdam HollierNo ratings yet

- Canadian Banking PDFDocument41 pagesCanadian Banking PDFFuria_hetalNo ratings yet

- Hungry Jack's Vouchers: Your Ticket To Delicious and Affordable Fast FoodDocument13 pagesHungry Jack's Vouchers: Your Ticket To Delicious and Affordable Fast FoodMonibulNo ratings yet

- Cityam 2011-07-05Document28 pagesCityam 2011-07-05City A.M.No ratings yet

- The Plastic Prison: Common Ground Creativity 0 CommentsDocument5 pagesThe Plastic Prison: Common Ground Creativity 0 CommentsSimply Debt SolutionsNo ratings yet

- JPM InitiatingCoverageDocument11 pagesJPM InitiatingCoveragePauline Da CostaNo ratings yet

- BUS 401.3 Movie Assignment On: Inside Job'Document4 pagesBUS 401.3 Movie Assignment On: Inside Job'Nabil HuqNo ratings yet

- Fraud 101: Techniques and Strategies for Understanding FraudFrom EverandFraud 101: Techniques and Strategies for Understanding FraudNo ratings yet

- File 48201260915 PMPQMIBSontario APR9Document1 pageFile 48201260915 PMPQMIBSontario APR9Dave VachonNo ratings yet

- Election Page 2012Document1 pageElection Page 2012Dave VachonNo ratings yet

- Bell 072012 21Document1 pageBell 072012 21Dave VachonNo ratings yet

- File 1011201182338 PMBSmoney OCT12Document1 pageFile 1011201182338 PMBSmoney OCT12Dave VachonNo ratings yet

- Bell 081911 C1Document1 pageBell 081911 C1Dave VachonNo ratings yet

- File 127201250647 PMPQMIBSEnt Jan 28 FIXDocument1 pageFile 127201250647 PMPQMIBSEnt Jan 28 FIXDave VachonNo ratings yet

- ED 8wing Major Troy PaisleyDocument2 pagesED 8wing Major Troy PaisleyDave VachonNo ratings yet

- File 921201165113 PMPQMIent Sept 22 BSDocument1 pageFile 921201165113 PMPQMIent Sept 22 BSDave VachonNo ratings yet

- ED QuinteResidentsRememberDocument3 pagesED QuinteResidentsRememberDave VachonNo ratings yet

- File 722201172918 PMPQMIBSMoney July 23Document1 pageFile 722201172918 PMPQMIBSMoney July 23Dave VachonNo ratings yet

- File 62201155751 PMPQMIjun 4 TdydvdmovieplusDocument1 pageFile 62201155751 PMPQMIjun 4 TdydvdmovieplusDave VachonNo ratings yet

- File 814201121228 PMBSsomalia FULLaug 15Document1 pageFile 814201121228 PMBSsomalia FULLaug 15Dave VachonNo ratings yet

- Traffic Restrictions - June 6 - June 10Document2 pagesTraffic Restrictions - June 6 - June 10Dave VachonNo ratings yet

- File 62201153258 PMPQMIjun 4 Today ENOUGHDocument1 pageFile 62201153258 PMPQMIjun 4 Today ENOUGHDave VachonNo ratings yet

- File 531201181651 PMPQMIBSMoney June 1 FixDocument1 pageFile 531201181651 PMPQMIBSMoney June 1 FixDave VachonNo ratings yet

- File 531201181933 PMBSnhlplayoffs June 1Document1 pageFile 531201181933 PMBSnhlplayoffs June 1Dave VachonNo ratings yet

- File 531201180357 PMBSontario JUN1Document1 pageFile 531201180357 PMBSontario JUN1Dave VachonNo ratings yet

- File5302011101255pmbs Money May 31 Fix Final 02Document1 pageFile5302011101255pmbs Money May 31 Fix Final 02Dave VachonNo ratings yet

- File 530201181927 PMBSontario MAY31Document1 pageFile 530201181927 PMBSontario MAY31Dave VachonNo ratings yet

- Mrs KavitamazumdaraDocument2 pagesMrs KavitamazumdaraMuhammad Asyrofi AnshariNo ratings yet

- LDNDocument2 pagesLDNShaharyar KhanNo ratings yet

- Week 5 Questions - RYDocument6 pagesWeek 5 Questions - RYRishat KayirlyNo ratings yet

- BankingDocument13 pagesBankingPranav SethNo ratings yet

- Rich Dads Guide To Investing With Opm 2019Document5 pagesRich Dads Guide To Investing With Opm 2019Mas Pion ArciereNo ratings yet

- Cma With Cra For Bank ProjectionDocument31 pagesCma With Cra For Bank ProjectionMuthu SundarNo ratings yet

- IBS - MBS - BHIM PNB FAQs - Revised-CompressedDocument13 pagesIBS - MBS - BHIM PNB FAQs - Revised-Compressedemraan KhanNo ratings yet

- Karina's Online Banking Project-1Document46 pagesKarina's Online Banking Project-1KashifNo ratings yet

- Anukrit CVDocument2 pagesAnukrit CVmarkytylerNo ratings yet

- Allied Banking Vs Lim Sio WanDocument3 pagesAllied Banking Vs Lim Sio WanSamantha Ann T. Tirthdas100% (1)

- Anoop Mohanty - Banking System Paradox - 1Document6 pagesAnoop Mohanty - Banking System Paradox - 1AasthaNo ratings yet

- Syllabus of Banking & Insurance LawDocument4 pagesSyllabus of Banking & Insurance LawAkshay DhawanNo ratings yet

- Vol Bills Booked With ProductivityDocument1,013 pagesVol Bills Booked With Productivityshail_juneNo ratings yet

- Fow Spring 2013Document27 pagesFow Spring 2013Arifisal DoankNo ratings yet

- CP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIDocument5 pagesCP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIeduardolavratiNo ratings yet

- Week 2 Marketing EnvironmentDocument19 pagesWeek 2 Marketing EnvironmentMeghna JainNo ratings yet

- 2 - Bank Contract - Hongda Chem Vzla CADocument12 pages2 - Bank Contract - Hongda Chem Vzla CAjose cordovezNo ratings yet

- 19TH0DEC02016Document2 pages19TH0DEC02016Anonymous Fyi4eNxsNo ratings yet

- Business Application 2018Document2 pagesBusiness Application 2018Janet SimovicNo ratings yet

- Zero Balance Form - SFLBDocument3 pagesZero Balance Form - SFLBroshcrazyNo ratings yet

- Barkatullah Vishwavidyalaya Migration Cert - Format FilledupDocument5 pagesBarkatullah Vishwavidyalaya Migration Cert - Format FilledupRojukurthi SudhakarNo ratings yet

- Cabuhat v. CADocument2 pagesCabuhat v. CALiana AcubaNo ratings yet

- Cape Mob 2014 U1 P1Document7 pagesCape Mob 2014 U1 P1danielle manleyNo ratings yet

- Banking MCQUESTIONSDocument43 pagesBanking MCQUESTIONSparthasarathi_inNo ratings yet

- Lic Nir QuestionaireDocument3 pagesLic Nir Questionaireneville79No ratings yet