Professional Documents

Culture Documents

Bab 11 - Conclusion (Edit)

Bab 11 - Conclusion (Edit)

Uploaded by

yadi suryadiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bab 11 - Conclusion (Edit)

Bab 11 - Conclusion (Edit)

Uploaded by

yadi suryadiCopyright:

Available Formats

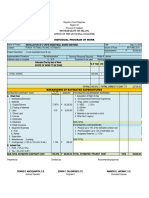

FEASIBILITY STUDY REPORT

Document Number

JAYAMUKTI MHPP

JYMT.52.1210

CHAPTER 11

CONCLUSION

11.1 CONCLUSION

Results of feasibility study on development plan of JAYAMUKTI MHPP that has done by

the consultant can be concluded as follows:

1) Location plan for JAYAMUKTI MHPP is in Casanggiri River that has 46.75 km2

catchment area. Catchment area is domiated by paddy field and annual dry soil.

JAYAMUKTI MHPP has head gross potential 62 m and net gross 60.22 m.

2) Dependable flow that can be used is 5.86 m3/s with probability 35%.

3) Flood discharge design for different period was calculated by HSS Nakayasu

method, where flood peak discharge for every 50 years that used as discharge

plan for weir 1 is 231 m3/s and weir 2 is 99.23 m3/s.

4) Wier 1 of JAYAMUKTI MHPP is designed with total width 14 m, high 2 m, 4 doors

intake and waterway length is 1300 m. Weir 2 is designed with total width 5.3 m,

high 2 m, 1 door intake and waterway length is 700 m.

5) JAYAMUKTI MHPP is planned to use 2 (two) turbines with capacity 1530 kW for

each turbine. Based on flow duration curve from this study, JAYAMUKTI MHPP

has plant factor 66.12%, capacity factor 66.11% and produce energy 17,720,370

kWh.

6) Investment cost for JAYAMUKTI MHPP is Rp 77,364,550,000 with detail as

follows:

A. INVESTMENT COST

1 COMPONENT A - INVESTMENT COST (IDR. 000,-)

Description 100%

a. Preparation works / Construction facilities 1.860.761

b. Civil & metal works 30.821.965

c. Electrical equipments 20.655.000

d. Transmission & distribution 1.250.000

e. Engineering & overheads 9,5% 5.907.879

f. Land acquistiton 7.642.743

g. Tax (Ppn) 10% 3.389.046

Direct cost ---> Rp 71.485.128

JAYAMUKTI MHPP Feasibility Study 1

1

FEASIBILITY STUDY REPORT

Document Number

JAYAMUKTI MHPP

JYMT.52.1210

h. Interest During Construction (IDC) 5.879.423

Total Sum ---> Rp 77.364.550

Unit investment cost ---> Rp 25.287.148

7) Financial analysis of JAYAMUKTI MHPP development plan can be seen as

follows:

Description Values

NPV Positive (IDR. 000,-) 89.855.558

PV (IDR. 000,-) 183.050.905

IRR Equity 31,50%

IRR Project 20,09%

Break Event Point (BEP) 2,96

PP (Years) 3,85

B/C Ratio 1,96

Statements is Feasible

Return on assets ( ROA ) 11,90%

Return of Investment (ROI) 8,93%

Return of Equity (ROE) 61,83%

Current Ratio (CR) 192,00%

Debt Service Coverage Ratio (DSCR) 89,92%

Profitability Index 127,71%

It can be concluded that in financial aspect, JAYAMUKTI MHPP is WORTHY to be

developed with NPV Rp. 89,855,558,000 and IRR project value is 20.09 %

JAYAMUKTI MHPP Feasibility Study 2

2

FEASIBILITY STUDY REPORT

Document Number

JAYAMUKTI MHPP

JYMT.52.1210

CHAPTER 11.....................................................................................................................

11.1 CONCLUSION............................................................................................

JAYAMUKTI MHPP Feasibility Study 3

3

You might also like

- Report Pumped Hydro Cost ModellingDocument38 pagesReport Pumped Hydro Cost Modellingfmboy700No ratings yet

- KOGAS 2020 Sustainability Bond Annual ReportDocument4 pagesKOGAS 2020 Sustainability Bond Annual ReportVinaya NaralasettyNo ratings yet

- Cost Accounting Assignment 1Document5 pagesCost Accounting Assignment 1MkaeDizonNo ratings yet

- Bab 09 - Feasibility Analysis (Edit)Document9 pagesBab 09 - Feasibility Analysis (Edit)yadi suryadiNo ratings yet

- Public Bidding SampleDocument7 pagesPublic Bidding SampleArvin Dela CruzNo ratings yet

- RM of Access Road Streetlight at LGDA - 2022Document6 pagesRM of Access Road Streetlight at LGDA - 2022Ace LangNo ratings yet

- Finansial Model .Upt 20.3.23Document8 pagesFinansial Model .Upt 20.3.23FirmanNo ratings yet

- Sector Update 14dec23Document7 pagesSector Update 14dec23Deepul WadhwaNo ratings yet

- Yambaling Hydro - RevisedDocument3 pagesYambaling Hydro - RevisedSudan KhatiwadaNo ratings yet

- PowDocument1 pagePowPreparation CELENo ratings yet

- Investment AnalysisDocument15 pagesInvestment Analysisvazzoleralex6884No ratings yet

- Executive Summary - Sintang 12 MW BTG Biomass Power PlantDocument11 pagesExecutive Summary - Sintang 12 MW BTG Biomass Power PlantKomang SuantikaNo ratings yet

- GPSC Ubs Apac Sustainable Finance Conference 2022Document12 pagesGPSC Ubs Apac Sustainable Finance Conference 2022Sittidath PrasertrungruangNo ratings yet

- Solar PV Detailed Project ReportDocument6 pagesSolar PV Detailed Project ReportExergy88% (8)

- Financial AnalysisDocument5 pagesFinancial AnalysisSuraj DahalNo ratings yet

- Project ReportDocument5 pagesProject ReportschhittarkaNo ratings yet

- Sime Darby Berhad: Maintain NEUTRAL Skeletons Emerge From The Energy & Utilities' ClosetDocument4 pagesSime Darby Berhad: Maintain NEUTRAL Skeletons Emerge From The Energy & Utilities' ClosetmanjamaheraNo ratings yet

- Residual Life Assessment ReportDocument32 pagesResidual Life Assessment ReportYanuar BayuNo ratings yet

- Sembcorp Marine LTD: Expecting Tardy RecoveryDocument6 pagesSembcorp Marine LTD: Expecting Tardy RecoveryJohn TanNo ratings yet

- Estimate Baghpat STP RevisedDocument23 pagesEstimate Baghpat STP Revisedankur yadavNo ratings yet

- Implementation Completion and Results Report: The World BankDocument39 pagesImplementation Completion and Results Report: The World Bankvarman12No ratings yet

- NCC Angel 030611Document11 pagesNCC Angel 030611profd3No ratings yet

- AffinHwang Capital - JAKS Resources Berhad - Third Time Lucky 18-08-2015Document17 pagesAffinHwang Capital - JAKS Resources Berhad - Third Time Lucky 18-08-2015LucasNo ratings yet

- Energy Turun 10%Document1 pageEnergy Turun 10%yayankedatongolfNo ratings yet

- Techno Electric & Engineering: Expensive ValuationsDocument9 pagesTechno Electric & Engineering: Expensive Valuationsarun_algoNo ratings yet

- Genus Power Infrastructure LTD - Stock-Reco-KotakDocument7 pagesGenus Power Infrastructure LTD - Stock-Reco-KotakanjugaduNo ratings yet

- HSL 20100609Document3 pagesHSL 20100609limml63No ratings yet

- Material Manpower Equipment CostDocument220 pagesMaterial Manpower Equipment CostMJ100% (3)

- TNB Handbook 4Q FY21 - 15032022 PDFDocument28 pagesTNB Handbook 4Q FY21 - 15032022 PDFAdrian SieNo ratings yet

- Sub: ABT Based REA For August, 2020Document5 pagesSub: ABT Based REA For August, 2020bahbah27No ratings yet

- EMD Report PDFDocument32 pagesEMD Report PDFVelmurugan KNo ratings yet

- Bab Iii NewDocument26 pagesBab Iii NewArif NugrohoNo ratings yet

- Group1 MEN Valuation FinalDocument24 pagesGroup1 MEN Valuation FinalJenishNo ratings yet

- Solarvest - 1QFY24Document4 pagesSolarvest - 1QFY24gee.yeap3959No ratings yet

- Metro Pacific Inv. Corp: Providing Clarity On The Negative News FlowsDocument2 pagesMetro Pacific Inv. Corp: Providing Clarity On The Negative News FlowsJNo ratings yet

- Local Development Investment Program FOR PLANNING PERIOD 2019-20124 Years Covered 2019-2021Document41 pagesLocal Development Investment Program FOR PLANNING PERIOD 2019-20124 Years Covered 2019-2021aaNo ratings yet

- KenGen Induction Sept 2018Document23 pagesKenGen Induction Sept 2018Mutwiri Kaaria John100% (1)

- Program of Work/ Budget Cost: For FundingDocument39 pagesProgram of Work/ Budget Cost: For FundingDaniel DanaoNo ratings yet

- PINA Profile - Renewable Energy - PPEBT and HAKITDocument14 pagesPINA Profile - Renewable Energy - PPEBT and HAKITEdo RonaldoNo ratings yet

- Profitability Sensitivity Analysis - RulesDocument6 pagesProfitability Sensitivity Analysis - RulesSwapnendu GoonNo ratings yet

- Residual Life Assessment ReportDocument37 pagesResidual Life Assessment ReportYanuar BayuNo ratings yet

- PreComm-Comm & RR Execution Plan Rev 0 PDFDocument22 pagesPreComm-Comm & RR Execution Plan Rev 0 PDFMaulana Hanief100% (1)

- KEC International - : Benefit From US$233bn Investment in The T&D SegmentDocument8 pagesKEC International - : Benefit From US$233bn Investment in The T&D Segmentharshul yadavNo ratings yet

- Cost Estimation Ninian BridgeDocument8 pagesCost Estimation Ninian BridgeAfrizal Dwi PutrantoNo ratings yet

- ENI WellDocument108 pagesENI WellsnnsnnsnnNo ratings yet

- Pentamaster 4QCY21Document5 pagesPentamaster 4QCY21nishio fdNo ratings yet

- GAIL - 3QFY23 - 31-01-2023 - SystematixDocument9 pagesGAIL - 3QFY23 - 31-01-2023 - SystematixvakilNo ratings yet

- Metropolitan Waterworks and Sewerage System Executive Summary 2012Document16 pagesMetropolitan Waterworks and Sewerage System Executive Summary 2012Rhodora DulayNo ratings yet

- Board & Ring at TibaoDocument5 pagesBoard & Ring at TibaoYeoj NosniNo ratings yet

- AxisCap - NTPC - CU - 7 Sep 2021Document10 pagesAxisCap - NTPC - CU - 7 Sep 2021jitendra76No ratings yet

- FInal Report CBN March 2022Document4 pagesFInal Report CBN March 2022Angga Dwi PutrantoNo ratings yet

- Westports Holdings: Company ReportDocument3 pagesWestports Holdings: Company ReportBrian StanleyNo ratings yet

- G2E - Executive Report - 3Document4 pagesG2E - Executive Report - 3RUANGLADDA LIMPONGSAWATNo ratings yet

- Book 1Document59 pagesBook 1ceetpcNo ratings yet

- Suki Kinari Hydropower Project Feasibility Study Report Financial AnalysisDocument29 pagesSuki Kinari Hydropower Project Feasibility Study Report Financial AnalysisArshad MahmoodNo ratings yet

- Eversendai Corporation Berhad - Bite The Bullet and Move On - 160608Document2 pagesEversendai Corporation Berhad - Bite The Bullet and Move On - 160608Afiq KhidhirNo ratings yet

- Shuvendu, Ravi-RE Integration (Roof Top Solar) - Group 6Document14 pagesShuvendu, Ravi-RE Integration (Roof Top Solar) - Group 6Kumar RaviNo ratings yet

- Program of Work/Budget Cost: Republic of The Philippines Department of Public Works and HighwaysDocument8 pagesProgram of Work/Budget Cost: Republic of The Philippines Department of Public Works and HighwaysLouie MacniNo ratings yet

- Optimization and Business Improvement Studies in Upstream Oil and Gas IndustryFrom EverandOptimization and Business Improvement Studies in Upstream Oil and Gas IndustryNo ratings yet

- Renewable Energy Tariffs and Incentives in Indonesia: Review and RecommendationsFrom EverandRenewable Energy Tariffs and Incentives in Indonesia: Review and RecommendationsNo ratings yet

- Hybrid and Battery Energy Storage Systems: Review and Recommendations for Pacific Island ProjectsFrom EverandHybrid and Battery Energy Storage Systems: Review and Recommendations for Pacific Island ProjectsNo ratings yet

- Sheet Pile NewDocument32 pagesSheet Pile Newyadi suryadiNo ratings yet

- Bab 09 - Feasibility Analysis (Edit)Document9 pagesBab 09 - Feasibility Analysis (Edit)yadi suryadiNo ratings yet

- Bab 08 - Construction Estimated CostDocument11 pagesBab 08 - Construction Estimated Costyadi suryadiNo ratings yet

- Bab 02 - Study Location Description - Correction01Document13 pagesBab 02 - Study Location Description - Correction01yadi suryadiNo ratings yet

- Hydrological Studies Rainfall and Climate Data Rainfall DataDocument40 pagesHydrological Studies Rainfall and Climate Data Rainfall Datayadi suryadiNo ratings yet

- Unit 1-5Document223 pagesUnit 1-5Aakriti PantNo ratings yet

- Formation of All India Muslim LeagueDocument2 pagesFormation of All India Muslim LeagueAnum Goher Ali 2460-FET/BSEE/F15No ratings yet

- Electricity Sector of New ZealandDocument24 pagesElectricity Sector of New ZealandJason JiaNo ratings yet

- Bottom-Of-The-Pyramid - Organizational Barriers ToDocument28 pagesBottom-Of-The-Pyramid - Organizational Barriers To20212111047 TEUKU MAULANA ARDIANSYAHNo ratings yet

- People v. PerezDocument1 pagePeople v. PerezNoreenesse SantosNo ratings yet

- Soviet Training and Research Programs For Africa PDFDocument233 pagesSoviet Training and Research Programs For Africa PDFChrisNo ratings yet

- Allama Iqbal Day SpeechesDocument5 pagesAllama Iqbal Day SpeechesHiba AhmedNo ratings yet

- Special Power of Attorney Pantawid Pasada ADocument1 pageSpecial Power of Attorney Pantawid Pasada Avivencio kampitanNo ratings yet

- MmpiDocument25 pagesMmpiMardans Whaisman100% (1)

- Phil. Press Institute vs. ComelecDocument2 pagesPhil. Press Institute vs. ComelecAnge DinoNo ratings yet

- Oranjestad The CapitalDocument4 pagesOranjestad The CapitalJAYSONN GARCIANo ratings yet

- The Advocates ' FirmDocument11 pagesThe Advocates ' FirmfelixmuyoveNo ratings yet

- Nestle PPT ReportDocument8 pagesNestle PPT ReportHamza AzharNo ratings yet

- Startup CompaniesDocument11 pagesStartup CompanieskillerNo ratings yet

- Fidic IV Conditions of Contract - OverviewDocument8 pagesFidic IV Conditions of Contract - Overviewlittledragon0110100% (2)

- Fall 2024 Seasonal CatalogDocument48 pagesFall 2024 Seasonal CatalogStanford University PressNo ratings yet

- Psychological ManipulationDocument2 pagesPsychological ManipulationAndrea ZanattaNo ratings yet

- 04.CNOOC Engages With Canadian Stakeholders PDFDocument14 pages04.CNOOC Engages With Canadian Stakeholders PDFAdilNo ratings yet

- Final Manual For Specification StandardsDocument192 pagesFinal Manual For Specification Standardsbhargavraparti100% (1)

- TSCM52 65Document17 pagesTSCM52 65Chirag SolankiNo ratings yet

- SUMMARY Chapter 16Document4 pagesSUMMARY Chapter 16Chevalier ChevalierNo ratings yet

- William Charles Berwick Sayers - Samuel Taylor, Musician - His Life and Letters (1915)Document366 pagesWilliam Charles Berwick Sayers - Samuel Taylor, Musician - His Life and Letters (1915)chyoungNo ratings yet

- Csm-Form SchoolDocument2 pagesCsm-Form SchoolLove MaribaoNo ratings yet

- CBS Tender Document 01.02 2019Document9 pagesCBS Tender Document 01.02 2019Yamraj YamrajNo ratings yet

- Hoba AcctgDocument5 pagesHoba Acctgfer maNo ratings yet

- Zach DeGregorio Civil Complaint Filed 01-03-2022Document261 pagesZach DeGregorio Civil Complaint Filed 01-03-2022DamienWillisNo ratings yet

- EMSC Enrollment Agreement EMT-BDocument2 pagesEMSC Enrollment Agreement EMT-BUSCBISCNo ratings yet

- Standard Helm OrdersDocument4 pagesStandard Helm OrdersYe Min htweNo ratings yet