Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

32 viewsDIS Report

DIS Report

Uploaded by

Rizki Aulia KusumawisantoThe Walt Disney Company is a global entertainment company with five business segments: media networks, parks and resorts, studio entertainment, consumer products, and interactive. Media networks, including ESPN, Disney Channels, and ABC Family, is Disney's largest segment. Parks and resorts include theme parks around the world. Disney competes with other media conglomerates and has proven to be the market leader with over 30% of total revenue from its top 10 competitors. Disney has competitive advantages through unique content and brand recognition.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Financial Statements StudentDocument4 pagesFinancial Statements StudentCarolina BecerraNo ratings yet

- Walt Disney Case AnalysisDocument8 pagesWalt Disney Case AnalysisPauline Beatrice Sombillo100% (2)

- Disney Industry CaseDocument6 pagesDisney Industry Caseapi-535570354No ratings yet

- 1 Executive-SummaryDocument6 pages1 Executive-SummaryJae GrandeNo ratings yet

- Risk Management Case StudyDocument15 pagesRisk Management Case Studynelsonpapa3No ratings yet

- Walt Disney - Strategy AnalysisDocument31 pagesWalt Disney - Strategy Analysisadityaseven84% (19)

- Walt DisneyDocument3 pagesWalt Disneyhb_shotgun50% (2)

- Walt Disney ReportDocument7 pagesWalt Disney ReportPratyuosh SrivastavNo ratings yet

- Disney StrategyDocument32 pagesDisney Strategyshashankgowda100% (2)

- Kaplan AssignmentDocument7 pagesKaplan AssignmentAli100% (1)

- Tivo Case Analysis BulletsDocument4 pagesTivo Case Analysis BulletsyellowbirdhnNo ratings yet

- Tivo Case Analysis: A. Swot Analysis StrengthDocument4 pagesTivo Case Analysis: A. Swot Analysis StrengthAfshin SalehianNo ratings yet

- Nutella Media PlanDocument12 pagesNutella Media Plankayla_kelly_fitnyc100% (5)

- Analysis of The Walt Disney CompanyDocument15 pagesAnalysis of The Walt Disney CompanygimbrinelNo ratings yet

- Walt Disney Investment Report 2020.10.16Document6 pagesWalt Disney Investment Report 2020.10.16uyenbp.a2.1720No ratings yet

- Group ATM (Association of Talented Managers)Document3 pagesGroup ATM (Association of Talented Managers)Le Vo Bao NganNo ratings yet

- Media Conglomerate PaperDocument6 pagesMedia Conglomerate PaperLauren K. MeltonNo ratings yet

- The Walt Disney Case StudyDocument2 pagesThe Walt Disney Case StudyNouhaNo ratings yet

- Disney AnalysisDocument5 pagesDisney AnalysisAli FaycalNo ratings yet

- Disney AnalysisDocument5 pagesDisney AnalysisgessyghesiyahNo ratings yet

- A Comparative Analysis of The North American Media and Entertainment IndustryDocument28 pagesA Comparative Analysis of The North American Media and Entertainment IndustryMax ZhuNo ratings yet

- Walt Disney Strategic CaseDocument28 pagesWalt Disney Strategic CaseArleneCastroNo ratings yet

- ACCT 503B Advanced Business Analysis - Disney Final Report V2Document16 pagesACCT 503B Advanced Business Analysis - Disney Final Report V2reiner satrioNo ratings yet

- BSDW ReportDocument7 pagesBSDW ReportxavilitoNo ratings yet

- Walt Disney CaseDocument14 pagesWalt Disney Casefarhanhaseeb7100% (1)

- Walt Disney Case AnalysisDocument9 pagesWalt Disney Case AnalysisHassam BalouchNo ratings yet

- Executive-Summary (Nishi)Document10 pagesExecutive-Summary (Nishi)Sanzida Sharmin RifaNo ratings yet

- Disney Case StudyDocument5 pagesDisney Case StudyAhmet KalamışNo ratings yet

- Baggu ReportDocument11 pagesBaggu ReportRuchith RameshNo ratings yet

- UNPUBLISHED Walt Disney Company ProfileDocument2 pagesUNPUBLISHED Walt Disney Company ProfilejocelynrubinNo ratings yet

- The Walt Disney Company Company AnalysisDocument16 pagesThe Walt Disney Company Company AnalysisSanjay BijaraniaNo ratings yet

- Swot AnalysisDocument6 pagesSwot Analysiskhushboo kohadkarNo ratings yet

- Analysis On The Current State of The Disney Economy and Sentiment Text Analysis On Customer ReviewsDocument11 pagesAnalysis On The Current State of The Disney Economy and Sentiment Text Analysis On Customer Reviewssam mirouNo ratings yet

- IntroductionDocument6 pagesIntroductionLinh ĐinhNo ratings yet

- Emarketer US Media and Entertainment Digital Ad Spending ForecastDocument13 pagesEmarketer US Media and Entertainment Digital Ad Spending ForecastTomasz SulewskiNo ratings yet

- Assignment SMDocument13 pagesAssignment SMsimNo ratings yet

- Walt DisneyDocument25 pagesWalt DisneyLukmaan Rehmaan100% (1)

- Case Analysis Disney3Document8 pagesCase Analysis Disney3visvisnuvNo ratings yet

- The Walt Disney CompanyDocument6 pagesThe Walt Disney Companybpowell2No ratings yet

- Strategic Analysis of Walt DisneyDocument13 pagesStrategic Analysis of Walt DisneyVISHISHTHA UPUL100% (3)

- Disney Vs TimeWarner Financial RatioDocument19 pagesDisney Vs TimeWarner Financial RatiopatternprojectNo ratings yet

- TV Ad Measurement 2021 EmarketerDocument14 pagesTV Ad Measurement 2021 EmarketerITRS SapraNo ratings yet

- The Walt Disney CompanyDocument19 pagesThe Walt Disney CompanyBMX2013100% (1)

- Waltdisney2 PPT CrdownloadDocument33 pagesWaltdisney2 PPT CrdownloadRaman ManchandaNo ratings yet

- Introduction To Management (BM007-3-1-ITM) AssignmentDocument9 pagesIntroduction To Management (BM007-3-1-ITM) AssignmentCk VinNo ratings yet

- DISNEY Case AnalysisDocument10 pagesDISNEY Case Analysis민혜지No ratings yet

- Memo 3 - Walt DisneyDocument6 pagesMemo 3 - Walt DisneyDolly_AmethystNo ratings yet

- Exercise 5B Evaluating DisneysDocument3 pagesExercise 5B Evaluating DisneysScribdTranslationsNo ratings yet

- Group 4 Strategy Case 'Disney' V 1.4Document10 pagesGroup 4 Strategy Case 'Disney' V 1.4Stijn Lfb50% (2)

- S10-Walt DisneyDocument2 pagesS10-Walt Disneysai kiran reddyNo ratings yet

- First Research Industry Profile - Motion Picture Production and DistributionDocument14 pagesFirst Research Industry Profile - Motion Picture Production and DistributionVictoria YampolskyNo ratings yet

- Final Case Memo - Mariam FaisalDocument7 pagesFinal Case Memo - Mariam FaisalMaryam FaisalNo ratings yet

- Walt Disney - BRAMDocument3 pagesWalt Disney - BRAMBramanto Adi NegoroNo ratings yet

- Report DisneyDocument8 pagesReport DisneyAlejandraNo ratings yet

- Porter's Five ForcesDocument17 pagesPorter's Five ForcesTe TeeNo ratings yet

- Nhật AnhDocument8 pagesNhật AnhNguyễn Ngọc TuấnNo ratings yet

- Poorna SMSL Draft 2Document22 pagesPoorna SMSL Draft 2Prabhashi WitharanaNo ratings yet

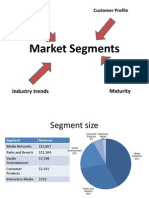

- Market Segments - GautamDocument5 pagesMarket Segments - GautamGautam SchaanNo ratings yet

- Asian Development Bank Trust Funds Report 2020: Includes Global and Special FundsFrom EverandAsian Development Bank Trust Funds Report 2020: Includes Global and Special FundsNo ratings yet

- ARforSocialInfrastructure FinalDocument21 pagesARforSocialInfrastructure FinalRizki Aulia KusumawisantoNo ratings yet

- Evolution of Infrastructure As An Asset Class: A Systematic Literature Review and Thematic AnalysisDocument28 pagesEvolution of Infrastructure As An Asset Class: A Systematic Literature Review and Thematic AnalysisRizki Aulia KusumawisantoNo ratings yet

- Mnj. Fungsional-All Kls-Final Term (R)Document7 pagesMnj. Fungsional-All Kls-Final Term (R)Rizki Aulia KusumawisantoNo ratings yet

- Modul Tutorial - Riset Dan Statistik TerapanDocument12 pagesModul Tutorial - Riset Dan Statistik TerapanRizki Aulia KusumawisantoNo ratings yet

- Chap005 UpdatedDocument35 pagesChap005 UpdatedRizki Aulia KusumawisantoNo ratings yet

- 10 1108 - JFMPC 07 2019 0065Document20 pages10 1108 - JFMPC 07 2019 0065Rizki Aulia KusumawisantoNo ratings yet

- Conflicts of Interest 101 Fall 2014Document11 pagesConflicts of Interest 101 Fall 2014Rizki Aulia KusumawisantoNo ratings yet

- Finman Merged Midterm ReviewerDocument90 pagesFinman Merged Midterm ReviewerAlliana CunananNo ratings yet

- Organizational Study at Birdy Exports PVT LTDDocument66 pagesOrganizational Study at Birdy Exports PVT LTDJOSHUA T JOHNSON 19D2097No ratings yet

- Top 100 Richest People Apr 2011Document9 pagesTop 100 Richest People Apr 2011Social HuesNo ratings yet

- Unit Test 7A Basic LevelDocument3 pagesUnit Test 7A Basic LevelВалентин БивалінNo ratings yet

- Strategy SsDocument8 pagesStrategy SsKaran HingmireNo ratings yet

- Cep473 Module 1-Introduction To Project ManagementDocument25 pagesCep473 Module 1-Introduction To Project ManagementseraevioslNo ratings yet

- Chapter Five: 5.4 Marketing CommunicationDocument26 pagesChapter Five: 5.4 Marketing CommunicationMasresha TasewNo ratings yet

- BSAIS-InAc 213 Information Sheet 1Document11 pagesBSAIS-InAc 213 Information Sheet 1Reena BoliverNo ratings yet

- LEED Green AssociateDocument1 pageLEED Green AssociateRaymond ChettiNo ratings yet

- Real Estate Agent Resume PDFDocument8 pagesReal Estate Agent Resume PDFadvxpfsmd100% (1)

- Reviewer MarketingDocument3 pagesReviewer MarketingXul ZeeNo ratings yet

- Mahendra & MahendraDocument111 pagesMahendra & MahendrasiddiqrehanNo ratings yet

- Project Report of Research Methodology OnDocument47 pagesProject Report of Research Methodology Onmj143143No ratings yet

- Null 5 PDFDocument620 pagesNull 5 PDFJames100% (2)

- BM Paper 1 Case Study May 2021Document5 pagesBM Paper 1 Case Study May 2021Amr AwadNo ratings yet

- Harvard, Report Sample, Ikea Comprehensive AnalysisDocument20 pagesHarvard, Report Sample, Ikea Comprehensive AnalysisParmenas Kivinga KisengeseNo ratings yet

- Concept Paper Final-EntrepDocument12 pagesConcept Paper Final-EntrepNovamar MaximoNo ratings yet

- E-Commerce - AssessmentDocument3 pagesE-Commerce - AssessmentAlexis Autor SuacilloNo ratings yet

- Environmental Highlights 2019Document47 pagesEnvironmental Highlights 2019Ahmed IshaqNo ratings yet

- NMIMS - Session 2 - Transfer Pricing and APA - An OverviewDocument51 pagesNMIMS - Session 2 - Transfer Pricing and APA - An OverviewYash SharmaNo ratings yet

- History of Swot AnalysisDocument4 pagesHistory of Swot AnalysisAzeem Ali Shah100% (1)

- Trade Fair by Nitish AroraDocument25 pagesTrade Fair by Nitish Aroranitisharora116No ratings yet

- Q4-ABM-Applied Economics-12-Week-6-8Document4 pagesQ4-ABM-Applied Economics-12-Week-6-8Jovelyn AvilaNo ratings yet

- Ind AS 102Document86 pagesInd AS 102Deepika GuptaNo ratings yet

- Proj MNGT Book Review Chap 8Document5 pagesProj MNGT Book Review Chap 8Myla MoriNo ratings yet

- Idea and OpportunityDocument11 pagesIdea and OpportunityAdil BeshayiNo ratings yet

- Term Loan/Project Appraisal A Presentation: by A K Mishra IifbDocument69 pagesTerm Loan/Project Appraisal A Presentation: by A K Mishra Iifbmithilesh tabhaneNo ratings yet

- India: On The Reit' Path: Sweta Ananthanarayanan and Shreyas NarlaDocument23 pagesIndia: On The Reit' Path: Sweta Ananthanarayanan and Shreyas Narlaalim shaikhNo ratings yet

- Chapter 6 - Global Information Systems and Market ResearchDocument27 pagesChapter 6 - Global Information Systems and Market Researchaqiilah subrotoNo ratings yet

DIS Report

DIS Report

Uploaded by

Rizki Aulia Kusumawisanto0 ratings0% found this document useful (0 votes)

32 views1 pageThe Walt Disney Company is a global entertainment company with five business segments: media networks, parks and resorts, studio entertainment, consumer products, and interactive. Media networks, including ESPN, Disney Channels, and ABC Family, is Disney's largest segment. Parks and resorts include theme parks around the world. Disney competes with other media conglomerates and has proven to be the market leader with over 30% of total revenue from its top 10 competitors. Disney has competitive advantages through unique content and brand recognition.

Original Description:

Original Title

DIS-Report

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Walt Disney Company is a global entertainment company with five business segments: media networks, parks and resorts, studio entertainment, consumer products, and interactive. Media networks, including ESPN, Disney Channels, and ABC Family, is Disney's largest segment. Parks and resorts include theme parks around the world. Disney competes with other media conglomerates and has proven to be the market leader with over 30% of total revenue from its top 10 competitors. Disney has competitive advantages through unique content and brand recognition.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

32 views1 pageDIS Report

DIS Report

Uploaded by

Rizki Aulia KusumawisantoThe Walt Disney Company is a global entertainment company with five business segments: media networks, parks and resorts, studio entertainment, consumer products, and interactive. Media networks, including ESPN, Disney Channels, and ABC Family, is Disney's largest segment. Parks and resorts include theme parks around the world. Disney competes with other media conglomerates and has proven to be the market leader with over 30% of total revenue from its top 10 competitors. Disney has competitive advantages through unique content and brand recognition.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

The Walt Disney Company (NYSE: DIS)

Sector: Consumer Discretionary

Target Price Current Price 52 Week High 52 Week Low P/E Market Cap. Dividend Yield Beta

$115.16 $91.41 $120.65 $86.25 15.73 $148.64B 1.55% 1.08

Business Description 5-Year Stock Performance

The Walt Disney Company is a diversified global entertainment

business with operations in five major segments: Media Networks,

Parks and Resorts, Studio Entertainment, Consumer Products, and

Interactive. Media Networks is Disney’s largest segment which is

made up of the company’s cable and broadcast television networks

which include ESPN, the Disney Channels, and ABC Family. The

segment generates revenues from affiliate and provider fees. The

Parks and Resorts segment consists of the domestic and international

theme parks and resorts the company owns or has effective

ownership in. The resorts generate the majority of revenue from the

sale of admission and the food and retail purchases made within the

parks. The Studio Entertainment segment produces live-action and Competitive Analysis

animated films, direct-to-video content, musical recordings, and live Disney competes with many different media conglomerates across its

theater performances. Disney distributes this media under the Walt various business lines. The company’s largest competitors are

Disney Pictures, Pixar, Marvel, Lucasfilm, and Touchstone banners Comcast, Time Warner, 21st Century Fox, CBS Corp., and Discovery

with revenues stemming from the distribution of the content. The Communications. Disney has proven to be the market leader in the

Consumer Products segment designs and develops a wide array of media industry, with the largest market-share by revenue of all

products based on its extensive intellectual property which produce competitors. This past year, Disney reported $52.465B in revenue

revenue through licensing, publishing, and the company’s retail stores. which is equivalent to 31.82% of the total revenue generated by its ten

The interactive segment develops console, mobile, and virtual games closest competitors combined.

sold globally and licenses content to publishers for mobile devices.

Competitive Advantages

Industry Trends Disney is an innovator and leader in its primary business segments.

The entertainment media industry consists of companies that own ESPN, ABC, and the Disney Channels offer unique content that

content and license intellectual property, as well as distribute media cannot be licensed or distributed by other media networks. The

through television and film. To remain competitive in this industry, strength and exclusive nature of this content allows Disney to

companies must continually adapt to consumers’ taste in both content generate profit above their competitors through advertising and

and distribution. The industry has observed a shift over the past few affiliate fees. The company also ties many of its business units

years where consumers are switching from cable programming to over- together where consumers are able to engage with the same characters

the-top (OTT) streaming services. To adjust for this change and the through television, film, consumer products, parks, and video games.

loss of subscribers throughout the industry, companies have been Disney’s brand recognition is one of its strongest assets and continues

seeking innovative solutions to expand their distribution channels. to be a household name across the globe.

Companies that grow popular content, expand internationally, and

innovate for future online trends are best positioned for long-term Risks

success. Disney faces a number of industry based risks. The primary concern

in Disney is its loss of subscribership for its ESPN networks with

Investment Thesis consumers who no longer wish to pay the high cable fees and instead

The Walt Disney Company has been a leader in the media are moving toward streaming services. However, Disney has made

entertainment industry throughout its history with its strong brand investments and partnerships with BAMTech, AT&T/DirecTV,

recognition and consumer loyalty. The company will continue to Hulu, PlayStation Vue, and Sling TV which are actively addressing

provide long run value due to its unique media network content, these concerns and moving the company toward streaming

domination in its world-renowned parks and resorts, and its distribution. Other risks include decline in economic conditions,

consistent ability to monetize on its intellectual property. The maintenance of intellectual property rights, and increased competition.

company has seen consistent and strong growth since inception and is As the top global content licensor with incredible control over its

continuing to innovate across all segments. Disney’s minority stake in unique and innovative intellectual property, this risk is not a concern

BAMTech and other OTT streaming services will help the company and barriers to entry remain high in all segments.

expand distribution and thus remain an industry leader. International

investment in Europe and Asia for the parks and resorts business will Corporate Social Responsibility

benefit the company through exposure to other high growth Environmental Disclosure Score: 27.91 (Industry average: 16.83)

economies. Social Disclosure Score: 24.56 (Industry average: 19.14)

Percent of Women on Board: 30.00 % (Industry average: 20.57%)

Valuation Assumptions Key Financials Community Spending: 333.30M (Industry average: 151.89M)

WACC: 8.84% ROA: 10.23% (Industry 6.80%) Energy Efficiency and Climate Change Policies: Yes

Terminal FCF Growth Rate: 3.5% ROE: 19.70% (Industry 20.79%)

DCF Stock Price: $107.52 D/E: 35.69% (Industry 105.97%) Report Prepared By:

DDM Stock Price: $122.79 Net Margin: 16.80% (Industry Tom Delaney and Tami Stawicki on 10/12/2016

Weighted 50/50 13.77%) Sources: Bloomberg, Yahoo! Finance, Reuters, 2015 Disney Annual Report

You might also like

- Financial Statements StudentDocument4 pagesFinancial Statements StudentCarolina BecerraNo ratings yet

- Walt Disney Case AnalysisDocument8 pagesWalt Disney Case AnalysisPauline Beatrice Sombillo100% (2)

- Disney Industry CaseDocument6 pagesDisney Industry Caseapi-535570354No ratings yet

- 1 Executive-SummaryDocument6 pages1 Executive-SummaryJae GrandeNo ratings yet

- Risk Management Case StudyDocument15 pagesRisk Management Case Studynelsonpapa3No ratings yet

- Walt Disney - Strategy AnalysisDocument31 pagesWalt Disney - Strategy Analysisadityaseven84% (19)

- Walt DisneyDocument3 pagesWalt Disneyhb_shotgun50% (2)

- Walt Disney ReportDocument7 pagesWalt Disney ReportPratyuosh SrivastavNo ratings yet

- Disney StrategyDocument32 pagesDisney Strategyshashankgowda100% (2)

- Kaplan AssignmentDocument7 pagesKaplan AssignmentAli100% (1)

- Tivo Case Analysis BulletsDocument4 pagesTivo Case Analysis BulletsyellowbirdhnNo ratings yet

- Tivo Case Analysis: A. Swot Analysis StrengthDocument4 pagesTivo Case Analysis: A. Swot Analysis StrengthAfshin SalehianNo ratings yet

- Nutella Media PlanDocument12 pagesNutella Media Plankayla_kelly_fitnyc100% (5)

- Analysis of The Walt Disney CompanyDocument15 pagesAnalysis of The Walt Disney CompanygimbrinelNo ratings yet

- Walt Disney Investment Report 2020.10.16Document6 pagesWalt Disney Investment Report 2020.10.16uyenbp.a2.1720No ratings yet

- Group ATM (Association of Talented Managers)Document3 pagesGroup ATM (Association of Talented Managers)Le Vo Bao NganNo ratings yet

- Media Conglomerate PaperDocument6 pagesMedia Conglomerate PaperLauren K. MeltonNo ratings yet

- The Walt Disney Case StudyDocument2 pagesThe Walt Disney Case StudyNouhaNo ratings yet

- Disney AnalysisDocument5 pagesDisney AnalysisAli FaycalNo ratings yet

- Disney AnalysisDocument5 pagesDisney AnalysisgessyghesiyahNo ratings yet

- A Comparative Analysis of The North American Media and Entertainment IndustryDocument28 pagesA Comparative Analysis of The North American Media and Entertainment IndustryMax ZhuNo ratings yet

- Walt Disney Strategic CaseDocument28 pagesWalt Disney Strategic CaseArleneCastroNo ratings yet

- ACCT 503B Advanced Business Analysis - Disney Final Report V2Document16 pagesACCT 503B Advanced Business Analysis - Disney Final Report V2reiner satrioNo ratings yet

- BSDW ReportDocument7 pagesBSDW ReportxavilitoNo ratings yet

- Walt Disney CaseDocument14 pagesWalt Disney Casefarhanhaseeb7100% (1)

- Walt Disney Case AnalysisDocument9 pagesWalt Disney Case AnalysisHassam BalouchNo ratings yet

- Executive-Summary (Nishi)Document10 pagesExecutive-Summary (Nishi)Sanzida Sharmin RifaNo ratings yet

- Disney Case StudyDocument5 pagesDisney Case StudyAhmet KalamışNo ratings yet

- Baggu ReportDocument11 pagesBaggu ReportRuchith RameshNo ratings yet

- UNPUBLISHED Walt Disney Company ProfileDocument2 pagesUNPUBLISHED Walt Disney Company ProfilejocelynrubinNo ratings yet

- The Walt Disney Company Company AnalysisDocument16 pagesThe Walt Disney Company Company AnalysisSanjay BijaraniaNo ratings yet

- Swot AnalysisDocument6 pagesSwot Analysiskhushboo kohadkarNo ratings yet

- Analysis On The Current State of The Disney Economy and Sentiment Text Analysis On Customer ReviewsDocument11 pagesAnalysis On The Current State of The Disney Economy and Sentiment Text Analysis On Customer Reviewssam mirouNo ratings yet

- IntroductionDocument6 pagesIntroductionLinh ĐinhNo ratings yet

- Emarketer US Media and Entertainment Digital Ad Spending ForecastDocument13 pagesEmarketer US Media and Entertainment Digital Ad Spending ForecastTomasz SulewskiNo ratings yet

- Assignment SMDocument13 pagesAssignment SMsimNo ratings yet

- Walt DisneyDocument25 pagesWalt DisneyLukmaan Rehmaan100% (1)

- Case Analysis Disney3Document8 pagesCase Analysis Disney3visvisnuvNo ratings yet

- The Walt Disney CompanyDocument6 pagesThe Walt Disney Companybpowell2No ratings yet

- Strategic Analysis of Walt DisneyDocument13 pagesStrategic Analysis of Walt DisneyVISHISHTHA UPUL100% (3)

- Disney Vs TimeWarner Financial RatioDocument19 pagesDisney Vs TimeWarner Financial RatiopatternprojectNo ratings yet

- TV Ad Measurement 2021 EmarketerDocument14 pagesTV Ad Measurement 2021 EmarketerITRS SapraNo ratings yet

- The Walt Disney CompanyDocument19 pagesThe Walt Disney CompanyBMX2013100% (1)

- Waltdisney2 PPT CrdownloadDocument33 pagesWaltdisney2 PPT CrdownloadRaman ManchandaNo ratings yet

- Introduction To Management (BM007-3-1-ITM) AssignmentDocument9 pagesIntroduction To Management (BM007-3-1-ITM) AssignmentCk VinNo ratings yet

- DISNEY Case AnalysisDocument10 pagesDISNEY Case Analysis민혜지No ratings yet

- Memo 3 - Walt DisneyDocument6 pagesMemo 3 - Walt DisneyDolly_AmethystNo ratings yet

- Exercise 5B Evaluating DisneysDocument3 pagesExercise 5B Evaluating DisneysScribdTranslationsNo ratings yet

- Group 4 Strategy Case 'Disney' V 1.4Document10 pagesGroup 4 Strategy Case 'Disney' V 1.4Stijn Lfb50% (2)

- S10-Walt DisneyDocument2 pagesS10-Walt Disneysai kiran reddyNo ratings yet

- First Research Industry Profile - Motion Picture Production and DistributionDocument14 pagesFirst Research Industry Profile - Motion Picture Production and DistributionVictoria YampolskyNo ratings yet

- Final Case Memo - Mariam FaisalDocument7 pagesFinal Case Memo - Mariam FaisalMaryam FaisalNo ratings yet

- Walt Disney - BRAMDocument3 pagesWalt Disney - BRAMBramanto Adi NegoroNo ratings yet

- Report DisneyDocument8 pagesReport DisneyAlejandraNo ratings yet

- Porter's Five ForcesDocument17 pagesPorter's Five ForcesTe TeeNo ratings yet

- Nhật AnhDocument8 pagesNhật AnhNguyễn Ngọc TuấnNo ratings yet

- Poorna SMSL Draft 2Document22 pagesPoorna SMSL Draft 2Prabhashi WitharanaNo ratings yet

- Market Segments - GautamDocument5 pagesMarket Segments - GautamGautam SchaanNo ratings yet

- Asian Development Bank Trust Funds Report 2020: Includes Global and Special FundsFrom EverandAsian Development Bank Trust Funds Report 2020: Includes Global and Special FundsNo ratings yet

- ARforSocialInfrastructure FinalDocument21 pagesARforSocialInfrastructure FinalRizki Aulia KusumawisantoNo ratings yet

- Evolution of Infrastructure As An Asset Class: A Systematic Literature Review and Thematic AnalysisDocument28 pagesEvolution of Infrastructure As An Asset Class: A Systematic Literature Review and Thematic AnalysisRizki Aulia KusumawisantoNo ratings yet

- Mnj. Fungsional-All Kls-Final Term (R)Document7 pagesMnj. Fungsional-All Kls-Final Term (R)Rizki Aulia KusumawisantoNo ratings yet

- Modul Tutorial - Riset Dan Statistik TerapanDocument12 pagesModul Tutorial - Riset Dan Statistik TerapanRizki Aulia KusumawisantoNo ratings yet

- Chap005 UpdatedDocument35 pagesChap005 UpdatedRizki Aulia KusumawisantoNo ratings yet

- 10 1108 - JFMPC 07 2019 0065Document20 pages10 1108 - JFMPC 07 2019 0065Rizki Aulia KusumawisantoNo ratings yet

- Conflicts of Interest 101 Fall 2014Document11 pagesConflicts of Interest 101 Fall 2014Rizki Aulia KusumawisantoNo ratings yet

- Finman Merged Midterm ReviewerDocument90 pagesFinman Merged Midterm ReviewerAlliana CunananNo ratings yet

- Organizational Study at Birdy Exports PVT LTDDocument66 pagesOrganizational Study at Birdy Exports PVT LTDJOSHUA T JOHNSON 19D2097No ratings yet

- Top 100 Richest People Apr 2011Document9 pagesTop 100 Richest People Apr 2011Social HuesNo ratings yet

- Unit Test 7A Basic LevelDocument3 pagesUnit Test 7A Basic LevelВалентин БивалінNo ratings yet

- Strategy SsDocument8 pagesStrategy SsKaran HingmireNo ratings yet

- Cep473 Module 1-Introduction To Project ManagementDocument25 pagesCep473 Module 1-Introduction To Project ManagementseraevioslNo ratings yet

- Chapter Five: 5.4 Marketing CommunicationDocument26 pagesChapter Five: 5.4 Marketing CommunicationMasresha TasewNo ratings yet

- BSAIS-InAc 213 Information Sheet 1Document11 pagesBSAIS-InAc 213 Information Sheet 1Reena BoliverNo ratings yet

- LEED Green AssociateDocument1 pageLEED Green AssociateRaymond ChettiNo ratings yet

- Real Estate Agent Resume PDFDocument8 pagesReal Estate Agent Resume PDFadvxpfsmd100% (1)

- Reviewer MarketingDocument3 pagesReviewer MarketingXul ZeeNo ratings yet

- Mahendra & MahendraDocument111 pagesMahendra & MahendrasiddiqrehanNo ratings yet

- Project Report of Research Methodology OnDocument47 pagesProject Report of Research Methodology Onmj143143No ratings yet

- Null 5 PDFDocument620 pagesNull 5 PDFJames100% (2)

- BM Paper 1 Case Study May 2021Document5 pagesBM Paper 1 Case Study May 2021Amr AwadNo ratings yet

- Harvard, Report Sample, Ikea Comprehensive AnalysisDocument20 pagesHarvard, Report Sample, Ikea Comprehensive AnalysisParmenas Kivinga KisengeseNo ratings yet

- Concept Paper Final-EntrepDocument12 pagesConcept Paper Final-EntrepNovamar MaximoNo ratings yet

- E-Commerce - AssessmentDocument3 pagesE-Commerce - AssessmentAlexis Autor SuacilloNo ratings yet

- Environmental Highlights 2019Document47 pagesEnvironmental Highlights 2019Ahmed IshaqNo ratings yet

- NMIMS - Session 2 - Transfer Pricing and APA - An OverviewDocument51 pagesNMIMS - Session 2 - Transfer Pricing and APA - An OverviewYash SharmaNo ratings yet

- History of Swot AnalysisDocument4 pagesHistory of Swot AnalysisAzeem Ali Shah100% (1)

- Trade Fair by Nitish AroraDocument25 pagesTrade Fair by Nitish Aroranitisharora116No ratings yet

- Q4-ABM-Applied Economics-12-Week-6-8Document4 pagesQ4-ABM-Applied Economics-12-Week-6-8Jovelyn AvilaNo ratings yet

- Ind AS 102Document86 pagesInd AS 102Deepika GuptaNo ratings yet

- Proj MNGT Book Review Chap 8Document5 pagesProj MNGT Book Review Chap 8Myla MoriNo ratings yet

- Idea and OpportunityDocument11 pagesIdea and OpportunityAdil BeshayiNo ratings yet

- Term Loan/Project Appraisal A Presentation: by A K Mishra IifbDocument69 pagesTerm Loan/Project Appraisal A Presentation: by A K Mishra Iifbmithilesh tabhaneNo ratings yet

- India: On The Reit' Path: Sweta Ananthanarayanan and Shreyas NarlaDocument23 pagesIndia: On The Reit' Path: Sweta Ananthanarayanan and Shreyas Narlaalim shaikhNo ratings yet

- Chapter 6 - Global Information Systems and Market ResearchDocument27 pagesChapter 6 - Global Information Systems and Market Researchaqiilah subrotoNo ratings yet