Professional Documents

Culture Documents

Chapter 3 Accounting

Chapter 3 Accounting

Uploaded by

Daniel Kounah0 ratings0% found this document useful (0 votes)

7 views1 pagePrinciples of Financial Accounting Chapter 3 and 4 Solutions

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPrinciples of Financial Accounting Chapter 3 and 4 Solutions

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views1 pageChapter 3 Accounting

Chapter 3 Accounting

Uploaded by

Daniel KounahPrinciples of Financial Accounting Chapter 3 and 4 Solutions

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

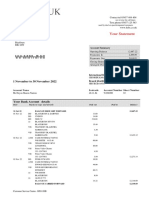

Example similar to P3-6A Record closing entries and prepare a post-closing trial balance

SUPPLY ACCOUNTING SERVICES

Income Statement

Service revenue $87,500

Expenses:

Salaries $46,000

Utilities 8,200

Insurance 5,800

Supplies 2,100 62,100

Net income $25,400

SUPPLY ACCOUNTING SERVICES

Statement of Stockholders' Equity

Common Retained

Stock Earnings Total SE

Beginning balance, Jan. 1 $60,000 $24,500 84,500

Issue stock 30,000 30,000

Net income 25,400 25,400

Dividends (6,000) (6,000)

Ending balance, Dec. 31 $90,000 $43,900 $133,900

SUPPLY ACCOUNTING SERVICES

Balance Sheet

Assets Liabilities

Cash $14,700 Accounts payable $3,000

Accounts receivable 7,200 Stockholders' Equity:

Land 115,000 Common stock $90,000

Retained earnings 43,900

Total SE 133,900

Total assets $136,900 Total liabilities and equities $136,900

1. Record year-end closing entries

Date General Journal Debit Credit

1 December 31 Service Revenue 87,500

Retained Earnings 87,500

2 December 31 Retained Earnings 62,100

Salaries Expense 46,000

Utilities Expense 8,200

Insurance Expense 5,800

Supplies Expense 2,100

3 December 31 Retained Earnings 6,000

Dividends 6,000

2.Prepare a post-closing trial balance.

SUPPLY ACCOUNTING SERVICES

Post-Closing Trial Balance

Accounts Debit Credit

Cash $14,700

Accounts Receivable 7,200

Land 115,000

Accounts Payable 3,000

Common Stock 90,000

Retained Earnings 43,900

Totals $136,900 $136,900

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 2022 11 30 - StatementDocument7 pages2022 11 30 - StatementGiovanni SlackNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- APECS VCCC Preliminary CaseDocument5 pagesAPECS VCCC Preliminary CaseNg Jun LongNo ratings yet

- Exercises-Stock ValuationDocument2 pagesExercises-Stock ValuationErjohn Papa50% (2)

- Section A - Group DDocument6 pagesSection A - Group DAbhishek Verma100% (1)

- Adjusting Entries: Measurement Prepare Financial Statements (Income STMT, STMT of SE, Balance Sheet, STMT of Cash Flows)Document3 pagesAdjusting Entries: Measurement Prepare Financial Statements (Income STMT, STMT of SE, Balance Sheet, STMT of Cash Flows)Daniel KounahNo ratings yet

- Record Adjusting EntriesDocument1 pageRecord Adjusting EntriesDaniel KounahNo ratings yet

- New England PatriotsDocument3 pagesNew England PatriotsDaniel KounahNo ratings yet

- Cloud Security Strategy Document: Name of OrganizationDocument9 pagesCloud Security Strategy Document: Name of OrganizationDaniel KounahNo ratings yet

- Running Head: Qualitative Data Visualization 1Document7 pagesRunning Head: Qualitative Data Visualization 1Daniel KounahNo ratings yet

- Risk Assessment Report - Proposal & Annotated BibliographyDocument7 pagesRisk Assessment Report - Proposal & Annotated BibliographyDaniel KounahNo ratings yet

- Rhetorical AnalysisDocument5 pagesRhetorical AnalysisDaniel KounahNo ratings yet

- Louvre Abu Dhabi2Document16 pagesLouvre Abu Dhabi2Daniel KounahNo ratings yet

- Sierra Leone Case StudyDocument39 pagesSierra Leone Case StudyDaniel KounahNo ratings yet

- Direct Tax Ca FinalDocument10 pagesDirect Tax Ca FinalGaurav GaurNo ratings yet

- Major ProjectDocument80 pagesMajor ProjectAllan RajuNo ratings yet

- Account PaperDocument8 pagesAccount PaperAhmad SiddiquiNo ratings yet

- Angel Investor List - Smallbiz America CapitalDocument6 pagesAngel Investor List - Smallbiz America CapitalJohn BanaskiNo ratings yet

- Accounting & Financial Management For BankersDocument2 pagesAccounting & Financial Management For BankersAditya KaushalNo ratings yet

- Examination Question and Answers, Set A (True or False), Chapter 1 - Introduction To Accounting and BusinessDocument2 pagesExamination Question and Answers, Set A (True or False), Chapter 1 - Introduction To Accounting and BusinessJohn Carlos DoringoNo ratings yet

- 71480bos57500 p1 PDFDocument33 pages71480bos57500 p1 PDFParmeet NainNo ratings yet

- NHPC 3Document49 pagesNHPC 3Hitesh Mittal100% (1)

- (Financial Accounting & Reporting 2) : Lecture AidDocument29 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- Mutual Fund Set-2Document37 pagesMutual Fund Set-2royal62034No ratings yet

- Chapter 25. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesDocument22 pagesChapter 25. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesPrashantKNo ratings yet

- 1 Financial Statements AnalysisDocument5 pages1 Financial Statements AnalysisMark Lawrence YusiNo ratings yet

- ASM Supple TekDocument16 pagesASM Supple TekRajendra JoshiNo ratings yet

- EmptyDocument2 pagesEmptyPranav ChaudhariNo ratings yet

- Comparison of Ifrs, Ind As AsDocument7 pagesComparison of Ifrs, Ind As AsRudrin DasNo ratings yet

- BAV Course OutlineDocument4 pagesBAV Course OutlineRishabh GuptaNo ratings yet

- Financial Statements: by Rama Krishna Animireddy Roll No: 109516 I - MbaDocument10 pagesFinancial Statements: by Rama Krishna Animireddy Roll No: 109516 I - MbaRamakrishna ReddyNo ratings yet

- Types of Earnings Management and Manipulation Examples of Earnings ManipulationDocument6 pagesTypes of Earnings Management and Manipulation Examples of Earnings Manipulationkhurram riazNo ratings yet

- CTT EXAMINATION REVIEWER - Compilation of MCQs (RJ Answers)Document21 pagesCTT EXAMINATION REVIEWER - Compilation of MCQs (RJ Answers)James RelletaNo ratings yet

- Ind AS 102Document86 pagesInd AS 102Deepika GuptaNo ratings yet

- Level III ModelDocument15 pagesLevel III Modelsolomon asfawNo ratings yet

- Chapter 3 Ethiopian Tax SystemDocument28 pagesChapter 3 Ethiopian Tax SystemMinaw BelayNo ratings yet

- Pa 2Document3 pagesPa 2vi ngelsNo ratings yet

- 12.20.10 ENER Dilution Tracker - Dec Debt Swap Boosts Share Out by 5%Document5 pages12.20.10 ENER Dilution Tracker - Dec Debt Swap Boosts Share Out by 5%ac310No ratings yet

- Gland Pharma LimitedDocument316 pagesGland Pharma LimitedPranav WarneNo ratings yet

- Management Name DesignationDocument5 pagesManagement Name DesignationDt.vijaya ShethNo ratings yet