Professional Documents

Culture Documents

Govt. Intervention+ Anti+subsidy, Dumping

Govt. Intervention+ Anti+subsidy, Dumping

Uploaded by

VANESSA SAGARIKA ALPHONSEOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Govt. Intervention+ Anti+subsidy, Dumping

Govt. Intervention+ Anti+subsidy, Dumping

Uploaded by

VANESSA SAGARIKA ALPHONSECopyright:

Available Formats

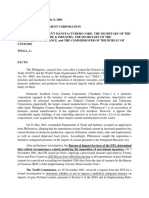

Govt moves on anti-subsidy;

dumping levies under lens

Tribunal, HC Dismiss Revenue Dept's Stand In Several Cases

Sidhartha@timesgroup.com mendation having been made

New Delhi: At least two judi-

cial pronouncements have ta-

TradeRemedies Allowed By WTO by the designated authority for

imposition of anti-dumping

duty, cannot be sustained and

Anti-dumping duty | Ifa domestic producers are hurt

ken a dim view of the finance company exports a product by imports of subsidised the matter would have to be re

ministry's decisions against at a price lower than the price products, countervailing duty mitted to the central govern-

imposing anti-dumping and it normally charges in its can be imposed ment for taking a fresh deci

safeguard duties despite fin- home market, it is said sion on the recommendation m

Safeguard action | It

dings and recommendations to be "dumping" the allows a country to made by the designated autho-

of the Directorate General of product. Govts have to rity" it observed.

establish that dumping is

A temporarily restrict At least one of the compa-

Trade Remedies (DGTR) es imports of a product if its

tablishing adverse impact of causing material or genuine domestic industry is injured nies, Sterlite Industries, who

cheap or subsidised imports injury to domestic industry or threatened with injury due se complaint regarding safe

on domestic industry Countervailing duty | If to an import "surge" guard action on single-mode

Several Indian companies optical fibre had established

and industry bodies have gone dustry will be wiped out. Customs, Excise& Service Tax that there were problems for ti

to court against the revenue In one case, the revenue de- Appellate Tribunal asked the the domestic industry, had sa- e

department's recent deci- partment's decision to "unila- Centre to reconsider its deci id that the finance ministry's

sions, which came after it op terally suspend" countervai- sions in a bunch of cases whe- decision was "arbitrary, unre

re it decided against accepting asoned and bad in law" and

ted to be selective in imposing ling duty on certain varieties

of stainless steel from China the designated authority's re should be set aside.

anti-dumping or safeguard du- The tribunal, while main-

ties to protect domestic indust has been quashedand set aside commendations. In several ca

by the Gujarat high court. The ses, where the revenue depart- taining the principle of natu

ry The finance ministry and

Niti Aayogare of the view that agencies concerned have also ment in the finance ministry ral justice has to be followed,

such actions impact other pro been asked to complete the didnot botherto communicate said, "If the central govern-

ducers in the chain, while the sunset review in line with the its final decision, the tribunal ment forms a prima facie opi

laid down process. Under the has taken the same view The nion that final findings of de

commerce ministry believes

the DGTR recommendations law, a duty is imposed for a spe- law governing anti-dumping signatedauthority recommen

cified period and is assessed ding imposition of anti-dum-

come after establishing adver- cases

requires the revenue de are not required to

se impact on domestic produ- again afterthat, which is refer- partment to decide on a matter ping duty

cers andare in line with World red to as sunset review within three months of the beaccepted, then tentativerea-

Trade Organization rules. The The Delhi high courtis

isalso DGTR's recommendations. sons have to be recorded and

commerce department is of hearing a bunch of petitions "..the decision taken by conveyed to domestic industry

the Centre not to impose anti So as to give an opportunity to

the opinion that unless such relatedtoanti-dumpingduty.

submit a representation."

an action is taken domestic in- Hearing a set of cases, the dumpingduty despitearecom-

You might also like

- State of Content Marketing 2023Document126 pagesState of Content Marketing 2023pavan teja100% (1)

- Parables AssignmentDocument5 pagesParables Assignmentangel_grrl6827No ratings yet

- Dumping and Anti-DumpingDocument16 pagesDumping and Anti-Dumpingamarendra pratap singhNo ratings yet

- Induslaw Competition Law Year in Review 2020Document10 pagesInduslaw Competition Law Year in Review 2020AnjaliSinghNo ratings yet

- CIR vs. Magsaysay LinesDocument11 pagesCIR vs. Magsaysay LinesIan LastNo ratings yet

- Essage From The Anaging Artner: MontageDocument6 pagesEssage From The Anaging Artner: MontagesclinterNo ratings yet

- Asia Counsel Insights August 2017Document2 pagesAsia Counsel Insights August 2017C_schaeferNo ratings yet

- WTO - Anti-Dumping - Technical InformationDocument5 pagesWTO - Anti-Dumping - Technical InformationcodesardarNo ratings yet

- ITLP - Notes2Document9 pagesITLP - Notes2Louis MalaybalayNo ratings yet

- Definition of TermsDocument3 pagesDefinition of TermsMARKNo ratings yet

- E-Journal: Vol - Vi Issue No.42 JAN 2008Document16 pagesE-Journal: Vol - Vi Issue No.42 JAN 2008CIERNo ratings yet

- Submitted To Submitted byDocument32 pagesSubmitted To Submitted byMANISH KUMARNo ratings yet

- Latest Updates in Indirect Tax Law For May 2015 Exams A. Central ExciseDocument21 pagesLatest Updates in Indirect Tax Law For May 2015 Exams A. Central Excisesivanpillai ganesanNo ratings yet

- 1 Paseo Realty and Development Corp Vs Court of Appeals 2 Walter Lutz Vs J. Antonio AranetaDocument3 pages1 Paseo Realty and Development Corp Vs Court of Appeals 2 Walter Lutz Vs J. Antonio AranetadrewdalapuNo ratings yet

- MFRS 137 ExamplesDocument6 pagesMFRS 137 ExamplesN FrzanahNo ratings yet

- Anti Dumping, Safeguards, and Countervailing Duties: Global Business ManagementDocument12 pagesAnti Dumping, Safeguards, and Countervailing Duties: Global Business Managementajiz tamboliNo ratings yet

- Lecture 4Document26 pagesLecture 4exotic trendsNo ratings yet

- What Is Dumping? What Is An Anti-Dumping Measure?Document8 pagesWhat Is Dumping? What Is An Anti-Dumping Measure?Shaina DalidaNo ratings yet

- I. Definition of Terms II. Safeguard Measures To Protect Small and Domestic Enterprise/remedies A. Countervailing DutiesDocument30 pagesI. Definition of Terms II. Safeguard Measures To Protect Small and Domestic Enterprise/remedies A. Countervailing DutiesKyllua Theoty Entendez DesolocNo ratings yet

- DEUTSCHE BANK AG MANILA BRANCH V CIRDocument17 pagesDEUTSCHE BANK AG MANILA BRANCH V CIROlivia JaneNo ratings yet

- Taxation Security Against Oppressive Taxation - The Power To Impose Taxes Is One SoDocument6 pagesTaxation Security Against Oppressive Taxation - The Power To Impose Taxes Is One SoAyana Dela CruzNo ratings yet

- 3 Anti Dumping DutyDocument20 pages3 Anti Dumping DutyPam PincaNo ratings yet

- SAFEGUARDDocument4 pagesSAFEGUARDMARIA CRISTINA LIMPAGNo ratings yet

- Deutsche Bank v. CIRDocument17 pagesDeutsche Bank v. CIRMlaNo ratings yet

- Ibt 6Document2 pagesIbt 6Glaizel LarragaNo ratings yet

- Direct Foreign Investment: Restrictions On ImportsDocument5 pagesDirect Foreign Investment: Restrictions On ImportsVenus Gavino ManaoisNo ratings yet

- SOUTHERN CROSS CEMENT CORPORATION V PHILCEMCOR Digest PDFDocument4 pagesSOUTHERN CROSS CEMENT CORPORATION V PHILCEMCOR Digest PDFJay IgpuaraNo ratings yet

- Anti-Dumping MeasuresDocument21 pagesAnti-Dumping MeasuresDrishti TiwariNo ratings yet

- Smuggling - Points To Consider in Anti Smuggling BillDocument8 pagesSmuggling - Points To Consider in Anti Smuggling BillMariver LlorenteNo ratings yet

- World Trade: Organization Subsidies and Countervailing MeasuresDocument24 pagesWorld Trade: Organization Subsidies and Countervailing MeasuresBanta EdmondNo ratings yet

- CDA Webinar Presentation PCCDocument27 pagesCDA Webinar Presentation PCCFrancene FranxNo ratings yet

- Unit 3 Part2Document12 pagesUnit 3 Part2Soumya RathoreNo ratings yet

- Wto 1Document45 pagesWto 1Ssg BNo ratings yet

- 20 Panasonic Communications vs. CIRDocument10 pages20 Panasonic Communications vs. CIRJohn BernalNo ratings yet

- Report Summary-Ecosystem of StartupsDocument1 pageReport Summary-Ecosystem of StartupsTrishala SinghNo ratings yet

- Anti Dumping Measures and AgreementDocument24 pagesAnti Dumping Measures and AgreementAqib khanNo ratings yet

- NTI Umping Easures: HapterDocument34 pagesNTI Umping Easures: Haptermaanushi JainNo ratings yet

- PWC Tax Alert - Deduction of Expenses Incurred Outside NigeriaDocument1 pagePWC Tax Alert - Deduction of Expenses Incurred Outside NigeriaEmmanuelNo ratings yet

- Synopsis: "WTO Agreement and Anti Dumping Duty With Special Reference To Indian Scenario'Document4 pagesSynopsis: "WTO Agreement and Anti Dumping Duty With Special Reference To Indian Scenario'nandhalawNo ratings yet

- Anti Dumping and Safeguard DutyDocument31 pagesAnti Dumping and Safeguard DutyPradeepNaiduRajanaNo ratings yet

- Chennai Business LineDocument15 pagesChennai Business LineShooeibNo ratings yet

- Primer RA8800 (SG)Document11 pagesPrimer RA8800 (SG)SamuelNo ratings yet

- Deutsche Bank Ag Manila Branch, Petitioner, vs. Commissioner of Internal Revenue, RespondentDocument15 pagesDeutsche Bank Ag Manila Branch, Petitioner, vs. Commissioner of Internal Revenue, RespondentSzia Darene MartinNo ratings yet

- Azmi Newsletteraug09 WebDocument4 pagesAzmi Newsletteraug09 WebTamzyNo ratings yet

- Tio v. Videogram Regulatory BoardDocument3 pagesTio v. Videogram Regulatory BoardAila AmpNo ratings yet

- Indirect Tax Latets UpdatesDocument12 pagesIndirect Tax Latets UpdatesSaurav KakkarNo ratings yet

- 11-Salient Feature - FY 2020-21 11.18AMDocument26 pages11-Salient Feature - FY 2020-21 11.18AMSahar BaigNo ratings yet

- Anti DumpingDocument16 pagesAnti DumpingFaisal JalalNo ratings yet

- Assignment Foreign Trade Law: Mdu-CpasDocument10 pagesAssignment Foreign Trade Law: Mdu-CpasTanuNo ratings yet

- 010 Southern Cross Cement Corp. v. Cement Manufacturers Assoc'n. of The Phils. (Uy)Document5 pages010 Southern Cross Cement Corp. v. Cement Manufacturers Assoc'n. of The Phils. (Uy)Avie UyNo ratings yet

- Current Affair JuneDocument9 pagesCurrent Affair JuneTarun JhaNo ratings yet

- Roxan, Intertax 1997, 367Document12 pagesRoxan, Intertax 1997, 367Selcen CenikogluNo ratings yet

- Lightening The Burden of GAARDocument3 pagesLightening The Burden of GAARNaveen SharmaNo ratings yet

- Cir v. Puregold (Full Text)Document13 pagesCir v. Puregold (Full Text)Jeng PionNo ratings yet

- Answering Queries: Mutual Agreement Procedure - Demystified Mutual Agreement ProcedureDocument13 pagesAnswering Queries: Mutual Agreement Procedure - Demystified Mutual Agreement Procedureupsc.bengalNo ratings yet

- 14 CIR v. Magsaysay Lines, Inc.Document1 page14 CIR v. Magsaysay Lines, Inc.Jued CisnerosNo ratings yet

- Tio V. Videogram Regulatory Board 151 SCRA 208 Facts: IssuesDocument14 pagesTio V. Videogram Regulatory Board 151 SCRA 208 Facts: IssuesJason ToddNo ratings yet

- QBE Technical Claims Brief May 2011Document11 pagesQBE Technical Claims Brief May 2011Philip De SausmarezNo ratings yet

- Primer RA8751 (CV)Document10 pagesPrimer RA8751 (CV)SamuelNo ratings yet

- 2 Green - Industrial - Policy - Book - Aw - Web (161-170)Document10 pages2 Green - Industrial - Policy - Book - Aw - Web (161-170)michelin77No ratings yet

- 6.case Study On Input Tax Credit Under GSTDocument17 pages6.case Study On Input Tax Credit Under GSTSUNIL PUJARINo ratings yet

- Agreements BBG enDocument26 pagesAgreements BBG enRajasheker ReddyNo ratings yet

- Beowulf StoryDocument6 pagesBeowulf StoryAndrey Zoe De LeonNo ratings yet

- AnnamayyaDocument4 pagesAnnamayyaSaiswaroopa IyerNo ratings yet

- View Full-Featured Version: Send To PrinterDocument5 pagesView Full-Featured Version: Send To PrinteremmanjabasaNo ratings yet

- Definition:: Handover NotesDocument3 pagesDefinition:: Handover NotesRalkan KantonNo ratings yet

- Organization and Management - Week - 1Document5 pagesOrganization and Management - Week - 1ღNightmare RadioღNo ratings yet

- Customs Procedure CodesDocument23 pagesCustoms Procedure CodesJonathan D'limaNo ratings yet

- Holy Spirit in Christianity - WikipediaDocument21 pagesHoly Spirit in Christianity - WikipediaSunny BautistaNo ratings yet

- Custody ServiceDocument4 pagesCustody ServicemuffadNo ratings yet

- 100 Earth Shattering Remote Sensing ApplicationsDocument145 pages100 Earth Shattering Remote Sensing ApplicationsENRIQUENo ratings yet

- St. Martin vs. LWVDocument2 pagesSt. Martin vs. LWVBaby T. Agcopra100% (5)

- Mindanao Development Authority v. CADocument14 pagesMindanao Development Authority v. CAKadzNitura0% (1)

- Winning The Easy GameDocument18 pagesWinning The Easy GameLeonardo PiovesanNo ratings yet

- The Effects of Monetary Policy:: A SummaryDocument43 pagesThe Effects of Monetary Policy:: A SummaryhumaidjafriNo ratings yet

- Certification 22000 Di Industri Kemasan Pangan: Analisis Pemenuhan Persyaratan Food Safety SystemDocument8 pagesCertification 22000 Di Industri Kemasan Pangan: Analisis Pemenuhan Persyaratan Food Safety SystemPeris tiantoNo ratings yet

- Vote of ThanksDocument3 pagesVote of ThanksSiva Shankar75% (4)

- RFQ For Site Fabricated TanksDocument10 pagesRFQ For Site Fabricated TanksNil BorichaNo ratings yet

- KaramuntingDocument14 pagesKaramuntingHaresti MariantoNo ratings yet

- B.A (English) Dec 2015Document32 pagesB.A (English) Dec 2015Bala SVDNo ratings yet

- LLB102 2023 2 DeferredDocument8 pagesLLB102 2023 2 Deferredlo seNo ratings yet

- 2518253520-April June 2013Document267 pages2518253520-April June 2013lakpaNo ratings yet

- Naval Mines/Torpedoes Mines USA MK 67 SLMM Self-Propelled MineDocument2 pagesNaval Mines/Torpedoes Mines USA MK 67 SLMM Self-Propelled MinesmithNo ratings yet

- Interpretation and ConstructionDocument10 pagesInterpretation and ConstructionMohd Shaji100% (1)

- Opening RemarksDocument2 pagesOpening Remarksjennelyn malayno100% (1)

- Site VisitDocument3 pagesSite Visitapi-259126280No ratings yet

- Revival Fires Baptist College Christian Ethics Professor: Dr. Dennis Corle Proper Use of AuthorityDocument19 pagesRevival Fires Baptist College Christian Ethics Professor: Dr. Dennis Corle Proper Use of AuthoritySnowman KingNo ratings yet

- Workplace Ethics Activity: Making Informed Ethical DecisionsDocument1 pageWorkplace Ethics Activity: Making Informed Ethical DecisionsGlaiza FloresNo ratings yet

- Cash and Cash Equivalents (Problems)Document9 pagesCash and Cash Equivalents (Problems)IAN PADAYOGDOGNo ratings yet