Professional Documents

Culture Documents

Suggested Answers Assignment Notes Payable

Suggested Answers Assignment Notes Payable

Uploaded by

KeikoCopyright:

Available Formats

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Module 3 - Business EthicsDocument12 pagesModule 3 - Business EthicsKeikoNo ratings yet

- Impact of Social Media in RTW Businesses in Trece Martires City in Terms of Sales and ImageDocument54 pagesImpact of Social Media in RTW Businesses in Trece Martires City in Terms of Sales and Imageagnus seighart75% (4)

- Code 4&7Document4 pagesCode 4&7Ir Ahmad Afiq100% (1)

- Particulars Taka Taka TakaDocument2 pagesParticulars Taka Taka TakaTushar Mahmud SizanNo ratings yet

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniNo ratings yet

- BADVAC1XDocument8 pagesBADVAC1Xfaye pantiNo ratings yet

- Activity 3Document1 pageActivity 3John Michael Gaoiran GajotanNo ratings yet

- Ice NineDocument4 pagesIce NinePolene GomezNo ratings yet

- 5.ast - Installment & FranchisingDocument12 pages5.ast - Installment & FranchisingElaineJrV-IgotNo ratings yet

- AccountingDocument9 pagesAccountingShella MatrizNo ratings yet

- Proft & Loss PT Pingai 31 Des 2017Document1 pageProft & Loss PT Pingai 31 Des 2017aetheryslNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- FranchiseDocument6 pagesFranchiseAngela Marie PenarandaNo ratings yet

- Assessment 1 - Assignment 1Document5 pagesAssessment 1 - Assignment 1Ten NineNo ratings yet

- Problem 7 4Document4 pagesProblem 7 4Paula BautistaNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooNo ratings yet

- v2 Assignment Due 26.3.2023Document24 pagesv2 Assignment Due 26.3.2023alisa rachelNo ratings yet

- Laporan Laba Rugi PT PUTRA BANUA - ISMI FATMASYARIDocument1 pageLaporan Laba Rugi PT PUTRA BANUA - ISMI FATMASYARIIsmi FatmasyariNo ratings yet

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- AK2 13 Kheisya Buku BesarDocument2 pagesAK2 13 Kheisya Buku BesarKheisya Siva Qolbi Kiss PutriXI AKL 2No ratings yet

- 2.7.1 Cash Flow StatementDocument6 pages2.7.1 Cash Flow StatementMonika KauraNo ratings yet

- Irene LaguioDocument18 pagesIrene LaguioAlvinNoay100% (2)

- Homework 1 - Statement of Financial PositionDocument2 pagesHomework 1 - Statement of Financial PositionBianca JovenNo ratings yet

- HOMEWORK 1. Statement of Financial PositionDocument2 pagesHOMEWORK 1. Statement of Financial PositionBianca JovenNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Auditing Problem Quiz 2 Long Problem SolutionsDocument7 pagesAuditing Problem Quiz 2 Long Problem Solutionsreina maica terradoNo ratings yet

- Problem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalDocument23 pagesProblem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalAngelica DizonNo ratings yet

- Beg. Balance Sales Journal Voucher Registry Check Register Cash ReceiptDocument4 pagesBeg. Balance Sales Journal Voucher Registry Check Register Cash ReceiptFred WilsonNo ratings yet

- Beg. Balance Sales Journal Voucher Registry Check Register Cash Receipt Account TitleDocument12 pagesBeg. Balance Sales Journal Voucher Registry Check Register Cash Receipt Account TitleFred WilsonNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- Usa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Dec 2007Document58 pagesUsa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Dec 2007MarcyNo ratings yet

- Partnership Accounting Comprehensive ProblemDocument10 pagesPartnership Accounting Comprehensive ProblemNikki GarciaNo ratings yet

- Balance Sheet (Standard) : Resa Harisma 195154024Document2 pagesBalance Sheet (Standard) : Resa Harisma 195154024Bikin OrtubanggaNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- Far460 Group Project 2Document4 pagesFar460 Group Project 2NURAMIRA AQILANo ratings yet

- Assignment-5-Single-Entry-Method-students-DAVID FinalDocument11 pagesAssignment-5-Single-Entry-Method-students-DAVID FinalJOY MARIE RONATONo ratings yet

- ShubhamTrial PDFDocument1 pageShubhamTrial PDFI am DannyHNo ratings yet

- Profit Loss - TPC Taram SilalahiDocument1 pageProfit Loss - TPC Taram Silalahirio silalahiNo ratings yet

- Profit & Loss (Standard) : Resa Harisma 195154024Document1 pageProfit & Loss (Standard) : Resa Harisma 195154024Bikin OrtubanggaNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- AFAR 2 NotesDocument157 pagesAFAR 2 NotesAlexandria EvangelistaNo ratings yet

- Movida CashtoaccrualDocument5 pagesMovida CashtoaccrualVivienne Rozenn LaytoNo ratings yet

- SOPL, SOFP Dynamic Peony EnterpriseDocument3 pagesSOPL, SOFP Dynamic Peony EnterpriseIsmahNo ratings yet

- StewpeedDocument10 pagesStewpeedau4seventeenNo ratings yet

- Mini Project CAIA (Financial Statement)Document2 pagesMini Project CAIA (Financial Statement)norizzatisyamrilNo ratings yet

- Suryapunja Saving & Credit Co-Operative LTD.: Group Balance Sheet As On 2074/03/31 (Details)Document2 pagesSuryapunja Saving & Credit Co-Operative LTD.: Group Balance Sheet As On 2074/03/31 (Details)BimalNo ratings yet

- Engineering Management 3000/5039: Tutorial Set 5Document5 pagesEngineering Management 3000/5039: Tutorial Set 5SahanNo ratings yet

- INCOTAXDocument4 pagesINCOTAXnicole bancoroNo ratings yet

- AFR Pilot PaperDocument7 pagesAFR Pilot PaperPa HabbakukNo ratings yet

- CSEC Accounting Formats and TemplatesDocument15 pagesCSEC Accounting Formats and TemplatesRealGenius (Carl)No ratings yet

- Accounting AssignmentDocument13 pagesAccounting AssignmentPetrinaNo ratings yet

- Balance Sheet AUTO IND After q5Document29 pagesBalance Sheet AUTO IND After q5DARSH SADANI 131-19No ratings yet

- PT Jayatama - Dhiwa - Laba Rugi (Standar)Document1 pagePT Jayatama - Dhiwa - Laba Rugi (Standar)Dhiwa RafiantoNo ratings yet

- Financial Statements FinalssssssDocument5 pagesFinancial Statements FinalssssssHelping Five (H5)No ratings yet

- Franchise and LTCCDocument4 pagesFranchise and LTCCAngela Marie PenarandaNo ratings yet

- LoadingDocument1 pageLoadingmonopolygoplusNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Purple Shirt Friday 03.10.23Document1 pagePurple Shirt Friday 03.10.23KeikoNo ratings yet

- National Women's Month Celebration (NWMC) ActivitiesDocument1 pageNational Women's Month Celebration (NWMC) ActivitiesKeikoNo ratings yet

- 04 2023 Gender and Development Accomplishment ReportDocument1 page04 2023 Gender and Development Accomplishment ReportKeikoNo ratings yet

- Mod 4 - Normal DistributionDocument9 pagesMod 4 - Normal DistributionKeikoNo ratings yet

- FAR 1 PDF (2020) - FINANCIAL ACCOUNTING REPORTINGDocument8 pagesFAR 1 PDF (2020) - FINANCIAL ACCOUNTING REPORTINGKeikoNo ratings yet

- Module 5 - Audit of Banks (Part 1)Document10 pagesModule 5 - Audit of Banks (Part 1)KeikoNo ratings yet

- It Application Tools in Business Topic 6 SoftwareDocument5 pagesIt Application Tools in Business Topic 6 SoftwareKeikoNo ratings yet

- Discover RKB ENDocument2 pagesDiscover RKB ENLuis Carlos FerréNo ratings yet

- Superfoods: English Level Pre - A1Document4 pagesSuperfoods: English Level Pre - A1Ana CelestinoNo ratings yet

- 4rights of Unpaid SellerDocument69 pages4rights of Unpaid SellerHarold B. LacabaNo ratings yet

- Voucher (Pre-Paid Booking) : ST - Havel ResidenceDocument2 pagesVoucher (Pre-Paid Booking) : ST - Havel ResidenceAlena KolesnykNo ratings yet

- Centrifugal CastingDocument18 pagesCentrifugal CastingArijit PatraNo ratings yet

- E15-7 AdmissionDocument12 pagesE15-7 AdmissionBorussian RamaNo ratings yet

- How To Get Yourself To Do The Thing: Brent HurasDocument9 pagesHow To Get Yourself To Do The Thing: Brent HurasShahuwadikar Supatre100% (1)

- ASME SB-338 (2013) - В-338-10е1 - eng.Document9 pagesASME SB-338 (2013) - В-338-10е1 - eng.TetianaNo ratings yet

- Water-Wise Water ParkDocument7 pagesWater-Wise Water Parkapi-353567032No ratings yet

- Autocad TTLM From Minilik.g 2023 G.CDocument114 pagesAutocad TTLM From Minilik.g 2023 G.Cminilikgetaye394No ratings yet

- Models of Teacher EducationDocument18 pagesModels of Teacher EducationBill Bellin0% (2)

- Portable Air Conditioner EP23475 User Manual: Very ImportantDocument8 pagesPortable Air Conditioner EP23475 User Manual: Very ImportantLemoj SerapseNo ratings yet

- Small Airplane Considerations For The Guidelines For Development of Civil Aircraft and SystemsDocument13 pagesSmall Airplane Considerations For The Guidelines For Development of Civil Aircraft and SystemsLucas LazaméNo ratings yet

- White Collor UnionDocument33 pagesWhite Collor Uniondeepa makhijaNo ratings yet

- LG 47lg90 Led LCD TV Training-ManualDocument109 pagesLG 47lg90 Led LCD TV Training-ManualErnie De Leon100% (2)

- Organizational DevelopmentDocument16 pagesOrganizational Developmentsagar09No ratings yet

- Transfer MouldingDocument5 pagesTransfer MouldingBonojit BhowmikNo ratings yet

- CORDIC Based BPSK ModulatorDocument5 pagesCORDIC Based BPSK ModulatorPuneet BansalNo ratings yet

- Microsoft and Github Motion To DismissDocument34 pagesMicrosoft and Github Motion To DismissForkLog AINo ratings yet

- Business Ethics: Unfair Trade PracticesDocument7 pagesBusiness Ethics: Unfair Trade PracticesNardsdel RiveraNo ratings yet

- Bgy. Sindalan Vs CA - DigestDocument2 pagesBgy. Sindalan Vs CA - Digestremoveignorance100% (1)

- Trainning ReportDocument81 pagesTrainning ReportRohan PandeNo ratings yet

- Iso 50001Document6 pagesIso 50001Juana AbetriaNo ratings yet

- Sae Mag 32Document56 pagesSae Mag 32javierzardoyaNo ratings yet

- Supply Chain ManagementDocument15 pagesSupply Chain ManagementMadhan KumarNo ratings yet

- Curs Foraj Engleza Definitiv PDFDocument236 pagesCurs Foraj Engleza Definitiv PDFGem ALiNo ratings yet

- Course Name - Applied Mechanics Course Code - 22203 Name of TopicDocument8 pagesCourse Name - Applied Mechanics Course Code - 22203 Name of TopicBajirao JetithorNo ratings yet

- PZ3-D0821 Porter S Fresco-Aus SDS PDFDocument5 pagesPZ3-D0821 Porter S Fresco-Aus SDS PDFdantiNo ratings yet

Suggested Answers Assignment Notes Payable

Suggested Answers Assignment Notes Payable

Uploaded by

KeikoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suggested Answers Assignment Notes Payable

Suggested Answers Assignment Notes Payable

Uploaded by

KeikoCopyright:

Available Formats

Audit 3

Audit of Liabilities

Assignment due November 25, 2023

Problem 1 (part 2)

Issue price 5,000,000.00

Market value w/o conversion privilege

(PV at 6%, 12 periods)

PV of principal 2,484,846.80

PV of interest 2,095,961.00 4,580,807.80

Equity component (Share premium - conversion privilege) 419,192.20

07.01.2019 Carrying amount 4,580,807.80

07.01-12.31.2019 Discount amortization

Effective interest 274,848.47

Stated interest 250,000.00 24,848.47

12.31.2019 Carrying amount 4,605,656.27

01.01-06.30.2020 Discount amortization

Effective interest 276,339.38

Stated interest 250,000.00 26,339.38

06.20.2020 Carrying amount 4,631,995.65

Conversion on July 1, 2020:

Carrying amount of bonds converted (P4,631,995.65 x 1,500 / 5,000) 1,389,598.69

Par value (15,000.00)

Increase in share premium 1,374,598.69

Face amount of bonds converted 1,500,000.00

Carrying amount of bonds converted 1,389,598.69

Unamortized discount of bonds converted 110,401.31

Journal entries:

Upon issuance (07.01.2019):

Cash 5,000,000.00

Discount on bonds payable 419,192.20

Bonds payable 5,000,000.00

Share premium - conversion privilege 419,192.20

Upon conversion (07.01.2020):

Bonds payable 1,500,000.00

Share premium - issuance 1,374,598.69

Discount on bonds payable 110,401.31

Ordinary share capital 15,000.00

Share premium - conversion privilege 419,192.20

Share premium - issuance 419,192.20

Audit 3

Audit of Liabilities

Assignment due November 25, 2023

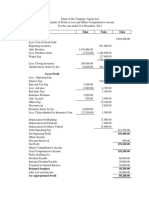

Problem 2

Journal Entries: Ashley, Inc.

1. Cash 3,500.00 Statement of Comprehensive Income

Sales 3,500.00 For the Year Ended December 31, 2017

To record cash sales

Sales 3,500.00

2. Purchases 2,000.00 Cost of goods sold (1,900.00)

Cash 2,000.00 Gross profit 1,600.00

To record purchases Salaries (700.00)

Depreciation (80.00)

3. Salaries 700.00 Interest expense (171.75)

Cash 700.00 Profit 648.25

To record salaries Other comprehensive income 0.00

Total comprehensive income 648.25

4. Depreciation expense 80.00

Accumulated depreciation 80.00

To record depreciation of PPE Ashley, Inc.

Statement of Financial Position

5. Inventory 1,900.00 December 31, 2017

Cost of goods sold 1,900.00

Inventory (beginning) 1,800.00 Cash 1,000.00

Purchases 2,000.00 Inventory 1,900.00

To set up ending inventory and cost of goods sold. Plant and equipment 2,000.00

Accumulated depreciation (240.00)

6. Retained earnings 100.00 Total assets 4,660.00

Cash 100.00

To record dividend declaration and payment Bonds payable 1,447.75

Ordinary share capital 1,500.00

7. Interest expense 85.56 Retained earnings 1,712.25

Cash 75.00 Total liabilities and equity 4,660.00

Bonds payable 10.56

To record amortization bond discount for the period 01.01-06.30.

8. Interest expense 86.19

Cash 75.00

Bonds payable 11.19

To record amortization bond discount for the period 01.01-06.30.

Audit 3

Audit of Liabilities

Assignment due November 25, 2023

Problem 3

1. Bonds were issued at a discount.

- initial carrying amount is less than face amount

- effective interest (12%) is greater than the stated interest (11%)

2. Stated interest (11,000 / 100,000) = 11.00%

Effective interest (11,322 / 94,349) = 12.00%

3. 01.01.2011 Cash 94,349.00

Discount on bonds payable 5,651.00

Bonds payable 100,000.00

4. 12.31.2011 Interest expense 11,322.00

Interest payable 11,000.00

Discount on bonds payable 322.00

Audit 3

Audit of Liabilities

Assignment due November 25, 2023

Problem 4

Excerpt from the amortization schedule

Discount Carrying

Date Stated Interest Effective Interest Amortization Amount

01.01.2018 11,000.00 11,712.00 712.00 98,309.00

Note 1 Note 2

10.01.2018 8,250.00 8,847.81 597.81 98,906.81 Carrying amounts of the bonds before redemption

(24,726.70) Carrying amounts of the bonds redeemed (1/4 of total)

74,180.11 Carrying amounts of remaining bonds at 10.01.2018

Note 3 Note 4

12.31.2018 2,062.50 2,211.95 149.45 74,329.56

Note 5 Note 6

12.31.2019 8,250.00 8,920.44 670.44 75,000.00

Note 1

P100,000 x 11% x 9 months / 12 months

Note 2

P98,309 x 12% x 9 months / 12 months

Note 3

P75,000 x 11% x 3 months / 12 months

Note 4

P98,309 x 3/4 x 12% x 3 months / 12 months

Note 5

P75,000 x 11%

Note 6

P74,329.56 x 12% (adjusted by 0.89 in order for carrying amount to zero out at end of term)

Redemption on 10.01.2018

Redemption price (P25,000 x .99) 24,750.00

Accrued interest (P25,000 x 11% x 9 / 12) 2,062.50

Total 26,812.50

Carrying amount

Principal 24,726.70

Interest 2,062.50 26,789.20

Loss on early redemption 23.30

Prior Year Charges to RE

Per Books Per Audit

Interest 2010-2017 88,000.00 91,960.00

Note 7

Interest 2018 8,250.00

see Note 2 above

Interest 01.01.2018-10.30.2018 8,847.81

see Note 4 above

Interest 10.01.2018-12.31.2018 2,211.95

Loss on early redemption 0.00 23.30

96,250.00 103,043.06

Note 7

P75,000 x 11%. The accrued interest on the bonds redeemed were charged to bonds

payable. Thus, we can assume that only the interest for the remaining 3/4 of the bonds

were recorded by the client as interest expense

Comparison of balances per audit and per books

Bonds payable Discount on B/P Interest Expense Interest Payable Retained Earnings

Per Audit 75,000.00 0.00 8,920.44 8,250.00 (103,043.06)

Note 8

Per Books 67,536.50 0.00 8,250.00 8,250.00 (96,250.00)

7,463.50 0.00 670.44 0.00 (6,793.06)

Proposed adjusting entry

Retained earnings 6,793.06

Interest expense 670.44

Bonds payable 7,463.50

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Module 3 - Business EthicsDocument12 pagesModule 3 - Business EthicsKeikoNo ratings yet

- Impact of Social Media in RTW Businesses in Trece Martires City in Terms of Sales and ImageDocument54 pagesImpact of Social Media in RTW Businesses in Trece Martires City in Terms of Sales and Imageagnus seighart75% (4)

- Code 4&7Document4 pagesCode 4&7Ir Ahmad Afiq100% (1)

- Particulars Taka Taka TakaDocument2 pagesParticulars Taka Taka TakaTushar Mahmud SizanNo ratings yet

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniNo ratings yet

- BADVAC1XDocument8 pagesBADVAC1Xfaye pantiNo ratings yet

- Activity 3Document1 pageActivity 3John Michael Gaoiran GajotanNo ratings yet

- Ice NineDocument4 pagesIce NinePolene GomezNo ratings yet

- 5.ast - Installment & FranchisingDocument12 pages5.ast - Installment & FranchisingElaineJrV-IgotNo ratings yet

- AccountingDocument9 pagesAccountingShella MatrizNo ratings yet

- Proft & Loss PT Pingai 31 Des 2017Document1 pageProft & Loss PT Pingai 31 Des 2017aetheryslNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- FranchiseDocument6 pagesFranchiseAngela Marie PenarandaNo ratings yet

- Assessment 1 - Assignment 1Document5 pagesAssessment 1 - Assignment 1Ten NineNo ratings yet

- Problem 7 4Document4 pagesProblem 7 4Paula BautistaNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooNo ratings yet

- v2 Assignment Due 26.3.2023Document24 pagesv2 Assignment Due 26.3.2023alisa rachelNo ratings yet

- Laporan Laba Rugi PT PUTRA BANUA - ISMI FATMASYARIDocument1 pageLaporan Laba Rugi PT PUTRA BANUA - ISMI FATMASYARIIsmi FatmasyariNo ratings yet

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- AK2 13 Kheisya Buku BesarDocument2 pagesAK2 13 Kheisya Buku BesarKheisya Siva Qolbi Kiss PutriXI AKL 2No ratings yet

- 2.7.1 Cash Flow StatementDocument6 pages2.7.1 Cash Flow StatementMonika KauraNo ratings yet

- Irene LaguioDocument18 pagesIrene LaguioAlvinNoay100% (2)

- Homework 1 - Statement of Financial PositionDocument2 pagesHomework 1 - Statement of Financial PositionBianca JovenNo ratings yet

- HOMEWORK 1. Statement of Financial PositionDocument2 pagesHOMEWORK 1. Statement of Financial PositionBianca JovenNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Auditing Problem Quiz 2 Long Problem SolutionsDocument7 pagesAuditing Problem Quiz 2 Long Problem Solutionsreina maica terradoNo ratings yet

- Problem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalDocument23 pagesProblem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalAngelica DizonNo ratings yet

- Beg. Balance Sales Journal Voucher Registry Check Register Cash ReceiptDocument4 pagesBeg. Balance Sales Journal Voucher Registry Check Register Cash ReceiptFred WilsonNo ratings yet

- Beg. Balance Sales Journal Voucher Registry Check Register Cash Receipt Account TitleDocument12 pagesBeg. Balance Sales Journal Voucher Registry Check Register Cash Receipt Account TitleFred WilsonNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- Usa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Dec 2007Document58 pagesUsa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Dec 2007MarcyNo ratings yet

- Partnership Accounting Comprehensive ProblemDocument10 pagesPartnership Accounting Comprehensive ProblemNikki GarciaNo ratings yet

- Balance Sheet (Standard) : Resa Harisma 195154024Document2 pagesBalance Sheet (Standard) : Resa Harisma 195154024Bikin OrtubanggaNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- Far460 Group Project 2Document4 pagesFar460 Group Project 2NURAMIRA AQILANo ratings yet

- Assignment-5-Single-Entry-Method-students-DAVID FinalDocument11 pagesAssignment-5-Single-Entry-Method-students-DAVID FinalJOY MARIE RONATONo ratings yet

- ShubhamTrial PDFDocument1 pageShubhamTrial PDFI am DannyHNo ratings yet

- Profit Loss - TPC Taram SilalahiDocument1 pageProfit Loss - TPC Taram Silalahirio silalahiNo ratings yet

- Profit & Loss (Standard) : Resa Harisma 195154024Document1 pageProfit & Loss (Standard) : Resa Harisma 195154024Bikin OrtubanggaNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- AFAR 2 NotesDocument157 pagesAFAR 2 NotesAlexandria EvangelistaNo ratings yet

- Movida CashtoaccrualDocument5 pagesMovida CashtoaccrualVivienne Rozenn LaytoNo ratings yet

- SOPL, SOFP Dynamic Peony EnterpriseDocument3 pagesSOPL, SOFP Dynamic Peony EnterpriseIsmahNo ratings yet

- StewpeedDocument10 pagesStewpeedau4seventeenNo ratings yet

- Mini Project CAIA (Financial Statement)Document2 pagesMini Project CAIA (Financial Statement)norizzatisyamrilNo ratings yet

- Suryapunja Saving & Credit Co-Operative LTD.: Group Balance Sheet As On 2074/03/31 (Details)Document2 pagesSuryapunja Saving & Credit Co-Operative LTD.: Group Balance Sheet As On 2074/03/31 (Details)BimalNo ratings yet

- Engineering Management 3000/5039: Tutorial Set 5Document5 pagesEngineering Management 3000/5039: Tutorial Set 5SahanNo ratings yet

- INCOTAXDocument4 pagesINCOTAXnicole bancoroNo ratings yet

- AFR Pilot PaperDocument7 pagesAFR Pilot PaperPa HabbakukNo ratings yet

- CSEC Accounting Formats and TemplatesDocument15 pagesCSEC Accounting Formats and TemplatesRealGenius (Carl)No ratings yet

- Accounting AssignmentDocument13 pagesAccounting AssignmentPetrinaNo ratings yet

- Balance Sheet AUTO IND After q5Document29 pagesBalance Sheet AUTO IND After q5DARSH SADANI 131-19No ratings yet

- PT Jayatama - Dhiwa - Laba Rugi (Standar)Document1 pagePT Jayatama - Dhiwa - Laba Rugi (Standar)Dhiwa RafiantoNo ratings yet

- Financial Statements FinalssssssDocument5 pagesFinancial Statements FinalssssssHelping Five (H5)No ratings yet

- Franchise and LTCCDocument4 pagesFranchise and LTCCAngela Marie PenarandaNo ratings yet

- LoadingDocument1 pageLoadingmonopolygoplusNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Purple Shirt Friday 03.10.23Document1 pagePurple Shirt Friday 03.10.23KeikoNo ratings yet

- National Women's Month Celebration (NWMC) ActivitiesDocument1 pageNational Women's Month Celebration (NWMC) ActivitiesKeikoNo ratings yet

- 04 2023 Gender and Development Accomplishment ReportDocument1 page04 2023 Gender and Development Accomplishment ReportKeikoNo ratings yet

- Mod 4 - Normal DistributionDocument9 pagesMod 4 - Normal DistributionKeikoNo ratings yet

- FAR 1 PDF (2020) - FINANCIAL ACCOUNTING REPORTINGDocument8 pagesFAR 1 PDF (2020) - FINANCIAL ACCOUNTING REPORTINGKeikoNo ratings yet

- Module 5 - Audit of Banks (Part 1)Document10 pagesModule 5 - Audit of Banks (Part 1)KeikoNo ratings yet

- It Application Tools in Business Topic 6 SoftwareDocument5 pagesIt Application Tools in Business Topic 6 SoftwareKeikoNo ratings yet

- Discover RKB ENDocument2 pagesDiscover RKB ENLuis Carlos FerréNo ratings yet

- Superfoods: English Level Pre - A1Document4 pagesSuperfoods: English Level Pre - A1Ana CelestinoNo ratings yet

- 4rights of Unpaid SellerDocument69 pages4rights of Unpaid SellerHarold B. LacabaNo ratings yet

- Voucher (Pre-Paid Booking) : ST - Havel ResidenceDocument2 pagesVoucher (Pre-Paid Booking) : ST - Havel ResidenceAlena KolesnykNo ratings yet

- Centrifugal CastingDocument18 pagesCentrifugal CastingArijit PatraNo ratings yet

- E15-7 AdmissionDocument12 pagesE15-7 AdmissionBorussian RamaNo ratings yet

- How To Get Yourself To Do The Thing: Brent HurasDocument9 pagesHow To Get Yourself To Do The Thing: Brent HurasShahuwadikar Supatre100% (1)

- ASME SB-338 (2013) - В-338-10е1 - eng.Document9 pagesASME SB-338 (2013) - В-338-10е1 - eng.TetianaNo ratings yet

- Water-Wise Water ParkDocument7 pagesWater-Wise Water Parkapi-353567032No ratings yet

- Autocad TTLM From Minilik.g 2023 G.CDocument114 pagesAutocad TTLM From Minilik.g 2023 G.Cminilikgetaye394No ratings yet

- Models of Teacher EducationDocument18 pagesModels of Teacher EducationBill Bellin0% (2)

- Portable Air Conditioner EP23475 User Manual: Very ImportantDocument8 pagesPortable Air Conditioner EP23475 User Manual: Very ImportantLemoj SerapseNo ratings yet

- Small Airplane Considerations For The Guidelines For Development of Civil Aircraft and SystemsDocument13 pagesSmall Airplane Considerations For The Guidelines For Development of Civil Aircraft and SystemsLucas LazaméNo ratings yet

- White Collor UnionDocument33 pagesWhite Collor Uniondeepa makhijaNo ratings yet

- LG 47lg90 Led LCD TV Training-ManualDocument109 pagesLG 47lg90 Led LCD TV Training-ManualErnie De Leon100% (2)

- Organizational DevelopmentDocument16 pagesOrganizational Developmentsagar09No ratings yet

- Transfer MouldingDocument5 pagesTransfer MouldingBonojit BhowmikNo ratings yet

- CORDIC Based BPSK ModulatorDocument5 pagesCORDIC Based BPSK ModulatorPuneet BansalNo ratings yet

- Microsoft and Github Motion To DismissDocument34 pagesMicrosoft and Github Motion To DismissForkLog AINo ratings yet

- Business Ethics: Unfair Trade PracticesDocument7 pagesBusiness Ethics: Unfair Trade PracticesNardsdel RiveraNo ratings yet

- Bgy. Sindalan Vs CA - DigestDocument2 pagesBgy. Sindalan Vs CA - Digestremoveignorance100% (1)

- Trainning ReportDocument81 pagesTrainning ReportRohan PandeNo ratings yet

- Iso 50001Document6 pagesIso 50001Juana AbetriaNo ratings yet

- Sae Mag 32Document56 pagesSae Mag 32javierzardoyaNo ratings yet

- Supply Chain ManagementDocument15 pagesSupply Chain ManagementMadhan KumarNo ratings yet

- Curs Foraj Engleza Definitiv PDFDocument236 pagesCurs Foraj Engleza Definitiv PDFGem ALiNo ratings yet

- Course Name - Applied Mechanics Course Code - 22203 Name of TopicDocument8 pagesCourse Name - Applied Mechanics Course Code - 22203 Name of TopicBajirao JetithorNo ratings yet

- PZ3-D0821 Porter S Fresco-Aus SDS PDFDocument5 pagesPZ3-D0821 Porter S Fresco-Aus SDS PDFdantiNo ratings yet