Professional Documents

Culture Documents

Reliance Industries: Performance Highlights

Reliance Industries: Performance Highlights

Uploaded by

Angel BrokingCopyright:

Available Formats

You might also like

- Micro Finance Sacco Software Features PDFDocument4 pagesMicro Finance Sacco Software Features PDFdavid5441100% (2)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- RIL and Network 18 DealDocument10 pagesRIL and Network 18 DealsharvariNo ratings yet

- Reliance IndustriesDocument7 pagesReliance IndustriesSanidhay SindhwaniNo ratings yet

- Company Analysis of Reliance Industries LTDDocument11 pagesCompany Analysis of Reliance Industries LTDSanny Das0% (1)

- RILDocument13 pagesRILArya ArifNo ratings yet

- Marketing Plan For Titan IndustryDocument32 pagesMarketing Plan For Titan Industry6038 Mugilan kNo ratings yet

- Reliance Industries Result UpdatedDocument13 pagesReliance Industries Result UpdatedAngel BrokingNo ratings yet

- Hindalco: Performance HighlightsDocument15 pagesHindalco: Performance HighlightsAngel BrokingNo ratings yet

- GAIL India: Performance HighlightsDocument12 pagesGAIL India: Performance HighlightsAngel BrokingNo ratings yet

- Reliance Industries Result UpdatedDocument14 pagesReliance Industries Result UpdatedAngel BrokingNo ratings yet

- Indraprasth Gas Result UpdatedDocument10 pagesIndraprasth Gas Result UpdatedAngel BrokingNo ratings yet

- Performance Highlights: 2QFY2012 Result Update - Oil & GasDocument10 pagesPerformance Highlights: 2QFY2012 Result Update - Oil & GasAngel BrokingNo ratings yet

- Indraprastha GasDocument11 pagesIndraprastha GasAngel BrokingNo ratings yet

- MOIL Result UpdatedDocument10 pagesMOIL Result UpdatedAngel BrokingNo ratings yet

- National Aluminium: Performance HighlightsDocument12 pagesNational Aluminium: Performance HighlightsAngel BrokingNo ratings yet

- Performance Highlights: 2QFY2013 Result Update - Oil & GasDocument11 pagesPerformance Highlights: 2QFY2013 Result Update - Oil & GasAngel BrokingNo ratings yet

- Spice JetDocument9 pagesSpice JetAngel BrokingNo ratings yet

- Coal India: Performance HighlightsDocument10 pagesCoal India: Performance HighlightsAngel BrokingNo ratings yet

- Rallis India Result UpdatedDocument10 pagesRallis India Result UpdatedAngel BrokingNo ratings yet

- Gail, 15th February 2013Document12 pagesGail, 15th February 2013Angel BrokingNo ratings yet

- National Aluminium Result UpdatedDocument12 pagesNational Aluminium Result UpdatedAngel BrokingNo ratings yet

- Ceat Result UpdatedDocument11 pagesCeat Result UpdatedAngel BrokingNo ratings yet

- Petronet LNG: Performance HighlightsDocument10 pagesPetronet LNG: Performance HighlightsAngel BrokingNo ratings yet

- Performance Highlights: 2QFY2013 Result Update - Auto AncillaryDocument11 pagesPerformance Highlights: 2QFY2013 Result Update - Auto AncillaryAngel BrokingNo ratings yet

- Neutral: Performance HighlightsDocument10 pagesNeutral: Performance HighlightsAngel BrokingNo ratings yet

- Petronet LNG: Performance HighlightsDocument10 pagesPetronet LNG: Performance HighlightsAngel BrokingNo ratings yet

- Ongc 4Q Fy 2013Document12 pagesOngc 4Q Fy 2013Angel BrokingNo ratings yet

- Exide Industries: Performance HighlightsDocument12 pagesExide Industries: Performance HighlightsAngel BrokingNo ratings yet

- ONGC Result UpdatedDocument11 pagesONGC Result UpdatedAngel BrokingNo ratings yet

- Vesuvius India: Performance HighlightsDocument12 pagesVesuvius India: Performance HighlightsAngel BrokingNo ratings yet

- Performance Highlights: ReduceDocument12 pagesPerformance Highlights: ReduceAngel BrokingNo ratings yet

- Ril, 4Q Fy 2013Document14 pagesRil, 4Q Fy 2013Angel BrokingNo ratings yet

- Ashok Leyland Result UpdatedDocument13 pagesAshok Leyland Result UpdatedAngel BrokingNo ratings yet

- Bajaj Auto: Performance HighlightsDocument12 pagesBajaj Auto: Performance HighlightsAngel BrokingNo ratings yet

- Graphite India Result UpdatedDocument10 pagesGraphite India Result UpdatedAngel BrokingNo ratings yet

- Steel Authority of India Result UpdatedDocument13 pagesSteel Authority of India Result UpdatedAngel BrokingNo ratings yet

- Graphite India: Performance HighlightsDocument11 pagesGraphite India: Performance HighlightsAngel BrokingNo ratings yet

- BGR Energy Systems: Performance HighlightsDocument12 pagesBGR Energy Systems: Performance HighlightsAngel BrokingNo ratings yet

- Graphite India: Performance HighlightsDocument11 pagesGraphite India: Performance HighlightsAngel BrokingNo ratings yet

- Coal India: Performance HighlightsDocument11 pagesCoal India: Performance HighlightsAngel BrokingNo ratings yet

- GAIL India: Performance HighlightsDocument12 pagesGAIL India: Performance HighlightsAngel BrokingNo ratings yet

- Gujarat Gas: Performance HighlightsDocument10 pagesGujarat Gas: Performance HighlightsAngel BrokingNo ratings yet

- Moil 2qfy2013Document10 pagesMoil 2qfy2013Angel BrokingNo ratings yet

- Hindalco: Performance HighlightsDocument14 pagesHindalco: Performance HighlightsAngel BrokingNo ratings yet

- Ashok Leyland Result UpdatedDocument13 pagesAshok Leyland Result UpdatedAngel BrokingNo ratings yet

- Ll& FS Transportation NetworksDocument14 pagesLl& FS Transportation NetworksAngel BrokingNo ratings yet

- Rallis India Result UpdatedDocument9 pagesRallis India Result UpdatedAngel BrokingNo ratings yet

- Hero MotocorpDocument11 pagesHero MotocorpAngel BrokingNo ratings yet

- Rallis India Result UpdatedDocument10 pagesRallis India Result UpdatedAngel BrokingNo ratings yet

- Amara Raja Batteries: Performance HighlightsDocument11 pagesAmara Raja Batteries: Performance HighlightsAngel BrokingNo ratings yet

- GIPCL Result UpdatedDocument11 pagesGIPCL Result UpdatedAngel BrokingNo ratings yet

- Hindalco, 1Q FY 2014Document12 pagesHindalco, 1Q FY 2014Angel BrokingNo ratings yet

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingNo ratings yet

- Acc 1Q CY 2013Document10 pagesAcc 1Q CY 2013Angel BrokingNo ratings yet

- NMDC 1qfy2013ruDocument12 pagesNMDC 1qfy2013ruAngel BrokingNo ratings yet

- Motherson Sumi Systems Result UpdatedDocument14 pagesMotherson Sumi Systems Result UpdatedAngel BrokingNo ratings yet

- Ceat, 11th January, 2013Document12 pagesCeat, 11th January, 2013Angel Broking100% (2)

- Apol Lo Tyres Result UpdatedDocument13 pagesApol Lo Tyres Result UpdatedAngel BrokingNo ratings yet

- Market Outlook 12th August 2011Document6 pagesMarket Outlook 12th August 2011Angel BrokingNo ratings yet

- Acc 3qcy2012ruDocument10 pagesAcc 3qcy2012ruAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Macroeconomic Policy Objectives Lesson 2Document12 pagesMacroeconomic Policy Objectives Lesson 2api-53255207No ratings yet

- DESRI Associate FTEDocument2 pagesDESRI Associate FTEeverydimension123No ratings yet

- Should Wealthy Nations Be Required To Share Their Wealth Among Poorer Nations by Providing Such Things As Food and EducationDocument7 pagesShould Wealthy Nations Be Required To Share Their Wealth Among Poorer Nations by Providing Such Things As Food and EducationPham Ba DatNo ratings yet

- Rohit Sunar Appeal CorrectedDocument2 pagesRohit Sunar Appeal CorrectedromanNo ratings yet

- The Five Financial Statements Based On IFRSDocument12 pagesThe Five Financial Statements Based On IFRSAngel GraceNo ratings yet

- CEO Entrepreneur - Essential Functions of A Small BusinessDocument15 pagesCEO Entrepreneur - Essential Functions of A Small Businessmilton_diaz5278No ratings yet

- Statement of Assets and Liabilities Form-B PDFDocument5 pagesStatement of Assets and Liabilities Form-B PDFRana rocksNo ratings yet

- Janina Louise Caliboso Bsa 3A: Tax Reform For Acceleration and Inclusion (TRAIN) "Document3 pagesJanina Louise Caliboso Bsa 3A: Tax Reform For Acceleration and Inclusion (TRAIN) "Ja CalibosoNo ratings yet

- A Study On Cost and Cost Techniques at Reid Braids India - HassanDocument58 pagesA Study On Cost and Cost Techniques at Reid Braids India - HassanSuresh100% (1)

- Lalakay Elementary School: Statement of AccountDocument4 pagesLalakay Elementary School: Statement of AccountReyes C. ErvinNo ratings yet

- Travancore - Revised - PO-1Document2 pagesTravancore - Revised - PO-1V.Sampath RaoNo ratings yet

- Mohit Malviya Kunal Assudani Aniket BushalDocument12 pagesMohit Malviya Kunal Assudani Aniket BushalMohit MalviyaNo ratings yet

- Motivation Letter For PHDDocument2 pagesMotivation Letter For PHDlivealone boyNo ratings yet

- Delivery Hero GMBH FY 2016 Cons enDocument178 pagesDelivery Hero GMBH FY 2016 Cons enms1279No ratings yet

- Commerce: Original Research Paper Growth of Textile Industry in IndiaDocument2 pagesCommerce: Original Research Paper Growth of Textile Industry in Indiapavithra nirmalaNo ratings yet

- Business Environment Chapter 07 Stock Exchanges in in Dia 1Document23 pagesBusiness Environment Chapter 07 Stock Exchanges in in Dia 1himanshu_choudhary_2No ratings yet

- Practical 4: Prepare A Report On Infosys FoundationDocument3 pagesPractical 4: Prepare A Report On Infosys FoundationSuvarna LangadeNo ratings yet

- Assignment On Labour Law PDFDocument11 pagesAssignment On Labour Law PDFTwokir A. Tomal100% (1)

- Class Work Chapter 5 Part ADocument2 pagesClass Work Chapter 5 Part Aaura fitrah auliya SomantriNo ratings yet

- Assignment 2: HRP 111 Submitted To Deepak SharmaDocument7 pagesAssignment 2: HRP 111 Submitted To Deepak Sharmaramandeep kaurNo ratings yet

- OM - Final Exam - Group 9 Beer HABECODocument24 pagesOM - Final Exam - Group 9 Beer HABECOmofil85832No ratings yet

- 36 Banking Terms/Terminologies You Should Know: Transfer The Balance of One Credit Card To AnotherDocument3 pages36 Banking Terms/Terminologies You Should Know: Transfer The Balance of One Credit Card To AnotherPutri ZalthieNo ratings yet

- Menu EngineeringDocument7 pagesMenu EngineeringDon LucaNo ratings yet

- The Ban On Plastic Bags in KenyaDocument4 pagesThe Ban On Plastic Bags in KenyaSheila ChumoNo ratings yet

- Article From S.directDocument8 pagesArticle From S.directmustefaNo ratings yet

- Handout in Unit 4D and 4EDocument10 pagesHandout in Unit 4D and 4EArgie Cayabyab CagunotNo ratings yet

- Marketing Mini Project - Final PresentationDocument11 pagesMarketing Mini Project - Final Presentationbhargav4987No ratings yet

- NF-370 P Srinu GaruantorDocument4 pagesNF-370 P Srinu GaruantorSreenu MudhirajNo ratings yet

- 2016-17 SARS ELogbookDocument17 pages2016-17 SARS ELogbookMfundo DlaminiNo ratings yet

Reliance Industries: Performance Highlights

Reliance Industries: Performance Highlights

Uploaded by

Angel BrokingOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reliance Industries: Performance Highlights

Reliance Industries: Performance Highlights

Uploaded by

Angel BrokingCopyright:

Available Formats

1QFY2012 Result Update | Oil & Gas

July 26, 2011

Reliance Industries

Performance Highlights

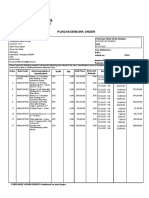

Y/E March (` cr) Net operating income EBITDA EBITDA margin (%) PAT

Source: Company, Angel Research

BUY

CMP Target Price

% chg (yoy) 39.1 6.3 (3.8) 16.7 4QFY11 72,674 9,843 13.5 5,376 % chg (qoq) 11.5 0.8 (1.3) 5.3

`870 `1,180

12 Months

1QFY12 81,018 9,926 12.3 5,661

1QFY11 58,228 9,342 16.0 4,851

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

Oil & Gas 285,183 0.9 1,187/829 285923 10 18,518 5,575 RELI.BO RIL@IN

For 1QFY2012, RIL reported 16.7% yoy growth in its bottom line due to strong growth in earnings from refining and petrochemical margins. On a qoq basis, PAT growth was restricted to 5.3% because of the dip in production from the KG-D6 field. We maintain our Buy recommendation on the stock. Strong 1QFY2012 performance: RIL's top line was above our estimates on account of higher-than-expected revenue from the petrochemicals and refining segments. The top line increased by 39.1% yoy to `81,018cr, primarily on the back of a 45.8% yoy increase in refining segments gross revenue to `73,689cr and a 32.1% yoy increase in the petrochemical segments gross revenue to `18,366cr. During the quarter, RIL reported a marginal sequential rise in GRMs to US$10.3/bbl (US$7.3/bbl), lower than our expectation of US$11.0/bbl. Singapore complex refining margin averaged US$8.5/bbl during 1QFY2012 from US$7.4/bbl in 4QFY2011. PAT grew by 16.7% yoy to `5,661cr, which was in-line with our expectation. Outlook and valuation: RILs extant businesses (refining and petrochemical) continued to perform well. We expect the company to report robust refining margins in the coming quarters as FCCU of DTA Refinery has started. On the petrochemical side, we do not expect margins to fall below the current level. However, there are some concerns on the KG basin gas output. Nevertheless, we believe RILs deal with BP deal is a positive one, as the combined expertise of both the parties will result in optimisation of producing blocks and enhancement of resources in exploratory blocks. Thus, the timely ramp-up in producing fields would improve investor confidence. We maintain Buy on RIL with an SOTP-based target price of `1,180. Key financials (Consolidated)

Y/E March (` cr) Net sales % chg Net profit % chg EPS (`) EBITDA margin (%) P/E (x) RoE (%) RoCE (%) P/BV (x) EV/ Sales (x) EV/ EBITDA (x)

Source: Company, Angel Research

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 44.7 10.8 17.4 27.1

Abs. (%) Sensex RIL

3m

(4.8)

1yr

2.4

3yr

29.1 (20.0)

(11.6) (17.3)

FY2010 203,740 34.7 18,572 29.8 56.7 15.2 15.3 14.1 9.4 1.8 1.5 10.1

FY2011 265,811 30.5 18,976 2.2 58.0 14.7 15.0 12.8 10.6 1.7 1.2 8.0

FY2012E 310,994 17.0 22,241 17.2 68.0 13.2 12.8 13.6 11.2 1.5 1.0 7.7

FY2013E 314,718 1.2 26,151 17.6 79.9 14.9 10.9 14.1 12.7 1.3 0.9 6.0

Bhavesh Chauhan

Tel: 022- 39357800 Ext: 6821 bhaveshu.chauhan@angelbroking.com

Please refer to important disclosures at the end of this report

Reliance Industries | 1QFY2012 Result Update

Exhibit 1: 1QFY2012 performance (Standalone)

Y/E March (` cr) Net Operating Income COGS Total operating expenditure EBITDA EBITDA Margin (%) Other Income Depreciation Interest Extraordinary Items PBT PBT Margin (%) Total Tax % of PBT PAT Exceptional items Adj. PAT PAT Margin (%)

Source: Company, Angel Research

1QFY2012 81,018 64,443 71,092 9,926 12.3 1,078 3,195 545 7,264 9.0 1,603 22.1 5,661 5,661 7.0

1QFY2011 58,228 45,818 48,886 9,342 16.0 563 3,485 541 6,038 10.4 1,187 19.7 4,851 4,851 8.3

% chg (yoy) 39.1 40.6 45.4 6.3 91.5 (8.3) 0.7 20.3 35.0 16.7 16.7

4QFY2010 72,674 57,533 62,831 9,843 13.5 917 3,387 696 6,677 9.2 1,301 19.5 5,376 5,376 7.4

% chg (yoy) 11.5 12.0 13.1 0.8 17.6 (5.7) (21.7) 8.8 23.2 5.3 5.3

FY2011 248,170 189,991 210,044 38,126 15.4 3,052 13,608 2,328 25,242 10.2 4,956 19.6 20,286 20,286 8.2

FY2010 192,461 143,971 161,880 30,581 15.9 2,460 10,497 1,997 20,547 10.7 4,311 21.0 16,236 16,236 8.4

% chg (yoy) 28.9 32.0 29.8 24.7 24.1 29.6 16.6 22.9 15.0 24.9 24.9

Exhibit 2: Segmental break-up (Standalone)

Y/E March (` cr) Revenue Petrochemicals Refining and marketing Oil and gas Others Gross revenue EBIT Petrochemicals Refining and marketing Oil and gas Others Total EBIT EBIT margin (%) Petrochemicals Refining and marketing Oil and gas Others Total

Source: Company, Angel Research

1QFY2012 18,366 73,689 3,894 235 96,184

1QFY2011 13,903 50,531 4,665 107 69,206

% chg (yoy) 32.1 45.8 (16.5) 119.6 39.0

4QFY2011 18,194 62,704 4,104 173 85,175

% chg (qoq) 0.9 17.5 (5.1) 35.8 12.9

FY2011 63,155 215,431 17,250 615 296,451

FY2010 55,251 163,249 12,649 398 231,547

% chg (yoy) 14.3 32.0 36.4 54.5 28.0

2,215 3,199 1,473 8 6,895

2,053 2,035 1,921 7 6,016

7.9 57.2 (23.3) 14.3 14.6

2,626 2,509 1,569 9 6,713

(15.7) 27.5 (6.1) (11.1) 2.7

9,305 9,172 6,700 33 25,210

8,581 6,011 5,413 43 20,048

8.4 52.6 23.8 (23.3) 25.7

12.1 4.3 37.8 3.4 7.2

14.8 4.0 41.2 6.5 8.7

14.4 4.0 38.2 5.2 7.9

14.7 4.3 38.8 5.4 8.5

15.5 3.7 42.8 10.8 8.7

July 26, 2011

Reliance Industries | 1QFY2012 Result Update

Exhibit 3: 1QFY2012 actual vs. Estimates

(` cr) Net operating income EBITDA EBITDA margin (%) PBT Adj. PAT

Source: Company, Angel Research

Estimates

68,849 10,534 15.3 7,018 5,615

Actual

81,018 9,926 12.3 7,264 5,661

Variation (%)

17.7 (5.8) 3.0 3.5 0.8

Petrochemicals and refining segments drive RILs top-line growth RIL's top line was above our estimates on account of higher-than-expected revenue from the petrochemicals and refining segments. The top line increased by 39.1% yoy to `81,018cr, primarily on the back of a 45.8% yoy increase in the refining segments gross revenue to `73,689cr and a 32.1% yoy increase in the petrochemical segments gross revenue to `18,366cr. Crude oil processed during the quarter was flat yoy at 17.0mn tonnes. KG-D6 gas production declined qoq, with average production at 49mmscmd in 1QFY2012 (compared to 51mmscmd in 4QFY2011).

Exhibit 4: Sales growth trend

85,000 82,000 79,000 76,000 73,000 70,000 67,000 64,000 61,000 58,000 55,000 4QFY10 1QFY11 140.0 120.7 86.7 120.0 100.0

(` cr)

60.0 39.1 22.7 5.2 2QFY11 3QFY11 4QFY11 1QFY12 26.2 40.0 20.0 -

Operating revenues

Operating revenues growth (RHS)

Source: Company, Angel Research

Operating performance impacted by lower-than-expected GRMs During the quarter, RIL reported a marginal sequential rise in GRMs to US$10.3/bbl (US$7.3/bbl in 1QFY2011). Singapore complex refining margin averaged US$8.5/bbl during 1QFY2012 from US$7.4/bbl in 4QFY2011. Thus, RIL managed to earn a spread of US$1.8/bbl. Operating profit grew by 65.0% yoy to `9,926cr as lower production from the oil and gas segment was more than offset by higher EBIT in the refining and petrochemicals segments.

July 26, 2011

(%)

80.0

Reliance Industries | 1QFY2012 Result Update

Exhibit 5: EBIT break-up

100% 80% 60% 40% 20% 0%

Exhibit 6: Operating performance trend

12,000 10,000 15.9 16.0 16.3 16.0 17.0 16.0 15.0 13.5 12 14.0 13.0 12.0 11.0 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 Operating Profit Operating Margins (RHS)

(` cr)

8,000 6,000 4,000 2,000

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

Petrochemicals

Refining

Oil and gas

Others

Source: Company, Angel Research

Source: Company, Angel Research

PAT surges by 16.7% yoy

Depreciation during the quarter declined by 8.3% yoy to `3,195cr, whereas interest expenditure was flat yoy to `545cr. Other income (net) increased by 91.5% yoy to `1,078cr mainly on account of higher cash balance coupled with higher yields. Consequently, PAT grew by 16.7% yoy to `5,661cr, in-line with our expectation.

Exhibit 7: PAT growth trend

6,000 5,000 100 90 80 70 60 50 40 30 20 10 0

(` cr)

4,000 3,000 2,000 1,000 4QFY10 1QFY11 2QFY11

PAT

32.3 19.1

27.8

28.1 14.1 7.0

3QFY11

4QFY11

1QFY12

PAT growth (RHS)

Source: Company, Angel Research

July 26, 2011

(%)

(%)

Reliance Industries | 1QFY2012 Result Update

Segment-wise performance

Refining: During the quarter, crude processing stood flat yoy at 17.0mn tonnes, with refinery reporting capacity utilisation of 110%. Despite flat crude throughput, higher petroleum product prices led to a 22.3% yoy increase in the refining segments revenue to `73,6894cr. On the margin front, RIL reported GRMs of US$10.3/bbl (US$7.3/bbl in 1QFY2011). Singapore margins during the quarter averaged US$8.5/bbl. Thus, RIL managed to earn a spread of US$1.8/bbl over the same. Exports of refined products increased to US$10.2bn in 1QFY2012 compared to US$6.3bn in 1QFY2011.

Exhibit 8: RIL vs. Benchmark Singapore GRMs

18.0 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 -

(US $/bbl)

1QFY09

2QFY09

3QFY09

4QFY09

1QFY10

2QFY10

3QFY10

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

RIL GRMs

Singapore GRMs

Source: Company, Angel Research

Exhibit 9: Capacity utilisation trend

120.0 100.0 80.0 (%) 60.0 40.0 20.0 1QFY09 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 17.0 15.0 13.0 11.0 9.0 7.0 (mn tonnes)

Capacity Utilisation

Crude Processing (RHS)

Source: Company, Angel Research

Petrochemicals: The petrochemicals segments revenue grew by 32.1% yoy to `18,366cr due to higher prices and sales volumes. Production of polymer products and fibre intermediaries increased by 17.0% and 12.0 yoy to 1.1mn tonnes and 1.2mn tonnes, respectively, in 1QFY2012. The segments EBIT margin slipped by 271bp yoy due to margin contraction in polyester and polymer chains.

July 26, 2011

1QFY12

Reliance Industries | 1QFY2012 Result Update

Oil and gas: The oil and gas segments revenue decreased by 16.5% yoy to `3,894cr due to lower production from KG-D6 and PMT blocks; however, this was partially offset by the increase in crude oil realisation. RILs KG-D6 gas production during the quarter averaged ~49mmscmd as against ~51mmscmd in 4QFY2011. Gas production from Panna and Mukta fields declined by 1.0% yoy to 17.5bcf, while crude oil production declined by 14.0% yoy to 2.7mn bbl in 1QFY2012. Consequently, the segments EBIT decreased by 23.3% yoy to `1,473cr.

Investment arguments

Ramp-up in KG-D6 could allay many concerns: RIL is still producing natural gas way below its potential 80mmscmd due to constraints over reservoir pressure. Management has also not given any guidance on production ramp-up due to its ongoing discussions with DGH; thus, due to pending clarity, overhang will continue on the stock. However, we are confident about RIL ramping up its production with the help of BPs deepwater technology and expertise in the medium term. The upstream segment still has a significant upside in store, considering the huge untapped resources. Timely ramp-up in producing fields would improve investor sentiment and aid investors to factor in other prospective basins as well. Core business margins to stabilise: We expect refining margins to hold and rise in the year ahead due to higher demand for middle distillates, supply disruptions and increasing light-heavy crude oil differential. Similarly, the petrochemicals segments margin is also expected to stabilise at the current level. The recent spurt was consequent to higher demand from emerging economies and stimulus-led recovery in OECD economies. Thus, the extant businesses will be the near-term growth drivers for RIL. Newer ventures could be long-term catalysts: RIL has been actively eyeing inorganic routes for diversifying its asset portfolio by entering into newer ventures. Significant cash pile and treasury stocks could see RIL venturing into more inorganic routes for growth and prove to be upside triggers for the stock. Out of all the companys recent initiatives, we find the shale gas venture the most promising on account of the in-place reserves of ~12TCF.

July 26, 2011

Reliance Industries | 1QFY2012 Result Update

Outlook and valuation

RILs extant businesses (refining and petrochemicals) continue to perform well. We expect the company to report robust refining margins in the coming quarters as FCCU of DTA Refinery has started. On the petrochemicals side, we do not expect margins to fall below the current level. Moreover, the companys proposed plans to increase the capacity of the petrochemicals segment and addition of coker in the refining segment are likely to further consolidate its position in its existing businesses. However, there are some concerns on the KG basin gas output. Nevertheless, we believe RILs deal with BP is a positive one, as the combined expertise of both the parties will result in optimisation of producing blocks and enhancement of resources in exploratory blocks. Thus, timely ramp-up in the producing fields would improve investor confidence. RILs significant cash pile and treasury stocks could see it venturing into more inorganic avenues, which could provide upside triggers to the stock. We believe RIL has already made significant investments in new businesses such as shale gas and telecom and is likely to crystallise its plans to foray into the other segments. This could address cash redeployment concerns to a large extent. Thus, we maintain our Buy rating on RIL with an SOTP-based target price of `1,180.

Exhibit 10: SOTP valuation (FY2013E)

Business segment (` cr) Refining (EV/EBITDA 6x) Petrochemical (EV/EBITDA 6x) KG-D6 gas (DCF) KG-MA oil (DCF) NEC-25 (EV/boe 5.5x) D3 (EV/boe 5.5x) D9 (EV/boe 5.5x) Shale gas ventures (EV/boe 3.5x) Other prospective basins Retail Investment/Others Total EV Net debt Equity value (`)

Source: Company, Angel Research

`/share

510 143 168 45 66 73 42 70 30 15 36 1,198

(18) 1,180

July 26, 2011

Reliance Industries | 1QFY2012 Result Update

Exhibit 11: Key assumptions

Particulars Exchange rate (`/US$) Refining capacity (MMT) Production (MMT) Capacity utilisation Blended GRMs (US$/bbl) KG -D6 gas production (mmscmd) KG -D6 gas realisations (US$/mmbtu) Oil production (kbpd)

Source: Company, Angel Research

FY2012E 45.0 62.0 66.3 107% 9.8 49.0 4.2 18.0

FY2013E 45.0 62.0 67.0 108% 10.5 52.0 4.2 20.0

Exhibit 12: Angel EPS forecast v/s consensus

Angel forecast FY2012E FY2013E

Source: Company, Angel Research

Bloomberg consensus

71.5 80.8

Variation (%)

(5.0) (1.1)

68.0 79.9

July 26, 2011

Reliance Industries | 1QFY2012 Result Update

Exhibit 13: Recommendation summary

Company RIL ONGC Cairn India GAIL CMP (`) 870 277 323 461 TP (`) 1,180 336 539 Buy Buy Neutral Buy Reco. Mcap (` cr) 285,183 236,644 61,451 55,413 Upside (%) 36 22 17 FY12E 12.8 8.5 6.7 15.5 P/E (x) FY13E 10.9 7.1 5.9 14.7 FY12E 1.5 1.7 1.3 2.6 P/BV (x) FY13E 1.3 1.5 1.0 2.3 EV/EBITDA (x) FY12E 7.7 3.7 4.3 9.4 FY13E 6.0 3.0 3.1 8.7 FY12E 13.6 21.9 21.0 18.2 RoE (%) FY13E 14.1 22.4 19.4 16.9 RoCE (%) FY12E FY13E 11.2 21.9 24.2 20.6 12.7 23.6 22.7 19.4

Source: Angel Research

Exhibit 14: One-year forward P/E

1,600 1,400 1,200 1,000 800 600 400 200 0

Share price (` )

Aug-08

Dec-10

19x

Apr-06

Mar-09

Nov-06

Oct-09

Share price

Source: Company, Angel Research

7x

10x

13x

16x

Exhibit 15: Premium/Discount in RIL (P/E) vs. Sensex (P/E)

60 50 40 30

(%)

20 10 0 (10) (20) (30)

Source: Company, Angel Research

July 26, 2011

Apr-07 Jun-07 Aug-07 Oct-07 Dec-07 Feb-08 Apr-08 Jun-08 Aug-08 Oct-08 Dec-08 Feb-09 Apr-09 Jun-09 Aug-09 Oct-09 Dec-09 Feb-10 Apr-10 Jun-10 Aug-10 Oct-10 Dec-10 Feb-11 Apr-11 Jun-11

Prem/Disc to Sensex Historic Avg Disc

May-10

Jun-07

Jan-08

Jul-11

Reliance Industries | 1QFY2012 Result Update

Profit and loss (Consolidated)

Y/E March (` cr) Total operating income % chg Total Expenditure Net Raw Materials Purchases of finished goods Personnel Other EBITDA % chg (% of Net Sales) Depreciation& Amortisation EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) Recurring PBT % chg Extraordinary Income/Exp PBT (reported) Tax (% of PBT) PAT (reported) Minority interest (MI) PAT after MI (reported) ADJ. PAT(core) % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg

FY2008 FY2009 FY2010 FY2011 FY2012E FY2013E

137,147 151,224 203,740 265,811 310,994 314,718 20.5 10.3 34.7 30.5 17.0 1.2 114,002 127,802 172,846 226,850 270,024 267,863 89,912 105,224 147,065 197,392 234,960 233,079 9,851 2,738 11,501 23,145 15.0 16.9 5,004 18,140 19.1 13.2 1,087 1,223 5.3 18,277 24.8 4,734 23,011 3,488 17.9 19,523 (1.9) 19,521 14,788 22.5 10.8 45.2 45.2 22.5 7,202 3,018 12,358 23,422 1.2 15.5 5,651 17,771 (2.0) 11.8 1,816 1,914 10.7 17,869 (2.2) 17,869 2,919 19.5 14,950 18.4 14,969 14,969 1.2 9.9 45.7 45.7 1.2 7,538 2,791 15,452 30,894 31.9 15.2 10,946 19,948 12.2 9.8 2,060 2,185 7.6 20,074 12.3 8,606 28,680 4,256 17.4 24,424 79.6 24,503 15,897 6.2 7.8 48.6 48.6 6.2 7,032 3,324 19,102 38,961 26.1 14.7 14,121 24,840 24.5 9.3 2,411 2,543 10.2 24,972 24.4 24,972 4,783 23.7 20,189 22.0 20,211 20,211 27.1 7.6 61.8 61.8 27.1 8,370 3,957 22,738 40,969 5.2 13.2 13,049 27,920 12.4 9.0 2,150 3,450 11.8 29,220 17.0 29,220 7,013 24.0 22,207 34.0 22,241 22,241 17.2 7.2 68.0 68.0 17.2 8,303 3,925 22,556 46,855 14.4 14.9 14,160 32,695 17.1 10.4 2,075 3,289 9.7 33,909 16.0 33,909 7,799 29.9 26,110 41.0 26,151 26,151 17.6 8.3 79.9 79.9 17.6

July 26, 2011

10

Reliance Industries | 1QFY2012 Result Update

Balance sheet (Consolidated)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Reserves& Surplus Shareholders Funds Total Loans Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Investments Current Assets Cash Loans & Advances Other Current liabilities and prov. Net Current Assets Mis. Exp. not written off Total Assets 109,180 157,182 224,125 238,293 254,973 275,371 45,119 49,884 9,523 51,489 4,474 21,748 25,267 26,867 24,622 3 50,138 73,846 6,436 58,746 22,742 11,002 25,002 38,872 19,874 4 63,934 17,034 13,112 69,106 13,891 10,647 44,568 42,586 26,520 2 80,193 29,742 21,596 30,139 13,726 54,215 57,445 40,634 1 93,242 107,402 15,272 21,596 40,141 13,726 57,087 59,919 51,034 1 17,172 21,596 49,460 13,710 56,046 58,735 60,480 1 64,061 107,044 160,191 158,099 161,731 167,969 3,136 1,444 2,978 2,981 2,981 2,981 86,463 119,952 138,598 151,112 170,636 193,765 89,599 121,396 141,576 154,094 173,618 196,748 50,696 7,798 76,257 9,551 64,606 10,678 84,106 11,071 62,500 12,714 54,830 14,839 FY2008 FY2009 FY2010 FY2011 FY2012E FY2013E

148,093 207,203 216,860 250,073 249,635 267,218

98,080 110,954 119,215

148,093 207,203 216,860 250,073 249,635 267,218

July 26, 2011

11

Reliance Industries | 1QFY2012 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr) Profit before tax Depreciation Change in Working Capital Less: Other income Direct taxes paid Cash Flow from Operations (Inc.)/ Dec. in Fixed Assets (Inc.)/ Dec. in Investments (Inc.)/ Dec. in loans and adv. Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY2008 23,011 6,785 (4,565) (5,827) (2,475) 16,929 4,335 (8,623) 503 1,682 17,652 (3,301) 16,033 2,537 1,937 4,474 FY2009 17,869 7,713 (5,771) (1,330) (1,926) 16,555 3,366 (102) 1,364 15,165 16,514 (1,908) FY2010 28,680 14,001 (1,786) (3,140) 31,815 2,645 (19) 2,160 513 (5,822) (2,219) 9,666 196 (2,431) (8,378) 16,248 13,891 30,139 FY2011 FY2012E FY2013E 24,055 16,820 (1,722) (4,243) 33,338 (8,102) 29,220 13,049 (398) (1,300) (7,013) 33,559 3,450 (2,683) (507) 10,002 30,139 40,141 33,909 14,160 (127) (1,214) (7,799) 38,929 16 3,289 (7,670) (2,981) 34 9,319 40,141 49,460

(5,939) (13,501)

(26,640) (27,732) (23,017) (33,604)

(2,210) (22,298)

(30,426) (23,103) (18,231) (32,040)

1,239 (18,993)

20,701 (21,606)

(4,954) (14,907) 24,817 (22,436) 18,268 4,474 22,742 (8,851) 22,742 13,891

14,950 (24,796) (10,617)

July 26, 2011

12

Reliance Industries | 1QFY2012 Result Update

Key ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV/Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Returns (%) RoCE (Pre-tax) Angel RoIC (Pre-tax) RoE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Int. Coverage (EBIT/Int.)

0.5 2.0 16.7 0.4 2.3 9.8 0.4 1.6 9.7 0.4 1.4 10.3 0.1 0.5 13.0 0.0 0.1 15.8 1.3 42.0 13.2 66.6 41.4 1.1 47.4 13.2 84.5 20.9 1.1 48.8 13.4 78.8 8.7 1.1 48.6 14.4 70.3 15.9 1.3 46.9 14.4 70.8 12.6 1.2 50.2 15.4 75.8 12.7 13.9 20.8 20.1 10.0 17.4 13.6 9.4 13.5 14.1 10.6 13.2 12.8 11.2 14.5 13.6 12.7 16.6 14.1 49.4 49.4 71.1 5.5 301 43.7 43.7 66.9 6.4 407 56.7 56.7 99.0 7.0 475 58.0 58.0 111.0 8.5 517 68.0 68.0 118.4 9.0 582 79.9 79.9 135.2 10.0 660 17.6 12.3 2.9 0.6 2.1 12.6 2.0 19.9 13.0 2.1 0.7 2.0 13.1 1.5 15.3 8.8 1.8 0.8 1.5 10.1 1.4 15.0 7.8 1.7 1.0 1.2 8.0 1.2 12.8 7.4 1.5 1.0 1.0 7.7 1.3 10.9 6.4 1.3 1.1 0.9 6.0 1.1 FY2008 FY2009 FY2010 FY2011 FY2012E FY2013E

July 26, 2011

13

Reliance Industries | 1QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

RIL No No Yes No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

July 26, 2011

14

You might also like

- Micro Finance Sacco Software Features PDFDocument4 pagesMicro Finance Sacco Software Features PDFdavid5441100% (2)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- RIL and Network 18 DealDocument10 pagesRIL and Network 18 DealsharvariNo ratings yet

- Reliance IndustriesDocument7 pagesReliance IndustriesSanidhay SindhwaniNo ratings yet

- Company Analysis of Reliance Industries LTDDocument11 pagesCompany Analysis of Reliance Industries LTDSanny Das0% (1)

- RILDocument13 pagesRILArya ArifNo ratings yet

- Marketing Plan For Titan IndustryDocument32 pagesMarketing Plan For Titan Industry6038 Mugilan kNo ratings yet

- Reliance Industries Result UpdatedDocument13 pagesReliance Industries Result UpdatedAngel BrokingNo ratings yet

- Hindalco: Performance HighlightsDocument15 pagesHindalco: Performance HighlightsAngel BrokingNo ratings yet

- GAIL India: Performance HighlightsDocument12 pagesGAIL India: Performance HighlightsAngel BrokingNo ratings yet

- Reliance Industries Result UpdatedDocument14 pagesReliance Industries Result UpdatedAngel BrokingNo ratings yet

- Indraprasth Gas Result UpdatedDocument10 pagesIndraprasth Gas Result UpdatedAngel BrokingNo ratings yet

- Performance Highlights: 2QFY2012 Result Update - Oil & GasDocument10 pagesPerformance Highlights: 2QFY2012 Result Update - Oil & GasAngel BrokingNo ratings yet

- Indraprastha GasDocument11 pagesIndraprastha GasAngel BrokingNo ratings yet

- MOIL Result UpdatedDocument10 pagesMOIL Result UpdatedAngel BrokingNo ratings yet

- National Aluminium: Performance HighlightsDocument12 pagesNational Aluminium: Performance HighlightsAngel BrokingNo ratings yet

- Performance Highlights: 2QFY2013 Result Update - Oil & GasDocument11 pagesPerformance Highlights: 2QFY2013 Result Update - Oil & GasAngel BrokingNo ratings yet

- Spice JetDocument9 pagesSpice JetAngel BrokingNo ratings yet

- Coal India: Performance HighlightsDocument10 pagesCoal India: Performance HighlightsAngel BrokingNo ratings yet

- Rallis India Result UpdatedDocument10 pagesRallis India Result UpdatedAngel BrokingNo ratings yet

- Gail, 15th February 2013Document12 pagesGail, 15th February 2013Angel BrokingNo ratings yet

- National Aluminium Result UpdatedDocument12 pagesNational Aluminium Result UpdatedAngel BrokingNo ratings yet

- Ceat Result UpdatedDocument11 pagesCeat Result UpdatedAngel BrokingNo ratings yet

- Petronet LNG: Performance HighlightsDocument10 pagesPetronet LNG: Performance HighlightsAngel BrokingNo ratings yet

- Performance Highlights: 2QFY2013 Result Update - Auto AncillaryDocument11 pagesPerformance Highlights: 2QFY2013 Result Update - Auto AncillaryAngel BrokingNo ratings yet

- Neutral: Performance HighlightsDocument10 pagesNeutral: Performance HighlightsAngel BrokingNo ratings yet

- Petronet LNG: Performance HighlightsDocument10 pagesPetronet LNG: Performance HighlightsAngel BrokingNo ratings yet

- Ongc 4Q Fy 2013Document12 pagesOngc 4Q Fy 2013Angel BrokingNo ratings yet

- Exide Industries: Performance HighlightsDocument12 pagesExide Industries: Performance HighlightsAngel BrokingNo ratings yet

- ONGC Result UpdatedDocument11 pagesONGC Result UpdatedAngel BrokingNo ratings yet

- Vesuvius India: Performance HighlightsDocument12 pagesVesuvius India: Performance HighlightsAngel BrokingNo ratings yet

- Performance Highlights: ReduceDocument12 pagesPerformance Highlights: ReduceAngel BrokingNo ratings yet

- Ril, 4Q Fy 2013Document14 pagesRil, 4Q Fy 2013Angel BrokingNo ratings yet

- Ashok Leyland Result UpdatedDocument13 pagesAshok Leyland Result UpdatedAngel BrokingNo ratings yet

- Bajaj Auto: Performance HighlightsDocument12 pagesBajaj Auto: Performance HighlightsAngel BrokingNo ratings yet

- Graphite India Result UpdatedDocument10 pagesGraphite India Result UpdatedAngel BrokingNo ratings yet

- Steel Authority of India Result UpdatedDocument13 pagesSteel Authority of India Result UpdatedAngel BrokingNo ratings yet

- Graphite India: Performance HighlightsDocument11 pagesGraphite India: Performance HighlightsAngel BrokingNo ratings yet

- BGR Energy Systems: Performance HighlightsDocument12 pagesBGR Energy Systems: Performance HighlightsAngel BrokingNo ratings yet

- Graphite India: Performance HighlightsDocument11 pagesGraphite India: Performance HighlightsAngel BrokingNo ratings yet

- Coal India: Performance HighlightsDocument11 pagesCoal India: Performance HighlightsAngel BrokingNo ratings yet

- GAIL India: Performance HighlightsDocument12 pagesGAIL India: Performance HighlightsAngel BrokingNo ratings yet

- Gujarat Gas: Performance HighlightsDocument10 pagesGujarat Gas: Performance HighlightsAngel BrokingNo ratings yet

- Moil 2qfy2013Document10 pagesMoil 2qfy2013Angel BrokingNo ratings yet

- Hindalco: Performance HighlightsDocument14 pagesHindalco: Performance HighlightsAngel BrokingNo ratings yet

- Ashok Leyland Result UpdatedDocument13 pagesAshok Leyland Result UpdatedAngel BrokingNo ratings yet

- Ll& FS Transportation NetworksDocument14 pagesLl& FS Transportation NetworksAngel BrokingNo ratings yet

- Rallis India Result UpdatedDocument9 pagesRallis India Result UpdatedAngel BrokingNo ratings yet

- Hero MotocorpDocument11 pagesHero MotocorpAngel BrokingNo ratings yet

- Rallis India Result UpdatedDocument10 pagesRallis India Result UpdatedAngel BrokingNo ratings yet

- Amara Raja Batteries: Performance HighlightsDocument11 pagesAmara Raja Batteries: Performance HighlightsAngel BrokingNo ratings yet

- GIPCL Result UpdatedDocument11 pagesGIPCL Result UpdatedAngel BrokingNo ratings yet

- Hindalco, 1Q FY 2014Document12 pagesHindalco, 1Q FY 2014Angel BrokingNo ratings yet

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingNo ratings yet

- Acc 1Q CY 2013Document10 pagesAcc 1Q CY 2013Angel BrokingNo ratings yet

- NMDC 1qfy2013ruDocument12 pagesNMDC 1qfy2013ruAngel BrokingNo ratings yet

- Motherson Sumi Systems Result UpdatedDocument14 pagesMotherson Sumi Systems Result UpdatedAngel BrokingNo ratings yet

- Ceat, 11th January, 2013Document12 pagesCeat, 11th January, 2013Angel Broking100% (2)

- Apol Lo Tyres Result UpdatedDocument13 pagesApol Lo Tyres Result UpdatedAngel BrokingNo ratings yet

- Market Outlook 12th August 2011Document6 pagesMarket Outlook 12th August 2011Angel BrokingNo ratings yet

- Acc 3qcy2012ruDocument10 pagesAcc 3qcy2012ruAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Macroeconomic Policy Objectives Lesson 2Document12 pagesMacroeconomic Policy Objectives Lesson 2api-53255207No ratings yet

- DESRI Associate FTEDocument2 pagesDESRI Associate FTEeverydimension123No ratings yet

- Should Wealthy Nations Be Required To Share Their Wealth Among Poorer Nations by Providing Such Things As Food and EducationDocument7 pagesShould Wealthy Nations Be Required To Share Their Wealth Among Poorer Nations by Providing Such Things As Food and EducationPham Ba DatNo ratings yet

- Rohit Sunar Appeal CorrectedDocument2 pagesRohit Sunar Appeal CorrectedromanNo ratings yet

- The Five Financial Statements Based On IFRSDocument12 pagesThe Five Financial Statements Based On IFRSAngel GraceNo ratings yet

- CEO Entrepreneur - Essential Functions of A Small BusinessDocument15 pagesCEO Entrepreneur - Essential Functions of A Small Businessmilton_diaz5278No ratings yet

- Statement of Assets and Liabilities Form-B PDFDocument5 pagesStatement of Assets and Liabilities Form-B PDFRana rocksNo ratings yet

- Janina Louise Caliboso Bsa 3A: Tax Reform For Acceleration and Inclusion (TRAIN) "Document3 pagesJanina Louise Caliboso Bsa 3A: Tax Reform For Acceleration and Inclusion (TRAIN) "Ja CalibosoNo ratings yet

- A Study On Cost and Cost Techniques at Reid Braids India - HassanDocument58 pagesA Study On Cost and Cost Techniques at Reid Braids India - HassanSuresh100% (1)

- Lalakay Elementary School: Statement of AccountDocument4 pagesLalakay Elementary School: Statement of AccountReyes C. ErvinNo ratings yet

- Travancore - Revised - PO-1Document2 pagesTravancore - Revised - PO-1V.Sampath RaoNo ratings yet

- Mohit Malviya Kunal Assudani Aniket BushalDocument12 pagesMohit Malviya Kunal Assudani Aniket BushalMohit MalviyaNo ratings yet

- Motivation Letter For PHDDocument2 pagesMotivation Letter For PHDlivealone boyNo ratings yet

- Delivery Hero GMBH FY 2016 Cons enDocument178 pagesDelivery Hero GMBH FY 2016 Cons enms1279No ratings yet

- Commerce: Original Research Paper Growth of Textile Industry in IndiaDocument2 pagesCommerce: Original Research Paper Growth of Textile Industry in Indiapavithra nirmalaNo ratings yet

- Business Environment Chapter 07 Stock Exchanges in in Dia 1Document23 pagesBusiness Environment Chapter 07 Stock Exchanges in in Dia 1himanshu_choudhary_2No ratings yet

- Practical 4: Prepare A Report On Infosys FoundationDocument3 pagesPractical 4: Prepare A Report On Infosys FoundationSuvarna LangadeNo ratings yet

- Assignment On Labour Law PDFDocument11 pagesAssignment On Labour Law PDFTwokir A. Tomal100% (1)

- Class Work Chapter 5 Part ADocument2 pagesClass Work Chapter 5 Part Aaura fitrah auliya SomantriNo ratings yet

- Assignment 2: HRP 111 Submitted To Deepak SharmaDocument7 pagesAssignment 2: HRP 111 Submitted To Deepak Sharmaramandeep kaurNo ratings yet

- OM - Final Exam - Group 9 Beer HABECODocument24 pagesOM - Final Exam - Group 9 Beer HABECOmofil85832No ratings yet

- 36 Banking Terms/Terminologies You Should Know: Transfer The Balance of One Credit Card To AnotherDocument3 pages36 Banking Terms/Terminologies You Should Know: Transfer The Balance of One Credit Card To AnotherPutri ZalthieNo ratings yet

- Menu EngineeringDocument7 pagesMenu EngineeringDon LucaNo ratings yet

- The Ban On Plastic Bags in KenyaDocument4 pagesThe Ban On Plastic Bags in KenyaSheila ChumoNo ratings yet

- Article From S.directDocument8 pagesArticle From S.directmustefaNo ratings yet

- Handout in Unit 4D and 4EDocument10 pagesHandout in Unit 4D and 4EArgie Cayabyab CagunotNo ratings yet

- Marketing Mini Project - Final PresentationDocument11 pagesMarketing Mini Project - Final Presentationbhargav4987No ratings yet

- NF-370 P Srinu GaruantorDocument4 pagesNF-370 P Srinu GaruantorSreenu MudhirajNo ratings yet

- 2016-17 SARS ELogbookDocument17 pages2016-17 SARS ELogbookMfundo DlaminiNo ratings yet