Professional Documents

Culture Documents

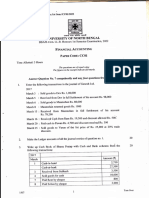

Account XI

Account XI

Uploaded by

Dik Esh0 ratings0% found this document useful (0 votes)

32 views2 pagesThis summary provides the key details from the document in 3 sentences:

The document includes various accounting transactions related to purchases, sales returns, cash and banking activities for different periods. Journal entries are required to be made for the purchase, sales return and other transactions. A trial balance is also given for a trader for the year ending 31st December 2019 along with various ledger balances.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis summary provides the key details from the document in 3 sentences:

The document includes various accounting transactions related to purchases, sales returns, cash and banking activities for different periods. Journal entries are required to be made for the purchase, sales return and other transactions. A trial balance is also given for a trader for the year ending 31st December 2019 along with various ledger balances.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

32 views2 pagesAccount XI

Account XI

Uploaded by

Dik EshThis summary provides the key details from the document in 3 sentences:

The document includes various accounting transactions related to purchases, sales returns, cash and banking activities for different periods. Journal entries are required to be made for the purchase, sales return and other transactions. A trial balance is also given for a trader for the year ending 31st December 2019 along with various ledger balances.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

21th August Returned to Asmita Books Distributors:

Gaindakot Namuna SS/College 20 piece Economics books @ Rs. 500 each

Second Internal Examinations -2078 [Less: Trade Discount @ 10%]

Required: (a) Sales return book [2]

Grade: 11 (MGMT) Full Marks:75

Time 3 hrs Subject: Account (1031) Pass Marks:27 [14] Following purchase related transactions are given:

1st July Purchased from Nabin, Biratnagar:

Candidates are required to give their answers in their own words as for as 40 Shirts @ Rs. 500 per shirt

practicable the figures in the margin indicate full marks. 30 Sweaters @ Rs. 1,000 per sweater

Section “A” [Less: 10% Trade discount]

Very Short Answer Questions. [11 x 1= 11] 5th July Purchase from Biraj on cash

[1] What is book-keeping? 100 Cap @ Rs. 100 per piece

[2] Describe any two function of accounting.

19th July Purchased from Subin, Kathmandu

[3] Write about accounting period concept.

[4] Write the meaning of double entry system. 10 Jeans Pants @ Rs. 2,000 per piece

[5] What is bank reconciliation statement? 20 Cotton Pants @ Rs. 500 per piece

[6] What do you mean by petty cash fund? Transportation cost Rs. 1,000

[7] Define trial balance. [Less: Trade Discount @ 10%]

[8] What is depreciation? 28th July Purchased a Sofa set of Rs. 25,000 on credit

[9] Write any two causes of depreciation. from Rabindra for office use.

[10] What is the purpose of preparing a bank reconciliation statement? Required: (a) Purchase book (b) Purchase A/c [3 + 2]

[11] Write the meaning of final account of a company.

Section “B” [15] Following cash & banking transactions are given to you:

Short Answer Questions. [8 x 5 = 40] Bhadra 1 Cash in hand Rs. 60,000, Balance at Bank Rs. 80,000. Bhadra 10 Goods

[12] A. State accounting process in brief. 3 purchased for Rs. 25,000

B. Journalize the following transactions in the book of Mr. A. 2 Bhadra 21 Interest received Rs. 5,000

Baishakh 1 Started business with cash Rs. 3,00,000. Bhadra 25 Deposited Rs. 10,000 into bank.

Baishakh 10 Goods purchased from ABC Traders of Rs. 15,000. Bhadra 28 Goods sold for Rs. 50,000 , Cash received Rs. 30,000

Baishakh 24 Received cheque of Rs.9,000 for interest income. and balance by cheque after deducting Rs. 1,000 discount.

Baishakh 28 Furniture of Rs. 10,000 sold to Hari on cash. Bhadra 30 Issued cheque of Rs. 9,500 to Rajan in full settlement of

his account of Rs. 10,000.

[13]A. Following transactions are given to you:

Required: Triple Column Cash Book. [5]

Shrawan 1 Purchased goods of Rs. 40,000 from Sundar.

Shrawan 9 Cheque of Rs. 30,000 issued to Sundar.

[16] You are required to prepare BRS from given information:

Shrawan 15 Again goods of Rs. 20,000 purchased from Sundar.

(a) Cheque sent for collection of Rs. 15,000 into bank, has not been credited by bank yet.

Shrawan 22 Goods of Rs. 5,000 returned to Sundar.

(b) Insurance premium Rs. 3,000 paid by bank as per instruction.

Shrawan 25 Paid Rs. 10,000 to Sundar.

(c) Cheque drawn and issued of Rs.8,000 omitted to record in cash book.

Required: (a) Journal entries (b) Sundar’s account [2 +1]

(d) Cheque printing charge Rs.400 recorded in pass book only.

B. Following purchase transactions are given:

(e) Receipt side of cash book overcast by Rs. 4,000

1st August Returned from Kamana Books: (f) Bank balance shown by Pass book Rs. 50,000 [5]

20 pieces of Account books @ Rs.800 each

10 dozens of pencil @ Rs. 8 per piece [17] Following transactions related to bank for the month of Baishakh are given to you:

[Trade discount @ 10% on book only] [a] Bank overdraft as per cash book Rs. 28,000

17th August Returned from Gandaki Books: [b] Issued cheque of Rs. 12,000 before Baishakh end but only presented for payment

100 piece of Note books @ Rs. 50 per piece Rs. 10,000

[c] Interest on overdraft debited in pass book Rs. 1,000 [21] From the given transactions, prepare Journal entry, necessary ledgers and trial

[d] A customer directly deposited into bank Rs. 9,000 balance. [8]

[e] Wrongly credited in cash book for Rs. 2,000 Baishakh 1 Started business with cash Rs. 5,00,000

[f] A cheque sent for collection Rs. 4,000 omitted to record in cash book. Baishakh 8 Machinery purchased for Rs. 1,00,000.

Required: Bank Reconciliation Statement [5] Baishakh 15 Goods of Rs. 50,000 sold to Ranjan.

Baishakh 19 Deposited Rs. 25,000 into bank.

[18] On 1st January 2015, ABC Company purchased a Machinery for Rs. 75,000 and spent Baishakh 22 Returned goods of Rs. 10,000 from Ranjan.

Rs. 5,000 on its installation. On 1st April 2016, it purchased another Machine for Rs. Baishakh 28 Ranjan paid Rs. 39,000 in full settlement of his account.

1,00,000. On 30th June 2017, it sold the Machine which was purchased on 1 st January 2015

for Rs. 60,000 and purchased another Machine for Rs. 50,000 on same date. [22] Trial balance of a trader as on 31st December, 2019 is given below:

Required: Prepare Machinery account in the books of ABC Company for first 3 years if the Particulars Debit Particulars Credit

company charges depreciation @ 12% p.a. on Straight Line Method. Accounts are closed on Opening stock 20,000 Capital 2,00,000

31st December each year. [5] Machinery 1,00,000 Sales 5,50,000

Salaries 50,000 Purchase return 17,000

[19] The following transactions related to furniture are given to you: Rent 40,000 Creditors 40,000

1st January 2001 Purchased furniture for Rs. 40,000 Commission 10,000 Bank loan 1,00,000

1st July 2001 Additional furniture purchased for Rs. 60,000 Cash 80,000 Discount 13,000

31st December 2003 Furniture purchased on 1 st January 2001 has been sold for Rs. Debtors 75,000 Bills payable 20,000

29,000 and purchased new furniture for Rs. 50,000. Carriage inwards 5,000 Provision for bad debt 7,000

Required: Furniture account for year 2001 to 2003, assuming rate of depreciation is 10% Purchase 2,20,000

under Written Down Value Method and accounts are closed on 31st December each year. Advertisement 18,000

[5] Sales return 14,000

Section “C” Insurance 9,000

Long Answer Question. [3 x 8 – 24] Interest on loan 7,000

[20] Trial balance of A Suppliers as on 30th Chaitra, 2075 is given below: Drawings 12,000

Particulars Debit Rs. Particulars Credit Rs. Bad debt 4,000

Salaries 30,000 Gross profit b/d 3,05,000 Goodwill 30,000

Insurance 20,000 Bank loan 28,000 Printing expenses 22,000

Machinery 2,00,000 Creditors 65,000 General expenses 11,000

Rent 45,000 Sundry income 18,000 Investment 90,000

Cash 1,00,000 Provision for bad debt 4,000 Land and building 1,30,000

Debtors 80,000 Capital 1,75,000

Investment 50,000 Total 9,47,000 9,47,000

Interest 10,000 Required: (a) Trading account (b) Profit and Loss account (c) Balance Sheet

Advertisement 15,000 [2 + 3 + 3]

Furniture 40,000

Discount 5,000 ***The End***

5,95,000 5,95,000

Additional information:

(a) Depreciation on machinery @ 10% p.a.

(b) Rent outstanding Rs. 5,000

(c) Bad debt written off Rs. 3,000

(d) Prepaid salary Rs. 7,000

Required: (a) Profit and Loss account (b) Balance Sheet [4+4]

You might also like

- FX Risk Hedging at EADSDocument14 pagesFX Risk Hedging at EADSAlexandra Ermakova100% (1)

- PAGE1Document1 pagePAGE1Joeyq MoyaNo ratings yet

- General JournalDocument11 pagesGeneral JournalZaheer Ahmed Swati100% (2)

- Central Banking and Monetary Policy PDFDocument43 pagesCentral Banking and Monetary Policy PDFWindyee TanNo ratings yet

- Accountancy Three SetDocument10 pagesAccountancy Three Setrt6043663No ratings yet

- Valmiki Shiksha Sadan H. S. S.: Sent Up Examination-2071Document3 pagesValmiki Shiksha Sadan H. S. S.: Sent Up Examination-2071Rabindra Raj BistaNo ratings yet

- 11 Accounts Final First Assessment 1Document4 pages11 Accounts Final First Assessment 1khush marooNo ratings yet

- Faculty of Commerce: Code No. 10001Document4 pagesFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNo ratings yet

- Xi Accounting Set 4Document8 pagesXi Accounting Set 4aashirwad2076No ratings yet

- Xi Accounting Set 3Document6 pagesXi Accounting Set 3aashirwad2076No ratings yet

- XI AccoutingDocument8 pagesXI AccoutingJaiswal BrotherNo ratings yet

- June, 2004 Q.P JRDocument4 pagesJune, 2004 Q.P JRM JEEVARATHNAM NAIDUNo ratings yet

- Xi Accountancy 80 Marks General InstructionsDocument5 pagesXi Accountancy 80 Marks General InstructionsJash ShahNo ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 3Document10 pages11 Sample Papers Accountancy 2020 English Medium Set 3Joshi DrcpNo ratings yet

- Accountancy XI. Raju Sir.1st TermDocument2 pagesAccountancy XI. Raju Sir.1st Termsuryarajaure554No ratings yet

- Xi Accounting Set 1Document6 pagesXi Accounting Set 1aashirwad2076No ratings yet

- Sample Paper 11 Term 1 - ACCOUNTANCY 2023 Grade 11Document12 pagesSample Paper 11 Term 1 - ACCOUNTANCY 2023 Grade 11Suhaim SahebNo ratings yet

- 11 Sample Papers Accountancy 2Document10 pages11 Sample Papers Accountancy 2AvcelNo ratings yet

- Fundamentals of Accounting 2021Document4 pagesFundamentals of Accounting 2021mariyabenny223No ratings yet

- Mid Term Accounts - SubjectiveDocument4 pagesMid Term Accounts - Subjectivekarishma prabagaranNo ratings yet

- Nava Bharath National School Annur Annual Examination - 2021 AccountancyDocument5 pagesNava Bharath National School Annur Annual Examination - 2021 AccountancypranavNo ratings yet

- Accounts Paper Class 11 Sem 1 2019Document4 pagesAccounts Paper Class 11 Sem 1 2019samarthj.9390No ratings yet

- Karnataka Ist PUC Accountcancy Sample Question Paper 4 PDFDocument4 pagesKarnataka Ist PUC Accountcancy Sample Question Paper 4 PDFNeha BaligaNo ratings yet

- 11 Accountancy TP Ch03 01 Journal EntriesDocument2 pages11 Accountancy TP Ch03 01 Journal EntriesBhavi ChaudharyNo ratings yet

- Exam Type Question of Accountancy, Class XiDocument3 pagesExam Type Question of Accountancy, Class Xirobinghimire100% (7)

- Financial Accounting Unit 1Document7 pagesFinancial Accounting Unit 1MOAAZ AHMEDNo ratings yet

- March, 2007 JRDocument4 pagesMarch, 2007 JRM JEEVARATHNAM NAIDUNo ratings yet

- May, 2007Document6 pagesMay, 2007M JEEVARATHNAM NAIDUNo ratings yet

- 9 Account (Repaired)Document1 page9 Account (Repaired)DK MoviesNo ratings yet

- (C) Prepare Suman Account With The Following Transactions:: I. Answer Any Two of The Following: 2 X 5 10Document3 pages(C) Prepare Suman Account With The Following Transactions:: I. Answer Any Two of The Following: 2 X 5 10M JEEVARATHNAM NAIDUNo ratings yet

- LHU8Q Olopr DaisyAcountXIDocument35 pagesLHU8Q Olopr DaisyAcountXIDido MuczNo ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- Acc Xi Class Test-I 2022Document4 pagesAcc Xi Class Test-I 2022shaurya kapoorNo ratings yet

- Class 11 Accounts Half Yearly SPDocument9 pagesClass 11 Accounts Half Yearly SPRakesh AgarwalNo ratings yet

- Sample Paper Commerce Class 11th CBSEDocument6 pagesSample Paper Commerce Class 11th CBSEShreyansh DhruwNo ratings yet

- ZR Ics Oray WFF 4 o YVGRi 7Document46 pagesZR Ics Oray WFF 4 o YVGRi 7RahulNo ratings yet

- Section "A" Very Short Answer Questions) (Attempt All Questions)Document5 pagesSection "A" Very Short Answer Questions) (Attempt All Questions)Ayusha TimalsinaNo ratings yet

- 11th Com DepreciationDocument4 pages11th Com DepreciationObaid KhanNo ratings yet

- Bachelor of Commerce in Information System - Semester 1 BM0001 - Financial Accounting - 4 CreditsDocument4 pagesBachelor of Commerce in Information System - Semester 1 BM0001 - Financial Accounting - 4 Creditssuman_kush1093No ratings yet

- March 2006 Q.P. JURDocument4 pagesMarch 2006 Q.P. JURM JEEVARATHNAM NAIDUNo ratings yet

- Bba Bcom Ll.b-I-Fincncial Accounting CC01Document2 pagesBba Bcom Ll.b-I-Fincncial Accounting CC01vijay.s12usNo ratings yet

- Question Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowDocument16 pagesQuestion Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowRaveendra KJNo ratings yet

- (Final) Accountancy Class XiDocument4 pages(Final) Accountancy Class XiUmang AgarwalNo ratings yet

- (Final) Accountancy Class XiDocument4 pages(Final) Accountancy Class XiUmang AgarwalNo ratings yet

- XI-com PPR 21-1-23Document2 pagesXI-com PPR 21-1-23Obaid KhanNo ratings yet

- Fundamentals of Accounting 2019Document4 pagesFundamentals of Accounting 2019sreehari dineshNo ratings yet

- Financial Accounts Questoin Paper UNOM 2019Document4 pagesFinancial Accounts Questoin Paper UNOM 2019lucy artemisNo ratings yet

- Assigment BBM Finacial AccountingDocument6 pagesAssigment BBM Finacial Accountingtripathi_indramani5185No ratings yet

- Accounts Specimen QP Class XiDocument7 pagesAccounts Specimen QP Class XiAnju TomarNo ratings yet

- RKG Institute: B - 193, Sector - 52, NoidaDocument4 pagesRKG Institute: B - 193, Sector - 52, NoidaBHS PRAYAGRAJNo ratings yet

- BCA & BSC (CS) Bussines Accounting I Internal QuestionDocument3 pagesBCA & BSC (CS) Bussines Accounting I Internal QuestionVignesh GopalNo ratings yet

- Smt. K.K. Dholakiya School - Rajkot: STD 11 Commerce AccountDocument3 pagesSmt. K.K. Dholakiya School - Rajkot: STD 11 Commerce AccountStudentBroNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 5 Journal PDFDocument46 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 5 Journal PDFQueen MNo ratings yet

- Hsslive Xi Acc Prvs QN Ans 4 Recording of Transaction IIDocument27 pagesHsslive Xi Acc Prvs QN Ans 4 Recording of Transaction IIMuhammed Rasil NaseerNo ratings yet

- Term 1 QP XI - Subjective Paper 40 MarksDocument3 pagesTerm 1 QP XI - Subjective Paper 40 MarksAditiNo ratings yet

- Kerala Samajam Model School Accounts Half YearlyDocument6 pagesKerala Samajam Model School Accounts Half YearlyEmperor YashNo ratings yet

- Cash BookDocument4 pagesCash BookSuneet SaxenaNo ratings yet

- Accountancy: General InstructionsDocument5 pagesAccountancy: General InstructionsSwami NarangNo ratings yet

- Bba 1 Sem Business Accounting 21102401 Oct 2021Document4 pagesBba 1 Sem Business Accounting 21102401 Oct 2021lizabnamazliaNo ratings yet

- Accounts Mock - 29178435Document6 pagesAccounts Mock - 29178435mopibam555No ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

- Web TechnologyDocument15 pagesWeb TechnologyDik EshNo ratings yet

- EconomicDocument6 pagesEconomicDik EshNo ratings yet

- 11 Management NepaliDocument2 pages11 Management NepaliDik EshNo ratings yet

- 11 M MathDocument2 pages11 M MathDik EshNo ratings yet

- Suraj Math ProjectDocument13 pagesSuraj Math ProjectDik EshNo ratings yet

- Computer SystemDocument13 pagesComputer SystemDik EshNo ratings yet

- Ganesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)Document11 pagesGanesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)ayushsapkota907No ratings yet

- Explanatory NotesDocument2 pagesExplanatory NotesAmirah IdrusNo ratings yet

- 15k BTC Dorks 2020Document540 pages15k BTC Dorks 2020ZyKox Bit57% (7)

- Local Media4930298822971004354Document17 pagesLocal Media4930298822971004354Haks MashtiNo ratings yet

- Kuwait Aug 07Document157 pagesKuwait Aug 07mfaisalidreisNo ratings yet

- The Garden Spot Year OneDocument2 pagesThe Garden Spot Year OneJellyBeanNo ratings yet

- AmalgamationDocument12 pagesAmalgamationNirav JadavNo ratings yet

- 0708 T1 Midterm AnsDocument16 pages0708 T1 Midterm AnsYudi KhoNo ratings yet

- Sibl-Fs 30 June 2018Document322 pagesSibl-Fs 30 June 2018Faizal KhanNo ratings yet

- 2010 Macro FRQDocument8 pages2010 Macro FRQKripansh GroverNo ratings yet

- Assignment 1 STUDENTS VERSION BM270120B 410-015-MM - AccountingDocument5 pagesAssignment 1 STUDENTS VERSION BM270120B 410-015-MM - AccountingkarandeepNo ratings yet

- 4.1.1 Rfi Barter System History PDFDocument2 pages4.1.1 Rfi Barter System History PDFBrent DawnNo ratings yet

- Chapter - 4: Risk and Return: An Overview of Capital Market TheoryDocument11 pagesChapter - 4: Risk and Return: An Overview of Capital Market TheoryAkash saxenaNo ratings yet

- Follow The Smart MoneyDocument50 pagesFollow The Smart MoneyVusi-Vuitton FreeThinker Mondlane100% (2)

- Berlian Laju Tanker: Sailing Over Tidal WatersDocument17 pagesBerlian Laju Tanker: Sailing Over Tidal WatersYoga PrakasaNo ratings yet

- O.M Scott and Sons Case SummaryDocument2 pagesO.M Scott and Sons Case SummarySUSHMITA SHUBHAMNo ratings yet

- STADIO Editable Lesson Plan Template - TEMS701-SS1 2024Document7 pagesSTADIO Editable Lesson Plan Template - TEMS701-SS1 2024tumelomohale98No ratings yet

- Rashtriya Sanskrit Vidyapeetha Fixed Deposits - GPF A/cDocument1 pageRashtriya Sanskrit Vidyapeetha Fixed Deposits - GPF A/cusraoscribdNo ratings yet

- Derivatives - Futures and ForwardsDocument56 pagesDerivatives - Futures and ForwardsSriram VasudevanNo ratings yet

- Word Problems On Commission, Discount, InterestDocument1 pageWord Problems On Commission, Discount, InterestMarivic Echaveria Depala100% (1)

- Assessment Test 2 Joint ArrangementsDocument8 pagesAssessment Test 2 Joint ArrangementsJas TanNo ratings yet

- Domondon Acctg 3 Prelim ExamDocument3 pagesDomondon Acctg 3 Prelim ExamPrince Anton DomondonNo ratings yet

- Us Postal CardsDocument6 pagesUs Postal Cardsapi-242424864No ratings yet

- Consumer CirDocument41 pagesConsumer CirLAXMIPUTRA JAMADARNo ratings yet

- SodapdfDocument22 pagesSodapdfYossantos SoloNo ratings yet

- 10 Ways To Deal With Car Salesmen Successfully... !!!Document4 pages10 Ways To Deal With Car Salesmen Successfully... !!!a rahNo ratings yet

- Accounting Principles: Statement of Cash FlowsDocument74 pagesAccounting Principles: Statement of Cash FlowsThế VinhNo ratings yet