Professional Documents

Culture Documents

EUR Liste

EUR Liste

Uploaded by

BuchotCopyright:

Available Formats

You might also like

- Apporva Chandra Comm Report (ACC)Document23 pagesApporva Chandra Comm Report (ACC)ThangarajNo ratings yet

- THINK L4 Unit 6 Grammar BasicDocument2 pagesTHINK L4 Unit 6 Grammar Basicniyazi polatNo ratings yet

- Quotation: Quotation Number: Revision NoDocument3 pagesQuotation: Quotation Number: Revision NoGaurav SharmaNo ratings yet

- OPIS Global Carbon Offsets Report Sample IssueDocument27 pagesOPIS Global Carbon Offsets Report Sample IssuefcbarreiraaNo ratings yet

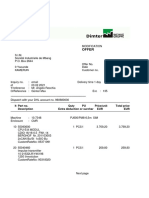

- Offer: It Part No. Quty PU Price/unit Total Price Description Extra Deduction or Surchar EUR EURDocument3 pagesOffer: It Part No. Quty PU Price/unit Total Price Description Extra Deduction or Surchar EUR EURMichelNo ratings yet

- Quote 25223436: Our Bank DetailsDocument6 pagesQuote 25223436: Our Bank DetailsAhmed RedžićNo ratings yet

- VontDocument128 pagesVontch tcNo ratings yet

- Valuation Report - by Country of Origin / Commodity: HS Code: 85044090 Other Static ConvertersDocument76 pagesValuation Report - by Country of Origin / Commodity: HS Code: 85044090 Other Static ConvertersTowfique AhmedNo ratings yet

- IAG - MC 2.1940 - 0.2240 - 9.26 International Consolidated Airlines Group, S.A. - Yahoo FinanceDocument1 pageIAG - MC 2.1940 - 0.2240 - 9.26 International Consolidated Airlines Group, S.A. - Yahoo FinanceJuanLuisNo ratings yet

- Car Rental Rate List: IndexDocument7 pagesCar Rental Rate List: IndexfeltifaydaNo ratings yet

- A 1170022 Professional PDFDocument2 pagesA 1170022 Professional PDFEraldMemaciNo ratings yet

- A 1170022 Professional PDFDocument2 pagesA 1170022 Professional PDFEraldMemaciNo ratings yet

- FY24 Ryanair PresentationDocument22 pagesFY24 Ryanair Presentationarunvel007No ratings yet

- AxaptaReport GDBDL62Document3 pagesAxaptaReport GDBDL62Sevim ErdincNo ratings yet

- General LedgerDocument12 pagesGeneral Ledgerahmed mawedNo ratings yet

- Pre Owned Cars For Sale 03242023Document6 pagesPre Owned Cars For Sale 03242023Jamali NagamoraNo ratings yet

- PHP 38 IZ1 NDocument5 pagesPHP 38 IZ1 Nfred607No ratings yet

- Tata Magic Final)Document1 pageTata Magic Final)ankitNo ratings yet

- 22-D0244 QuotationDocument2 pages22-D0244 QuotationpernetiNo ratings yet

- Mitsubishi GreasingDocument13 pagesMitsubishi GreasingmmNo ratings yet

- Galileo Quick Reference Tins ReportDocument27 pagesGalileo Quick Reference Tins ReportMomin QadirNo ratings yet

- Danieli Engineering & Services GMBH: by Means ofDocument4 pagesDanieli Engineering & Services GMBH: by Means ofneid smajicNo ratings yet

- Daite PLC Fu Sep 15,2021Document20 pagesDaite PLC Fu Sep 15,2021Melak YizengawNo ratings yet

- Quto-DT - Shova Rani GhoshDocument1 pageQuto-DT - Shova Rani Ghoshsrahman.bddocNo ratings yet

- 0 Logica Price List 2017 Costrut - 7 - IngDocument22 pages0 Logica Price List 2017 Costrut - 7 - IngoxooxooxoNo ratings yet

- PHPJ 774 e YDocument5 pagesPHPJ 774 e Yfred607No ratings yet

- PHP ASYP25Document6 pagesPHP ASYP25fred607No ratings yet

- Bill 1Document2 pagesBill 1Jubaraj DebnathNo ratings yet

- Investment Accounts-Master Mind Answers PDFDocument7 pagesInvestment Accounts-Master Mind Answers PDFRam IyerNo ratings yet

- Cox Communications XLS372 XLS ENGDocument13 pagesCox Communications XLS372 XLS ENGPriyank BoobNo ratings yet

- MBB 19810 Julossfru Ac Ex37802 PDFDocument18 pagesMBB 19810 Julossfru Ac Ex37802 PDFAnonymous IAMwm2sgNo ratings yet

- List+No 347+update+Available+BGs, MTNS, CDs+&+BONDsDocument15 pagesList+No 347+update+Available+BGs, MTNS, CDs+&+BONDsJuan Pablo ArangoNo ratings yet

- PHP WKy VgeDocument5 pagesPHP WKy Vgefred607No ratings yet

- Latest Date For Receipt of Comments: 18 January 2023: Form 36Document9 pagesLatest Date For Receipt of Comments: 18 January 2023: Form 36J MrNo ratings yet

- PHP AAj PVXDocument5 pagesPHP AAj PVXfred607No ratings yet

- Marc MarcDocument12 pagesMarc MarcISABEL PARRONo ratings yet

- Pre Owned Cars For Sale - 02022023Document4 pagesPre Owned Cars For Sale - 02022023Shaina MabborangNo ratings yet

- PHP H8 TV OTDocument5 pagesPHP H8 TV OTfred607No ratings yet

- 1330SE 0407SE PM Rev C Sep 2021Document217 pages1330SE 0407SE PM Rev C Sep 2021mehmetNo ratings yet

- HeatExchanger 2Document1 pageHeatExchanger 2KAMAL HAASANNo ratings yet

- GTJZ0608&0808 Parts ManualDocument178 pagesGTJZ0608&0808 Parts ManualHải Đăng PhanNo ratings yet

- 0 Logica Price List 2017 Costrut - 7 - Ing V201802 (Terminal's Conflicted Copy 2019-10-02)Document24 pages0 Logica Price List 2017 Costrut - 7 - Ing V201802 (Terminal's Conflicted Copy 2019-10-02)oxooxooxoNo ratings yet

- AFR 0321 KBOS/LFPG 29.AUG.2022/0035Z: Dispatcher CommentsDocument21 pagesAFR 0321 KBOS/LFPG 29.AUG.2022/0035Z: Dispatcher CommentsBenoit VoisinNo ratings yet

- Lokko SEN - ETH - AUS 190092 - 23Document36 pagesLokko SEN - ETH - AUS 190092 - 23Ndeye MaremeNo ratings yet

- Intermodal 2019101602Document3 pagesIntermodal 2019101602simo maacheNo ratings yet

- Pre Owned Cars For Sale - 10252022Document6 pagesPre Owned Cars For Sale - 10252022George PamaNo ratings yet

- Contrato Compra-Venta 4.4Document4 pagesContrato Compra-Venta 4.4EMMELI ESTEPHANYA HERNANDEZ SANCHEZNo ratings yet

- Vehicles As of February 17Document24 pagesVehicles As of February 17Angel RoaringNo ratings yet

- Data ScriptDocument5 pagesData ScriptNydia Evelina HermawanNo ratings yet

- Renewal of Third Party Insurance Premium To 2 DeptDocument3 pagesRenewal of Third Party Insurance Premium To 2 DeptDeepak SNo ratings yet

- Bill 071153222Document1 pageBill 071153222parantapkayalNo ratings yet

- UHBVN Executive Summary FY 2010-11Document46 pagesUHBVN Executive Summary FY 2010-11Neeraj KumarNo ratings yet

- III WK March 2010 3/15/2010Document2 pagesIII WK March 2010 3/15/2010Ajith Chand BhandaariNo ratings yet

- CM 899 20231002 01243899Document2 pagesCM 899 20231002 01243899vineetdoshi7No ratings yet

- Pt. Kayu Lapis Indonesia Receive Order Form Tanda Terima Barang (TTB)Document1 pagePt. Kayu Lapis Indonesia Receive Order Form Tanda Terima Barang (TTB)Hari SetiawanNo ratings yet

- Amount Netto No Article Description Qty Return Qty Net Retur Amount Amount Qty Article Code Article GroupDocument1 pageAmount Netto No Article Description Qty Return Qty Net Retur Amount Amount Qty Article Code Article GroupAndriawan RINo ratings yet

- Chad-Cameroon Case AnalysisDocument15 pagesChad-Cameroon Case AnalysisPooja TyagiNo ratings yet

- Copia de Reporte - Vencimiento2022 - Prop (1) ATICODocument49 pagesCopia de Reporte - Vencimiento2022 - Prop (1) ATICOjesus angel quispe agramonteNo ratings yet

- PHPTVM Ms 6Document5 pagesPHPTVM Ms 6fred607No ratings yet

- DatasheetDocument2 pagesDatasheetGibson MichaelNo ratings yet

- EU China Energy Magazine 2022 Christmas Double Issue: 2022, #11From EverandEU China Energy Magazine 2022 Christmas Double Issue: 2022, #11No ratings yet

- 7 Eleven MalaysiaDocument10 pages7 Eleven MalaysiaKimchhorng HokNo ratings yet

- Joaquin E. David v. Court of Appeals and People of The Philippines, G.R. Nos. 111168-69. June 17, 1998Document1 pageJoaquin E. David v. Court of Appeals and People of The Philippines, G.R. Nos. 111168-69. June 17, 1998Lemrose DuenasNo ratings yet

- Passive Form (1) This Test Comes From - The Site To Learn English (Test N°5733)Document2 pagesPassive Form (1) This Test Comes From - The Site To Learn English (Test N°5733)Maria Rajendran MNo ratings yet

- Real Exam 22.03.2024 (With Answers) - UpdatedDocument12 pagesReal Exam 22.03.2024 (With Answers) - Updatedtd090404No ratings yet

- Trades About To Happen - David Weiss - Notes FromDocument3 pagesTrades About To Happen - David Weiss - Notes FromUma Maheshwaran100% (1)

- Infosys Verification FormDocument6 pagesInfosys Verification Formamanueljoseph1310No ratings yet

- Andheri WestDocument60 pagesAndheri WestNikunj VaghasiyaNo ratings yet

- Getting The Call From Stockholm: My Karolinska Institutet ExperienceDocument31 pagesGetting The Call From Stockholm: My Karolinska Institutet ExperienceucsfmededNo ratings yet

- Perfecto Floresca Vs Philex Mining CorporationDocument11 pagesPerfecto Floresca Vs Philex Mining CorporationDelsie FalculanNo ratings yet

- Philips+22PFL3403-10+Chassis+TPS1 4E+LA+LCD PDFDocument53 pagesPhilips+22PFL3403-10+Chassis+TPS1 4E+LA+LCD PDFparutzu0% (1)

- Indonesian - 1 - 1 - Audiobook - KopyaDocument93 pagesIndonesian - 1 - 1 - Audiobook - KopyaBurcu BurcuNo ratings yet

- Masonic SymbolismDocument19 pagesMasonic SymbolismOscar Cortez100% (7)

- Physiology of LactationDocument29 pagesPhysiology of Lactationcorzpun16867879% (14)

- Tbaqarah Tafseer Lesson 3 OnDocument221 pagesTbaqarah Tafseer Lesson 3 OnArjumand AdilNo ratings yet

- Bangalore Startups CompaniesDocument14 pagesBangalore Startups CompaniesAparna GanesenNo ratings yet

- Broadwater Farm Estate - The Active CommunityDocument5 pagesBroadwater Farm Estate - The Active CommunitycvaggasNo ratings yet

- Pre-Feasibility of Tunnel Farming in BahawalpurDocument10 pagesPre-Feasibility of Tunnel Farming in Bahawalpurshahidameen2100% (1)

- LEGAL REASONING SKILLS ProjectDocument19 pagesLEGAL REASONING SKILLS ProjectShreya Ghosh DastidarNo ratings yet

- Chapter 4 - Group 3 - Behavioral Processes in Marketing ChannelsDocument26 pagesChapter 4 - Group 3 - Behavioral Processes in Marketing ChannelsJanine Mariel LedesmaNo ratings yet

- 1999 Aversion Therapy-BEDocument6 pages1999 Aversion Therapy-BEprabhaNo ratings yet

- Preliminary PagesDocument9 pagesPreliminary PagesdorothyNo ratings yet

- Caltex V CA & Security Bank and Trust CompanyDocument2 pagesCaltex V CA & Security Bank and Trust CompanyMaureen CoNo ratings yet

- The Titans Curse - Robert VendittiDocument134 pagesThe Titans Curse - Robert VendittimarianaqueirosluzNo ratings yet

- 107 Hand Tool Field Maintenance v0311Document8 pages107 Hand Tool Field Maintenance v0311rabbit_39No ratings yet

- Barker CH Naish D - Where On Earth Dinosaurs and Other Prehistoric Life The Amazing History of Earth 39 S Most Incredible ADocument162 pagesBarker CH Naish D - Where On Earth Dinosaurs and Other Prehistoric Life The Amazing History of Earth 39 S Most Incredible ARumen Deshkov100% (3)

- BMR 2105 PDFDocument6 pagesBMR 2105 PDFSitoraKodirovaNo ratings yet

- Ruq Abdominal PainDocument55 pagesRuq Abdominal PainriphqaNo ratings yet

- Architecture in EthDocument4 pagesArchitecture in Ethmelakumikias2No ratings yet

EUR Liste

EUR Liste

Uploaded by

BuchotOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EUR Liste

EUR Liste

Uploaded by

BuchotCopyright:

Available Formats

EUR liste

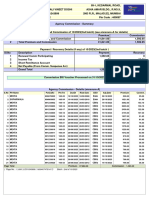

Bond list (Sorted by Workout Date)

EUR

Isin Ccy Cpn Issuer Maturity Amnt Out. Ask Yield D/Swap Durat. Pieces ESG Rating Cty / Sector Miscellaneous

0 to 1 year

DE000A2YN6V1 EUR 1.875 THYSSENKRUPP AG 06.03.2023 1B 99.47 3.82 194 0.27 1k+1k l B+ DE / Basic Mat. C 2023@100

FR0013240835 EUR 1.000 RENAULT SA * 08.03.2023 750 MM 99.80 1.70 -20 0.28 1k+1k l BB FR / Auto C 2022@100, MWC (25bp)

XS1591416679 EUR 2.625 K+S AG * 06.04.2023 396.4 MM 100.00 2.60 55 0.36 1k+1k l BB DE / Chemical C 2023@100, MWC (45bp)

IT0004917842 EUR 5.750 MEDIOBANCA DI CRED FIN 18.04.2023 496.6 MM 101.50 1.86 -27 0.39 1k+1k l BB+ IT / Banks W/Tax, Sub

XS0943370543 EUR 6.250 ORSTED A/S ** 26.06.3013 350.0 MM 101.26 3.94 c 153 0.57 1k+1k l BB+ DK / Utilities Junior, FTF, C 2023@100, MWC (75bp)

XS1457553367 EUR 3.750 REPUBLIC OF CYPRUS 26.07.2023 1B 101.36 1.67 -82 0.66 1k+1k l BB+ CY / Government

1 to 3 years

DE000A2TEDB8 EUR 2.875 THYSSENKRUPP AG 22.02.2024 1.5 B 98.25 4.34 153 1.16 1k+1k l B+ DE / Basic Mat. C 2023@100

DE000A2YB7A7 EUR 1.875 SCHAEFFLER AG 26.03.2024 800 MM 98.38 3.14 32 1.26 1k+1k l BB+ DE / Auto C 2023@100

GR0114031561 EUR 3.450 HELLENIC REPUBLIC 02.04.2024 2.5 B 101.10 2.61 -21 1.28 1k+1k l BB- GR / Government

XS1637276848 EUR 2.750 REPUBLIC OF CYPRUS 27.06.2024 850 MM 100.53 2.40 -44 1.52 1k+1k l BB+ CY / Government

XS2049726990 EUR 0.250 DEUTSCHE LUFTHANSA AG 06.09.2024 500 MM 95.13 3.11 25 1.71 1k+1k l BB- DE / Transport

XS1989405425 EUR 0.625 REPUBLIC OF CYPRUS 03.12.2024 1B 96.55 2.39 -48 1.94 1k+1k l BB+ CY / Government

GR0118017657 EUR 3.375 HELLENIC REPUBLIC 15.02.2025 3B 100.95 2.92 7 2.07 1k+1k l BB- GR / Government

DE000DB7XJJ2 EUR 2.750 DEUTSCHE BANK AG ** 17.02.2025 1.25 B 98.76 3.33 48 2.07 1k+1k l BB+ DE / Banks Sub

XS0213101073 EUR 5.500 PETROLEOS MEXICANOS ** 24.02.2025 1B 101.00 5.01 215 1.99 10k+1k l B+ MX / Energy

DE000A14J587 EUR 2.500 THYSSENKRUPP AG 25.02.2025 600 MM 95.25 4.77 191 2.07 1k+1k l B+ DE / Basic Mat.

XS0215093534 EUR 4.875 LEONARDO SPA 24.03.2025 500 MM 103.10 3.46 61 2.11 50k+1k l BB+ IT / Industrial W/Tax

IT0005127508 EUR 3.086 MEDIOBANCA DI CRED FIN 10.09.2025 374.1 MM 99.95 4.14 132 0.05 1k+1k l BB+ IT / Banks W/Tax, Sub, FRN, (3mo EURIBOR+225 bp)

Yields are annualized. -1-

www.bridport.ch See last page for abbreviations, explanations and disclaimer. 25.11.2022 14:45

Isin Ccy Cpn Issuer Maturity Amnt Out. Ask Yield D/Swap Durat. Pieces ESG Rating Cty / Sector Miscellaneous

XS1314321941 EUR 4.250 REPUBLIC OF CYPRUS 04.11.2025 1B 104.32 2.69 -6 2.72 1k+1k l BB+ CY / Government

3 to 5 years

FR0013299435 EUR 1.000 RENAULT SA * 28.11.2025 750 MM 92.75 3.59 79 2.83 1k+1k l BB FR / Auto C 2025@100, MWC (20bp)

XS2297209293 EUR 0.000 REPUBLIC OF CYPRUS 09.02.2026 1B 90.25 3.25 46 3.10 1k+1k l BB+ CY / Government

DE000CZ40LD5 EUR 4.000 COMMERZBANK AG 23.03.2026 1B 98.06 4.64 186 2.95 1k+1k l BB+ DE / Banks Sub

Yields are annualized. -2-

www.bridport.ch See last page for abbreviations, explanations and disclaimer. 25.11.2022 14:45

EUR liste

Abbreviations, explanations and disclaimer

Abbreviations Taxes and Restrictions

Price Options Coupon Frequency Amount GU: Gross Up - All bonds are subject to EU tax for European residents (35%),

a: Adjusted price S-A: Semi-annual k: Thousand unless written ‘GU’ (Gross-Up)

d: Dirty price Qtrly: Quarterly MM: Million W/Tax: Subject to a Withholding Tax

u: Unit traded Mthly: Monthly B: Billion RegS: A bond issued for non-US investors only

144A: A placement designed for US investors only

Call and Put Features

c: The yield is calculated on the next call date CoCos: Contingent convertibles - Please, note that this class of asset is subject to

p: The yield is calculated on the next put date sales restrictions to retail investors in some jurisdictions (UK for instance)

w: The yield is calculated on a call/put date, but not the next one

Called: The call option has been exercised

Our own indicators

The Value Rank ascertains if the D/Swap of the bond is amongst the cheapest or the most expensive of

Coupon Types

comparable bonds in terms of both rating and life to workout date.

FRN: Floating Rate Note - The coupon is reset every quarter

FTF: Fix-To-Float or Float-To-Fix - A specific case of variable coupon

Every week, we check the liquidity of each bond in our database. Our proprietary Liquidity Rank helps

ILB: Inflation Linked Bond - The coupon is linked to a inflation indicator

identifying bonds that match client’s liquidity needs.

PIK: Pay in Kind - The coupon is paid with debt or stock instead of cash

VAR: Variable Coupon - The coupon changes during the life of the bond

Our Credit Review Model classifies issuers according to their debt sustainability.

Various Each company's ratio is compared to its sector and to its rating median ratios.

** This bond is part of our bond picking / investment case selection

* This issuer is part of our bond picking / investment case selection The ESG consensus is an assessment methodology offering easy comparison of any portfolio or fund. It

Cpn: Currency of coupon - used for dual currencies bonds guaranties a consistent approach and avoids any methodological bias. It is based on amulti scan of several

independent complementary and recognized ESG sources. It covers a universe of more than 5’000 companies

Dom.: Domestic bonds - Bonds issued on a domestic market

and over 200 countries. ESG report shows also implication in Sensitive Sectors, Major Controversies and

Into...: Convertible into .... Climate Impact. ESG Data is provided by Conser (www.conser.ch). More details on the methodology can be

LT2: Lower Tier 2 - A specific rank of subordinated debt discussed with your usual sales contact.

LTM or LTW: Life to Maturity or Life to Workout

MWC: Make Whole Call - A specific type of call provision

Disclaimer

Rdp: Currency of redemption - used for dual currencies bonds This document has been issued by bridport & cie sa. It has been prepared solely for informational purposes and

Rdpt: Price of redemption - indicated when it is different than 100% should not be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any security or

Sub: Subordinated - In case of default, the debt is reimbursed after the senior debts instrument or to participate in any transaction or trading activity. The contents are based on sources believed to

be reliable, accurate and complete. No representations or guarantees are hereby made as regards the accuracy

UT2: Upper Tier 2 - A specific rank of subordinated debt or completeness of the information contained herein and such information does not replace the advice or

recommendations of a qualified professional, which prospective investors (whether individual or institutional) are

ESG

strongly encouraged to seek. No responsibility whatsoever is hereby accepted for any damage arising out of or in

l Above average with a strong consensus of positive opinions connection with the use of the information contained in this document, whether direct or indirect and whether

arising in contract, tort or otherwise. For the avoidance of doubt, this document is neither an offer, a contractual

l Above average with a medium to weak consensus of opinions

document or any form of recommendation. Any information (including prices, availability and expressions) in this

l Below average with a medium to weak consensus of opinions document is purely indicative and is subject to change without notice. This document may not be copied,

l Below average with a strong consensus of negative opinions distributed, reproduced or transmitted for any purpose without bridport & cie sa’s prior consent in writing.

bridport & cie sa

bridport & co ltd

Geneva

Jersey

+41 (22) 817 70 00

+44 (1534) 887 448

-3-

bridport & co ag Zurich +41 (44) 567 37 00 25.11.2022 14:45

You might also like

- Apporva Chandra Comm Report (ACC)Document23 pagesApporva Chandra Comm Report (ACC)ThangarajNo ratings yet

- THINK L4 Unit 6 Grammar BasicDocument2 pagesTHINK L4 Unit 6 Grammar Basicniyazi polatNo ratings yet

- Quotation: Quotation Number: Revision NoDocument3 pagesQuotation: Quotation Number: Revision NoGaurav SharmaNo ratings yet

- OPIS Global Carbon Offsets Report Sample IssueDocument27 pagesOPIS Global Carbon Offsets Report Sample IssuefcbarreiraaNo ratings yet

- Offer: It Part No. Quty PU Price/unit Total Price Description Extra Deduction or Surchar EUR EURDocument3 pagesOffer: It Part No. Quty PU Price/unit Total Price Description Extra Deduction or Surchar EUR EURMichelNo ratings yet

- Quote 25223436: Our Bank DetailsDocument6 pagesQuote 25223436: Our Bank DetailsAhmed RedžićNo ratings yet

- VontDocument128 pagesVontch tcNo ratings yet

- Valuation Report - by Country of Origin / Commodity: HS Code: 85044090 Other Static ConvertersDocument76 pagesValuation Report - by Country of Origin / Commodity: HS Code: 85044090 Other Static ConvertersTowfique AhmedNo ratings yet

- IAG - MC 2.1940 - 0.2240 - 9.26 International Consolidated Airlines Group, S.A. - Yahoo FinanceDocument1 pageIAG - MC 2.1940 - 0.2240 - 9.26 International Consolidated Airlines Group, S.A. - Yahoo FinanceJuanLuisNo ratings yet

- Car Rental Rate List: IndexDocument7 pagesCar Rental Rate List: IndexfeltifaydaNo ratings yet

- A 1170022 Professional PDFDocument2 pagesA 1170022 Professional PDFEraldMemaciNo ratings yet

- A 1170022 Professional PDFDocument2 pagesA 1170022 Professional PDFEraldMemaciNo ratings yet

- FY24 Ryanair PresentationDocument22 pagesFY24 Ryanair Presentationarunvel007No ratings yet

- AxaptaReport GDBDL62Document3 pagesAxaptaReport GDBDL62Sevim ErdincNo ratings yet

- General LedgerDocument12 pagesGeneral Ledgerahmed mawedNo ratings yet

- Pre Owned Cars For Sale 03242023Document6 pagesPre Owned Cars For Sale 03242023Jamali NagamoraNo ratings yet

- PHP 38 IZ1 NDocument5 pagesPHP 38 IZ1 Nfred607No ratings yet

- Tata Magic Final)Document1 pageTata Magic Final)ankitNo ratings yet

- 22-D0244 QuotationDocument2 pages22-D0244 QuotationpernetiNo ratings yet

- Mitsubishi GreasingDocument13 pagesMitsubishi GreasingmmNo ratings yet

- Galileo Quick Reference Tins ReportDocument27 pagesGalileo Quick Reference Tins ReportMomin QadirNo ratings yet

- Danieli Engineering & Services GMBH: by Means ofDocument4 pagesDanieli Engineering & Services GMBH: by Means ofneid smajicNo ratings yet

- Daite PLC Fu Sep 15,2021Document20 pagesDaite PLC Fu Sep 15,2021Melak YizengawNo ratings yet

- Quto-DT - Shova Rani GhoshDocument1 pageQuto-DT - Shova Rani Ghoshsrahman.bddocNo ratings yet

- 0 Logica Price List 2017 Costrut - 7 - IngDocument22 pages0 Logica Price List 2017 Costrut - 7 - IngoxooxooxoNo ratings yet

- PHPJ 774 e YDocument5 pagesPHPJ 774 e Yfred607No ratings yet

- PHP ASYP25Document6 pagesPHP ASYP25fred607No ratings yet

- Bill 1Document2 pagesBill 1Jubaraj DebnathNo ratings yet

- Investment Accounts-Master Mind Answers PDFDocument7 pagesInvestment Accounts-Master Mind Answers PDFRam IyerNo ratings yet

- Cox Communications XLS372 XLS ENGDocument13 pagesCox Communications XLS372 XLS ENGPriyank BoobNo ratings yet

- MBB 19810 Julossfru Ac Ex37802 PDFDocument18 pagesMBB 19810 Julossfru Ac Ex37802 PDFAnonymous IAMwm2sgNo ratings yet

- List+No 347+update+Available+BGs, MTNS, CDs+&+BONDsDocument15 pagesList+No 347+update+Available+BGs, MTNS, CDs+&+BONDsJuan Pablo ArangoNo ratings yet

- PHP WKy VgeDocument5 pagesPHP WKy Vgefred607No ratings yet

- Latest Date For Receipt of Comments: 18 January 2023: Form 36Document9 pagesLatest Date For Receipt of Comments: 18 January 2023: Form 36J MrNo ratings yet

- PHP AAj PVXDocument5 pagesPHP AAj PVXfred607No ratings yet

- Marc MarcDocument12 pagesMarc MarcISABEL PARRONo ratings yet

- Pre Owned Cars For Sale - 02022023Document4 pagesPre Owned Cars For Sale - 02022023Shaina MabborangNo ratings yet

- PHP H8 TV OTDocument5 pagesPHP H8 TV OTfred607No ratings yet

- 1330SE 0407SE PM Rev C Sep 2021Document217 pages1330SE 0407SE PM Rev C Sep 2021mehmetNo ratings yet

- HeatExchanger 2Document1 pageHeatExchanger 2KAMAL HAASANNo ratings yet

- GTJZ0608&0808 Parts ManualDocument178 pagesGTJZ0608&0808 Parts ManualHải Đăng PhanNo ratings yet

- 0 Logica Price List 2017 Costrut - 7 - Ing V201802 (Terminal's Conflicted Copy 2019-10-02)Document24 pages0 Logica Price List 2017 Costrut - 7 - Ing V201802 (Terminal's Conflicted Copy 2019-10-02)oxooxooxoNo ratings yet

- AFR 0321 KBOS/LFPG 29.AUG.2022/0035Z: Dispatcher CommentsDocument21 pagesAFR 0321 KBOS/LFPG 29.AUG.2022/0035Z: Dispatcher CommentsBenoit VoisinNo ratings yet

- Lokko SEN - ETH - AUS 190092 - 23Document36 pagesLokko SEN - ETH - AUS 190092 - 23Ndeye MaremeNo ratings yet

- Intermodal 2019101602Document3 pagesIntermodal 2019101602simo maacheNo ratings yet

- Pre Owned Cars For Sale - 10252022Document6 pagesPre Owned Cars For Sale - 10252022George PamaNo ratings yet

- Contrato Compra-Venta 4.4Document4 pagesContrato Compra-Venta 4.4EMMELI ESTEPHANYA HERNANDEZ SANCHEZNo ratings yet

- Vehicles As of February 17Document24 pagesVehicles As of February 17Angel RoaringNo ratings yet

- Data ScriptDocument5 pagesData ScriptNydia Evelina HermawanNo ratings yet

- Renewal of Third Party Insurance Premium To 2 DeptDocument3 pagesRenewal of Third Party Insurance Premium To 2 DeptDeepak SNo ratings yet

- Bill 071153222Document1 pageBill 071153222parantapkayalNo ratings yet

- UHBVN Executive Summary FY 2010-11Document46 pagesUHBVN Executive Summary FY 2010-11Neeraj KumarNo ratings yet

- III WK March 2010 3/15/2010Document2 pagesIII WK March 2010 3/15/2010Ajith Chand BhandaariNo ratings yet

- CM 899 20231002 01243899Document2 pagesCM 899 20231002 01243899vineetdoshi7No ratings yet

- Pt. Kayu Lapis Indonesia Receive Order Form Tanda Terima Barang (TTB)Document1 pagePt. Kayu Lapis Indonesia Receive Order Form Tanda Terima Barang (TTB)Hari SetiawanNo ratings yet

- Amount Netto No Article Description Qty Return Qty Net Retur Amount Amount Qty Article Code Article GroupDocument1 pageAmount Netto No Article Description Qty Return Qty Net Retur Amount Amount Qty Article Code Article GroupAndriawan RINo ratings yet

- Chad-Cameroon Case AnalysisDocument15 pagesChad-Cameroon Case AnalysisPooja TyagiNo ratings yet

- Copia de Reporte - Vencimiento2022 - Prop (1) ATICODocument49 pagesCopia de Reporte - Vencimiento2022 - Prop (1) ATICOjesus angel quispe agramonteNo ratings yet

- PHPTVM Ms 6Document5 pagesPHPTVM Ms 6fred607No ratings yet

- DatasheetDocument2 pagesDatasheetGibson MichaelNo ratings yet

- EU China Energy Magazine 2022 Christmas Double Issue: 2022, #11From EverandEU China Energy Magazine 2022 Christmas Double Issue: 2022, #11No ratings yet

- 7 Eleven MalaysiaDocument10 pages7 Eleven MalaysiaKimchhorng HokNo ratings yet

- Joaquin E. David v. Court of Appeals and People of The Philippines, G.R. Nos. 111168-69. June 17, 1998Document1 pageJoaquin E. David v. Court of Appeals and People of The Philippines, G.R. Nos. 111168-69. June 17, 1998Lemrose DuenasNo ratings yet

- Passive Form (1) This Test Comes From - The Site To Learn English (Test N°5733)Document2 pagesPassive Form (1) This Test Comes From - The Site To Learn English (Test N°5733)Maria Rajendran MNo ratings yet

- Real Exam 22.03.2024 (With Answers) - UpdatedDocument12 pagesReal Exam 22.03.2024 (With Answers) - Updatedtd090404No ratings yet

- Trades About To Happen - David Weiss - Notes FromDocument3 pagesTrades About To Happen - David Weiss - Notes FromUma Maheshwaran100% (1)

- Infosys Verification FormDocument6 pagesInfosys Verification Formamanueljoseph1310No ratings yet

- Andheri WestDocument60 pagesAndheri WestNikunj VaghasiyaNo ratings yet

- Getting The Call From Stockholm: My Karolinska Institutet ExperienceDocument31 pagesGetting The Call From Stockholm: My Karolinska Institutet ExperienceucsfmededNo ratings yet

- Perfecto Floresca Vs Philex Mining CorporationDocument11 pagesPerfecto Floresca Vs Philex Mining CorporationDelsie FalculanNo ratings yet

- Philips+22PFL3403-10+Chassis+TPS1 4E+LA+LCD PDFDocument53 pagesPhilips+22PFL3403-10+Chassis+TPS1 4E+LA+LCD PDFparutzu0% (1)

- Indonesian - 1 - 1 - Audiobook - KopyaDocument93 pagesIndonesian - 1 - 1 - Audiobook - KopyaBurcu BurcuNo ratings yet

- Masonic SymbolismDocument19 pagesMasonic SymbolismOscar Cortez100% (7)

- Physiology of LactationDocument29 pagesPhysiology of Lactationcorzpun16867879% (14)

- Tbaqarah Tafseer Lesson 3 OnDocument221 pagesTbaqarah Tafseer Lesson 3 OnArjumand AdilNo ratings yet

- Bangalore Startups CompaniesDocument14 pagesBangalore Startups CompaniesAparna GanesenNo ratings yet

- Broadwater Farm Estate - The Active CommunityDocument5 pagesBroadwater Farm Estate - The Active CommunitycvaggasNo ratings yet

- Pre-Feasibility of Tunnel Farming in BahawalpurDocument10 pagesPre-Feasibility of Tunnel Farming in Bahawalpurshahidameen2100% (1)

- LEGAL REASONING SKILLS ProjectDocument19 pagesLEGAL REASONING SKILLS ProjectShreya Ghosh DastidarNo ratings yet

- Chapter 4 - Group 3 - Behavioral Processes in Marketing ChannelsDocument26 pagesChapter 4 - Group 3 - Behavioral Processes in Marketing ChannelsJanine Mariel LedesmaNo ratings yet

- 1999 Aversion Therapy-BEDocument6 pages1999 Aversion Therapy-BEprabhaNo ratings yet

- Preliminary PagesDocument9 pagesPreliminary PagesdorothyNo ratings yet

- Caltex V CA & Security Bank and Trust CompanyDocument2 pagesCaltex V CA & Security Bank and Trust CompanyMaureen CoNo ratings yet

- The Titans Curse - Robert VendittiDocument134 pagesThe Titans Curse - Robert VendittimarianaqueirosluzNo ratings yet

- 107 Hand Tool Field Maintenance v0311Document8 pages107 Hand Tool Field Maintenance v0311rabbit_39No ratings yet

- Barker CH Naish D - Where On Earth Dinosaurs and Other Prehistoric Life The Amazing History of Earth 39 S Most Incredible ADocument162 pagesBarker CH Naish D - Where On Earth Dinosaurs and Other Prehistoric Life The Amazing History of Earth 39 S Most Incredible ARumen Deshkov100% (3)

- BMR 2105 PDFDocument6 pagesBMR 2105 PDFSitoraKodirovaNo ratings yet

- Ruq Abdominal PainDocument55 pagesRuq Abdominal PainriphqaNo ratings yet

- Architecture in EthDocument4 pagesArchitecture in Ethmelakumikias2No ratings yet