Professional Documents

Culture Documents

Aayush Jain

Aayush Jain

Uploaded by

dingle2Copyright:

Available Formats

You might also like

- The Rights and Privileges of Teachers in The PhilippinesDocument2 pagesThe Rights and Privileges of Teachers in The PhilippinesStephanie Catcho90% (41)

- Speaking Midterm Questions Market Leader Intermediate 3rdDocument16 pagesSpeaking Midterm Questions Market Leader Intermediate 3rdOanh Nguyễn100% (1)

- Employees Pre-Confirmation & Increment FormDocument3 pagesEmployees Pre-Confirmation & Increment FormSayed Aasim Jawaid100% (2)

- Form No. 16: Part ADocument8 pagesForm No. 16: Part ANidhish AgrawalNo ratings yet

- Assignment 4 FopDocument5 pagesAssignment 4 FopAyesha Binte SafiullahNo ratings yet

- Guidelines Relating To 20% Devt FundDocument8 pagesGuidelines Relating To 20% Devt FundAehruj Blet100% (2)

- 1 - Form16 - 218 - FY 2021-22Document9 pages1 - Form16 - 218 - FY 2021-22Sasi NimmakayalaNo ratings yet

- 0.00 Verification: TotalDocument4 pages0.00 Verification: TotalKesava KesNo ratings yet

- Form 16 - 2020-21 - Part A and B - FY 2020 - 2021 3Document10 pagesForm 16 - 2020-21 - Part A and B - FY 2020 - 2021 3kamalkarki03No ratings yet

- Form 16: TLG India Private LimitedDocument9 pagesForm 16: TLG India Private LimitedcagopalofficebackupNo ratings yet

- Form 16: Here Solutions India Private LimitedDocument10 pagesForm 16: Here Solutions India Private LimitedIt's your ChannelNo ratings yet

- Anspg5953f 2018-19Document3 pagesAnspg5953f 2018-19virajv1No ratings yet

- Tushar - Jagtap@amdocs - Com f16Document10 pagesTushar - Jagtap@amdocs - Com f16pvd6d52kd2No ratings yet

- From16 A PDFDocument2 pagesFrom16 A PDFAadarshNo ratings yet

- Form16 Mar 2023Document9 pagesForm16 Mar 2023PRAJAKTA GAJBHIYENo ratings yet

- FS46265257 PDFDocument9 pagesFS46265257 PDFPankaj KumarNo ratings yet

- Form 16: SLN Facility Management Private LimitedDocument10 pagesForm 16: SLN Facility Management Private LimitedChetan NarasannavarNo ratings yet

- Documents - 5e3566f922a8cf6780001bbb - SCFTPL060 AJVPM4973C21 09 2020 16 28 55Document2 pagesDocuments - 5e3566f922a8cf6780001bbb - SCFTPL060 AJVPM4973C21 09 2020 16 28 55Nikhil MenonNo ratings yet

- Form 16: Warora Kurnool Transmission LimitedDocument10 pagesForm 16: Warora Kurnool Transmission LimitedBHASKAR pNo ratings yet

- Abdfa2602a Q2 2019-20 PDFDocument2 pagesAbdfa2602a Q2 2019-20 PDFTarun AgarwalNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedArun MohantyNo ratings yet

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- Form 16 2023-24Document9 pagesForm 16 2023-24Santosh PradhanNo ratings yet

- Annual Aso14211form16Document8 pagesAnnual Aso14211form16SOUMITRA CHATTERJEENo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part AFarhan23inamdaRNo ratings yet

- EyspsDocument2 pagesEyspsrasoolvaliskNo ratings yet

- Form 16-2021-2022 - UnlockedDocument9 pagesForm 16-2021-2022 - Unlockedvhacky123No ratings yet

- Form 16Document9 pagesForm 16Ponns KarnanNo ratings yet

- Abfpw1788f 2017-18 PDFDocument2 pagesAbfpw1788f 2017-18 PDFNikhil121314No ratings yet

- N/A AMRS16666G CGAPS6779N: Certificate Under Section 203 of The Income Tax-Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesN/A AMRS16666G CGAPS6779N: Certificate Under Section 203 of The Income Tax-Act, 1961 For Tax Deducted at Source On SalaryZUHAIB ASHFAQNo ratings yet

- Agcpa9205b 2019-20Document2 pagesAgcpa9205b 2019-20HRNo ratings yet

- BOHPxxxx5E Q3 2019-20Document2 pagesBOHPxxxx5E Q3 2019-20Tamziul IslamNo ratings yet

- Form16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Document6 pagesForm16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Mankamuthaka VemaratananaNo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part AParikshit ModiNo ratings yet

- Rrr3Document2 pagesRrr3rohitkawade2707No ratings yet

- Form No 16Document3 pagesForm No 16rsharma09170No ratings yet

- 2019 20 PDFDocument7 pages2019 20 PDFSanjeet SinghNo ratings yet

- BalajiGollapalli 3429 F16 2022-23Document10 pagesBalajiGollapalli 3429 F16 2022-23p. r ravichandraNo ratings yet

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- HTMLReportsDocument7 pagesHTMLReportsPushpraj ThakurNo ratings yet

- Annual.202111684 Form16 - Kaustubh KandharkarDocument8 pagesAnnual.202111684 Form16 - Kaustubh KandharkarKaustubh KandharkarNo ratings yet

- Form 16 FY 18-19 PART - ADocument2 pagesForm 16 FY 18-19 PART - Asai venkataNo ratings yet

- Geeta - Form 16 A 2022-23Document2 pagesGeeta - Form 16 A 2022-23Sourabh PunshiNo ratings yet

- Form16 18 19Document9 pagesForm16 18 19rushigadhave12No ratings yet

- Form 16 FY 19-20Document6 pagesForm 16 FY 19-20Anurag SharmaNo ratings yet

- Form16 PDFDocument9 pagesForm16 PDFHarish KumarNo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023HeetNo ratings yet

- Part A 4883020Document2 pagesPart A 4883020AkchikaNo ratings yet

- Form 16 1Document2 pagesForm 16 1Vijay JiíväNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- Animesh Das - Form16 FY 21-22 - FY 2021 - 2022.Document7 pagesAnimesh Das - Form16 FY 21-22 - FY 2021 - 2022.Dass AniNo ratings yet

- Polymorphism of The WorldDocument9 pagesPolymorphism of The WorldShobhit MathurNo ratings yet

- Part A 1991 PDFDocument2 pagesPart A 1991 PDFDARSHAN NAIKNo ratings yet

- TDS Certificate PDFDocument2 pagesTDS Certificate PDFSoumyabrata BhattacharyyaNo ratings yet

- Form 16-2021-2022Document12 pagesForm 16-2021-2022Kunal BansodeNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToPridex Medical Technologies LLNo ratings yet

- Form16 2021Document8 pagesForm16 2021Mahammad HachanNo ratings yet

- Form16 SignedDocument7 pagesForm16 SignedrajNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Valdez v. GSISDocument8 pagesValdez v. GSISlouis adriano baguioNo ratings yet

- Completion in Feasibility Study Final 101Document93 pagesCompletion in Feasibility Study Final 101renatoNo ratings yet

- PLDT v. NLRC and AbucayDocument8 pagesPLDT v. NLRC and AbucayPamela BalindanNo ratings yet

- Salary SlipDocument1 pageSalary Slipsaadbshaheen97No ratings yet

- Report On WFSE-UW Relations, April 2014Document275 pagesReport On WFSE-UW Relations, April 2014WFSEc28No ratings yet

- Architects Scale of Minimun FeesDocument23 pagesArchitects Scale of Minimun FeesNek ManNo ratings yet

- Drivers AgreementDocument5 pagesDrivers Agreementramesh BabuNo ratings yet

- Econ Math ProjectDocument14 pagesEcon Math ProjectAndy ChiuNo ratings yet

- Assignment 1: Csc415: Fundamental of Computer Problem SolvingDocument5 pagesAssignment 1: Csc415: Fundamental of Computer Problem SolvingshiranazariNo ratings yet

- Offer Marvel Softech India PVTDocument4 pagesOffer Marvel Softech India PVTBabypravallika VelineniNo ratings yet

- Job Analysis Description EtcDocument6 pagesJob Analysis Description EtcfabyunaaaNo ratings yet

- Employee CompensationDocument9 pagesEmployee Compensationjaydee_atc5814100% (1)

- Ma - Vidia LargoDocument27 pagesMa - Vidia Largo2022-09-103No ratings yet

- Jusmag vs. NLRCDocument7 pagesJusmag vs. NLRCdudekie14344No ratings yet

- Best Performing Cities 2021Document75 pagesBest Performing Cities 2021Adam ForgieNo ratings yet

- Summer Training Report On Yatra ComDocument87 pagesSummer Training Report On Yatra ComRaksha100% (1)

- Ampeloquio v. Jaka Distribution, Inc.Document10 pagesAmpeloquio v. Jaka Distribution, Inc.AnnieNo ratings yet

- Application: This Employer Requires A Pre-Employment Physical and Drug TestDocument7 pagesApplication: This Employer Requires A Pre-Employment Physical and Drug Testapi-30292005No ratings yet

- NEA v. COA (2002)Document6 pagesNEA v. COA (2002)Jude FanilaNo ratings yet

- Stat 9 14Document139 pagesStat 9 14MonicaFrancesSalvadorNo ratings yet

- 3 EASTERN Telecommunications PhilsDocument5 pages3 EASTERN Telecommunications PhilsmayNo ratings yet

- SQL ExercisesDocument4 pagesSQL ExercisesZephyrTRNo ratings yet

- Effects of A Good Orientation ProgramDocument16 pagesEffects of A Good Orientation ProgramMicca Mae RafaelNo ratings yet

- 3 Regular Employment ContractDocument4 pages3 Regular Employment ContractKaria SaNo ratings yet

- HR 01 PY Basic Setting ConfigurationDocument71 pagesHR 01 PY Basic Setting ConfigurationShrouk GamalNo ratings yet

Aayush Jain

Aayush Jain

Uploaded by

dingle2Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aayush Jain

Aayush Jain

Uploaded by

dingle2Copyright:

Available Formats

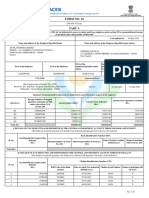

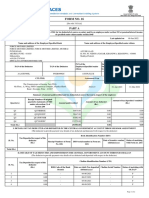

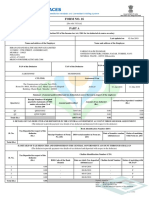

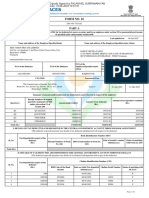

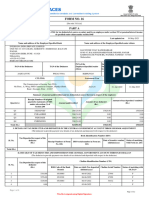

FORM NO.

16

[See Rule 31(1)(a)]

PART A

Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source on Salary

Certificate No.192/112 Last updated on: 28/06/2022

Name and address of the Employer Name and address of the Employee

HETTICH COMPETENCE SERVICES PRIVATE LIMITED AAYUSH JAIN

1201 - 1202, PLATINUM TECHNOPARK ASSOCIATE CONSULTANT - GST

PLOT NO.17&18,SECTOR- 30 1201 - 1202, PLATINUM TECHNOPARK, PLOT NO. 17 &

VASHI 18, SECTOR - 30A

NAVI MUMBAI - 400705 VASHI

MAHARASHTRA Navi Mumbai - 400705

Maharashtra

PAN of the Deductor TAN of the Deductor PAN of the Employee Employee Reference No.

provided by the

Employer (If available)

AACCH2019K MUMH12120D AGZPJ4143N

CIT (TDS) Assessment Year Period

Address: Room No. 900A, 9th Floor,,K.G.Mittal From To

Hospital Bldg,,Charni Road, 2022-23

City: Mumbai Pincode: 400002 01/04/2021 31/03/2022

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s) Receipt Numbers Amount paid/ Amount of tax Amount of tax

of original credited deducted (Rs.) deposited/

quarterly remitted (Rs.)

statements of TDS

under sub-section

(3) of section 200

1 QUNKVWTC

2 QUQVVWVE

3 QUUHCWIE

4 QUYXDZWA

Total (Rs.)

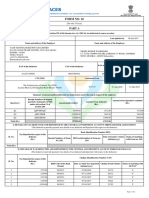

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH

BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Not Applicable

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH

CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sl.No. Tax Deposited in respect Challan Identification Number (CIN)

of the deductee (Rs.)

BSR Code of the Bank Date on which tax Challan Serial Number Status of

Branch deposited (dd/mm/yyyy) matching with

OLTAS

Total 0.00

Verification

I, PANKAJ MAHAJAN, son of SUBHASH MAHAJAN working in the capacity of DIRECTOR (designation) do hereby

certify that a sum of Rs. Nil [Rupees Zero] has been deducted at source and deposited to the credit of the Central

Government. I further certify that the information given above is true, complete and correct and is based on the

books of account, documents, TDS statements, TDS deposited and other available records.

Place NAVI MUMBAI

Date 28/06/2022 Signature of person responsible for deduction of tax

Designation DIRECTOR Full Name: PANKAJ MAHAJAN

Page 1 of 3

Digitially Signed By:MAHAJAN PANKAJ SUBHASH

Reason:I attest to the accuracy and authenticity of this

document

Location:Hettich Competence Services Private

Limited,1201-1202 Platinum Techno Park,Vashi, Navi

Mumbai – 400 705,Maharashtra, India Mobile No:- +91

Certificate No.: 192/112

Notes:

1. Government deductors to fill information in item I if tax is paid without production of an income-tax challan and in item II

if tax is paid accompanied by an income-tax challan.

2. Non-Government deductors to fill information in item II.

3. The deductor shall furnish the address of the Commissioner of Income-tax (TDS) having jurisdiction as regards TDS

statements of the assessee.

4. If an assessee is employed under one employer only during the year, certificate in Form No. 16 issued for the quarter

ending on 31st March of the financial year shall contain the details of tax deducted and deposited for all the quarters of

the financial year.

5. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of

the certificate in Form No. 16 pertaining to the period for which such assessee was employed with each of the employers.

Part B (Annexure) of the certificate in Form No.16 may be issued by each of the employers or the last employer at the

option of the assessee.

6. In items I and II, in column for tax deposited in respect of deductee, furnish total amount of TDS and education cess

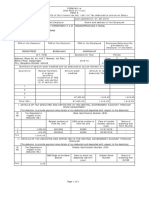

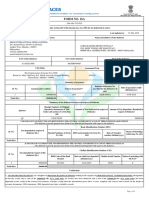

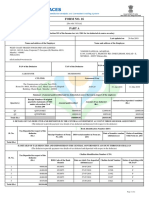

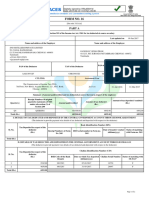

PART B (Annexure)

Details of Salary paid and any other income and tax deducted

A. Whether opting for taxation u/s 115BAC? NO

1. Gross Salary

a) Salary as per provisions contained in sec. 17(1) Rs. 5,89,833.00

b) Value of perquisites u/s 17(2) Rs.

c) Profits in lieu of salary under section 17(3) Rs.

d) Total Rs. 5,89,833.00

e) Reported total amount of salary received from other employer(s) Rs.

2. Less: Allowances to the extent exempt under section 10

(a) Travel concession or assistance u/s 10(5) Rs.

(b) Death-cum-retirement gratuity u/s 10(10) Rs.

(c) Commuted value of pension u/s 10(10A) Rs.

(d) Cash equivalent of leave salary encashment u/s 10(10AA) Rs.

(e) House rent allowance u/s 10(13A) Rs.

(f) Amount of any other exemption under section 10

(g) Total amount of any other exemption under section 10 Rs.

(h) Total amount of exemption claimed under section 10 Rs.

3. Total amount of salary received from current employer [1(d)-2(h)] Rs. 5,89,833.00

4. Less: Deductions under section 16

(a) Standard deduction under section 16(ia) Rs. 50,000.00

(b) Entertainment allowance under section 16(ii) Rs.

(c) Tax on employment under section 16(iii) Rs. 2,500.00

5. Total amount of deductions under section 16 [4(a)+4(b)+4(c)] Rs. 52,500.00

6. Income chargeable under the head 'Salaries' [(3+1(e)-5] Rs. 5,37,333.00

7. Add: Any other income reported by the employee

(a) Income (or admissible loss) from house property Rs.

(b) Income under the head Other Sources Rs.

8. Total amount of other income reported by the employee [7(a)+7(b)] Rs.

9. Gross total income (6+8) Rs. 5,37,333.00

10. Deductions under Chapter VI-A

Gross Amount Deductible Amount

(a) Deductions in respect of specified investments/savings - 80C Rs. 1,85,739.00 Rs. 1,50,000.00

(b) Contributions to Specified Pension Funds - 80CCC Rs. Rs.

(c) Contributions to Pension Funds 80CCD(1) Rs. Rs.

Page 2 of 3

Digitially Signed By:MAHAJAN PANKAJ SUBHASH

Reason:I attest to the accuracy and authenticity of this

document

Location:Hettich Competence Services Private

Limited,1201-1202 Platinum Techno Park,Vashi, Navi

Mumbai – 400 705,Maharashtra, India Mobile No:- +91

Certificate No.: 192/112

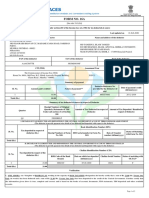

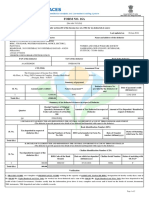

(d) Total deduction under section 80C, 80CCC and 80CCD(1) Rs. 1,85,739.00 Rs. 1,50,000.00

(e) Contribution to National Pension System 80CCD(1B) Rs. Rs.

(f) Contributions to Pension Funds 80CCD(2) Rs. Rs.

(g) Medical Insurance Premium Paid - 80D Rs. Rs.

(h) Repayment of Interest on Higher Education Loan - 80E Rs. Rs.

Gross Amount Qualifying Amount Deductible Amount

(i) Donations to Specified funds / Institutions - 80G Rs. Rs. Rs.

(j) Interest on Savings Account - 80TTA Rs. Rs. Rs.

(k) Amount deductible under any other provision(s) of Chapter VI-A

(l) Total of amount deductible under any other provision(s) Rs. Rs. Rs.

11. Aggregate of deductible amount under Chapter VI-A Rs. 1,50,000.00

[10(d)+10(e)+10(f)+10(g)+10(h)+10(i)+10(j)+10(l)]

12. Total taxable income (9-11) Rs. 3,87,330.00

13. Tax on total income Rs. 6,867.00

14. Rebate under section 87A, if applicable Rs. 6,867.00

15. Surcharge, wherever applicable Rs.

16. Health and education cess (@ 4%) Rs.

17. Tax payable (13+15+16-14) Rs. Nil

18. Less: Relief under section 89 (attach details) Rs.

19. Net tax payable (17-18) Rs.

Verification

I, PANKAJ MAHAJAN, son of SUBHASH MAHAJAN working in the capacity of DIRECTOR (designation) do hereby

certify that the information given above is true, complete and correct and is based on the books of account,

documents, TDS statements, TDS deposited and other available records.

Place NAVI MUMBAI

Date 28/06/2022 Signature of person responsible for deduction of tax

Designation DIRECTOR Full Name: PANKAJ MAHAJAN

Page 3 of 3

Digitially Signed By:MAHAJAN PANKAJ SUBHASH

Reason:I attest to the accuracy and authenticity of this

document

Location:Hettich Competence Services Private

Limited,1201-1202 Platinum Techno Park,Vashi, Navi

Mumbai – 400 705,Maharashtra, India Mobile No:- +91

You might also like

- The Rights and Privileges of Teachers in The PhilippinesDocument2 pagesThe Rights and Privileges of Teachers in The PhilippinesStephanie Catcho90% (41)

- Speaking Midterm Questions Market Leader Intermediate 3rdDocument16 pagesSpeaking Midterm Questions Market Leader Intermediate 3rdOanh Nguyễn100% (1)

- Employees Pre-Confirmation & Increment FormDocument3 pagesEmployees Pre-Confirmation & Increment FormSayed Aasim Jawaid100% (2)

- Form No. 16: Part ADocument8 pagesForm No. 16: Part ANidhish AgrawalNo ratings yet

- Assignment 4 FopDocument5 pagesAssignment 4 FopAyesha Binte SafiullahNo ratings yet

- Guidelines Relating To 20% Devt FundDocument8 pagesGuidelines Relating To 20% Devt FundAehruj Blet100% (2)

- 1 - Form16 - 218 - FY 2021-22Document9 pages1 - Form16 - 218 - FY 2021-22Sasi NimmakayalaNo ratings yet

- 0.00 Verification: TotalDocument4 pages0.00 Verification: TotalKesava KesNo ratings yet

- Form 16 - 2020-21 - Part A and B - FY 2020 - 2021 3Document10 pagesForm 16 - 2020-21 - Part A and B - FY 2020 - 2021 3kamalkarki03No ratings yet

- Form 16: TLG India Private LimitedDocument9 pagesForm 16: TLG India Private LimitedcagopalofficebackupNo ratings yet

- Form 16: Here Solutions India Private LimitedDocument10 pagesForm 16: Here Solutions India Private LimitedIt's your ChannelNo ratings yet

- Anspg5953f 2018-19Document3 pagesAnspg5953f 2018-19virajv1No ratings yet

- Tushar - Jagtap@amdocs - Com f16Document10 pagesTushar - Jagtap@amdocs - Com f16pvd6d52kd2No ratings yet

- From16 A PDFDocument2 pagesFrom16 A PDFAadarshNo ratings yet

- Form16 Mar 2023Document9 pagesForm16 Mar 2023PRAJAKTA GAJBHIYENo ratings yet

- FS46265257 PDFDocument9 pagesFS46265257 PDFPankaj KumarNo ratings yet

- Form 16: SLN Facility Management Private LimitedDocument10 pagesForm 16: SLN Facility Management Private LimitedChetan NarasannavarNo ratings yet

- Documents - 5e3566f922a8cf6780001bbb - SCFTPL060 AJVPM4973C21 09 2020 16 28 55Document2 pagesDocuments - 5e3566f922a8cf6780001bbb - SCFTPL060 AJVPM4973C21 09 2020 16 28 55Nikhil MenonNo ratings yet

- Form 16: Warora Kurnool Transmission LimitedDocument10 pagesForm 16: Warora Kurnool Transmission LimitedBHASKAR pNo ratings yet

- Abdfa2602a Q2 2019-20 PDFDocument2 pagesAbdfa2602a Q2 2019-20 PDFTarun AgarwalNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedArun MohantyNo ratings yet

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- Form 16 2023-24Document9 pagesForm 16 2023-24Santosh PradhanNo ratings yet

- Annual Aso14211form16Document8 pagesAnnual Aso14211form16SOUMITRA CHATTERJEENo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part AFarhan23inamdaRNo ratings yet

- EyspsDocument2 pagesEyspsrasoolvaliskNo ratings yet

- Form 16-2021-2022 - UnlockedDocument9 pagesForm 16-2021-2022 - Unlockedvhacky123No ratings yet

- Form 16Document9 pagesForm 16Ponns KarnanNo ratings yet

- Abfpw1788f 2017-18 PDFDocument2 pagesAbfpw1788f 2017-18 PDFNikhil121314No ratings yet

- N/A AMRS16666G CGAPS6779N: Certificate Under Section 203 of The Income Tax-Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesN/A AMRS16666G CGAPS6779N: Certificate Under Section 203 of The Income Tax-Act, 1961 For Tax Deducted at Source On SalaryZUHAIB ASHFAQNo ratings yet

- Agcpa9205b 2019-20Document2 pagesAgcpa9205b 2019-20HRNo ratings yet

- BOHPxxxx5E Q3 2019-20Document2 pagesBOHPxxxx5E Q3 2019-20Tamziul IslamNo ratings yet

- Form16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Document6 pagesForm16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Mankamuthaka VemaratananaNo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part AParikshit ModiNo ratings yet

- Rrr3Document2 pagesRrr3rohitkawade2707No ratings yet

- Form No 16Document3 pagesForm No 16rsharma09170No ratings yet

- 2019 20 PDFDocument7 pages2019 20 PDFSanjeet SinghNo ratings yet

- BalajiGollapalli 3429 F16 2022-23Document10 pagesBalajiGollapalli 3429 F16 2022-23p. r ravichandraNo ratings yet

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- HTMLReportsDocument7 pagesHTMLReportsPushpraj ThakurNo ratings yet

- Annual.202111684 Form16 - Kaustubh KandharkarDocument8 pagesAnnual.202111684 Form16 - Kaustubh KandharkarKaustubh KandharkarNo ratings yet

- Form 16 FY 18-19 PART - ADocument2 pagesForm 16 FY 18-19 PART - Asai venkataNo ratings yet

- Geeta - Form 16 A 2022-23Document2 pagesGeeta - Form 16 A 2022-23Sourabh PunshiNo ratings yet

- Form16 18 19Document9 pagesForm16 18 19rushigadhave12No ratings yet

- Form 16 FY 19-20Document6 pagesForm 16 FY 19-20Anurag SharmaNo ratings yet

- Form16 PDFDocument9 pagesForm16 PDFHarish KumarNo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023HeetNo ratings yet

- Part A 4883020Document2 pagesPart A 4883020AkchikaNo ratings yet

- Form 16 1Document2 pagesForm 16 1Vijay JiíväNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- Animesh Das - Form16 FY 21-22 - FY 2021 - 2022.Document7 pagesAnimesh Das - Form16 FY 21-22 - FY 2021 - 2022.Dass AniNo ratings yet

- Polymorphism of The WorldDocument9 pagesPolymorphism of The WorldShobhit MathurNo ratings yet

- Part A 1991 PDFDocument2 pagesPart A 1991 PDFDARSHAN NAIKNo ratings yet

- TDS Certificate PDFDocument2 pagesTDS Certificate PDFSoumyabrata BhattacharyyaNo ratings yet

- Form 16-2021-2022Document12 pagesForm 16-2021-2022Kunal BansodeNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToPridex Medical Technologies LLNo ratings yet

- Form16 2021Document8 pagesForm16 2021Mahammad HachanNo ratings yet

- Form16 SignedDocument7 pagesForm16 SignedrajNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Valdez v. GSISDocument8 pagesValdez v. GSISlouis adriano baguioNo ratings yet

- Completion in Feasibility Study Final 101Document93 pagesCompletion in Feasibility Study Final 101renatoNo ratings yet

- PLDT v. NLRC and AbucayDocument8 pagesPLDT v. NLRC and AbucayPamela BalindanNo ratings yet

- Salary SlipDocument1 pageSalary Slipsaadbshaheen97No ratings yet

- Report On WFSE-UW Relations, April 2014Document275 pagesReport On WFSE-UW Relations, April 2014WFSEc28No ratings yet

- Architects Scale of Minimun FeesDocument23 pagesArchitects Scale of Minimun FeesNek ManNo ratings yet

- Drivers AgreementDocument5 pagesDrivers Agreementramesh BabuNo ratings yet

- Econ Math ProjectDocument14 pagesEcon Math ProjectAndy ChiuNo ratings yet

- Assignment 1: Csc415: Fundamental of Computer Problem SolvingDocument5 pagesAssignment 1: Csc415: Fundamental of Computer Problem SolvingshiranazariNo ratings yet

- Offer Marvel Softech India PVTDocument4 pagesOffer Marvel Softech India PVTBabypravallika VelineniNo ratings yet

- Job Analysis Description EtcDocument6 pagesJob Analysis Description EtcfabyunaaaNo ratings yet

- Employee CompensationDocument9 pagesEmployee Compensationjaydee_atc5814100% (1)

- Ma - Vidia LargoDocument27 pagesMa - Vidia Largo2022-09-103No ratings yet

- Jusmag vs. NLRCDocument7 pagesJusmag vs. NLRCdudekie14344No ratings yet

- Best Performing Cities 2021Document75 pagesBest Performing Cities 2021Adam ForgieNo ratings yet

- Summer Training Report On Yatra ComDocument87 pagesSummer Training Report On Yatra ComRaksha100% (1)

- Ampeloquio v. Jaka Distribution, Inc.Document10 pagesAmpeloquio v. Jaka Distribution, Inc.AnnieNo ratings yet

- Application: This Employer Requires A Pre-Employment Physical and Drug TestDocument7 pagesApplication: This Employer Requires A Pre-Employment Physical and Drug Testapi-30292005No ratings yet

- NEA v. COA (2002)Document6 pagesNEA v. COA (2002)Jude FanilaNo ratings yet

- Stat 9 14Document139 pagesStat 9 14MonicaFrancesSalvadorNo ratings yet

- 3 EASTERN Telecommunications PhilsDocument5 pages3 EASTERN Telecommunications PhilsmayNo ratings yet

- SQL ExercisesDocument4 pagesSQL ExercisesZephyrTRNo ratings yet

- Effects of A Good Orientation ProgramDocument16 pagesEffects of A Good Orientation ProgramMicca Mae RafaelNo ratings yet

- 3 Regular Employment ContractDocument4 pages3 Regular Employment ContractKaria SaNo ratings yet

- HR 01 PY Basic Setting ConfigurationDocument71 pagesHR 01 PY Basic Setting ConfigurationShrouk GamalNo ratings yet