Professional Documents

Culture Documents

MarketLineIC - Television Broadcasts LTD - Profile - 211122

MarketLineIC - Television Broadcasts LTD - Profile - 211122

Uploaded by

WerchampiomsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MarketLineIC - Television Broadcasts LTD - Profile - 211122

MarketLineIC - Television Broadcasts LTD - Profile - 211122

Uploaded by

WerchampiomsCopyright:

Available Formats

Television Broadcasts Ltd

Television Broadcasts Ltd - SWOT Analysis

Television Broadcasts Ltd (TVB) holds investments in television business. An established

market position, revenue growth, and higher TV ratings are its strengths, even as profitability,

and liabilities could be a cause for concern. Acquisition of Ztore Investment Ltd, global media

industry, and relaxation of regulations are likely to provide growth opportunities for the

company. However, viewer preference, competition, and industry consolidations could affect

its operations.

Television Broadcasts Ltd- Strengths

Strengths - TV Ratings

Higher TV ratings enable the company to secure higher advertisement revenue from

advertisers and more views on digital platforms and sell its content in digital platforms. TVB’s

Jade is the most popular channel in Hong Kong in terms of an average audience share of

77% and strengthened its programming line to serve local tastes and preferences. This

channel also secured an average prime time TV rating of 24.

Strengths - Market Position

An established market position enables the company to meet growing customer demand and

secure opportunities from market transition trends. With an audience share of 83% in young

audience group and 85% in high income viewership of Hong Kong TV broadcasting. TVB's

Jade channel is the most-watched TV channel in Hong-Kong and co-produces programs with

Chinese online platforms. The company is one of the few broadcasters in the world operating

an integrated business model covering production, broadcasting, and distribution,

supplemented by a potent artiste pool. As of December 2021, the company had 9.9 million

myTV SUPER’s registered users, over one million myTV SUPER’s paying subscribers, and

1.9 million myTV SUPER MAU registered users. In China, the company had 76 million

followers of TVB-related accounts on Chinese social media platforms, 34 million Mai Dui Dui

downloads, and 5.6 million Mai Dui Dui users. In other markets, the company had 20.5 million

TVB YouTube Channels MAU, 9 million TVB Anywhere aggregated users, and 7.5 million

TVB YouTube subscribers.

Strengths - Revenue Growth

Growth in revenue improves investors’ confidence in the company and enables it to pursue

expansion plans. In FY2021, the company generated revenue of HKD2,898.6 million as

compared to HKD2,724 million in FY2020, with an annual growth of 6.4%. such growth in

revenue was due to the increase in Hong Kong TV Broadcasting, and E-commerce business

segment revenues.

Strengths - Profitability

Though the company’s revenue increased in FY2021 over that in the previous fiscal, its

profitability declined. Declining profitability decreases the company’s ability to provide higher

returns to its shareholders. In FY2021, the company reported an operating loss of HKD654.3

million as compared to an operating loss of HKD243.4 million in FY2020. A decline in

operating performance indicates lack of efficiency in cost management. The net loss of the

company was HKD646.7 million in FY2021, compared to a net loss of HKD280.9 million in

FY2020.

Television Broadcasts Ltd - Weaknesses

Weaknesses - Liabilities

Increasing liabilities might prevent the company from meeting its short-term obligations. In

FY2021, the company reported current liabilities of HKD2,955.8 million as compared to

Published: 29 Aug 2022 Page 1

Extracted: 21 Nov 2022

Television Broadcasts Ltd

HKD2,533.8 million in FY2020, which shows an increase of 16.6%. The current ratio was 1.4

in FY2021 as compared to 2.5 in FY2020. Such significant increase in liabilities could affect

the company’s credibility in the market and pose operational risk when it strives to raise

money for investment.

Television Broadcasts Ltd- Opportunities

Opportunities - Global Media Industry

The company stands to benefit from the growing global media industry. According to in-house

research, the industry is expected to reach US$1,234 billion in 2024. Advertising is the

largest segment of the global advertising industry, accounting for 52.7% of the industry's total

value, followed by Broadcasting and Cable Tv (21.2%), Publishing (19.1%), and Movies and

Entertainment (7%). The US accounted for 35.1% of the global advertising industry value,

followed by Asia-Pacific (34.1%), Europe (23.5%), the Middle East (1.2%), and Rest of the

World (6.1%). The company, being a provider of media services, stands to benefit from the

growing outlook for global media industry.

Opportunities - Acquisition of Ztore Investment Limited

TVB continues to view strategic acquisitions as a major part of its growth strategy. In August

2021, the company acquired Ztore Investment Ltd, an operator of online supermarkets. This

acquisition could help the company strengthen strategic potentials of TVB e-commerce

business and operations of Big Big Shop and Neigbuy. It would also help TVB to become a

new landscape of Hong Kong’s e-commerce and fulfill the needs of consumers and

merchants, making the entire online retail market thriving and maximizing benefits for

shareholders, merchants and customers.

Opportunities - Relaxation of Regulations

Favorable regulations could benefit the company’s operations. The Communications Authority

relaxed the regulation of indirect advertising in television program services and lifted the ban

on broadcast of advertisements for undertaking and associated services. This diversifies

advertising sources and provides a balance between providing a contributory business

environment to licensees in strict competition environment in the broadcasting industry and

protecting viewer interests. Indirect advertising would be permitted in TV programs except for

news, current affairs, children programs, educational programs, religious services and other

devotional programs. Relief from restrictive broadcasting regulations helped myTV SUPER to

allow advertisers market their products and thus, manage to lift conversion rate through

interactive ad procedures. It enhanced the efficiency of advertising solutions and

strengthened digital and data-driven proficiencies through targeting technology and big data

analytics.

Television Broadcasts Ltd - Threats

Threats - Industry Consolidation

Industry consolidation could affect the company’s ability to maximize its content value through

distribution platforms. Many of the territories in which TVB distributes its networks also have a

small number of dominant distributors. Continued consolidation within industry could reduce

the number of distributors to carry the company’s programming, subject its affiliate fee

revenue to greater discount volume, and increase the negotiating leverage of the cable and

satellite television system operators.

Threats - Intense Competition

The company operates in a highly competitive media and entertainment market. The factors

that determine competition in the industry include service performance, price, and sales and

Published: 29 Aug 2022 Page 2

Extracted: 21 Nov 2022

Television Broadcasts Ltd

distribution capabilities. TVB faces competition from Asia Television Limited, APT Satellite TV

Development Limited, HK Television Entertainment Co Ltd, and Network 18 Media &

Investments Ltd among others. Apart from the established players in developed countries,

players from emerging countries are also competing hard to garner greater market share.

Many of its competitors have a longer operating history, greater brand recognition,

established customer and supplier relationships, and greater financial resources, which could

lead to the creation of innovative products and business expansion through acquisitions.

Threats - Viewer Preference

The company is subject to change in viewer preference due to advancements in the

technology, which allow users to access content avoiding advertisements, and could affect

TVB's advertising revenue. Multiplying uses of technological advancements on such user-

generated content sites, Internet and mobile distribution of video content, streaming and

downloading from the Internet and digital outdoor displays also affect the company’s

business. Advanced technological devices allow customers to view or listen to television or

radio programs, forwarding or skipping advertisements. High-churn rates to TVB's overseas

pay TV partners because of change in viewership preferences and media consumption

affected its revenue flows in Programme Licensing and Distribution.

Disclaimer:

All Rights Reserved.

This information has been extracted from MarketLine by a registered user

No part of this publication may be reproduced, stored in a retrieval system or

transmitted in any form by any means, electronic, mechanical, photocopying,

recording or otherwise, without the prior permission of the publisher, MarketLine.

The facts of this report are believed to be correct at the time of publication but cannot

be guaranteed. Please note that the findings, conclusions and recommendations that

MarketLine delivers will be based on information gathered in good faith from both

primary and secondary sources, whose accuracy we are not always in a position to

guarantee. As such MarketLine can accept no liability whatever for actions taken

based on any information that may subsequently prove to be incorrect.

Published: 29 Aug 2022 Page 3

Extracted: 21 Nov 2022

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hot Desking Policy TemplateDocument3 pagesHot Desking Policy Templatesfdfsdf100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Weaever Carpet Company Wearever Carpet Com...Document4 pagesThe Weaever Carpet Company Wearever Carpet Com...WerchampiomsNo ratings yet

- AMIND 440 Study Guide For Exam 1Document8 pagesAMIND 440 Study Guide For Exam 1WerchampiomsNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- A National Catalog and Internet Retailer Has Three...Document4 pagesA National Catalog and Internet Retailer Has Three...WerchampiomsNo ratings yet

- Carrefour Expansion To Pakistan: International Business Management (MGT 521) Spring 2017-2018 (Term B)Document23 pagesCarrefour Expansion To Pakistan: International Business Management (MGT 521) Spring 2017-2018 (Term B)WerchampiomsNo ratings yet

- Test Report BΩSS Conduit (new)Document10 pagesTest Report BΩSS Conduit (new)Em Es WeNo ratings yet

- Eco 222-1 Fa 22-23 ProjectDocument5 pagesEco 222-1 Fa 22-23 ProjectWerchampiomsNo ratings yet

- Solomon Cb12 CultureDocument56 pagesSolomon Cb12 CultureWerchampiomsNo ratings yet

- Individual SolutionDocument2 pagesIndividual SolutionWerchampiomsNo ratings yet

- DemandHub Customer Agreement - Equilibrium Chiropractic & Wellness CentreDocument4 pagesDemandHub Customer Agreement - Equilibrium Chiropractic & Wellness CentreWerchampiomsNo ratings yet

- Week 6 Lecture 6 Race Color National Origin Bennett9e Ch06 & UAEDocument28 pagesWeek 6 Lecture 6 Race Color National Origin Bennett9e Ch06 & UAEWerchampiomsNo ratings yet

- Week 2 & 3 Lecture 2b Religious Discrimination Bennett9e Ch11 W UAEDocument36 pagesWeek 2 & 3 Lecture 2b Religious Discrimination Bennett9e Ch11 W UAEWerchampiomsNo ratings yet

- ENGL 200 Fall 2022 Quiz APA-Fig-Lang S1Document1 pageENGL 200 Fall 2022 Quiz APA-Fig-Lang S1WerchampiomsNo ratings yet

- Week 6 Lecture 6 Race Color National Origin Bennett9e Ch06 & UAEDocument28 pagesWeek 6 Lecture 6 Race Color National Origin Bennett9e Ch06 & UAEWerchampiomsNo ratings yet

- A Multimodal Analysis of How Apple Inc UDocument86 pagesA Multimodal Analysis of How Apple Inc UWerchampiomsNo ratings yet

- SWE5206-Assignment1 - 22-23Document9 pagesSWE5206-Assignment1 - 22-23WerchampiomsNo ratings yet

- Level HE6: Vidhya Ragesh - Abidha ViswanathanDocument9 pagesLevel HE6: Vidhya Ragesh - Abidha ViswanathanWerchampiomsNo ratings yet

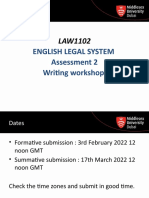

- ELS Assessment 2 Writing Workshop 2022Document19 pagesELS Assessment 2 Writing Workshop 2022WerchampiomsNo ratings yet

- Week 5 Lecture 4 Employment DiscriminationDocument15 pagesWeek 5 Lecture 4 Employment DiscriminationWerchampiomsNo ratings yet

- Risk Register: ID Risk Name Risk Description Impact Probability Risk Ranking Positive/Negative Proactive Response PlanDocument4 pagesRisk Register: ID Risk Name Risk Description Impact Probability Risk Ranking Positive/Negative Proactive Response PlanWerchampiomsNo ratings yet

- Handling Conflict and Effective Communication (98) - Read-OnlyDocument21 pagesHandling Conflict and Effective Communication (98) - Read-OnlyWerchampiomsNo ratings yet

- Assessment 3: Letter of ApplicationDocument14 pagesAssessment 3: Letter of ApplicationWerchampiomsNo ratings yet

- BSBMKG512 Forecast International Market and Business Needs: Assessment Tasks (Learner Copy)Document16 pagesBSBMKG512 Forecast International Market and Business Needs: Assessment Tasks (Learner Copy)WerchampiomsNo ratings yet

- Analytical Approach To The Springfield Interchange Improvement Project University of Maryland University College Oct 30, 2016Document8 pagesAnalytical Approach To The Springfield Interchange Improvement Project University of Maryland University College Oct 30, 2016WerchampiomsNo ratings yet

- Solve The Following Goal Programming Model Graphic...Document3 pagesSolve The Following Goal Programming Model Graphic...WerchampiomsNo ratings yet

- The Weaever Carpet Company Wearever Carpet Com...Document4 pagesThe Weaever Carpet Company Wearever Carpet Com...WerchampiomsNo ratings yet

- Executive Incentives ResitDocument8 pagesExecutive Incentives ResitWerchampiomsNo ratings yet

- Maintenance ScheduleDocument12 pagesMaintenance ScheduleVanHoangNo ratings yet

- K80000 Technical Datasheet PDFDocument1 pageK80000 Technical Datasheet PDFKhalid ZghearNo ratings yet

- Agriculture AhmedabadDocument33 pagesAgriculture AhmedabadKrupam Thetenders.com100% (1)

- Ge1000 Guitar Complex Effect ManualDocument3 pagesGe1000 Guitar Complex Effect Manualpaolo.sinistroNo ratings yet

- CSCI207 Lab3Document3 pagesCSCI207 Lab3Ali Rida SiblaniNo ratings yet

- Service Experience (OCSE) Using The Emerging Consensus Technique (ECT)Document41 pagesService Experience (OCSE) Using The Emerging Consensus Technique (ECT)Naveen KNo ratings yet

- Nordstrom Research AnalysisDocument19 pagesNordstrom Research AnalysisCindy Cabrera100% (2)

- Executive Coaching AgreementDocument2 pagesExecutive Coaching AgreementAntonio PassarelliNo ratings yet

- Third Quarter TLE 7 HandicraftDocument5 pagesThird Quarter TLE 7 HandicraftVanessa Biado0% (1)

- RBLDocument19 pagesRBLD J GamingNo ratings yet

- Can You Dribble The Ball Like A ProDocument4 pagesCan You Dribble The Ball Like A ProMaradona MatiusNo ratings yet

- Ireland Climate Action Plan 2024Document7 pagesIreland Climate Action Plan 2024Fursey WhyteNo ratings yet

- Kinetic Theory of GasesDocument8 pagesKinetic Theory of GasesGupta GuptaNo ratings yet

- IEEE 1149.6 - A Practical PerspectiveDocument9 pagesIEEE 1149.6 - A Practical Perspective18810175224No ratings yet

- T REC G.984.4 200911 I!Amd2!PDF EDocument164 pagesT REC G.984.4 200911 I!Amd2!PDF ERoberto CardosoNo ratings yet

- Management of Juvenile Glaucoma With TrabeculectomyDocument147 pagesManagement of Juvenile Glaucoma With TrabeculectomyErlinaerlin100% (1)

- Darkeden Legend - The Rare Skills ListDocument6 pagesDarkeden Legend - The Rare Skills ListGM Badr100% (4)

- RDBMS SeminarDocument70 pagesRDBMS SeminarSohoo Abdul QayoomNo ratings yet

- Market Risk ConceptDocument27 pagesMarket Risk ConceptMhmd ZaraketNo ratings yet

- Cool Pavement For Green Building SystemDocument29 pagesCool Pavement For Green Building SystemPrashant ChelaniNo ratings yet

- Experimental and Clinical Metastasis A Comprehensive Review PDFDocument467 pagesExperimental and Clinical Metastasis A Comprehensive Review PDFCoțovanu IulianNo ratings yet

- Lab 2 - Protection RelaysDocument10 pagesLab 2 - Protection RelaysLeo GeeNo ratings yet

- STAFFINGDocument14 pagesSTAFFINGHimanshu DarganNo ratings yet

- Mathematics 3Document2 pagesMathematics 3Tony StarkNo ratings yet

- Free As A Bird - Complete Video PDFDocument22 pagesFree As A Bird - Complete Video PDFAdam J RothschildNo ratings yet

- Lecture 5 EOF AllDocument45 pagesLecture 5 EOF Allguru_maheshNo ratings yet

- Measures of Central Tendency and Dispersion (Week-07)Document44 pagesMeasures of Central Tendency and Dispersion (Week-07)Sarmad Altaf Hafiz Altaf HussainNo ratings yet

- WS Emergency Echo SYMCARD 2022Document33 pagesWS Emergency Echo SYMCARD 2022IndRa KaBhuomNo ratings yet