Professional Documents

Culture Documents

Accountancy Sample Question Paper

Accountancy Sample Question Paper

Uploaded by

SoNam ZaNgmoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accountancy Sample Question Paper

Accountancy Sample Question Paper

Uploaded by

SoNam ZaNgmoCopyright:

Available Formats

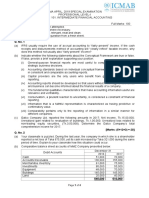

PART I

(30 Marks)

Answer ALL questions.

Question 1

A) For each question, there are four alternatives: A, B, C and D. Choose the

correct alternative and circle it. Do not circle more than ONE alternative.

If there is more than one choice circled, NO score will be awarded. [10 Marks]

i) Income tax expense for the current year includes

A current tax expense.

B deferred tax expense.

C current tax liabilities.

D current tax expense and deferred tax expense.

ii) An example of performance based remuneration is

A pension.

B basic Salary.

C share options.

D house rent allowance.

iii) Which ONE of the following best fits in the definition of Property, Plant & Equipment?

A Building used for office purpose

B Machinery purchased for selling purpose

C Investment in the shares of other companies

D Purchase of cow to be used in dairy business

iv) Which ONE of the following is an intangible asset under BAS 38?

A Market share

B Patent rights

C Customer loyalty

D Employee training

v) Contingent liabilities are disclosed in the financial statements as a

A equity.

B current liabilities.

C non-current liabilities.

D note to the financial statements.

REC-BHSEC/Accountancy/Sample Question Page 1 of 8

vi) A company has a retained earning balance of Nu. 100,000 on 1st January 2015. During the

year, the company earned a net profit of Nu. 20,000 and a dividend of Nu. 10,000 was

declared. Further, a reserve amount of Nu. 8,000 was created for business expansion

purpose. The company also issued 1,000 equity share of Nu. 10 each. The ending balance

of retained earnings will be

A Nu. 112,000.

B Nu. 122,000.

C Nu. 102,000.

D Nu. 110,000.

vii) Pema and Sonam are partners sharing profits and losses in the ratio of 3:2. The net profit

during the year was Nu. 12,000. Interest on capital was allotted as Nu. 400 to Pema and

Nu. 250 to Sonam. Sonam received a salary of Nu. 5,000. How much was Pema’s share of

profit?

A Nu. 2,540

B Nu. 3,810

C Nu. 4,950

D Nu. 3,060

viii) The income statement shows the

A financial position of the business.

B financial performance of the business.

C amount of cash generated and used in the business.

D change in the equity of the business over a period of time.

ix) Which ONE of the following is an example of liquidity ratio?

A Quick ratio

B Return on sales

C Return on equity

D Gross profit margin

x) All of the following are allowable deductions under the Income Tax Act, EXCEPT

A donations.

B entertainment expenses.

C legal and professional fees.

D fess paid to employees for processing identity cards.

REC-BHSEC/Accountancy/Sample Question Page 2 of 8

B) State TRUE or FALSE for the statements given below. Rewrite the false

statements giving reasons. [5 Marks]

i) Intangible assets with an indefinite useful life should not be amortised.

ii) Sales tax are levied on cash sales only.

iii) All accrued remunerations are recognized as current liabilities.

iv) Fixed cost does not change with the volume of output in the short run.

v) Cash budget is the part of operating budget.

C) Fill in the blanks with appropriate words. [5 marks]

i) The type of liability where possible obligation will arise from past events, which will

be confirmed by events in the future is ____________________________________.

ii) Retained earning used for the intended or specific purpose is called

_____________________________.

iii) Profit and loss appropriation account is ______________________________account in

nature.

iv) While presenting financial statements, an entity should present separately each material

class of items and items of dissimilar nature or function unless they are

___________________________________.

v) Inventory comprises of inventory of raw materials, inventory of

______________________________and inventory of finished goods.

D) Answer the following questions. [10 Marks]

a) Why are gains on disposal of Property, Plant and Equipment transferred to income

statement but the gain on revaluation of Property, Plant and Equipment are transferred

to equity? Give TWO reasons. [2]

b) Identify any FOUR elements of financial statements. [2]

c) Assume that you work in Department of Revenue and Customs and you noticed

that the tax rate for Business Income Tax and Corporate Income Tax is 30%.

What would you recommend to promote more companies in the country?

Suggest any TWO. [2]

d) The management of PCAL is confused whether to obtain long term loans from

Bank of Bhutan. The rate of interest charged by the bank is 12% and the Return

on Capital Employed of PCAL is 10%. Do you think the management of PCAL

should obtain the loan? Why? [2]

e) Do you think using up all budget amount is unethical? Why? Justify with TWO

reasons. [2]

REC-BHSEC/Accountancy/Sample Question Page 3 of 8

Part II (50 Marks)

Answer any FIVE questions

Question 2

a) The statement of profit or loss and other comprehensive income of ABC Ltd for the

financial year ending 30th Dec 2010 was as follows:

Revenue Nu. 250, 000

Add: Accrued Income Nu. 10,000

Profit Before Tax Nu. 260,000

i) Calculate and pass the journal entry to record current year tax expense and

deferred tax expense assuming the tax rate is 30%. [2]

ii) Redraft the statement of income and other comprehensive income of ABC Ltd.

for tax purpose after computing tax at 30%. [2]

b) Bhutan Telecom Limited (BTL) decided to issue Nu. 1 million of 10% bonds on

1st January 2015 repayable three years after the date of issue. Further, BTL announced

the right issue of 2 for every 5 shares held at Nu. 6 per share. BTL has 2 million

shares of Nu. 10 each.

i) Pass the journal entry to record the issue of bonds on 1st January 2015 and interest

payable on the bonds on 31st December 2015. [2]

ii) Pass the journal entry to record right issue of shares. [2]

iii) Should the management of BTL opt for debt financing or equity financing? Why? [2]

Question 3

ABC Company has a building with a carrying amount of Nu. 100,000 which is revalued

at the end of the year for Nu. 120,000. ABC Co. has published an environmental policy to

replant trees in order to counter-balance the environmental damage resulting from its

operations. It has a consistent history of honoring this policy though there is no legal

obligation. During 2018, it opened a new factory, leading to some environmental damage

estimated at Nu.400,000 for restoration works.

i) Pass the journal entry to record the revalue of building. How will this impact the

financial statements of ABC Company? [3]

ii) ABC Company further purchased machinery on 1st Jan 2018 for Nu. 200,000 with

estimated scrape value of Nu. 10,000 and useful life of 10 years. What amount of

depreciation will be charged for 31st Dec 2018? Pass the journal entry to record the

depreciation charged. [3]

iii) Differentiate between Liability and Provisions. [2]

iv) Should Provision of Nu. 400,000 be recognized in the year 2018? Why? [2]

REC-BHSEC/Accountancy/Sample Question Page 4 of 8

Question 4

The following is the draft income statement of XYZ Co. for the year ending 2018.

Particulars Amount(Nu.)

Dividend Income 500,000

Interest and other borrowed cost 320,000

Buildings 670,000

Depreciation – office building 150,000

Marketing Van 560,000

Depreciation – Meaketing Van 200,000

Sales Revenue 2,100,000

Salary 520,000

Sales Commission 400,000

Bonus (Sales Person) 350,000

Income from Government Grants 300,000

Cost of Sales 650,000

Employee Training and Development 420,000

i) Present the statement of income from the above account balances using Function of

Expense Method assuming 30% Corporate Tax. [5]

ii) Mr. Dorji works as a manger in sales department. In order to increase the sales

commission from Nu. 400,000 to Nu. 600,000, he decided to manipulate the sales

revenue from Nu. 2,100,000 to Nu. 2,900,000. What ethical issues do you see in

the case of Mr. Dorji? How will this affect the income statement? [2]

iii) Suppose XYZ Co. receives Nu. 200,000 as government grants on 1st Jan 2019 for

the project with useful life of 10 years, how will this grant be treated for the year

ending 31st December 2019? (Use Deferred Income approach). [3]

Question 5

The following is the Statement of Financial Position of ABC Ltd Co.

Non-Current Assets 2016 2017

Property, Plant & Equipment 720,000 820,000

Less: Accumulated Depreciation (242,000) (258,000)

478,000 562,000

Investments 180,000 240,000

Current Assets

Inventory 590,000 407,000

Accounts Receivables 332,000 392,000

Cash and Cash Equivalent 11,000 4,000

1,591,000 1,605,000

Equity and Liabilities

Equity Shares 350,000 500,000

Retained Earnings 212,000 369,000

REC-BHSEC/Accountancy/Sample Question Page 5 of 8

Non-Current Liabilities

Bonds 400,000 150,000

Current Liabilities

Accounts Payable 478,000 418,000

Accrued Expense 151,000 168,000

1,591,000 1,605,000

During the year, machinery costing Nu. 150,000 with accumulated depreciation of

Nu. 20,000 was sold for Nu. 125,000.

Required:

i) Prepare Cash from Investing and Financing Activities. [4]

ii) Interpret your findings on cash generated or used in investing activities. [1]

iii) Assume that a dividend of Nu. 20,000 is declared in the year 2017. Pass the journal

entry to record the transaction. [1]

iv) Compute the current ratio of ABC Ltd Co. for the year 2016 and 2017. Is ABC

Co. Ltd doing better in terms of current ratio in the year 2016 or 2017? Why? [4]

Question 6

a) Sonam recently graduated from Gedu college of business and is undergoing internship

programe at production department of Penden Cement Authoirty Limited (PCAL). During

the year 2017, the company has a direct material standard of 2 kg per bag of cement at Nu.

4.5 per Kg to produce one bag of cement. The company purchased 1,700 kg of material to

make 1,000 bags of cement. The total cost of material is Nu. 6,630.

i) Compute material price variance and material usage variance. State whether the

balances are favourable or unfavourable. [4]

ii) Supposing you are Sonam and you are asked to develop the direct material standard

to produce one bag of cement for the year 2018, what ethical issues do you see if

you are paid higher bonus for favourable balance? [2]

b)

i) A company purchased building worth Nu. 2 million with estimated life of 20 years

depreciated using straight line method. The company has used the building for 5

years. The recoverable amount of building is estimated at the cost of Nu. 1.2 million.

Pass the journal entry to record the impairment loss on building. [2]

ii) Assume that you are working in one of the firm whereby huge amount is spent in

the form of advertisement. During the board meeting, the sales department manager

proposed the idea of recognizing advertisement as intangible assets since it creates

future economic benefits. Should the firm recognize advertisement as intangible

assets? Why? [2]

REC-BHSEC/Accountancy/Sample Question Page 6 of 8

Question 7

a) X and Y business earned a net profit of Nu. 790,000 in the year 2016 after deducting

Interest on loan Nu. 30,000, Entertainment Expenses Nu. 80,000 and Donation of Nu.

100,000. The following are the additional information relating to X and Y business.

The donation was given for earthquake victims.

The loan amount was availed in the name of X’s wife from Bank of Bhutan

i) Compute Business Income Tax for the year 2016 assuming tax rate of 30%. [3]

ii) Do you think evasion of tax is recommended? Why? [2]

b) Smart Company Pvt. Ltd. has been producing Pure Butter. You are provided with the details

of cost incurred at different stages in the production of 10,000 kilograms of butter in 2019.

Amount in Nu.

Material consumed 1,000,000

Direct labour and Expenses 100,000

Factory Lighting 50,000

Office Overhead 80,000

Selling and Distribution overheads 30,000

From the above data:

i) calculate Cost of Production. [3]

ii) give TWO suggestions to maximize profit keeping in mind that there is another

competitor in the market producing similar products. [2]

Question 8

a) You are provided with the statement of financial position of Namgay and Sujata’s

partnership firm on 31st December 2018.

Assets Amount(Nu.)

Accounts Receivable 200,000

PP& E 1,000,000

Cash 50,000

1,250,000

Capital and liabilities Nu.

Namgay's Capital 400,000

Sujata's Capital 600,000

Bank loan 150,000

Accounts Payable 100,000

1,250,000

REC-BHSEC/Accountancy/Sample Question Page 7 of 8

On 1st January 2019, the partnership was dissolved. All the assets except accounts receivable

realised Nu.1,300,000. All the liabilities were paid off and dissolution expenses amounted to

Nu.50,000. Sujata took all the accounts receivable at half the book value.

You as a Cost Accountant, prepare;

i) an account to inform the partners whether they dissolved the firm at a

profit or loss. [3]

ii) a statement to find out the amount that they can claim from the firm. [2]

b) XY Company has an average employees of 1,000 during the year 2017. 100 employees

had resigned from the company due to dissatisfaction related to job. The company has

been performing poorly for the last three years with significant decline in the profit margin

of the company. Most of the funds of the company were misused by the payroll accountant

by creating ghost employees.

Required:

i) Calculate staff turnover ratio. [1]

ii) Suggest TWO measures to the management of XY company to curb down the

problem of employees resigning from the firm. [2]

iii) How would the action of accountant impact financial statements of XY Company? [2]

REC-BHSEC/Accountancy/Sample Question Page 8 of 8

You might also like

- CH 10Document9 pagesCH 10Tien Thanh DangNo ratings yet

- Dana Trott Reference LetterDocument83 pagesDana Trott Reference LetterChrisNo ratings yet

- PSLP 0112174 201411Document1 pagePSLP 0112174 201411soumava chakrabortyNo ratings yet

- FIN111 Financial Markets Midterm Exam: 2 Pts. 2 PtsDocument3 pagesFIN111 Financial Markets Midterm Exam: 2 Pts. 2 PtsJobert CincoNo ratings yet

- Mba (2019 Pattern) - 230212 - 181328Document171 pagesMba (2019 Pattern) - 230212 - 181328ManavNo ratings yet

- 2022 ActDocument32 pages2022 ActKlly KllyNo ratings yet

- F5 Bafs 1 AnsDocument6 pagesF5 Bafs 1 Ansouo So方No ratings yet

- Ac PaperDocument6 pagesAc PaperAshwini SakpalNo ratings yet

- 2013 PDFDocument126 pages2013 PDFomiraskar1212No ratings yet

- 57 International Financial Reporting Standards May 2022Document8 pages57 International Financial Reporting Standards May 2022premium info2222No ratings yet

- Question PaperDocument3 pagesQuestion PaperAmbrishNo ratings yet

- M.B.A (2021 Pattern)Document63 pagesM.B.A (2021 Pattern)Sahil DhumalNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Document4 pagesCommerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Sanaullah M SultanpurNo ratings yet

- Cma January-2022 Examination Operational Level Subject: F1. Financial OperationsDocument9 pagesCma January-2022 Examination Operational Level Subject: F1. Financial Operationsnatsu broNo ratings yet

- FM QPDocument18 pagesFM QPjpkassociates2019No ratings yet

- 2020 ActDocument28 pages2020 ActKlly KllyNo ratings yet

- 9706 31 Insert o N 20Document5 pages9706 31 Insert o N 20chirag mehtaNo ratings yet

- Cma Question PaperDocument4 pagesCma Question PaperHilary GaureaNo ratings yet

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- F1 FIOO - L-December-2020Document8 pagesF1 FIOO - L-December-2020Laskar REAZNo ratings yet

- ECO-2 - ENG-J18 - CompressedDocument6 pagesECO-2 - ENG-J18 - CompressedAmit AdhikariNo ratings yet

- (EXTERNAL) 2013 Pattern PDFDocument63 pages(EXTERNAL) 2013 Pattern PDFAshwin kaleNo ratings yet

- 14 Corporate Accounting - April May 2021 (Repeaters 2013-14 and Onwards)Document8 pages14 Corporate Accounting - April May 2021 (Repeaters 2013-14 and Onwards)premium info2222No ratings yet

- II PUC ACC REVISED POQs FOR 2022-23Document3 pagesII PUC ACC REVISED POQs FOR 2022-23Shree Lakshmi vNo ratings yet

- FAR MA-2023 QuestionDocument4 pagesFAR MA-2023 QuestionMd HasanNo ratings yet

- KL Taxtaion I May June 2012Document2 pagesKL Taxtaion I May June 2012asdfghjkl007No ratings yet

- CAF 1 FAR1 Autumn 2022Document6 pagesCAF 1 FAR1 Autumn 2022QasimNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- 5 6053042764831000707Document16 pages5 6053042764831000707SoNam ZaNgmoNo ratings yet

- Taxtion II Nov Dec 2014Document5 pagesTaxtion II Nov Dec 2014Md HasanNo ratings yet

- ALL Course Exit ExamDocument343 pagesALL Course Exit Examnaolmeseret22No ratings yet

- Workshop 2 - Questions - Introduction To Accounting and FinanceDocument7 pagesWorkshop 2 - Questions - Introduction To Accounting and FinanceSu FangNo ratings yet

- FM Assignment 4Document3 pagesFM Assignment 4Vundi RohitNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- CSS Accounting Papers-1Document2 pagesCSS Accounting Papers-1rabia khanNo ratings yet

- Account Model QuestionsDocument41 pagesAccount Model QuestionsPrerana NepaliNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Financial Management Semester II 2016 PatternDocument4 pagesFinancial Management Semester II 2016 PatternSwati DafaneNo ratings yet

- 8104 MbaexDocument3 pages8104 Mbaexgaurav jainNo ratings yet

- TAX PLANNING & COMPLIANCE - MA-2022 - QuestionDocument6 pagesTAX PLANNING & COMPLIANCE - MA-2022 - QuestionsajedulNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- Solution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Document10 pagesSolution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Shaindra SinghNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- FINANCIAL MANAGEMENT October 20172016 PatternSemester IIDocument4 pagesFINANCIAL MANAGEMENT October 20172016 PatternSemester IISwati DafaneNo ratings yet

- The Title of KingdomDocument6 pagesThe Title of KingdomKailash RNo ratings yet

- Financial Reporting II ACC 402/602, Section 1001-1002 Practice Exam 1Document12 pagesFinancial Reporting II ACC 402/602, Section 1001-1002 Practice Exam 1Joel Christian MascariñaNo ratings yet

- Zimbabwe School Examinations Council: General Certificate of Education Advanced Level 6001/3Document7 pagesZimbabwe School Examinations Council: General Certificate of Education Advanced Level 6001/3chauromweaNo ratings yet

- Acc TestDocument3 pagesAcc Testsk23skNo ratings yet

- 63 Question PaperDocument4 pages63 Question PaperSam NayakNo ratings yet

- November 2020 Insert Paper 31Document12 pagesNovember 2020 Insert Paper 31Shahmeer HasanNo ratings yet

- DA-Examination-JUNE-2020-Q-A (1) (1)Document215 pagesDA-Examination-JUNE-2020-Q-A (1) (1)Dickson PhiriNo ratings yet

- CP 123 PDFDocument4 pagesCP 123 PDFJoshi DrcpNo ratings yet

- Css Accountancy2 2018 PDFDocument2 pagesCss Accountancy2 2018 PDFMaria NazNo ratings yet

- MTP - Final - Syllabus 2016 - Dec 2019 - Set2: Paper 17-Corporate Financial ReportingDocument6 pagesMTP - Final - Syllabus 2016 - Dec 2019 - Set2: Paper 17-Corporate Financial ReportingBhupen SharmaNo ratings yet

- Question August 2010Document50 pagesQuestion August 2010zia4000No ratings yet

- Question CMA April 2019 SP Exam.Document4 pagesQuestion CMA April 2019 SP Exam.F A Saffat RahmanNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- (2008 Pattern) PDFDocument231 pages(2008 Pattern) PDFKundan DeoreNo ratings yet

- CO3CRT07 - Corporate Accounting I (T)Document5 pagesCO3CRT07 - Corporate Accounting I (T)shemymuhammad289No ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- Financial Management - II CA QPDocument4 pagesFinancial Management - II CA QPSivaramkrishna KasilingamNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Employees' Deposit Linked Insurance Scheme, 1976Document1 pageEmployees' Deposit Linked Insurance Scheme, 1976vaidehiNo ratings yet

- TuteDocument2 pagesTutekna123450% (2)

- First Mockboard-Correct Answer KeyDocument28 pagesFirst Mockboard-Correct Answer KeyWolfy PlayzNo ratings yet

- IIT-D EV BrochureDocument2 pagesIIT-D EV BrochureKarthick FerruccioNo ratings yet

- Schultz Company Prepares Interim Financial Statements at The End ofDocument1 pageSchultz Company Prepares Interim Financial Statements at The End ofFreelance WorkerNo ratings yet

- Taxation - Botswana (TX - Bwa) : Applied SkillsDocument20 pagesTaxation - Botswana (TX - Bwa) : Applied Skillsgajendra.naiduNo ratings yet

- Finals Tax301Document9 pagesFinals Tax301Pauline De VillaNo ratings yet

- Edli: Employees' Deposit Linked Insurance Scheme 1976Document7 pagesEdli: Employees' Deposit Linked Insurance Scheme 1976priyanka pinkyNo ratings yet

- Ey Global Payroll Operate 2021 UpdatedDocument498 pagesEy Global Payroll Operate 2021 UpdatedBelén De BlasisNo ratings yet

- Agreement Between Syrian Arab Republic andDocument15 pagesAgreement Between Syrian Arab Republic andOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Compute Taxable IncomeDocument5 pagesCompute Taxable IncomeShraddha TiwariNo ratings yet

- The Effect of Reward On EmployeeDocument64 pagesThe Effect of Reward On EmployeeSiyad GaleyrNo ratings yet

- Inbound 9210653396620867995Document37 pagesInbound 9210653396620867995bossfibeeNo ratings yet

- To, Shri P. K. Purwar, Chairman and Managing Director, Bharat Sanchar Nigam Limited, New DelhiDocument2 pagesTo, Shri P. K. Purwar, Chairman and Managing Director, Bharat Sanchar Nigam Limited, New DelhiY_AZNo ratings yet

- Flexible Benefit Plan - v1.17Document58 pagesFlexible Benefit Plan - v1.17Mukesh SinghNo ratings yet

- Revenue Administration in Tamil NaduDocument191 pagesRevenue Administration in Tamil NaduspsishivaNo ratings yet

- Sales - Brochure - LIC S New Money Back 25 Yrs PlanDocument11 pagesSales - Brochure - LIC S New Money Back 25 Yrs PlanShubham PandeyNo ratings yet

- CIT (1994) 207 ITR 252 (Bom) - With Regard To The Clubing of IncomeDocument13 pagesCIT (1994) 207 ITR 252 (Bom) - With Regard To The Clubing of IncomeShimran ZamanNo ratings yet

- Employment Offer LetterDocument2 pagesEmployment Offer Lettermike0% (1)

- How To Claim PIP 1Document10 pagesHow To Claim PIP 1luckyvales94No ratings yet

- Employee BenefitsDocument83 pagesEmployee BenefitsArlene Rose GonzaloNo ratings yet

- Rashmitha Information Systems Private Limited 32/C, SDF-1 Building, VSEZ Duvvada, Visakhapatnam - 530049Document3 pagesRashmitha Information Systems Private Limited 32/C, SDF-1 Building, VSEZ Duvvada, Visakhapatnam - 530049Uday Krishna DadiNo ratings yet

- CPAR Income Tax of Individuals (Batch 93) - HandoutDocument36 pagesCPAR Income Tax of Individuals (Batch 93) - HandoutJuan Miguel UngsodNo ratings yet

- SBR NotesDocument165 pagesSBR NotesMD SAIFUL ISLAMNo ratings yet

- Rent To OwnDocument3 pagesRent To OwnEfefiong Udo-NyaNo ratings yet

- D2 Accounting For LabourDocument13 pagesD2 Accounting For LabourNkatlehiseng MabuselaNo ratings yet

- Karan Peshwani-Payslip - Sep-2023Document1 pageKaran Peshwani-Payslip - Sep-2023Karan PeshwaniNo ratings yet