Professional Documents

Culture Documents

Charge On GST

Charge On GST

Uploaded by

KN NetworkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Charge On GST

Charge On GST

Uploaded by

KN NetworkCopyright:

Available Formats

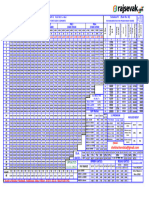

CHARGE OF GST

Sec 9(1) Sec 9(2) Sec 9(3) Sec 9(4) Sec 9(5)

HPMAN Levy of GST Reverse Charge - Electronic Commerce

Levy of GST Unregistered to Registerd Operator 17/2017

GST will be levied from the (Reverse Charge)

(Forward Charge) date it is notified by the notified supplies 4 Services Coverd

council 13/2017 (1 supply) THAR

18 Services

On which type of supply ? High speed diesel 1. An Insurance Agent T H A R

2. Recovery Agent Construction Service

Intra State Petroleum crude Transporatation Housekeeping Accomodation Restaurant

Motor Spirit 3.DSA

Aviation turbine 4.Business Facilitators

Natural Gas 5. An agent of Business

Correspondent

Levied on ? 6.GTA Normal Goods Cement and Captial

ECO is liable to pay GST ECO is liable to pay GST ECO is liable to pay GST From specified premies Other person

All goods except liquor (Steel, rods) Goods

7.Legal services

(Senior advocate and individual

)

8. Arbitral tribunal

On which amount ? 9.Music composer Incase 80% or more goods Incase purchase from If turnover of supplier If turnover of supplier

80% concept doesnt apply Even if turnover of Hotel rent more than 7500

Value of supply are purchased from registered person is less doesnt exceed limit u/s doesnt exceed limit u/s ECO is liable to pa

Photographer RCM shall be paid on full supplier exceeds the limit per day

(Sec 15) registered person than 80% 22(1) 22(1)

Artist value from the purchase

made from the

10. Author unregistered person

11. Security Services

Maximum Rate ? 12. Government services RCM is applicable on If turnover of sup

9 (4) doesnt applicable

20% CGST 13. Renting of Motor Vechicle the short fall amount 9(5) is not applicable doesnt exceed lim

Forward charge 22(1)

(overall 40%) 14.Lending of Securities to 80 %

15.Transfer of developmental

rights

who will fix the rate ? 16. Long term Lease

1. Recommendation by 17. Dirctors Hotel liable to pay GST

GST council FCM

18. Sponsorship

2. Notification - Cental Gvt

Who should pay?

Taxable person under

forward charge

Section

4. 9(c)

Conditio

2. Busines 10.Servi 11.

n 6.GTA 7. Legal 13. Renting

Insurance agentRecover 3. DSA s 5. Service 8.Services ces of Security 14. Lending of securities Sponsorship services

Goods Services 9.Services By of motor 15. Transfer of 16. Long term 12.

Receipent y Agent

1. Condition Facilitat

Condition by agent of GTA services By Arbitral AuthorFCM if Services

Condition 17. Directors

Transpo Senior junior Music composer Generall folllowi vehicle development Lease Services

has to pay Service or to business tribunall Receipie

1. Service to 1. Service Other than 6% Advocat advocat FCM RCM rights

GST to correspond rt /Phtotgraphers/ y RCM ng1. Authoris a 1. Nature of nt By Govt

bank,NBFI, bank,NBFI, Agency CGST + 6% SGST) Body e Fellow Body e Busines registered suppliers RCM ( If following

bank,NB ent conditio Normall Body

RCM Financial Financial Transpo Persona Governm Fellow

PY s Entity PY Employ artisst conditions are Independent Other other (

FI, does not corpora

ent

Advocat corporate, Advocate ns person 2. y RCM is more directors corporate/fir

Example instituitions instituitions Condition rter Register PY te PY l or PY e Personal / ee satisfied) Promoter director individual PAT Renting

Financia issue To PY Always turnove Turnove Not satisfied Regestratio m Other

NoLIC 1. Serivce to issues ed Turnove Turnove criminal Exempt Turnove Turnover Original RCM than 35 yrs

l 2. Nature of 2. Bank ,NBFI consignme Unregist criminal, Exempted r r Doent Non original n of services(Police)

Conditio Receipe consign person case ed 2. File declaraion Renumerati Located Located

instituiti DSA ect...Branch bank or Main nt note ered r limit is r Doesnt r limit is Doesnt Government irrespective exceeds Exceed Busines Work

work receipet 1. Supplier - Not a body Not covered FCM Registered Unregistered

ns Bank nt Branch ment exceede Recipie Recipie to GST officer - corporate on declared Renumeration is in indua outside under 13/17

ons Others DSA correspondent Person RCM exceede Exempt exceede exceeded Same as of PY limit limit s Entity Supplier Not treated as

NBFC area Agent to note d d d RCM nt in nt FCM To pay GST emplyee as salary in not declared as indian RCM

(Car LLP,firm,bo Rural Business undertakes Doesnt Other Exempt ed Exempt Senior turnover FCM 2. Supplier doesnt RCM

Individu Urban business Person Eg.Gene RCM India outside under FCM Body the books salary RCM FCM

Financia dy Area correspo the risk undertake ed RCM ed Advcate Exempt charge GST @12% FCM

dealer) al Agent Area correspond specifie india Corpora Others FCM

l corporate mdent to relating to the risk ral ed RCM Exmpted

FCM Branch

Exempt ent d under Public te 3. Recipient - Body

Instituiti Bank transportati FCM 3.Cant withdraw RCM RCM If P.Y Turnover

RCM FCM ed RCM Rural Urban relating to 1. Factory

note If Recipient Corporate

ons on Exem the option for 1 FCM exceeds

RCM 12/2017 BANK is Urban Rural area area transportatio 13/2017 is

FCM 2. Society pted yr from the date 4.cost of fuel is included registration

Area area Exempt RCM n Register Unregistere

liable to GTA of option in the value limit and value

Busines Exempt ed 3. Co ed d

pay BC is Not a exeeds 5000

s operative

ed liable to Taxable GTA Society

in FY

Corresp RCM FCM

pay GST RCM Exempt 4. Make

ondent 4.

is liable ed declaration in

12/17 Company invoice issued to

to pay

GST 5. Firm,LLp pilisher

AOP

6. Casual

TAXABLE

taxable

RCM

person

Registration

is

complusory

You might also like

- Bangladesh Bank Circular - FinalDocument2 pagesBangladesh Bank Circular - Finalmaka007No ratings yet

- EC1 Experiential Learning Report For MBAZC415 Financial and Management AccountingDocument51 pagesEC1 Experiential Learning Report For MBAZC415 Financial and Management Accountingkarunakar vNo ratings yet

- Financial Management:: Understanding Financial Statements, Taxes, and Cash FlowsDocument102 pagesFinancial Management:: Understanding Financial Statements, Taxes, and Cash FlowsArgem Jay PorioNo ratings yet

- Annex G Work Program - Osec Fms Form No. 3 As of .141 Lamitan CityDocument3 pagesAnnex G Work Program - Osec Fms Form No. 3 As of .141 Lamitan CityGayeGabriel100% (1)

- Price List SonetDocument1 pagePrice List SonetRishiNo ratings yet

- (Package 2 - Pec-Dcsm) NSRP Daily Progress Report - 201910 - 23Document21 pages(Package 2 - Pec-Dcsm) NSRP Daily Progress Report - 201910 - 23duyanhNo ratings yet

- Adobe Scan 29-Dec-2020Document1 pageAdobe Scan 29-Dec-2020hemanthNo ratings yet

- 165-4-BQE-002, Rev.C0Document6 pages165-4-BQE-002, Rev.C0Muhmmad udassirNo ratings yet

- Sec 5 - Final As-Built Submission Tracker As of 25.5 2022 (To Subcon)Document51 pagesSec 5 - Final As-Built Submission Tracker As of 25.5 2022 (To Subcon)Hazim AffendiNo ratings yet

- Sec 5 - Final As-Built Submission Tracker As of 18.5 2022 (To Subcon)Document47 pagesSec 5 - Final As-Built Submission Tracker As of 18.5 2022 (To Subcon)Hazim AffendiNo ratings yet

- Govt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2020-21Document9 pagesGovt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2020-21Nihit SandNo ratings yet

- Incometax Calculation 2022 23 For MobileDocument10 pagesIncometax Calculation 2022 23 For Mobileanuj palNo ratings yet

- Total Invoice - State Code-09 State Code-09: - Pan No. ADIPY2538ADocument1 pageTotal Invoice - State Code-09 State Code-09: - Pan No. ADIPY2538Aramroshan712No ratings yet

- Technical Note: Service Factor (SF) Calculation of Inertia Moment I GD Flywheel EffectDocument1 pageTechnical Note: Service Factor (SF) Calculation of Inertia Moment I GD Flywheel EffectNan OoNo ratings yet

- Tank Activity LogDocument5 pagesTank Activity Logdada khalandarNo ratings yet

- Pricing ScheduleDocument1 pagePricing ScheduleKano MolapisiNo ratings yet

- Notification No.1 2009 - Service TaxDocument1 pageNotification No.1 2009 - Service Taxmanoj kumarNo ratings yet

- MRR Package 20 July 2019Document18 pagesMRR Package 20 July 2019K KARTHIKNo ratings yet

- Innova Hycross Pricelist-3Document1 pageInnova Hycross Pricelist-3Kiran ThakkarNo ratings yet

- Annexure 12Document5 pagesAnnexure 12Ramesh-NairNo ratings yet

- April28-30 DifferentialDocument1 pageApril28-30 DifferentialPraise BuenaflorNo ratings yet

- Income Tax Calculation 2022 2023Document9 pagesIncome Tax Calculation 2022 2023GungamerNo ratings yet

- List of Advertised Locations TNDocument10 pagesList of Advertised Locations TNRed LubricantsNo ratings yet

- Sensitivity: LNT Construction Internal UseDocument5 pagesSensitivity: LNT Construction Internal UseAnjum JauherNo ratings yet

- Vsup2-0511 (Vi) Wac 01Document12 pagesVsup2-0511 (Vi) Wac 01JENNNo ratings yet

- HPC h2 Andhra Pradesh 24-11-18Document30 pagesHPC h2 Andhra Pradesh 24-11-18ravindra reddy MoraNo ratings yet

- Forest ApprenticeDocument77 pagesForest ApprenticeTopRankersNo ratings yet

- CRSI Summary Claim & Technical Data 20210323154154Document3 pagesCRSI Summary Claim & Technical Data 20210323154154jefry sitorusNo ratings yet

- Irp AcDocument2 pagesIrp Acjpharley603No ratings yet

- LPMTDocument15 pagesLPMTflomoutonNo ratings yet

- Sprint ReinhartDocument60 pagesSprint Reinhartdeni rytmheNo ratings yet

- Govt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2021-22Document8 pagesGovt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2021-22Nitesh YNo ratings yet

- $R3691Q7Document2 pages$R3691Q7IT IIPRDNo ratings yet

- Chapter 3 - RCMDocument14 pagesChapter 3 - RCMMohit Jain100% (1)

- Progress Monitoring Summary Report in Connection With Payment of Instalment To Contractors (Dmcs/Ngos/Entities)Document10 pagesProgress Monitoring Summary Report in Connection With Payment of Instalment To Contractors (Dmcs/Ngos/Entities)Vikinguddin AhmedNo ratings yet

- Eng-27 For ACDocument5 pagesEng-27 For ACABBAS KHANNo ratings yet

- SPS-19 After Balance QtyDocument2 pagesSPS-19 After Balance QtyAbhishek BhandariNo ratings yet

- Anwar Invoice 1Document4 pagesAnwar Invoice 1Unni KrishnanNo ratings yet

- Addl - Pay Bill of Officer From 09-08-2019 To 23-10-2019 Sircila Court.Document20 pagesAddl - Pay Bill of Officer From 09-08-2019 To 23-10-2019 Sircila Court.SRINIVAS MOGILINo ratings yet

- MDR Pipeline Segment 4 & 5 - 23 September 2021Document7 pagesMDR Pipeline Segment 4 & 5 - 23 September 2021Dheska AgungwNo ratings yet

- Sec 5 - Final As-Built Submission Tracker As of 13 Apr 2022Document54 pagesSec 5 - Final As-Built Submission Tracker As of 13 Apr 2022Hazim AffendiNo ratings yet

- SPH Erection Piping System Rev 2-2-5Document4 pagesSPH Erection Piping System Rev 2-2-5dony ramdhani100% (2)

- New Proforma Progress ReportDocument5 pagesNew Proforma Progress ReportinsafaNo ratings yet

- Begfthahatgreánd, Auality: OsurugramDocument1 pageBegfthahatgreánd, Auality: OsurugramR ChandruNo ratings yet

- Pay Chart NewDocument1 pagePay Chart Newveenushreya2012No ratings yet

- Financial Status Till March-2023 All ProjectsDocument1 pageFinancial Status Till March-2023 All ProjectsFAISAL Shahzad KhokharNo ratings yet

- Merit NoDocument1 pageMerit NoKottapalli Sundar mahesh (RA1811034010048)No ratings yet

- MRR Govt 300 July Go Report.Document8 pagesMRR Govt 300 July Go Report.K KARTHIKNo ratings yet

- TransmittalForm-CM16 - 10-7-20 - v508 - 101420 Submittals For NPSDocument2 pagesTransmittalForm-CM16 - 10-7-20 - v508 - 101420 Submittals For NPSLiliana PatiñoNo ratings yet

- Tamil Nadu Public Service CommissionDocument28 pagesTamil Nadu Public Service Commissionஅம்ரீNo ratings yet

- HYCROSS PRICE LIST 1 MARCH 2023Document1 pageHYCROSS PRICE LIST 1 MARCH 2023Raman AgarwalNo ratings yet

- D089110692 14672067237399333 SchedulescDocument2 pagesD089110692 14672067237399333 SchedulescHeramb SharmaNo ratings yet

- Appendix 20 - Sabudb - Far 2Document1 pageAppendix 20 - Sabudb - Far 2pdmu regionixNo ratings yet

- Progress Report - 01.04.2021-31.03.2022Document145 pagesProgress Report - 01.04.2021-31.03.2022rahmangisNo ratings yet

- Cloud Controls Matrix (CCM) R1.2: Architectural Relevance Corp Gov RelevanceDocument11 pagesCloud Controls Matrix (CCM) R1.2: Architectural Relevance Corp Gov RelevanceKalyanaraman JayaramanNo ratings yet

- E& I RFI Schedule: Jizan Refinery & Marine Terminal Project (Epc-Package 14)Document1 pageE& I RFI Schedule: Jizan Refinery & Marine Terminal Project (Epc-Package 14)sadik coolsadyNo ratings yet

- 9686-PO0025-CPP-PL-001 - Honeywell Reply Confirmance For PL 26-Dec-2020 - CPPE ReplyDocument2 pages9686-PO0025-CPP-PL-001 - Honeywell Reply Confirmance For PL 26-Dec-2020 - CPPE ReplyANIL PLAMOOTTILNo ratings yet

- 2018 Kia Stinger 2.0L Eng VIN A BaseDocument161 pages2018 Kia Stinger 2.0L Eng VIN A BaseData TécnicaNo ratings yet

- RUBY GRAND 4200 - PRICE LIST - REV - 16 16-10-14 - LatestDocument24 pagesRUBY GRAND 4200 - PRICE LIST - REV - 16 16-10-14 - LatestAnshul KumarNo ratings yet

- Collection ReportDocument1 pageCollection ReportStepinconsultancy NamchettyNo ratings yet

- MONITORING TRAINING 2024Document6 pagesMONITORING TRAINING 2024Muhammad DzakyNo ratings yet

- Bankinng PPT - PPTMDocument19 pagesBankinng PPT - PPTMKeshav ThadaniNo ratings yet

- Capital Budgeting 1Document8 pagesCapital Budgeting 1Alyssa Gabrielle SamsonNo ratings yet

- StatementOfAccount 9Document4 pagesStatementOfAccount 9brapayne4No ratings yet

- Value Creation in Global Apparel Industry: Assignment 1Document11 pagesValue Creation in Global Apparel Industry: Assignment 1Shivi Shrivastava100% (1)

- Top Business Books of All TimeDocument5 pagesTop Business Books of All Timechandel08No ratings yet

- COA CIRCULAR NO. 2023 008 August 17 2023Document14 pagesCOA CIRCULAR NO. 2023 008 August 17 2023Leah FlorentinoNo ratings yet

- Supply Chain Management 1Document26 pagesSupply Chain Management 1taraka krishna kishoreNo ratings yet

- Transfer Taxes: Atty. Kim M. Aranas Faculty, USC-SOLGDocument61 pagesTransfer Taxes: Atty. Kim M. Aranas Faculty, USC-SOLGethel hyugaNo ratings yet

- Hassellhouf Company S Trial Balance at December 31 2015 Is PresentedDocument1 pageHassellhouf Company S Trial Balance at December 31 2015 Is Presentedtrilocksp SinghNo ratings yet

- Taxation Law ProjectDocument15 pagesTaxation Law Projectraj vardhan agarwalNo ratings yet

- Old MembersDocument50 pagesOld MemberssNo ratings yet

- Kingfisher CaseDocument8 pagesKingfisher CaseBizEasy AdvisorsNo ratings yet

- Tiffany Goldstein ReceiptDocument19 pagesTiffany Goldstein ReceiptAllan AbadNo ratings yet

- Samanvaya Law & PartnersDocument6 pagesSamanvaya Law & PartnersROHIT YADAVNo ratings yet

- 365.81.97-CX Dated 15.12.97Document18 pages365.81.97-CX Dated 15.12.97taxrecoverycell25No ratings yet

- Ebook Hotel Performance MetricsDocument14 pagesEbook Hotel Performance Metricsanon_694720079No ratings yet

- NRI News Letter From SBI Thiruvananthapuram CircleDocument5 pagesNRI News Letter From SBI Thiruvananthapuram CircleDev RajNo ratings yet

- Sales Management-Chapter 1Document18 pagesSales Management-Chapter 1Ashik PaulNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership LiquidationMonica MangobaNo ratings yet

- Mepco Online BillDocument1 pageMepco Online BillSajid AliNo ratings yet

- AO Code Search For TANDocument1 pageAO Code Search For TANSubhashis DasNo ratings yet

- 3 Waas Presentation Slide DeckDocument26 pages3 Waas Presentation Slide Decktuborg2011No ratings yet

- MKT Report DigiMartDocument63 pagesMKT Report DigiMartSabrina RahmanNo ratings yet

- Predicting The Success of Mergers and Acquisitions in Manufacturing Sector in India: A Logistic AnalysisDocument30 pagesPredicting The Success of Mergers and Acquisitions in Manufacturing Sector in India: A Logistic AnalysisShoury AnandNo ratings yet

- CarmelaDocument2 pagesCarmelaCatherine PardoNo ratings yet

- FIFO and WA PROCESS COSTINGDocument20 pagesFIFO and WA PROCESS COSTINGSymon AngeloNo ratings yet

- Revenue Terms (Rohit Karwasra)Document10 pagesRevenue Terms (Rohit Karwasra)C kNo ratings yet