Professional Documents

Culture Documents

CCRC SM Section 1.F

CCRC SM Section 1.F

Uploaded by

Salomao DelfinoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CCRC SM Section 1.F

CCRC SM Section 1.F

Uploaded by

Salomao DelfinoCopyright:

Available Formats

Section 1.F.

Financial Planning and Management

F. Financial Planning and 1.F. 2. Budgets are prepared:

2.F. Financial Mgmt

Management 2.a.F. Financial Mgmt

a. Prior to the start of the fiscal year.

b. That:

2.b.F. Financial Mgmt

Description (1) Include:

2.b.(1)F. Financial Mgmt

CARF-accredited organizations strive to be (a) Reasonable projections of:

2.b.(1)(a)F. Financial Mgmt

financially responsible and solvent, conducting (i) Revenues.

2.b.(1)(a)(i)F. Financial Mgmt

fiscal management in a manner that supports (ii) Expenses.

2.b.(1)(a)(ii)F. Financial Mgmt

their mission, values, and annual performance (iii) Capital expenditures.

objectives. Fiscal practices adhere to established 2.b.(1)(a)(iii)F. Financial Mgmt

(b) Input from various stake-

accounting principles and business practices. holders, as required.

Fiscal management covers daily operational 2.b.(1)(b)F. Financial Mgmt

(c) Comparison to historical

cost management and incorporates plans for performance.

long-term solvency. 2.b.(1)(c)F. Financial Mgmt

(d) Consideration of necessary

cash flow.

1.F. 1. The organization’s financial planning and 2.b.(1)(d)F. Financial Mgmt

(e) Consideration of external

management activities are designed to

environment information.

meet: 2.b.(1)(e)F. Financial Mgmt

1.F. Financial Mgmt (2) Are disseminated, as appropriate,

a. Established outcomes for the persons

to:

served. 2.b.(2)F. Financial Mgmt

1.a.F. Financial Mgmt

(a) Personnel.

b. Organizational performance 2.b.(2)(a)F. Financial Mgmt

objectives. (b) Other stakeholders.

2.b.(2)(b)F. Financial Mgmt

1.b.F. Financial Mgmt

(3) Are:

Examples 2.b.(3)F. Financial Mgmt

(a) Written.

Strategic planning and financial planning are 2.b.(3)(a)F. Financial Mgmt

(b) Approved by the identified

integrated to ensure that initiatives or changes

authority.

in programs are adequately funded or supported 2.b.(3)(b)F. Financial Mgmt

to maximize success. Examples

1.a. This may tie to Section 1.M. Performance The annual budget can reflect projected income

Measurement and Management. See Standard and expenses. Input from professional and

1.M.6. related to service performance indicators administrative personnel in budget development

such as efficiency, effectiveness, access, and may demonstrate the organization’s intent to

satisfaction. anticipate its fiscal needs.

1.b. The organization’s performance objectives Input from persons served can be gathered by

may include, but are not limited to areas of a variety of means. For example:

potential financial risk such as reductions in ■ Formal meetings to discuss the budget.

funding or new regulations that might impact ■ Informally, via ongoing conversations

services or expand the population to be served. with staff.

This may tie to Standard 1.M.3. related to setting

■ Through participation on the board or

and measuring performance indicators for busi-

advisory groups.

ness function improvement.

2.b.(3)(b) Approval of the budget could be

conducted by an owner, executive leadership,

governing board, or other authority. If an

organization is dependent on funding from

an external entity’s budget which has not been

finalized prior to the beginning of the fiscal year,

2016 Continuing Care Retirement Community Standards Manual 59

Section 1.F. Financial Planning and Management

an organization may adopt a provisional budget Management information can include items such

until the final budget is approved for the year. as:

■ Amount of time it takes to sell or lease a

1.F. 3. Actual financial results are: vacant unit.

3.F. Financial Mgmt

a. Compared to budget. ■ Percentage of private pay versus Medicare/

3.a.F. Financial Mgmt

b. Reported, as appropriate, to: Medicaid or pay from other public funds.

3.b.F. Financial Mgmt

(1) Personnel. An organization might benefit from knowing

3.b.(1)F. Financial Mgmt

(2) Persons served. how sensitive it is to a variety of issues and how

much of a drop in certain areas of revenue can

3.b.(2)F. Financial Mgmt

(3) Other stakeholders.

3.b.(3)F. Financial Mgmt

c. Reviewed at least monthly. occur before it begins to lose cash, possibly

3.c.F. Financial Mgmt

leading to a default on debt repayment. For

Examples example, how low can persons served census

3.c. The monthly review of actual financial from a certain payer source become before the

results may be conducted by program manage- decline causes the organization stress in cash

ment, finance staff, or the governing board. flow or with meeting the terms of debt.

An organization might develop a remediation

1.F. 4. The organization identifies and reviews, plan to determine underlying causes of the

at a minimum: decline in number of persons served through

a variety of means, which might include reassess-

4.F. Financial Mgmt

a. Revenues.

4.a.F. Financial Mgmt

b. Expenses. ing the performance of the liaisons to referring

4.b.F. Financial Mgmt

hospitals, community-based providers, and

c. Internal:

4.c.F. Financial Mgmt referring physicians; conducting a survey of past

(1) Financial trends. persons served; or conducting a competitive

4.c.(1)F. Financial Mgmt

(2) Financial challenges. analysis to determine if the census decline is

4.c.(2)F. Financial Mgmt

(3) Financial opportunities. widespread or only at one organization.

4.c.(3)F. Financial Mgmt

(4) Management information. A remediation plan could identify strategies to

4.c.(4)F. Financial Mgmt

d. External: increase the number of persons served through

strategies such as advertising and/or senior

4.d.F. Financial Mgmt

(1) Financial trends.

4.d.(1)F. Financial Mgmt

(2) Financial challenges. management meetings with referring hospitals,

4.d.(2)F. Financial Mgmt

physicians, or other referral sources to ensure

(3) Financial opportunities.

4.d.(3)F. Financial Mgmt that they are informed about the services offered

(4) Industry trends. by the organization.

4.d.(4)F. Financial Mgmt

e. Financial solvency, with the dev-

An organization can demonstrate that consider-

elopment of remediation plans

ation of these items occurs through meeting

if appropriate.

4.e.F. Financial Mgmt

minutes or other type of document.

Examples 4.c. Key metrics can include census and

External events that have a financial impact on utilization.

the organization can include items such as: 4.e. Financial solvency could be described as the

■ Changes in reimbursement rates. ability of an organization to meet its financial

■ Competition in the marketplace. obligations, long-term expenses, and to accom-

plish long-term expansion and growth.

■ Changes in consumer preferences.

■ Interest rates and the availability of financing.

1.F. 5. If the organization has related entities,

■ Regulatory and legislative changes.

it identifies:

5.F. Financial Mgmt

a. The types of relationships.

5.a.F. Financial Mgmt

b. Financial reliance on related entities.

5.b.F. Financial Mgmt

60 2016 Continuing Care Retirement Community Standards Manual

Section 1.F. Financial Planning and Management

c. Responsibilities between related enti- reasonable person relying on that information

ties and the organization, including: would have been changed or influenced by the

omission or misstatement. When used in finance,

5.c.F. Financial Mgmt

(1) Legal.

5.c.(1)F. Financial Mgmt

(2) Contractual. it refers to the magnitude of the financial impact

5.c.(2)F. Financial Mgmt

on an organization. If the magnitude of the items

(3) Other.

5.c.(3)F. Financial Mgmt relative to the whole organization is significant,

d. Any material transactions. then it is material. For example, a company with

5.d.F. Financial Mgmt

Intent Statements $2,000 of total assets has $1,000 worth of invest-

Full disclosure of relationships demonstrates an ments, the investment is material. A $1,000

organization’s commitment to excellence and impact on a $500 million total asset corporation

transparency. The organization discloses infor- is immaterial.

mation to persons served and other stakeholders

that explains its assets and liabilities, reflects the 1.F. 6. The organization:

position and responsibilities of any parent or 6.F. Financial Mgmt

a. Implements fiscal policies and pro-

sponsoring organizations, and discloses any

cedures, including internal control

material and legal relationships with other

practices.

entities. 6.a.F. Financial Mgmt

b. Provides training related to fiscal

Examples policies and procedures to appro-

Organizations often form strategic relationships priate personnel including:

with other entities to share financial and non-

6.b.F. Financial Mgmt

(1) Initial training.

financial resources or to guarantee debt. At times, 6.b.(1)F. Financial Mgmt

(2) Ongoing training.

organizations benefit from a third party revenue 6.b.(2)F. Financial Mgmt

source. The relationship of this revenue source Intent Statements

and the risks or value of this relationship should To reduce risk, it is important that the organi-

be disclosed. zation, regardless of size, establish who has

Examples of relationships include: responsibility and authority in all financial activi-

ties, such as in purchasing materials and capital

■ Parent-subsidiary structures.

equipment, writing checks, making investments,

■ Affiliations. and billing.

■ Alliances.

Examples

■ Guarantees. Written internal controls provide management

■ Limited partnerships. with some assurance that information provided

■ Other third-party operating support. by the accounting system is reliable and timely;

therefore, an auditor’s report on internal control

■ Material contracts such as food services,

is not a substitute for an organization having

pharmacy, and therapy.

internal control procedures.

Disclosure of these relationships can be

accomplished through:

■ Audited financial statements.

■ Annual reports distributed to residents

and persons served.

■ Marketing materials.

■ Tax report filings.

5.d. Material, when used in accounting, is

defined as the magnitude of an omission or

misstatement of accounting information that

makes it probable that the judgment of a

2016 Continuing Care Retirement Community Standards Manual 61

Section 1.F. Financial Planning and Management

services, the cost of delivering service, and the

1.F. 7. If the organization bills for services local market.

provided, a review of a representative

sampling of records of the persons CCRCs can use a variety of techniques to

served is conducted: determine fees, including actuarial studies and

7.F. Financial Mgmt

financial analyses. For example, CCRCs may use

a. At least quarterly.

7.a.F. Financial Mgmt actuarial studies with mortality and morbidity

b. To: tables to assess the likely inflow, outflow, and

7.b.F. Financial Mgmt

(1) Document that dates of services turnover of CCRC residents. Other CCRCs

provided coincide with billed might use some combination of resident statis-

episodes of care. tics, government reimbursement rates, marketing

7.b.(1)F. Financial Mgmt

(2) Determine that the bills accu- data, and operating costs. While CARF does not

rately reflect the services that require CCRCs to use actuarial studies, they may

were provided. be required as part of financial feasibility studies

7.b.(2)F. Financial Mgmt

(3) Identify necessary corrective necessary in the CCRC licensing process. Actuar-

action. ial studies can be a useful tool for CCRCs that

7.b.(3)F. Financial Mgmt

offer contracts which incur long-term liabilities

Intent Statements

such as guaranteeing health care services over the

Determining that billing statements match long term.

service information in the records of the persons

8.b. The organization may demonstrate this in

served is a proactive method for an organization

to help reduce or eliminate costly audit excep- different ways. It might include dates on docu-

tions. This review and corresponding corrective ments, mention this activity in meeting minutes,

action will assist in that process. various staff could discuss how this process

occurred, etc.

Refer to the Glossary for the definition of repre-

sentative sampling. 8.b.(2) Comparison of fee schedules could be

with what it has charged before and what new

analysis might show is needed; it could be com-

1.F. 8. The organization, if responsible for fee

paring to fee schedules from the funding source

structures:

8.F. Financial Mgmt or other organizations. It does not require that it

a. Identifies the basis of the fee be external to the organization.

structures.

8.a.F. Financial Mgmt 8.c. These may be called unfunded services, or

b. Demonstrates:

8.b.F. Financial Mgmt

services that include the beauty shop, meals, tuck

(1) Review of fee schedules. shop, country store, cafe, car ports, or covered

8.b.(1)F. Financial Mgmt

(2) Comparison of fee schedules. parking spaces. While disclosure in writing is

8.b.(2)F. Financial Mgmt

(3) Modifications when necessary. not required, it may be useful to provide written

disclosure to persons served.

8.b.(3)F. Financial Mgmt

c. Discloses to the persons served all

fees for which they will be

8.c.F. Financial Mgmt

responsible. 1.F. 9. If the organization takes responsibility

Intent Statements

for the funds of persons served, it imple-

ments written procedures that define:

An accountable organization assists the persons 9.F. Financial Mgmt

served in understanding the fee structure and a. How the persons served will give

whether there might be any additional charges informed consent for the expenditure

to the individual. of funds.

9.a.F. Financial Mgmt

b. How the persons served will access

Examples

the records of their funds.

On a regular basis, the organization can evaluate 9.b.F. Financial Mgmt

c. How funds will be segregated for

its current fee structure to ensure that the fees accounting purposes.

are adjusted as necessary to reflect changes in 9.c.F. Financial Mgmt

62 2016 Continuing Care Retirement Community Standards Manual

Section 1.F. Financial Planning and Management

d. Safeguards in place to ensure that applied to financial data. It is substantially less

funds are used for the designated in scope than an examination using generally

and appropriate purposes. accepted auditing standards. Typically, a review

9.d.F. Financial Mgmt

e. How interest will be credited to the will result in a report expressing limited assurance

accounts of the persons served, that there are not material modifications that

unless the organization is subject should be made to the statements.

to guidelines that prohibit interest- As part of a compilation engagement, an

bearing accounts. accountant will compile the financial statements

9.e.F. Financial Mgmt

based on management representations without

f. How monthly account reconciliation

expressing any assurance on the statements. A

is provided to the persons served.

9.f.F. Financial Mgmt compilation will not meet this standard.

Examples

Examples

This standard applies if the organization serves

The scope of this independent examination may

as a representative payee for the persons served,

vary based on the accounting requirements to

is involved in managing the funds of the persons

which the organization is subject. It may be a full

served, receives benefits on behalf of the persons

audit or a review. The CPA, chartered accountant,

served, or temporarily safeguards funds or

or similar accountant retained must be indepen-

personal property for the persons served.

dent of the organization and may not represent

These may be referred to as Trust Accounts.

the organization’s funding sources or be a mem-

ber of the governance authority.

1.F. 10. There is evidence of an annual review For a governmental entity, this standard may be

or audit of the financial statements of

met by review within its own system of oversight.

the organization conducted by an inde-

pendent accountant authorized by the

appropriate authority. 1.F. 11. If the review or audit generates a

10.F. Financial Mgmt

management letter, the organization:

Intent Statements 11.F. Financial Mgmt

a. Provides the letter during the survey

An accountant authorized by the appropriate for review.

authority means a CPA in the United States; 11.a.F. Financial Mgmt

b. Provides management’s response,

in countries outside the United States, the

including corrective actions taken or

terminology for a similar accountant qualified

reasons why corrective actions will

to conduct a review or audit would be used.

not be taken.

It is important for the organization to determine 11.b.F. Financial Mgmt

that its financial position is accurately repre-

sented in its financial statements. Accountants

may typically undertake three types of engage- 1.F. 12. If the organization has a financial audit,

ments: audit, review, and compilation. Each is it is completed within 120 days of fiscal

described in more detail below, but in summary, year end.

the audit is the most extensive effort and accord- 12.F. Financial Mgmt

Examples

ingly the highest cost to the organization.

An audit requires an examination of the financial An organization may demonstrate conformance

statements in accordance with generally by sharing the cover letter that is received from

accepted auditing standards, including tests the auditing firm.

of the accounting records and other auditing

procedures as necessary. An audit will result in a Long-Term Financial Planning

report expressing an opinion as to conformance CCRCs are complex organizations that often rely

of the financial statements to generally accepted on a variety of revenue sources. Some CCRCs

accounting principles. offer a resident contract that includes prepaid

A review consists principally of inquiries of healthcare. Prudent financial management

company personnel and analytical procedures requires these organizations to have financial

2016 Continuing Care Retirement Community Standards Manual 63

Section 1.F. Financial Planning and Management

analysis and planning skills in order to monitor the average of three years of financial ratios

their financial operations, liquidity, and the capi- data for the purpose of determining a level of

tal structure of the organization, and to translate conformance:

their analysis into financial plans that will ensure ■ 13.a.(1) Net operating margin ratio

the long-term solvency of the organization. ■ 13.a.(2) Total excess margin ratio

■ 13.a.(3) Operating ratio

1.F. 13. The organization addresses: ■ 13.b. Days cash on hand ratio

13.F. Financial Mgmt

a. Margin/profitability, including:

13.a.F. Financial Mgmt

■ 13.c.(1) Cash to debt ratio

(1) Revenue and expenses related

■ 13.c.(2) Debt service coverage ratio

to the persons served.

13.a.(1)F. Financial Mgmt

(2) Earnings related to businesses Effective asset/liability (balance sheet) manage-

not directly related to the per- ment is a key to an organization’s long-term

survival. It ensures that funds are available to

sons served (ancillary revenue)

meet strategic objectives; to replace, renovate,

and third-party sources of

or expand current facilities; and to meet the

revenue, such as contributions,

contractual obligations of residents and persons

investment income, and financial

served.

support from a third party.

13.a.(2)F. Financial Mgmt

(3) Expense management. Examples

13.a.(3)F. Financial Mgmt

b. Liquidity. NOTE: Organizations submit audited financial

13.b.F. Financial Mgmt

statements and Ratio Pro for their most current

c. Capital structure to ensure:

13.c.F. Financial Mgmt fiscal year end with the survey application. If the

(1) Financial flexibility. organization has more current audited financial

13.c.(1)F. Financial Mgmt

(2) Ability to meet the needs of statements available once the survey has been

persons served and other scheduled, the most current audited financial

stakeholders. statements and updated Ratio Pro should be

13.c.(2)F. Financial Mgmt

d. Use of financial ratio information. submitted for use in assessing conformance to

13.d.F. Financial Mgmt

e. Bond covenant compliance, if your accreditation standards during the survey. CARF

organization has bond covenants must receive the more current audited financial

statements and updated Ratio Pro at least two

that must be met.

13.e.F. Financial Mgmt weeks prior to the start of the on-site survey in

Intent Statements order to be considered for inclusion.

Financially savvy organizations analyze the NOTE: If CARF does not receive more current audited

various revenue and expense components of the financial statements two weeks prior to the survey,

net income in order to make informed decisions. the financial statements submitted with the Appli-

They understand the revenues/expenses associ- cation will be used to determine conformance to the

ated solely with the delivery of services to standards during the survey.

residents and other persons served. They identify Refer to the annual publication Financial Ratios

their financial reliance on nonresident income, & Trend Analysis of CARF–Accredited Continuing

such as contributions, investment earnings, and

Care Retirement Communities, Chapter 2. Margin

auxiliary income (earned from services not

(Profitability) Ratios for assistance in analyzing

related to delivery of services to residents, such

your organization’s margin (profitability). Ratio

as space rental and catering services). They must

Pro has five margin/profitability ratios that will

also understand their dependence on third-party

funding sources necessary for them to meet their assist in your analysis:

obligations to residents. ■ Operating Margin Ratio

For CCRC programs, conformance with these ■ Operating Ratio

standards is determined by the organization’s ■ Total Excess Margin Ratio

financial ratios calculated from the audit

■ Net Operating Margin Ratio

report for the most recent fiscal year. These

financial ratios are then benchmarked against ■ Net Operating Margin—Adjusted Ratio

64 2016 Continuing Care Retirement Community Standards Manual

Section 1.F. Financial Planning and Management

If an organization’s cash operating expenses NOTE: All trustee-held funds (debt service reserve,

exceed cash revenue, either unintentionally or operating reserves) are not considered unrestricted.

by design, this shortfall will need to be funded. The amount of days cash on hand will vary

Examples of non-operating funding sources among organizations and is dependent on many

include: factors, such as ownership type (for profit/non-

■ Admission fees of new residents.

profit), resident contract type (A, B, C, rental),

and the philosophy of boards and senior manage-

■ A parent or affiliate organization.

ment. For example, while both nonprofits and

■ Owners, including limited partners. for-profit CCRCs take in cash entrance fees,

■ Contributions. the nonprofit is restricted by tax laws as to the

■ Unrestricted cash balances. amount of cash that can be legally removed from

the organization. Conversely, for-profits are not

■ Release of temporarily restricted net assets.

limited on cash removal and may chose to with-

■ Sale of investments.

draw the cash and maintain an alternative source

Financial flexibility can be obtained by a variety of cash to fund operating shortfalls. Hence a for-

of mechanisms, including: profit may have lower days cash on hand.

■ Legally structuring an organization to provide Contract types will also influence the amount of

flexibility for debt cross-collateralization. days cash on hand. Contract type A organizations

■ Targeting a mix of fixed versus floating rate

take in a larger upfront entrance fee and may

debt. invest these monies until they are needed for

future healthcare costs. On the other hand, rental

■ Hedging variable rate debt with swaps, caps,

communities do not charge entrance fees and

and other derivative products.

hence tend not to have large days cash on hand

■ Hedging fixed rate debt with swaps. as they price their monthly service fees to cover

■ Using obligated groups. their monthly expenses. Hence contract type A

■ Using bond ratings and insurance. CCRCs will have a higher days cash on hand

benchmark.

Refer to the annual publication Financial Ratios

& Trend Analysis of CARF–Accredited Continuing The Financial Ratios & Trend Analysis of CARF–

Care Retirement Communities, Chapter 3. Accredited Continuing Care Retirement Commu-

Liquidity–Days Cash on Hand and Appendix B. nities publication lists financial ratio benchmarks

Discussion of Cash for assistance in analyzing for CCRC contracts type A, B, and C.

your organizations unrestricted cash reserves. Regardless of contract type, ownership type, etc.,

Ratio Pro has one ratio, Days Cash on Hand, to it is essential that organizations have access to

assist you in your analysis. liquidity either through days cash on hand or

Unrestricted cash and investment balances are via a third party.

those asset balances that are freely available for Third-party sources of liquidity may include:

use in operations. Therefore, temporarily or ■ A parent or affiliate organization’s legal

permanently restricted funds and those held guarantee to fund operating shortfalls.

in trust by a third party are not considered ■ A parent or affiliate organization’s history

unrestricted cash/investments. of funding operating short-falls without a

Unrestricted cash and investments include: guarantee (“moral obligation”).

■ Cash and short-term investments that are ■ Foundations.

not subject to temporary or permanent ■ Annual subsidies.

restrictions.

■ Annual appropriation from Congress.

■ Non-trustee held state operating reserves.

■ Owner/limited partners.

■ Board-restricted reserves.

Refer to Financial Ratios & Trend Analysis of

CARF–Accredited Continuing Care Retirement

2016 Continuing Care Retirement Community Standards Manual 65

Section 1.F. Financial Planning and Management

Communities, Chapter 4. Capital Structure Ratios and to meet the commitments of their residents

for a discussion of how to measure and interpret and other persons served.

balance sheet ratios. Ratio Pro has the following If an organization is required to maintain

capital structure ratios to assist you in your restricted reserves, it must have procedures to

analysis: ensure that account balances are adequate and

■ Debt service coverage that time and usage restrictions are adhered to.

■ Debt service coverage—adjusted Examples

■ Cash to debt A sound investment policy should incorporate a

■ Debt to equity variety of themes. For example:

■ Debt to equity—adjusted ■ Investment objective: a statement outlining

the purpose of the portfolio.

■ Debt to total assets

■ Approved investments: the risk tolerance of

■ Average age of facility

an organization will dictate the percentage of

■ Capital expenditures as a percentage of investment assets in less risky, more liquid

depreciation investments (cash, bank CDs, money market

13.d. The organization may describe ways that it fund) and the percentage in riskier stocks and

has used current financial ratio information to bonds.

make planning decisions, or it may explain how ■ Investment restrictions: outlines the type of

using financial ratio data to benchmark itself to investments that have been prohibited; i.e.,

other organizations might inform changes to investments are restricted to bonds with a

operations or service delivery, or perhaps affirm BBB rating or better.

current practices. ■ Investment safekeeping: what entity will

13.e. Examples shared with surveyors regarding hold the investment certificates and other

how bond covenants are met might include peri- documentation.

odic reports to bondholders, audit compliance ■ Portfolio management:

reports, or other methods.

– How is portfolio performance monitored?

– How often are results reviewed?

1.F. 14. If the organization has material invest-

ments, it implements an investment – Whose responsibility is it to monitor the

policy that: portfolio?

14.F. Financial Mgmt

a. Address at minimum: 14.a.(3) This standard applies if the organization

is required to maintain restricted reserves under

14.a.F. Financial Mgmt

(1) Portfolio return.

14.a.(1)F. Financial Mgmt

(2) Portfolio risk. debt agreements, state statutory requirements,

14.a.(2)F. Financial Mgmt

and/or restricted endowments.

(3) Restricted cash reserves.

14.a.(3)F. Financial Mgmt

b. Is reviewed annually for relevance. 14.b. Review of the investment policy may be

14.b.F. Financial Mgmt

conducted by a finance committee, a manage-

Intent Statements ment team, a financial expert that is retained by

Organizations, especially those that offer life care the organization for this review, or by another

contracts, generally have material assets to invest. entity that the organization identifies as having

Organizations with investment assets that are the appropriate knowledge. The review could

material to the organization must have policies result in revision of the policy or it may result in

and procedures in place to address investment affirmation that the policy is still relevant.

portfolio return and risk.

Financially sound organizations maintain ade- 1.F. 15. Identified leadership of the organization

quate unrestricted cash and investment reserves, reviews investment results at least annu-

or have access to third-party cash/reserves, to ally in conformance with the investment

fund any unforeseen operating cash shortfalls policy.

15.F. Financial Mgmt

66 2016 Continuing Care Retirement Community Standards Manual

Section 1.F. Financial Planning and Management

Intent Statements

1.F. 16. The organization implements a cash

Accredited organizations analyze key financial

management strategy that:

16.F. Financial Mgmt performance indicators, such as contract type

a. Address at minimum: information, to aid in strategic fiscal planning

16.a.F. Financial Mgmt

(1) Accounts receivable efforts.

management.

16.a.(1)F. Financial Mgmt

(2) Accounts payable management. 1.F. 18. The organization has a mechanism to

16.a.(2)F. Financial Mgmt

b. Is reviewed annually for relevance. make the audited financial statements

16.b.F. Financial Mgmt

Intent Statements

and footnotes available to:

18.F. Financial Mgmt

a. Prospective persons served.

Effective management of accounts receivables 18.a.F. Financial Mgmt

ensures a steady stream of cash that can be b. Current persons served.

18.b.F. Financial Mgmt

invested to earn additional income for the c. Other stakeholders.

18.c.F. Financial Mgmt

organization.

Intent Statements

Examples To demonstrate an organization’s commitment

Accounts receivables must be analyzed periodi- to excellence and transparency, the organization

cally to determine if the receivables are being fully discloses the financial information contained

paid according to the invoice due date. Receiv- in the audited financial statements and footnotes.

able conversion can vary depending on the type Examples

of receivable; generally government reimburse-

Copies could be made available in the marketing

ment receivables take longer to collect than

office or resident service office. A summary

private pay. Therefore, the receivable mix will

could be made available in the resident

influence your overall days in accounts receivable

newsletter.

that are outstanding.

A key financial benchmark of the efficiency of

accounts receivable management is “Days in

1.F. 19. The organization has a capitalization

plan addressing both equity and capital

Accounts Receivable.” Refer to the annual publi-

that includes:

cation Financial Ratios & Trend Analysis of 19.F. Financial Mgmt

CARF–Accredited Continuing Care Retirement a. Information about management

Communities, Chapter 3. Liquidity Ratios for a of assets.

19.a.F. Financial Mgmt

discussion of Days in Accounts Receivable ratio. b. Information about management

Ratio Pro has a “Days in Accounts Receivable” of liabilities.

19.b.F. Financial Mgmt

ratio against which to benchmark. c. Fixed asset management.

19.c.F. Financial Mgmt

Examples of current assets include: d. Review of debt management

■ Cash and current investments.

plan risks.

19.d.F. Financial Mgmt

■ Accounts receivables.

e. Documentation of an annual

management review of:

Examples of current liabilities include: 19.e.F. Financial Mgmt

(1) The capitalization plan.

■ Short-term debt.

19.e.(1)F. Financial Mgmt

(2) Cash reserves available for

■ Accounts payable capital needs.

19.e.(2)F. Financial Mgmt

f. Policy related to swaps, if the organi-

1.F. 17. The organization evaluates key perfor- zation uses swaps as an investment

mance indicators that include, but are tool.

19.f.F. Financial Mgmt

not limited to, contract types identified

by:

17.F. Financial Mgmt

a. Level or type of care or service.

17.a.F. Financial Mgmt

b. Number of residents per contract

type.

17.b.F. Financial Mgmt

2016 Continuing Care Retirement Community Standards Manual 67

Section 1.F. Financial Planning and Management

g. If applicable, information: projected financial ratios for to inform its debt

management. The organization may have a plan

19.g.F. Financial Mgmt

(1) Relative to:

19.g.(1)F. Financial Mgmt

(a) New real estate in place for replacing a letter of credit.

development. 19.e. The management representatives that the

19.g.(1)(a)F. Financial Mgmt

(b) Expansion of service organization determines to have the appropriate

projects. knowledge can conduct this review annually.

19.g.(1)(b)F. Financial Mgmt

(2) That maintains: This review documents that the budgeting for

19.g.(2)F. Financial Mgmt

cash and investments required for the capital

(a) Legal compliance.

19.g.(2)(a)F. Financial Mgmt

needs of the organization are addressed. Cash

(b) Regulatory compliance. flow projections include what is required to

19.g.(2)(b)F. Financial Mgmt

(c) Contractual obligations for address upcoming capital spending.

current persons served. 19.f. If the organization has swaps, a policy

19.g.(2)(c)F. Financial Mgmt

h. Disclosure of information contained related to swaps should be implemented.

in the capitalization plan.

19.h.F. Financial Mgmt 19.g. This is applicable to organizations that are

Intent Statements in the planning/development stages of a new

This standard is applicable to all organizations project or renovation/expansion of an existing

whether they are currently involved in a capital project. To be in conformance with this standard,

investment project, or whether they are simply the organization can discuss and current or pro-

conducting capital planning for the future. The posed real estate development. The organization

capitalization plan can be composed of multiple can demonstrate the ability to quantify and

documents that work together to form the capi- explain the financial impact of any project on

talization plan. the organization's financial position and discuss

With any capital investment project there are the major assumptions used to in the analysis of

inherent risks. There may be construction risk, the project.

lease-up risk, and the risk that once a project is Business plan examples include:

stabilized it will not be economically viable and

■ Feasibility studies for major construction

as such it will be unable to meet its debt and/or

projects.

regulatory obligations and it will need funding

from other sources. Good business planning can ■ Excel spreadsheet for smaller projects.

mitigate these risks. Business plans include:

Organizations that depend on capital assets for ■ List of key assumptions used in developing

delivery of services should plan for repair and the plan.

replacement of these assets.

■ Projected financials (statements of financial

Examples position, activities, and cash flow). Projec-

19.a.–b. The organization is demonstrating how tions are done at both the project level and

assets are safeguarded and how it is managing the organization level.

financial obligations such as debt, so these topics ■ Projected financial ratios for both the project

could be addressed in the organization's account- and the organization.

ing policies and procedures. ■ Sensitivity analysis. With construction proj-

19.c. The organization conducts fixed asset ects, organizations can experience

management through its policies and procedures construction and lease-up delays, construc-

outlining requirements for capitalizing an asset, tion costs overruns, etc. Organizations should

purchasing assets, and capital repair and replace- perform additional analysis on their financial

ment for current assets. projections assuming various scenarios (i.e.,

19.d. The organization can list or describe its it took a year longer to sell the new units than

outstanding long term debt and implements a projected) to determine the impact on their

long-range plan for meeting debt covenants. existing financial structure.

It may use long term financial projections or

68 2016 Continuing Care Retirement Community Standards Manual

Capital assets are property, plant, and equipment

items, such as:

■ Bricks and mortar.

■ Sidewalks.

■ Landscaping.

■ HVAC systems.

■ Personal computers/servers/electronic

medical records.

■ Buses and other vehicles.

For each item identified, the following should

be addressed:

■ Date put into service.

■ Estimated repair/replacement date.

■ Estimated cost of repair/replacement.

Based on the capital schedule, organizations

should identify a funding source for the esti-

mated costs of repair/replacement.

Projected financial statements are prepared in a

format consistent with the organization’s annual

audited financial statements. These financial

statements include statements of:

■ Financial position.

■ Activities.

■ Cash flow.

19.h. The organization shares the information in

the capitalization plan with various stakeholders

including, but not limited to, organizational lead-

ership and governance.

2016 Continuing Care Retirement Community Standards Manual 69

You might also like

- MAS Basic Concepts BobadillaDocument9 pagesMAS Basic Concepts BobadillaPearl Alicando CaadanNo ratings yet

- Sample Report II - Card System Forensic Audit ReportDocument24 pagesSample Report II - Card System Forensic Audit ReportArif AhmedNo ratings yet

- Financial ManagementDocument4 pagesFinancial Managementkiran gaikwad0% (1)

- Cfas ReviewerDocument14 pagesCfas ReviewerCHARLES KEVIN MINANo ratings yet

- Adb Financial Report 2018Document252 pagesAdb Financial Report 2018Gevorg SaakyanNo ratings yet

- C. The Carrying Amount of Property, Plant and Equipment : Financial Accounting Theory Preweek Summary IiDocument56 pagesC. The Carrying Amount of Property, Plant and Equipment : Financial Accounting Theory Preweek Summary Iibobo kaNo ratings yet

- Financial Accounting TheoryDocument15 pagesFinancial Accounting TheoryMarcus MonocayNo ratings yet

- MS 34a-3 PDFDocument1 pageMS 34a-3 PDFSeanNo ratings yet

- PDF To WordDocument5 pagesPDF To WordDUDUNG dudongNo ratings yet

- Chapter 1 Test Bank - Booklet PDFDocument10 pagesChapter 1 Test Bank - Booklet PDFjasmineNo ratings yet

- Financial Planning and StrategiesDocument5 pagesFinancial Planning and StrategiesHads LunaNo ratings yet

- Quiz 1: Basic ConsiderationsDocument4 pagesQuiz 1: Basic ConsiderationsMarriah Izzabelle Suarez RamadaNo ratings yet

- Far 05 - Long Quiz2Document11 pagesFar 05 - Long Quiz2Mark Domingo MendozaNo ratings yet

- Business Strategic Analysis - Review Questions and ProblemsDocument4 pagesBusiness Strategic Analysis - Review Questions and ProblemsJaneth BarreteNo ratings yet

- Fin Man ReviewerDocument17 pagesFin Man ReviewerJohn Henry VillaNo ratings yet

- ACC201-Intermediate Accounting IDocument11 pagesACC201-Intermediate Accounting ItucchelNo ratings yet

- LAS BF Q3 Week 3 4 IGLDocument5 pagesLAS BF Q3 Week 3 4 IGLdaisymae.buenaventuraNo ratings yet

- 01 x01 Basic ConceptsDocument9 pages01 x01 Basic ConceptsNorfaidah IbrahimNo ratings yet

- Week 4 - BT - Chap IAS1 - IcaewDocument4 pagesWeek 4 - BT - Chap IAS1 - IcaewPhương NhungNo ratings yet

- MAS Review QuestionnairesDocument13 pagesMAS Review QuestionnairesLye Loren MarceloNo ratings yet

- Chapter 1Document2 pagesChapter 1Kelly CardejonNo ratings yet

- Management Accounting Trivia QuestionsDocument2 pagesManagement Accounting Trivia QuestionsKiersten UyNo ratings yet

- Fabm 1 Exam BDocument2 pagesFabm 1 Exam BVinalyn GaringoNo ratings yet

- Annual Reports ActivityDocument1 pageAnnual Reports ActivityRoy SunNo ratings yet

- Year Book 2008 - 2009: Government of Pakistan Finance Division Islamabad WWW - Finance.gov - PKDocument176 pagesYear Book 2008 - 2009: Government of Pakistan Finance Division Islamabad WWW - Finance.gov - PKJohn FridayNo ratings yet

- Satisfy Short-Term Obligations.: Maintain IAS Levels of Preference and Ordinary DividendsDocument12 pagesSatisfy Short-Term Obligations.: Maintain IAS Levels of Preference and Ordinary DividendsJohn FloresNo ratings yet

- I. Financial Accounting & Reporting (FAR) Code Course Description Topics Based On CPALE Syllabus (2019)Document2 pagesI. Financial Accounting & Reporting (FAR) Code Course Description Topics Based On CPALE Syllabus (2019)LuiNo ratings yet

- CB - As - Xii - Economics - Mid Term 27022-23Document22 pagesCB - As - Xii - Economics - Mid Term 27022-23Akshat KhetanNo ratings yet

- THEORY QUESTIONSDocument15 pagesTHEORY QUESTIONSJersey SNo ratings yet

- Cfas (!)Document4 pagesCfas (!)albertojrmoradoNo ratings yet

- 2023 Financial Audit Manual Vol 3Document312 pages2023 Financial Audit Manual Vol 3Bilal Ahmed KhanNo ratings yet

- Cfas CH 1 QuizletDocument4 pagesCfas CH 1 Quizletagm25No ratings yet

- MSA 1 Question Wise Paper Analysis S17 To S22 by ST AcademyDocument5 pagesMSA 1 Question Wise Paper Analysis S17 To S22 by ST AcademyRafayAliNo ratings yet

- Review 105 - Day 22 TOADocument6 pagesReview 105 - Day 22 TOAAbriel BumatayNo ratings yet

- Financial Statement ReportingDocument20 pagesFinancial Statement ReportingAshwini Khare0% (1)

- MAS - 1 - Basic Concepts and Recent Developments - TBPDocument5 pagesMAS - 1 - Basic Concepts and Recent Developments - TBPFederico Angoluan Socia Jr.No ratings yet

- Basic Concepts in Management AccountingDocument9 pagesBasic Concepts in Management AccountingKeach Harrel CabagayNo ratings yet

- Comparative Schedule VIDocument23 pagesComparative Schedule VIRajkumar MathurNo ratings yet

- MCQ On Financial ManagementDocument237 pagesMCQ On Financial ManagementAnamika AnandNo ratings yet

- MasDocument3 pagesMaschowchow123No ratings yet

- TheoriesDocument13 pagesTheoriesZee RoeNo ratings yet

- MCQ CmaDocument255 pagesMCQ CmaMahak AgarwalNo ratings yet

- Compilation Review Agreed-Upon ProceduresDocument11 pagesCompilation Review Agreed-Upon ProceduresJulrick Cubio EgbusNo ratings yet

- 2023 Annual Financial Report en 2024.02.29Document287 pages2023 Annual Financial Report en 2024.02.29Boycho BoychevNo ratings yet

- Final-Topic-Outline-group-2Document2 pagesFinal-Topic-Outline-group-2April Rose Sobrevilla DimpoNo ratings yet

- ACtion PlanDocument14 pagesACtion PlanShihab HasanNo ratings yet

- 2016 MARCH Financial Accounting Reporting Fundamentals-ENG-March-2016 - EnglishDocument13 pages2016 MARCH Financial Accounting Reporting Fundamentals-ENG-March-2016 - EnglishJahanzaib ButtNo ratings yet

- Audtheo Reviewer For MidtermsDocument21 pagesAudtheo Reviewer For MidtermsPandaNo ratings yet

- Strategic Cost Multiple ChoiceDocument7 pagesStrategic Cost Multiple ChoiceChristian ZanoriaNo ratings yet

- 2 Chapt 1 Conceptual FrameworkDocument20 pages2 Chapt 1 Conceptual FrameworkMANIRAGABA AlphonseNo ratings yet

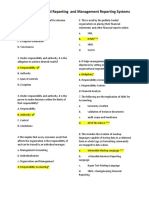

- By: Group 2: CHAPTER 8: Financial Reporting and Management Reporting SystemsDocument3 pagesBy: Group 2: CHAPTER 8: Financial Reporting and Management Reporting Systemssammie helsonNo ratings yet

- 1.03 Why Money MattersDocument5 pages1.03 Why Money MattersJosue Lopez ChavarriaNo ratings yet

- Cfas DeptDocument11 pagesCfas DeptKevin MagdayNo ratings yet

- Lombard International Assurance SADocument42 pagesLombard International Assurance SAKalaiarasan GNo ratings yet

- FR MCQ Book 1300+ Mcqs CA SJDocument216 pagesFR MCQ Book 1300+ Mcqs CA SJfaheh37570No ratings yet

- Prelims - TheoriesDocument9 pagesPrelims - TheoriesShorinNo ratings yet

- Cost Accounting Basic ConceptsDocument9 pagesCost Accounting Basic ConceptsRidskiee VivanggNo ratings yet

- FINMAN 2nd To 4thDocument9 pagesFINMAN 2nd To 4thGiane Bernard PunayanNo ratings yet

- 9 Completing AuditDocument1 page9 Completing AuditARMIZAWANI BINTI MOHAMED BUANG BMNo ratings yet

- (DBM 2019) Primer On Local Government BudgetingDocument68 pages(DBM 2019) Primer On Local Government BudgetingMaria Angelica BasaNo ratings yet

- Materi Kuliah Auditing Atestasi Kls Reguler Sesi 4 5 Vierna Suryaningsih Se Ak Cpa CIA 1061Document94 pagesMateri Kuliah Auditing Atestasi Kls Reguler Sesi 4 5 Vierna Suryaningsih Se Ak Cpa CIA 1061Kadek Dwi Putra AtmajaNo ratings yet

- Hock CMA P1 2019 (Sections D & E) AnswersDocument9 pagesHock CMA P1 2019 (Sections D & E) AnswersNathan DrakeNo ratings yet

- 2023-03-31 00 - 00 - 00 - AA1 - Auditors - ReportDocument8 pages2023-03-31 00 - 00 - 00 - AA1 - Auditors - ReportdurgaNo ratings yet

- Assignment UnitDocument17 pagesAssignment UnitAbhishekNo ratings yet

- PSA 200 Overall Objectives of The Independent Auditor and The Conduct of Audit in Accordance With PSADocument6 pagesPSA 200 Overall Objectives of The Independent Auditor and The Conduct of Audit in Accordance With PSASkye LeeNo ratings yet

- Aud Theo - 3Document5 pagesAud Theo - 3Cyra EllaineNo ratings yet

- 10 1108 - Jabs 03 2018 0073Document16 pages10 1108 - Jabs 03 2018 0073211210050 NOVIANTI NOVIANTINo ratings yet

- MIA Audit and Assurance Practice Guide AAPG 2 PDFDocument37 pagesMIA Audit and Assurance Practice Guide AAPG 2 PDFSyah MuhammadNo ratings yet

- CR - MA-2023 - Suggested - AnswersDocument15 pagesCR - MA-2023 - Suggested - AnswersfahadsarkerNo ratings yet

- Sap S4hana Cloud 2105 Release InfoDocument109 pagesSap S4hana Cloud 2105 Release InfoISAINo ratings yet

- SP Audit Plan For SMEDocument8 pagesSP Audit Plan For SMEChiah ChyiNo ratings yet

- Focus NotesDocument3 pagesFocus NotesJean Ysrael Marquez100% (1)

- Summary Auditing Theory Chapter 1 15 Book Principles of AuditingDocument16 pagesSummary Auditing Theory Chapter 1 15 Book Principles of AuditingDymphna Ann CalumpianoNo ratings yet

- Asme Annual Report - 1Document60 pagesAsme Annual Report - 1abodeaudi20No ratings yet

- Financials InfosysDocument155 pagesFinancials InfosysvishnuNo ratings yet

- Module 3 - Overview of The Audit ProcessDocument2 pagesModule 3 - Overview of The Audit ProcessLysss EpssssNo ratings yet

- Basic Audit 2017Document51 pagesBasic Audit 2017DikaRPertiwiNo ratings yet

- COA PresentationDocument155 pagesCOA PresentationRonnie Balleras Pagal100% (1)

- Audit ReportDocument2 pagesAudit ReportNorhian AlmeronNo ratings yet

- Advanced Auditing Module GuideDocument230 pagesAdvanced Auditing Module GuideArtwell Zulu100% (1)

- Sadernia Investments LTD - 2021 - Draft FSDocument23 pagesSadernia Investments LTD - 2021 - Draft FSzubairNo ratings yet

- ICAB-CL-Assurance - Question AnalysisDocument75 pagesICAB-CL-Assurance - Question AnalysisShakil IslamNo ratings yet

- Auditing Theory TEST BANKDocument23 pagesAuditing Theory TEST BANKGelyn CruzNo ratings yet

- CHAPTER 1B Risk Based AuditDocument5 pagesCHAPTER 1B Risk Based AuditLydelle Mae CabaltejaNo ratings yet

- At.3510 - Determining The Extent of TestingDocument8 pagesAt.3510 - Determining The Extent of TestingJohn MaynardNo ratings yet

- AttDocument8 pagesAttcutieaikoNo ratings yet

- Sarbanes Oxley ActDocument6 pagesSarbanes Oxley ActBiggun554No ratings yet

- As Non Company Entities CA Chintan PatelDocument25 pagesAs Non Company Entities CA Chintan PatelAkshayNo ratings yet

- 2019 SBCA-SHS ConstitutionDocument36 pages2019 SBCA-SHS ConstitutionJatriya SphynxsNo ratings yet