Professional Documents

Culture Documents

Audit Risk Practical Points June 2020

Audit Risk Practical Points June 2020

Uploaded by

PAGAL pantiCopyright:

Available Formats

You might also like

- The Portable MBA in Finance and AccountingFrom EverandThe Portable MBA in Finance and AccountingRating: 4 out of 5 stars4/5 (19)

- FINS3630 Finals Formula SheetDocument3 pagesFINS3630 Finals Formula SheetElaineKongNo ratings yet

- Assurance Ip1 11Document6 pagesAssurance Ip1 11rui zhangNo ratings yet

- ACCA AAA Sample AnswersDocument4 pagesACCA AAA Sample AnswersAzhar RahamathullaNo ratings yet

- CAPITAL ADEQUACY BEYOND BASEL Banking, Securities, and InsuranceDocument354 pagesCAPITAL ADEQUACY BEYOND BASEL Banking, Securities, and Insurancetarekmn1100% (1)

- MSC530M - The Game Theory of EDSA Revolution - MidTermsDocument5 pagesMSC530M - The Game Theory of EDSA Revolution - MidTermsValerie Joy Macatumbas Limbauan100% (1)

- ACCO 400 Weeks 5 and 6 Discussion Questions and AnswersDocument4 pagesACCO 400 Weeks 5 and 6 Discussion Questions and AnswersWasif SethNo ratings yet

- The Ultimate Guide To Trend Following PDFDocument43 pagesThe Ultimate Guide To Trend Following PDFsaingthy100% (4)

- Price Action Trading Introduction - Learn To TradeDocument8 pagesPrice Action Trading Introduction - Learn To Tradeimamitohm75% (4)

- Form 66 Declaration of SolvencyDocument2 pagesForm 66 Declaration of SolvencyolingirlNo ratings yet

- Gartner Market Share Analysis - Security Consulting, Worldwide, 2012Document9 pagesGartner Market Share Analysis - Security Consulting, Worldwide, 2012Othon CabreraNo ratings yet

- Practical Points That Affect Audit Risks 1703145062Document8 pagesPractical Points That Affect Audit Risks 1703145062fktman69No ratings yet

- Practical Points That Affect Audit Risks: School of Business StudiesDocument6 pagesPractical Points That Affect Audit Risks: School of Business Studiesramen pandeyNo ratings yet

- M20 Answers AAAUKDocument16 pagesM20 Answers AAAUKMUSSICALLY SHOUTOUTNo ratings yet

- Redback Sport AJ21Document9 pagesRedback Sport AJ21FarNo ratings yet

- Solution Advanced Audit and Prof Ethics May 2010Document15 pagesSolution Advanced Audit and Prof Ethics May 2010Samuel DwumfourNo ratings yet

- P7int 2013 Jun A PDFDocument17 pagesP7int 2013 Jun A PDFhiruspoonNo ratings yet

- Advanced Audit and Assurance - International: Specimen Exam - September 2022Document35 pagesAdvanced Audit and Assurance - International: Specimen Exam - September 2022Asif RiazNo ratings yet

- Maple & Co. (September 2022 - Q1) : Briefing NotesDocument8 pagesMaple & Co. (September 2022 - Q1) : Briefing NotesRachana HegdeNo ratings yet

- Industrial SicknessDocument19 pagesIndustrial SicknessAnkit SoniNo ratings yet

- Test 1Document7 pagesTest 1Maithili KulkarniNo ratings yet

- Chapter 09 AssignedDocument4 pagesChapter 09 Assignedmariko1234No ratings yet

- Rick GroupDocument5 pagesRick Grouprajip sthNo ratings yet

- 21 - AAA Mock 1Document8 pages21 - AAA Mock 1Safa AzizNo ratings yet

- P7 Notes Training CostsDocument8 pagesP7 Notes Training CostsKhaled SherifNo ratings yet

- Dmp3e Ch06 Solutions 01.26.10 FinalDocument39 pagesDmp3e Ch06 Solutions 01.26.10 Finalmichaelkwok1No ratings yet

- P7int 2010 Jun ADocument17 pagesP7int 2010 Jun AFzr JamNo ratings yet

- Discussion Question W9 Creative AccountingDocument5 pagesDiscussion Question W9 Creative AccountingElaine LimNo ratings yet

- Advanced Audit & Assurance: Revision Mock Examination December 2019 Answer GuideDocument21 pagesAdvanced Audit & Assurance: Revision Mock Examination December 2019 Answer GuidecryoffalconNo ratings yet

- 2019 Mock Exam A - Morning SessionDocument21 pages2019 Mock Exam A - Morning SessionYash DoshiNo ratings yet

- Aviva PLC Investor and Analyst Update 5 July 2012Document45 pagesAviva PLC Investor and Analyst Update 5 July 2012Aviva GroupNo ratings yet

- Audit RiskDocument12 pagesAudit RiskAli MaqsoodNo ratings yet

- Reporting and Analyzing Revenues and Receivables: Learning Objectives - Coverage by QuestionDocument34 pagesReporting and Analyzing Revenues and Receivables: Learning Objectives - Coverage by QuestionpoollookNo ratings yet

- Honda (Pakistan) : Individual Report On Audit ProcessDocument11 pagesHonda (Pakistan) : Individual Report On Audit ProcesssadiaNo ratings yet

- ENCORE CO SOLUTION March and June 2023Document6 pagesENCORE CO SOLUTION March and June 2023nakoinvestments26No ratings yet

- Auditing and AssuranceDocument15 pagesAuditing and AssuranceWanambisi JnrNo ratings yet

- AARS Test 4 Solution FinalDocument7 pagesAARS Test 4 Solution FinalShahzaib VirkNo ratings yet

- Examination: Subject SA3 General Insurance Specialist ApplicationsDocument265 pagesExamination: Subject SA3 General Insurance Specialist Applicationsscamardela79No ratings yet

- Tong Ngoc Tram Risk 22070166Document7 pagesTong Ngoc Tram Risk 22070166tongngoctram15062004No ratings yet

- Going ConcernDocument5 pagesGoing ConcernkawsursharifNo ratings yet

- Explanation: Inherent Limitations of The AuditDocument4 pagesExplanation: Inherent Limitations of The AuditRiz WanNo ratings yet

- Moranda Sills LLP Served 10 Years Auditor Financial Statements Highland Bank Trust Firm Co q71787860 PDFDocument1 pageMoranda Sills LLP Served 10 Years Auditor Financial Statements Highland Bank Trust Firm Co q71787860 PDFIlham TaufanNo ratings yet

- ACCA AAA EthicsDocument24 pagesACCA AAA EthicsSIRUI DINGNo ratings yet

- Suggested Answer TechniquesDocument11 pagesSuggested Answer TechniquesAzhar RahamathullaNo ratings yet

- Imp of Financial StatementDocument4 pagesImp of Financial StatementSunit DasNo ratings yet

- Corporate Reporting Homework (Day 6)Document4 pagesCorporate Reporting Homework (Day 6)Sara MirchevskaNo ratings yet

- Act380 Case Study Hasan Mahmuud MarufDocument5 pagesAct380 Case Study Hasan Mahmuud MarufHasan Mahmud Maruf 1621513630No ratings yet

- Assignmnet 5.5Document2 pagesAssignmnet 5.5chrislupinjrNo ratings yet

- Homework On Materiality and Audit RiskDocument3 pagesHomework On Materiality and Audit RiskI'j Chut MoHammadNo ratings yet

- Audit tt6Document11 pagesAudit tt6CHYE CHING OOINo ratings yet

- FS AnalysesDocument4 pagesFS Analysessecret 12No ratings yet

- Foreign SuppliersDocument3 pagesForeign SuppliersShahzaib KhanNo ratings yet

- Types of Earnings Management and Manipulation Examples of Earnings ManipulationDocument6 pagesTypes of Earnings Management and Manipulation Examples of Earnings Manipulationkhurram riazNo ratings yet

- Audit and Assurance: Page 1 of 7Document7 pagesAudit and Assurance: Page 1 of 7online lecturesNo ratings yet

- SMChap 006Document25 pagesSMChap 006yasminemagdi3No ratings yet

- Filesure Task 2Document4 pagesFilesure Task 2shrutiNo ratings yet

- Solution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian EditionDocument38 pagesSolution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian Editionwarpingmustacqgmael100% (19)

- Eidi For Audit StudentsDocument5 pagesEidi For Audit StudentsMehak RasheedNo ratings yet

- 2016 Audit Risk AnswerDocument2 pages2016 Audit Risk AnswerAliNo ratings yet

- 1.accountancy True False Questions by AVJDocument19 pages1.accountancy True False Questions by AVJHarshad TupeNo ratings yet

- Accounting HammadDocument7 pagesAccounting Hammadshan khanNo ratings yet

- Q3Document4 pagesQ3talhazaman76No ratings yet

- CAF Examination Program Spring 2023Document9 pagesCAF Examination Program Spring 2023Asad ZahidNo ratings yet

- Assuranc Unit 1Document10 pagesAssuranc Unit 1hyojin YUNNo ratings yet

- SD20 AAAINT Sample - AnswersDocument16 pagesSD20 AAAINT Sample - AnswersVarvNo ratings yet

- RISKS OF MATERIAL MISSTATEMENT/AUDIT RISKS Each Risk Is Usually Worth 1Document5 pagesRISKS OF MATERIAL MISSTATEMENT/AUDIT RISKS Each Risk Is Usually Worth 1future moyoNo ratings yet

- Chapter 7 QuizDocument2 pagesChapter 7 QuizliviaNo ratings yet

- Loss of ContainmentDocument68 pagesLoss of Containmentpetrolhead1No ratings yet

- Environmental Management System and Environmental AuditDocument23 pagesEnvironmental Management System and Environmental Auditanandvishnu_bnair100% (1)

- Rotek Valves Risk Assessment - Process: If You Have Any Questions, Please Contact The ManagerDocument3 pagesRotek Valves Risk Assessment - Process: If You Have Any Questions, Please Contact The ManagerPieter BezuidenhoutNo ratings yet

- 2020 Level III Final Branded Exam Information DocumentDocument12 pages2020 Level III Final Branded Exam Information DocumentJBNo ratings yet

- Disaster Risk Reduction Management LectureDocument19 pagesDisaster Risk Reduction Management LectureJames Joseph ObispoNo ratings yet

- Ind SafetyDocument28 pagesInd Safetygowrisankar32No ratings yet

- Contractor HSE Management ProcedureDocument9 pagesContractor HSE Management ProcedureWinnie Eldama100% (1)

- 8 Project Risk ManagementDocument43 pages8 Project Risk ManagementMUHAMAD TARUNA PRAMUDHITANo ratings yet

- Hazard Identification and Risk AssessmentDocument3 pagesHazard Identification and Risk AssessmentShehada HemaidNo ratings yet

- Batc 641Document14 pagesBatc 641ankit kumarNo ratings yet

- SPO-MDG-OrB-0001-E - Advanced Pilot Operations Learner Guide 1Document82 pagesSPO-MDG-OrB-0001-E - Advanced Pilot Operations Learner Guide 1ANICETH KARWANINo ratings yet

- Trending Causes Marine IncidentsDocument10 pagesTrending Causes Marine IncidentsVinod DsouzaNo ratings yet

- Cyber Security Maturity Assessment Framework For Technology Startups A Systematic Literature ReviewDocument11 pagesCyber Security Maturity Assessment Framework For Technology Startups A Systematic Literature ReviewZukoNo ratings yet

- Quality Manual 06. Planning: Title Document No. REV Effective DateDocument4 pagesQuality Manual 06. Planning: Title Document No. REV Effective DateISUKepri.ComNo ratings yet

- IGC2Document20 pagesIGC2tharwatNo ratings yet

- Pindyck Solutions Chapter 5Document13 pagesPindyck Solutions Chapter 5Ashok Patsamatla100% (1)

- The Impact of Strategic Planning On Crisis Management Styles in The 5-Star HotelsDocument10 pagesThe Impact of Strategic Planning On Crisis Management Styles in The 5-Star HotelsVarun AVNo ratings yet

- Flight Safety Analysis Handbook Final 9 2011v1Document224 pagesFlight Safety Analysis Handbook Final 9 2011v1blackhawk100% (1)

- Adoption Metrics Template 2018Document8 pagesAdoption Metrics Template 2018George Cristian Aquiño HuamanNo ratings yet

- Exhibit H-Hse1 - 230315 - 122438Document36 pagesExhibit H-Hse1 - 230315 - 122438Nada AmmarNo ratings yet

- Jsa Energizing Final Tapping Back FeedingDocument7 pagesJsa Energizing Final Tapping Back FeedingekapadwiNo ratings yet

- Final Community Diagnosis 14Document41 pagesFinal Community Diagnosis 14mico zarsadiazNo ratings yet

Audit Risk Practical Points June 2020

Audit Risk Practical Points June 2020

Uploaded by

PAGAL pantiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Risk Practical Points June 2020

Audit Risk Practical Points June 2020

Uploaded by

PAGAL pantiCopyright:

Available Formats

KnS School of Business Studies

ACCA F8 & CA CAF 9 Audit & Assurance

AUDIT RISK – For Scenario based questions

Audit Risks kay cheetay Points

(Practical Points that affect Audit Risks)

1. Incurred revenue & capital expenditure during the year OR increase in capital expenditure

during the year. OR

2. Increase in subsequent expenditure during the year.

RISKS: There is a risk of incorrect classification between revenue and capital expenditure

as per IAS 16, resulting in both P.P.E and profit being overstated OR understated.

As per IAS 16 ….only purchase price plus directly attributable costs are part of the cost of

the asset. (Other future costs e.g. servicing and maintenance costs are amortized over the

period accordingly)

3. Increase in research & development cost (IAS 38)/Expenditure on Brands incurred during

the year e.g. Costs capitalized as development costs.

RISKS: There is a risk of incorrect classification between research and development

expenditure as per IAS 38, resulting in both I.A and profit being over stated and understated.

In case, question only mentions that cost has been capitalized as development costs than in

that case …….There is a risk of overstatement of Intangible asset and overstatement of

profit.

4. Various provisions made during the year e.g. Provision for lawsuit / warranty or

restructuring

RISK: There is a risk that because of wrong estimates and judgement (both Intentional and

unintentional), provision could be both undervalued or overvalued in the F/S.

5. There are pending cases against the company OR new cases imposed during the year

RISK: There is a risk of completeness of provisions or inadequate or no disclosure in the

F/S as per IAS 37.

(If it is probable that company will make a payment, a provision is required. If the payment

is possible rather than probable, a contingent liability disclosure would be necessary.

Prepared by: M.Sajid Kapadia (ACA, FCCA, APFA)

KnS School of Business Studies

ACCA F8 & CA CAF 9 Audit & Assurance

AUDIT RISK – For Scenario based questions

Both drafting’s are correct:

a)There is a risk over the completeness of any provisions or contingent liabilities.) or

b)There is a risk of provision being over / under valued and risk of inadequate or no

disclosure in the F/S as per IAS 37.

6. Imposition of new laws & regulations on the company

RISK: There is a risk of penalty not being recorded in the F/S resulting in profit being

overstated or risk of incorrect disclosure in the F/S.

7. Inadequate Internal controls/SOP’s / or lack of controls in Sales or Purchase department

RISK: There is a risk of controls not being operating effectively leading to overall ROMM

in the F/S or sales and debtors & purchases and payables being overstated or understated

8. During the year employees were made redundant e.g. Branch office was closed (Part of

restructuring)

RISK: There is a risk that because of wrong estimates the provision could be both

overvalued or undervalued. (OR SAY …There is a risk of completeness of Provision in the

F/S.)

9. Bank Loan obtained for 5 / 10 years

RISK: There is a risk of incorrect classification between current and long-term portion of

long-term loan & risk of incorrect disclosure of security provided against bank loan in the

F/S.

10. Bank Loan increased as compared to last year.

RISK: There should be additional interest costs therefore there is a risk that this has been

omitted from profit and loss a/c leading to understated finance costs and overstated profit.

11. Bank loan has loan covenants attached, plus the company is facing cash flow problems or

faces liquidity issues.

Prepared by: M.Sajid Kapadia (ACA, FCCA, APFA)

KnS School of Business Studies

ACCA F8 & CA CAF 9 Audit & Assurance

AUDIT RISK – For Scenario based questions

RISK: There is a risk that if these loan covenants (profit or assets targets) are breached and

the loan becomes repayable immediately than the company will face going concern risk.

(ISA 570)

In addition, there is a risk of manipulation of profits and net assets to ensure that bank

covenants are met.

12. Interest / Finance cost increased during the year because of increase in bank loan.

RISK: There is a risk that interest costs will be understated to manipulate profits especially

if there are profit based bonuses for senior management.

13. Introduction of new accounting software during the period and run in parallel during the

year

RISK: There is risk of data being lost & balances being misstated if they have not been

transferred completely and accurately, therefore there is a risk of overall R.O.M.M in the

F/S.

14. Senior management joins the organization with different prior experience (CFO has joined

a BANK who was previously CFO in a pharmaceutical company)

RISK: There is a risk that there will be overall errors in making judgements and estimates

leading to overall R.O.M.M in the F/S

15. Hiring of unqualified /incompetent / inexperienced staff in the finance department

RISK: There is an inherent as well as control risk that there will be overall R.O.M.M in the

F/S.

16. Revaluation of assets during the year (treatment of IAS 16)

RISK: There is a risk that if the treatment of revaluation is not done as per IAS 16 than both

PPE and profits will be over or under-stated.

17. New product has been manufactured by the company but it won’t be allowed to be sold by

the company or its expected that a new law will be imposed which will stop the sales of the

product.

RISK: There is risk of going concern for the company plus if stock is not written down than

profit and inventory will be overstated.

Prepared by: M.Sajid Kapadia (ACA, FCCA, APFA)

KnS School of Business Studies

ACCA F8 & CA CAF 9 Audit & Assurance

AUDIT RISK – For Scenario based questions

18. Top Management/Senior Management from the finance dept. has left the Company very

close to the balance sheet date.

RISK: There is an inherent risk of increased work load for the finance team resulting in

control risks (C.R) for the auditor leading to misstatements in the F/S.

Alternative Drafting

There is an inherent risk of increased work load for the finance team resulting in control

risks (C.R) as there will be errors within the accounting records by the over -worked finance

team and there is no supervision from senior mgmt.

19. Default of major customer/receivable during the year OR

20. Receivables balance is increasing over the years as compared to last year or collection in

days has increased as compared to last year.

RISK: There is a risk that if receivables are not recoverable and adequate provisioning is

not done than debtors will be overvalued.

--------------------------------------------------------------------------------------------------------------------------------

21. Out of court settlement with the customers / suppliers (before or after the B/S date)

RISK: There is a risk that resulting provision or liability will be over or under valued. (also

termed as completeness of provisions and disclosures)

22. Excess inventory & fixed assets in the warehouse.

RISK: There is a risk of Increased theft & misappropriation of assets resulting in loss of

sundry income leading to profit being understated.

23. First year of audit or it’s a new audit client

RISK: There is a risk of not detecting the errors in the F/S being the first year resulting in

detection risk (D.R) for the external auditor.

(As the team is not familiar with transactions and balances, there will be an increased

detection risk on the audit.)

24. Proper disclosures as per I.F.R.S or local laws are required in the F/S

RISK: There is a risk of incorrect or inadequate disclosures in the F/S.

Prepared by: M.Sajid Kapadia (ACA, FCCA, APFA)

KnS School of Business Studies

ACCA F8 & CA CAF 9 Audit & Assurance

AUDIT RISK – For Scenario based questions

25. Sales related bonus / incentive being offered to employees.

RISK: There is a risk of sales and debtors being overstated in the F/S by inaccurate sales

cutoff.

26. Subsequent fraud discovered by senior management after leaving the organization.

RISK: There is a risk that if previous fraud is not adjusted, than F/S will be materially

misstated. (or say overall R.O.M.M in the F/S will increase)

Alternative: There is a risk that if the impact of the fraud has not been quantified and

corrected in the statement of profit or loss or any other frauds have not been uncovered, the

financial statements could be misstated.

27. Risk of improper/ incorrect classification between current and non-current assets, current

and non-current liabilities.

28. Disposal of fixed assets during the year

RISK: There is a risk of wrong calculation of profit on disposal leading to profit being over

and understated.

29. Abnormal gain / loss on disposal of fixed assets during the year.

RISK: There is a risk of unreasonable depreciation policy (accounting estimate) leading to

both P.P.E and profit being under or overstated.

30. The company has both owned & rented assets.

RISK: There is risk that if rented assets are classified as owned assets than assets will be

overvalued and profit will be overstated.

31. Sudden conversion of accumulated losses into profits in the current year.

RISK: There is a risk of admin expenses being understated and profits being overstated.

32. Management bonus is linked on the total assets of the company.

RISK: There is a risk that management will manipulate assets of the company via

estimates and provisions and this will lead to assets being overvalued in order to increase

their personnel bonus.

Prepared by: M.Sajid Kapadia (ACA, FCCA, APFA)

KnS School of Business Studies

ACCA F8 & CA CAF 9 Audit & Assurance

AUDIT RISK – For Scenario based questions

33. Management bonus is linked on the profits of the company

RISK: There is a risk that management will manipulate profits of the company via

estimates and provisions and this will lead to profits being overstated in order to increase

their personnel bonus.

34. Sudden decrease in Admin expenses without any change in company’s operations.

RISK: There is a risk of profit being overstated.

35. Company has Intangible assets under IAS 38 (Patent, license, Franchise etc.)

RISK: There is a risk that if treatment is not done as per IAS 38 than both Intangible

assets and profits could be over/under stated.

INVENTORY

36. Assets/Inventory ordered/procured with no certainty that they will be received at the

yearend or not.

RISK: There is a risk of inaccurate cutoff leading to stock/purchases and payables both

being overstated at the B/S date.

OR there is a risk that if inventory / fixed assets are recorded before they physically exist

than both inventory / fixed assets and payables will be over-stated in the F/S.

IMP

37. There are various locations / stores for inventory counting at the B/S date and company /

client management is willing to get 100 per % stock counted at the B/S date.

Please note :100% verification of inventory at all locations is not always practically possible

for the external auditor.

RISK: There is a risk that auditor will not be able to obtain S.A.A.E over the existence and

completeness of inventory locations not visited by the auditor at the B/S date.

Prepared by: M.Sajid Kapadia (ACA, FCCA, APFA)

KnS School of Business Studies

ACCA F8 & CA CAF 9 Audit & Assurance

AUDIT RISK – For Scenario based questions

38. Company values its inventory at the lower of cost and net realizable value. Cost includes

both production and general overheads.

RISK: If general overheads are included in inventory cost, then this will result in

inventory being over-valued.

39. Inventory is destroyed by fire / flood BEFORE the B/S Date

RISK: There is a risk that inventory is damaged and not valued as per IAS 2 resulting in

closing stock being overvalued.

40. The company is planning to undertake the full year-end inventory count after the B/S date

and then adjust for inventory movements from the year end.

RISK: If the adjustments are not completed accurately, then the year-end inventory could

be under or over-valued.

41. Stock returned after / or before the B/S date being damaged or expired or product recalled

by the company. (inventory was at the B/S date)

RISK: There is a risk that if inventory is not valued as per IAS 2 then closing stock would

be overvalued plus refunds will need to be made to the customers and sales will have to be

reversed, which if not done, then revenue will be overstated and liabilities will be

understated.

42. Closing stock balance has increased as compared to last year. (or turnover in days have

increased)

RISK: There is a risk that stock is old fashioned / or out of demand and not being sold

resulting in its NRV being lower than cost and if not adjusted as per IAS 2, will result in

closing stock being overvalued.

43. In the case of W.I.P, expert service must be obtained

RISK: There is a risk of W.I.P being under or overvalued.

(The level of work in progress needs to be assessed at the year end. Assessing the percentage

of completion for partially constructed inventory can be very subjective, and an expert

should undertake this. If the percentage of completion is not calculated correctly, the

inventory valuation may be under or over-valued.

Prepared by: M.Sajid Kapadia (ACA, FCCA, APFA)

KnS School of Business Studies

ACCA F8 & CA CAF 9 Audit & Assurance

AUDIT RISK – For Scenario based questions

44. Useful life of assets or depreciation rates have been reassessed or reviewed by the

management during the year.

RISK: There is a risk that this has been done to manipulate the profits or to achieve some

kind of profit targets resulting in profit and PPE being overstated.

45. Contingent assets as per IAS 37 should only be recorded when virtually certain.

RISK: There is a risk that assets are not virtually certain and are recorded as assets

resulting in assets being overvalued in the F/S.

To comply with IAS 37 contingent assets should not be recognized until the receipt is

virtually certain. If recorded there is a risk of assets and profits being over-stated.

46. The client is requesting to complete the audit early quickly than last year.

RISK: This will result in detection risk for the external auditor plus there will be less time

for the finance team to prepare the financial statements leading to an inherent risk that

F/S will me be materially misstated.

47. Bank reconciliations are not made on timely basis.

RISK: There is a risk that differences will not be reconciled resulting in the risk of bank

balances being over /under valued.

48. Physical stock is not reconciled with General ledger or book records.

RISK: There is a risk that closing stock could be over/under valued.

49. If physical cash is not reconciled with General ledger (Cash Book cash column)

RISK: There is a risk that cash balance would be over / under valued.

50. New technology has been introduced by the company because of which old & existing

P & M have been impaired.

RISK: There is a risk that if impairment treatment is not done as per IAS 36 than both

P & M and profits will be overstated.

51. Sales ledger and creditors ledger were closed 10 days after the B/S date

RISK: There is a risk of incorrect cutoff in both sales and purchases leading to over /

under sales and debtors as well as purchases and payables.

52. No supplier statement or purchase ledger control account reconciliations have been

performed during the period.

RISK: There is an increased risk of errors within trade payables and the year-end payables

balance may be under or over-valued.

Prepared by: M.Sajid Kapadia (ACA, FCCA, APFA)

KnS School of Business Studies

ACCA F8 & CA CAF 9 Audit & Assurance

AUDIT RISK – For Scenario based questions

53. A patent / franchise has been purchased by the company for X no of years and if the

management has expensed the full amount in the current year P&L than…..

RISK: There is a risk that as the sum has been fully expensed and not treated in accordance

with IAS 38 than both intangible assets and profits are understated.

(In accordance with IAS 38 Intangible Assets, this should have been included as an

intangible asset and amortized over its useful life accordingly )

54. The company has raised new finance / equity through issuing of shares at a premium. This

needs to be treated correctly, with adequate disclosures made and proper allocation between

share capital and share premium in the B/S.

RISK: If this is not done, then there is a risk that accounts may be misstated due to a lack

of disclosure as well as share capital and share premium will be misstated.

55. During the year, company outsourced its ABC department / function to an external service

organization / service provider.

RISK: A detection risk arises as to whether sufficient and appropriate evidence is available

at the audit client to verify the completeness and accuracy of controls over that ABC

function / transactions and balances at the year end.

Few Accounting standards to be covered for Audit Risk Topic….

IAS 2,16,10,36,37,38 and IFRS 15

*Accounting Ratios and Audit Risks to be covered separately

Prepared by: M.Sajid Kapadia (ACA, FCCA, APFA)

KnS School of Business Studies

ACCA F8 & CA CAF 9 Audit & Assurance

AUDIT RISK – For Scenario based questions

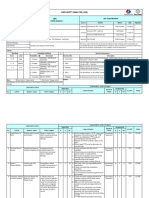

Indicators for Risk of Going Concern

Other Risks

Prepared by: M.Sajid Kapadia (ACA, FCCA, APFA)

You might also like

- The Portable MBA in Finance and AccountingFrom EverandThe Portable MBA in Finance and AccountingRating: 4 out of 5 stars4/5 (19)

- FINS3630 Finals Formula SheetDocument3 pagesFINS3630 Finals Formula SheetElaineKongNo ratings yet

- Assurance Ip1 11Document6 pagesAssurance Ip1 11rui zhangNo ratings yet

- ACCA AAA Sample AnswersDocument4 pagesACCA AAA Sample AnswersAzhar RahamathullaNo ratings yet

- CAPITAL ADEQUACY BEYOND BASEL Banking, Securities, and InsuranceDocument354 pagesCAPITAL ADEQUACY BEYOND BASEL Banking, Securities, and Insurancetarekmn1100% (1)

- MSC530M - The Game Theory of EDSA Revolution - MidTermsDocument5 pagesMSC530M - The Game Theory of EDSA Revolution - MidTermsValerie Joy Macatumbas Limbauan100% (1)

- ACCO 400 Weeks 5 and 6 Discussion Questions and AnswersDocument4 pagesACCO 400 Weeks 5 and 6 Discussion Questions and AnswersWasif SethNo ratings yet

- The Ultimate Guide To Trend Following PDFDocument43 pagesThe Ultimate Guide To Trend Following PDFsaingthy100% (4)

- Price Action Trading Introduction - Learn To TradeDocument8 pagesPrice Action Trading Introduction - Learn To Tradeimamitohm75% (4)

- Form 66 Declaration of SolvencyDocument2 pagesForm 66 Declaration of SolvencyolingirlNo ratings yet

- Gartner Market Share Analysis - Security Consulting, Worldwide, 2012Document9 pagesGartner Market Share Analysis - Security Consulting, Worldwide, 2012Othon CabreraNo ratings yet

- Practical Points That Affect Audit Risks 1703145062Document8 pagesPractical Points That Affect Audit Risks 1703145062fktman69No ratings yet

- Practical Points That Affect Audit Risks: School of Business StudiesDocument6 pagesPractical Points That Affect Audit Risks: School of Business Studiesramen pandeyNo ratings yet

- M20 Answers AAAUKDocument16 pagesM20 Answers AAAUKMUSSICALLY SHOUTOUTNo ratings yet

- Redback Sport AJ21Document9 pagesRedback Sport AJ21FarNo ratings yet

- Solution Advanced Audit and Prof Ethics May 2010Document15 pagesSolution Advanced Audit and Prof Ethics May 2010Samuel DwumfourNo ratings yet

- P7int 2013 Jun A PDFDocument17 pagesP7int 2013 Jun A PDFhiruspoonNo ratings yet

- Advanced Audit and Assurance - International: Specimen Exam - September 2022Document35 pagesAdvanced Audit and Assurance - International: Specimen Exam - September 2022Asif RiazNo ratings yet

- Maple & Co. (September 2022 - Q1) : Briefing NotesDocument8 pagesMaple & Co. (September 2022 - Q1) : Briefing NotesRachana HegdeNo ratings yet

- Industrial SicknessDocument19 pagesIndustrial SicknessAnkit SoniNo ratings yet

- Test 1Document7 pagesTest 1Maithili KulkarniNo ratings yet

- Chapter 09 AssignedDocument4 pagesChapter 09 Assignedmariko1234No ratings yet

- Rick GroupDocument5 pagesRick Grouprajip sthNo ratings yet

- 21 - AAA Mock 1Document8 pages21 - AAA Mock 1Safa AzizNo ratings yet

- P7 Notes Training CostsDocument8 pagesP7 Notes Training CostsKhaled SherifNo ratings yet

- Dmp3e Ch06 Solutions 01.26.10 FinalDocument39 pagesDmp3e Ch06 Solutions 01.26.10 Finalmichaelkwok1No ratings yet

- P7int 2010 Jun ADocument17 pagesP7int 2010 Jun AFzr JamNo ratings yet

- Discussion Question W9 Creative AccountingDocument5 pagesDiscussion Question W9 Creative AccountingElaine LimNo ratings yet

- Advanced Audit & Assurance: Revision Mock Examination December 2019 Answer GuideDocument21 pagesAdvanced Audit & Assurance: Revision Mock Examination December 2019 Answer GuidecryoffalconNo ratings yet

- 2019 Mock Exam A - Morning SessionDocument21 pages2019 Mock Exam A - Morning SessionYash DoshiNo ratings yet

- Aviva PLC Investor and Analyst Update 5 July 2012Document45 pagesAviva PLC Investor and Analyst Update 5 July 2012Aviva GroupNo ratings yet

- Audit RiskDocument12 pagesAudit RiskAli MaqsoodNo ratings yet

- Reporting and Analyzing Revenues and Receivables: Learning Objectives - Coverage by QuestionDocument34 pagesReporting and Analyzing Revenues and Receivables: Learning Objectives - Coverage by QuestionpoollookNo ratings yet

- Honda (Pakistan) : Individual Report On Audit ProcessDocument11 pagesHonda (Pakistan) : Individual Report On Audit ProcesssadiaNo ratings yet

- ENCORE CO SOLUTION March and June 2023Document6 pagesENCORE CO SOLUTION March and June 2023nakoinvestments26No ratings yet

- Auditing and AssuranceDocument15 pagesAuditing and AssuranceWanambisi JnrNo ratings yet

- AARS Test 4 Solution FinalDocument7 pagesAARS Test 4 Solution FinalShahzaib VirkNo ratings yet

- Examination: Subject SA3 General Insurance Specialist ApplicationsDocument265 pagesExamination: Subject SA3 General Insurance Specialist Applicationsscamardela79No ratings yet

- Tong Ngoc Tram Risk 22070166Document7 pagesTong Ngoc Tram Risk 22070166tongngoctram15062004No ratings yet

- Going ConcernDocument5 pagesGoing ConcernkawsursharifNo ratings yet

- Explanation: Inherent Limitations of The AuditDocument4 pagesExplanation: Inherent Limitations of The AuditRiz WanNo ratings yet

- Moranda Sills LLP Served 10 Years Auditor Financial Statements Highland Bank Trust Firm Co q71787860 PDFDocument1 pageMoranda Sills LLP Served 10 Years Auditor Financial Statements Highland Bank Trust Firm Co q71787860 PDFIlham TaufanNo ratings yet

- ACCA AAA EthicsDocument24 pagesACCA AAA EthicsSIRUI DINGNo ratings yet

- Suggested Answer TechniquesDocument11 pagesSuggested Answer TechniquesAzhar RahamathullaNo ratings yet

- Imp of Financial StatementDocument4 pagesImp of Financial StatementSunit DasNo ratings yet

- Corporate Reporting Homework (Day 6)Document4 pagesCorporate Reporting Homework (Day 6)Sara MirchevskaNo ratings yet

- Act380 Case Study Hasan Mahmuud MarufDocument5 pagesAct380 Case Study Hasan Mahmuud MarufHasan Mahmud Maruf 1621513630No ratings yet

- Assignmnet 5.5Document2 pagesAssignmnet 5.5chrislupinjrNo ratings yet

- Homework On Materiality and Audit RiskDocument3 pagesHomework On Materiality and Audit RiskI'j Chut MoHammadNo ratings yet

- Audit tt6Document11 pagesAudit tt6CHYE CHING OOINo ratings yet

- FS AnalysesDocument4 pagesFS Analysessecret 12No ratings yet

- Foreign SuppliersDocument3 pagesForeign SuppliersShahzaib KhanNo ratings yet

- Types of Earnings Management and Manipulation Examples of Earnings ManipulationDocument6 pagesTypes of Earnings Management and Manipulation Examples of Earnings Manipulationkhurram riazNo ratings yet

- Audit and Assurance: Page 1 of 7Document7 pagesAudit and Assurance: Page 1 of 7online lecturesNo ratings yet

- SMChap 006Document25 pagesSMChap 006yasminemagdi3No ratings yet

- Filesure Task 2Document4 pagesFilesure Task 2shrutiNo ratings yet

- Solution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian EditionDocument38 pagesSolution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian Editionwarpingmustacqgmael100% (19)

- Eidi For Audit StudentsDocument5 pagesEidi For Audit StudentsMehak RasheedNo ratings yet

- 2016 Audit Risk AnswerDocument2 pages2016 Audit Risk AnswerAliNo ratings yet

- 1.accountancy True False Questions by AVJDocument19 pages1.accountancy True False Questions by AVJHarshad TupeNo ratings yet

- Accounting HammadDocument7 pagesAccounting Hammadshan khanNo ratings yet

- Q3Document4 pagesQ3talhazaman76No ratings yet

- CAF Examination Program Spring 2023Document9 pagesCAF Examination Program Spring 2023Asad ZahidNo ratings yet

- Assuranc Unit 1Document10 pagesAssuranc Unit 1hyojin YUNNo ratings yet

- SD20 AAAINT Sample - AnswersDocument16 pagesSD20 AAAINT Sample - AnswersVarvNo ratings yet

- RISKS OF MATERIAL MISSTATEMENT/AUDIT RISKS Each Risk Is Usually Worth 1Document5 pagesRISKS OF MATERIAL MISSTATEMENT/AUDIT RISKS Each Risk Is Usually Worth 1future moyoNo ratings yet

- Chapter 7 QuizDocument2 pagesChapter 7 QuizliviaNo ratings yet

- Loss of ContainmentDocument68 pagesLoss of Containmentpetrolhead1No ratings yet

- Environmental Management System and Environmental AuditDocument23 pagesEnvironmental Management System and Environmental Auditanandvishnu_bnair100% (1)

- Rotek Valves Risk Assessment - Process: If You Have Any Questions, Please Contact The ManagerDocument3 pagesRotek Valves Risk Assessment - Process: If You Have Any Questions, Please Contact The ManagerPieter BezuidenhoutNo ratings yet

- 2020 Level III Final Branded Exam Information DocumentDocument12 pages2020 Level III Final Branded Exam Information DocumentJBNo ratings yet

- Disaster Risk Reduction Management LectureDocument19 pagesDisaster Risk Reduction Management LectureJames Joseph ObispoNo ratings yet

- Ind SafetyDocument28 pagesInd Safetygowrisankar32No ratings yet

- Contractor HSE Management ProcedureDocument9 pagesContractor HSE Management ProcedureWinnie Eldama100% (1)

- 8 Project Risk ManagementDocument43 pages8 Project Risk ManagementMUHAMAD TARUNA PRAMUDHITANo ratings yet

- Hazard Identification and Risk AssessmentDocument3 pagesHazard Identification and Risk AssessmentShehada HemaidNo ratings yet

- Batc 641Document14 pagesBatc 641ankit kumarNo ratings yet

- SPO-MDG-OrB-0001-E - Advanced Pilot Operations Learner Guide 1Document82 pagesSPO-MDG-OrB-0001-E - Advanced Pilot Operations Learner Guide 1ANICETH KARWANINo ratings yet

- Trending Causes Marine IncidentsDocument10 pagesTrending Causes Marine IncidentsVinod DsouzaNo ratings yet

- Cyber Security Maturity Assessment Framework For Technology Startups A Systematic Literature ReviewDocument11 pagesCyber Security Maturity Assessment Framework For Technology Startups A Systematic Literature ReviewZukoNo ratings yet

- Quality Manual 06. Planning: Title Document No. REV Effective DateDocument4 pagesQuality Manual 06. Planning: Title Document No. REV Effective DateISUKepri.ComNo ratings yet

- IGC2Document20 pagesIGC2tharwatNo ratings yet

- Pindyck Solutions Chapter 5Document13 pagesPindyck Solutions Chapter 5Ashok Patsamatla100% (1)

- The Impact of Strategic Planning On Crisis Management Styles in The 5-Star HotelsDocument10 pagesThe Impact of Strategic Planning On Crisis Management Styles in The 5-Star HotelsVarun AVNo ratings yet

- Flight Safety Analysis Handbook Final 9 2011v1Document224 pagesFlight Safety Analysis Handbook Final 9 2011v1blackhawk100% (1)

- Adoption Metrics Template 2018Document8 pagesAdoption Metrics Template 2018George Cristian Aquiño HuamanNo ratings yet

- Exhibit H-Hse1 - 230315 - 122438Document36 pagesExhibit H-Hse1 - 230315 - 122438Nada AmmarNo ratings yet

- Jsa Energizing Final Tapping Back FeedingDocument7 pagesJsa Energizing Final Tapping Back FeedingekapadwiNo ratings yet

- Final Community Diagnosis 14Document41 pagesFinal Community Diagnosis 14mico zarsadiazNo ratings yet