Professional Documents

Culture Documents

INclass 2&3-2013a-1

INclass 2&3-2013a-1

Uploaded by

Ferdnance ChekaiCopyright:

Available Formats

You might also like

- PDF PDFDocument7 pagesPDF PDFMikey MadRatNo ratings yet

- Assure Model Lesson PlanDocument2 pagesAssure Model Lesson PlanNicole Hernandez71% (17)

- GZU Fin Reporting Masters Question BankDocument31 pagesGZU Fin Reporting Masters Question BankTawanda Tatenda Herbert100% (2)

- The British Student's Guide To Obtaining Your Visa To Study at The Islamic University of Madinah v.2Document76 pagesThe British Student's Guide To Obtaining Your Visa To Study at The Islamic University of Madinah v.2Nouridine El KhalawiNo ratings yet

- 13 Week Cash Flow ModelDocument16 pages13 Week Cash Flow ModelASChipLeadNo ratings yet

- ACCA F9 Mock Examination 2Document5 pagesACCA F9 Mock Examination 2daria0% (1)

- AGoT2 Illustrated Cheat SheetDocument2 pagesAGoT2 Illustrated Cheat SheetIgor Silva100% (1)

- Enron Case StudyDocument3 pagesEnron Case StudycharleejaiNo ratings yet

- Ifrs December 2020 Key WebDocument10 pagesIfrs December 2020 Key Webjad NasserNo ratings yet

- FAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionDocument9 pagesFAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionRene EngelbrechtNo ratings yet

- ACC 401-2023 GA 2-EvenDocument3 pagesACC 401-2023 GA 2-EvenOhene Asare PogastyNo ratings yet

- Accounting 22 - Final Exam - 2023Document9 pagesAccounting 22 - Final Exam - 2023LaurenNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- TXZAF 2019 Dec ADocument8 pagesTXZAF 2019 Dec AKAH MENG KAMNo ratings yet

- Revision QN On Ratio AnalysisDocument3 pagesRevision QN On Ratio Analysisamosoundo59No ratings yet

- AFA Tut11 Anaylsis & Interpretation of FSDocument9 pagesAFA Tut11 Anaylsis & Interpretation of FSJIA HUI LIMNo ratings yet

- ACCT 2208 - Final Review (Ch. 18, 22, 23)Document16 pagesACCT 2208 - Final Review (Ch. 18, 22, 23)MitchieNo ratings yet

- Financial Management MidtermDocument4 pagesFinancial Management MidtermGrace Sinoy BastanteNo ratings yet

- (Download PDF) Management and Cost Accounting 10th Edition Drury Solutions Manual Full ChapterDocument40 pages(Download PDF) Management and Cost Accounting 10th Edition Drury Solutions Manual Full Chapterhaouayusuri100% (7)

- Caf 5 Far1 Spring 2019xsxDocument5 pagesCaf 5 Far1 Spring 2019xsxMustafa ZaheerNo ratings yet

- Acct6005 Company Accounting: Assessment 2 Case StudyDocument8 pagesAcct6005 Company Accounting: Assessment 2 Case StudyRuhan SinghNo ratings yet

- IAS 28 AssociatesDocument7 pagesIAS 28 AssociatesRumbidzai Mapanzure100% (1)

- IAS 38 - Intangible Assets Question BankDocument37 pagesIAS 38 - Intangible Assets Question Bankcouragemutamba3No ratings yet

- This Assessment Is in Three Parts, Please Answer All ElementsDocument5 pagesThis Assessment Is in Three Parts, Please Answer All ElementsAyesha SheheryarNo ratings yet

- F7 SolutionsDocument15 pagesF7 Solutionsnoor ul anum100% (1)

- Solution Test 2 (1) June 19Document5 pagesSolution Test 2 (1) June 19Nur Dina AbsbNo ratings yet

- 20CCP07/18CCP07 PSG College of Arts & Science Mcom (Ca) Degree Examination May 2021Document8 pages20CCP07/18CCP07 PSG College of Arts & Science Mcom (Ca) Degree Examination May 2021Jerry PonmaniNo ratings yet

- S20 TX ZAF Sample AnswersDocument8 pagesS20 TX ZAF Sample AnswersKAH MENG KAMNo ratings yet

- Balance Sheet SampleDocument1 pageBalance Sheet Samplewaqas akramNo ratings yet

- Test-7 (Sol.)Document4 pagesTest-7 (Sol.)iamneonkingNo ratings yet

- Advanced Financial Accounting and Reporting ExamDocument10 pagesAdvanced Financial Accounting and Reporting ExamMuhammad HassaanNo ratings yet

- Test WorksheetDocument1 pageTest WorksheetattackcairoNo ratings yet

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- QuizDocument4 pagesQuizRinconada Benori ReynalynNo ratings yet

- Question June - 2010Document8 pagesQuestion June - 2010pawan kumar MaheshwariNo ratings yet

- Facgdse07T-B.C - (DSE2) : West Bengal State UniversityDocument3 pagesFacgdse07T-B.C - (DSE2) : West Bengal State UniversityurqjaaucqxNo ratings yet

- P6MYS 2012 Dec ADocument15 pagesP6MYS 2012 Dec AFakhrul Azman NawiNo ratings yet

- Less: Municipal Taxes Paid by Mr. Raj: © The Institute of Chartered Accountants of IndiaDocument11 pagesLess: Municipal Taxes Paid by Mr. Raj: © The Institute of Chartered Accountants of IndiaKetan DedhaNo ratings yet

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaNo ratings yet

- Advanced Financial Management (Singapore) : Thursday 4 June 2009Document13 pagesAdvanced Financial Management (Singapore) : Thursday 4 June 2009Lim CZNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- AP Module 01 - Accounting Changes and ErrorsDocument10 pagesAP Module 01 - Accounting Changes and ErrorsjasfNo ratings yet

- Dea Aul - QuizDocument5 pagesDea Aul - QuizDea Aulia AmanahNo ratings yet

- FR 2019 Marjun Sample A PDFDocument10 pagesFR 2019 Marjun Sample A PDFJenifer KlintonNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- L19 RC Problems On ROI and EVADocument8 pagesL19 RC Problems On ROI and EVAapi-3820619100% (2)

- MT Test Review-Taxation 1-Win 2024Document4 pagesMT Test Review-Taxation 1-Win 2024Mariola AlkuNo ratings yet

- Past Exam Final 1Document4 pagesPast Exam Final 1hieu daoNo ratings yet

- SCIENCEDocument6 pagesSCIENCEAbby NavarroNo ratings yet

- JayathDocument5 pagesJayathJayaprakash JayathNo ratings yet

- Prelim Exam Part 2 SolutionsDocument4 pagesPrelim Exam Part 2 SolutionseaeNo ratings yet

- CAF-07 FAR-II Q. Paper (Final)Document5 pagesCAF-07 FAR-II Q. Paper (Final)ANo ratings yet

- Learning Unit 6 Acquisition of An Interest in A Subsidiary DuringDocument17 pagesLearning Unit 6 Acquisition of An Interest in A Subsidiary DuringThulani NdlovuNo ratings yet

- Mocktest 02Document4 pagesMocktest 02Nga LêNo ratings yet

- FAR - March-April-2021Document8 pagesFAR - March-April-2021Towhidul IslamNo ratings yet

- Management and Cost Accounting 10th Edition Drury Solutions ManualDocument17 pagesManagement and Cost Accounting 10th Edition Drury Solutions Manualeliasvykh6in8100% (31)

- Management and Cost Accounting 10th Edition Drury Solutions Manual Full Chapter PDFDocument38 pagesManagement and Cost Accounting 10th Edition Drury Solutions Manual Full Chapter PDFirisdavid3n8lg100% (13)

- Professional Examination IiDocument55 pagesProfessional Examination IiFuchoin ReikoNo ratings yet

- National University of Science and TechnologyDocument5 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- Government Grant ActivitiesDocument5 pagesGovernment Grant Activitiesjoong wanNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Ias 12 Practice QuestionsDocument9 pagesIas 12 Practice QuestionsKeith P. KatsandeNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Test 1 - VatDocument2 pagesTest 1 - VatFerdnance ChekaiNo ratings yet

- Ac412 Test 2 - Marking SchemeDocument2 pagesAc412 Test 2 - Marking SchemeFerdnance ChekaiNo ratings yet

- FinAcc2 Tut 102 Group Accounting Revision - CAA SlidesDocument174 pagesFinAcc2 Tut 102 Group Accounting Revision - CAA SlidesFerdnance ChekaiNo ratings yet

- Group Assignment - Capital Gains TaxDocument2 pagesGroup Assignment - Capital Gains TaxFerdnance ChekaiNo ratings yet

- Financial Instruments Updated VersionDocument46 pagesFinancial Instruments Updated VersionFerdnance ChekaiNo ratings yet

- FinAcc 1 - Tut 102 CAA SlidesDocument221 pagesFinAcc 1 - Tut 102 CAA SlidesFerdnance Chekai100% (1)

- Public Space Thesis ArchitectureDocument5 pagesPublic Space Thesis Architecturestephaniejohnsonsyracuse100% (2)

- Sensores para PuentesDocument11 pagesSensores para PuentesJuan RestrepoNo ratings yet

- How Is Paper MadeDocument9 pagesHow Is Paper MadeDeo WarrenNo ratings yet

- Angela's Infantwear and Accessories: InvoiceDocument1 pageAngela's Infantwear and Accessories: InvoiceAngelas InfantwearNo ratings yet

- Third Merit List FY BMS 2021-2022 Christian Minority: Form No Denomination Name Gender Stream 12th %Document8 pagesThird Merit List FY BMS 2021-2022 Christian Minority: Form No Denomination Name Gender Stream 12th %Albin JohnNo ratings yet

- Victor Manuel Chevere v. Jerry Johnson Stephen Kaiser Rick E. Peters Jim Keith Bob Affolter, 38 F.3d 1220, 10th Cir. (1994)Document4 pagesVictor Manuel Chevere v. Jerry Johnson Stephen Kaiser Rick E. Peters Jim Keith Bob Affolter, 38 F.3d 1220, 10th Cir. (1994)Scribd Government DocsNo ratings yet

- Diagnosis of Stroke-Associated PneumoniaDocument16 pagesDiagnosis of Stroke-Associated PneumoniaCecilia Casandra UneputtyNo ratings yet

- Organization and Management: Quarter 1, Week 2 Functions, Roles and Skills of A ManagerDocument13 pagesOrganization and Management: Quarter 1, Week 2 Functions, Roles and Skills of A ManagerMaryNo ratings yet

- 904B Compact Wheel LoaderDocument40 pages904B Compact Wheel LoaderSaid TouhamiNo ratings yet

- Test Bank For Quantitative Analysis For Management, 12th EditionDocument12 pagesTest Bank For Quantitative Analysis For Management, 12th Editionnurfhatihah50% (6)

- Noli Me Tangere CharactersDocument2 pagesNoli Me Tangere Characterseloisa quelitesNo ratings yet

- LEARNING ACTIVITY SHEET-CHEM 1 q1 Week 1 StudentDocument6 pagesLEARNING ACTIVITY SHEET-CHEM 1 q1 Week 1 StudentJhude JosephNo ratings yet

- s3 Rooted GuideDocument14 pagess3 Rooted GuideRyn HtNo ratings yet

- 20 Century Cases Where No Finding of Gross Immorality Was MadeDocument6 pages20 Century Cases Where No Finding of Gross Immorality Was MadeLeonel OcanaNo ratings yet

- From Lovemaking To Superconsciousness-0shoDocument31 pagesFrom Lovemaking To Superconsciousness-0shoRAGUPATHYNo ratings yet

- Aisc-Asd 89 PDFDocument15 pagesAisc-Asd 89 PDFKang Mas Wiralodra100% (4)

- Live Outside The BoxDocument2 pagesLive Outside The BoxKrishnaKumarDeepNo ratings yet

- Scotia Bank WorkDocument3 pagesScotia Bank WorkVaidant SunejaNo ratings yet

- Shark Tank Episodes: Season 2 Episode ProductsDocument2 pagesShark Tank Episodes: Season 2 Episode ProductsAdelfa Alap-apNo ratings yet

- 080930-Antarctica TourismDocument15 pages080930-Antarctica TourismVân PhươngNo ratings yet

- Online Class Student GuidelinesDocument12 pagesOnline Class Student GuidelinesElaine Fiona Villafuerte100% (1)

- Motion Regarding Admission of Out of Court Statement 1Document2 pagesMotion Regarding Admission of Out of Court Statement 1WXMINo ratings yet

- All Bodies Are Beautiful: Don't Know Where To Start With Your Assignment?Document1 pageAll Bodies Are Beautiful: Don't Know Where To Start With Your Assignment?Hades RiegoNo ratings yet

- Operations Management PDFDocument290 pagesOperations Management PDFVinay Mulay100% (3)

- Pe SyllabusDocument26 pagesPe SyllabusJosh SchultzNo ratings yet

- 3 A Comparative Study in The Calcium Content of The Shells of Oyster Crassostrea Echinata Green Shell Perna Viridis Capiz Shell Placuna Placenta and Nylon Shell PDFDocument8 pages3 A Comparative Study in The Calcium Content of The Shells of Oyster Crassostrea Echinata Green Shell Perna Viridis Capiz Shell Placuna Placenta and Nylon Shell PDFKing LeonidasNo ratings yet

INclass 2&3-2013a-1

INclass 2&3-2013a-1

Uploaded by

Ferdnance ChekaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

INclass 2&3-2013a-1

INclass 2&3-2013a-1

Uploaded by

Ferdnance ChekaiCopyright:

Available Formats

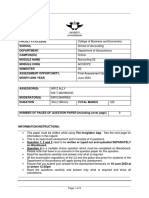

BINDURA UNIVERSITY OF SCIENCE EDUCATION

FACULTY OF COMMERCE

DEPARTMENT OF ACCOUNTANCY

__________________________________________________________________________

FINANCIAL ACCOUNTING 3B (AC402)

In-class Test 2

Suggested solutions

a) PEE Ltd

Year Capital b/f Lease Capital Finance Capital

payment outstanding charge at year end

@ 15.15%

$ $ $ $ $

2009 20,000 5,200 14,800 2,242 17,042

2010 17,042 5,200 11,842 1,794 13,636

2011 13,636 5,200 8,436 1,278 9,714

2012 9,714 5,200 4,514 686 5,200

2013 5,200 5,200 --- ---- ----

Non-current liability at 31 December 2009

Amounts due under finance lease (17,042 – 5,200) 11,842

In this situation the lease payments are in advance. So the next payment is due in 1 day and the year

end current liability includes the current year's finance charge (which has accrued but not been

paid). To calculate the non-current liability, the full amount of the next payment is deducted from

the year end capital balance.

In-class 2&3_AC402_Block-Release_2013a Page 1 of 4

b) Blue Ltd

Impairment to the statement of comprehensive income only goodwill $ 3 600

Identifiable assets 13 500

Goodwill 400

Workings and explanation

A portion of True Ltd’s recoverable amount of $15 000 is attributable to the unrecognised non-

controlling interest in goodwill. Therefore, in accordance with IAS 36, the carrying amount of True Ltd

must be notionally adjusted to include goodwill attributable to the non-controlling interest, before

being compared with the recoverable amount of $15 000.

Total Identifiable Goodwill: Blue Goodwill: NCI

assets Ltd

Initial carrying 20 000 1 5000 4 0001 -----

amount

Depreciation (1 500) (1 500) ----- -----

Unrecognised 1 0002 ----- ----- 1 000

non-controlling

interest

in goodwill

19 500 13 500 4 000 1 000

Impairment (4 500)3 ---- (3 600)4 (900)5

Recoverable 15 000 13 500 400 100

amount

1 16 000 (Investment) – (15 000 Assets x 80%) = 4 000 goodwill

2 4 000 x 20/80 = 1 000

3 19 500 – 15 000 = 4 500 impairment

4 4 500 x 80% = 3 600 Interest of Blue group

5 4 500 x 20% = 900 non-controlling interest

In-class 2&3_AC402_Block-Release_2013a Page 2 of 4

The full $4 500 of the impairment loss is allocated to the goodwill. However, only 80% of Blue Ltd’s

interest in goodwill is recognised in the consolidated financial statements, therefore only 80% of the

impairment loss will be recognised by the group. As shown in (b), the carrying amount of True Ltd

comprises the identifiable assets of True Ltd + 80% of the remaining goodwill ($13 500 + $400 = $13

900).

In-Class 2

QUESTION 2

a) Grants related to assets are government grants whose primary condition is that an entity should

purchase, construct or otherwise acquire long-term assets. Subsidiary conditions may also be

attached restricting the type or location of the assets or the periods during which they are to be

acquired or held. This type of grant is recorded either by setting up a deferred income account in

respect of the receipt, or by deducting the grant in arriving at the carrying amount of the asset. The

grant is then recognised as income on a systematic and rational basis, either over the useful life of

the asset (if deferred income), or by way of a reduced depreciation charge over the life of the

depreciable asset (if deducted from the carrying amount). If the grant relates to a non-depreciable

asset (for example land), one has to identify the periods that will be burdened with the costs of

complying with the attached conditions, and then recognise the grant as income over these periods

(for example the useful life of the building erected on the land).

b) If it is the policy of Alpha Ltd to account for the grant as deferred income, the repayment will be

accounted for as follows:

Profit or loss (Statement of comprehensive income) Year 1 Year 2 Year 3

$ $ $

Depreciation (250 000 / 4) (62 500) (62 500) (62 500)

Grant received (80 000 / 4);(60 000 / 4) 20 000 20 000 15 000

Grant income adjustment i.r.o. year 1 and 2 [(20 000 -15 000)x 2] (10 000)

(This adjustment represents a debit to profit or loss, being a reversal of excess grant income

recognised in years 1 and 2. NB: The change in estimate in year 3 will amount to $15 000, consisting

of the reduction in grant income in year 3 from $20 000 to $15 000, as well as the adjustment of $10

000 in respect of years 1 and 2. The future effect of the change in estimate will amount to $5 000,

being the reduction in grant income in year 4.)

c) Statement of financial position Year 1 Year 2 Year 3

In-class 2&3_AC402_Block-Release_2013a Page 3 of 4

$ $ $

Property, plant and equipment- Cost 250 000 250 000 250 000

Accumulated depreciation (62 500) (125 000) (187 500)

Deferred income (80 000 - 20 000); (60 000 -

20 000);(40 000 balance - 20 000 repayment +

10 000 adjustment - 15 000 current year) (60 000) (40 000) (15 000)

In-class 2&3_AC402_Block-Release_2013a Page 4 of 4

You might also like

- PDF PDFDocument7 pagesPDF PDFMikey MadRatNo ratings yet

- Assure Model Lesson PlanDocument2 pagesAssure Model Lesson PlanNicole Hernandez71% (17)

- GZU Fin Reporting Masters Question BankDocument31 pagesGZU Fin Reporting Masters Question BankTawanda Tatenda Herbert100% (2)

- The British Student's Guide To Obtaining Your Visa To Study at The Islamic University of Madinah v.2Document76 pagesThe British Student's Guide To Obtaining Your Visa To Study at The Islamic University of Madinah v.2Nouridine El KhalawiNo ratings yet

- 13 Week Cash Flow ModelDocument16 pages13 Week Cash Flow ModelASChipLeadNo ratings yet

- ACCA F9 Mock Examination 2Document5 pagesACCA F9 Mock Examination 2daria0% (1)

- AGoT2 Illustrated Cheat SheetDocument2 pagesAGoT2 Illustrated Cheat SheetIgor Silva100% (1)

- Enron Case StudyDocument3 pagesEnron Case StudycharleejaiNo ratings yet

- Ifrs December 2020 Key WebDocument10 pagesIfrs December 2020 Key Webjad NasserNo ratings yet

- FAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionDocument9 pagesFAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionRene EngelbrechtNo ratings yet

- ACC 401-2023 GA 2-EvenDocument3 pagesACC 401-2023 GA 2-EvenOhene Asare PogastyNo ratings yet

- Accounting 22 - Final Exam - 2023Document9 pagesAccounting 22 - Final Exam - 2023LaurenNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- TXZAF 2019 Dec ADocument8 pagesTXZAF 2019 Dec AKAH MENG KAMNo ratings yet

- Revision QN On Ratio AnalysisDocument3 pagesRevision QN On Ratio Analysisamosoundo59No ratings yet

- AFA Tut11 Anaylsis & Interpretation of FSDocument9 pagesAFA Tut11 Anaylsis & Interpretation of FSJIA HUI LIMNo ratings yet

- ACCT 2208 - Final Review (Ch. 18, 22, 23)Document16 pagesACCT 2208 - Final Review (Ch. 18, 22, 23)MitchieNo ratings yet

- Financial Management MidtermDocument4 pagesFinancial Management MidtermGrace Sinoy BastanteNo ratings yet

- (Download PDF) Management and Cost Accounting 10th Edition Drury Solutions Manual Full ChapterDocument40 pages(Download PDF) Management and Cost Accounting 10th Edition Drury Solutions Manual Full Chapterhaouayusuri100% (7)

- Caf 5 Far1 Spring 2019xsxDocument5 pagesCaf 5 Far1 Spring 2019xsxMustafa ZaheerNo ratings yet

- Acct6005 Company Accounting: Assessment 2 Case StudyDocument8 pagesAcct6005 Company Accounting: Assessment 2 Case StudyRuhan SinghNo ratings yet

- IAS 28 AssociatesDocument7 pagesIAS 28 AssociatesRumbidzai Mapanzure100% (1)

- IAS 38 - Intangible Assets Question BankDocument37 pagesIAS 38 - Intangible Assets Question Bankcouragemutamba3No ratings yet

- This Assessment Is in Three Parts, Please Answer All ElementsDocument5 pagesThis Assessment Is in Three Parts, Please Answer All ElementsAyesha SheheryarNo ratings yet

- F7 SolutionsDocument15 pagesF7 Solutionsnoor ul anum100% (1)

- Solution Test 2 (1) June 19Document5 pagesSolution Test 2 (1) June 19Nur Dina AbsbNo ratings yet

- 20CCP07/18CCP07 PSG College of Arts & Science Mcom (Ca) Degree Examination May 2021Document8 pages20CCP07/18CCP07 PSG College of Arts & Science Mcom (Ca) Degree Examination May 2021Jerry PonmaniNo ratings yet

- S20 TX ZAF Sample AnswersDocument8 pagesS20 TX ZAF Sample AnswersKAH MENG KAMNo ratings yet

- Balance Sheet SampleDocument1 pageBalance Sheet Samplewaqas akramNo ratings yet

- Test-7 (Sol.)Document4 pagesTest-7 (Sol.)iamneonkingNo ratings yet

- Advanced Financial Accounting and Reporting ExamDocument10 pagesAdvanced Financial Accounting and Reporting ExamMuhammad HassaanNo ratings yet

- Test WorksheetDocument1 pageTest WorksheetattackcairoNo ratings yet

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- QuizDocument4 pagesQuizRinconada Benori ReynalynNo ratings yet

- Question June - 2010Document8 pagesQuestion June - 2010pawan kumar MaheshwariNo ratings yet

- Facgdse07T-B.C - (DSE2) : West Bengal State UniversityDocument3 pagesFacgdse07T-B.C - (DSE2) : West Bengal State UniversityurqjaaucqxNo ratings yet

- P6MYS 2012 Dec ADocument15 pagesP6MYS 2012 Dec AFakhrul Azman NawiNo ratings yet

- Less: Municipal Taxes Paid by Mr. Raj: © The Institute of Chartered Accountants of IndiaDocument11 pagesLess: Municipal Taxes Paid by Mr. Raj: © The Institute of Chartered Accountants of IndiaKetan DedhaNo ratings yet

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaNo ratings yet

- Advanced Financial Management (Singapore) : Thursday 4 June 2009Document13 pagesAdvanced Financial Management (Singapore) : Thursday 4 June 2009Lim CZNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- AP Module 01 - Accounting Changes and ErrorsDocument10 pagesAP Module 01 - Accounting Changes and ErrorsjasfNo ratings yet

- Dea Aul - QuizDocument5 pagesDea Aul - QuizDea Aulia AmanahNo ratings yet

- FR 2019 Marjun Sample A PDFDocument10 pagesFR 2019 Marjun Sample A PDFJenifer KlintonNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- L19 RC Problems On ROI and EVADocument8 pagesL19 RC Problems On ROI and EVAapi-3820619100% (2)

- MT Test Review-Taxation 1-Win 2024Document4 pagesMT Test Review-Taxation 1-Win 2024Mariola AlkuNo ratings yet

- Past Exam Final 1Document4 pagesPast Exam Final 1hieu daoNo ratings yet

- SCIENCEDocument6 pagesSCIENCEAbby NavarroNo ratings yet

- JayathDocument5 pagesJayathJayaprakash JayathNo ratings yet

- Prelim Exam Part 2 SolutionsDocument4 pagesPrelim Exam Part 2 SolutionseaeNo ratings yet

- CAF-07 FAR-II Q. Paper (Final)Document5 pagesCAF-07 FAR-II Q. Paper (Final)ANo ratings yet

- Learning Unit 6 Acquisition of An Interest in A Subsidiary DuringDocument17 pagesLearning Unit 6 Acquisition of An Interest in A Subsidiary DuringThulani NdlovuNo ratings yet

- Mocktest 02Document4 pagesMocktest 02Nga LêNo ratings yet

- FAR - March-April-2021Document8 pagesFAR - March-April-2021Towhidul IslamNo ratings yet

- Management and Cost Accounting 10th Edition Drury Solutions ManualDocument17 pagesManagement and Cost Accounting 10th Edition Drury Solutions Manualeliasvykh6in8100% (31)

- Management and Cost Accounting 10th Edition Drury Solutions Manual Full Chapter PDFDocument38 pagesManagement and Cost Accounting 10th Edition Drury Solutions Manual Full Chapter PDFirisdavid3n8lg100% (13)

- Professional Examination IiDocument55 pagesProfessional Examination IiFuchoin ReikoNo ratings yet

- National University of Science and TechnologyDocument5 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- Government Grant ActivitiesDocument5 pagesGovernment Grant Activitiesjoong wanNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Ias 12 Practice QuestionsDocument9 pagesIas 12 Practice QuestionsKeith P. KatsandeNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Test 1 - VatDocument2 pagesTest 1 - VatFerdnance ChekaiNo ratings yet

- Ac412 Test 2 - Marking SchemeDocument2 pagesAc412 Test 2 - Marking SchemeFerdnance ChekaiNo ratings yet

- FinAcc2 Tut 102 Group Accounting Revision - CAA SlidesDocument174 pagesFinAcc2 Tut 102 Group Accounting Revision - CAA SlidesFerdnance ChekaiNo ratings yet

- Group Assignment - Capital Gains TaxDocument2 pagesGroup Assignment - Capital Gains TaxFerdnance ChekaiNo ratings yet

- Financial Instruments Updated VersionDocument46 pagesFinancial Instruments Updated VersionFerdnance ChekaiNo ratings yet

- FinAcc 1 - Tut 102 CAA SlidesDocument221 pagesFinAcc 1 - Tut 102 CAA SlidesFerdnance Chekai100% (1)

- Public Space Thesis ArchitectureDocument5 pagesPublic Space Thesis Architecturestephaniejohnsonsyracuse100% (2)

- Sensores para PuentesDocument11 pagesSensores para PuentesJuan RestrepoNo ratings yet

- How Is Paper MadeDocument9 pagesHow Is Paper MadeDeo WarrenNo ratings yet

- Angela's Infantwear and Accessories: InvoiceDocument1 pageAngela's Infantwear and Accessories: InvoiceAngelas InfantwearNo ratings yet

- Third Merit List FY BMS 2021-2022 Christian Minority: Form No Denomination Name Gender Stream 12th %Document8 pagesThird Merit List FY BMS 2021-2022 Christian Minority: Form No Denomination Name Gender Stream 12th %Albin JohnNo ratings yet

- Victor Manuel Chevere v. Jerry Johnson Stephen Kaiser Rick E. Peters Jim Keith Bob Affolter, 38 F.3d 1220, 10th Cir. (1994)Document4 pagesVictor Manuel Chevere v. Jerry Johnson Stephen Kaiser Rick E. Peters Jim Keith Bob Affolter, 38 F.3d 1220, 10th Cir. (1994)Scribd Government DocsNo ratings yet

- Diagnosis of Stroke-Associated PneumoniaDocument16 pagesDiagnosis of Stroke-Associated PneumoniaCecilia Casandra UneputtyNo ratings yet

- Organization and Management: Quarter 1, Week 2 Functions, Roles and Skills of A ManagerDocument13 pagesOrganization and Management: Quarter 1, Week 2 Functions, Roles and Skills of A ManagerMaryNo ratings yet

- 904B Compact Wheel LoaderDocument40 pages904B Compact Wheel LoaderSaid TouhamiNo ratings yet

- Test Bank For Quantitative Analysis For Management, 12th EditionDocument12 pagesTest Bank For Quantitative Analysis For Management, 12th Editionnurfhatihah50% (6)

- Noli Me Tangere CharactersDocument2 pagesNoli Me Tangere Characterseloisa quelitesNo ratings yet

- LEARNING ACTIVITY SHEET-CHEM 1 q1 Week 1 StudentDocument6 pagesLEARNING ACTIVITY SHEET-CHEM 1 q1 Week 1 StudentJhude JosephNo ratings yet

- s3 Rooted GuideDocument14 pagess3 Rooted GuideRyn HtNo ratings yet

- 20 Century Cases Where No Finding of Gross Immorality Was MadeDocument6 pages20 Century Cases Where No Finding of Gross Immorality Was MadeLeonel OcanaNo ratings yet

- From Lovemaking To Superconsciousness-0shoDocument31 pagesFrom Lovemaking To Superconsciousness-0shoRAGUPATHYNo ratings yet

- Aisc-Asd 89 PDFDocument15 pagesAisc-Asd 89 PDFKang Mas Wiralodra100% (4)

- Live Outside The BoxDocument2 pagesLive Outside The BoxKrishnaKumarDeepNo ratings yet

- Scotia Bank WorkDocument3 pagesScotia Bank WorkVaidant SunejaNo ratings yet

- Shark Tank Episodes: Season 2 Episode ProductsDocument2 pagesShark Tank Episodes: Season 2 Episode ProductsAdelfa Alap-apNo ratings yet

- 080930-Antarctica TourismDocument15 pages080930-Antarctica TourismVân PhươngNo ratings yet

- Online Class Student GuidelinesDocument12 pagesOnline Class Student GuidelinesElaine Fiona Villafuerte100% (1)

- Motion Regarding Admission of Out of Court Statement 1Document2 pagesMotion Regarding Admission of Out of Court Statement 1WXMINo ratings yet

- All Bodies Are Beautiful: Don't Know Where To Start With Your Assignment?Document1 pageAll Bodies Are Beautiful: Don't Know Where To Start With Your Assignment?Hades RiegoNo ratings yet

- Operations Management PDFDocument290 pagesOperations Management PDFVinay Mulay100% (3)

- Pe SyllabusDocument26 pagesPe SyllabusJosh SchultzNo ratings yet

- 3 A Comparative Study in The Calcium Content of The Shells of Oyster Crassostrea Echinata Green Shell Perna Viridis Capiz Shell Placuna Placenta and Nylon Shell PDFDocument8 pages3 A Comparative Study in The Calcium Content of The Shells of Oyster Crassostrea Echinata Green Shell Perna Viridis Capiz Shell Placuna Placenta and Nylon Shell PDFKing LeonidasNo ratings yet