Professional Documents

Culture Documents

Lecture 1 IS-LM Closed Economy

Lecture 1 IS-LM Closed Economy

Uploaded by

Tannu RadhaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture 1 IS-LM Closed Economy

Lecture 1 IS-LM Closed Economy

Uploaded by

Tannu RadhaCopyright:

Available Formats

Lecture 1: IS-LM Closed Economy

B. A. (P) Economics 2nd Year Principles of Macroeconomics II

IS–LM Model in Closed Economy

Let’s consider following two sectors IS –LM model.

Goods Market

The IS equation is

Y = C(Y – t(Y)) + I(r) + G 0 < c’, t’ < 1 I’< 0 (1)

Here

Y is output

t(Y) is tax function which is depends on Y

Y – t(Y) is disposable income

C is consumption which is a function of disposable income (Y – t(Y)).

I is investment which is now a function of rate of interest(r).

G is government expenditure

c’ (dC/dY) is a marginal propensity to consume out of disposable income and as we know its lie between

0 and 1.

t’ (dt/dY) is tax rate and it’s also lie between 0 and 1 because people pay fraction of their income to

government in the form of tax.

I' (dI/dr) is interest sensitivity to r

Let’s find out slope of IS curve

After taking total differentiation of IS Equation (1), we get

dY = c’( dY – t’dY) + I’dr + dG

After taking dY common form consumption function we get

dY = c’( 1 – t’) dY + I’dr + dG

After taking dY term on the left side

dY -c’( 1 – t’) dY = I’dr + dG

After taking dY common, we get

By Suresh Kumar Page 1

Lecture 1: IS-LM Closed Economy

B. A. (P) Economics 2nd Year Principles of Macroeconomics II

[1 - c’( 1 – t’)]dY = I’dr + dG

After putting dG = 0 , we get

dY/dr = I’/ [1 - c’( 1 – t’)] < 0 since 0 < c’< 1 I’< 0

dY/dr is the slope of IS curve and which is negative in Y and r space. in other words we have downward

sloping IS curve in Y and r space.

IS

Money market

The LM equation is

M/P = K(Y) + L(r) K’ (dK/dY) > 0 L’(dL/dY) < 0

M is nominal money supply

P is price

M/P is real money supply

K(Y) is transaction demand for money and it’s positively related to Income(Y).

L(r) is speculating demand for money and it’s negatively related to rate of interest.

Let P = 1

The LM equation become

M = K(Y) + L(r) (2)

Let’s find out slope of LM curve

By Suresh Kumar Page 2

Lecture 1: IS-LM Closed Economy

B. A. (P) Economics 2nd Year Principles of Macroeconomics II

After taking total differentiation of LM Equation (2), we get

dM = K’dY + L’dr

After putting dM = 0, we get

dr/dY = -K’/L’ > 0 since K’ > 0 L’ < 0

dY/dr is the slope of LM curve and which is positive in Y and r space. In other words we have upward

sloping LM curve in Y and r space.

r LM

Now let’s find out fiscal and monetary multiplier of closed economy.

Fiscal multiplier

After taking total differentiation of IS Equation (1), we get

dY = C’( dY – t’dY) + I’dr + dG

After taking dY common form consumption function we get

dY = C’( 1 – t’) dY + I’dr + dG

After taking dY term on the left side

dY - C’( 1 – t’) dY = I’dr + dG

After taking dY common, we get

[1 - C’( 1 – t’) ]dY = I’dr + dG (3)

After taking total differentiation of LM Equation (2), we get

dM = K’dY + L’dr

After putting dM = 0, we get

By Suresh Kumar Page 3

Lecture 1: IS-LM Closed Economy

B. A. (P) Economics 2nd Year Principles of Macroeconomics II

dr = -K’/L’dY (4)

After putting the value of dr from equation (4) into (3) we get

[1 - C’( 1 – t’) ]dY = I’-K’/L’dY + dG

After taking dY term in left hand side , we get

[1 - C’( 1 – t’) ]dY + I’K’/L’dY = dG

After taking dY common, we get

[1 - C’( 1 – t’) + I’K’/L’]dY = dG

dY/dG = 1/[1 - C’( 1 – t’) + I’K’/L’] > 0 since 0 < c’, t’ < 1 K’ > 0 L’ < 0

Now let’s see it by theoretically and diagrammatically.

r LM0

r2

r0 A B C G1 > G0

IS(G0) IS(G1)

Y0 Y2 Y1 Y

G↑→Y↑( G is adding in Y) →C↑( 0< C <1’) → Y1↑( C is adding in Y) →MdT↑( K’ > 0) →r1↑(

Ms is constant) → MdSP↓( L’ < 0) → r2↓( Ms is constant) → (but all over r has increased) I↓( I’ <

0) →Y2↓( I is adding in Y)

Y1↑ > Y2 ↓

r1↑ > r2 ↓

By Suresh Kumar Page 4

Lecture 1: IS-LM Closed Economy

B. A. (P) Economics 2nd Year Principles of Macroeconomics II

Red color is Goods market effect and Green color is Money market effect.

AB = dY = {1/[1 - C’( 1 – t’)]} dG

AC = dY = {1/[1 - C’( 1 – t’) + I’K’/L’]} dG

I’K’/L’ is the money market effect which is reducing fiscal policy multiplier value.

BC is called crowding out. Crowding out refers as a reduction in private investment due to increase in

government expenditure. I’K’/L’ is crowding out part in Fiscal multiplier but we cannot separate it

because it is in denominator.

Monetary multiplier

After taking total differentiation of IS Equation (1), we get

dY = C’( dY – t’dY) + I’dr + dG

After taking dY common form consumption function we get

dY = C’( 1 – t’) dY + I’dr + dG

After taking dY term on the left side

dY - C’( 1 – t’) dY = I’dr + dG

After taking dY common, we get

[1 - C’( 1 – t’) ]dY = I’dr + dG (3)

Put dG = 0

After taking total differentiation of LM Equation (2), we get

dM = K’dY + L’dr

dr = dM/L’ -K’/L’dY

(4)

After putting the value of dr from equation (4) into (3) we get

[1 - C’( 1 – t’) ]dY = I’-K’/L’dY + I’/L’dM)

After taking dY term in left hand side , we get

[1 - C’( 1 – t’) ]dY + I’K’/L’dY = I’/L’dM

By Suresh Kumar Page 5

Lecture 1: IS-LM Closed Economy

B. A. (P) Economics 2nd Year Principles of Macroeconomics II

After taking dY common, we get

[1 - C’( 1 – t’) + I’K’/L’]dY = I’/L’dM

dY/dM = (I’/L’)/[1 - C’( 1 – t’) + I’K’/L’] > 0 since 0 < c’, t’ < 1 I’< 0 K’ > 0 L’ < 0

Now let’s see it by theoretically and diagrammatically.

r LM(M0)

LM(M1)

r0

r1 M 1 > M0

IS0

Y0 Y1 Y

M↑→ r1↓( Md is constant) → I↑ ( I’ < 0) →Y1↑ ( I is adding in Y)

Now let’s study IS-LM in extreme cases

Case-I

Speculative demand for money is completely inelastic with rate of interest. In the other word

L 0. Recall Speculating demand for money chapter where we studied that there exist a maximum

rmax where speculative demand for money is equal to zero. Suppose this maximum rmax exist in the

economy. IS equation and shape of IS curve are in this case is same as in normal case but LM

equation and shape of LM curve will change. LM equation is this case is

Ms = K(Y) or Y = A where A is some positive No.

LM curve will become a vertical line in Y and r space. You can see it by looking LM equation because Y

= A is a vertical line in Y and r space.

By Suresh Kumar Page 6

Lecture 1: IS-LM Closed Economy

B. A. (P) Economics 2nd Year Principles of Macroeconomics II

r LM

IS

A Y

Now let’s find out fiscal and monetary multiplier of closed economy in this extreme case-I.

Fiscal Multiplier

dY/dG = 1/[1 - C’( 1 – t’) + I’K’/L’] = o

LimL’ 0

This show that fiscal policy is completely ineffective if there is no speculative demand for money.

Now let’s see it by theoretically and diagrammatically.

r LM

r1

r0

IS0 IS1

A Y

G↑→Y↑( G is adding in Y) →C↑( 0< C <1’) → Y1↑( C is adding in Y) →MdT↑( K’ > 0) →r1↑ →

I↓( I’ < 0) →Y2↓( I is adding in Y)

Y1↑ = Y2 ↓

By Suresh Kumar Page 7

Lecture 1: IS-LM Closed Economy

B. A. (P) Economics 2nd Year Principles of Macroeconomics II

Increase in G will shift IS curve right from IS0 to IS1 and output didn’t change only interest rate goes

up from r0 to r1.

Monetary Multiplier

dY/dM = I’K’/L’/[1 - C’( 1 – t’) + I’K’/L’] = 1/ K’ (using L-hospital rule) > 0 because K’ > 0

Lim L’ 0

Increase in Ms by dMs will increase Y* by dY*. Increase in Ms will increase the value of A because A =

Y* = Ms/k. we can say that monetary policy is effecting in case-I

Now let’s see it by theoretically and diagrammatically.

r LM0 LM1

IS

A A* Y

M↑→ r1↓( Md is constant) → I↑ ( I’ < 0) →Y1↑ ( I is adding in Y)

Increase in Ms will shift LM curve right from LM0 to LM1 and output increase from A to A*.

Case-II

Speculative demand for money is infinitely elastic with rate of interest. In the other word

L’ ∞. Recall Speculating demand for money chapter where we studied that there exist a

minimum rmin where speculative demand for money is infinite. Suppose this minimum rmin exist in the

economy. IS equation and shape of IS curve are in this case is same as in normal case but shape of

LM curve will change.

LM curve will become a horizontal line at rmin in Y and r space.

By Suresh Kumar Page 8

Lecture 1: IS-LM Closed Economy

B. A. (P) Economics 2nd Year Principles of Macroeconomics II

rmin LM

Now let’s find out fiscal and monetary multiplier of closed economy in this extreme case-II.

Fiscal Multiplier

dY*/dG = 1/[1 - C’( 1 – t’) + I’K’/L’] = 1/[1 - C’( 1 – t’)] > 0 because 0 < C1 < 1

Lim L’ ∞

This shows that fiscal policy is effective. Increase in G by dG will increase Y0 by Y1.

Now let’s see it by theoretically and diagrammatically.

G1 > G0

rmin LM

IS(G0) IS(G1)

Y0* Y1 * Y

G↑→Y↑( G is adding in Y) →C↑( 0< C <1’) → Y1↑( C is adding in Y)

Increase in G will shift IS curve right from IS0 to IS1 and output increase from Y0* to Y1*.

By Suresh Kumar Page 9

Lecture 1: IS-LM Closed Economy

B. A. (P) Economics 2nd Year Principles of Macroeconomics II

Monetary multiplier

dY*/dMs = (I’/L’)/[1 - C’( 1 – t’) + I’K’/L’] = 0

Lim l ∞

This shows that monetary policy is completely ineffective.

Now let’s see it by diagrammatically.

rmin LM

IS

M↑, r will not change

Increase in Ms will not shift LM curve because it fixed at rmin and output an interest rate will not

change.

By Suresh Kumar Page 10

You might also like

- (Transaction # 1Document3 pages(Transaction # 1Caryl May Esparrago MiraNo ratings yet

- Company LAW: Classification of CompaniesDocument1 pageCompany LAW: Classification of Companiessiti nadhirah100% (1)

- Chapter 5Document22 pagesChapter 5ibrahim AYDINNo ratings yet

- Macroeconomics 2021/2022: Practice Lesson 1 Prof. Marco Di Domizio EmailDocument10 pagesMacroeconomics 2021/2022: Practice Lesson 1 Prof. Marco Di Domizio EmailghadiNo ratings yet

- Solutions Problem Set 1 Macro II (14.452) How Well Does The IS-LM Model Fit Postwar U.S. Data?Document7 pagesSolutions Problem Set 1 Macro II (14.452) How Well Does The IS-LM Model Fit Postwar U.S. Data?m7shahidNo ratings yet

- Chapter 10 Goods Market Is LMDocument6 pagesChapter 10 Goods Market Is LMmulengaadamson00No ratings yet

- E435 CCLM s13Document4 pagesE435 CCLM s13Park Seo YoonNo ratings yet

- Comparative Static Analysis of The Keynesian ModelDocument5 pagesComparative Static Analysis of The Keynesian Modelsimao_sabrosa7794No ratings yet

- IS LM Togather PDFDocument9 pagesIS LM Togather PDFakjNo ratings yet

- ECN 403 Lecture NoteDocument26 pagesECN 403 Lecture Noteveronicakaren404No ratings yet

- Economics 4023 Mid Part 2 #Document5 pagesEconomics 4023 Mid Part 2 #Rafina AzizNo ratings yet

- Lecture4 en 2012Document38 pagesLecture4 en 2012Citio LogosNo ratings yet

- Ec2010 T1 PDFDocument67 pagesEc2010 T1 PDFAlayou TeferaNo ratings yet

- Is-LM Model With A General Consumption TaxDocument14 pagesIs-LM Model With A General Consumption TaxAisyah Fahma ArdianaNo ratings yet

- 2 Islm WBDocument6 pages2 Islm WBALDIRSNo ratings yet

- Closed Economy1Document38 pagesClosed Economy1Addai SamuelNo ratings yet

- Aggregate Demand II: Applying The - Model: IS LMDocument46 pagesAggregate Demand II: Applying The - Model: IS LMRyan SukrawanNo ratings yet

- Eia1009 - Tutorial 6Document3 pagesEia1009 - Tutorial 6zaim ilyasaNo ratings yet

- Analisis Is LM 1Document38 pagesAnalisis Is LM 1Paelo MaldiniNo ratings yet

- Problem Set 1: ECON 4330Document14 pagesProblem Set 1: ECON 4330NeemaNo ratings yet

- Is LMDocument21 pagesIs LMtushar kathuria100% (1)

- Chap 12Document59 pagesChap 12Anonymous lW5is17xPNo ratings yet

- Distributed Lag ModelDocument6 pagesDistributed Lag Modelatul211988No ratings yet

- LectureNote1 GRIPS PDFDocument5 pagesLectureNote1 GRIPS PDFprasadpatankar9No ratings yet

- RSM 332 Lecture 2: Tina TanDocument26 pagesRSM 332 Lecture 2: Tina TanBella ChungNo ratings yet

- Econ 1001Document3 pagesEcon 1001Tricia KiethNo ratings yet

- Mundel Flemming Model HardvardDocument13 pagesMundel Flemming Model Hardvarditalos1977No ratings yet

- Examination: Subject CT6 Statistical Methods Core TechnicalDocument13 pagesExamination: Subject CT6 Statistical Methods Core TechnicalPooja SachdevaNo ratings yet

- The LM Curve With Money TargetingDocument25 pagesThe LM Curve With Money TargetingVeronicaNo ratings yet

- Macroeconomics IIDocument177 pagesMacroeconomics IIly baoNo ratings yet

- Aggregate Demand II: Applying The - Model: IS LMDocument58 pagesAggregate Demand II: Applying The - Model: IS LMShofikul islam ShawonNo ratings yet

- Intermediate Macroeconomics SummaryDocument22 pagesIntermediate Macroeconomics SummaryJildert OppedijkNo ratings yet

- All India Integrated Test Series: JEE (Advanced) - 2022Document13 pagesAll India Integrated Test Series: JEE (Advanced) - 2022Akashdeep Singh Ninth 'A'30No ratings yet

- Problem Set n2 Answers 2018 10 23 00 07 57Document2 pagesProblem Set n2 Answers 2018 10 23 00 07 57Ziad ElhoshyNo ratings yet

- The Short Run Lecture NotesDocument29 pagesThe Short Run Lecture NotesDuc Tao ManhNo ratings yet

- Macro Prelim SolutionsDocument94 pagesMacro Prelim SolutionsMegan JohnstonNo ratings yet

- Chapter 12Document26 pagesChapter 12Unique OmarNo ratings yet

- EC2102 Topic 4 - Solution SketchDocument3 pagesEC2102 Topic 4 - Solution SketchsqhaaNo ratings yet

- Lec 2 IS - LMDocument42 pagesLec 2 IS - LMDương ThùyNo ratings yet

- Electronics and Communication Department The Lnmiit, Jaipur Digital Circuits and Systems (Code: DCS)Document4 pagesElectronics and Communication Department The Lnmiit, Jaipur Digital Circuits and Systems (Code: DCS)Ravindra KumarNo ratings yet

- Manual EconometricsDocument20 pagesManual EconometricsmrrnahidNo ratings yet

- High Finance (I) : Week 4Document22 pagesHigh Finance (I) : Week 4jlosamNo ratings yet

- Linearity and NonlinearityDocument36 pagesLinearity and Nonlinearitysandra.montelongo651100% (11)

- Suggested Answers For Written Exam For The B.Sc. in Economics, Winter 2010/2011 Macro B/Macro 3 Final Exam January 13, 2011 (3-Hour Closed-Book Exam)Document16 pagesSuggested Answers For Written Exam For The B.Sc. in Economics, Winter 2010/2011 Macro B/Macro 3 Final Exam January 13, 2011 (3-Hour Closed-Book Exam)Baz CokeNo ratings yet

- Macroeconomics: Chapter 11Document50 pagesMacroeconomics: Chapter 11AchalGuptaNo ratings yet

- Macroeconomics 6Document28 pagesMacroeconomics 6Quần hoaNo ratings yet

- Week2 TwoPeriodEconomyDocument7 pagesWeek2 TwoPeriodEconomyNickNo ratings yet

- ISLMDocument4 pagesISLMmapuordominic1No ratings yet

- Regularization & PreconditioningDocument4 pagesRegularization & PreconditioningBSSNo ratings yet

- Why Is Indonesia A High Inflation Country?: - Real and Monetary FactorsDocument17 pagesWhy Is Indonesia A High Inflation Country?: - Real and Monetary FactorseviewsNo ratings yet

- IS-LM Model - CLOSED ECONOMYDocument41 pagesIS-LM Model - CLOSED ECONOMYExcellino Nehemia LaksonoNo ratings yet

- Full Advanced Macroeconomics 5Th Edition Romer Solutions Manual Online PDF All ChapterDocument50 pagesFull Advanced Macroeconomics 5Th Edition Romer Solutions Manual Online PDF All Chaptercordllasanmardno89100% (8)

- CHAPTER-12: Aggregate Demand-Ii: Applying The Is-Lm ModelDocument28 pagesCHAPTER-12: Aggregate Demand-Ii: Applying The Is-Lm ModelAfiqul IslamNo ratings yet

- The Labour-Leisure Choice: Part 1: Robinson CrusoeDocument30 pagesThe Labour-Leisure Choice: Part 1: Robinson CrusoeCitio LogosNo ratings yet

- Libor Market ModelDocument16 pagesLibor Market ModelVaibhav VijayNo ratings yet

- Full Download Differential Equations and Linear Algebra 2nd Edition Farlow Solutions ManualDocument13 pagesFull Download Differential Equations and Linear Algebra 2nd Edition Farlow Solutions Manualhytrosbrandons2129100% (42)

- Topic 1 Derivation of Is Curve - StudentDocument31 pagesTopic 1 Derivation of Is Curve - StudentCharaka VimuktthiNo ratings yet

- Fall2017 MidtermDocument12 pagesFall2017 MidtermHui LiNo ratings yet

- Solution To Problem Set #4Document4 pagesSolution To Problem Set #4testingNo ratings yet

- Mathematical Modelling and Financial Engineering in The Worlds Stock MarketsDocument7 pagesMathematical Modelling and Financial Engineering in The Worlds Stock MarketsVijay ParmarNo ratings yet

- FroyenDocument27 pagesFroyenSuzana KarimNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Sale of Goods Act 1930Document33 pagesSale of Goods Act 1930Tannu RadhaNo ratings yet

- Question PapersDocument7 pagesQuestion PapersTannu RadhaNo ratings yet

- EcoooDocument1 pageEcoooTannu RadhaNo ratings yet

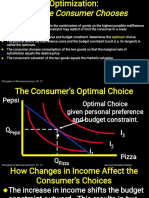

- The Theory of Consumer Choice The Theory of Consumer Choice: MicroeconomicsDocument28 pagesThe Theory of Consumer Choice The Theory of Consumer Choice: MicroeconomicsTannu RadhaNo ratings yet

- The Theory of Consumer ChoiceDocument33 pagesThe Theory of Consumer ChoiceTannu RadhaNo ratings yet

- What The Consumer ChoosesDocument13 pagesWhat The Consumer ChoosesTannu RadhaNo ratings yet

- Accountancy ProjectDocument26 pagesAccountancy ProjectTannu RadhaNo ratings yet

- EVS Assignment (Bcom Hons)Document7 pagesEVS Assignment (Bcom Hons)Tannu RadhaNo ratings yet

- ABRAHIM Research .2021.update .Document43 pagesABRAHIM Research .2021.update .Abdi Mucee TubeNo ratings yet

- Business Plan For TeachersDocument19 pagesBusiness Plan For TeachersMelita Stephen NatalNo ratings yet

- Kuliah Pekan Ke 6 Disajikan Secara DaringDocument4 pagesKuliah Pekan Ke 6 Disajikan Secara Daringprudent novelleaNo ratings yet

- Verify SGS Documents - SGS Portugal-2Document3 pagesVerify SGS Documents - SGS Portugal-2Salvador SilvaNo ratings yet

- Corrigendum 01Document3 pagesCorrigendum 01sagi prathimaNo ratings yet

- Foundational-FinalPPTTemplate - MILESTONE 4-StrapMaskDocument11 pagesFoundational-FinalPPTTemplate - MILESTONE 4-StrapMaskChristhoper AriwinataNo ratings yet

- Workshop 8 SolutionsDocument8 pagesWorkshop 8 SolutionsAssessment Help SolutionsNo ratings yet

- Cbre RMZ ProposalDocument3 pagesCbre RMZ Proposalarif_abdinNo ratings yet

- Industry Economics Market ModelsDocument10 pagesIndustry Economics Market ModelsrosheelNo ratings yet

- Multinational Capital BudgetingDocument20 pagesMultinational Capital BudgetingBibiNo ratings yet

- ONEYTS3QO2587700Document1 pageONEYTS3QO2587700BunnyNo ratings yet

- OMGT 222 Week 1Document9 pagesOMGT 222 Week 1Aline PedrosoNo ratings yet

- Aschalew Adane: Submitted To: Dr. Gondar, EthiopiaDocument17 pagesAschalew Adane: Submitted To: Dr. Gondar, EthiopiaAhmed Bashir HassanNo ratings yet

- Recharge Card Business PlanDocument13 pagesRecharge Card Business Planetukblest11No ratings yet

- Iso Ims Cross ReferenceDocument24 pagesIso Ims Cross ReferencePraneshNo ratings yet

- Deltona AgendaDocument16 pagesDeltona AgendaAnthony TalcottNo ratings yet

- Ability Course 1 Assignment 2Document15 pagesAbility Course 1 Assignment 2Saurabh TiwariNo ratings yet

- Chetana's Ramprasad Khandelwal Institute of Management & ResearchDocument63 pagesChetana's Ramprasad Khandelwal Institute of Management & ResearchsamruddhiNo ratings yet

- R2301F PDF ENG CompressedDocument18 pagesR2301F PDF ENG CompressedMarioAbuyeresNo ratings yet

- Stages of New Service DevelopmentDocument8 pagesStages of New Service Developmentgauravmittal200% (1)

- My StatementDocument2 pagesMy Statementyeshu12046No ratings yet

- Pre-Mediation ApplicationDocument2 pagesPre-Mediation ApplicationHarshitha MNo ratings yet

- Cartoon AIDocument10 pagesCartoon AIlongvandinh1312No ratings yet

- Equity KycDocument39 pagesEquity KycRP groupNo ratings yet

- Asus Rog 5KDocument1 pageAsus Rog 5KAmar WaqiuddinNo ratings yet

- Regular Casual Project Seasonal Probational Fixed-Term: TenureDocument1 pageRegular Casual Project Seasonal Probational Fixed-Term: Tenurejulia abadillaNo ratings yet

- Marketing Research On Tesla Inc. - Strategic Analysis: PresentationDocument28 pagesMarketing Research On Tesla Inc. - Strategic Analysis: PresentationMuhammad BaihaqiNo ratings yet

- HKICA Train Carbon Audit Dec22 CKDocument6 pagesHKICA Train Carbon Audit Dec22 CKlpdung-duoc13b-vb2No ratings yet