Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

72 viewsPremium Receipts

Premium Receipts

Uploaded by

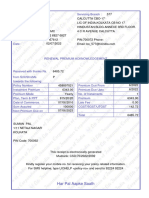

Uttam kumar chintu1. This receipt is for Mr. Deepak Kumar's annual premium payment of Rs. 51,951.98 for his Max Life Monthly Income Advantage Plan policy.

2. The policy details include a policy term of 22 years, premium payment term of 12 years, and date of maturity of 08-OCT-2042.

3. The receipt provides breakdown of GST amounts totaling Rs. 1,251.02 that are included in the premium payment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- Abi Premium 1Document1 pageAbi Premium 1manikandan BalasubramaniyanNo ratings yet

- Biller Details GTPL Broadband PVT LTD.: Terms & ConditionsDocument1 pageBiller Details GTPL Broadband PVT LTD.: Terms & ConditionsRajeev SinghNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailssatish varmaNo ratings yet

- Health Insurance Premium Receipt: Personal DetailsDocument1 pageHealth Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Insurance Premium Payment Certification: E-Policy ServiceDocument2 pagesInsurance Premium Payment Certification: E-Policy ServiceMuntana TewpaingamNo ratings yet

- "Let Not The Failure and The Pain Turn Aside The WorshippersDocument35 pages"Let Not The Failure and The Pain Turn Aside The Worshipperspdavidthomas100% (1)

- Work Method Statement For Directional DrillingDocument3 pagesWork Method Statement For Directional Drillingnice hossainNo ratings yet

- Premium Receipts - LifeInsuranceDocument1 pagePremium Receipts - LifeInsuranceUttam kumar chintuNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsVijay PendurthiNo ratings yet

- Consolidated Life Insurence Premium Receipt FY-2022-2023-SujanDocument1 pageConsolidated Life Insurence Premium Receipt FY-2022-2023-SujanSujanNo ratings yet

- Premium ReceiptDocument1 pagePremium Receiptsvruma2No ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsNeeraj TyagiNo ratings yet

- 297511794-OctDocument1 page297511794-OctVikash SinghNo ratings yet

- July 3Document1 pageJuly 3Vikash SinghNo ratings yet

- Life Insurance 47KDocument1 pageLife Insurance 47KRaghupathi PaindlaNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailskathik MNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsThakur Pranay SinghNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancesunil dinodiyaNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal DetailssunnybisnoiNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailssukhpreetdass89686No ratings yet

- Official Receipt 1676234862Document1 pageOfficial Receipt 1676234862vasim hatwadkarNo ratings yet

- LIC Combined ReceiptsDocument6 pagesLIC Combined Receiptssumanpal78No ratings yet

- KTM rc200 Insurance - MA877865 - E - 1Document2 pagesKTM rc200 Insurance - MA877865 - E - 1smartguyxNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Premium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021Document1 pagePremium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021ceogaursNo ratings yet

- Zprmrnot - 22253699 - 17202314 2Document1 pageZprmrnot - 22253699 - 17202314 2Inder Raj GuptaNo ratings yet

- Official Receipt 1676234863Document1 pageOfficial Receipt 1676234863vasim hatwadkarNo ratings yet

- Zprmrnot 22847670 15676911Document1 pageZprmrnot 22847670 15676911Gulshan GavelNo ratings yet

- Zprmrnot - 22303149 - 12926353 2Document1 pageZprmrnot - 22303149 - 12926353 2RKGUPTANo ratings yet

- UnlockedDocument1 pageUnlockedAshish NaikNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Iphone 11 Imagine PDFDocument2 pagesIphone 11 Imagine PDFJonassy SumaïliNo ratings yet

- Zprmrnot 23345535 17208239Document1 pageZprmrnot 23345535 17208239bharat4u04No ratings yet

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- Sinvoice 4000025727 9394530Document2 pagesSinvoice 4000025727 9394530ajit23nayakNo ratings yet

- Piped Natural Gas Invoice DomesticDocument2 pagesPiped Natural Gas Invoice DomesticBalasubramanian GurunathanNo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 28/07/2021Document1 pagePersonal Details: Duration For Which The Premium Is Received: 28/07/2021ravi kumarNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailschanam bedantaNo ratings yet

- Invoice 1250938210Document1 pageInvoice 1250938210writetorajesh1987No ratings yet

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Policydownload 230207 000615-43Document1 pagePolicydownload 230207 000615-43Anindya SundarNo ratings yet

- UnknownDocument85 pagesUnknownmukeshnayak1431999No ratings yet

- Zprmrnot 23764103 16031216Document1 pageZprmrnot 23764103 16031216Kiran KumarNo ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailschethanchethanmn8No ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptChandPari AkulNo ratings yet

- App Premium-1Document1 pageApp Premium-1manikandan BalasubramaniyanNo ratings yet

- Consolidated Premium Receipt (Chosen Policy)Document1 pageConsolidated Premium Receipt (Chosen Policy)sreeleoenterprisesNo ratings yet

- Nvoice 4000025727 9359298 PDFDocument2 pagesNvoice 4000025727 9359298 PDFajit23nayakNo ratings yet

- Zprmrnot - 22442221 - 9000233 2Document1 pageZprmrnot - 22442221 - 9000233 2Manju SinghalNo ratings yet

- D037434231 980906345227435 TpschedulescDocument2 pagesD037434231 980906345227435 Tpschedulescpratish mokashiNo ratings yet

- Lipc C222668767Document1 pageLipc C222668767Bahirkhand SchoolNo ratings yet

- Mh43av0575 Utkarsha SharmaDocument2 pagesMh43av0575 Utkarsha SharmaJainam AjmeraNo ratings yet

- Telephone BillDocument4 pagesTelephone BillSankar SundaramNo ratings yet

- We Value Your Relationship With ICICI Lombard General Insurance Company Limited and Thank You For Choosing Us As Your Preferred Insurance ProviderDocument3 pagesWe Value Your Relationship With ICICI Lombard General Insurance Company Limited and Thank You For Choosing Us As Your Preferred Insurance ProviderSagarNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Rohit Gupta E 249 Ram Nagar Extension Sodala Jaipur Rajasthan New Sanganer Road Shyam NagarDocument56 pagesRohit Gupta E 249 Ram Nagar Extension Sodala Jaipur Rajasthan New Sanganer Road Shyam NagarModicare ConsultantNo ratings yet

- Sinvoice 4000025727 9313824 PDFDocument2 pagesSinvoice 4000025727 9313824 PDFajit23nayakNo ratings yet

- 10600631216760000056Document2 pages10600631216760000056Manojit SarkarNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 9 CH 1 2024-25Document12 pages9 CH 1 2024-25Muhammad Abdullah ToufiqueNo ratings yet

- Lesson 3Document18 pagesLesson 3tariqravianNo ratings yet

- Live Partition Mobility: Power SystemsDocument196 pagesLive Partition Mobility: Power Systemsmevtorres1977No ratings yet

- Numerical ModellingDocument119 pagesNumerical Modellingjanusz_1025No ratings yet

- GB 50010-2002 Concrete StructuresDocument359 pagesGB 50010-2002 Concrete Structuresabdul lubisNo ratings yet

- Dramaturgies of Change: Greek Theatre Now: EditorialDocument6 pagesDramaturgies of Change: Greek Theatre Now: EditorialElsa TsiafidouNo ratings yet

- Nisha RuchikaDocument24 pagesNisha RuchikaRishabh srivastavNo ratings yet

- Tos - TrendsDocument2 pagesTos - TrendsBernadette Falceso100% (1)

- ShaykhNazimHaqqani MercyOceansBookOne PDFDocument208 pagesShaykhNazimHaqqani MercyOceansBookOne PDFNishaat Parween NaqshbandiNo ratings yet

- 28 - HSE-Compressed Gas CylindersDocument10 pages28 - HSE-Compressed Gas CylindersP Eng Suraj SinghNo ratings yet

- Heri-Azalea-management of Odontogenic Keratocyst of Mandible With SegmentalDocument14 pagesHeri-Azalea-management of Odontogenic Keratocyst of Mandible With SegmentalReniza OctafianaNo ratings yet

- Woodrats and Cholla-Dependence of A Small MammalDocument5 pagesWoodrats and Cholla-Dependence of A Small MammalDylan PeroNo ratings yet

- Back To School LiturgyDocument2 pagesBack To School LiturgyChristopher C HootonNo ratings yet

- Wireless Price ListDocument21 pagesWireless Price ListnboninaNo ratings yet

- Overall T/A Coordinator Senior Machinery Specialist: Machinery Component Maintenance and RepairDocument1 pageOverall T/A Coordinator Senior Machinery Specialist: Machinery Component Maintenance and RepairKarim MohamedNo ratings yet

- A Miniaturized Dual-Band Implantable Antenna System For Medical ApplicationsDocument5 pagesA Miniaturized Dual-Band Implantable Antenna System For Medical Applicationsrajesh yadavNo ratings yet

- Tidal Boom at Waters EdgeDocument1 pageTidal Boom at Waters Edgeapi-3703371No ratings yet

- Dsa PaperDocument24 pagesDsa Paperhimanshusharma15868No ratings yet

- Genetic: Introduction To Genetic AlgorithmsDocument44 pagesGenetic: Introduction To Genetic AlgorithmsMeyer Al-HayaliNo ratings yet

- BlusatranspassadaAriadne Top 123-1-3Document32 pagesBlusatranspassadaAriadne Top 123-1-3Nadiele MoraesNo ratings yet

- Other Publications by CADCIM Technologies: Autodesk Revit Architecture TextbooksDocument2 pagesOther Publications by CADCIM Technologies: Autodesk Revit Architecture Textbooksankit suriNo ratings yet

- Satellite Communication NotesDocument17 pagesSatellite Communication NotesAkhil RajuNo ratings yet

- 3m SUPERABRASIVESDocument40 pages3m SUPERABRASIVESGaurav BediNo ratings yet

- Drums and Hardware: General CatalogDocument39 pagesDrums and Hardware: General CatalogmiquNo ratings yet

- Talal AsadDocument30 pagesTalal Asadcarolinasacarva2175No ratings yet

- 1Registration-View Registration 230pm PDFDocument14 pages1Registration-View Registration 230pm PDFNeil CNo ratings yet

- Pipes Angles BM 22 36 en - 2Document1 pagePipes Angles BM 22 36 en - 2elias aouadNo ratings yet

- Leica Repair Manual RomneyDocument26 pagesLeica Repair Manual RomneyTimothyDamienRohdeNo ratings yet

Premium Receipts

Premium Receipts

Uploaded by

Uttam kumar chintu0 ratings0% found this document useful (0 votes)

72 views1 page1. This receipt is for Mr. Deepak Kumar's annual premium payment of Rs. 51,951.98 for his Max Life Monthly Income Advantage Plan policy.

2. The policy details include a policy term of 22 years, premium payment term of 12 years, and date of maturity of 08-OCT-2042.

3. The receipt provides breakdown of GST amounts totaling Rs. 1,251.02 that are included in the premium payment.

Original Description:

Original Title

Premium receipts

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. This receipt is for Mr. Deepak Kumar's annual premium payment of Rs. 51,951.98 for his Max Life Monthly Income Advantage Plan policy.

2. The policy details include a policy term of 22 years, premium payment term of 12 years, and date of maturity of 08-OCT-2042.

3. The receipt provides breakdown of GST amounts totaling Rs. 1,251.02 that are included in the premium payment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

72 views1 pagePremium Receipts

Premium Receipts

Uploaded by

Uttam kumar chintu1. This receipt is for Mr. Deepak Kumar's annual premium payment of Rs. 51,951.98 for his Max Life Monthly Income Advantage Plan policy.

2. The policy details include a policy term of 22 years, premium payment term of 12 years, and date of maturity of 08-OCT-2042.

3. The receipt provides breakdown of GST amounts totaling Rs. 1,251.02 that are included in the premium payment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Premium Receipt

Receipt No.: 345932875OCT2101 | Receipt Date: 10-OCT-2021

Personal Details

Policy Number: 345932875 Email ID: deepakmca.it@gmail.com

Policyholder Name: Mr. Deepak Kumar PAN Number: DCNPK0878Q

Address: VILLAGE MUSEPUR KHAIRA KHAIRA Customer GSTIN: Not Available

POST ARAI PS DAUDNAGAR AURANGABAD Current Residential State: Bihar

DAUDNAGAR- 824143

Bihar

Mobile Number: 9711496554

Policy Details

Plan Name: Max Life Monthly Income Advantage Plan Policy Commencement Date: 08-OCT-2020

Life Insured: Mr. Deepak Kumar Policy Term: 22 Years Premium Payment Term: 12 Years

Premium Payment Frequency: Annual Date of Maturity: 08-OCT-2042 Modal Premium (incl. GST): ` 51,951.98

Late Payment Fee (incl GST): ` 0.00 Premium Received (incl. GST): ` 51,951.98

GST Details Connect for more details

Coverage Taxable SGST/UTGST CGST IGST Name

Type Value (`) Rate Amount (`) Rate Amount (`) Rate Amount (`) Customer Services

Base 6,250.11 NA 0.00 NA 0.00 18% 1,125.02

Rider 700.00 NA 0.00 NA 0.00 18% 126.00

Late Payment 0.00 NA 0.00 NA 0.00 18% 0.00 Contact Number

Total GST Value: ` 1,251.02 18601205577

GSTIN: 07AACCM3201E1Z5 GST Regd. State: Delhi SAC CODE: 997132

Mudrank: Paid by e-Stamps Certificate no. 321/Issue Date: 13/09/2021/ Vide Treasury (E-CHALLAN) GRN NO.81686598

Minimum Guaranteed Death

Benefit (of base plan and term

rider (if any))

08-OCT-2021 to

` 7,31,436.00 ` 51,951.98 07-OCT-2022 08-OCT-2022

*Important Note:

1.For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk commencement starts

after acceptance of risk by us.

2.Amount received would be adjusted against the due premium as per terms and conditions of the policy.

3.Premiums may be eligible for tax benefits under section 80C/80CCC/80D/37(1) of the income Tax Act 1961. Kindly consult your tax advisor for more information. Tax benefits are liable to change

due to changes in legislation or government notification.

4.GST shall comprise CGST, SGST / UTGST or IGST (whichever is applicable) including cesses and levies, if any. All applicable taxes, cesses and levies, as per prevailing laws, shall be borne by you. For

GST purposes, this premium receipt is Tax invoice. Assessable Value in GST for Endowment First Year is 25%, Renewal Year is 12.5%, Single Premium Annuity is 10%, Term and Health is 100%.

Authorised Signatory

PRM21V5.9 10072021 PRODUCT UIN: 104N091V05

E.&O.E 2021-10-10.03.35.14.280981

You might also like

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- Abi Premium 1Document1 pageAbi Premium 1manikandan BalasubramaniyanNo ratings yet

- Biller Details GTPL Broadband PVT LTD.: Terms & ConditionsDocument1 pageBiller Details GTPL Broadband PVT LTD.: Terms & ConditionsRajeev SinghNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailssatish varmaNo ratings yet

- Health Insurance Premium Receipt: Personal DetailsDocument1 pageHealth Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Insurance Premium Payment Certification: E-Policy ServiceDocument2 pagesInsurance Premium Payment Certification: E-Policy ServiceMuntana TewpaingamNo ratings yet

- "Let Not The Failure and The Pain Turn Aside The WorshippersDocument35 pages"Let Not The Failure and The Pain Turn Aside The Worshipperspdavidthomas100% (1)

- Work Method Statement For Directional DrillingDocument3 pagesWork Method Statement For Directional Drillingnice hossainNo ratings yet

- Premium Receipts - LifeInsuranceDocument1 pagePremium Receipts - LifeInsuranceUttam kumar chintuNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsVijay PendurthiNo ratings yet

- Consolidated Life Insurence Premium Receipt FY-2022-2023-SujanDocument1 pageConsolidated Life Insurence Premium Receipt FY-2022-2023-SujanSujanNo ratings yet

- Premium ReceiptDocument1 pagePremium Receiptsvruma2No ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsNeeraj TyagiNo ratings yet

- 297511794-OctDocument1 page297511794-OctVikash SinghNo ratings yet

- July 3Document1 pageJuly 3Vikash SinghNo ratings yet

- Life Insurance 47KDocument1 pageLife Insurance 47KRaghupathi PaindlaNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailskathik MNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsThakur Pranay SinghNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancesunil dinodiyaNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal DetailssunnybisnoiNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailssukhpreetdass89686No ratings yet

- Official Receipt 1676234862Document1 pageOfficial Receipt 1676234862vasim hatwadkarNo ratings yet

- LIC Combined ReceiptsDocument6 pagesLIC Combined Receiptssumanpal78No ratings yet

- KTM rc200 Insurance - MA877865 - E - 1Document2 pagesKTM rc200 Insurance - MA877865 - E - 1smartguyxNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Premium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021Document1 pagePremium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021ceogaursNo ratings yet

- Zprmrnot - 22253699 - 17202314 2Document1 pageZprmrnot - 22253699 - 17202314 2Inder Raj GuptaNo ratings yet

- Official Receipt 1676234863Document1 pageOfficial Receipt 1676234863vasim hatwadkarNo ratings yet

- Zprmrnot 22847670 15676911Document1 pageZprmrnot 22847670 15676911Gulshan GavelNo ratings yet

- Zprmrnot - 22303149 - 12926353 2Document1 pageZprmrnot - 22303149 - 12926353 2RKGUPTANo ratings yet

- UnlockedDocument1 pageUnlockedAshish NaikNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Iphone 11 Imagine PDFDocument2 pagesIphone 11 Imagine PDFJonassy SumaïliNo ratings yet

- Zprmrnot 23345535 17208239Document1 pageZprmrnot 23345535 17208239bharat4u04No ratings yet

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- Sinvoice 4000025727 9394530Document2 pagesSinvoice 4000025727 9394530ajit23nayakNo ratings yet

- Piped Natural Gas Invoice DomesticDocument2 pagesPiped Natural Gas Invoice DomesticBalasubramanian GurunathanNo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 28/07/2021Document1 pagePersonal Details: Duration For Which The Premium Is Received: 28/07/2021ravi kumarNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailschanam bedantaNo ratings yet

- Invoice 1250938210Document1 pageInvoice 1250938210writetorajesh1987No ratings yet

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Policydownload 230207 000615-43Document1 pagePolicydownload 230207 000615-43Anindya SundarNo ratings yet

- UnknownDocument85 pagesUnknownmukeshnayak1431999No ratings yet

- Zprmrnot 23764103 16031216Document1 pageZprmrnot 23764103 16031216Kiran KumarNo ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailschethanchethanmn8No ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptChandPari AkulNo ratings yet

- App Premium-1Document1 pageApp Premium-1manikandan BalasubramaniyanNo ratings yet

- Consolidated Premium Receipt (Chosen Policy)Document1 pageConsolidated Premium Receipt (Chosen Policy)sreeleoenterprisesNo ratings yet

- Nvoice 4000025727 9359298 PDFDocument2 pagesNvoice 4000025727 9359298 PDFajit23nayakNo ratings yet

- Zprmrnot - 22442221 - 9000233 2Document1 pageZprmrnot - 22442221 - 9000233 2Manju SinghalNo ratings yet

- D037434231 980906345227435 TpschedulescDocument2 pagesD037434231 980906345227435 Tpschedulescpratish mokashiNo ratings yet

- Lipc C222668767Document1 pageLipc C222668767Bahirkhand SchoolNo ratings yet

- Mh43av0575 Utkarsha SharmaDocument2 pagesMh43av0575 Utkarsha SharmaJainam AjmeraNo ratings yet

- Telephone BillDocument4 pagesTelephone BillSankar SundaramNo ratings yet

- We Value Your Relationship With ICICI Lombard General Insurance Company Limited and Thank You For Choosing Us As Your Preferred Insurance ProviderDocument3 pagesWe Value Your Relationship With ICICI Lombard General Insurance Company Limited and Thank You For Choosing Us As Your Preferred Insurance ProviderSagarNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Rohit Gupta E 249 Ram Nagar Extension Sodala Jaipur Rajasthan New Sanganer Road Shyam NagarDocument56 pagesRohit Gupta E 249 Ram Nagar Extension Sodala Jaipur Rajasthan New Sanganer Road Shyam NagarModicare ConsultantNo ratings yet

- Sinvoice 4000025727 9313824 PDFDocument2 pagesSinvoice 4000025727 9313824 PDFajit23nayakNo ratings yet

- 10600631216760000056Document2 pages10600631216760000056Manojit SarkarNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 9 CH 1 2024-25Document12 pages9 CH 1 2024-25Muhammad Abdullah ToufiqueNo ratings yet

- Lesson 3Document18 pagesLesson 3tariqravianNo ratings yet

- Live Partition Mobility: Power SystemsDocument196 pagesLive Partition Mobility: Power Systemsmevtorres1977No ratings yet

- Numerical ModellingDocument119 pagesNumerical Modellingjanusz_1025No ratings yet

- GB 50010-2002 Concrete StructuresDocument359 pagesGB 50010-2002 Concrete Structuresabdul lubisNo ratings yet

- Dramaturgies of Change: Greek Theatre Now: EditorialDocument6 pagesDramaturgies of Change: Greek Theatre Now: EditorialElsa TsiafidouNo ratings yet

- Nisha RuchikaDocument24 pagesNisha RuchikaRishabh srivastavNo ratings yet

- Tos - TrendsDocument2 pagesTos - TrendsBernadette Falceso100% (1)

- ShaykhNazimHaqqani MercyOceansBookOne PDFDocument208 pagesShaykhNazimHaqqani MercyOceansBookOne PDFNishaat Parween NaqshbandiNo ratings yet

- 28 - HSE-Compressed Gas CylindersDocument10 pages28 - HSE-Compressed Gas CylindersP Eng Suraj SinghNo ratings yet

- Heri-Azalea-management of Odontogenic Keratocyst of Mandible With SegmentalDocument14 pagesHeri-Azalea-management of Odontogenic Keratocyst of Mandible With SegmentalReniza OctafianaNo ratings yet

- Woodrats and Cholla-Dependence of A Small MammalDocument5 pagesWoodrats and Cholla-Dependence of A Small MammalDylan PeroNo ratings yet

- Back To School LiturgyDocument2 pagesBack To School LiturgyChristopher C HootonNo ratings yet

- Wireless Price ListDocument21 pagesWireless Price ListnboninaNo ratings yet

- Overall T/A Coordinator Senior Machinery Specialist: Machinery Component Maintenance and RepairDocument1 pageOverall T/A Coordinator Senior Machinery Specialist: Machinery Component Maintenance and RepairKarim MohamedNo ratings yet

- A Miniaturized Dual-Band Implantable Antenna System For Medical ApplicationsDocument5 pagesA Miniaturized Dual-Band Implantable Antenna System For Medical Applicationsrajesh yadavNo ratings yet

- Tidal Boom at Waters EdgeDocument1 pageTidal Boom at Waters Edgeapi-3703371No ratings yet

- Dsa PaperDocument24 pagesDsa Paperhimanshusharma15868No ratings yet

- Genetic: Introduction To Genetic AlgorithmsDocument44 pagesGenetic: Introduction To Genetic AlgorithmsMeyer Al-HayaliNo ratings yet

- BlusatranspassadaAriadne Top 123-1-3Document32 pagesBlusatranspassadaAriadne Top 123-1-3Nadiele MoraesNo ratings yet

- Other Publications by CADCIM Technologies: Autodesk Revit Architecture TextbooksDocument2 pagesOther Publications by CADCIM Technologies: Autodesk Revit Architecture Textbooksankit suriNo ratings yet

- Satellite Communication NotesDocument17 pagesSatellite Communication NotesAkhil RajuNo ratings yet

- 3m SUPERABRASIVESDocument40 pages3m SUPERABRASIVESGaurav BediNo ratings yet

- Drums and Hardware: General CatalogDocument39 pagesDrums and Hardware: General CatalogmiquNo ratings yet

- Talal AsadDocument30 pagesTalal Asadcarolinasacarva2175No ratings yet

- 1Registration-View Registration 230pm PDFDocument14 pages1Registration-View Registration 230pm PDFNeil CNo ratings yet

- Pipes Angles BM 22 36 en - 2Document1 pagePipes Angles BM 22 36 en - 2elias aouadNo ratings yet

- Leica Repair Manual RomneyDocument26 pagesLeica Repair Manual RomneyTimothyDamienRohdeNo ratings yet