Professional Documents

Culture Documents

Solution - Business Income - Bonda Enterprise Feb2021

Solution - Business Income - Bonda Enterprise Feb2021

Uploaded by

HANIS IZYAN MAT ISA0 ratings0% found this document useful (0 votes)

15 views2 pages1) Bonda Enterprise had a net profit of RM147,700 according to its statement of profit and loss for the year of assessment (YA) 2020. After adjusting for drawings, its gross business income was RM149,500.

2) Certain amounts were deducted from gross business income as non-business income, including interest income from bank and customers totaling RM24,200, leaving a net amount of RM125,300.

3) Additional expenses totaling RM162,425 were added back as non-allowable expenses under the tax law. This resulted in an adjusted business income of RM287,725.

4) After deducting double deduction of RM16,200 for remun

Original Description:

Original Title

SOLUTION_BUSINESS INCOME_BONDA ENTERPRISE FEB2021

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) Bonda Enterprise had a net profit of RM147,700 according to its statement of profit and loss for the year of assessment (YA) 2020. After adjusting for drawings, its gross business income was RM149,500.

2) Certain amounts were deducted from gross business income as non-business income, including interest income from bank and customers totaling RM24,200, leaving a net amount of RM125,300.

3) Additional expenses totaling RM162,425 were added back as non-allowable expenses under the tax law. This resulted in an adjusted business income of RM287,725.

4) After deducting double deduction of RM16,200 for remun

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

15 views2 pagesSolution - Business Income - Bonda Enterprise Feb2021

Solution - Business Income - Bonda Enterprise Feb2021

Uploaded by

HANIS IZYAN MAT ISA1) Bonda Enterprise had a net profit of RM147,700 according to its statement of profit and loss for the year of assessment (YA) 2020. After adjusting for drawings, its gross business income was RM149,500.

2) Certain amounts were deducted from gross business income as non-business income, including interest income from bank and customers totaling RM24,200, leaving a net amount of RM125,300.

3) Additional expenses totaling RM162,425 were added back as non-allowable expenses under the tax law. This resulted in an adjusted business income of RM287,725.

4) After deducting double deduction of RM16,200 for remun

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

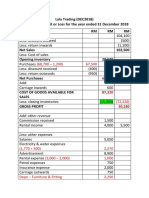

BUSINESS INCOME (TAX267 – FEBRUARY 2021)

Computation of Statutory Business Income of Bonda Enterprise for the

YA 2020

RM RM

Net Profit as per SOPL 147,700√

Add: Adjustment-Drawing 1,800 √

149,500

Less: Non-Business-income

Interest income (CIMB bank) 4,500√

Interest income (Customers) 8,900√

Rental income 10,800√ (24,200)

125,300

Add: Non-Allowable Expenses

Remuneration:

Salary, bonus and EPF (Halim) 97,000√

Salary and bonus (normal employees) NIL√

EPF (all employees) 17,615√

44,500-(19% x 141,500 = 26,885)

Fees:

Accounting service NIL√

Fines paid for exceeding speed limit 1,800√

Legal fees for purchase of land 3,500√

Legal fees on recovery of trade debts NIL√

Fees for designing business logo 2,400√

Entertainment expenses:

Gift vouchers to customers NIL√

Annual dinner for employees NIL√

Lunch with suppliers (2,500 x 50%) 1,250√

Family Day with staff and their families NIL√

Donation:

Business Zakat 4,200√

Contribution made to a political party 2,500√

Contribution to an approved Institution:

(Infrastructure for the poor s 34(6)(h)) NIL√

Repair and Maintenance:

Repair of delivery van NIL√

Renovation of business premise 6,800√

Installation of new air conditioner in the premise 2,600√

Repainting of Halim’s house 2,300√

Bad debts:

Net increase in specific provision NIL√

Net increase in general provision 3,200√

Trade bad debts written off NIL√

Travelling expense:

Carriage cost for delivering stock to customer NIL√

Halim’s holiday to Langkawi 3,000√

Water and electricity expenses (80%) NIL√

Water and electricity expenses (20%) 1,460√

Compensation to dismissal an employee NIL√

Depreciation 12,800√ 162,425

287,725

Less: Double deduction

Remuneration of disabled employee (16,200) √

Adjusted Business Income√ 271,525

Less: Capital Allowance (25,000)

Statutory Business Income√ 246,525

(36 √ x ½ mark = 18 marks)

You might also like

- Hyundai Excavators Manuals and Parts Catalogs Sitemap 8bdfeDocument6 pagesHyundai Excavators Manuals and Parts Catalogs Sitemap 8bdfeJhoncyto BorysNo ratings yet

- List of Cement Companies in IndiaDocument6 pagesList of Cement Companies in Indiaygadiya50% (8)

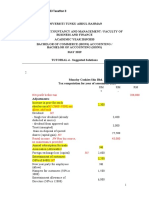

- Lala Trading DEC2018 - SOPL & SOFP DEC2018 AFTER ADJUSTMENTDocument3 pagesLala Trading DEC2018 - SOPL & SOFP DEC2018 AFTER ADJUSTMENTAFIQ RAFIQIN RAHMADNo ratings yet

- Marine CV Captain Template Modern Seafarer Application FormDocument1 pageMarine CV Captain Template Modern Seafarer Application FormMarine CVNo ratings yet

- The Baptist FaithDocument3 pagesThe Baptist FaithJeanelle Denosta100% (1)

- Pajuyo Vs CA DigestDocument1 pagePajuyo Vs CA DigestAngel Urbano100% (3)

- Solution Tax667 - Dec 2016Document7 pagesSolution Tax667 - Dec 2016Zahiratul QamarinaNo ratings yet

- UntitledDocument2 pagesUntitledNur AsnadirahNo ratings yet

- Answer Exercise 1Document2 pagesAnswer Exercise 1MUHAMMAD SYAZWAN MAZLANNo ratings yet

- Quiz 3: Profit Before Taxation - s4 (A) 67,069Document5 pagesQuiz 3: Profit Before Taxation - s4 (A) 67,069fujinlim98No ratings yet

- Suggested Answers TAX667 - DEC 2016Document7 pagesSuggested Answers TAX667 - DEC 2016diysNo ratings yet

- SOLUTION JUN 2018Document8 pagesSOLUTION JUN 2018faiqahn602No ratings yet

- SS Mar22 PDFDocument8 pagesSS Mar22 PDFuser mrmysteryNo ratings yet

- Solution June 2019Document8 pagesSolution June 2019faiqahn602No ratings yet

- Mark Scheme - AccountingDocument23 pagesMark Scheme - AccountingDanielNo ratings yet

- Solution Test 1Document3 pagesSolution Test 1anis izzatiNo ratings yet

- Solutions IhcDocument19 pagesSolutions IhcWahida AmalinNo ratings yet

- TUTO_SS_PYQJULY 2023Document2 pagesTUTO_SS_PYQJULY 20232022871354No ratings yet

- SCI Gerry LTD - Co. SolutionDocument1 pageSCI Gerry LTD - Co. SolutionSamira JahinNo ratings yet

- Company Tax SS Sept 2021 (Rate 2021) .For StudentsDocument3 pagesCompany Tax SS Sept 2021 (Rate 2021) .For StudentsizzahNo ratings yet

- Chapter 8 - Answer TutorialDocument3 pagesChapter 8 - Answer TutorialNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Mark Scheme (Results) January 2016: Pearson Edexcel IAL in Accounting (WAC01) Paper 01Document21 pagesMark Scheme (Results) January 2016: Pearson Edexcel IAL in Accounting (WAC01) Paper 01hisakofelixNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Solution Far510 - Jun 2015Document8 pagesSolution Far510 - Jun 2015azila aliasNo ratings yet

- 2007 Jan U1 U2 PDFDocument31 pages2007 Jan U1 U2 PDFTharakaaNo ratings yet

- IT AY 2022-23 Probs On PGBPDocument15 pagesIT AY 2022-23 Probs On PGBPmojesnandas9935No ratings yet

- FAR Revision Answer Scheme Jul 2017Document8 pagesFAR Revision Answer Scheme Jul 2017Nurul Farahdatul Ashikin RamlanNo ratings yet

- Cost SheetDocument12 pagesCost SheetBharat ki BaatNo ratings yet

- Taxation Solution 2017 SeptemberDocument11 pagesTaxation Solution 2017 Septemberzezu zazaNo ratings yet

- Post-Closing Trial BalanceDocument8 pagesPost-Closing Trial BalanceNicole Andrea TuazonNo ratings yet

- Exam 2 Input Sheet-FinalDocument24 pagesExam 2 Input Sheet-Finalさくら樱花No ratings yet

- Happyjacline Robert Njako Acc128 BHRM 2Document8 pagesHappyjacline Robert Njako Acc128 BHRM 2jupiter stationeryNo ratings yet

- PGBP Part 2 SolutionDocument14 pagesPGBP Part 2 SolutionDhruv SetiaNo ratings yet

- Profit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaDocument8 pagesProfit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaUmesh SharmaNo ratings yet

- Assignment 2Document6 pagesAssignment 2TAWHID ARMANNo ratings yet

- Taxation Solution 2018 SeptemberDocument9 pagesTaxation Solution 2018 SeptemberIffah NasuhaaNo ratings yet

- Solution To Q1 Summer 2022Document2 pagesSolution To Q1 Summer 2022dgornik021No ratings yet

- SS Project January 2023Document2 pagesSS Project January 2023NUR AFFIDAH LEENo ratings yet

- Business Income Template (Ain)Document9 pagesBusiness Income Template (Ain)Imran FarhanNo ratings yet

- Chapter7 - Unadjusted Principles - of - Accounts - For - Caribbean - StudentsDocument11 pagesChapter7 - Unadjusted Principles - of - Accounts - For - Caribbean - StudentsZahra BaptisteNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- Solution To Compiled QuestionsDocument7 pagesSolution To Compiled Questionslovia mensahNo ratings yet

- Solution Test 2 (1) June 19Document5 pagesSolution Test 2 (1) June 19Nur Dina AbsbNo ratings yet

- Individual AssignmentDocument22 pagesIndividual AssignmentEda LimNo ratings yet

- SolutionDocument4 pagesSolutionIGO SAUCENo ratings yet

- Assets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedDocument6 pagesAssets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedMehul Gupta100% (1)

- Gwapa Ko Chapter 3 Tax 1Document10 pagesGwapa Ko Chapter 3 Tax 1adarose romaresNo ratings yet

- Solution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsDocument7 pagesSolution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsIsyraf Hatim Mohd TamizamNo ratings yet

- Tax267 Ex3Document5 pagesTax267 Ex3SITI NUR DIANA SELAMATNo ratings yet

- Fac1601 Exam Pack 2018Document98 pagesFac1601 Exam Pack 2018OlebogengPNo ratings yet

- 4 A TUTORIAL 4 AnswerDocument6 pages4 A TUTORIAL 4 AnswerLee HansNo ratings yet

- TAX317 SS JUN2019. (Rate 2021.for Students)Document10 pagesTAX317 SS JUN2019. (Rate 2021.for Students)izzahNo ratings yet

- Unrealized Gain On Sale of Equipment: Cost ModelDocument25 pagesUnrealized Gain On Sale of Equipment: Cost ModelLove FreddyNo ratings yet

- Problem 12 Preparing The Financial Statements 4Document1 pageProblem 12 Preparing The Financial Statements 4Chunne LinqueNo ratings yet

- Exam 14 October 2012, Answers Exam 14 October 2012, AnswersDocument9 pagesExam 14 October 2012, Answers Exam 14 October 2012, AnswerscandiceNo ratings yet

- The Statement of Cash Flows Problems 5-1. (Currency Company)Document7 pagesThe Statement of Cash Flows Problems 5-1. (Currency Company)Marcos DmitriNo ratings yet

- Tugas 20.445cs4Document8 pagesTugas 20.445cs4ina aktNo ratings yet

- Example 2Document4 pagesExample 2Raudhatun Nisa'No ratings yet

- Fac2601-2013-6 - Answers PDFDocument9 pagesFac2601-2013-6 - Answers PDFcandiceNo ratings yet

- AFS SolutionsDocument19 pagesAFS SolutionsRolivhuwaNo ratings yet

- ABFT2020 Tutorial 12 Busines ExpenseDocument6 pagesABFT2020 Tutorial 12 Busines ExpensePUI TUNG CHONGNo ratings yet

- Wac01 w15 Ms 01Document21 pagesWac01 w15 Ms 01mohamedyanaal2020No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Weekly Lessonplan - Oct2022Document3 pagesWeekly Lessonplan - Oct2022HANIS IZYAN MAT ISANo ratings yet

- Topic 6 TutorialDocument16 pagesTopic 6 TutorialHANIS IZYAN MAT ISANo ratings yet

- Topic 2 Residence Status For IndividualDocument23 pagesTopic 2 Residence Status For IndividualHANIS IZYAN MAT ISANo ratings yet

- Topic 1 Basis of Malaysian TaxationDocument15 pagesTopic 1 Basis of Malaysian TaxationHANIS IZYAN MAT ISANo ratings yet

- Oceanic Wireless Network, Inc. V. Cir G.R. NO. 148380 December 9, 2005 FactsDocument2 pagesOceanic Wireless Network, Inc. V. Cir G.R. NO. 148380 December 9, 2005 FactsGyelamagne EstradaNo ratings yet

- Case Study Parole JetherDocument6 pagesCase Study Parole JetherBryan ChuNo ratings yet

- Exercício Do Mês: October 2012 Wish / If OnlyDocument0 pagesExercício Do Mês: October 2012 Wish / If OnlyDudu LauraNo ratings yet

- GR 113213 - Wright V Court of AppealsDocument1 pageGR 113213 - Wright V Court of AppealsApple Gee Libo-on100% (1)

- Adiabatic and Isothermal ProcessesDocument2 pagesAdiabatic and Isothermal ProcessesphydotsiNo ratings yet

- Hand Out#: Far 01 Topic: Accounting Process Classification: TheoriesDocument3 pagesHand Out#: Far 01 Topic: Accounting Process Classification: TheoriesJolaica DiocolanoNo ratings yet

- Chordu Guitar Chords Ensamble Tejedora Manabita Expresarte Música Chordsheet Id GiY7U7AjCaYDocument3 pagesChordu Guitar Chords Ensamble Tejedora Manabita Expresarte Música Chordsheet Id GiY7U7AjCaYAngelita;3 Neko:3No ratings yet

- International Arbitration Conference - MNLU Mumbai - 6 December PDFDocument4 pagesInternational Arbitration Conference - MNLU Mumbai - 6 December PDFRCR 75No ratings yet

- A00-02 - Grid Setout PlanDocument1 pageA00-02 - Grid Setout PlanazikNo ratings yet

- Leaflet - HDFC Balanced Advantage Fund - June 2024Document3 pagesLeaflet - HDFC Balanced Advantage Fund - June 2024DeepakNo ratings yet

- CA San BernardinoDocument6 pagesCA San BernardinotressanavaltaNo ratings yet

- CA1 NewDocument39 pagesCA1 NewGarcia Rowell S.100% (1)

- Appointment Letter FormatDocument9 pagesAppointment Letter FormatNiraliNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument5 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Tata Technologies Limited: Corporate Identity Number: U72200PN1994PLC013313Document436 pagesTata Technologies Limited: Corporate Identity Number: U72200PN1994PLC013313RoshanNo ratings yet

- Contracts - Case Briefs - PriyanshDocument87 pagesContracts - Case Briefs - PriyanshManju Nadger100% (1)

- Sex HD MOBILE Pics Ann Angel XXX Ann Angel Ideal Booty Playmate 5Document1 pageSex HD MOBILE Pics Ann Angel XXX Ann Angel Ideal Booty Playmate 5mariawalker47kNo ratings yet

- 620 MessagesDocument518 pages620 MessagesMan YauNo ratings yet

- How To Block Storage Location - SCNDocument4 pagesHow To Block Storage Location - SCNSushil KanuNo ratings yet

- Audit of Investment - 2Document4 pagesAudit of Investment - 2Juvy Dimaano0% (1)

- Appeal Section 374 CRPCDocument11 pagesAppeal Section 374 CRPCHet DoshiNo ratings yet

- Aritcle of Incorporation CodedDocument8 pagesAritcle of Incorporation CodedmmmnnyskrtNo ratings yet

- But The Fruit of The Spirit Is LoveDocument1 pageBut The Fruit of The Spirit Is LovextneNo ratings yet

- Health Law Report CompleteDocument46 pagesHealth Law Report CompleteMeenakshiNo ratings yet

- Vault-Best-Practice-IPJ & Vault StructureDocument14 pagesVault-Best-Practice-IPJ & Vault StructuretKc1234No ratings yet