Professional Documents

Culture Documents

Bajaj Allianz Fund Factsheet

Bajaj Allianz Fund Factsheet

Uploaded by

girlsbioCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bajaj Allianz Fund Factsheet

Bajaj Allianz Fund Factsheet

Uploaded by

girlsbioCopyright:

Available Formats

September 2022

Rate hikes con nued across the globe in September 2022 with global infla on remaining at mul -decade

high. The Indian markets have managed to outperform its peers globally given its rela vely be er macro-

economic situa on. However, we con nue to believe that given the global headwinds & growth

slowdown, the Indian markets may con nue to witness some vola lity, and therefore expect moderate

returns in the near term.

BEWARE OF SPURIOUS FRAUD PHONE CALLS

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investments of premiums. Public receiving such

phone calls are requested to lodge a police complaint.

Bajaj Allianz House,

Ver: September 2022

7 10

Large Cap To provide capital appreciation Money Market

through investment in selected equity Instruments

2.14%

Equity ETF

11.34%

stocks that have the potential for

capital appreciation.

-1.31% 22.23% 14.85% 11.80% 11.56% 12.57% 14.04% 13.49% 06-Jan-10

Equity Shares

86.52%

Benchmark index: Ni y 50 Index -2.97% 23.28% 14.20% 11.82% 11.79% 11.55% 11.59%

Peer Category: Morningstar India Insurance Large-Cap Category* -1.08% 23.66% 14.79% 11.89% 10.99% 11.30% 12.41%

Money Market Equity ETF

To specifically exclude companies Instruments 5.02%

5.57%

Ethical Fund dealing in gambling, contests, liquor,

entertainment (films, TV etc.), hotels,

banks and financial institutions. -2.80% 17.77% 16.27% 11.62% 11.57% 12.26% 15.07% 14.98% 21-Jul-06

Equity Shares

89.41%

Benchmark index: Ni y 50 Index -2.97% 23.28% 14.20% 11.82% 11.79% 11.55% 11.59%

Peer Category: Morningstar India Insurance Mul -Cap Category* -1.33% 24.21% 16.40% 12.58% 11.07% 10.87% 11.74%

The investment objective of this fund Money Market

Instruments

will be to realize a level of total income, 5.29%

Equity ETF

0.88%

including current income and capital

Asset Allocation Govt Securities

appreciation, which is consistent with 28.21%

reasonable investment risk. The

ULIF07205/12/13ASSETALL02116

investment strategy will involve a -0.83% 14.79% 10.46% 9.21% 8.71% 9.25% - 10.26% 31-Mar-14

flexible policy for allocating assets

among equities, bonds and cash.

Equity Shares

65.63%

Benchmark index: CRISIL Balanced Fund - Aggressive Index -1.07% 16.35% 12.29% 11.26% 10.57% 10.61% 10.75%

Peer Category: Morningstar India Insurance Balanced Asset Alloca on Category* -0.59% 12.70% 9.66% 9.21% 8.04% 8.66% 9.43%

Money Market

Mid Cap To achieve capital appreciation by Instruments , Equity ETF,

investing in a diversified basket of mid 7.44% 8.45%

cap stocks and large cap stocks.

-0.31% 25.52% 17.21% 11.39% 9.12% 13.45% 15.28% 13.46% 06-Jan-10

Equity Shares ,

84.10%

Benchmark index: NIFTY Midcap 50 Index 0.65% 33.63% 23.75% 15.86% 12.19% 14.63% 13.96%

Peer Category: Morningstar India Insurance Mid-Cap Category* 2.85% 30.62% 20.66% 13.73% 10.44% 13.40% 15.60%

Money Market

To provide capital appreciation Instruments

Index Linked Nifty Fund 7.10%

through investment in equities

Blue Chip Equity Fund

forming part of the National Stock

ULIF06026/10/10BLUECHIPEQ116 0.24% 23.69% 16.79% 13.03% 12.97% 12.17% 12.22% 9.83% 01-Nov-10

Exchange NIFTY.

Equity Shares

92.90%

Benchmark index: Ni y 50 Index -2.97% 23.28% 14.20% 11.82% 11.79% 11.55% 11.59%

Peer Category: Morningstar India Insurance Large-Cap Category* -1.08% 23.66% 14.79% 11.89% 10.99% 11.30% 12.41%

To have a Fund that protects the

Cash Fund invested capital through investments

in liquid money market and short-term 3.20% 2.97% 3.35% 2.26% 2.51% 3.73% 5.15% 6.48% 10-Jul-06

instruments like commercial papers,

certificate of deposits, money market Money Market

mutual funds, and bank FDs etc. Instruments

100.00%

Benchmark index: Crisil Liquid Fund Index 4.34% 3.96% 4.37% 5.11% 5.53% 6.00% 6.85%

Peer Category: Morningstar India Insurance Ultra Short Dura on Category* 3.10% 2.93% 3.56% 3.84% 4.05% 4.80% 5.84%

Non Convertible

To provide accumulation of income Debentures

34.52%

through investment in high quality

Debt Fund fixed income securities like G-Secs,

and corporate debt rated AA and 0.32% 2.42% 4.05% 6.37% 5.24% 6.32% 7.30% 7.99% 10-Jul-06

above.

Govt Securities

Money Market

54.08%

Instruments

11.40%

Benchmark index: Crisil Composite Bond Fund Index 1.03% 3.40% 5.99% 7.86% 6.36% 7.30% 7.85%

Peer Category: Morningstar India Insurance Medium to Long Dura on Category* 0.44% 2.85% 4.97% 6.73% 5.50% 6.38% 7.26%

The above information is as on 30th September 2022

*Source: Morningstar. Morningstar India Insurance category return is average return of all ULIP funds in the respective Morningstar Category.

Disclaimer: © 2021 Morningstar. All Rights Reserved. The Morningstar name and logo are registered marks of Morningstar, Inc. The information, data, analyses and opinions (“Information”)

contained herein: (1) include the proprietary information of Morningstar and its content providers; (2) may not be copied or redistributed except as speci cally authorized; (3) do not

constitute investment advice; (4) are provided solely for informational purposes; (5) are not warranted to be complete, accurate or timely; and (6) may be drawn from fund data published on

various dates and procured from various sources. Morningstar, its affiliates, and its officers, directors and employees shall not be liable for any trading decision, damage or any other loss

arising from using the Information. Please verify all of the Information before using it and do not make any investment decision, except upon the advice of a professional nancial adviser. Past

performance is no guarantee of future results. The value and income derived from investments may go down as well as up.

Ver: September 2022

You might also like

- Living TrustDocument3 pagesLiving TrustShevis Singleton Sr.100% (5)

- Beware of Spurious Fraud Phone CallsDocument2 pagesBeware of Spurious Fraud Phone Callsrajish2014No ratings yet

- Beware of Spurious Fraud Phone CallsDocument2 pagesBeware of Spurious Fraud Phone CallsHardik BajajNo ratings yet

- Beware of Spurious/ Fraud Phone Calls!Document3 pagesBeware of Spurious/ Fraud Phone Calls!Mcnet WideNo ratings yet

- Vanguard Small Cap Value ETFDocument4 pagesVanguard Small Cap Value ETFKhalilBenlahccenNo ratings yet

- Cambria Emerging Shareholder Yield ETF: Strategy Overview Fund DetailsDocument2 pagesCambria Emerging Shareholder Yield ETF: Strategy Overview Fund DetailsJexNo ratings yet

- PBW - Invesco WilderHill Clean Energy ETF Fact SheetDocument2 pagesPBW - Invesco WilderHill Clean Energy ETF Fact SheetRahul SalveNo ratings yet

- 91 SA Institutional Cautious Managed Fund Factsheet enDocument1 page91 SA Institutional Cautious Managed Fund Factsheet enXola Xhayimpi JwaraNo ratings yet

- FSISectoralFund MonthlyDocument1 pageFSISectoralFund MonthlyVNo ratings yet

- Fidelity Wealth Builder Fund NFO PresentationDocument35 pagesFidelity Wealth Builder Fund NFO Presentationdrashti.investments1614100% (1)

- Blue Chip JulyDocument1 pageBlue Chip JulyPiyushNo ratings yet

- U.S. DAQ Index: Net Assets: 680.2 MillionDocument2 pagesU.S. DAQ Index: Net Assets: 680.2 MillionAlex MoidlNo ratings yet

- Edelweiss Balanced Advantage Fund - Presentation Feb 2021 - 11022021 - 060534 - PMDocument22 pagesEdelweiss Balanced Advantage Fund - Presentation Feb 2021 - 11022021 - 060534 - PMMythili BalakrishnanNo ratings yet

- Blackrock US Index FundDocument2 pagesBlackrock US Index FundAlex MoidlNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- Invesco India Caterpillar PortfolioDocument1 pageInvesco India Caterpillar PortfolioAnkurNo ratings yet

- Invesco MSCI Sustainable Future ETF: Growth of $10,000Document3 pagesInvesco MSCI Sustainable Future ETF: Growth of $10,000sarah martinNo ratings yet

- UTI Mastershare Unit Scheme-Growth: Objective of The SchemeDocument1 pageUTI Mastershare Unit Scheme-Growth: Objective of The SchemeGurvansh SinghNo ratings yet

- HDFC Diversified Equity FundDocument1 pageHDFC Diversified Equity FundMayank RajNo ratings yet

- Conservative Mutual Funds AssessmentDocument24 pagesConservative Mutual Funds AssessmentRula Abu NuwarNo ratings yet

- Global Opportunities (Loomis Sayles) : Net Assets: 29.3 MillionDocument2 pagesGlobal Opportunities (Loomis Sayles) : Net Assets: 29.3 MillionAlex MoidlNo ratings yet

- UTI Nifty Fund - Growth31052017Document2 pagesUTI Nifty Fund - Growth31052017Pruthvi KumarNo ratings yet

- Mutual Fund ProjectDocument9 pagesMutual Fund Projectraviw1989No ratings yet

- Peso Asia Pacific Property Income Fund - Fund Fact Sheet - October - 2020Document2 pagesPeso Asia Pacific Property Income Fund - Fund Fact Sheet - October - 2020Jayr LegaspiNo ratings yet

- Multi-Asset Fund Whatsapp Snippets 06-08-2021Document1 pageMulti-Asset Fund Whatsapp Snippets 06-08-2021amukherjee22No ratings yet

- Vaneck Vectors Video Gaming and Esports Ucits Etf: Fund Details Fund DescriptionDocument2 pagesVaneck Vectors Video Gaming and Esports Ucits Etf: Fund Details Fund DescriptionsigurddemizarNo ratings yet

- Peso Powerhouse Fund - Fund Fact Sheet - December - 2020Document2 pagesPeso Powerhouse Fund - Fund Fact Sheet - December - 2020Jayr LegaspiNo ratings yet

- HLA Venture Income Fund March 22Document3 pagesHLA Venture Income Fund March 22ivyNo ratings yet

- AD15 June11Document2 pagesAD15 June11Alvin LimNo ratings yet

- Balanced Mutual Funds AssessmentDocument23 pagesBalanced Mutual Funds AssessmentRula Abu NuwarNo ratings yet

- ATRAM Total Return Peso Bond Fund - KIIDS Dec 2022Document4 pagesATRAM Total Return Peso Bond Fund - KIIDS Dec 2022ParazolaNo ratings yet

- Peso Wealth Optimizer Fund 2036 - Fund Fact Sheet - December - 2020Document3 pagesPeso Wealth Optimizer Fund 2036 - Fund Fact Sheet - December - 2020Jayr LegaspiNo ratings yet

- ALFM Peso Bond FundDocument2 pagesALFM Peso Bond FundkimencinaNo ratings yet

- Comaparison of HDFC & Sbi - BFDocument5 pagesComaparison of HDFC & Sbi - BFsandeep aryaNo ratings yet

- HLA Venture Income Fund May 22Document3 pagesHLA Venture Income Fund May 22ivyNo ratings yet

- Equity Fund: % Top 10 Holding As On 31st March 2019Document1 pageEquity Fund: % Top 10 Holding As On 31st March 2019Sajith KumarNo ratings yet

- Sbi-Bluechip-Fund Jan 2021Document1 pageSbi-Bluechip-Fund Jan 2021pdk jyotNo ratings yet

- BMO Low Volatility US Equity ETF-EN-CAD UnitsDocument4 pagesBMO Low Volatility US Equity ETF-EN-CAD Unitsmaxime1.pelletierNo ratings yet

- UTI Nifty Index Fund - Regular Plan - Regular: HistoryDocument1 pageUTI Nifty Index Fund - Regular Plan - Regular: HistorySharun JacobNo ratings yet

- R72J en-GB Wrap ABI SWSingleBrandedDocument3 pagesR72J en-GB Wrap ABI SWSingleBrandedJ RNo ratings yet

- Kotak Multi Asset Allocation Fund 2-Page (Front-Back) Leaflet A4 Printab...Document2 pagesKotak Multi Asset Allocation Fund 2-Page (Front-Back) Leaflet A4 Printab...rajbir singh ChauhanNo ratings yet

- RHB Islamic Global Developed Markets FundDocument2 pagesRHB Islamic Global Developed Markets FundIrfan AzmiNo ratings yet

- Diversified JulyDocument1 pageDiversified JulyPiyushNo ratings yet

- Marketing Brochure TradePlus S&P New China Tracker - July 2019 (English)Document14 pagesMarketing Brochure TradePlus S&P New China Tracker - July 2019 (English)Alyssa AnnNo ratings yet

- Rootstock SCI Worldwide Flexible Fund - Minimum Disclosure DocumentDocument4 pagesRootstock SCI Worldwide Flexible Fund - Minimum Disclosure DocumentMartin NelNo ratings yet

- Bei 3Document25 pagesBei 3Anggih Nur HamidahNo ratings yet

- U.S. Equity Index Fund (TDAM) : As at June 30, 2021Document1 pageU.S. Equity Index Fund (TDAM) : As at June 30, 2021Tony ParkNo ratings yet

- IE00B18GC888Document4 pagesIE00B18GC888a28hzNo ratings yet

- HLA Venture Income Fund Feb 22Document3 pagesHLA Venture Income Fund Feb 22ivyNo ratings yet

- Managed Fund January 2021Document3 pagesManaged Fund January 2021CHEONG WEI HAONo ratings yet

- Fund Fact Sheets NAVPU Captains FundDocument1 pageFund Fact Sheets NAVPU Captains FundJohh-RevNo ratings yet

- Fact Sheet MDEAP (IDR) 2211 AJMI ENGDocument1 pageFact Sheet MDEAP (IDR) 2211 AJMI ENGXadipuNo ratings yet

- Sip Presentation - May 2020Document40 pagesSip Presentation - May 2020DBCGNo ratings yet

- MR DE en IE00B6R52259 YESDocument4 pagesMR DE en IE00B6R52259 YESGuilhermeNo ratings yet

- Horizon Fund May 22Document5 pagesHorizon Fund May 22ivyNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalNo ratings yet

- Diversified Equity FundDocument1 pageDiversified Equity FundHimanshu AgrawalNo ratings yet

- Conservative at Least Five (5) Years: Account of The ClientDocument2 pagesConservative at Least Five (5) Years: Account of The ClientkimencinaNo ratings yet

- IBTG (1 - 3 Year Treasury Bonds GBP)Document5 pagesIBTG (1 - 3 Year Treasury Bonds GBP)gibi.yu19No ratings yet

- Bajaj 20 LakhsDocument9 pagesBajaj 20 LakhsgirlsbioNo ratings yet

- HDFC 20 LakhsDocument3 pagesHDFC 20 LakhsgirlsbioNo ratings yet

- Risk Profiler - NEWDocument4 pagesRisk Profiler - NEWgirlsbioNo ratings yet

- PAN Updation FormDocument1 pagePAN Updation FormgirlsbioNo ratings yet

- MITC-Final Nov17Document4 pagesMITC-Final Nov17girlsbioNo ratings yet

- CIF2Document4 pagesCIF2girlsbioNo ratings yet

- CIF1Document4 pagesCIF1girlsbioNo ratings yet

- AOFDocument2 pagesAOFgirlsbioNo ratings yet

- Handbook How To Do Business in GC enDocument8 pagesHandbook How To Do Business in GC enСергей МартынецNo ratings yet

- Chapter II Consolidation of Financial InformationDocument57 pagesChapter II Consolidation of Financial InformationEnat EndawokeNo ratings yet

- Facebook IPODocument4 pagesFacebook IPOvaibhavNo ratings yet

- Ey 2022 WCTG WebDocument2,010 pagesEy 2022 WCTG WebPedro J Contreras ContrerasNo ratings yet

- FioriDocument9 pagesFioriAhmed ElhawaryNo ratings yet

- How To Use BDO Nomura Online Trading Platform PDFDocument20 pagesHow To Use BDO Nomura Online Trading Platform PDFRaymond PacaldoNo ratings yet

- Test 7 - IND AS 102, 19 - QuestionsDocument3 pagesTest 7 - IND AS 102, 19 - QuestionskrishbafanaNo ratings yet

- Lecture 31 Credit+Analysis+-+Credit+Ratings+and+Ratings+AgenciesDocument19 pagesLecture 31 Credit+Analysis+-+Credit+Ratings+and+Ratings+AgenciesTaanNo ratings yet

- All India Bank Employees' Association: "Prabhat Nivas"Document3 pagesAll India Bank Employees' Association: "Prabhat Nivas"Abhinav KumarNo ratings yet

- CARSONDocument2 pagesCARSONShubhangi AgrawalNo ratings yet

- Risk Measurement CalculationsDocument35 pagesRisk Measurement CalculationsChashona BerryNo ratings yet

- TridentDocument3 pagesTridentSubham MazumdarNo ratings yet

- NYU Lecture NotesDocument18 pagesNYU Lecture NotesHE HUNo ratings yet

- Candle Making Business Budget: Items Variance Budgeted Amount Actual AmountDocument4 pagesCandle Making Business Budget: Items Variance Budgeted Amount Actual AmountAisyah ZulzurinNo ratings yet

- Accounting InformationDocument3 pagesAccounting Informationnenette cruzNo ratings yet

- Module-8 Break Even AnalysisDocument17 pagesModule-8 Break Even AnalysisDrKanchan GhodkeNo ratings yet

- CFA Level 3 - 2020 Curriculum Changes (300hours)Document1 pageCFA Level 3 - 2020 Curriculum Changes (300hours)duc anhNo ratings yet

- Mode of Defining Existence of PartnershipDocument12 pagesMode of Defining Existence of PartnershipTanvi23780% (5)

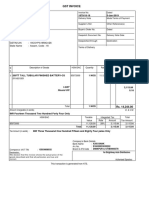

- GST Invoice: Circular Road, Dimapur Nagaland GSTIN/UIN: 13CHIPM1831L1ZC State Name: Nagaland, Code: 13Document1 pageGST Invoice: Circular Road, Dimapur Nagaland GSTIN/UIN: 13CHIPM1831L1ZC State Name: Nagaland, Code: 13Yogesh GuptaNo ratings yet

- Aligning Enterprise Risk Management With Strategy Through The BSC The Bank of Tokyo-Mitsubishi ApproachDocument6 pagesAligning Enterprise Risk Management With Strategy Through The BSC The Bank of Tokyo-Mitsubishi ApproachanushaNo ratings yet

- Bitcoin Price History Apr 2013 - May 09, 2023 - SDocument8 pagesBitcoin Price History Apr 2013 - May 09, 2023 - SAndrew I.L IdiNo ratings yet

- Vasquez v. PNB - Principle of MutualityDocument2 pagesVasquez v. PNB - Principle of MutualityJcNo ratings yet

- Islamic Finance Sweden 201Document38 pagesIslamic Finance Sweden 201Khin SweNo ratings yet

- ConclusionDocument2 pagesConclusionanujbhagatNo ratings yet

- Donor's TaxDocument1 pageDonor's TaxJustineMaeMillanoNo ratings yet

- GDBDocument1 pageGDBsajidschannelNo ratings yet

- Power of Compounding in Mutual Funds PDFDocument5 pagesPower of Compounding in Mutual Funds PDFVinod NairNo ratings yet

- Tina 2020 W2 PDFDocument1 pageTina 2020 W2 PDFgary haysNo ratings yet

- Fib Trade Union White PaperDocument98 pagesFib Trade Union White PaperakiNo ratings yet