Professional Documents

Culture Documents

400007647933310-VAL APLNotice

400007647933310-VAL APLNotice

Uploaded by

Abdul HalimCopyright:

Available Formats

You might also like

- SATYA PAL SINGH - Settlement LetterDocument6 pagesSATYA PAL SINGH - Settlement LetterPradeep KapoorNo ratings yet

- Sanction 4Document4 pagesSanction 4ParinithNo ratings yet

- HLA-Policy Change Application FormDocument4 pagesHLA-Policy Change Application FormJinieNo ratings yet

- Madison Scouts 2009 Audition Packet (2013!04!15 10-54-01 UTC)Document24 pagesMadison Scouts 2009 Audition Packet (2013!04!15 10-54-01 UTC)Jenni Stevens100% (4)

- 620000977631310-VAL APLNoticeDocument2 pages620000977631310-VAL APLNoticesiti awangNo ratings yet

- Val AplnoticeDocument2 pagesVal AplnoticeHennyza FaisalNo ratings yet

- 20577621-REV NonPay Pre-APL PDFDocument2 pages20577621-REV NonPay Pre-APL PDFLilyNo ratings yet

- Rev Nonpay Pre AplDocument2 pagesRev Nonpay Pre AplpunitharathanaNo ratings yet

- Hayat Diinsuranskan Pemunya Polisi: Prudential Assurance Malaysia BerhadDocument2 pagesHayat Diinsuranskan Pemunya Polisi: Prudential Assurance Malaysia BerhadWinnie TickminNo ratings yet

- 20102700-Endt Rider Exp Conf LTRDocument2 pages20102700-Endt Rider Exp Conf LTRbakiroosly859No ratings yet

- PDS PF-i PrivateDocument8 pagesPDS PF-i PrivateMuhammad FawwazNo ratings yet

- Contoh PolisiDocument13 pagesContoh PolisiJayZx WayNo ratings yet

- 00302821-EnDT Auto Extension RL 2Document4 pages00302821-EnDT Auto Extension RL 2Letchumy Krishnan ThevarNo ratings yet

- Property Financing IDocument3 pagesProperty Financing IAmirul Ashraf MuhamadNo ratings yet

- Product Disclosure Sheet: Sun Cover-I: Dd/mm/yyyy Person CoveredDocument2 pagesProduct Disclosure Sheet: Sun Cover-I: Dd/mm/yyyy Person CoveredNasuha MusaNo ratings yet

- Ilp AlterationDocument3 pagesIlp AlterationJasper LeeNo ratings yet

- Terms & Conditions: Product Name: Tata Aia Life Insurance Sampoorna Raksha Supreme - Non Pos LP/RP UIN: 110N160V02Document3 pagesTerms & Conditions: Product Name: Tata Aia Life Insurance Sampoorna Raksha Supreme - Non Pos LP/RP UIN: 110N160V02Himanshi ChauhanNo ratings yet

- 34287751-REv - PreLapse 3Document1 page34287751-REv - PreLapse 3Iskandar RazakNo ratings yet

- PDS8011032797316937 FormDocument4 pagesPDS8011032797316937 FormSarawanan ArumugamNo ratings yet

- Income BuilderDocument3 pagesIncome BuilderFarrahAbdullahNo ratings yet

- PDS Personal Financing IDocument2 pagesPDS Personal Financing IfireflydudeNo ratings yet

- SM RT: DHFL Pramerica Smart Income, A Non-Participating Endowment Insurance PlanDocument4 pagesSM RT: DHFL Pramerica Smart Income, A Non-Participating Endowment Insurance PlankulaseraNo ratings yet

- REv PreLapseDocument1 pageREv PreLapsetxjqgkctwyNo ratings yet

- Fire Consequential Loss PDSDocument2 pagesFire Consequential Loss PDSRam KojuNo ratings yet

- PDS Equity Home Financing-IDocument8 pagesPDS Equity Home Financing-IAlan BentleyNo ratings yet

- Product Disclosure Sheet: Standard Chartered Bank Malaysia Berhad Page 1 of 4Document4 pagesProduct Disclosure Sheet: Standard Chartered Bank Malaysia Berhad Page 1 of 4Esabell OliviaNo ratings yet

- Affin Home Flexi Plus: Product Disclosure SheetDocument6 pagesAffin Home Flexi Plus: Product Disclosure SheetPoi 3647No ratings yet

- SmartSampoornRaksha Terms and ConditionsDocument2 pagesSmartSampoornRaksha Terms and ConditionsJignesh PatelNo ratings yet

- SME Micro Financing PDS Conventional Jan 2019Document8 pagesSME Micro Financing PDS Conventional Jan 2019Zul HilmiNo ratings yet

- Cimb Targeted Assistance Programme TNC Auto Eng PDFDocument2 pagesCimb Targeted Assistance Programme TNC Auto Eng PDFFareez isaNo ratings yet

- Agrobank Strategic Alliance Financing (SALF-i) Product Disclosure SheetDocument4 pagesAgrobank Strategic Alliance Financing (SALF-i) Product Disclosure Sheetsolar.suria.sdn.bhdNo ratings yet

- REv PreLapseDocument1 pageREv PreLapsenurulshafika7994No ratings yet

- Offer LetterDocument12 pagesOffer LetterPradeep G MenonNo ratings yet

- Terms & Conditions - Insta Jumbo Loan (Jumbo Cash) : PhonebankingDocument2 pagesTerms & Conditions - Insta Jumbo Loan (Jumbo Cash) : PhonebankingMadhu BabuNo ratings yet

- Be There For Your Family. Always.: Assure PlusDocument10 pagesBe There For Your Family. Always.: Assure PlusSidhant kumarNo ratings yet

- EN Machinery - Breakdown - Product Disclosure Sheet PDFDocument2 pagesEN Machinery - Breakdown - Product Disclosure Sheet PDFDikshit KapilaNo ratings yet

- RHB - PDS - OverdraftDocument6 pagesRHB - PDS - OverdraftjoekaledaNo ratings yet

- eEASY Save FAQs PDFDocument6 pageseEASY Save FAQs PDFterrygohNo ratings yet

- PDS Credit Card Auto Balance ConversionDocument4 pagesPDS Credit Card Auto Balance ConversionErda Wati Mohd SaidNo ratings yet

- 831 J Sangam IntroDocument6 pages831 J Sangam IntroJames WilliamsNo ratings yet

- Premier 500Document17 pagesPremier 500nelsonNo ratings yet

- Bhagyalakshmi Sales Brochure W 4 5in X H 8in SPDocument8 pagesBhagyalakshmi Sales Brochure W 4 5in X H 8in SPMexico EnglishNo ratings yet

- 5 2 10885 Hospicash BrochureDocument13 pages5 2 10885 Hospicash BrochureKamalesh Narayan NairNo ratings yet

- Bima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFDocument7 pagesBima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFMutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- Life Gain Premier BrochureDocument12 pagesLife Gain Premier BrochureNeeralNo ratings yet

- Product Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving LoanDocument4 pagesProduct Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving Loanthong_wheiNo ratings yet

- Toyota Extended Warranty Insurance Policy and Product Disclosure StatementDocument16 pagesToyota Extended Warranty Insurance Policy and Product Disclosure Statementankc92No ratings yet

- PDS Vehicle Financing-I PDFDocument8 pagesPDS Vehicle Financing-I PDFakusuperNo ratings yet

- Product Disclosure Sheet: Personal Financing-I For Civil Sector Via AngkasaDocument4 pagesProduct Disclosure Sheet: Personal Financing-I For Civil Sector Via Angkasageena1980No ratings yet

- CSC Motorcycle Eng Ver 1.1 10.04.19 06.01.2020Document8 pagesCSC Motorcycle Eng Ver 1.1 10.04.19 06.01.2020Haikal MashkovNo ratings yet

- Revival Application Form - 2Document7 pagesRevival Application Form - 2AliffKhusairiNo ratings yet

- Aviation Fuelling Liability PdsDocument3 pagesAviation Fuelling Liability PdsNoraini Mohd Shariff100% (1)

- 20556058-REV Revival InvDocument1 page20556058-REV Revival InvShermin NgNo ratings yet

- Payment Acknowledgement 0311151431193119Document1 pagePayment Acknowledgement 0311151431193119Rishabh goswamiNo ratings yet

- Life Insurance Corporation Pension PlusDocument9 pagesLife Insurance Corporation Pension PlusAmitabh AnandNo ratings yet

- Revival Application Form V052020Document6 pagesRevival Application Form V052020Hifzhan El FarhanNo ratings yet

- AKPK Power - Chapter 3 - Wise Usage of Credit CardDocument20 pagesAKPK Power - Chapter 3 - Wise Usage of Credit CardEncik AnifNo ratings yet

- Instalment Premium in Arogya Sanjeevani Cir No 664Document1 pageInstalment Premium in Arogya Sanjeevani Cir No 664Virendra VedNo ratings yet

- Agrocash I EnglishDocument4 pagesAgrocash I EnglishiskandarbasiruddinNo ratings yet

- Pds BSN An Naim Home - BiDocument4 pagesPds BSN An Naim Home - BiMohd NizamuddinNo ratings yet

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageDocument6 pagesInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaNo ratings yet

- Nature of Fraud and Its Effects in The Medical Insurance KenyaDocument12 pagesNature of Fraud and Its Effects in The Medical Insurance KenyaSaarah ConnieNo ratings yet

- Questionpaper Paper3F November2018 PDFDocument20 pagesQuestionpaper Paper3F November2018 PDFMontaha ToohaNo ratings yet

- Adobe Scan 14 Feb 2024Document2 pagesAdobe Scan 14 Feb 2024VikrantTandelNo ratings yet

- Problems - Adjusting EntriesDocument3 pagesProblems - Adjusting EntriesaNo ratings yet

- Indemnity and Guarantee NotesDocument13 pagesIndemnity and Guarantee NotesOtim Martin LutherNo ratings yet

- School Board Backs. Plea by Parents: Dr:iver HeldDocument32 pagesSchool Board Backs. Plea by Parents: Dr:iver Heldjack mehiffNo ratings yet

- PC Niapolicyschedulecirtificatepc 59647646Document3 pagesPC Niapolicyschedulecirtificatepc 59647646Monty SharmaNo ratings yet

- HDFC ERGO - Bharat Griha Raksha: 16 July, 2023Document4 pagesHDFC ERGO - Bharat Griha Raksha: 16 July, 2023kuntalbhNo ratings yet

- Accounting For Special Transactions - SyllabusDocument3 pagesAccounting For Special Transactions - SyllabusMARIA THERESA ABRIONo ratings yet

- A Study of Consumer Behavior in Relation To Insurance Products in IDBIDocument9 pagesA Study of Consumer Behavior in Relation To Insurance Products in IDBIPurnanand SathuaNo ratings yet

- Re InsuranceDocument2 pagesRe InsuranceLegese TusseNo ratings yet

- Zprmrnot - 22303149 - 12926353 2Document1 pageZprmrnot - 22303149 - 12926353 2RKGUPTANo ratings yet

- Contract Infovision Inc., DigitalBytes Inc.Document10 pagesContract Infovision Inc., DigitalBytes Inc.Micheal TrustNo ratings yet

- Black Book Project With CorrectionDocument80 pagesBlack Book Project With CorrectionAbhishek BandalNo ratings yet

- Lecture Notes For Choice Under UncertaintyDocument16 pagesLecture Notes For Choice Under UncertaintyVikram SharmaNo ratings yet

- Vstep Reading: Lớp Vstep B1B2C1 Cô Thủy - Thầy Cương Luyện Thi Trọng Tâm - Cấp Tốc - Đạt Chứng ChỉDocument7 pagesVstep Reading: Lớp Vstep B1B2C1 Cô Thủy - Thầy Cương Luyện Thi Trọng Tâm - Cấp Tốc - Đạt Chứng ChỉTín Lương ThanhNo ratings yet

- HDFC Life IR22 040622Document492 pagesHDFC Life IR22 040622Javed KhanNo ratings yet

- Building Façade Maintenance: Legal Liability and Damage LimitationDocument8 pagesBuilding Façade Maintenance: Legal Liability and Damage LimitationalfieNo ratings yet

- The Budget Process-Cabilangan Crispin JayDocument3 pagesThe Budget Process-Cabilangan Crispin JayJerico ManaloNo ratings yet

- Insurance Contract Quiz - CompressDocument11 pagesInsurance Contract Quiz - CompressChristian GarciaNo ratings yet

- New Dem ACA Letter To Congressional LeadershipDocument4 pagesNew Dem ACA Letter To Congressional LeadershipSahil KapurNo ratings yet

- Statement Ilps 2020Document8 pagesStatement Ilps 2020Faiz RosliNo ratings yet

- COA Jul23Document28 pagesCOA Jul23mayNo ratings yet

- Insurance Financial and Actuarial AnalysisDocument12 pagesInsurance Financial and Actuarial AnalysisKamal UddinNo ratings yet

- KyivDocument68 pagesKyivPlyukalo LiliaNo ratings yet

- Bajaj Allianz General Insurance Company Limited: Quotation For Travel - Travel Prime Individual SilverDocument2 pagesBajaj Allianz General Insurance Company Limited: Quotation For Travel - Travel Prime Individual SilverSrinivas RoyalNo ratings yet

- Care Plus0123enDocument6 pagesCare Plus0123enAnne SaiNo ratings yet

- Gross Estate InclusionDocument4 pagesGross Estate InclusionAlaineNo ratings yet

400007647933310-VAL APLNotice

400007647933310-VAL APLNotice

Uploaded by

Abdul HalimOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

400007647933310-VAL APLNotice

400007647933310-VAL APLNotice

Uploaded by

Abdul HalimCopyright:

Available Formats

ABDUL HALIM BIN JOHAN

A3 JALAN SINAR MENTARI A1

TAMAN SINAR MENTARI

BEDONG

08100 KEDAH DARUL AMAN

MALAYSIA

Date / Tarikh : 03-12-2022

Ref / Ruj : ILPSVAL_0015_001/SERVCTRL

Dear Sir/Madam,/ Tuan/Puan/Cik,

Policy Number / Nombor Polisi : 400007647933310

Life Assured / Hayat Diinsuranskan : ABDUL HALIM BIN JOHAN

Assured / Pemunya Polisi : ABDUL HALIM BIN JOHAN

Subject / Subjek : Notice of Automatic Premium Loan & Non-Forfeiture Option / Notis

Pinjaman Premium Automatik & Pilihan Tanpa Perlucutan Hak

We understand that your duties and position may leave you little time to attend to your policy. We would like

to advise that we have not received your installment premium of RM 63.00 due on 19-10-2022.

Kami memahami bahawa disebabkan tugas dan keadaan, Tuan/Puan mungkin kesuntukan masa untuk

menguruskan polisi anda. Justeru itu, kami ingin memaklumkan bahawa kami masih belum menerima

premium ansuran yang berjumlah is RM 63.00 sepatutnya dibayar pada 19-10-2022.

In accordance with your policy provision, all premiums are to be received within one month from your

premium due date, otherwise the policy may lapse. However, as your policy has acquired a surrender value,

an Automatic Premium Loan (APL) has been generated in accordance with your policy provision to keep the

policy in force. The APL will continue to apply as long as your surrender value (after deduction of all

indebtedness i.e any outstanding loan and premium with interest) is sufficient to pay the outstanding

premiums. The current interest rate charged daily, levied on the APL is 6.50% per annum, which is

compounded at every policy anniversary for as long as it remains outstanding.

Menurut terma dan syarat polisi, semua premium perlu diterima dalam tempoh satu bulan dari tarikh

premium patut dibayar, jika tidak polisi akan luput. Namun begitu, oleh sebab polisi Tuan/Puan telah

mengumpulkan nilai serahan, Skim Pinjaman Premium Automatik (APL) telah diguna pakai mengikut

peruntukan polisi anda untuk memastikan polisi terus berkuatkuasa. APL akan diteruskan asalkan semua nilai

serahan (selepas menolak semua hutang, iaitu sebarang pinjaman tertunggak dan premium tertunggak

bersama faedah) adalah mencukupi untuk membayar premium tertunggak. Kadar faedah harian yang

dikenakan ke atas APL ialah 6.50% setahun yang akan dikompaunkan pada setiap ulang tahun polisi selagi

tunggakan masih belum dijelaskan.

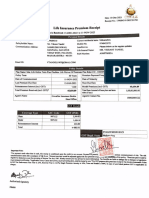

The outstanding amount attached to your policy as at 03-12-2022 is as follows:

Jumlah tunggakan di dalam policy tuan/puan pada 03-12-2022 adalah seperti di bawah:

Capital Outstanding / Interest Outstanding / Total (RM) /

Modal Belum Jelas Faedah Tertunggak Jumlah (RM)

Automatic Premium Loan

(APL) / Skim Pinjaman 126.00 1.35 127.35

Premium Automatik (APL)

Gross Surrender Value as at 19-11-2022 is RM 285.22

Nilai Serahan Kasar pada 19-11-2022 adalah RM 285.22

*Capital Outstanding is inclusive of Compounded Interest

*Modal Belum Jelas termasuk Faedah Kompaun

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur,

Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1_C1 Page 1 of 2

You may repay the loan in whole or in part at any time while the policy is in force. We would recommend you

to repay your loan progressively, as each repayment will reduce the indebtedness as well as the interest

charged on the policy. Additionally, you may want to consider, amongst others, either of the following:

Anda boleh membayar balik pinjaman sepenuhnya atau sebahagiannya pada bila-bila masa selagi polisi ini

berkuatkuasa. Kami mencadangkan agar anda membayar balik pinjaman secara progresif, kerana setiap

pembayaran balik akan mengurangkan hutang dan juga faedah yang dikenakan pada polisi. Tambahan pula,

anda boleh mempertimbangkan, cadangan berikut:

1. Changing your premium payment frequency if the current payment frequency does not suit your

financial obligations.

Menukar kekerapan bayaran premium jika kekerapan premium semasa tidak sesuai dengan

tanggungan kewangan anda.

2. Converting your policy to Paid-Up status whereby the death benefit of your policy will be converted

to a revised sum assured using the surrender value and no further premium payment is required for

your policy upon this conversion. However, please be advised that any other benefits under this

policy will be terminated. Participation in profits for this policy or any part of the policy will also

cease from the date the policy is converted to a Paid-Up policy.

Menukar polisi kepada status Polisi Berbayar Penuh di mana manfaat kematian polisi anda akan

ditukar kepada jumlah diinsuranskan yang baru berdasarkan nilai serahan dan premium selanjutnya

tidak lagi perlu dibayar untuk polisi anda selepas ditukar kepada Polisi Berbayar Penuh.

Walaubagaimanapun, sila dinasihatkan bahawa sebarang manfaat lain di bawah polisi ini juga akan

ditamatkan pada tarikh Polisi ini ditukar kepada Polisi Berbayar Penuh.

Should you wish to know other available option(s), choose to execute any of the above options or need any

further clarification, please do not hesitate to refer to your Agent/Sales Representative or Customer Service

representative at :

Sekiranya anda ingin mengetahui pilihan-pilihan lain yang tersedia, memilih untuk melaksanakan sebarang

pilihan di atas atau memerlukan lebih penjelasan, sila rujuk kepada ejen/wakil jualan anda atau wakil

khidmat pelanggan di:

Telephone / Telefon : +603-27710228

Email / Emel : customer.mys@prudential.com.my

1

Note / Nota: If payment or non-forfeiture option(s) has been made, please disregard this notice.

2

Sila abaikan notis ini jika bayaran atau Pilihan Tanpa Perlucutan Hak sudah dibuat.

Please be informed that the APL will continue to apply for non-payment of premium(s) if you did

not execute any of the Non-Forfeiture Option.

Sila dimaklumkan bahawa APL akan terus diguna pakaikan bagi premium yang tidak dibayar

sekiranya anda tidak melaksanakan sebarang Pilihan Tanpa Perlucutan Hak.

Thank you.

Terima kasih.

Policy Servicing Department

PRUDENTIAL ASSURANCE MALAYSIA BERHAD

[Note : This is a computer generated document and does not require a signature]

[Nota: Ini adalah dokumen yang dihasilkan komputer dan tidak memerlukan tandatangan]

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur,

Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1_C1 Page 2 of 2

You might also like

- SATYA PAL SINGH - Settlement LetterDocument6 pagesSATYA PAL SINGH - Settlement LetterPradeep KapoorNo ratings yet

- Sanction 4Document4 pagesSanction 4ParinithNo ratings yet

- HLA-Policy Change Application FormDocument4 pagesHLA-Policy Change Application FormJinieNo ratings yet

- Madison Scouts 2009 Audition Packet (2013!04!15 10-54-01 UTC)Document24 pagesMadison Scouts 2009 Audition Packet (2013!04!15 10-54-01 UTC)Jenni Stevens100% (4)

- 620000977631310-VAL APLNoticeDocument2 pages620000977631310-VAL APLNoticesiti awangNo ratings yet

- Val AplnoticeDocument2 pagesVal AplnoticeHennyza FaisalNo ratings yet

- 20577621-REV NonPay Pre-APL PDFDocument2 pages20577621-REV NonPay Pre-APL PDFLilyNo ratings yet

- Rev Nonpay Pre AplDocument2 pagesRev Nonpay Pre AplpunitharathanaNo ratings yet

- Hayat Diinsuranskan Pemunya Polisi: Prudential Assurance Malaysia BerhadDocument2 pagesHayat Diinsuranskan Pemunya Polisi: Prudential Assurance Malaysia BerhadWinnie TickminNo ratings yet

- 20102700-Endt Rider Exp Conf LTRDocument2 pages20102700-Endt Rider Exp Conf LTRbakiroosly859No ratings yet

- PDS PF-i PrivateDocument8 pagesPDS PF-i PrivateMuhammad FawwazNo ratings yet

- Contoh PolisiDocument13 pagesContoh PolisiJayZx WayNo ratings yet

- 00302821-EnDT Auto Extension RL 2Document4 pages00302821-EnDT Auto Extension RL 2Letchumy Krishnan ThevarNo ratings yet

- Property Financing IDocument3 pagesProperty Financing IAmirul Ashraf MuhamadNo ratings yet

- Product Disclosure Sheet: Sun Cover-I: Dd/mm/yyyy Person CoveredDocument2 pagesProduct Disclosure Sheet: Sun Cover-I: Dd/mm/yyyy Person CoveredNasuha MusaNo ratings yet

- Ilp AlterationDocument3 pagesIlp AlterationJasper LeeNo ratings yet

- Terms & Conditions: Product Name: Tata Aia Life Insurance Sampoorna Raksha Supreme - Non Pos LP/RP UIN: 110N160V02Document3 pagesTerms & Conditions: Product Name: Tata Aia Life Insurance Sampoorna Raksha Supreme - Non Pos LP/RP UIN: 110N160V02Himanshi ChauhanNo ratings yet

- 34287751-REv - PreLapse 3Document1 page34287751-REv - PreLapse 3Iskandar RazakNo ratings yet

- PDS8011032797316937 FormDocument4 pagesPDS8011032797316937 FormSarawanan ArumugamNo ratings yet

- Income BuilderDocument3 pagesIncome BuilderFarrahAbdullahNo ratings yet

- PDS Personal Financing IDocument2 pagesPDS Personal Financing IfireflydudeNo ratings yet

- SM RT: DHFL Pramerica Smart Income, A Non-Participating Endowment Insurance PlanDocument4 pagesSM RT: DHFL Pramerica Smart Income, A Non-Participating Endowment Insurance PlankulaseraNo ratings yet

- REv PreLapseDocument1 pageREv PreLapsetxjqgkctwyNo ratings yet

- Fire Consequential Loss PDSDocument2 pagesFire Consequential Loss PDSRam KojuNo ratings yet

- PDS Equity Home Financing-IDocument8 pagesPDS Equity Home Financing-IAlan BentleyNo ratings yet

- Product Disclosure Sheet: Standard Chartered Bank Malaysia Berhad Page 1 of 4Document4 pagesProduct Disclosure Sheet: Standard Chartered Bank Malaysia Berhad Page 1 of 4Esabell OliviaNo ratings yet

- Affin Home Flexi Plus: Product Disclosure SheetDocument6 pagesAffin Home Flexi Plus: Product Disclosure SheetPoi 3647No ratings yet

- SmartSampoornRaksha Terms and ConditionsDocument2 pagesSmartSampoornRaksha Terms and ConditionsJignesh PatelNo ratings yet

- SME Micro Financing PDS Conventional Jan 2019Document8 pagesSME Micro Financing PDS Conventional Jan 2019Zul HilmiNo ratings yet

- Cimb Targeted Assistance Programme TNC Auto Eng PDFDocument2 pagesCimb Targeted Assistance Programme TNC Auto Eng PDFFareez isaNo ratings yet

- Agrobank Strategic Alliance Financing (SALF-i) Product Disclosure SheetDocument4 pagesAgrobank Strategic Alliance Financing (SALF-i) Product Disclosure Sheetsolar.suria.sdn.bhdNo ratings yet

- REv PreLapseDocument1 pageREv PreLapsenurulshafika7994No ratings yet

- Offer LetterDocument12 pagesOffer LetterPradeep G MenonNo ratings yet

- Terms & Conditions - Insta Jumbo Loan (Jumbo Cash) : PhonebankingDocument2 pagesTerms & Conditions - Insta Jumbo Loan (Jumbo Cash) : PhonebankingMadhu BabuNo ratings yet

- Be There For Your Family. Always.: Assure PlusDocument10 pagesBe There For Your Family. Always.: Assure PlusSidhant kumarNo ratings yet

- EN Machinery - Breakdown - Product Disclosure Sheet PDFDocument2 pagesEN Machinery - Breakdown - Product Disclosure Sheet PDFDikshit KapilaNo ratings yet

- RHB - PDS - OverdraftDocument6 pagesRHB - PDS - OverdraftjoekaledaNo ratings yet

- eEASY Save FAQs PDFDocument6 pageseEASY Save FAQs PDFterrygohNo ratings yet

- PDS Credit Card Auto Balance ConversionDocument4 pagesPDS Credit Card Auto Balance ConversionErda Wati Mohd SaidNo ratings yet

- 831 J Sangam IntroDocument6 pages831 J Sangam IntroJames WilliamsNo ratings yet

- Premier 500Document17 pagesPremier 500nelsonNo ratings yet

- Bhagyalakshmi Sales Brochure W 4 5in X H 8in SPDocument8 pagesBhagyalakshmi Sales Brochure W 4 5in X H 8in SPMexico EnglishNo ratings yet

- 5 2 10885 Hospicash BrochureDocument13 pages5 2 10885 Hospicash BrochureKamalesh Narayan NairNo ratings yet

- Bima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFDocument7 pagesBima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFMutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- Life Gain Premier BrochureDocument12 pagesLife Gain Premier BrochureNeeralNo ratings yet

- Product Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving LoanDocument4 pagesProduct Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving Loanthong_wheiNo ratings yet

- Toyota Extended Warranty Insurance Policy and Product Disclosure StatementDocument16 pagesToyota Extended Warranty Insurance Policy and Product Disclosure Statementankc92No ratings yet

- PDS Vehicle Financing-I PDFDocument8 pagesPDS Vehicle Financing-I PDFakusuperNo ratings yet

- Product Disclosure Sheet: Personal Financing-I For Civil Sector Via AngkasaDocument4 pagesProduct Disclosure Sheet: Personal Financing-I For Civil Sector Via Angkasageena1980No ratings yet

- CSC Motorcycle Eng Ver 1.1 10.04.19 06.01.2020Document8 pagesCSC Motorcycle Eng Ver 1.1 10.04.19 06.01.2020Haikal MashkovNo ratings yet

- Revival Application Form - 2Document7 pagesRevival Application Form - 2AliffKhusairiNo ratings yet

- Aviation Fuelling Liability PdsDocument3 pagesAviation Fuelling Liability PdsNoraini Mohd Shariff100% (1)

- 20556058-REV Revival InvDocument1 page20556058-REV Revival InvShermin NgNo ratings yet

- Payment Acknowledgement 0311151431193119Document1 pagePayment Acknowledgement 0311151431193119Rishabh goswamiNo ratings yet

- Life Insurance Corporation Pension PlusDocument9 pagesLife Insurance Corporation Pension PlusAmitabh AnandNo ratings yet

- Revival Application Form V052020Document6 pagesRevival Application Form V052020Hifzhan El FarhanNo ratings yet

- AKPK Power - Chapter 3 - Wise Usage of Credit CardDocument20 pagesAKPK Power - Chapter 3 - Wise Usage of Credit CardEncik AnifNo ratings yet

- Instalment Premium in Arogya Sanjeevani Cir No 664Document1 pageInstalment Premium in Arogya Sanjeevani Cir No 664Virendra VedNo ratings yet

- Agrocash I EnglishDocument4 pagesAgrocash I EnglishiskandarbasiruddinNo ratings yet

- Pds BSN An Naim Home - BiDocument4 pagesPds BSN An Naim Home - BiMohd NizamuddinNo ratings yet

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageDocument6 pagesInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaNo ratings yet

- Nature of Fraud and Its Effects in The Medical Insurance KenyaDocument12 pagesNature of Fraud and Its Effects in The Medical Insurance KenyaSaarah ConnieNo ratings yet

- Questionpaper Paper3F November2018 PDFDocument20 pagesQuestionpaper Paper3F November2018 PDFMontaha ToohaNo ratings yet

- Adobe Scan 14 Feb 2024Document2 pagesAdobe Scan 14 Feb 2024VikrantTandelNo ratings yet

- Problems - Adjusting EntriesDocument3 pagesProblems - Adjusting EntriesaNo ratings yet

- Indemnity and Guarantee NotesDocument13 pagesIndemnity and Guarantee NotesOtim Martin LutherNo ratings yet

- School Board Backs. Plea by Parents: Dr:iver HeldDocument32 pagesSchool Board Backs. Plea by Parents: Dr:iver Heldjack mehiffNo ratings yet

- PC Niapolicyschedulecirtificatepc 59647646Document3 pagesPC Niapolicyschedulecirtificatepc 59647646Monty SharmaNo ratings yet

- HDFC ERGO - Bharat Griha Raksha: 16 July, 2023Document4 pagesHDFC ERGO - Bharat Griha Raksha: 16 July, 2023kuntalbhNo ratings yet

- Accounting For Special Transactions - SyllabusDocument3 pagesAccounting For Special Transactions - SyllabusMARIA THERESA ABRIONo ratings yet

- A Study of Consumer Behavior in Relation To Insurance Products in IDBIDocument9 pagesA Study of Consumer Behavior in Relation To Insurance Products in IDBIPurnanand SathuaNo ratings yet

- Re InsuranceDocument2 pagesRe InsuranceLegese TusseNo ratings yet

- Zprmrnot - 22303149 - 12926353 2Document1 pageZprmrnot - 22303149 - 12926353 2RKGUPTANo ratings yet

- Contract Infovision Inc., DigitalBytes Inc.Document10 pagesContract Infovision Inc., DigitalBytes Inc.Micheal TrustNo ratings yet

- Black Book Project With CorrectionDocument80 pagesBlack Book Project With CorrectionAbhishek BandalNo ratings yet

- Lecture Notes For Choice Under UncertaintyDocument16 pagesLecture Notes For Choice Under UncertaintyVikram SharmaNo ratings yet

- Vstep Reading: Lớp Vstep B1B2C1 Cô Thủy - Thầy Cương Luyện Thi Trọng Tâm - Cấp Tốc - Đạt Chứng ChỉDocument7 pagesVstep Reading: Lớp Vstep B1B2C1 Cô Thủy - Thầy Cương Luyện Thi Trọng Tâm - Cấp Tốc - Đạt Chứng ChỉTín Lương ThanhNo ratings yet

- HDFC Life IR22 040622Document492 pagesHDFC Life IR22 040622Javed KhanNo ratings yet

- Building Façade Maintenance: Legal Liability and Damage LimitationDocument8 pagesBuilding Façade Maintenance: Legal Liability and Damage LimitationalfieNo ratings yet

- The Budget Process-Cabilangan Crispin JayDocument3 pagesThe Budget Process-Cabilangan Crispin JayJerico ManaloNo ratings yet

- Insurance Contract Quiz - CompressDocument11 pagesInsurance Contract Quiz - CompressChristian GarciaNo ratings yet

- New Dem ACA Letter To Congressional LeadershipDocument4 pagesNew Dem ACA Letter To Congressional LeadershipSahil KapurNo ratings yet

- Statement Ilps 2020Document8 pagesStatement Ilps 2020Faiz RosliNo ratings yet

- COA Jul23Document28 pagesCOA Jul23mayNo ratings yet

- Insurance Financial and Actuarial AnalysisDocument12 pagesInsurance Financial and Actuarial AnalysisKamal UddinNo ratings yet

- KyivDocument68 pagesKyivPlyukalo LiliaNo ratings yet

- Bajaj Allianz General Insurance Company Limited: Quotation For Travel - Travel Prime Individual SilverDocument2 pagesBajaj Allianz General Insurance Company Limited: Quotation For Travel - Travel Prime Individual SilverSrinivas RoyalNo ratings yet

- Care Plus0123enDocument6 pagesCare Plus0123enAnne SaiNo ratings yet

- Gross Estate InclusionDocument4 pagesGross Estate InclusionAlaineNo ratings yet