Professional Documents

Culture Documents

DHLF - Loan Sanction Letter

DHLF - Loan Sanction Letter

Uploaded by

Raju BhaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DHLF - Loan Sanction Letter

DHLF - Loan Sanction Letter

Uploaded by

Raju BhaiCopyright:

Available Formats

MOST IMPORTANT TERMS AND CONDITIONS (MITC)

(For Personal Loan)

The Most Important Terms and Conditions (MITC) of the loan agreed between ‘Chunnuru Manjula &

Employee in Government of Municipal Department (hereinafter called the borrower/s) and the

Dewan Housing Finance Corporation Limited (DHFL) are mentioned below.

1. Loan

Loan Amount Sanctioned : Rs. 200000/-

Loan Amount Disbursal : Rs. 192390/-

Purpose of Loan : Personal Loan

Rate of Interest : 13.65 % p.a.

Tenure : 8 Years- Equated Monthly Instalments

Any changes in the interest rate would be available on www.dhfl.com and also displayed in our DHFL

branches.

2. Fees and Other Charges : Please refer attached Tariff Schedule in Annexure I

Note: Tariff Schedule is subject to change and is binding to customers. Updated Tariff Schedule is

available on www.dhfl.com and also displayed in our Branches.

3. Security for the Loan

Guarantee 1) SK.VASU

Other Security : Hypothecation of stock in trade & Receivables

Insurance of the Property/ Borrowers: The Borrower may be required to obtain

insurance cover for the property or himself, as per the terms and conditions contained in

the sanction letter. In case you have opted for insurance cover, DHFL shall be made as sole

beneficiary under these insurance cover policies and the insurance policy will be mailed

4. directly to your mailing address.

5. Conditions for Disbursement of the Loan

The Borrower shall:

(i) Submit all the relevant documents as mentioned in the sanction letter / Loan

agreement;

(ii) Comply with all pre- conditions for disbursement of the loan as mentioned in the

sanction letter;

(iii) Ensure that he/she has absolute clear and marketable title to the property (security)

and the said property is absolutely unencumbered and free from any liability whatsoever;

(iv) Create appropriate security to secure the loan.

1 Model Draft for Academic Purpose

6. Repayment of Loan & Interest

The EMI For your loan is :

From Year To Year EMI Amount

Dec 2022 Dec 2031 Rs 2546

EMI CHART ENCLOSED

Term for Repayment 8Years

Number of Instalments to be paid 96

h

EMI shall be presented on the 15 T of each month. Request you to maintain sufficient balance to

ensure clearance of EMI.

Any changes in interest rate, EMI or loan tenure would be communicated to you via letter or through

email.

7. Recovery of overdue

In case of nonpayment of dues, DHFL shall remind borrowers for payment of overdue

amount via tele calling, letters, emails, or through SMS on the details provided by the

borrower.

Personal visit by DHFL employees or by third parties appointed by DHFL will be done to

remind, follow up and collect outstanding dues.

Legal action u/s 138 of Negotiable Instrument Act and / or SARFAESI or any other legal

action available to DHFL will be initiated on case to case basis.

8. Date on which annual outstanding balance statement will be issued:

As per the request of the Borrower, after the end of the financial year.

9. Customer Services

For any queries, please call us on 1800 3000 1919 from Monday to Friday between 9:30 a.m. to 6:00

p.m. and on Saturday between 9:30 a.m. to 2:00 p.m. or write to us at response@dhfl.com.

Home Branch: Branch Timings

Monday to Friday: 09:30 a.m. to 6:00 p.m.

Saturday: 09:30 a.m. to 2:00 p.m.

Important documents

All requests for obtaining copies of your documents are accepted at our Customer Care on 1800 3000

1919 from Monday to Friday between 9:30 a.m. to 6:00 p.m. and on Saturday between 9:30 a.m. to

2:00 p.m. or write to us at response@dhfl.com.

I. Statement of Account (SOA) / IT Certificate/ Amortisation Schedule

SOA/ IT certificates are provided free of cost once a year. For duplicate copies, nominal

charges will apply.

II. Copy of Title Documents

Copy of title documents are provided on request.

You might also like

- Sanction Letter V2Document3 pagesSanction Letter V2SRINIVASREDDY PIRAMALNo ratings yet

- Loan Sanction-Letter With kfs4330739025633689315Document4 pagesLoan Sanction-Letter With kfs4330739025633689315Sapan MishraNo ratings yet

- Kotak Sanction LetterDocument1 pageKotak Sanction LetterKeshav MahatoNo ratings yet

- 32642892-PL WelcomeLetterDocument4 pages32642892-PL WelcomeLetterMohan ChandraNo ratings yet

- Welcome Letter - 203319753 PDFDocument6 pagesWelcome Letter - 203319753 PDFRITIK DESHBHRATARNo ratings yet

- Loan Cum Hypothecation Agreement: L&T Finance Limited (Erstwhile Known As Family Credit LTD.)Document19 pagesLoan Cum Hypothecation Agreement: L&T Finance Limited (Erstwhile Known As Family Credit LTD.)niranjan krishnaNo ratings yet

- Registration Certificate Government of Andhra PradeshDocument4 pagesRegistration Certificate Government of Andhra PradeshRaju BhaiNo ratings yet

- Reg No: Dl8Cav0116: Registration Certificate For VehicleDocument1 pageReg No: Dl8Cav0116: Registration Certificate For Vehicleh4ckerNo ratings yet

- HDFC Loan EMI Bill Payments - Billdesk122019 PDFDocument1 pageHDFC Loan EMI Bill Payments - Billdesk122019 PDFPrasadNo ratings yet

- Branch Code:07339 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:07339 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateRavi Kumar100% (1)

- Branch Code:02186 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:02186 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest Certificatesudarsan kingNo ratings yet

- Astronaut AstroDocument2 pagesAstronaut AstroSugar SugarNo ratings yet

- Muthoot FinanceRBI Licence RegnDocument30 pagesMuthoot FinanceRBI Licence RegnTHE PHILOSOPHER MADDYNo ratings yet

- Amex STMTDocument1 pageAmex STMTMark GalantyNo ratings yet

- 4 PDFDocument4 pages4 PDFsatish sharmaNo ratings yet

- Sanction LetterDocument2 pagesSanction LetterSathyan JrNo ratings yet

- Welcome LetterDocument3 pagesWelcome LetterDeepak DevasiNo ratings yet

- Mitc PDFDocument3 pagesMitc PDFShreeNo ratings yet

- Duplicate: 1 of Page No: File No: / 1 / 2Document2 pagesDuplicate: 1 of Page No: File No: / 1 / 2Anand AdkarNo ratings yet

- Ofltr 4311063 181103114418718 1 3Document3 pagesOfltr 4311063 181103114418718 1 3폴로 쥰 차No ratings yet

- Loan Details: TWO - Wheeler Sandhya Automotives, KURNOOLDocument1 pageLoan Details: TWO - Wheeler Sandhya Automotives, KURNOOLmohammed rafiNo ratings yet

- Welcome LetterDocument4 pagesWelcome LetterAkash SinghNo ratings yet

- Welcome LetterDocument4 pagesWelcome LetterChetan ChoudharyNo ratings yet

- Annexure - 1: Mode of RepaymentDocument2 pagesAnnexure - 1: Mode of RepaymentRohit chavanNo ratings yet

- Loan Sanction-Letter181240016761170869Document3 pagesLoan Sanction-Letter181240016761170869Sanjay MohapatraNo ratings yet

- True Credits Private Limited: Loan Sanction LetterDocument17 pagesTrue Credits Private Limited: Loan Sanction LetterTECH SOUL100% (1)

- WelcomeKit - T02972221022093313 - 2 Feb 2023Document3 pagesWelcomeKit - T02972221022093313 - 2 Feb 2023rajkumar sainiNo ratings yet

- Welcome Letter 193521762Document3 pagesWelcome Letter 193521762Deeptej Singh MatharuNo ratings yet

- Aditya Life InsuranceDocument2 pagesAditya Life InsuranceMirzaNo ratings yet

- AC Bajaj Finance - 2Document2 pagesAC Bajaj Finance - 2prsnjt11No ratings yet

- Lony3004 00000037809338867 HDocument1 pageLony3004 00000037809338867 HlimcysebastinNo ratings yet

- IT CertificateDocument1 pageIT CertificateManoj DasNo ratings yet

- Loan AgreementDocument20 pagesLoan AgreementRANJIT BISWAL (Ranjit)No ratings yet

- Star HealthDocument1 pageStar HealthpalanivelNo ratings yet

- Sanction LetterDocument5 pagesSanction LetterIssac EbbuNo ratings yet

- Homeloan IT Lcertificate Mithun 2023Document1 pageHomeloan IT Lcertificate Mithun 2023yaligartechNo ratings yet

- Home Loan - Certificate - 2022-23Document1 pageHome Loan - Certificate - 2022-23cont2chandu100% (1)

- Munar8257 - Welcome LetterDocument3 pagesMunar8257 - Welcome LetterYash DaymaNo ratings yet

- Person With Disability RegistrationDocument2 pagesPerson With Disability RegistrationSelvakumar KumarNo ratings yet

- keyFactStatement PDFDocument8 pageskeyFactStatement PDFINAM JUNG GUJJARNo ratings yet

- Shriram Chit Jewel Loan AgreementDocument12 pagesShriram Chit Jewel Loan AgreementSenthil KumarNo ratings yet

- 9473667098713233264Document1 page9473667098713233264Parth NayakNo ratings yet

- Pvss Dav Public School: ReceiptDocument1 pagePvss Dav Public School: ReceiptSanjeevNo ratings yet

- MR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074Document1 pageMR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074javedmonis07No ratings yet

- Homeloancertificate - 38180652 DBFDBDocument1 pageHomeloancertificate - 38180652 DBFDBKRIS BARSAGADE100% (1)

- Sanction Letter For ICICI Bank Car Loan Application of MITESHBHAI SARATANBHAI BHARVAD - NC002047354Document1 pageSanction Letter For ICICI Bank Car Loan Application of MITESHBHAI SARATANBHAI BHARVAD - NC002047354Sanjay SolankiNo ratings yet

- IT Certificate 608466263Document1 pageIT Certificate 608466263Selvakumaran GNo ratings yet

- Received With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromDocument5 pagesReceived With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromAkash MitraNo ratings yet

- PremiumRept FamilyDocument2 pagesPremiumRept Familynavengg521No ratings yet

- Ravi Education Loan Interest-2023Document1 pageRavi Education Loan Interest-2023Cut Copy PateNo ratings yet

- VF 20 05 2017Document1 pageVF 20 05 2017rameshNo ratings yet

- Sanction LetterDocument1 pageSanction LetterSurya NarayanaNo ratings yet

- Branch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateRishaan Ranjan100% (1)

- Idfc Two Wheeler Personal LoanDocument1 pageIdfc Two Wheeler Personal Loanrohit100% (1)

- Sanction LetterDocument17 pagesSanction LetterAbhishek gautamNo ratings yet

- Health InsuranceDocument1 pageHealth InsuranceGaurav SaxenaNo ratings yet

- Insurance Smart Sampoorna RakshaDocument10 pagesInsurance Smart Sampoorna RakshaArpit ShahNo ratings yet

- 524243536624287Document1 page524243536624287support marenNo ratings yet

- Loan LetterDocument4 pagesLoan Lettermohd.hadi36No ratings yet

- Premium Receipt 008102909 - 14 02 2023 14 02 2023Document1 pagePremium Receipt 008102909 - 14 02 2023 14 02 2023UTSAV DUBEYNo ratings yet

- Most Important Terms and Conditions (Mitc) (For Individual Housing/ Non-Housing Loan)Document2 pagesMost Important Terms and Conditions (Mitc) (For Individual Housing/ Non-Housing Loan)Venkatesh W0% (1)

- Mitc - Blank-Format - SampleDocument3 pagesMitc - Blank-Format - SampleRavi yadavNo ratings yet

- OpTransactionHistoryUX3 - PDF24 08 2023Document3 pagesOpTransactionHistoryUX3 - PDF24 08 2023Raju BhaiNo ratings yet

- Hero Fincorp Ltd. Account Statement Generated On (Date & Time) :29/11/2022 04:27:41Document6 pagesHero Fincorp Ltd. Account Statement Generated On (Date & Time) :29/11/2022 04:27:41Raju BhaiNo ratings yet

- MFM HVT Vs 7 N KD8 V 0Document4 pagesMFM HVT Vs 7 N KD8 V 0Raju BhaiNo ratings yet

- L Bglbeu 9 XHTL XV BPDocument16 pagesL Bglbeu 9 XHTL XV BPRaju BhaiNo ratings yet

- Niruword 3Document11 pagesNiruword 3Raju BhaiNo ratings yet

- BSUBA5 CKD CW N3 LD 6Document11 pagesBSUBA5 CKD CW N3 LD 6Raju BhaiNo ratings yet

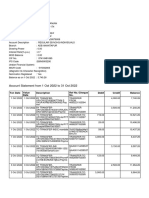

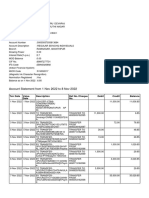

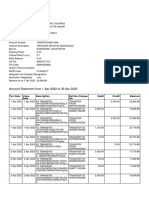

- Account Statement From 1 Jul 2022 To 31 Jul 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 1 Jul 2022 To 31 Jul 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRaju BhaiNo ratings yet

- StatementDocument2 pagesStatementRaju BhaiNo ratings yet

- Monthly Statement PF PayrollDocument2 pagesMonthly Statement PF PayrollRaju BhaiNo ratings yet

- ManjuDocument15 pagesManjuRaju BhaiNo ratings yet

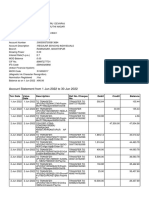

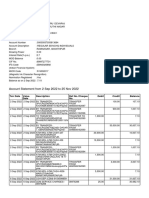

- Account Statement From 2 Sep 2022 To 25 Nov 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument15 pagesAccount Statement From 2 Sep 2022 To 25 Nov 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRaju BhaiNo ratings yet

- Kotak 6 MonthsDocument35 pagesKotak 6 MonthsRaju BhaiNo ratings yet

- PDF MayDocument5 pagesPDF MayRaju BhaiNo ratings yet

- CBDT e Filing ITR 2 Validation RulesDocument34 pagesCBDT e Filing ITR 2 Validation RulesRaju BhaiNo ratings yet

- STMT 81120100006392 1667970677522Document8 pagesSTMT 81120100006392 1667970677522Raju BhaiNo ratings yet

- Nov SbiDocument2 pagesNov SbiRaju BhaiNo ratings yet

- KM101872517 StatementDocument12 pagesKM101872517 StatementRaju BhaiNo ratings yet

- Apr SbiDocument11 pagesApr SbiRaju BhaiNo ratings yet

- Oct SbiDocument9 pagesOct SbiRaju BhaiNo ratings yet

- Account Statement: 9645818421 Ananthapur BranchDocument22 pagesAccount Statement: 9645818421 Ananthapur BranchRaju BhaiNo ratings yet

- VaKia Motors-243 - 220131 - 122451Document1 pageVaKia Motors-243 - 220131 - 122451Raju BhaiNo ratings yet

- International Business Trade SeatworkDocument2 pagesInternational Business Trade SeatworkMaia Carmela JoseNo ratings yet

- #3 Deferred Taxes PDFDocument3 pages#3 Deferred Taxes PDFjanus lopezNo ratings yet

- Quotation For Manpower Services: Sl. No. Categories Duty Hours Basic EPF ESI Rate S.C. @10% TotalDocument1 pageQuotation For Manpower Services: Sl. No. Categories Duty Hours Basic EPF ESI Rate S.C. @10% TotalAwadh GroupNo ratings yet

- Cost Benefit Analysis Is Done To Determine How WellDocument5 pagesCost Benefit Analysis Is Done To Determine How WellShaikh JahirNo ratings yet

- Dimla Selene S Assignment On Aggregate PlanningDocument3 pagesDimla Selene S Assignment On Aggregate PlanningJhaister Ashley LayugNo ratings yet

- Efisiensi Biaya Operasional Kendaraan Pada Pelebaran Jalan Brawijaya Kabupaten JemberDocument12 pagesEfisiensi Biaya Operasional Kendaraan Pada Pelebaran Jalan Brawijaya Kabupaten Jemberashadi asriNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document3 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)Amit YearnNo ratings yet

- Technical Design DocumentDocument20 pagesTechnical Design Documentram kNo ratings yet

- No. 4-37 Page 146Document6 pagesNo. 4-37 Page 146Nemalai VitalNo ratings yet

- CGTMSE - Claim Lodgment Part-IIDocument10 pagesCGTMSE - Claim Lodgment Part-IISunil KumarNo ratings yet

- Fixed Deposit of Global Ime Bank Ltd.Document12 pagesFixed Deposit of Global Ime Bank Ltd.tradelinkemeraldNo ratings yet

- Depreciation ExerciseDocument7 pagesDepreciation ExerciseMuskan LohariwalNo ratings yet

- The Role of Supplier Base Rationalisation in Operational Performance in The Retail Sector in ZimbabweDocument10 pagesThe Role of Supplier Base Rationalisation in Operational Performance in The Retail Sector in ZimbabweJorge Alejandro Patron ChicanaNo ratings yet

- Target Validation ProtocolDocument63 pagesTarget Validation ProtocolSireethus SaovaroNo ratings yet

- Regional Economics Class NotesDocument21 pagesRegional Economics Class NotesCabletv10No ratings yet

- Feasibility StudiesDocument60 pagesFeasibility Studiesice100% (2)

- November CY2022 Cold Storage WarehouseDocument27 pagesNovember CY2022 Cold Storage Warehousedexterbautistadecember161985No ratings yet

- CVDocument4 pagesCVThiha ZawNo ratings yet

- A Gift To My Children Summary - Jim Rogers - PDF DownloadDocument4 pagesA Gift To My Children Summary - Jim Rogers - PDF Downloadgato44450% (2)

- PPDA Contracts 2023Document56 pagesPPDA Contracts 2023richard.musiimeNo ratings yet

- BOP-Group 2Document35 pagesBOP-Group 2Waleed ElsebaieNo ratings yet

- Fua Cun vs. Summers, 44 PHIL 705Document3 pagesFua Cun vs. Summers, 44 PHIL 705Vincent BernardoNo ratings yet

- Myths of GlobalizationDocument8 pagesMyths of GlobalizationCheskaNo ratings yet

- Trade Credit Insurance Presentation - HDFC ERGO 05012016Document22 pagesTrade Credit Insurance Presentation - HDFC ERGO 05012016BOC ClaimsNo ratings yet

- Pleting The CycleDocument21 pagesPleting The CycleAL Babaran CanceranNo ratings yet

- Fiarlocks LTD: Invoice and Packing ListDocument1 pageFiarlocks LTD: Invoice and Packing ListDeelaka DheeraratneNo ratings yet

- Corporations CH 12 Lecture 1Document18 pagesCorporations CH 12 Lecture 1Faisal SiddiquiNo ratings yet

- Ofw Application FormDocument1 pageOfw Application FormJan Carlos SuykoNo ratings yet

- Actual Estimated Contract Percent Project No. Cost Total Cost Price CompleteDocument10 pagesActual Estimated Contract Percent Project No. Cost Total Cost Price CompleteRalph Renz CastilloNo ratings yet