Professional Documents

Culture Documents

Interest Rates On Loans and Advances

Interest Rates On Loans and Advances

Uploaded by

Bala RathnamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interest Rates On Loans and Advances

Interest Rates On Loans and Advances

Uploaded by

Bala RathnamCopyright:

Available Formats

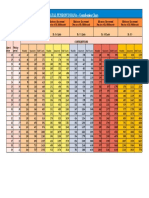

KARNATAKA VIKAS GRAMEENA BANK

Rate of Interest on loans and advances with effect from 13.04.2020

No Priority Sector Advances Particulars Rate of

Interest %

1a KCC/CROP LOANS / Pledge (i.e. Produce) a. Up to Rs.3.00 lakhs

Loan – under interest subvention-Applicable 7.00

rate of Interest up to one year from the date

of disbursement or due date or date of b. Above Rs.3.00 lakh 12.00

payment / renewal, whichever is earlier.

1b KCC/CROP LOANS (after one year of a. Up to Rs.1.00 lakh 11.00

disbursement) / Pledge (i.e. Produce) Loan–

Normal rate of interest(without interest b. Above Rs.1.00 lakh up 11.00

subvention) to Rs.3,00 lakh

c. Above Rs.3.00 lakh 12.00

2a Agri. Term Loans/allied activities (including Irrespective of Loan 12.00

purchase of Agriculture land, Commercial Amount

production of Organic inputs, Vikas

Bahumukha, Drip Irrigation for Sugar Cane

cultivation, Stall fed goat /sheep rearing,

Model dairy unit, Agri. Tourism, Krishi

samruddi etc.)

2b Tractor / Trailer , Agricultural equipments, With 25% Margin 12.00

irrespective of Loan amount

3a Rural Artisans, Cottage Industries, Tertiary a. Up to Rs. 5 Lakhs 11.50

Sectors including loan to Retail Traders, 12.00

Small Business and Other Self Employed,

Professionals and Medical Practitioners, b. Above Rs. 5 Lakhs

Swarojagar Credit Card, Rural Godown,

Cold storage, Kisan Seva Kendras, SRTO,

Vikas Abnnaoorna & other Non- farm sectors

including Loans extended to Educational

Institutions.(& MSME)

3b Vikas Sanjeevini Scheme Above Rs.5.00 lakh 12.00

3c Vikas Sarala Sanjeevini –OD Scheme Irrespective of Loan 12.00

Amount

3d Vikas Saathi Scheme Irrespective of Loan 11.50

Amount

3e Vikas Mitra Scheme Irrespective of Loan 11.50

Amount

3f Financing for Landscaping Irrespective of Loan 12.50

Amount

4 Vikas Mahila Snehi Scheme Irrespective of Loan 10.00

Amount

5 Vikas She plus Scheme Irrespective of Loan 11.00

Amount (Presently

quantum of loan is Mini.

Rs.0.50 lakh & maxi. Rs.

2 lakh)

KARNATAKA VIKAS GRAMEENA BANK

6 Vikas Griha Flexi Scheme Irrespective of Loan 10.00

Amount

7 Vikas Grihalankar Scheme Irrespective of Loan 10.00

Amount

8 Vikas Griha Snehi Irrespective of Loan 10.00

Amount

(Presently quantum of

loan is Mini. Rs. 1 lakh &

maxi. Rs. 2 lakh)

9 Education Loans a. Up to & inclusive of Rs 11.50

4,00,000

b. Above Rs 4.00,000 12.00

10 Self Help Groups * Irrespective of Loan 12.50

Amount

11 Joint Liability Groups ** Irrespective of Loan 12.00

Amount

12 Solar Lighting Irrespective of Loan 12.00

Amount

13 Solar Water heating Irrespective of Loan 12.00

amount

14 General Credit Cards (GCC) Irrespective of Loan 12.00

amount

15 Vikas Janashakti (Present maximum 13.50

quantum of loan is

Rs.2.00 lakhs)

16 Farm House(with effect from 13.10.2020) (Irrespective of loan 8.50

amount for loan

sanctioned )

17 Housing Loan (with effect from Vikas Griha-High Score 7.50%

13.10.2020) (750 or more)

Vikas Griha- Medium

7.75%

Score (-1,1 to 5 and 600

to 749)

Vikas Griha-Low Score (* 8.50%

Score less than 600)

Non Priority sector advances Particulars Revised%

1 Loans to Wholesale Dealers, Commission a. Up to Rs. 2.00 lakhs 12.50

Agents b. Above Rs.2.00 lakhs 13.00

2 Loans to Real Estate Developers and all Irrespective of Loan

other commercial / NPS Advances 13.50

amount

3 Mortgage Loan Irrespective of Loan

amount 12.50

KARNATAKA VIKAS GRAMEENA BANK

4 Irrespective of Loan

Vikas Rent Scheme 12.50

Amount

Vehicle Loan to Public (4 wheeler & 2 Up to Rs.5,00,000/- 9.00% p.a.

wheeler) – For loan sanctioned during

5 festival credit campaign with effect Rs.5,00,001 to 8.50% p.a.

from 17.10.2020 Rs.10,00,000/-

Normal rate of interest- 10.00% p.a

(Irrespective of loan amount) Rs.10,00,001 and above 8.00% p.a.

6 Ware House receipt loans.(Other than

Irrespective of loan

Produce Loan) 13.00

amount

Repayment period more than 6 months.

Loans and Advances against NSC/KVP/LIC

7 Irrespective of amount 12.00

Policies (Surrender Value)

Demand Loans for Salaried Class & Non- Irrespective of loan

8 salaried (Purchase of Consumer Durables amount 13.00

and Demand Loans)

9 DL to Nirantara Deposit Agents Irrespective of loan

12.50

amount

10 DL to Agriculturists As per Scheme 13.50

11 Branch Premises Loans Irrespective of the Amount 12.00

DL on security of Nirantara Deposit A/cs Up to Rs.1. 50 lakhs

12 13.50

(NDDL)

13 Cheque Discounting / Purchasing Irrespective of amount 16.00

14 Debit balances in SB / Current accounts Irrespective of amount

from the date of over 18.00

drawals.

15 Loans on Deposits on Nirantara Deposit Irrespective of the amount

10.00

16 Jewel Loans (Cir.161/61/2019/ ADV

Upto Rs.3 lakhs

Dt.1.10.2019)

(maximum limit Rs.3 9.50

16 a. Multi-Purpose agricultural jewel loan

lakhs only)

scheme -without interest subvention.

16 b. Jewel Loans Non Agri. Irrespective of Loan

11.00

Amount

16 c. Vikas Laghu Suvarna ( With effect 7.25% per

from 17.08.2020. annum

Overdue

Maximum of Rs.15.00 accounts

lakhs per party. shall be

charged at

10.50% per

annum

17 Loans on Term Deposits/ODD 2 % above Deposit Rate

18 Vikas Santushti-ODD 1.50% above the Deposit Interest rate

You might also like

- BilledStatements 8558 16-04-23 22.39Document2 pagesBilledStatements 8558 16-04-23 22.39Adish BhagwatNo ratings yet

- Deposit Offer LetterDocument1 pageDeposit Offer LetterMahmudul Hoque100% (1)

- Revision of Service Charges Wef 01042023Document53 pagesRevision of Service Charges Wef 01042023kkrandy01No ratings yet

- Information On Interest Rates and Sercice Charges As Per Rbi FormatDocument1 pageInformation On Interest Rates and Sercice Charges As Per Rbi Formatthiyagu_advNo ratings yet

- Pre Closestatement PDFDocument2 pagesPre Closestatement PDFsaroj purkaitNo ratings yet

- IOB9540Foot Service Charges 01.07.2017 PDFDocument39 pagesIOB9540Foot Service Charges 01.07.2017 PDFHarishPratabhccNo ratings yet

- Service Charges Final - 03.06.2017for Circular IssuingDocument39 pagesService Charges Final - 03.06.2017for Circular IssuingshivaNo ratings yet

- BOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)Document5 pagesBOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)AvunNo ratings yet

- Afcott: Nigeria Limited Will Be Distributed To Deserving Farmers atDocument6 pagesAfcott: Nigeria Limited Will Be Distributed To Deserving Farmers atPolaganirajesh RajeshNo ratings yet

- PNB Shikhar SchemeDocument3 pagesPNB Shikhar Schemeomkar maharanaNo ratings yet

- 2024 26 5 08 42 11 Pre ClosestatementDocument2 pages2024 26 5 08 42 11 Pre ClosestatementMallikarjun BNo ratings yet

- 2024 04 4 14 41 49 Pre ClosestatementDocument3 pages2024 04 4 14 41 49 Pre ClosestatementPankaj GoenkaNo ratings yet

- Advances Related Service Charges W.E.F. 01.04.2019 A PDFDocument11 pagesAdvances Related Service Charges W.E.F. 01.04.2019 A PDFSudhakar BataNo ratings yet

- Sanction DlaDocument17 pagesSanction DlaAkhila SureshNo ratings yet

- Crop LoanDocument3 pagesCrop LoanRamana GNo ratings yet

- Revsecuritisation SummitDocument15 pagesRevsecuritisation SummitaishwaryasamantaNo ratings yet

- Loan Account Statement For 402Tpfgb920674Document2 pagesLoan Account Statement For 402Tpfgb920674Prashant landgeNo ratings yet

- HOME LOAN SANCTION TICKET VAMSHIDHARDocument6 pagesHOME LOAN SANCTION TICKET VAMSHIDHARIb SulochanaNo ratings yet

- Dhani Loans and Services Limited Foreclosure/Closure Simulation ReportDocument1 pageDhani Loans and Services Limited Foreclosure/Closure Simulation Reportshobhna sharmaNo ratings yet

- Banking OadsdDocument85 pagesBanking Oadsdkalis vijayNo ratings yet

- Pre ClosestatementDocument2 pagesPre Closestatementkhurafaat inNo ratings yet

- 2023 11 12 12 10 30 Pre ClosestatementDocument4 pages2023 11 12 12 10 30 Pre ClosestatementshrinivasrssfeedNo ratings yet

- Prepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Document2 pagesPrepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Daniel GnanaselvamNo ratings yet

- Sanction DlaDocument17 pagesSanction DlaJATIN MOHANNo ratings yet

- Bank AGRICULTUREDocument23 pagesBank AGRICULTUREdecenttsunanditNo ratings yet

- Foreclosure Letter - 20 - 26 - 19Document3 pagesForeclosure Letter - 20 - 26 - 19Santhosh AnantharamanNo ratings yet

- Aryadhan New CAM Format For NBFC Clean Version CAM & AnnexuresDocument67 pagesAryadhan New CAM Format For NBFC Clean Version CAM & AnnexuresSwarna SinghNo ratings yet

- Pre ClosestatementDocument2 pagesPre ClosestatementMURALI KRISHNA MADDINENINo ratings yet

- RBI Format ROI PCDocument6 pagesRBI Format ROI PCSandesh ManeNo ratings yet

- Icici IrrDocument1 pageIcici Irrsaurabh_sam81No ratings yet

- Hii Full Fill To ToDocument3 pagesHii Full Fill To ToNagasai PraveenNo ratings yet

- 2023 20 11 10 51 50 Pre ClosestatementDocument2 pages2023 20 11 10 51 50 Pre ClosestatementMohit pathakNo ratings yet

- Sanction DlaDocument17 pagesSanction Dlampriya_rajesh1435No ratings yet

- Pre CloseStatementDocument2 pagesPre CloseStatementMadhu BalaNo ratings yet

- 4080CDJL956903 Foreclosure LetterDocument3 pages4080CDJL956903 Foreclosure LetterJanakiram TammineniNo ratings yet

- Loan Summary: Congratulations! Welcome To The Home Credit FamilyDocument1 pageLoan Summary: Congratulations! Welcome To The Home Credit FamilyRadha kushwahNo ratings yet

- Prepayment of Your ICICI Bank Loan Account:XXXXXXXXXXXX1963Document2 pagesPrepayment of Your ICICI Bank Loan Account:XXXXXXXXXXXX1963LavSainiNo ratings yet

- 2024 01 5 00 34 31 Pre ClosestatementDocument2 pages2024 01 5 00 34 31 Pre ClosestatementAjay KukretiNo ratings yet

- DebtswapschemeDocument7 pagesDebtswapschemeANBUNo ratings yet

- Tiic Interest RateDocument3 pagesTiic Interest RatePriyaNo ratings yet

- Commercial Banking AssignmentDocument9 pagesCommercial Banking AssignmentDinesh KumarNo ratings yet

- BilledStatements 9605 18-02-24 22.45Document1 pageBilledStatements 9605 18-02-24 22.45cryovikas1975No ratings yet

- Loan Summary: Congratulations! Welcome To The Home Credit FamilyDocument1 pageLoan Summary: Congratulations! Welcome To The Home Credit FamilyDipanshu SinhaNo ratings yet

- ICICI Housing LoansDocument3 pagesICICI Housing LoansAdv Sheetal SaylekarNo ratings yet

- Statement of Account - 11!30!26Document5 pagesStatement of Account - 11!30!26Kalpana HariNo ratings yet

- Soa Abbaibil000000712575 12062024 113142Document4 pagesSoa Abbaibil000000712575 12062024 113142hardeepcok123No ratings yet

- Bu Mock Test Ans & Results - 11 Dec 2022Document3 pagesBu Mock Test Ans & Results - 11 Dec 2022Deepu MannatilNo ratings yet

- Key Fact Statement/fact Sheet: Details About Contingent Charges Late Fee ChargesDocument17 pagesKey Fact Statement/fact Sheet: Details About Contingent Charges Late Fee ChargesRasNo ratings yet

- Bajaj Flexi Loan NewDocument28 pagesBajaj Flexi Loan NewKiran KumarNo ratings yet

- 40jrdpip697862 SoaDocument4 pages40jrdpip697862 Soasofiqulislam071188No ratings yet

- Foreclosure LetterDocument3 pagesForeclosure LetterabinayaNo ratings yet

- Sanctional Letter 3908838977 2020-01-15 PDFDocument1 pageSanctional Letter 3908838977 2020-01-15 PDFSurendra TagleNo ratings yet

- Int RateDocument2 pagesInt Ratej krishnanNo ratings yet

- ForeclosureDocument3 pagesForeclosuremohammadafreed223No ratings yet

- Mudra - Interest RateDocument4 pagesMudra - Interest RateDr. S KELATHNo ratings yet

- ForeclosureLetter 4080CDJU248908Document3 pagesForeclosureLetter 4080CDJU248908sankar007kNo ratings yet

- BilledStatements 0425 03-01-24 16.24Document3 pagesBilledStatements 0425 03-01-24 16.24amaanswalehNo ratings yet

- LHKLR00001286286Document3 pagesLHKLR00001286286Nikhil SinhaNo ratings yet

- LOANRATEOFINTERESTDocument10 pagesLOANRATEOFINTERESTgaurav singhNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyNo ratings yet

- Analysis of Financial Performance of BD Lamps LimitedDocument23 pagesAnalysis of Financial Performance of BD Lamps LimitedGolam RabbaneNo ratings yet

- Chanakya National Law University: Topic-Pledge and Hypothecation Subject - Law of Contract IiDocument23 pagesChanakya National Law University: Topic-Pledge and Hypothecation Subject - Law of Contract IiashishNo ratings yet

- Practice Exercises - Note PayableDocument2 pagesPractice Exercises - Note PayableShane TabunggaoNo ratings yet

- Can Sustainable Investments Outperform Traditional Benchmarks? Evidence From Global Stock MarketsDocument16 pagesCan Sustainable Investments Outperform Traditional Benchmarks? Evidence From Global Stock MarketsRodrigoNo ratings yet

- Summer Internship ReportDocument22 pagesSummer Internship ReportBeljohn AlappatNo ratings yet

- Apy ChartDocument1 pageApy ChartMohit PathaniaNo ratings yet

- Cfs NumericalsDocument12 pagesCfs NumericalsNeelu AhluwaliaNo ratings yet

- 3i Infotech-Developing A Hybrid StrategyDocument20 pages3i Infotech-Developing A Hybrid StrategyVinod JoshiNo ratings yet

- ChallanDocument1 pageChallannaresh maddu100% (1)

- MCM Tutorial 2Document3 pagesMCM Tutorial 2SHU WAN TEHNo ratings yet

- Secretary Certificate SampleDocument2 pagesSecretary Certificate SampleAngelica DaoNo ratings yet

- Subic Power Corp V CIR (CTA 6059, May 8 2003)Document16 pagesSubic Power Corp V CIR (CTA 6059, May 8 2003)Firenze PHNo ratings yet

- Gada Individual AssignmentDocument10 pagesGada Individual AssignmentAboma MekonnenNo ratings yet

- Ayush CVDocument1 pageAyush CVHimalaya GaurNo ratings yet

- M.B.A (2019 Pattern)Document291 pagesM.B.A (2019 Pattern)SurajNo ratings yet

- GNP DefinitionDocument2 pagesGNP Definition林衍諾No ratings yet

- 2010 Annual ReportDocument68 pages2010 Annual ReportMbongeni ShongweNo ratings yet

- Tenancy ContractDocument4 pagesTenancy ContractАндрей МатюшинNo ratings yet

- Chapter 15 - Long-Term Financing: An IntroductionDocument33 pagesChapter 15 - Long-Term Financing: An IntroductionHà HoàngNo ratings yet

- Derivatives AccountingDocument28 pagesDerivatives Accountingkotha123No ratings yet

- Mozambican EconomicDocument19 pagesMozambican Economicgil999999No ratings yet

- Assignment - Chapter 5 (Due 10.11.20)Document4 pagesAssignment - Chapter 5 (Due 10.11.20)Tenaj KramNo ratings yet

- A162 Tutorial 1Document5 pagesA162 Tutorial 1Danny SeeNo ratings yet

- Account Statement As of 10-01-2018 15:54:43 GMT +0530: TXN Date Value Date Cheque No. Description Debit Credit BalanceDocument3 pagesAccount Statement As of 10-01-2018 15:54:43 GMT +0530: TXN Date Value Date Cheque No. Description Debit Credit BalanceideepujNo ratings yet

- Performance Audit Report On Management of Property Investments As Implemented by NSSF and PSSFDocument166 pagesPerformance Audit Report On Management of Property Investments As Implemented by NSSF and PSSFSwahibu MgamboNo ratings yet

- MPA - 6SA2 - 1710110471 - Alfina Fadhila SoesiloDocument4 pagesMPA - 6SA2 - 1710110471 - Alfina Fadhila SoesiloAlfina FadhilaNo ratings yet

- Chapter 25 (Pension Fund Operation)Document20 pagesChapter 25 (Pension Fund Operation)Aguntuk ShawonNo ratings yet

- Fast Track TradingDocument5 pagesFast Track TradingTomasrdNo ratings yet

- AFW368Tutorial 2answerDocument6 pagesAFW368Tutorial 2answerSiRo Wang100% (1)

- General LedgerDocument6 pagesGeneral LedgerErika Sta. AnaNo ratings yet