Professional Documents

Culture Documents

Asian Liquidity Sweep V1.3

Asian Liquidity Sweep V1.3

Uploaded by

AJCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asian Liquidity Sweep V1.3

Asian Liquidity Sweep V1.3

Uploaded by

AJCopyright:

Available Formats

Asian Liquidity Sweep

Confirmed BOS (Break of Structure – Supply or demand failed)

ALS 20221014 AB V1.3 Prana Trading

Identify the Asian range according to time zone as specified above. Wait for sweep of high or low of Asian

range. Price action to return within the structure (Asia zone) which can offer a high probability trade. At times

price will not return within the zone. Identify Imbalance zones where price will correct back for point of

interest / entry execution. These zones will not likley be visual in the same time frame. Always confirm

structure break on 5 minute chart with a 5 minute extreme zone. To enhance risk reward it may be viable to

refine to lower time frames.

ALS 20221014 AB V1.3 Prana Trading

Substructure break (SSB) Supply or demand still intact

Substructure (SSB) trading increases risk, as supply or demand are still intact and not failed. Price did not

return to Asia range as above, substructure break was confirmed and trade executed from the 5 min POI

extreme zone.

Note price always needs liquidity to draw either buys or sells, look for reasons of buying or selling

ALS 20221014 AB V1.3 Prana Trading

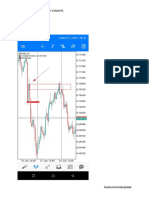

Higher Timeframe (HTF) Point of Interest (POI) with BOS/SSB

High probability trade from HTF point of interest. Reaction by rejection from one hour supply area leading to a

sub structure break. Imbalance left to purge from lower time frame. Cause below to drive prices lower. Overall

drawdown time 24 minutes before trade rolled over in to profit. Managing stop loss is vital part of trading

moving to break even could have closed out the trade. Scale in opportunity presented with clear sell of

meeting target. Although SSB by the wicks only trade met its targets.

ALS 20221014 AB V1.3 Prana Trading

Risk Entry (RE)

Buy or sell limit placed on area of interest identified prior to session open. Take imbalance and liquidity draw

into account when identifying these levels. High risk trade. Wicks are liquidity draws which should be taken

into account when trading the ALS and identifying points if interest.

ALS 20221014 AB V1.3 Prana Trading

ALS 20221014 AB V1.3 Prana Trading

Asia liquidity grab trades don’t run every day, focusing on just a few pairs will give a decent return per month,

quarter or annually.

Optimum execution time for ALS between 6.30am and 10.00am anything beyond that point will severely

reduce the profitability outcome

Identify extreme supply and demand zones with more confluences on higher time frame zones preferably one

hour to increase the win ratio

Look for imbalance and internal liquidity, double tops/ bottoms where price will be attracted to

Only execute trade once market structure break or substructure break has been confirmed following an Asia

sweep

Take into account higher time frame order flow, prepare a score system for when more than one pair of ALS

lines with the entry model. Take into consideration time at the zone, strength of the move that broke structure

and is the level fresh or retested

If structure has broken within Asia range this could be a trend continuation trade.

Price runs away too far from Asia highs and lows do not chase as the ASL will most likley be invalidated unless

price reacts to higher time frame point of interest

Don’t correlate pairs and cross reference with DXY or USD based pairs to evaluate price.

Consider when moving stop loss price more than often mitigates entry level as back test proves

Read price, see if it is respecting lower time frame breaker blocks or wick rejections

Look at taking partials at areas of interest

Logical system that works over long run, do not interfere once trade has been executed

Do not let others analysis cloud yours, trade your own system and your own analysis!!

Be prepared to flip bias if price tells you a different story

ALS 20221014 AB V1.3 Prana Trading

Extreme Risk: Buy/ Sell

Asia HTF Do not Manage

BOS/ SSB zone with Reward limit placed

High/Low orderflow interfere accordingly

confirmed? Imbalance greater on Extreme

sweeped? identified with trade to PA

identified than 3R zone

ALS 20221014 AB V1.3 Prana Trading

You might also like

- Zuessy - TIMEDocument75 pagesZuessy - TIMEcoupko100% (1)

- Sanction Letter A2301300139 1Document1 pageSanction Letter A2301300139 1Mohammed Masood50% (2)

- ICT Turtle Soup Pattern - A Run On Stops Model - ICTDocument4 pagesICT Turtle Soup Pattern - A Run On Stops Model - ICTchadleruo099No ratings yet

- First 18 Magic FXDocument18 pagesFirst 18 Magic FXNurSofiayantie100% (2)

- Break of StructureDocument7 pagesBreak of Structurelinoshan0350% (2)

- Analysis of The Coffee House's Marketing StrategyDocument33 pagesAnalysis of The Coffee House's Marketing StrategyLe Vo Bao NganNo ratings yet

- LIQUIDITY A-Z SMC For BeginnersDocument5 pagesLIQUIDITY A-Z SMC For BeginnersCaser TOtNo ratings yet

- Govind Doors Report - Group 1 - Team - 10 PDFDocument7 pagesGovind Doors Report - Group 1 - Team - 10 PDF1921 Vishwanath Pakhare100% (3)

- Lesson 5 Order Blocks-1Document9 pagesLesson 5 Order Blocks-1Nguyễn Trường100% (1)

- TRADING A CHochDocument8 pagesTRADING A CHochAdrian DunicariNo ratings yet

- CryptoDocument57 pagesCryptoafs100% (1)

- Key Info (ICT)Document1 pageKey Info (ICT)Planet TravisNo ratings yet

- MahadFX Course 5Document11 pagesMahadFX Course 5Tuong Nguyen50% (2)

- Supply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.From EverandSupply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.No ratings yet

- Inventory AssignmentDocument3 pagesInventory AssignmentMuhammad Bilal100% (1)

- Market Structure and InducementDocument1 pageMarket Structure and InducementS WavesurferNo ratings yet

- Order BlockDocument39 pagesOrder BlockRobertNo ratings yet

- My Trading PlanDocument4 pagesMy Trading PlanEdrinanimous AnandezNo ratings yet

- Purpose Without The Consent of Dipprofit Is Illegal and Will Be PenalizedDocument50 pagesPurpose Without The Consent of Dipprofit Is Illegal and Will Be PenalizedYoulee PratamaNo ratings yet

- Entry Criteria, Targets and Market DirectionDocument16 pagesEntry Criteria, Targets and Market DirectionRui Almeida100% (2)

- Protected Structure Vs Targeted StructureDocument4 pagesProtected Structure Vs Targeted StructureFrom Shark To WhaleNo ratings yet

- Entry ModelsDocument5 pagesEntry Modelssatori investmentsNo ratings yet

- Trading Hub 2.o - Vietsub - Wetrix22Document48 pagesTrading Hub 2.o - Vietsub - Wetrix22nguyenthaihung1986No ratings yet

- How To Trade Smart Money Concepts (SMC) - FTMODocument7 pagesHow To Trade Smart Money Concepts (SMC) - FTMObrightenyimuNo ratings yet

- C.T.E SMC StrategyDocument5 pagesC.T.E SMC Strategyhlapisiathrop0% (1)

- Safe - Target - and - LTF - Price - ActionDocument9 pagesSafe - Target - and - LTF - Price - ActionRui Almeida100% (2)

- Primary Analysis@Falcon BooksDocument16 pagesPrimary Analysis@Falcon BookspierodicarloNo ratings yet

- Market Structure MSDocument32 pagesMarket Structure MSadama kafando100% (1)

- 3.1 7.3. How To Define POIDocument6 pages3.1 7.3. How To Define POIJardel QuefaceNo ratings yet

- Market Structure Shift-TTrades - EduDocument6 pagesMarket Structure Shift-TTrades - Edumahatma street0% (1)

- Order Block (Inner Circle)Document12 pagesOrder Block (Inner Circle)cplus.srilankaNo ratings yet

- Liquidity Void and Fair Value GapDocument19 pagesLiquidity Void and Fair Value GapAbdul azeez100% (1)

- Week 1 Markup 4 NotesDocument3 pagesWeek 1 Markup 4 Notesabas100% (1)

- Sniper Entries UsingDocument7 pagesSniper Entries UsingRayNanty100% (1)

- High Probability ConditionsDocument6 pagesHigh Probability ConditionsHuynh NguyenNo ratings yet

- BOS CTS: Smart Money Concept - SMCDocument6 pagesBOS CTS: Smart Money Concept - SMCViaan Johnson100% (2)

- Market Structure GuidelinesDocument40 pagesMarket Structure GuidelinesShabab Ahmad100% (1)

- Breaker BlocksDocument16 pagesBreaker Blocksyygtorrent11100% (1)

- FX Personal Trading Strategy ACLDocument29 pagesFX Personal Trading Strategy ACLAlberto Campos López100% (2)

- Batus - Price Will Tell (Entry)Document187 pagesBatus - Price Will Tell (Entry)Tengku Din100% (1)

- Forex GuideDocument64 pagesForex GuideWax CapitalzNo ratings yet

- Bilal - Forex - What Is Mitigation BlocksDocument4 pagesBilal - Forex - What Is Mitigation Blocksrex anthony50% (2)

- 60 Minutes Classic Ict Thread by fx4 LivingDocument10 pages60 Minutes Classic Ict Thread by fx4 LivingFrom Shark To WhaleNo ratings yet

- The Weekly Profile 01Document65 pagesThe Weekly Profile 01Devie ChristianNo ratings yet

- QM North GodDocument5 pagesQM North GodMye RakNo ratings yet

- Obstacles, Predictions and Market DirectionDocument22 pagesObstacles, Predictions and Market DirectionRui AlmeidaNo ratings yet

- Wa0006.Document7 pagesWa0006.Vinoth Kumar D100% (1)

- Thread On Balanced Price Ranges (BPR) and How To Use Them &: 20 Tweets - 2023-04-29Document14 pagesThread On Balanced Price Ranges (BPR) and How To Use Them &: 20 Tweets - 2023-04-29satori investmentsNo ratings yet

- Illustration 3: Order Block-Smart Money ConceptsDocument5 pagesIllustration 3: Order Block-Smart Money ConceptsRobiyanto WedhaNo ratings yet

- Prediction - Understanding HTF DirectionDocument10 pagesPrediction - Understanding HTF DirectionRui AlmeidaNo ratings yet

- FX Trading Supply and DemandDocument18 pagesFX Trading Supply and DemandZack Ming100% (1)

- Liquility / Smart MoneyDocument4 pagesLiquility / Smart MoneyViaan JohnsonNo ratings yet

- Supply Demand Cheat SheetDocument2 pagesSupply Demand Cheat SheetSatz TradesNo ratings yet

- PA Model-9 - One Shot One Kill Trading ModelDocument16 pagesPA Model-9 - One Shot One Kill Trading Modelsohailswati6585No ratings yet

- IRL ERL TTrades EduDocument11 pagesIRL ERL TTrades Edus pNo ratings yet

- What Is Liquidity in The Forex Market - FX Liquidity - SMCDocument13 pagesWhat Is Liquidity in The Forex Market - FX Liquidity - SMCSebastian Gherman100% (2)

- LiquidityDocument17 pagesLiquidityBesart Rexhepi100% (1)

- Thread by @mrlondonhere On Thread Reader App - Thread Reader AppDocument5 pagesThread by @mrlondonhere On Thread Reader App - Thread Reader AppHasbullah Turbo Insta100% (1)

- Order Flow No Raid No Trade Strategy by James J King @SmartMoneycourseDocument24 pagesOrder Flow No Raid No Trade Strategy by James J King @SmartMoneycourseKevin MwauraNo ratings yet

- Algohub PDF (001-052) .Fa - enDocument52 pagesAlgohub PDF (001-052) .Fa - ennfydny1No ratings yet

- Three Drive Price Action - CMF - ToBeaTraderDocument194 pagesThree Drive Price Action - CMF - ToBeaTraderNabinChhetri100% (2)

- What Is FLIP ZONE in The MarketDocument33 pagesWhat Is FLIP ZONE in The MarketAnto Richards100% (1)

- Introduction To Market Structures and Order Blocks: by Alex MwegaDocument13 pagesIntroduction To Market Structures and Order Blocks: by Alex MwegaHenry Jura100% (5)

- CAGEDocument28 pagesCAGEAbhijeet Kashyap83% (6)

- Bcog 172 2Document1 pageBcog 172 2ACS DersNo ratings yet

- PROJECTDocument1 pagePROJECTdes gandaNo ratings yet

- 高顿财经ACCA acca.gaodun.cn: Advanced Performance ManagementDocument12 pages高顿财经ACCA acca.gaodun.cn: Advanced Performance ManagementIskandar BudionoNo ratings yet

- FFM Group 3 PresentationDocument5 pagesFFM Group 3 Presentationlohithagowda122001No ratings yet

- Offshoring Global Outsourcing and The Australian-Economy Continuing Australias Integration Intothe Global Economy 14-7-2004 PDFDocument20 pagesOffshoring Global Outsourcing and The Australian-Economy Continuing Australias Integration Intothe Global Economy 14-7-2004 PDFckNo ratings yet

- IEH2H3 Production Planning & ControlDocument49 pagesIEH2H3 Production Planning & ControlMuhammad Rizky ParamartaNo ratings yet

- August InvoiceDocument1 pageAugust Invoicecindyshweta95No ratings yet

- "LE PEST C" Analysis of Brac Aarong:: Legal EnvironmentDocument5 pages"LE PEST C" Analysis of Brac Aarong:: Legal EnvironmentSiam Ahmed100% (3)

- Circular BBA Sem-1 Major MinorDocument2 pagesCircular BBA Sem-1 Major MinoranishNo ratings yet

- Money MarketDocument25 pagesMoney Marketvicky_n007No ratings yet

- Seven Procure Presentation IntroductionDocument28 pagesSeven Procure Presentation IntroductiondikshaNo ratings yet

- Paras, Princess Erica Mae M. Bsba - 4A Entreprenuerial Management 02 Activity 03Document3 pagesParas, Princess Erica Mae M. Bsba - 4A Entreprenuerial Management 02 Activity 03Princess ParasNo ratings yet

- Submitted By: Saiful Islam Chowdhury ID: 1711038: Submitted To: Iftekhar MahfuzDocument36 pagesSubmitted By: Saiful Islam Chowdhury ID: 1711038: Submitted To: Iftekhar MahfuzSaiful Islam HridoyNo ratings yet

- Sustainability and The Transition ChallengeDocument34 pagesSustainability and The Transition ChallengeSebastianCasanovaCastañedaNo ratings yet

- Bitcoin Price AnalysisDocument6 pagesBitcoin Price Analysischinki shuklaNo ratings yet

- Roadmap To Trading Success, Essential Tips and Techniques For New TradersDocument26 pagesRoadmap To Trading Success, Essential Tips and Techniques For New TradersShehroz HabibNo ratings yet

- Nature and Scope of SalesDocument14 pagesNature and Scope of Salesvmals1878950% (6)

- Company ProfileDocument15 pagesCompany ProfileAslam HossainNo ratings yet

- Quali ExamDocument15 pagesQuali ExamDexell Mar MotasNo ratings yet

- Applied AuditingDocument2 pagesApplied AuditingjjabarquezNo ratings yet

- Flow Chart CompletionDocument3 pagesFlow Chart CompletionCuong Huy NguyenNo ratings yet

- Workplaces: Automation ADocument5 pagesWorkplaces: Automation APriyanshu ThakurNo ratings yet

- MERCIDAR FISHING CORPORATION Represented by Its President DOMINGO BDocument2 pagesMERCIDAR FISHING CORPORATION Represented by Its President DOMINGO BChristine Gel MadrilejoNo ratings yet

- Technical AnalysisDocument20 pagesTechnical AnalysisaroranidhsNo ratings yet

- WMAI - Project Synopsis - Group 12Document4 pagesWMAI - Project Synopsis - Group 12Varun SharmaNo ratings yet