Professional Documents

Culture Documents

ZJC Tax Rates Tables - Tax Year 2023

ZJC Tax Rates Tables - Tax Year 2023

Uploaded by

Mux ConsultantOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ZJC Tax Rates Tables - Tax Year 2023

ZJC Tax Rates Tables - Tax Year 2023

Uploaded by

Mux ConsultantCopyright:

Available Formats

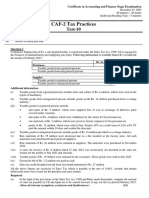

TAX RATES TABLES - TAX YEAR 2023

Tax Rates for Non-Salaried Individuals / AOPs Minimum Tax Section 113

[Division I, Part I of the First Schedule] [Division IX, Part I of the First Schedule]

1 Upto Rs. 600,000 0% Individual & AOP’s (having annual turnover Rs.

1 1.25%

2 Rs. 600,000 to Rs. 800,000 5% 100 Million or more)

3 Rs. 800,000 to Rs. 1,200,000 Rs. 10,000 + 12.5% 2 For Companies 1.25%

4 Rs. 1,200,000 to Rs. 2,400,000 Rs. 60,000 + 17.5%

5 Rs. 2,400,000 to Rs. 3,000,000 Rs. 270,000 + 22.5% (a) Sui Southern Gas Company Limited and Sui

6 Rs. 3,000,000 to Rs.4,000,000 Rs. 405,000 + 27.5% Northern Gas Pipelines Limited (for the cases

where annual turnover exceeds rupees one

7 Rs. 4,000,000 to Rs. 6,000,000 Rs. 680,000 + 32.5% billion.)

8 Exceeding Rs. 6,000,000 Rs. 1,330,000 + 35% 3 (b) Pakistani International Airlines Corporation; 0.75%

and

(c) Poultry industry including poultry breeding,

Tax Rates for Salaried Persons broiler production, egg production and poultry

feed production;

“salary” exceeds seventy-five per cent of his taxable income

[Division I, Part I of the First Schedule] (a) Oil refineries

(b) Motorcycle dealers registered under the Sales

4 0.50%

1 up to Rs. 600,000 0% Tax Act, 1990

(c) Oil marketing companies

(a) Distributors of pharmaceutical products, fast

2 Rs. 600,000 to Rs. 1,200,000 2.5% moving consumer goods and cigarettes;

(b) Petroleum agents and distributors who are

registered under the Sales Tax Act, 1990;

3 Rs. 1,200,000 to Rs. 2,400,000 Rs. 15,000 + 12.5%

(c) Rice mills and dealers;

(d) Tier-1 retailers of fast moving consumer

4 Rs. 2,400,000 to Rs. 3,600,000 Rs. 165,000 + 20% goods who are integrated with Board or its

5 computerized system for real time reporting of 0.25%

sales and receipts;

5 Rs. 3,600,000 to Rs. 6,000,000 Rs. 405,000 + 25%

(e) Person’s turnover from supplies through

6 Rs. 6,000,000 to Rs.12,000,000 Rs. 1,005,000 + 32.5%

ecommerce including from running an online

marketplace as defined in clause (38B) of section

(f) Persons engaged in the sale and purchase of

7 Exceeding Rs. 12,000,000 Rs. 2,955,000 + 35% used vehicles; and

(g) Flour mills

Tax Rates for Companies Rate of Dividend Tax

[Division II, Part I of the First Schedule] [Division III, Part I of the First Schedule]

Type Rate Person

not

No. Nature of Payment Section Rate

Small Company 20% Appear in

ATL

Public / Private Companies 29% a IPP, (CPPA-G) 150 7.50% 15%

Mutual fund, (REIT) and other

Banking Companies 39% b 150 15% 30%

than a, c & d

2 ZAHID JAMIL & CO. Audit | Tax | Advisory | Risk www.zahidjamilco.com

TAX RATES TABLES - TAX YEAR 2023

REIT scheme from Special

150 0% 0%

Purpose Vehicle

Alternate Corporate Tax 17% c

Others from Special Purpose

150 35% 70%

Vehicle

Clause (c) of Division III of Part I

d 150 25% 50%

of the First Schedule

Rates for Super Tax Rate for Profit on Debt

[Division IIA, Part I of the First Schedule]

No. Nature of Payment Section Rate [Division IIIA, Part I of the First Schedule]

1 Banking Company 4B 4% Nature of Payment Section Rate

2 Other Companies 4B 0%

Profit on debt imposed under section 7B 151 15%

Capital Gain on Disposal of Securities

[Division VII, Part I of the First Schedule]

Under Section 37A

Tax Year

No Period 2023 and onwards

(1) (2) (3)

1 Where the holding period does not exceed one year 15%

2 Where the holding period exceeds one year but does not exceed two years 12.5%

3 Where the holding period exceeds two years but does not exceed three years 10%

4 Where the holding period exceeds three years but does not exceed four years 7.5%

5 Where the holding period exceeds four years but does not exceed five years 5%

6 Where the holding period exceeds five years but does not exceed six years 2.5%

7 Where the holding period exceeds six years 0%

8 Future commodity contracts entered into by members of Pakistan Mercantile Exchange 5%

Capital Gain on Disposal of Immovable Property

[Division VIII, Part I of the First Schedule]

Sub-Section (1A) of Section 37

Constructed

No Holding Period Open Plots Flats

Property

(1) (2) (3) (4) (5)

1 Where the holding period does not exceed one year 15% 15% 15%

2 Where the holding period exceeds one year but does not exceed two years 12.5% 10% 7.5%

3 Where the holding period exceeds two years but does not exceed three years 10% 7.5% 0%

4 Where the holding period exceeds three years but does not exceed four years 7.5% 5% -

5 Where the holding period exceeds four years but does not exceed five years 5% 0% -

6 Where the holding period exceeds five years but does not exceed six years 2.5% - -

Where the holding period exceeds six years

7 0 - -

3 ZAHID JAMIL & CO. Audit | Tax | Advisory | Risk www.zahidjamilco.com

TAX RATES TABLES - TAX YEAR 2023

Rate for Tax Collected at Import Stage

[Division IIIA, Part I of the First Schedule]

No. Persons Rate

Section

(1) (2) (3)

1 Persons importing goods classified in Part I of the Twelfth Schedule 1%

2 Persons importing goods classified in Part II of the Twelfth Schedule 148 2%

3 Persons importing goods classified in Part III of the Twelfth Schedule 5.5%

Manufacturers covered under Notification No. S.R.O. 1125(I)/2011 dated the 31st December, 2011 and

4 148 1%

importing items covered under S.R.O. 1125(I)/2011 dated the 31st December, 2011;

Persons importing finished pharmaceutical products that are not manufactured otherwise in Pakistan, as

5 148 4%

certified by the Drug Regulatory Authority of Pakistan

In case of importers of CKD kits of electric vehicles for small cars or SUVs with 50 kwh battery or below

and LCVs with 150 kwh battery or below

6 148 1%

The rate of tax on value of import of mobile phone by any person shall be as set out in the following table: - Tax (in Rs.)

IN CKD/SKD

In CBU

condition

condition PCT

No. C & F Value of mobile phone (in US Dollar) under PCT

Heading

Heading

8517.1219

8517.1211

1 Up to 30 except smart phones 70 0

2 Exceeding 30 and up to 100 and smart phones up to 100 100 0

3 Exceeding 100 and up to 200 930 0

4 Exceeding 200 and up to 350 970 0

5 Exceeding 350 and up to 500 5,000 3,000

6 Exceeding 500 11,500 5,200

Payments to Non-Residents

[Division II, Part III of the First Schedule]

Person

Not

152 Nature of Payment Rate

Appear in

ATL

(1) Royalty & fee for technical services 15% 15%

a) Contract or sub-contract under a construction, assembly or installation project in Pakistan

including a contract for the supply of supervisory activities relating to such project.

(1A) b) Any other contract for construction or services rendered relating there to. 7% 7%

c) Contract for advertisement services rendered by TV Satellite Channels.

(1AA) Payment of insurance premium or re-insurance premium 5% 5%

(1AAA) Payment for advertisement services from non-resident person relaying from outside Pakistan 10% 10%

4 ZAHID JAMIL & CO. Audit | Tax | Advisory | Risk www.zahidjamilco.com

TAX RATES TABLES - TAX YEAR 2023

Tax shall be deducted on remittance outside Pakistan, of fee for off-shore digital services,

(1C) chargeable to tax u/s 6, to a non-resident person on behalf of any resident or a permanent 5% 5%

establishment of a non-resident in Pakistan

(2) All other payment to non- resident 20% 40%

Payment to Permanent Establishment of Non-Resident:

(a) For sale of goods

(i) In case of a company 4% 8%

(ii) In any other case 4.5% 9%

Transport services, freight forwarding services, air cargo services, courier services, manpower

outsourcing services, hotel services, security guard services, software development services, IT

services and IT enabled services as defined in section 2, tracking services, advertising services (other

than by print or electronic media), share registrar services, engineering services, car rental services, 3% 6%

building maintenance services, services rendered of Pakistan Stock Exchange Limited and Pakistan

(2A) Mercantile Exchange Limited inspection and certification, testing and training services, oilfield

services

(b) For services other than above:

(i) In case of a company 8% 16%

(ii) In any other case 10% 20%

(c) For execution of contracts, other than a contract for sale of goods for providing/ rendering of services

(i) In case of sportspersons 10% 20%

(ii) In case of any person 7% 14%

Payments for foreign produced commercials

152A

Payment to non-resident person directly to through an agent for foreign produced commercial for

20% 40%

advertisement on any Television Channel or any other Media.

Payments for Goods or Services

[Division III, Part III of the First Schedule]

Person

Not

153 Nature of Payment Rate

Appear in

ATL

Sale of Goods

(a) Rice, cotton seed or edible oil. 1.50% 3%

153(1)(a) (b) For sale of any other goods

In case of a company 4% 8%

In any other case 4.5% 9%

Rendering of Services

(i) Services

153(1)(b) Transport Services

Freight Forwarding Services

Air Cargo Services

5 ZAHID JAMIL & CO. Audit | Tax | Advisory | Risk www.zahidjamilco.com

TAX RATES TABLES - TAX YEAR 2023

Courier Services

Manpower Outsourcing Services

Hotel Services

Security Guard Services

Software Development Services

IT Services and IT enabled services as defined in section 2

Tracking Services

Advertising services (Other than by print or electronic media)

Share registrar services

Engineering services including architectural services

Warehousing services

Services rendered by asset management companies

Data services provided under license issued by the Pakistan Telecommunication Authority

Telecommunication infrastructure (tower) services 3% 6%

Car Rental services

Building maintenance services

Services rendered by PSX Limited and Pakistan Mercantile Exchange Limited

Inspection

Certification

Testing & training services

Oilfield services

Telecommunication services

Collateral management services

Travel and tour services

REIT management services

Services rendered by National Clearing Company of Pakistan Limited

(ii) All other services:

In case of a company 8% 16%

In any other case 10% 20%

Payments to electronic and print media for advertising services 1.5% 3%

Execution of Contracts

(i) In case of sportspersons 10% 20%

153(1)(c)

(ii) In case of a company 6.5% 13%

(iii) In any other case 7% 14%

Every Exporter or Export House shall deduct Tax on payments in respect of services of stitching, dying,

153(2) 1% 2%

printing etc.

Exports Proceeds Advance tax on Private Motor Vehicle

[Division IV, Part III of the First Schedule] Section 231B

Advance tax on Registration of private motor vehicle:

154 Nature of Payment Rate

[Division VII, Part IV of the First Schedule]

(1) Export proceeds realization 1% Up to 850 cc Rs. 10,000 Rs. 30,000

851 cc – 1000 cc Rs. 20,000 Rs. 60,000

Realization of commission due to an indenting agent

1001 cc – 1300 cc Rs. 25,000 Rs. 75,000

(2)

I. Non-export indenting agent 1% 1301 cc – 1600 cc Rs. 50,000 Rs. 150,000

II. Export indenting agent / export buying house 1% 1601 cc – 1800 cc Rs. 150,000 Rs. 450,000

On realization of proceeds under inland back-to-back 1801 cc – 2000 cc Rs. 200,000 Rs. 600,000

(3) 1%

LC 2001 cc – 2500 cc Rs. 300,000 Rs. 900,000

(3A) Industrial undertaking in EPZ 1% 2501 cc – 3000 cc Rs. 400,000 Rs. 1,200,000

6 ZAHID JAMIL & CO. Audit | Tax | Advisory | Risk www.zahidjamilco.com

TAX RATES TABLES - TAX YEAR 2023

(3B) Indirect exporters (DTRE rules, 2001) 1% above 3000 cc Rs. 500,000 Rs. 1,500,000

(3C) Clearance of goods exported 1% Section 231B (1A)

Export proceeds of Computer software or

IT services or IT Enabled services by

0.25% Leasing of Motor Vehicle to a Peron not appear in ATL.

154A persons registered with Pakistan

Software Export Board 4% of the value of Motor Vehicle

Any other services 1%

Section 231B (2)

Tax Rates of Rental Income

[Division VIA, Part I of the First Schedule] Transfer of registration or ownership of motor vehicle

In the case of Individual & AOP (Section 155) Up to 850 cc - -

1 up to Rs. 300,000 Nil 851 cc – 1000 cc Rs. 5,000 Rs. 15,000

2 Rs. 300,000 to Rs. 600,000 5% 1001 cc – 1300 cc Rs. 7,500 Rs. 22,500

3 Rs. 600,000 to Rs. 2,000,000 Rs. 15,000 + 10% 1301 cc – 1600 cc Rs. 12,500 Rs. 37,500

4 Exceeding Rs. 2,000,000 Rs. 155,000 + 25% 1601 cc – 1800 cc Rs. 18,750 Rs. 56,250

1801 cc – 2000 cc Rs. 25,000 Rs. 75,000

In the case of Company (Section 155) 15%

Prizes & Winnings 2001 cc – 2500 cc Rs. 37,500 Rs. 112,500

[Division VI, Part IV of the First Schedule] 2501 cc – 3000 cc Rs. 50,000 Rs. 150,000

above 3000 cc Rs. 62,500 Rs. 187,500

Person Section 231B (3)

Not

156 Nature of Payment Rate

Appear

Up to 850 cc Rs. 10,000 Rs. 30,000

in ATL 851 cc – 1000 cc Rs. 20,000 Rs. 60,000

1001 cc – 1300 cc Rs. 25,000 Rs. 75,000

Prizes on prize bonds or cross-word puzzle 15% 30% 1301 cc – 1600 cc Rs. 50,000 Rs. 150,000

Winning from a raffle, lottery, quiz, prize offered by 1601 cc – 1800 cc Rs. 150,000 Rs. 450,000

20% 40%

Companies for sale promotion 1801 cc – 2000 cc Rs. 200,000 Rs. 600,000

Petroleum Products 2001 cc – 2500 cc Rs. 300,000 Rs. 900,000

[Division VIA, Part IV of the First Schedule] 2501 cc – 3000 cc Rs. 400,000 Rs. 1,200,000

Person above 3000 cc Rs. 500,000 Rs. 1,500,000

Not

156A Nature of Payment Rate Section 231B (2A)

Appear

in ATL Up to 1000 cc Rs. 100,000 Rs. 300,000

1000 cc – 2000 cc Rs. 200,000 Rs. 600,000

Sale of petroleum products to petrol pump operators 12% 24%

above 2000 cc Rs. 400,000 Rs. 1,200,000

7 ZAHID JAMIL & CO. Audit | Tax | Advisory | Risk www.zahidjamilco.com

TAX RATES TABLES - TAX YEAR 2023

Brokerage & Commission Advance tax on Electricity

[Division V, Part IV of the First Schedule]

Person Not Gross amount of Electricity Bill of Commercial and

Nature of Payment Rate Appear in Industrial consumer

ATL Slabs (Rs.)

a) Up to Rs. 500 0

233 In case of advertising agents 10% 20% b) Rs. 501 to Rs. 20,000 10% of the amount

c) exceeds Rs.20,000 Rs. 1950 plus 12% of

Life Insurance Agents where 235 the amount exceeding

Commission received is less than Rs, 0.5 8% 16%

Rs.20,000 for

Million per annum

commercial consumers

In all other cases 12% 24% Rs. 1950 plus 5% of the

amount exceeding

Rs.20,000 for industrial

Tax on Motor Vehicles consumers

[Division III, Part IV of the First Schedule] Tax on Domestic electricity consumption if the

amount of monthly bill is

Tax on Motor Vehicles:

235A less than Rs.25,000 0% of bill amount

Rs. 2.50 per Rs. 5 per Kg.

(i) Goods transport vehicles Kg. of the of the laden 7.5% of bill amount, If

laden weight weight Rs,25,000/- or more the person not appear

in ATL.

Tax on electricity consumption from retailers other

1(A) Vehicle with laden weight of 8120

than Tier-I retailers

Kgs or more, tax after ten (10) years

Rs. 1,200 Rs. 2,400 a) Up to Rs. 30,000 Rs. 3,000

from first registration in Pakistan

passenger transport. b) Rs. 30,000 to Rs. 50,000 Rs. 5,000

99A

(2) In the case of Passenger transport Rupees (per Rupees (per c) Rs. 50,000 to Rs.100,000 Rs. 10,000

vehicles plying for hire, seating capacity seat per seat per d) Retailers and service

of: annum) annum) providers as notified by the

Up to Rs.200,000

Board in the income tax

i) 4 to 10 persons 500 1000

general order.

ii) 10 to 20 persons 1500 2000

Advance tax on Telephone Users

234 iii) 20 and above 2500 4000 [Division IV, Part IV of the First Schedule]

(3) Other Motor vehicles, including car, jeep, van, sport utility vehicle, pick- Telephone and internet, 10% of the exceeding

up trucks for private use, caravan automobile, limousine, wagon or any where the monthly bill amount of bill

other automobile used for private purpose: - exceeds Rs. 1,000

Annual collection of tax: (Rs. p.a.) (Rs. p.a.) In the case of subscriber of 15% of amount of bill

internet, mobile telephone or price of internet

up to 1000 cc 800 1600 and pre-paid internet or prepaid card or

telephone card prepaid telephone

1001cc to 1199cc 1,500 3,000 card or sale of units

236

1200cc to 1299cc 1,750 4,500 through any electronic

1300cc to 1499cc 2,500 5,000 medium or whatever

form

1500cc to 1599cc 3,750 7,500

1600cc to 1999cc 4,500 9,000

8 ZAHID JAMIL & CO. Audit | Tax | Advisory | Risk www.zahidjamilco.com

TAX RATES TABLES - TAX YEAR 2023

2000cc and above 10,000 20,000

Advance tax at the time of Sale by Auction

(4) where the motor vehicle tax is collected in lump sum [Division VIII, Part IV of the First Schedule]

Engine capacity lump sum Person

up to 1000 cc Not

Rs. 10,000 Rs. 20,000 Nature of Payment Rate

Appear

1001cc to 1199cc Rs. 18,000 Rs. 36,000 in ATL

1200cc to 1299cc Sale by public auction/

Rs. 20,000 Rs. 40,000 tender of any property or

1300cc to 1499cc goods shall deduct tax 10% 20%

Rs. 30,000 Rs. 60,000 including award of any

1500cc to 1599cc Rs. 45,000 Rs. 90,000 236A lease to any person

1600cc to 1999cc Rs. 60,000 Rs. 120,000 In case of immovable

5% 10%

2000cc and above property sold by auction

Rs. 120,000 Rs. 240,000

Advance tax on Purchase of Immovable

Advance tax on Sale of Immovable Property Property

[Division X, Part IV of the First Schedule] [Division XVIII, Part IV of the First Schedule]

Person Nature of Payment Person

Not Not

Section Nature of Payment Rate Section Rate

Appear in Appear in

ATL ATL

Registering or attesting the

236C 2% 4%

transfer of immovable property

Advance tax on Sale of distributors, dealers or

wholesalers

[Division XIV, Part IV of the First Schedule] Advance Tax on purchase of

236K(1) 2% 7%

immovable property

Every manufacturer or commercial importer shall has to

be collected advance tax from wholesaler, distributor &

dealers at the time of sales made to them (of

pharmaceuticals, poultry and animal feed, edible oil and

ghee, auto-parts, tyres, varnishes, chemicals, cosmetics, IT

equipment, electronics, sugar, cement, iron and steel

products, fertilizer, motorcycles, pesticides, cigarettes, Advance Tax on payment of

glass, textile, beverages, paint or foam sector): installment in respect of

236G

purchase of allotment of

immovable property where

transfer is to be effected after

making payment of all

236K(3) 2% 7%

Person installments:

Not

Nature of Payment Rate

Appear in

ATL

9 ZAHID JAMIL & CO. Audit | Tax | Advisory | Risk www.zahidjamilco.com

TAX RATES TABLES - TAX YEAR 2023

Fertilizers 0.7% 1.4%

Other than fertilizers 0.1% 0.2% Advance tax on amount remitted abroad

through credit, debit or prepaid cards

[Division XXI, Part IV of the First Schedule]

Provided that the rate of advance tax on sale to

distributors, dealers or wholesalers of fertilizer shall be Nature of Payment Rate

0.25%, if they are already appearing on both the Active Section

Taxpayers’ Lists issued under the provisions of the Sales

Tax Act, 1990 and the Income Tax Ordinance, 2001 (XLIX

of 2001)

Advance tax on sales to retailers

[Division XV, Part IV of the First Schedule]

Sales to retailers by Person Advance tax on amount remitted

manufacturer, distributor, Not 236Y abroad through credit, debit or 1%

Rate prepaid cards

dealer, wholesaler or Appear in

commercial importer shall has ATL

to be collected advance tax

from (pharmaceuticals, poultry

and animal feed, edible oil and

236H ghee, auto-parts, tyres,

varnishes, chemicals, cosmetics,

IT equipment, electronics, 0.5% 1%

sugar, cement, iron and steel

products, fertilizer, motorcycles,

pesticides, cigarettes, glass,

textile, beverages, paint or

foam sector):

10 ZAHID JAMIL & CO. Audit | Tax | Advisory | Risk www.zahidjamilco.com

You might also like

- Dmart BillDocument1 pageDmart BillSai Sidhartha TanneruNo ratings yet

- TaxRates2021 22Document2 pagesTaxRates2021 22Amir NazirNo ratings yet

- Tax Rates For The Tax Year 2019Document1 pageTax Rates For The Tax Year 2019Mubashir RiazNo ratings yet

- Tax Card 2019Document1 pageTax Card 2019Waqas AtharNo ratings yet

- Tax Rates For The Tax Year 2016Document1 pageTax Rates For The Tax Year 2016Ghulam HaiderNo ratings yet

- Tax Rates - For The Tax Year - 2019Document5 pagesTax Rates - For The Tax Year - 2019nomanjavid88No ratings yet

- Summary Ty 2018Document1 pageSummary Ty 2018BADER MUNIRNo ratings yet

- SWHCC Tax Card - Ty 2019Document1 pageSWHCC Tax Card - Ty 2019Muhammad HaseebNo ratings yet

- Tax Rates For The Tax Year 2015Document1 pageTax Rates For The Tax Year 2015Ghulam HaiderNo ratings yet

- Tax Card TY 2022Document8 pagesTax Card TY 2022princecharming14No ratings yet

- Minimum Tax Tax Rates For Aop & Business Individuals: Nature of Payment Section Rate (ATL)Document1 pageMinimum Tax Tax Rates For Aop & Business Individuals: Nature of Payment Section Rate (ATL)Anum TariqNo ratings yet

- Tax Card For The Tax Year 2018-19: Maqbool Haroon Shahid Safdar & Co., Chartered AccountantsDocument3 pagesTax Card For The Tax Year 2018-19: Maqbool Haroon Shahid Safdar & Co., Chartered AccountantsThe MaximusNo ratings yet

- TaxRateCard 2022-23Document7 pagesTaxRateCard 2022-23Anas KhanNo ratings yet

- Tax Card TY 2020Document1 pageTax Card TY 2020princecharming14No ratings yet

- Tax Rate Card For Tax Year 2023 24Document10 pagesTax Rate Card For Tax Year 2023 24srismailNo ratings yet

- Test 5 (QP)Document4 pagesTest 5 (QP)iamneonkingNo ratings yet

- Tax Card Global Tax Consultants Tax Year 2019Document3 pagesTax Card Global Tax Consultants Tax Year 2019AqeelAhmadNo ratings yet

- SHCC Tax Card - Ty 2021Document1 pageSHCC Tax Card - Ty 2021Muhammad AdeelNo ratings yet

- Tax Card 2024-25Document2 pagesTax Card 2024-25inam.khosaNo ratings yet

- Dexter Consultants: Updated Through Finance Act 2022Document1 pageDexter Consultants: Updated Through Finance Act 2022fahid aslamNo ratings yet

- Income Tax Card 2023-24 (Finance Act 2023)Document1 pageIncome Tax Card 2023-24 (Finance Act 2023)shahidNo ratings yet

- ACCA F6 Taxation Solved Past PapersDocument235 pagesACCA F6 Taxation Solved Past Paperssaiporg100% (1)

- Tax Rates 2021Document6 pagesTax Rates 2021Muazam memonNo ratings yet

- WHT Tax CardDocument2 pagesWHT Tax CardAsim JavedNo ratings yet

- Tax Card 2012Document1 pageTax Card 2012Ch Attique WainsNo ratings yet

- Tax Rate For Individual & Salaried: Reduction For Senior Citizen/Disabled PersonDocument2 pagesTax Rate For Individual & Salaried: Reduction For Senior Citizen/Disabled PersonFrantsForum DiscussionNo ratings yet

- Income Tax Card Tax Year 2015Document3 pagesIncome Tax Card Tax Year 2015Sardar Shahid KhanNo ratings yet

- Tax Card 23-24Document1 pageTax Card 23-24humag143No ratings yet

- Test 6 (QP)Document4 pagesTest 6 (QP)iamneonkingNo ratings yet

- Tax Rates For Tax Year 2020Document5 pagesTax Rates For Tax Year 2020Ghulam MuhiuddinNo ratings yet

- Test 10Document4 pagesTest 10ls786580302No ratings yet

- Direct Tax Summary For Ay 2023-24Document39 pagesDirect Tax Summary For Ay 2023-24CA PASSNo ratings yet

- RLA Rate Card 2020 2021Document13 pagesRLA Rate Card 2020 2021Muhammad EjazNo ratings yet

- Income Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanDocument18 pagesIncome Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanZain RehmanNo ratings yet

- 4/25/2016 21st MCMC 1Document19 pages4/25/2016 21st MCMC 1ShaniNo ratings yet

- 2019 Tax Card PakistanDocument9 pages2019 Tax Card PakistanRaja Hamza rasgNo ratings yet

- The National Small Industries Corporation Limited: Registration Fee For Enlistment Under SprsDocument1 pageThe National Small Industries Corporation Limited: Registration Fee For Enlistment Under SprsRenuka KNNo ratings yet

- Mmco Tax Card 2021Document1 pageMmco Tax Card 2021Naeem Amjad.kalsiyaNo ratings yet

- WithholdingRatesCards 2022-2023Document17 pagesWithholdingRatesCards 2022-2023ausafhaider5345No ratings yet

- Frequently Asked Question Single Point Registration Scheme: Page 1 of 4Document4 pagesFrequently Asked Question Single Point Registration Scheme: Page 1 of 4Bubbly GalNo ratings yet

- Khilji Co Rate Card 2021 22Document14 pagesKhilji Co Rate Card 2021 22Khalid ButtNo ratings yet

- Setting Up Msmes in India - v1.0Document8 pagesSetting Up Msmes in India - v1.0HHP13579No ratings yet

- Tax Rates Year 2024Document7 pagesTax Rates Year 2024hamidullah415161No ratings yet

- Capital Budgeting-2Document48 pagesCapital Budgeting-2Adarsh Singh RathoreNo ratings yet

- Taxation (CHN) - Dec 2020 FinalDocument3 pagesTaxation (CHN) - Dec 2020 FinalALEX TRANNo ratings yet

- Union Budget - 2023-24 - Direct Tax Proposals (K&Co)Document54 pagesUnion Budget - 2023-24 - Direct Tax Proposals (K&Co)Charul ChhajerNo ratings yet

- Test 8Document3 pagesTest 8lalshahbaz57No ratings yet

- Taxation (Pakistan) : Tuesday 3 December 2013Document13 pagesTaxation (Pakistan) : Tuesday 3 December 2013Mashhood AhmedNo ratings yet

- FM Assignment 2Document3 pagesFM Assignment 2NOEL ThomasNo ratings yet

- KC Withholding Chart - Tax Year 2024Document13 pagesKC Withholding Chart - Tax Year 2024Muhammad Ghazanfar Sabir QureshiNo ratings yet

- KCO-Rate-Card 2021Document13 pagesKCO-Rate-Card 2021Aqib SheikhNo ratings yet

- Union DT PA 16 2020 Chap 3-0605adc91095086.06897136Document38 pagesUnion DT PA 16 2020 Chap 3-0605adc91095086.06897136SsvashistNo ratings yet

- Test 6 PDFDocument3 pagesTest 6 PDFHåris Khån MøhmånďNo ratings yet

- Changes in Income-Tax - 2020-21 PDFDocument32 pagesChanges in Income-Tax - 2020-21 PDFmir makarim ahsanNo ratings yet

- Tax Rates For Non-Salaried Individuals and AopsDocument4 pagesTax Rates For Non-Salaried Individuals and AopsAdeel QaiserNo ratings yet

- Direct Tax For Assessment Year 2020-21Document28 pagesDirect Tax For Assessment Year 2020-21CA PASSNo ratings yet

- 7.co-Operative Society and Producer Companies-3Document14 pages7.co-Operative Society and Producer Companies-3Muthu nayagamNo ratings yet

- Tax Rates 2009Document1 pageTax Rates 2009Ch Attique WainsNo ratings yet

- Tax Card For Tax Year 2020Document1 pageTax Card For Tax Year 2020zohaib shahNo ratings yet

- TAX RATE CARD 2021-22 Income Tax Withholding Rates Sales Tax Withholding RatesDocument14 pagesTAX RATE CARD 2021-22 Income Tax Withholding Rates Sales Tax Withholding RatesTax Management ConsultingNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Tax Case Doctrines PDFDocument30 pagesTax Case Doctrines PDFAnony mousNo ratings yet

- Registered Agent ListDocument1 pageRegistered Agent ListZparo YinkuzNo ratings yet

- FD Circular No 32019Document2 pagesFD Circular No 32019Sarfaraz AhmedNo ratings yet

- Asian Paints: Sales Turnover: Sales Turnover of The Asian Paints Is Shows The Remarkable Increase FromDocument3 pagesAsian Paints: Sales Turnover: Sales Turnover of The Asian Paints Is Shows The Remarkable Increase FromHarsh AryaNo ratings yet

- Feasibility Paper Bamm Tecnomask Group6Document103 pagesFeasibility Paper Bamm Tecnomask Group6Sharmaine De LeonNo ratings yet

- Draft Prospectus-Bdpl (26.12.19)Document300 pagesDraft Prospectus-Bdpl (26.12.19)Mohammad helal uddin ChowdhuryNo ratings yet

- Golden Ribbon Lumber Vs City of ButuanDocument3 pagesGolden Ribbon Lumber Vs City of ButuanFrancis Emmanuel ArceoNo ratings yet

- SBP Bugle Issue 11.02 (Vol. 43, No. 2), Spring 2011Document20 pagesSBP Bugle Issue 11.02 (Vol. 43, No. 2), Spring 2011Strathmore Bel PreNo ratings yet

- Withholding Tax On Wages: Ruther N. Martinez Tax Reporting and Operations Group (TROG)Document183 pagesWithholding Tax On Wages: Ruther N. Martinez Tax Reporting and Operations Group (TROG)Johnallen MarillaNo ratings yet

- Taxation XIDocument179 pagesTaxation XIAleti NithishNo ratings yet

- R12 Finance For AmericasDocument808 pagesR12 Finance For AmericassentbobbyNo ratings yet

- Finance MajorDocument7 pagesFinance Majorkna xaiyo talaiNo ratings yet

- GAIL Gas Limited: Tender Document For Procurement of Pe Pipes (1 Year Arc)Document219 pagesGAIL Gas Limited: Tender Document For Procurement of Pe Pipes (1 Year Arc)BGL NAGARNo ratings yet

- 1989 - Contemporary West African States - D.B.C. O'Brien, J. Dunn, R. Rathbone PDFDocument235 pages1989 - Contemporary West African States - D.B.C. O'Brien, J. Dunn, R. Rathbone PDFRenato AraujoNo ratings yet

- Salary Statement AnnexureDocument2 pagesSalary Statement AnnexureziggyNo ratings yet

- Baronsmead VCT 20090930Document56 pagesBaronsmead VCT 20090930marcoayuNo ratings yet

- AC13.4.1 Module 4 Income TaxesDocument23 pagesAC13.4.1 Module 4 Income TaxesRenelle HabacNo ratings yet

- Tax Alert: Introduction of Digital Tax Stamps For Excisable GoodsDocument2 pagesTax Alert: Introduction of Digital Tax Stamps For Excisable GoodsEdwin UlikayeNo ratings yet

- A Wealth Tax To Address Five Global DisruptionsDocument6 pagesA Wealth Tax To Address Five Global DisruptionsSibghat ShahNo ratings yet

- Batam Incorp ProposalDocument7 pagesBatam Incorp ProposalFan ChristyNo ratings yet

- Analysis of FSDocument28 pagesAnalysis of FSHaseeb TariqNo ratings yet

- CA Inter Accounts - Cash Flow Statement by CA Nitin GoelDocument32 pagesCA Inter Accounts - Cash Flow Statement by CA Nitin Goelvishwas jagrawal100% (1)

- CFP Syllabus and Topics: CFP Certification Programme Components DetailsDocument8 pagesCFP Syllabus and Topics: CFP Certification Programme Components DetailsDeep ShethNo ratings yet

- ABEJARON V.nabasaDocument2 pagesABEJARON V.nabasairis_irisNo ratings yet

- Taxation Direct and IndirectDocument304 pagesTaxation Direct and IndirectJagat Patel100% (1)

- Evaluasi Pelaksanaan Program Amnesti Pajak Tahun 2016 Di IndonesiaDocument17 pagesEvaluasi Pelaksanaan Program Amnesti Pajak Tahun 2016 Di IndonesiaAnjas HeoNo ratings yet

- Stonebridge Aquaforest Quote 19056Document2 pagesStonebridge Aquaforest Quote 19056coNo ratings yet

- Premier Support AutoRenew Eligible Store Terms Conditions v082420 091420Document2 pagesPremier Support AutoRenew Eligible Store Terms Conditions v082420 091420Stefan AmarandeiNo ratings yet

- June 2014 p1Document10 pagesJune 2014 p1zhart1921No ratings yet