Professional Documents

Culture Documents

PD Accounting Technician

PD Accounting Technician

Uploaded by

TatotOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PD Accounting Technician

PD Accounting Technician

Uploaded by

TatotCopyright:

Available Formats

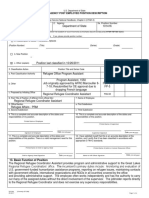

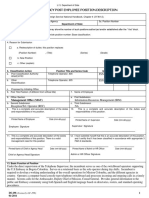

INTERAGENCY FOREIGN SERVICE NATIONAL EMPLOYEE POSITION DESCRIPTION

Prepare according to instructions given in Foreign Service National Handbook, Chapter 4 (3 FAH-2)

1. POST 2. AGENCY 3a. POSITION NO.

KAMPALA STATE 530004

3b. SUBJECT TO IDENTICAL POSITIONS? AGENCIES MAY SHOW THE NUMBER OF SUCH POSITIONS AUTHORIZED AND/OR ESTABLISHED

AFTER THE “YES” BLOCK. Yes No 101313, 101828

4. REASON FOR SUBMISSION

a. Reclassification of duties: This position replaces

Position No.

, (Title) (Series) (Grade)

b. New Position

c. Other (explain)

Date

5. CLASSIFICATION ACTION Position Title and Series Code Grade Initials (mm-dd-yy)

a. Post Classification Authority ACCOUNTING TECHNICIAN FSN-410

b. Other Accounting Technician, FSN 410 8 AFRC: 2/16/2016

AFRC kmt

c. Proposed by Initiating Office

6. POST TITLE POSITION (if different from official title) 7. NAME OF EMPLOYEE

8. OFFICE/SECTION a. First Subdivision

U.S.EMBASSY KAMPALA ADMINISTRATIVE OFFICE

b. Second Subdivision c. Third Subdivision

BUDGET AND FISCAL SECTION N/A

9. This is a complete and accurate description of the duties and 10. This is a complete and accurate description of the duties and

responsibilities of my position. responsibilities of this position.

Typed Name and Signature of Employee Date(mm-dd-yy) Typed Name and Signature of Local Supervisor Date(mm-dd-yy)

11. This is a complete and accurate description of the duties and 12. I have satisfied myself that this is an accurate description of the

responsibilities of this position. There is a valid management need position, and I certify that it has been classified in accordance

for this position. with appropriate 3 FAH-2 standards.

Typed Name and Signature of American Supervisor Date (mm-dd-yy) Typed Name and Signature of Human Resources Officer Date (mm-dd-yy)

13. BASIC FUNCTION OF POSITION

Under the direct supervision of the Financial Specialist, the incumbent performs the budgeting and accounting

responsibilities for more than two major budget and accounting segments (DS, PROGRAM, OBO, CONSULAR, PRM,

PROGRAM REPRESENTAITON, NIH, DOD PEPFAR and CDC) in a large and complex financial management center,

servicing more than 6 agencies across a myriad of allotments, each with individual limitations and restrictions. The position

is responsible for complete, integrated allotment accounting, preparing related financial reports, complex budget formulation

and execution and provision of financial management advice to agency and section heads at post. This includes, review of

records for all financial transactions from a wide variety of documents, such as purchase orders, work orders, vouchers,

journal vouchers, transfers between appropriations, liquidation reports, and travel authorizations. The position codifies a

wide variety of obligating documents by type of expense, after determining that each obligation is valid and that funds are

available and performs regular (quarterly or more frequent) records and ledger reconciliations to develop and prepare

official monthly, quarterly, and annual reports by allotment and sub-object status to be briefed to agency and section heads

at post.

SENSITIVE BUT UNCLASSIFIED

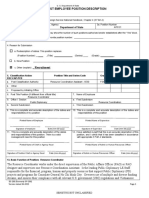

14. MAJOR DUTIES AND RESPONSIBILITIES % OF TIME

ALLOTMENT ACCOUNTING DUTIES: 50%

Maintains official accounting records for assigned accounts. Reviews budget limitations and reviews funds availability in

appropriate ledgers to determine adequate funding level before recording financial transactions from a wide variety of

documents, such as purchase orders, BPA Calls, Petty cash, payment vouchers, journal vouchers, and transfers between

appropriations, liquidation reports, and travel authorizations. Provides fiscal coding for a wide variety of obligation documents

by type of expense after determining that each obligation is legal/valid and funds are available as per the limitations outlined

in the Advice of Allotment to post. Maintains extensive electronic records on non-post-held VIP travel fund cites to ensure

there is no over-obligation of funds provided to post. Responsible for determining the legal and regulatory limits of proposed

expenditures and entering these transactions into RFMS/M. Responsible for accurate input of vendor and employee banking

information into the RFMS/M Disbursing system in conformance with specified CGFS standards. This position is responsible

for meeting all Accounting ICASS Service Standards.

BUDGET FORMULATION AND EXECUTION: 25%

Prepares and participates in formulation of budgets with detailed written justification to assist assigned agencies in presenting

their financial requirements to headquarters. Ensuring that budgets are prepared in conformance with the Agency's budget

formulation policies and procedures. This is accomplished after gaining an understanding of each agency’s programs,

individual projects and priorities. Monitor the execution of the budget to ensure that obligations and expenditures are made in

accordance with the financial plan, with respect to purpose and tempo. Conducts regular (quarterly or more frequent)analysis

of the budgets, advising the FMO and agency or section head of the status of funds and alerting them to problems, trends

and needed reprogramming actions brought about by unplanned expenditures, funding reductions, exchange rate

losses/gains, and increasing cost of goods and services. All information should be provided in a timely and meaningful manner

that permits management proactive planning and intervention relative to reprogramming of resources or alteration of program

plans. Performing research and preparing computations necessary to establish cost/expense levels, reviewing past

documents to identify and analyze recurring costs, analyze staffing patterns to anticipate employee cost, review indicators of

economic conditions having an effect on budget planning, establishing “cuff” records adequate to allow analysis of obligations

and liquidations to ascertain conformance with financial plans.

FINANCIAL REPORTING: 25%

Establishes and monitors a regular (quarterly or more frequent) budget review process which is discussed with agency or

section heads to identify trends, or issues of concern, which may impact the availability of funds. Maintains and distributes

on a monthly basis the Status of Funds and Status of Obligations (P60 and 62) to enable serviced agencies manage their

funds. Answers queries from serviced agencies on the reports, maintains obligation files and documentation to justify

obligations set up in the system that are included in the reports. Prepare detailed official monthly, quarterly, and annual reports

and graphs by allotment and sub-object status. Prepares correspondence and reports for all budget requests, including

justifications which support changes resulting from the periodic reviews. The financial reporting responsibilities also include

the management of Unliquidated Obligations. This includes the Quarterly (or more frequent) review of obligations, decreases

and closes as required to maintain clean financial records and to release unused funding for re-obligation. Review and close,

as appropriate, all obligations and provide extensive end of year reconciliation reports including the year end ULO certification.

5. QUALIFICATIONS REQUIRED FOR EFFECTIVE PERFORMANCE

a. Education

University degree in finance and accounting, auditing, commerce, business administration, statistics is required.

b. Prior Work Experience

Three years of progressively responsible experience in budget work, accounts maintenance, bookkeeping and

accounting or auditing work with a computerized system is required.

c. Post Entry Training

Training on various FMO Software

d. Language Proficiency:

Level IV (fluent - written and spoken) English ability.

SENSITIVE BUT UNCLASSIFIED

e. Knowledge

Must have comprehensive working knowledge of pertinent State Department and/or one or more associated agencies

laws, regulations, and procedures relating to budgeting, accounting, and financial management, and the full range of

skills and abilities required in computing both procedural, technical and financial program planning and analysis budget

work. A thorough knowledge of the organization and functions of the major program areas of the embassy and/or

associated agency/agencies served is a must.

f. Skills and Abilities

Must be able to relate funds management with mission, programs, and projects of the post. Must be able to understand

budget management implications of changes of priorities, tempo, and direction of programs and projects and be able to

analyze accounting transactions and recommend appropriate adjustments to financial plans. Must be able to relate

changes to funding levels brought about by reductions in allotments due to cuts, variations in exchange rates, increase

cost of material and labor, etc., and advise appropriate management officials of budget implications. Must possess a

high level of interpersonal skills in order to be able to gain acceptance of recommendations related to budget

management issues. Must possess high level of skill in articulating (orally and in writing) complex issues and relationships

between functions/programs/projects and funding options. Level II typing ability (30 wpm or more) is required. Advanced

Excel skills, including the use of charts, pivot tables and lookup formulas are required.

16. POSITION ELEMENTS

a. Supervision Received

Financial Specialist.

b. Available Guidelines

Budget & Fiscal Manuals

c. Exercise of Judgment

N/A

d. Authority to Make Commitments

N/A

e. Nature, Level and Purpose of Contacts

GSO and Facilities colleagues, US Direct Hire Employees, Agency financial personnel.

f. Supervision Exercised

N/A.

g. Time Required to Perform Full Range of Duties after Entry into the Position

Six (6) months.

OF 298 (08-2001)

SENSITIVE BUT UNCLASSIFIED

You might also like

- Chapter 10Document41 pagesChapter 10Nada YoussefNo ratings yet

- Definition of AccountingDocument3 pagesDefinition of AccountingWithDoctorWu100% (1)

- Lacey Act Questionnaire (01986070-2xDE682)Document10 pagesLacey Act Questionnaire (01986070-2xDE682)fcjr79No ratings yet

- 2019 10 PD Logistics Assistant MIA A 07 CleanDocument6 pages2019 10 PD Logistics Assistant MIA A 07 Cleanminh congNo ratings yet

- PROCUREMENT AGENT For PostingDocument4 pagesPROCUREMENT AGENT For PostingHiền Vũ NgọcNo ratings yet

- JD - SDO - OSDS - Admin - PERS - ADAS3 - 28jan2019Document3 pagesJD - SDO - OSDS - Admin - PERS - ADAS3 - 28jan2019JAHARA PANDAPATANNo ratings yet

- Master PD Kampala 4998 Switchboard Operator AFRCC Signed 9 2021Document3 pagesMaster PD Kampala 4998 Switchboard Operator AFRCC Signed 9 2021Ssekajja TrevorNo ratings yet

- Session 1 Terms of Reference BAC Members and HOPE KRA of BookkeeperDocument58 pagesSession 1 Terms of Reference BAC Members and HOPE KRA of BookkeeperaprilleiannetanNo ratings yet

- Pontipedra Rex Cotoner CVDocument4 pagesPontipedra Rex Cotoner CVCassandra LopezNo ratings yet

- PD CDMX ChauffeurDocument4 pagesPD CDMX Chauffeurnayeli contrerasNo ratings yet

- La Paz State: Interagency Post Employee Position DescriptionDocument6 pagesLa Paz State: Interagency Post Employee Position Descriptioneddy_maxNo ratings yet

- JD Sdo Osds Admin Pers Adas2 28jan2019Document3 pagesJD Sdo Osds Admin Pers Adas2 28jan2019Deserie RuizNo ratings yet

- JED Cs Form No. 212 Attachment Work Experience SheetDocument4 pagesJED Cs Form No. 212 Attachment Work Experience SheetBrandon BorromeoNo ratings yet

- PGO LA UNION-ADMINISTRATIVE OFFICER I RepublicationDocument2 pagesPGO LA UNION-ADMINISTRATIVE OFFICER I RepublicationMarijoe Kate HufalarNo ratings yet

- Retroactive Payroll Adjustments: PurposeDocument4 pagesRetroactive Payroll Adjustments: Purposezafer nadeemNo ratings yet

- AAO Deputation-1Document8 pagesAAO Deputation-1Tofiq AhamadNo ratings yet

- ADS 631 Accrued Expenditures PDFDocument14 pagesADS 631 Accrued Expenditures PDFZac CatulongNo ratings yet

- Sample JDA - Billing Collection Staff OfficeDocument3 pagesSample JDA - Billing Collection Staff OfficeAyana Mae BaetiongNo ratings yet

- Commercial Specialist Mozambique PDDocument5 pagesCommercial Specialist Mozambique PDAli PaquiraNo ratings yet

- Sdo Pangasinan Ii Sdo Pangasinan Ii Tayug NHS: Department of EducationDocument4 pagesSdo Pangasinan Ii Sdo Pangasinan Ii Tayug NHS: Department of Educationarianne zamoraNo ratings yet

- Napsshi 2023Document34 pagesNapsshi 2023aprilleiannetanNo ratings yet

- AID 415-2 CS-To-FS Conversion Evaluation Form FINAL 08.2020 Privacy Edits 3Document2 pagesAID 415-2 CS-To-FS Conversion Evaluation Form FINAL 08.2020 Privacy Edits 3Josh WolfeNo ratings yet

- PD Posho ForemanDocument4 pagesPD Posho Foremanjimmy MukNo ratings yet

- HRPR03 Certificate of ClearanceDocument9 pagesHRPR03 Certificate of ClearancePauline Caceres AbayaNo ratings yet

- Application Inviting For The Post of Harbour Master On Deputation Basis in Port Management BoardDocument6 pagesApplication Inviting For The Post of Harbour Master On Deputation Basis in Port Management BoardAkash KumarNo ratings yet

- PD Refuge Program Assistant KampalaDocument3 pagesPD Refuge Program Assistant KampalaCharlesNo ratings yet

- Notice of Filling-Up-06 August 2021Document11 pagesNotice of Filling-Up-06 August 2021Pauline LagtoNo ratings yet

- VA 18 - PD - Resource Coordinator For PostingDocument6 pagesVA 18 - PD - Resource Coordinator For PostingHod rhNo ratings yet

- End User CVDocument3 pagesEnd User CVaravintharkNo ratings yet

- Narrative Report Group 2Document19 pagesNarrative Report Group 2Danica Ann PaladNo ratings yet

- JD - OSDS - Admin - CASH - ADOF4Document2 pagesJD - OSDS - Admin - CASH - ADOF4JAHARA PANDAPATANNo ratings yet

- CHAPTER 5 Accounting ProcessDocument15 pagesCHAPTER 5 Accounting Processreviewrecord.rr2No ratings yet

- Indian Statistical Institute 203 B.T. Road, Kolkata - 108: (An Autonomous Institute Under Mospi, Government of India)Document4 pagesIndian Statistical Institute 203 B.T. Road, Kolkata - 108: (An Autonomous Institute Under Mospi, Government of India)Abhishekhar BoseNo ratings yet

- 8498 Program Sponsor Agreement For Continuing Education For Enrolled AgentsDocument1 page8498 Program Sponsor Agreement For Continuing Education For Enrolled AgentsIRSNo ratings yet

- Adas 2 3 PDF New RevisedDocument4 pagesAdas 2 3 PDF New Revisederlene lim100% (1)

- Government Accounting and AuditingDocument190 pagesGovernment Accounting and AuditingCharles John Palabrica CubarNo ratings yet

- Vacancy Announcement: Department of EducationDocument1 pageVacancy Announcement: Department of EducationKaren CariagaNo ratings yet

- ANNUAL CONFIDENTIAL REPORT FORMAT FOR WATER RESOURCES DEPARTMENT AP MemoNo 10789 Ser CDocument6 pagesANNUAL CONFIDENTIAL REPORT FORMAT FOR WATER RESOURCES DEPARTMENT AP MemoNo 10789 Ser CkasuparthivgpNo ratings yet

- New Government Accounting System (Ngas) : Mr. Antonio P. Retrato, Cpa Chief Accountant Odc, PNPDocument56 pagesNew Government Accounting System (Ngas) : Mr. Antonio P. Retrato, Cpa Chief Accountant Odc, PNPRainier NabarteyNo ratings yet

- Circular Englis DS 2024Document9 pagesCircular Englis DS 2024samytenureNo ratings yet

- Name of Div/Dte/Centre/Instt/ProgrammeDocument3 pagesName of Div/Dte/Centre/Instt/ProgrammeHRIS PARCNo ratings yet

- Non Initiation of ACRDocument19 pagesNon Initiation of ACRRajkumar MathurNo ratings yet

- Commission On Audit Department of Budget and Management: Joint Circular No. 2019-1 January 1, 2019Document42 pagesCommission On Audit Department of Budget and Management: Joint Circular No. 2019-1 January 1, 2019Xhile FoxheadNo ratings yet

- Vacancy Circular AAO NSRTC Dated 08012024 0Document6 pagesVacancy Circular AAO NSRTC Dated 08012024 0RajeshNo ratings yet

- Range Officers DutyDocument14 pagesRange Officers Dutysaran91No ratings yet

- JD 1Document2 pagesJD 1Murti RehmanNo ratings yet

- Fa Ffa Syllandsg Sept19 Aug20 PDFDocument16 pagesFa Ffa Syllandsg Sept19 Aug20 PDFÄlï RäżäNo ratings yet

- AR - COLLECTION STAFF - Project Based - Signed - MGDDocument1 pageAR - COLLECTION STAFF - Project Based - Signed - MGDMarideth Gonzales DiazNo ratings yet

- Interagency Post Employee Position DescriptionDocument3 pagesInteragency Post Employee Position DescriptionPierreNo ratings yet

- Comments On Accrual Based Accounting SOPs-Salman SBDocument2 pagesComments On Accrual Based Accounting SOPs-Salman SBMuhammad EzaanNo ratings yet

- Telephone-Operator Vacancy PDDocument4 pagesTelephone-Operator Vacancy PDCamilo ParraNo ratings yet

- Gam - FSDocument30 pagesGam - FSAubrey Shaiyne OfianaNo ratings yet

- Government AccountingDocument56 pagesGovernment AccountingJoleaNo ratings yet

- Sipack Fabm2 1st QTR FinalDocument106 pagesSipack Fabm2 1st QTR FinalAlexa SalvadorNo ratings yet

- Chapter 1 The Conceptual Framework: 1. ObjectivesDocument18 pagesChapter 1 The Conceptual Framework: 1. Objectivessamuel_dwumfourNo ratings yet

- BADVAC3X MOD 5 Financial StatementsDocument9 pagesBADVAC3X MOD 5 Financial StatementsEouj Oliver DonatoNo ratings yet

- Ref: No.: To Personnel ReformsDocument8 pagesRef: No.: To Personnel ReformsasokanNo ratings yet

- CDMX PD 312872100007 - HCTM PD - Doc2Document5 pagesCDMX PD 312872100007 - HCTM PD - Doc2Spanda FilmsNo ratings yet

- Interagency Post Employee Position Description: J B. New PositionDocument2 pagesInteragency Post Employee Position Description: J B. New PositionKien NgNo ratings yet

- Circular - 240124043142142 MCDDocument3 pagesCircular - 240124043142142 MCDkhanthahah12No ratings yet

- No. CSL/P&A/RECTT/CANSRU PERMA/SUP/HR/03/2023/2 Dated 6 May 2024 Page 1 of 11Document11 pagesNo. CSL/P&A/RECTT/CANSRU PERMA/SUP/HR/03/2023/2 Dated 6 May 2024 Page 1 of 11saikrishnaps31No ratings yet

- JD AccountantDocument2 pagesJD AccountantSahNo ratings yet

- AfricSearch Ouncement enDocument3 pagesAfricSearch Ouncement enTatotNo ratings yet

- Bank yDocument30 pagesBank yTatotNo ratings yet

- Ireland FelloogrammesDocument168 pagesIreland FelloogrammesTatotNo ratings yet

- Strategybusiness Summer 22Document88 pagesStrategybusiness Summer 22TatotNo ratings yet

- Java A4 Master Uganda MenuDocument8 pagesJava A4 Master Uganda MenuTatotNo ratings yet

- Chapter 1 OpaudDocument5 pagesChapter 1 OpaudMelissa Kayla Maniulit0% (1)

- Sales and Collection PracticeDocument12 pagesSales and Collection Practice潘妍伶No ratings yet

- Bsbsus401 Implement and Monitor Environmentally Sustainable Work Practices - Student GuideDocument69 pagesBsbsus401 Implement and Monitor Environmentally Sustainable Work Practices - Student Guidefaraz100% (1)

- Hall SolmanDocument188 pagesHall SolmanMariel SalangsangNo ratings yet

- Guidelines For Mahila Kisan Sashaktikaran Pariyojana (MKSP) - For Women NTFP CollectorsDocument30 pagesGuidelines For Mahila Kisan Sashaktikaran Pariyojana (MKSP) - For Women NTFP CollectorsArun Kumar SinghNo ratings yet

- Income Statement, Its Elements, Usefulness and LimitationsDocument5 pagesIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNo ratings yet

- 06-600 QA Assessment ProceduresDocument18 pages06-600 QA Assessment ProceduresTep PiNo ratings yet

- VELUX Group CR Report 2013Document72 pagesVELUX Group CR Report 2013CSRMedia NetworkNo ratings yet

- Iso 27000 2018 Standards For Information SecurityDocument35 pagesIso 27000 2018 Standards For Information SecurityCarlosLaraLópezNo ratings yet

- SA8000 2014 Auditor Guidance For Social FingerprintDocument10 pagesSA8000 2014 Auditor Guidance For Social FingerprintDiego Astorga Diaz LealNo ratings yet

- Checklist ISO IEC Guide 65-1996 PDFDocument27 pagesChecklist ISO IEC Guide 65-1996 PDFThuHoangThanhNo ratings yet

- Ch.2-Evaluating Operational PerformanceDocument21 pagesCh.2-Evaluating Operational PerformanceTiwi PangestiNo ratings yet

- Test Bank For Business Research Methods 12th Edition by CooperDocument4 pagesTest Bank For Business Research Methods 12th Edition by CooperLala AlalNo ratings yet

- Model Set SolutionDocument40 pagesModel Set SolutionRajan NeupaneNo ratings yet

- ACCA PER Objective BookletsDocument24 pagesACCA PER Objective BookletsJohn-Ben Sankoh JrNo ratings yet

- Report On AGPRDocument42 pagesReport On AGPRSaud Khan WazirNo ratings yet

- LEARNING MODULE-Financial Accounting and ReportingDocument7 pagesLEARNING MODULE-Financial Accounting and ReportingAira AbigailNo ratings yet

- Operational Review Guide For Ontario District School Boards, 4th Edition (September 2010)Document3 pagesOperational Review Guide For Ontario District School Boards, 4th Edition (September 2010)CityNewsTorontoNo ratings yet

- Philippine Standards On Quality Control (PSQC) (PSQC1, PSA 220)Document17 pagesPhilippine Standards On Quality Control (PSQC) (PSQC1, PSA 220)Mary Grace Dela CruzNo ratings yet

- Apply Quality Control TTLM FinalDocument46 pagesApply Quality Control TTLM FinalTemesgen LealemNo ratings yet

- Quotation: Nuri Consulting & ServicesDocument5 pagesQuotation: Nuri Consulting & ServicesBuwanah SelvaarajNo ratings yet

- Aasthavinayak Estate Company Private Limited-Annual Report-2010Document22 pagesAasthavinayak Estate Company Private Limited-Annual Report-2010Vinay WadhwaniNo ratings yet

- Eugenio vs. CSC, 242 SCRA 196 (1995)Document10 pagesEugenio vs. CSC, 242 SCRA 196 (1995)Christiaan CastilloNo ratings yet

- Test Bank For Principles of Auditing and Other Assurance Services 18th Edition Ray WhittingtonDocument31 pagesTest Bank For Principles of Auditing and Other Assurance Services 18th Edition Ray WhittingtonestherpatrickhxdnNo ratings yet

- Code of Conduct - BritanniaDocument26 pagesCode of Conduct - BritanniaEsha ChaudharyNo ratings yet

- Required Documents For IATF - 16949Document5 pagesRequired Documents For IATF - 16949Rajesh Sahasrabuddhe50% (2)

- Sample ISO 9001 Project WorkplanDocument4 pagesSample ISO 9001 Project WorkplanArun Byakod100% (8)