Professional Documents

Culture Documents

HDFC Life Premium Receipts Nov 2022

HDFC Life Premium Receipts Nov 2022

Uploaded by

kapsekunalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HDFC Life Premium Receipts Nov 2022

HDFC Life Premium Receipts Nov 2022

Uploaded by

kapsekunalCopyright:

Available Formats

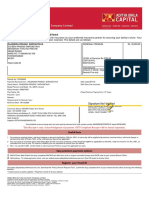

PSRLE023120041802

We have received your premium

Comp/Nov/Int/4743

06/11/2022 Receipt No: 0027835300

Kunal Kapse

Rilletta F0205, Casa Rio Gold

Off Kalyan Shil Road

Palava City

Mumbai - 421204

Maharashtra

☎ : 919702289990

@ : kapsekunal@gmail.com

Your details as per our records

Client ID: D8465251 Payor Name: Kunal Kapse

Policy No.: 19746610 Policy Status: In Force

Plan: HDFC Life Click 2 Protect 3D+ UIN: 101N115V02

Sum Assured (INR): 10000000 Risk Commencement Date: November 06, 2017

Payment Term: Na years Payment Frequency: Monthly

Dear Kunal Kapse,

Thank you for staying insured with HDFC Life. We have received the premium payment of INR 1915 for your policy. The details are as below:

Payment mode Payment avenue Date Transaction ID Amount Received (INR)

Online Auto Debit/Fund transfer November 07, 2022 - 1915

Benefit Opted For / Particulars Premium Amount (INR) Taxes and Levies as applicable (INR) Total Amount Due (INR)

HDFC Life Click 2 Protect 3D+ 1446 292 1738

Critical Illness Plus Rider 154 0 154

Income Benefit Acc Dis Rider 23 0 23

Total Amount Due (INR) 1915

Less: Amount in Deposit (If any) (INR) 0

Total Premium Payable (INR) 1915

Actual Amount Paid (INR) 1915

NOTE:

This receipt is valid subject to realisation of payment by all modes.

The policy status mentioned above is as on the date of generation of this receipt. It does not necessarily indicate the status mentioned above at a later

date.

Taxes and levies will be applicable as per prevailing tax laws and are subject to change. Please consult your tax advisors to confirm the applicability of

the tax benefits at your end.

Tax would be deducted at source (as applicable) from the policy payments, as per the Income tax Act, 1961.

As per section 10(10D) of the Income Tax Act, 1961, any sum received under a life insurance policy will be exempt subject to conditions specified

therein.

Tax benefit under Section 80C and 80 CCC of the Income Tax Act, 1961 is available to an individual or HUF for premium paid towards life insurance or

pension policy, subject to the conditions/limits specified therein.

The premiums paid towards CI rider are allowed as deduction from the Gross Total Income under Section 80D of the Income Tax Act, 1961, subject to

the conditions and limits specified therein.

Visit www.hdfclife.com for various premium payment options.

In case of any queries, please feel free to contact us. We'll be glad to hear from you!

Warm regards,

HDFC Life

Please verify your email ID and contact number with us to continue receiving your premium payment receipts.

******** This is an electronically generated receipt and does not require a signature. ********

You might also like

- PremiumRept MDS - RameshDocument2 pagesPremiumRept MDS - Rameshnavengg521No ratings yet

- 80D Pdf-AnkitDocument1 page80D Pdf-AnkitSaurabh RaghuvanshiNo ratings yet

- 80D.pdf-Piyush - Copy 3Document1 page80D.pdf-Piyush - Copy 3Saurabh RaghuvanshiNo ratings yet

- SBI Insurance 2021Document1 pageSBI Insurance 2021personal listNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateSenthil balasubramanianNo ratings yet

- Religare PDFDocument5 pagesReligare PDFsomnathNo ratings yet

- Premium Paid Acknowledgement PDFDocument1 pagePremium Paid Acknowledgement PDFsanto02No ratings yet

- Donation Detail Partner Ngo Program Donation Giveindia Retention TotalDocument1 pageDonation Detail Partner Ngo Program Donation Giveindia Retention TotalHarshit SinghNo ratings yet

- Measurement of Line Impedances and Mutual Coupling of Parallel LinesDocument8 pagesMeasurement of Line Impedances and Mutual Coupling of Parallel LinesKhandai SeenananNo ratings yet

- An Assignment On Business Ethics..Document11 pagesAn Assignment On Business Ethics..Rahul Dhurka100% (1)

- Northern Research GroupDocument2 pagesNorthern Research GroupTeam GuidoNo ratings yet

- Zprmrnot - 22253699 - 17202314 2Document1 pageZprmrnot - 22253699 - 17202314 2Inder Raj GuptaNo ratings yet

- Birla Premium Paid Certificate 2020Document2 pagesBirla Premium Paid Certificate 2020SindhuNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid Acknowledgementharsh421No ratings yet

- Donatekart Foundation: Tax Exempt ReceiptDocument1 pageDonatekart Foundation: Tax Exempt ReceiptSunilSingh100% (1)

- Premium Receipt 008102909 - 14 02 2023 14 02 2023Document1 pagePremium Receipt 008102909 - 14 02 2023 14 02 2023UTSAV DUBEYNo ratings yet

- PremiumReceipt PR0941870700012324Document2 pagesPremiumReceipt PR0941870700012324gjsivakumarNo ratings yet

- Premium Receipt PDFDocument1 pagePremium Receipt PDFAjit Kumar TiwariNo ratings yet

- LIC Premium Jan 2023Document4 pagesLIC Premium Jan 2023Akriti SinghNo ratings yet

- PremiumRept FamilyDocument2 pagesPremiumRept Familynavengg521No ratings yet

- C320284551-Renewal Premium ReceiptDocument1 pageC320284551-Renewal Premium ReceiptThelu RajuNo ratings yet

- PolicyDocument55 pagesPolicyBaneNo ratings yet

- Star Health Policy DocDocument6 pagesStar Health Policy DocDev PandayNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- HDFC Tli Converted by AbcdpdfDocument1 pageHDFC Tli Converted by Abcdpdfharshim guptaNo ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- Kavita 2Document2 pagesKavita 2api-3721187No ratings yet

- PM Relief Care FundsDocument1 pagePM Relief Care FundsSumit RoyNo ratings yet

- Preventive Health Check Up Receipt PDFDocument41 pagesPreventive Health Check Up Receipt PDFsan mohNo ratings yet

- Received With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromDocument5 pagesReceived With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromAkash MitraNo ratings yet

- Receipt Under Section 80G of The Income Tax ActDocument1 pageReceipt Under Section 80G of The Income Tax ActdpfsopfopsfhopNo ratings yet

- Consolidated Premium Paid STMT 2020-2021 PDFDocument1 pageConsolidated Premium Paid STMT 2020-2021 PDFSHITESH KUMARNo ratings yet

- Renewal of Your Ican Essential Advanced Insurance PolicyDocument3 pagesRenewal of Your Ican Essential Advanced Insurance PolicySuganthi ChandrasekaranNo ratings yet

- NPSPayment ReceiptDocument1 pageNPSPayment ReceiptSanthosh DamaNo ratings yet

- Health InsuranceDocument1 pageHealth InsuranceGaurav SaxenaNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Donation Detail Partner Ngo Donation Giveindia Retention TotalDocument1 pageDonation Detail Partner Ngo Donation Giveindia Retention TotalSelvamNo ratings yet

- Rajendra Prasad ShrivastavaDocument2 pagesRajendra Prasad ShrivastavaSourabh ShrivastavaNo ratings yet

- Lic Policy For Jeevan BeemaDocument14 pagesLic Policy For Jeevan BeemaPatel ZeelNo ratings yet

- Bill 12sep2023Document1 pageBill 12sep2023UR12ME148 PrafullaNo ratings yet

- Elss - Fy 2021-22Document2 pagesElss - Fy 2021-22Amit SinghNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document4 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)Ameya SudameNo ratings yet

- PPF e ReceiptDocument1 pagePPF e ReceiptDhananjay RambhatlaNo ratings yet

- Consolidated Premium Paid STMT 2012-2013Document1 pageConsolidated Premium Paid STMT 2012-2013jahmeddNo ratings yet

- 2018032388Document1 page2018032388Vengal reddyNo ratings yet

- Interest Certificate: Shivam Garg and Ramkrishna GargDocument1 pageInterest Certificate: Shivam Garg and Ramkrishna GargShivamNo ratings yet

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Tax Declaration Form 2021 22Document4 pagesTax Declaration Form 2021 22Kasiviswanathan ChinnathambiNo ratings yet

- DonationDocument7 pagesDonationSwapnil ChodankarNo ratings yet

- Premium Paid Certificate: Date: 14-DEC-2017Document1 pagePremium Paid Certificate: Date: 14-DEC-2017zuhebNo ratings yet

- Form No 10Document2 pagesForm No 10javedmonis07No ratings yet

- Donation Receipt: Details of DoneeDocument1 pageDonation Receipt: Details of DoneeNaveen BansalNo ratings yet

- Icici Lombard Mh!49966Document3 pagesIcici Lombard Mh!49966suresh sivadasanNo ratings yet

- Medical Insurance Star Health SelfDocument1 pageMedical Insurance Star Health SelfMadhumitha LNo ratings yet

- Group Activ Travel - Certificate of Insurance: Insured Person DetailsDocument2 pagesGroup Activ Travel - Certificate of Insurance: Insured Person Detailsabhinay anandNo ratings yet

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDocument1 pageRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNo ratings yet

- Mediclaim Format 1Document1 pageMediclaim Format 1Urvashi JainNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- Policy ParentsDocument6 pagesPolicy Parentsaniket goyalNo ratings yet

- Premium ReceiptsDocument1 pagePremium Receiptspinki gNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsMuthyam PallapuNo ratings yet

- We Have Received Your Premium: Keshav PrasadDocument1 pageWe Have Received Your Premium: Keshav Prasadnavinyadavkori67No ratings yet

- 4229 1542982512 0 Receipt 0023138589Document1 page4229 1542982512 0 Receipt 0023138589Ekta BaraskarNo ratings yet

- Public Holidays and Vacation 21-22Document1 pagePublic Holidays and Vacation 21-22kapsekunalNo ratings yet

- Grade 2 Collage TestDocument8 pagesGrade 2 Collage TestkapsekunalNo ratings yet

- Jdetips: JD Edwards Materials Planning, Demand Rules, and Forecast ConsumptionDocument3 pagesJdetips: JD Edwards Materials Planning, Demand Rules, and Forecast ConsumptionkapsekunalNo ratings yet

- NPAS Project ProposalDocument43 pagesNPAS Project ProposalkapsekunalNo ratings yet

- Allie Brown: Southern Paws Pet Grooming, Cordele, GA. - BatherDocument2 pagesAllie Brown: Southern Paws Pet Grooming, Cordele, GA. - Batherapi-548153301No ratings yet

- 9 Polyethylene Piping SystemDocument4 pages9 Polyethylene Piping SystemPrashant PatilNo ratings yet

- A Hybrid Intrution Detection Approach Based On Deep LearningDocument16 pagesA Hybrid Intrution Detection Approach Based On Deep LearningVictor KingbuilderNo ratings yet

- 8 - Correspondance UML-JAVADocument3 pages8 - Correspondance UML-JAVAoussama sfiriNo ratings yet

- Turbine Blade Shop-Block 3 BhelDocument40 pagesTurbine Blade Shop-Block 3 Bheldeepak GuptaNo ratings yet

- Food Safety: Research PaperDocument6 pagesFood Safety: Research PaperJon Slavin100% (1)

- (CHIP IC) w25x20cl - A02Document51 pages(CHIP IC) w25x20cl - A02Felipe de san anicetoNo ratings yet

- Cartoon and Texture Decomposition Based Color Transfer For Fabric ImagesDocument12 pagesCartoon and Texture Decomposition Based Color Transfer For Fabric ImagesPooja GNo ratings yet

- Steel-Concrete Composites Beams Considering Shear Slip EffectDocument23 pagesSteel-Concrete Composites Beams Considering Shear Slip EffectAnnisa Prita MelindaNo ratings yet

- Artikel Sardi SantosaDocument18 pagesArtikel Sardi SantosaSardi Santosa NastahNo ratings yet

- SPP ADC Flightplan UnderstandingDocument25 pagesSPP ADC Flightplan UnderstandingYesid BarraganNo ratings yet

- Code of Practice For Power System ProtectionDocument3 pagesCode of Practice For Power System ProtectionVinit JhingronNo ratings yet

- Content Marketing Workflow EbookDocument39 pagesContent Marketing Workflow Ebookjuan gutierrez100% (1)

- The 2020 Lithium-Ion Battery Guide - The Easy DIY Guide To Building Your Own Battery Packs (Lithium Ion Battery Book Book 1)Document101 pagesThe 2020 Lithium-Ion Battery Guide - The Easy DIY Guide To Building Your Own Battery Packs (Lithium Ion Battery Book Book 1)Hangar Graus75% (4)

- Irene RAYOS-OMBAC, Complainant, Orlando A. RAYOS, RespondentDocument5 pagesIrene RAYOS-OMBAC, Complainant, Orlando A. RAYOS, RespondentGraceNo ratings yet

- Training LV PanelDocument108 pagesTraining LV PanelruslanNo ratings yet

- Lec04.UDP LinhdtDocument16 pagesLec04.UDP LinhdtHọc Sinh Nghiêm TúcNo ratings yet

- Sylvania Lumalux Ordering Guide 1986Document2 pagesSylvania Lumalux Ordering Guide 1986Alan MastersNo ratings yet

- Topic 6:sustainability & Green EngineeringDocument5 pagesTopic 6:sustainability & Green EngineeringyanNo ratings yet

- 3admin - 7Document13 pages3admin - 7JMXNo ratings yet

- Study On Vehicle Loan Disbursement ProceDocument11 pagesStudy On Vehicle Loan Disbursement ProceRuby PrajapatiNo ratings yet

- FEA - Calculation of The Hydroforming Process With LS-DYNADocument8 pagesFEA - Calculation of The Hydroforming Process With LS-DYNAadrianNo ratings yet

- Funda ExamDocument115 pagesFunda ExamKate Onniel RimandoNo ratings yet

- Lesson 10b: Aggregate Planning Finding An Optimal Production Plan Using Excel SolverDocument7 pagesLesson 10b: Aggregate Planning Finding An Optimal Production Plan Using Excel SolvervaraduNo ratings yet

- GSB Samaj Foundation - List of Goud Saraswat Brahmin SurnamesDocument2 pagesGSB Samaj Foundation - List of Goud Saraswat Brahmin SurnamesShree Vishnu ShastriNo ratings yet

- Analytical Investigation of Entropy Production With Convective Heat Transfer in Pressure Driven Flow of A Generalised Newtonian FluidDocument30 pagesAnalytical Investigation of Entropy Production With Convective Heat Transfer in Pressure Driven Flow of A Generalised Newtonian FluidUğur DemirNo ratings yet

- Chase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestDocument3 pagesChase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestCristhian ValverdeNo ratings yet