Professional Documents

Culture Documents

02 Intercompany Module Manual

02 Intercompany Module Manual

Uploaded by

sanjayj71Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02 Intercompany Module Manual

02 Intercompany Module Manual

Uploaded by

sanjayj71Copyright:

Available Formats

Bennett, Coleman & Co. Ltd.

Version: 2010-11; FI 1005 Original Issue date : 28-July-2010

Area : Financial Accounting – Group Company Transactions Revision date :

• A move towards Group Company transaction rationalization

• Eliminate manual account reconciliation across the Group companies

Objective • Facilitate Related Party Transaction reporting requirements under Companies Act

• Improved operational discipline on inter Company transactions

• A move towards Group Consolidation under IFRS convergence

Input Source / Responsibility

Responsibility • Head – Financial Accounting

Responsibility

Records to be • Original Invoice / Debit / Credit Note Document duly supported by RO /

and

Maintained: PO and Business Head’s approval

Documents

Source • Business Heads

SAP Trans Code • ZFIINTCOMP

Activity Operating Guidelines

• Finance User will generate accounting entry in Inter Company Transaction Module

based on the Invoice Document or any payments made on behalf Group

Companies

• After completing the accounting entry, the user will have the option to park the

accounting document

Process

• Account Supervisor will authorize the transaction in SAP based on the original

Involved

documents such as Vendor Invoice, Release Order, PO and confirmation of services

(Sending

• After posting the transaction to Financial Accounting, the user will have following

Company)

options

o Attach supporting documents pertaining to this transaction

o Intimation in the form of email to respective Finance Head of the receiving

Company.

Operating

o Option to print the Group Company Invoice / Debit Note

Guidelines

• The finance user will be required to input the following data during the accounting

process

Basic Data Input / Selection Remarks

Account Type Vendor / Customer Select Customer in case of Invoicing

Data Input

and Vendor in case of payment

(Sending

Transaction Selection from the Select Invoice / Credit Memo / Loan

Company)

drop down given / repayment

Business Selection from the Select right and appropriate nature of

Transaction drop down transaction from the master (If not

found, request you to approach Mr.

Madhusudan Sawant, BCCL Finance,

Mumbai)

Team Finance Page 1 of 26

Bennett, Coleman & Co. Ltd.

Basic Data Input / Selection Remarks

Sender Company Selection from the Select the respective sending

drop down Company Code from the master

Receiving Selection from the Select the respective receiving

Company drop down Company Code from the master

Reference Input Input SD Module Document Number

After completing the above parameters, the user needs to press “Enter” button to

arrive the screen layout for the proposed transaction

Customer Display Derived by the system

Vendor Display Derived by the system

Spl GL Indicator Input from the top Relevant only in case of Loans (L) and

down Advances (A)

Document Date Input Enter the Reference Document Date

Posting Date Input Enter posting date (Accounting Date)

Amount Input Enter the invoice / debit note value

(Gross)

Reference 1 Input Enter Release Order No

Reference 2 Input

Header Text Input Short Narration of the Transaction

Person Input Input name of the person who has

Responsible requested service/ RO released

GL Account Display

(Sender) Derived based on the Business

GL Account Display Transaction Master

(Receiver)

Debit / Credit Display

Amount Input Input Invoice Value

Tax Code Modify Derived from the Business

Transaction Master with option to

change

Assignment Input Input Cheque Number in case of

payouts (Settlement / Loans etc)

Cost Centre Input

Profit Centre Input

Business Area Input

Business Place Input

Text Input Input detailed narration about the

nature of services which will get

printed on the invoice document

.

Parameters

to be used Business Nature Account Business Spl GL Indicator

while raising Type Transaction

Invoice /

Debit note Invoice raised for services Customer Invoice Not Applicable

from sending Credit

company Reversal of Invoice raised Customer Not Applicable

Memo

Team Finance Page 2 of 26

Bennett, Coleman & Co. Ltd.

Loans given Customer Loan L - Loan

Loan

Repayment of Loan Vendor L - Loan

Repayment

Interest on loan given Customer Loan Not Applicable

Funds Transfer - Out Customer Invoice A - Advance to Sub

Reimbursement of Expenses Customer Invoice A - Advance to Sub

Credit

Payment against Invoice Vendor Not Applicable

Memo

collection / Credit Transfer to

Vendor Invoice A - Advance to Sub

Group Company

• Receiving Company Finance User should review the open items lying in Group

Company Accounting Module on day to day basis

Process • If any dispute observed, the user will capture the nature of dispute in the field

Involved provided for

(Receiving • Coordinate with the sending company for resolution of dispute by obtaining clarity

Company) on the transactions including necessary supporting documents

• On receipt of original documents including RO, Internal approvals etc., the

receiving company user will post transaction after due validation process

• The finance user will be required to input the following data while posting

Incoming Documents.

Basic Data Input / Remarks

Selection

GL Account Display System to default GL code based on Business

(Receiver) transaction master with option to change.

Data Input

Cost Centre Input

(Receiving

Business Area Input

Company)

Business Place Input

Internal Order Input

Text Input Input detailed narration about the nature of

services which will get printed on the invoice

document

TDS Vendor Based on Vendor Master setting, the system will

Master prompt the user to select relevant TDS Code

.

Accounting • TDS deducted by service receiving Company will get accounted by the sending

of TDS company.

• Financial Accounting transaction created in Group Company Transaction Module

should be accounted within 15 days from the date of creation.

Controlling • During the half yearly and annual closing process, there should not be any open

Measures item pending for accounting purpose.

• On weekly basis, BCCL GL Team will generate report on overdue pending

transaction for accounting across the Group (More than 15 / 30 / 45 days)

Team Finance Page 3 of 26

Bennett, Coleman & Co. Ltd.

• Any major dispute arising out of transaction will be handled centrally by BCCL GL

Team across the Group

Create & Post Send Validate the Post the

Flow Chart Accounting Documents to Invoice & Transaction to

Entry receiving Supporting FI Module

company

• All payouts / receipts among Group Companies should be accounted through this process module by

issuing manual Cheques / bank transfer letter

Impact

• Invoices raised through MM and SD Module on Group Company should be routed through “Parking

Analysis

Account” (GL : Advance to Subsidiaries)

(Highly

• Finance user should not use reverse document option in SAP for the transactions routed through this

Critical)

process module (FB 08) instead use Credit / Debit Note provided in the process module

Team Finance Page 4 of 26

Bennett, Coleman & Co. Ltd.

FIRST SCREEN

For raising invoice on receiving company

click Here

Team Finance Page 5 of 26

Bennett, Coleman & Co. Ltd.

Select Account type,

Transaction Type, Business

Nature, Reference ,Sending &

Receiving Company and then

press Enter

Team Finance Page 6 of 26

Bennett, Coleman & Co. Ltd.

Enter Amount, Profit

Centre, Business Area,

Business Place, Text, etc

for line item for Sender

Company “S”

Team Finance Page 7 of 26

Bennett, Coleman & Co. Ltd.

PRESS

CHECK TAB

Team Finance Page 8 of 26

Bennett, Coleman & Co. Ltd.

Press Park

Document

Team Finance Page 9 of 26

Bennett, Coleman & Co. Ltd.

Note document

No.

Team Finance Page 10 of 26

Bennett, Coleman & Co. Ltd.

Option to View Parked Invoices raised on Group Company

“Execute”

Team Finance Page 11 of 26

Bennett, Coleman & Co. Ltd.

“DOUBLE CLICK ON CONTROL NO.”

Team Finance Page 12 of 26

Bennett, Coleman & Co. Ltd.

“PRESS POST DOCUMENT TAB”

Team Finance Page 13 of 26

Bennett, Coleman & Co. Ltd.

Note FI

document No.

Team Finance Page 14 of 26

Bennett, Coleman & Co. Ltd.

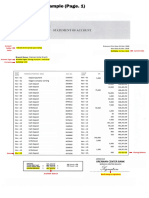

View of Financial Document

Team Finance Page 15 of 26

Bennett, Coleman & Co. Ltd.

Accounting of Invoice in Receiving Company

Team Finance Page 16 of 26

Bennett, Coleman & Co. Ltd.

Select parameter viz. Receiving company code, Business Transaction, Sending company

code and press “EXECUTE”

Team Finance Page 17 of 26

Bennett, Coleman & Co. Ltd.

System will display the list of Invoices raised on receiving company.

Double click on the control doc no which you want to account in receiving company.

Team Finance Page 18 of 26

Bennett, Coleman & Co. Ltd.

Enter Posting date and Cost Centre, Business Area, Business place and text against the

Receiving company line item “R”

Press “Post Document” tab to post the document.

Team Finance Page 19 of 26

Bennett, Coleman & Co. Ltd.

User can view the document posted in books of receiving company

Team Finance Page 20 of 26

Bennett, Coleman & Co. Ltd.

Accounting of TDS deducted by receiving company in books of Sending company

“PRESS TDS RECIEVABLE ADVICES”

Team Finance Page 21 of 26

Bennett, Coleman & Co. Ltd.

Enter parameter viz. Sending company and Receiving company code and radio button

“TDS Entry pending” and then excute

Team Finance Page 22 of 26

Bennett, Coleman & Co. Ltd.

Double click on TDS Amount

Team Finance Page 23 of 26

Bennett, Coleman & Co. Ltd.

System will default for TDS GL code with option to change. After validating GL a/c user

to post the document.

Team Finance Page 24 of 26

Bennett, Coleman & Co. Ltd.

“REFRESH REPORT”

Team Finance Page 25 of 26

Bennett, Coleman & Co. Ltd.

The revised report shows “X” under column “TDS Post” against the selected invoice.

Team Finance Page 26 of 26

You might also like

- Sap Fi Accounts PayableDocument87 pagesSap Fi Accounts Payablethaheer0009100% (1)

- Fusion Accounts Payables SetupsDocument24 pagesFusion Accounts Payables SetupsVenkyNo ratings yet

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- Paradis Rdebuts enDocument8 pagesParadis Rdebuts endeepak_sachdeva81No ratings yet

- Retail Payable Invoice: Solution Design DocumentDocument11 pagesRetail Payable Invoice: Solution Design DocumentVikas SinghNo ratings yet

- User Manual Import-SSLDocument26 pagesUser Manual Import-SSLvarunbisariaNo ratings yet

- MD050 Supplier Outstanding Report As of DateDocument9 pagesMD050 Supplier Outstanding Report As of DateKrishaNo ratings yet

- Sap Fi User Manual Step by Step With ScreenshotsDocument79 pagesSap Fi User Manual Step by Step With Screenshotsvikrant.chutke12100% (1)

- Treasury Risk ManagementDocument122 pagesTreasury Risk Managementaalanis53No ratings yet

- For Fintech Academy UI 2023 - Finance Functions in OVODocument35 pagesFor Fintech Academy UI 2023 - Finance Functions in OVODede IrwandaNo ratings yet

- Accounts PayableDocument84 pagesAccounts PayableKrishna Sukhwal100% (1)

- Sop Accounts Payables Axiom EasyDocument16 pagesSop Accounts Payables Axiom EasyRiskyKurniasih100% (1)

- RG Brochure 17 13-10-2022Document8 pagesRG Brochure 17 13-10-2022GOODS AND SERVICES TAXNo ratings yet

- P13 - BPP - Billing and Interco - 001 - Billing Due ListDocument21 pagesP13 - BPP - Billing and Interco - 001 - Billing Due ListtarekNo ratings yet

- AIS-1 - Module On Topic 2Document8 pagesAIS-1 - Module On Topic 2MiaNo ratings yet

- Account Recivable PDFDocument70 pagesAccount Recivable PDFkhaledNo ratings yet

- Key Features of The SoftwareDocument73 pagesKey Features of The SoftwareFine GalleriaNo ratings yet

- Sap Fi Accounts PayableDocument87 pagesSap Fi Accounts PayableRobert van MeijerenNo ratings yet

- Procure To Pay Enterprise Structures Best Implementation PracticesDocument40 pagesProcure To Pay Enterprise Structures Best Implementation PracticesSrinivasa Rao AsuruNo ratings yet

- SAP FI Account Payable APDocument91 pagesSAP FI Account Payable APahmed shomanNo ratings yet

- Vendor Invoice Booking (With TDS Entry) and PaymentDocument27 pagesVendor Invoice Booking (With TDS Entry) and PaymentMamunoor RashidNo ratings yet

- Accounting PackageDocument148 pagesAccounting PackagenafeesNo ratings yet

- P13 - BPP - Billing and Interco - 008 - Intercompany Sales Order of Fixed Amount With Billing PlanDocument28 pagesP13 - BPP - Billing and Interco - 008 - Intercompany Sales Order of Fixed Amount With Billing PlantarekNo ratings yet

- FSAPreRead 210728 102848Document42 pagesFSAPreRead 210728 102848Anuj PrajapatiNo ratings yet

- Interco Setup DemoDocument18 pagesInterco Setup DemoBala RanganathNo ratings yet

- User Manual For Customer Advance Payment V1.1Document27 pagesUser Manual For Customer Advance Payment V1.1SUMITAVA GHOSALNo ratings yet

- Audit Program Cash & BankDocument23 pagesAudit Program Cash & BankSarang SinghNo ratings yet

- Sap Fi Accounts ReceivableDocument70 pagesSap Fi Accounts ReceivableRinaldo PaulinoNo ratings yet

- Data Mining Final PrezDocument16 pagesData Mining Final PrezgulshanlatifzadehNo ratings yet

- Oracle R12 AP New FeaturesDocument120 pagesOracle R12 AP New Featuressanjayapps100% (6)

- Interco Invoicing Flow Setup1Document20 pagesInterco Invoicing Flow Setup1lakshmi_13100% (1)

- BBP New Format Vendor MasterDocument21 pagesBBP New Format Vendor Mastersowndarya vangalaNo ratings yet

- Ap CRP2Document25 pagesAp CRP2srikar valluNo ratings yet

- Intercompany Cross Charges TrainingDocument16 pagesIntercompany Cross Charges TrainingNatasha BhalothiaNo ratings yet

- Annexure B VIM Self Help User Manual 1 PDFDocument37 pagesAnnexure B VIM Self Help User Manual 1 PDFGURGAON DO100% (1)

- P13 - BPP - Billing and Interco - 003 - Intercompany Sales Order of Travel ExpensesDocument38 pagesP13 - BPP - Billing and Interco - 003 - Intercompany Sales Order of Travel ExpensestarekNo ratings yet

- 2M0 S4hana2021 BPD en inDocument18 pages2M0 S4hana2021 BPD en invenkatNo ratings yet

- User Manual - : Title: Module NameDocument4 pagesUser Manual - : Title: Module NameRaviNo ratings yet

- Tally Ledger Groups List (Ledger Under Which Head or Group in Accounts PDFDocument13 pagesTally Ledger Groups List (Ledger Under Which Head or Group in Accounts PDFravi100% (2)

- SAP ERP Modules - OverviewDocument2 pagesSAP ERP Modules - Overviewutsav bartwalNo ratings yet

- P13 - BPP - Billing and Interco - 002 - Manage and Control BillingDocument23 pagesP13 - BPP - Billing and Interco - 002 - Manage and Control BillingtarekNo ratings yet

- Plus Loans Training Deck 23062021115312Document28 pagesPlus Loans Training Deck 23062021115312ronak voraNo ratings yet

- 05 SupplierInvoicetoPaymentDocument65 pages05 SupplierInvoicetoPaymentsujit nayakNo ratings yet

- Payablespresentation 130415061210 Phpapp02Document22 pagesPayablespresentation 130415061210 Phpapp02mhaireenNo ratings yet

- Oracle R12 OVERVIEWDocument67 pagesOracle R12 OVERVIEWJulio FerrazNo ratings yet

- Invoice2BMW en Rel2021.06Document40 pagesInvoice2BMW en Rel2021.06Purushothaman PJNo ratings yet

- EDU3484YDocument87 pagesEDU3484YAtif JavaidNo ratings yet

- RD050 Business Requirements - BESCOM - PayrollDocument12 pagesRD050 Business Requirements - BESCOM - PayrollVK SHARMANo ratings yet

- Biz Ops User ManualDocument28 pagesBiz Ops User ManualRounak KhubchandaniNo ratings yet

- Basic Principles & Theories of ManagmentDocument81 pagesBasic Principles & Theories of ManagmentMuhamad Fadli HarunNo ratings yet

- Transaction ManagementDocument58 pagesTransaction ManagementhalimabiNo ratings yet

- 05 0 TRM PSCD Specific Posting ProcessesDocument26 pages05 0 TRM PSCD Specific Posting ProcessesBatboy BatkoNo ratings yet

- SAP CCS - PublicDocument19 pagesSAP CCS - PublicrsalomasNo ratings yet

- GM Andean Accounts Payable Workshop v1 April09Document18 pagesGM Andean Accounts Payable Workshop v1 April09Subbireddy ChintapalliNo ratings yet

- DYNA ERP Document English FinaDocument13 pagesDYNA ERP Document English Finacyousefabueed96No ratings yet

- BBP - FI - 007 - Customer Vendor CommunicationDocument4 pagesBBP - FI - 007 - Customer Vendor CommunicationPrem PrakashNo ratings yet

- Recording and Accounting For Capital Leases in EBSDocument36 pagesRecording and Accounting For Capital Leases in EBSAmeer PashaNo ratings yet

- Oracle PeopleSoft Enterprise Financial Management 9.1 ImplementationFrom EverandOracle PeopleSoft Enterprise Financial Management 9.1 ImplementationNo ratings yet

- NRB ActDocument31 pagesNRB Actaneupane465No ratings yet

- Treasury Management Fasa SF A F 1rf1f Qs Q F A A Qu Qu SF QF Uqwf Qu Qu Quqw F C Q1wag DFB BDocument21 pagesTreasury Management Fasa SF A F 1rf1f Qs Q F A A Qu Qu SF QF Uqwf Qu Qu Quqw F C Q1wag DFB BhoangthingoclinhNo ratings yet

- Naresh Chandra Committee Report On Corporate Audit andDocument20 pagesNaresh Chandra Committee Report On Corporate Audit andHOD CommerceNo ratings yet

- Financial Asset at Fair ValueDocument4 pagesFinancial Asset at Fair ValueDianna DayawonNo ratings yet

- Loan Agreement Lender Loan NumberDocument6 pagesLoan Agreement Lender Loan Numbermr_3647839No ratings yet

- This Study Resource Was: QuestionsDocument5 pagesThis Study Resource Was: QuestionsXNo ratings yet

- Absolute Vs Relative ValuationDocument3 pagesAbsolute Vs Relative ValuationLilliane EstrellaNo ratings yet

- Offer in Compromise Requirement LetterDocument2 pagesOffer in Compromise Requirement LetterSagar PatelNo ratings yet

- Accounting 3 Investment in AssociatesDocument2 pagesAccounting 3 Investment in AssociatesMina ChouNo ratings yet

- FinancialDocument2 pagesFinancialgeorge muchuhaNo ratings yet

- Guide To Careers in Financial PlanningDocument62 pagesGuide To Careers in Financial PlanningTung TaNo ratings yet

- Financial Accounting and Reporting: Small and Medium-Sized EntitiesDocument19 pagesFinancial Accounting and Reporting: Small and Medium-Sized EntitiesDan DiNo ratings yet

- SlokaDocument2 pagesSlokaRajeshNo ratings yet

- Valuation Report SonyDocument38 pagesValuation Report SonyankurNo ratings yet

- Bai Virbaiji Soparivala Bai Virbaiji Soparivala Bai Virbaiji SoparivalaDocument1 pageBai Virbaiji Soparivala Bai Virbaiji Soparivala Bai Virbaiji SoparivalaHuzaifa AftabNo ratings yet

- Ae 112 Prelim Assessment 1Document7 pagesAe 112 Prelim Assessment 1Chelssy ParadoNo ratings yet

- 31 RRC ME Dubai - Course Booking Form v1.03 1908Document3 pages31 RRC ME Dubai - Course Booking Form v1.03 1908Khlalid SHahNo ratings yet

- Final Terms Condition For Sub BrokerDocument7 pagesFinal Terms Condition For Sub Brokersandeep_bhandariNo ratings yet

- Special Laws The New Central Bank Act RA 7653Document3 pagesSpecial Laws The New Central Bank Act RA 7653dave_88opNo ratings yet

- A Summary of Your Relationship/s With Us:: Alex PrabhuDocument11 pagesA Summary of Your Relationship/s With Us:: Alex PrabhuArvind HarikrishnanNo ratings yet

- 0968 Hostplus Additional Contributions BrochureDocument9 pages0968 Hostplus Additional Contributions BrochureSepehrNo ratings yet

- Sadaf StatementDocument37 pagesSadaf StatementadilfaqiNo ratings yet

- Exfoliation in Granite RocksDocument2 pagesExfoliation in Granite RocksCharlieEleerNo ratings yet

- Statement 67796213 GBP 2023-08-28 2023-09-27Document7 pagesStatement 67796213 GBP 2023-08-28 2023-09-27pawkpeekNo ratings yet

- Asasah Islamic Micro FinanceDocument34 pagesAsasah Islamic Micro FinanceAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Bulk Purchase Depreciation Calculator 1Document7 pagesBulk Purchase Depreciation Calculator 1asianetixNo ratings yet

- Exercises FME LFG2 KeyDocument9 pagesExercises FME LFG2 KeyÆbđ ÆÆķNo ratings yet

- Financial Performance AnalysisDocument9 pagesFinancial Performance AnalysisTahmina ChowdhuryNo ratings yet

- Financial Transaction WorksheetDocument4 pagesFinancial Transaction WorksheetChristian paul LaguertaNo ratings yet

- Bank Management & Financial Services PDF Drive Bank Management & Financial Services PDF DriveDocument769 pagesBank Management & Financial Services PDF Drive Bank Management & Financial Services PDF Drivedragon longNo ratings yet