Professional Documents

Culture Documents

Bus Fin

Bus Fin

Uploaded by

Lenard TaberdoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bus Fin

Bus Fin

Uploaded by

Lenard TaberdoCopyright:

Available Formats

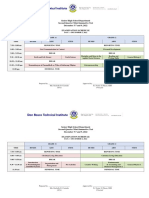

Globe Telecom, Inc.

Statements of Total Comprehensive Income

For the years ended December 31, 2019 and 2018

(All amounts in Philippine Peso)

Notes 2019

Revenues

Service revenues 149,009,963

Non-service revenues 17,650,374

34 166,660,337

Income (Losses)

Equity share in net losses of associates and joint ventur 15 -2,554,782

Interest income 23 500,437

Gain on disposal of property and equipment – net 43,012

Gain on fair value of retained interest 15

Other income – net 24 1,047,007

-964,326

Cost and Expenses

General, selling and administrative expenses 25 64,471,409

Depreciation and amortization 26 34,143,541

Cost of inventories sold 9, 34 18,554,814

Interconnect costs 35 3,982,873

Financing costs 27 6,802,861

Impairment and other losses 28 4,913,137

132,868,635

Income Before Income Tax 32,827,376

Provisions for Income Tax

Current 8,488,595

Deffered 2,055,024

30 10,543,619

Net Income 22,283,757

Other Comprehensive Income (Loss)

Items that will be reclassified into profit or loss in subsequent periods:

Transactions

Exchange on cash flow

differences hedges

arising from–translations

net of -1,213,355

foreign investments

Changes in fair value of available-for-sale -106,988

investment in equity securities

22.6 -1,320,343

Item that will not be reclassified into profit or loss in subsequent periods:

Changes in fair value of financial assets at fair value

through other comprehensive income 440,349

Remeasurement gain on defined benefit plan -1,373,043

22.6 -932,694

Total other Comprehensive Income -2,253,037

Total Comprehensive Income 20,030,720

Total net income attributable to:

Equity holders of the Parent 22,269,340

Non-controlling interest 14,417

22,283,757

Total comprehensive income attributable to:

Equity holders of the Parent 20,016,303

Non-controlling interest 14,417

20,030,720

Earnings Per Share

Basic 31 162.96

Diluted 31 162.2

Cash dividends declared per common share 22.3 91

ve Income

019 and 2018

eso)

Horizontal Analysis Vertical Analysis

Increase (Decrease) % 2019 2018

2018 (D - E) (F/E)

132,875,310 16,134,653 12.1% 100.0% 100.0%

18,297,496 -647,122 -3.5% 11.8% 13.8%

151,172,806 15,487,531 10.2% 111.8% 113.8%

-1,249,603 -1,305,179 104.4% -1.7% -0.9%

391,030 109,407 28.0% 0.3% 0.3%

73,088 -30,076 -41.2% 0.0% 0.1%

0.0%

695,405 351,602 50.6% 0.7% 0.5%

-90,080 -874,246 970.5% -0.6% -0.1%

57,742,131 6,729,278 11.7% 43.3% 43.5%

30,421,721 3,721,820 12.2% 22.9% 22.9%

18,645,314 -90,500 -0.5% 12.5% 14.0%

5,677,375 -1,694,502 -29.8% 2.7% 4.3%

6,195,225 607,636 9.8% 4.6% 4.7%

4,787,644 125,493 2.6% 3.3% 3.6%

123,469,410 9,399,225 7.6% 89.2% 93%

27,613,316 5,214,060 18.9% 22.0% 20.8%

7,259,985 1,228,610 16.9% 5.7% 5.5%

1,727,388 327,636 19.0% 1.4% 1.3%

8,987,373 1,556,246 17.3% 7.1% 6.8%

18,625,943 3,657,814 19.6% 15.0% 14.0%

863,715 -2,077,070 -240.5% -0.8% 0.0%

28,524 -135,512 -475.1% -0.1% 0.7%

-

892,239 -2,212,582 -248.0% -0.9% 0.7%

151,974 288,375 189.8% 0.3% 0.1%

49,709 -1,422,752 -2862.2% -0.9% 0.0%

201,683 -1,134,377 -562.5% -0.6% 0.2%

1,093,922 -3,346,959 -306.0% -1.5% 0.8%

19,719,865 310,855 1.6% 13.4% 14.8%

18,640,740 3,628,600 19.5% 14.9% 14.0%

-14,797 29,214 -197.4% 0.0% 0.0%

18,625,943 3,657,814 19.6% 15.0% 14.0%

19,734,662 281,641 1.4% 13.4% 14.9%

-14,797 29,214 -197.4% 0.0% 0.0%

19,719,865 310,855 1.6% 13.4% 14.8%

135.91

135.4

91

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tecson, AaronDocument4 pagesTecson, AaronLenard TaberdoNo ratings yet

- Research Articles FS ActivityDocument5 pagesResearch Articles FS ActivityLenard TaberdoNo ratings yet

- Personal Data SheetDocument1 pagePersonal Data SheetLenard TaberdoNo ratings yet

- ReviewerDocument14 pagesReviewerLenard TaberdoNo ratings yet

- Fabm 2 and FinanceDocument5 pagesFabm 2 and FinanceLenard TaberdoNo ratings yet

- PizzaDocument10 pagesPizzaLenard TaberdoNo ratings yet

- Wrtite A Short Story of Your Life Using Erikson S Stages As A FrameworkDocument3 pagesWrtite A Short Story of Your Life Using Erikson S Stages As A FrameworkLenard TaberdoNo ratings yet

- Group 4 Set BDocument3 pagesGroup 4 Set BLenard TaberdoNo ratings yet

- Etech-G5 PetaDocument25 pagesEtech-G5 PetaLenard TaberdoNo ratings yet

- Lenard John Paolo REYES TABERDO - PETA Grouping RubricsDocument6 pagesLenard John Paolo REYES TABERDO - PETA Grouping RubricsLenard TaberdoNo ratings yet

- Perdev Reviewer 1Document1 pagePerdev Reviewer 1Lenard TaberdoNo ratings yet

- Lenard John Paolo REYES TABERDO - PETA Grouping RubricsDocument4 pagesLenard John Paolo REYES TABERDO - PETA Grouping RubricsLenard TaberdoNo ratings yet

- Group 4 - (Set B) PETA Leader RubricsDocument2 pagesGroup 4 - (Set B) PETA Leader RubricsLenard TaberdoNo ratings yet

- Income Statement FINALDocument2 pagesIncome Statement FINALLenard TaberdoNo ratings yet

- Finance ReviewerDocument17 pagesFinance ReviewerLenard TaberdoNo ratings yet

- Group 5 - Feasibility Proposal Intro - pt1Document7 pagesGroup 5 - Feasibility Proposal Intro - pt1Lenard TaberdoNo ratings yet

- Rws Reviewer 1Document1 pageRws Reviewer 1Lenard TaberdoNo ratings yet

- Finacial Position FINALDocument4 pagesFinacial Position FINALLenard TaberdoNo ratings yet

- Group 4 - (Set B) PETA Leader RubricsDocument2 pagesGroup 4 - (Set B) PETA Leader RubricsLenard TaberdoNo ratings yet

- Cle ReviewerDocument3 pagesCle ReviewerLenard TaberdoNo ratings yet

- Ratios FinalDocument2 pagesRatios FinalLenard TaberdoNo ratings yet

- Group 4 - (Set B) PETA Leader RubricsDocument2 pagesGroup 4 - (Set B) PETA Leader RubricsLenard TaberdoNo ratings yet

- Group 4 - (Set B) PETA Leader RubricsDocument2 pagesGroup 4 - (Set B) PETA Leader RubricsLenard TaberdoNo ratings yet

- 2Q MST Examination ScheduleDocument4 pages2Q MST Examination ScheduleLenard TaberdoNo ratings yet

- Group 4 - (Set B) PETA Leader RubricsDocument2 pagesGroup 4 - (Set B) PETA Leader RubricsLenard TaberdoNo ratings yet

- Being Mindful With The Self - Asynchronous ActivityDocument6 pagesBeing Mindful With The Self - Asynchronous ActivityLenard TaberdoNo ratings yet

- Ella Nicole GELLADOLA ROBLES - PETA Leader RubricsDocument2 pagesElla Nicole GELLADOLA ROBLES - PETA Leader RubricsLenard TaberdoNo ratings yet

- Ella Nicole GELLADOLA ROBLES - PETA Leader RubricsDocument2 pagesElla Nicole GELLADOLA ROBLES - PETA Leader RubricsLenard TaberdoNo ratings yet

- Finacial Position FINAL GLOBE TELECOMDocument4 pagesFinacial Position FINAL GLOBE TELECOMLenard TaberdoNo ratings yet

- Bonsai by EDITH TIEMPODocument2 pagesBonsai by EDITH TIEMPOLenard TaberdoNo ratings yet