Professional Documents

Culture Documents

02 - Task - Performance - 2 - To Give To Students 10.10.22

02 - Task - Performance - 2 - To Give To Students 10.10.22

Uploaded by

Justine OrdonioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02 - Task - Performance - 2 - To Give To Students 10.10.22

02 - Task - Performance - 2 - To Give To Students 10.10.22

Uploaded by

Justine OrdonioCopyright:

Available Formats

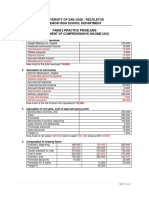

BM2108

NAME: DATE: SCORE:

TASK PERFORMANCE #2

Case 1: Include or exclude? (6 items x 1 point)

Indicate whether the following transactions should be included or excluded from the cash budget—no need for

an explanation.

1. Purchase of new equipment - included

2. Payment of income tax - included

3. Write-off of bad debts - excluded

4. Depreciation of equipment – excluded

5. Repairs on equipment - included

6. Payment to supplier – included

Case 2: Preparing budgets (2 items x 10 points)

ABC Company operates a retail business. The following data shows the budgeted amounts for the following

months:

Sales Labor Expenses

January 40,000.00 3,000.00 4,000.00

February 60,000.00 3,000.00 6,000.00

March 160,000.00 5,000.00 7,000.00

April 120,000.00 4,000.00 7,000.00

Other information is as follows:

1. Purchase cost is 75% of the selling price

2. Management policy requires to have sufficient inventory at the end of each month to meet the sales

demand for the next half month

3. Payables for materials and expenses are paid in the following month after the purchases are made

or expenses incurred.

4. Labor is paid in full at the end of each month

5. Expenses include a monthly depreciation charge of P2,000

6. Sales projections are based on the following assumptions:

a. 75% of sales are cash

b. 25% of sales are collectible within one month

7. The company will purchase equipment for cash costing P18,000 in February and pay dividends

amounting to P20,000 in March. The opening balance of cash on February 1 is P1000

02 Task Performance 2 *Property of STI

Page 1 of 2

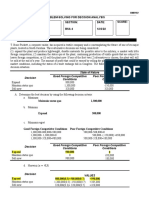

BM2108

Required:

1. Prepare a budgeted income statement for February and March

2. Prepare a cash budget for February and

March

CRITERIA POINTS

Rubric for grading Case 2:

Correct accounts and amounts used 7

Computed final amounts are correct and balanced 3

Total 10

February March

Beginning balance 1,000 (4,500)

Cash receipts

Sales receipts 55,000 135,000

Total cash receipts 56.000 130,000

Cash payments

Purchase payments 37,500 82,500

Labor 3,000 5,000

Cash expenses 2,000 4,000

Purchase equipment 18,000 -

Payment dividends - 20,000

Total Cash Payment 60,500 111,500

Net cash excess/ deficiency (4,500) 19,000

Financing

Loan proceeds - -

Loan repayments - -

Ending balance (4,500) 19,000

a.) Projected sales receipts January February March

Sales 40,000 60,000 160,000

Cash 75% 30,000 45,000 120,000

Accounts receivables 25% 10,000 15,000

Total Receipts 55,000 135,000

b.) Projected cash payments from production budget

January February March

Estimated sales 40,000 60,000 160,000

Purchase cost 75% 30,000 45,000 120,000

Sales: 50%

January 15,000

February 22,500 22,500

March 60,000

Purchase payments 37,500 82,500

Labor 3,000 5,000

Expense 2,000 2,000 4,000

Purchase of equipment 18,000

Payment of dividends 20,000

Total Purchase Payment 60,500 111,500

02 Task Performance 2 *Property of STI

Page 2 of 2

BM2108

February March Total

Sales 60,000 160,000 220,000

Less:

Purchase cost 0.75 45,000 120,000

45,000 120,000 165,000

Gross profit 15,000 40,000

Less:

Labor 3,000 5,000 8,000

Expense 6,000 7,000 13,000

9,000 12,000 21,000

Net income (loss) 6,000 28,000 34,000

Case 3: (3 items x 5 points)

Management accountants must try to implement systems that are acceptable to budget stakeholders to

produce positive effects.

Now, as a management accountant, choose three (3) negative attitudes, explain them and write your

recommendations on how you will address these negative attitudes from a management’s perspective. It could

either be a policy that the management will implement or an action that will be undertaken by management to

counteract the negative attitude.

Certified public accountants work in public companies, private companies, and government agencies.

These professionals are sometimes called expense accountants, chief accountants, industrial accountants,

personal accountants, or corporate accountants. Preparing data for use within an enterprise is one of the

characteristics that distinguishes management accountants from other types of accounting jobs, such as

public accounting. The example of negative attitudes is, someone who doesn’t collaborate with others,

Arrogant about their performance, and Taking credit for other people’s work. As a management accountant

you are dealing with the company’s finances, and if you don’t collaborate with your co-worker there will be a

miscommunication and might led to a big problem in the future. Do not be arrogant when it comes to your

performance at work, your performance will vary if you are still worthy of that job and position. Stealing a work

of others is not a very pleasing attitude not just in your work, but it brings up on how you deal with people

outside the work place. If I were to make a policy in the management or an action in the management, I would

personally take action and talk to the employee to have a positive and good environment in the work place. It

is also a good idea if once in a while there will be an open forum in the company, such as going on a retreat

with the whole team to have a safe place of work for everyone.

Rubric for grading Case 3:

CRITERIA PERFORMANCE INDICATORS POINTS

Content Provided pieces of evidence, supporting details,

4

and factual scenarios

Organization Expressed the points in a clear and logical

1

of ideas arrangement of ideas in the paragraph

Total 5

02 Task Performance 2 *Property of STI

Page 3 of 2

You might also like

- Break Even AnalysisDocument5 pagesBreak Even Analysisblue_mugNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- Application 1 (Basic Steps in Accounting)Document2 pagesApplication 1 (Basic Steps in Accounting)Maria Nezka Advincula86% (7)

- Summative Test-FABM2 2018-2019Document2 pagesSummative Test-FABM2 2018-2019Raul Soriano Cabanting88% (8)

- Problems: 2-58. Cost ConceptsDocument16 pagesProblems: 2-58. Cost ConceptsChristy HabelNo ratings yet

- Financial Management Midtem ExamDocument4 pagesFinancial Management Midtem Examzavria100% (1)

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Segmented Reporting, Investment Center Evaluation, and Transfer PricingDocument80 pagesSegmented Reporting, Investment Center Evaluation, and Transfer PricingHanabusa Kawaii Idou0% (1)

- Final Assessmenr Paper - Fa - Spring - 2021Document4 pagesFinal Assessmenr Paper - Fa - Spring - 2021Anus GhufranNo ratings yet

- Accounting, Budgeting and Control Systems in Their Organizational Context: Theoretical and Empirical PerspectivesDocument1 pageAccounting, Budgeting and Control Systems in Their Organizational Context: Theoretical and Empirical Perspectivesrhynos loversNo ratings yet

- Michael Roberts Is A Cost Accountant and Business Analyst ForDocument1 pageMichael Roberts Is A Cost Accountant and Business Analyst ForAmit PandeyNo ratings yet

- Activity Based CostingDocument13 pagesActivity Based CostingKunal JainNo ratings yet

- Internship ReportDocument18 pagesInternship Reportaamirqaisar10No ratings yet

- Activity No. 4 - Attach Your Activity With The Filename SURNAME - SECTION - ACT#4Document3 pagesActivity No. 4 - Attach Your Activity With The Filename SURNAME - SECTION - ACT#4-st3v3craft-No ratings yet

- ACCT 10001: Accounting Reports & Analysis - Lecture 9 Illustration: BudgetingDocument4 pagesACCT 10001: Accounting Reports & Analysis - Lecture 9 Illustration: BudgetingBáchHợpNo ratings yet

- Exercises 7A1 and 7B1: Book: Administrative AccountingDocument9 pagesExercises 7A1 and 7B1: Book: Administrative AccountingScribdTranslationsNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- Case 3 BudgetingDocument13 pagesCase 3 BudgetingPatrick SalvadorNo ratings yet

- Preparation of Financial StatementsDocument13 pagesPreparation of Financial StatementsSharina Mhyca SamonteNo ratings yet

- 07 Reconciliation FTDocument7 pages07 Reconciliation FTnsm2zmvnbbNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- Deso 04Document5 pagesDeso 04Nguyễn Quốc TuấnNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Accountancy Auditing 2018Document7 pagesAccountancy Auditing 2018Abdul basitNo ratings yet

- ACMA Unit 5 Problems - CFS PDFDocument3 pagesACMA Unit 5 Problems - CFS PDFPrabhat SinghNo ratings yet

- Spring Semester 2019 Final Exam Closed Notes: INSTRUCTOR: Marios MavridesDocument4 pagesSpring Semester 2019 Final Exam Closed Notes: INSTRUCTOR: Marios MavridesyandaveNo ratings yet

- ACC 102 - QuizDocument11 pagesACC 102 - QuizSarah Mae EscutonNo ratings yet

- Cost Management 2Document5 pagesCost Management 2melesemelaku1234No ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- Accountancy and Auditing-2018Document6 pagesAccountancy and Auditing-2018Aisar Ud DinNo ratings yet

- Accountancy-I Subjective PDFDocument4 pagesAccountancy-I Subjective PDFM Umar MughalNo ratings yet

- Model Exam Work Out FADocument5 pagesModel Exam Work Out FAnewaybeyene5No ratings yet

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Accounts DDocument13 pagesAccounts DRahit MitraNo ratings yet

- Cash Flow StatementDocument19 pagesCash Flow StatementROHIT SHANo ratings yet

- Lecture 7-8 Working CapitalDocument18 pagesLecture 7-8 Working CapitalAfzal AhmedNo ratings yet

- Domondon - Acctg 3 - Prelim Quiz 2Document2 pagesDomondon - Acctg 3 - Prelim Quiz 2Prince Anton DomondonNo ratings yet

- 8104 MbaexDocument3 pages8104 Mbaexgaurav jainNo ratings yet

- Financial Analysis TestDocument11 pagesFinancial Analysis TestAlaitz GNo ratings yet

- Chapter 5 Exercises-Exercise BankDocument9 pagesChapter 5 Exercises-Exercise BankPATRICIUS ALAN WIRAYUDHA KUSUMNo ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- Marjon M. Lucero Bsais-4 Strategic Cost ManagementDocument4 pagesMarjon M. Lucero Bsais-4 Strategic Cost ManagementMarjon Maurillo LuceroNo ratings yet

- Midterm Review QuestionsDocument6 pagesMidterm Review QuestionsnamiyuartsNo ratings yet

- Minicases 5Document3 pagesMinicases 5dini sofiaNo ratings yet

- Onetake CutieeDocument4 pagesOnetake CutieeCleo Meguel AbogadoNo ratings yet

- AssignmentDocument5 pagesAssignmentOur Beatiful Waziristan OfficialNo ratings yet

- Income Statement: Format: Single Step: List All Revenues and SubtotalDocument2 pagesIncome Statement: Format: Single Step: List All Revenues and SubtotalRabia RabiaNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- Assignment No. 2 - Cash Flow Statement AnalysisDocument3 pagesAssignment No. 2 - Cash Flow Statement AnalysisNCF- Student Assistants' OrganizationNo ratings yet

- Assignment No. 2 - Cash Flow Statement AnalysisDocument3 pagesAssignment No. 2 - Cash Flow Statement AnalysisNCF- Student Assistants' OrganizationNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Accounts AIP FINALDocument14 pagesAccounts AIP FINALManthanNo ratings yet

- BT Ias1 (SV)Document3 pagesBT Ias1 (SV)HÀ THỚI NGUYỄN NGÂNNo ratings yet

- Perfect Practice SolutionDocument41 pagesPerfect Practice Solutionnarutevarsha5No ratings yet

- Final Revision Part 2 Language (2st)Document21 pagesFinal Revision Part 2 Language (2st)Magdy KamelNo ratings yet

- Sanchez Activity2.2Document5 pagesSanchez Activity2.2Carmina SanchezNo ratings yet

- Exercise No 1 (CGS CGM) - P SDocument11 pagesExercise No 1 (CGS CGM) - P SArun kumarNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingXen XeonNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- CE Interim ReportingDocument2 pagesCE Interim ReportingalyssaNo ratings yet

- Ma 2020Document8 pagesMa 2020Hamsa PNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- 05 Task Performance 1Document6 pages05 Task Performance 1Justine OrdonioNo ratings yet

- 04 Task Performance 1Document4 pages04 Task Performance 1Justine OrdonioNo ratings yet

- 06 Handout 1Document6 pages06 Handout 1Justine OrdonioNo ratings yet

- Why There's So Much ConflictDocument1 pageWhy There's So Much ConflictJustine OrdonioNo ratings yet

- 08 - Task - Performance - 1 - BENJAMIN 1Document4 pages08 - Task - Performance - 1 - BENJAMIN 1Justine OrdonioNo ratings yet

- Good Foreign Competitive Conditions Poor Foreign Competitive ConditionsDocument3 pagesGood Foreign Competitive Conditions Poor Foreign Competitive ConditionsJustine OrdonioNo ratings yet

- Ordonio - 08 Task Performance - Management ScienceDocument3 pagesOrdonio - 08 Task Performance - Management ScienceJustine OrdonioNo ratings yet

- 06 Task Performance 1Document3 pages06 Task Performance 1Justine OrdonioNo ratings yet

- Profit PlanningDocument43 pagesProfit PlanningLouiseNo ratings yet

- Problem-2.28 - & - 3.32 HMDocument8 pagesProblem-2.28 - & - 3.32 HMCorry MargarethaNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- Module 3 - Overhead Allocation and ApportionmentDocument55 pagesModule 3 - Overhead Allocation and Apportionmentkaizen4apexNo ratings yet

- CVPDocument9 pagesCVPClei UbandoNo ratings yet

- AAU Training ProgramsDocument44 pagesAAU Training ProgramskemimeNo ratings yet

- MANACC Module 1 Assignment No. 1.1Document4 pagesMANACC Module 1 Assignment No. 1.1Allana GuintoNo ratings yet

- Dustin Resume 7 10 14Document1 pageDustin Resume 7 10 14api-270322257No ratings yet

- Atswa Cost AccountingDocument504 pagesAtswa Cost Accountinggarba shuaibuNo ratings yet

- Introduction To Business and AccountingDocument25 pagesIntroduction To Business and AccountingNot Going to Argue Jesus is KingNo ratings yet

- Managerial Accounting - Chapter 2Document50 pagesManagerial Accounting - Chapter 2GiorgosDimopoulosNo ratings yet

- Capital StructureDocument19 pagesCapital StructureRatul HasanNo ratings yet

- Bastrcsx q1m Set BDocument9 pagesBastrcsx q1m Set BAdrian MontemayorNo ratings yet

- Job Description and Person Specification Finance Manager Aug 2015Document4 pagesJob Description and Person Specification Finance Manager Aug 2015MinMonica Ranoy SulivaNo ratings yet

- Is It Wise To Challenge The Usefulness of Cost andDocument3 pagesIs It Wise To Challenge The Usefulness of Cost andMomoh PessimaNo ratings yet

- Chapter 12 Standard Costing Nov 2020 2Document112 pagesChapter 12 Standard Costing Nov 2020 2Kunal KuvadiaNo ratings yet

- Fact PatternDocument1 pageFact PatternEl - loolNo ratings yet

- Process Cost System: Part I. Lecture and IllustrationDocument22 pagesProcess Cost System: Part I. Lecture and IllustrationMildred Angela DingalNo ratings yet

- Mixed PDFDocument8 pagesMixed PDFChris Tian FlorendoNo ratings yet

- Ch05-Job CostingDocument35 pagesCh05-Job Costingemanmaryum7No ratings yet

- Attachment Report FinalDocument25 pagesAttachment Report FinalkajakatajulioNo ratings yet

- Abc CostingDocument4 pagesAbc CostingHammad HussainNo ratings yet

- Chapter 4: Type of Cost: Direct Costs (Prime Costs) Indirect Costs (Overheads)Document8 pagesChapter 4: Type of Cost: Direct Costs (Prime Costs) Indirect Costs (Overheads)Claudia WongNo ratings yet