Professional Documents

Culture Documents

SME Trifolds

SME Trifolds

Uploaded by

Ravi KhandgeCopyright:

Available Formats

You might also like

- Metrobank Strama PaperDocument28 pagesMetrobank Strama PaperAnderei Acantilado67% (9)

- Metrobank - AnalysisDocument28 pagesMetrobank - AnalysisMeditacio Monto89% (27)

- Nclex Cheat SheetDocument6 pagesNclex Cheat SheetLeeAnn Marie100% (34)

- An Assessment of The Emirates NBD BankDocument25 pagesAn Assessment of The Emirates NBD BankHND Assignment Help100% (1)

- Case-Security Bank CorpDocument6 pagesCase-Security Bank CorpFernando VergaraNo ratings yet

- Cerenity SanitizerDocument14 pagesCerenity SanitizerAshwin KalraNo ratings yet

- JP Morgan AnalysisDocument4 pagesJP Morgan Analysishrushikesh keneNo ratings yet

- Uia UC1901 76146 7Document28 pagesUia UC1901 76146 7That Dude GageNo ratings yet

- Substructure Design & Intro Exercise TU DelftDocument62 pagesSubstructure Design & Intro Exercise TU DelftManish Shrivastava100% (1)

- Financing of SSIs in Developing CountriesDocument5 pagesFinancing of SSIs in Developing CountriesMd Ajmal malikNo ratings yet

- Chapter 1: Introduction: A. Company BackgroundDocument34 pagesChapter 1: Introduction: A. Company Backgroundwangyu roqueNo ratings yet

- Chapter 1: Introduction: A. Company BackgroundDocument30 pagesChapter 1: Introduction: A. Company Backgroundwangyu roqueNo ratings yet

- International Journal of Economics, Commerce and Management: United Kingdom Vol. II, Issue 6, 2014Document13 pagesInternational Journal of Economics, Commerce and Management: United Kingdom Vol. II, Issue 6, 2014PeterNo ratings yet

- The Future of Microfinance in IndiaDocument6 pagesThe Future of Microfinance in Indiaanushri2No ratings yet

- Performance Dynamics One BankDocument8 pagesPerformance Dynamics One BankZabed HussainNo ratings yet

- The Future of Microfinance in IndiaDocument3 pagesThe Future of Microfinance in IndiaSurbhi AgarwalNo ratings yet

- 08-11-24 Credit Scoring For SME LendingDocument36 pages08-11-24 Credit Scoring For SME LendingSimon MutekeNo ratings yet

- Introduction of BanksDocument4 pagesIntroduction of BanksNoman AnsariNo ratings yet

- Chapter One: 1.1. Back Ground of The StudyDocument46 pagesChapter One: 1.1. Back Ground of The StudyBobasa S AhmedNo ratings yet

- Metrobank Strama Paper, Group 3/M0531 Strategic Planning and Management: Group 3 Metropolitan Bank and Trust Company (METROBANK)Document28 pagesMetrobank Strama Paper, Group 3/M0531 Strategic Planning and Management: Group 3 Metropolitan Bank and Trust Company (METROBANK)sheila mae adayaNo ratings yet

- UNO Digital Bank Annual Report 2022Document65 pagesUNO Digital Bank Annual Report 2022tuando.bongbongNo ratings yet

- Small Industries Development Bank of India: Home Our Program Press & PublicationsDocument1 pageSmall Industries Development Bank of India: Home Our Program Press & PublicationsPraveen MorpakaNo ratings yet

- Global SME Finance Facility Progress Report 2012 2015Document42 pagesGlobal SME Finance Facility Progress Report 2012 2015Aarajita ParinNo ratings yet

- World Bank SME FinanceDocument8 pagesWorld Bank SME Financepaynow580No ratings yet

- Atif Bajwa InterviewDocument4 pagesAtif Bajwa Interviewtrillion5No ratings yet

- BCG Asean Digital Lending Can Turn The Dial On Financial Access For MsmesDocument14 pagesBCG Asean Digital Lending Can Turn The Dial On Financial Access For Msmesharsh.v.voraNo ratings yet

- Business Level Strategy of IFIC Bank MGT 490Document3 pagesBusiness Level Strategy of IFIC Bank MGT 490Shadman ShahadNo ratings yet

- An Analysis of Credit Management in The Nigerian Commercial Banks Chapter One To ThreeDocument44 pagesAn Analysis of Credit Management in The Nigerian Commercial Banks Chapter One To Threeabdulmalik saniNo ratings yet

- 2.5.3 Zenith Bank PLC HistoryDocument3 pages2.5.3 Zenith Bank PLC HistoryOyeleye TofunmiNo ratings yet

- IFC SME Banking Guide 2009Document80 pagesIFC SME Banking Guide 2009Chiemezie OhajiNo ratings yet

- Project of Commercial Banking: "Comparison of Islamic Bank and Conventional Bank Investment Activities"Document33 pagesProject of Commercial Banking: "Comparison of Islamic Bank and Conventional Bank Investment Activities"jannat2No ratings yet

- Factors Affecting Deposit MobilizationDocument13 pagesFactors Affecting Deposit MobilizationVu Minh ChauNo ratings yet

- Bus 424Document43 pagesBus 424davidechogaNo ratings yet

- Background of The StudyDocument4 pagesBackground of The Studymusing100% (1)

- Universal BankingDocument13 pagesUniversal BankingShrutikaKadamNo ratings yet

- SME Changemakers Asia PacificDocument4 pagesSME Changemakers Asia PacificHumphreyNo ratings yet

- 1.1 Origin of The Report: Prime Bank LimitedDocument93 pages1.1 Origin of The Report: Prime Bank LimitedAami TanimNo ratings yet

- Yes BankDocument2 pagesYes BankAmol KakdeNo ratings yet

- Yes Bank Case FinalDocument5 pagesYes Bank Case FinalSourav JainNo ratings yet

- Public BankDocument4 pagesPublic BankKhairul AslamNo ratings yet

- Internship Report On Global Ime Bank LimDocument32 pagesInternship Report On Global Ime Bank LimManju MaharaNo ratings yet

- Abstract The Objective of This Study Was To Examine The Factors Influence Credit Rationing by Commercial Banks in KenyaDocument8 pagesAbstract The Objective of This Study Was To Examine The Factors Influence Credit Rationing by Commercial Banks in KenyaMrxNo ratings yet

- IFIC Bank Full Review AssignmentDocument5 pagesIFIC Bank Full Review AssignmentJonaed Ashek Md. Robin100% (1)

- Financial Statement Analysis of Bank AsiDocument37 pagesFinancial Statement Analysis of Bank AsiFahim AlamNo ratings yet

- Swot AnalysisDocument6 pagesSwot Analysisbegaduhmetal100% (2)

- Kenya Digital RegsDocument6 pagesKenya Digital RegsThanasis DimasNo ratings yet

- Money and Capital Markets PresentationDocument29 pagesMoney and Capital Markets PresentationRashid MustahsanNo ratings yet

- Return On Assets RatioDocument21 pagesReturn On Assets RatioKaviya KaviNo ratings yet

- FinalDocument31 pagesFinalAniruddha RantuNo ratings yet

- METROBANKDocument28 pagesMETROBANKMa Teresa Angelyn100% (5)

- Bendigo Final ReportDocument26 pagesBendigo Final ReportHumayra Sharif0% (1)

- Summit Bank Final-1Document48 pagesSummit Bank Final-1ABDUL BASIT100% (2)

- Mummy Rodiah Report On Balogun Fulani Microfinance BankDocument26 pagesMummy Rodiah Report On Balogun Fulani Microfinance Bankmariamoyeniyi20No ratings yet

- Micro Finance: Mukesh Ranga Roll No. 078 GH BatchDocument14 pagesMicro Finance: Mukesh Ranga Roll No. 078 GH BatchMukesh KumarNo ratings yet

- Tutorial 5 AnswersDocument7 pagesTutorial 5 Answerskung siew houngNo ratings yet

- Chapter One: 1.1. Back Ground of The StudyDocument18 pagesChapter One: 1.1. Back Ground of The StudyReta TolesaNo ratings yet

- SIP SidbiDocument72 pagesSIP Sidbipalaksinghal100% (1)

- Swot AnalysisDocument7 pagesSwot AnalysisSikandar AkramNo ratings yet

- Annual Report 2021 202Document63 pagesAnnual Report 2021 202Datta KateNo ratings yet

- IndusInd Bank AnalysisDocument15 pagesIndusInd Bank AnalysisAvinash LoharNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Annual Report 2017 on EIB activity in Africa, the Caribbean and Pacific, and the overseas territoriesFrom EverandAnnual Report 2017 on EIB activity in Africa, the Caribbean and Pacific, and the overseas territoriesNo ratings yet

- Crane SafetyDocument166 pagesCrane Safetymordidomi100% (2)

- Luck-Key (2016)Document98 pagesLuck-Key (2016)samsung2k10No ratings yet

- Dominator 208 Mega IIIDocument31 pagesDominator 208 Mega IIIarmandsNo ratings yet

- Chemistry - Study of MatterDocument23 pagesChemistry - Study of MatterSachin KumarNo ratings yet

- Personal Profile: Jamia Mosque: I Have Done 2 Years of Voluntary Work in Central Jamia Mosque. in ThisDocument2 pagesPersonal Profile: Jamia Mosque: I Have Done 2 Years of Voluntary Work in Central Jamia Mosque. in ThisA.M NationNo ratings yet

- Talking To Teens About SextingDocument1 pageTalking To Teens About SextingActionNewsJaxNo ratings yet

- The Use of Chinese Taro (Xanthosoma Sagittifolium) As Source of BioplasticDocument24 pagesThe Use of Chinese Taro (Xanthosoma Sagittifolium) As Source of Bioplasticfantastic ladyNo ratings yet

- A Detailed Lesson Plan in Technology and Livelihood Education - Beauty Care (Nail Care)Document4 pagesA Detailed Lesson Plan in Technology and Livelihood Education - Beauty Care (Nail Care)Exequiel Macalisang Ramientos Jr.No ratings yet

- Nursing Consultation Applied To Hypertensive Clients: Application of Orem's Self-Care Theory AbstractsDocument16 pagesNursing Consultation Applied To Hypertensive Clients: Application of Orem's Self-Care Theory AbstractsRio RioNo ratings yet

- Application and Meter Selection: 1 Company NameDocument1 pageApplication and Meter Selection: 1 Company Namejammu_d_gr8No ratings yet

- Installation and Use Instructions: PatentedDocument32 pagesInstallation and Use Instructions: PatentedvizanteaNo ratings yet

- NTPC Project ReportDocument3 pagesNTPC Project Reportmeghshyam551No ratings yet

- Wendel Et Al. (2009) - Genetics and Genomics of CottonDocument20 pagesWendel Et Al. (2009) - Genetics and Genomics of CottonAna Luiza Atella de FreitasNo ratings yet

- Pickerlaza: A Website On Iot Based Garbage Collection SystemDocument20 pagesPickerlaza: A Website On Iot Based Garbage Collection SystemBeckyNo ratings yet

- Pdx8X Single and Dual Channel Din Rail Parking Detector User ManualDocument10 pagesPdx8X Single and Dual Channel Din Rail Parking Detector User ManualJose MorenoNo ratings yet

- Wrokbook For Science Week 2Document10 pagesWrokbook For Science Week 2Honeyjo NetteNo ratings yet

- LifeSaver Bottle Instruction Manual 1Document13 pagesLifeSaver Bottle Instruction Manual 1VladimirNo ratings yet

- Philips Wireless Phone Jack Model PH0900 (PX211 D Rev 2.2)Document29 pagesPhilips Wireless Phone Jack Model PH0900 (PX211 D Rev 2.2)chapicab6211No ratings yet

- Test Planner - Lakshya NEET 2024 - (Only PDFDocument2 pagesTest Planner - Lakshya NEET 2024 - (Only PDFdakshahirwar0708No ratings yet

- Paid Payback (091 120)Document30 pagesPaid Payback (091 120)sabaebrahimii83No ratings yet

- Malocclusion: Professor Nabeel ShamaaDocument14 pagesMalocclusion: Professor Nabeel ShamaaAhmed HegazyNo ratings yet

- Batteries PresentationDocument24 pagesBatteries PresentationGajendraPatelNo ratings yet

- Clinical Oncology AssignmentDocument10 pagesClinical Oncology Assignmentapi-635186395No ratings yet

- Bitter Kola Nut and Edulis Trees Production To ConsumptionDocument125 pagesBitter Kola Nut and Edulis Trees Production To Consumptionalkhwarizmi1968100% (1)

- U11 BMW X1 SAV Sales BrochureDocument32 pagesU11 BMW X1 SAV Sales BrochureJCNo ratings yet

- GB Syndrome and Other: Immune Mediated NeuropathiesDocument82 pagesGB Syndrome and Other: Immune Mediated NeuropathiesTeena ChandranNo ratings yet

SME Trifolds

SME Trifolds

Uploaded by

Ravi KhandgeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SME Trifolds

SME Trifolds

Uploaded by

Ravi KhandgeCopyright:

Available Formats

Client Highlights

Saigon Thuong Tin CommerCial JoinT SToCk Bank (SaCom Bank) VieTnam

objective and Client needs: Sacombank is the largest Joint Stock Commercial Bank in terms of distribution network in Vietnam. It has built a successful niche as a lender to retail and SME clients. IFC has partnered with Sacombank since 2002, providing both investment and advisory services. iFCs response and results: IFCs investment has helped Sacombank support its continued growth, particularly in the areas of SME financing, mortgage lending, trade finance, and investing in branch expansion and technology. IFC has provided Sacombank with advisory services to improve its business operations, outreach to SMEs, delivery channels, product development, reporting policies and procedures, management information system, and data centers. IFC has provided on-site training courses for bank staff and advice on the organizational adjustments necessary to strengthen the banks efficiency and enhance its operational risk management system. Development impact: Sacombank has increased its number of loans to MSMEs by 60 percent and its MSME portfolio volume by 68 percent per year on average. As of December 31, 2007, the bank had an outstanding MSME portfolio of 5,385 loans (of which 84.4 percent was in SME loans), worth a total of $498.8 million (of which 99 percent was for SMEs). Tran Xuan huy, Ceo, Sacombank: The IFC advisory services that started in 2006 have significantly assisted us in improving our business processes and organizational ability. After two years, the advisory service components provided tangible results. We look forward to IFC enabling Sacombank to improve its capacity to manage risks while continuing to be highly profitable.

IFC: The Partner Of Choice

hamkorBank uzBekiSTan

objective and Client needs: Hamkorbank, established in 1991, is a private bank focused on serving micro and small businesses. It has been undergoing a transformation into a nationwide FI with 24 branches across the country. IFC has partnered with Hamkorbank since 2001, providing both investments and advisory services. iFCs response and results: IFC committed $1 million in 2001, and another $3 million in 2006 in debt. To strengthen the banks capacity, IFC has supported Hamkorbank in its institution building efforts over a number of years. IFC advisory services focused on improving the lending processes, introducing risk management, improving asset and liability management and treasury operations, establishing human resource management, and upgrading the management information systems. IFC has provided Hamkorbank with advisory services to introduce leasing as a new financial product. Development impact: As of December 31, 2007, the bank had 6,510 MSME loans (of which 10.2 percent were SME loans), worth a total of $45 million (of which 61.3 percent was for SMEs). The bank grew its MSME portfolio by 34 percent in terms of number of loans and by 165 percent in volume from 2005 to 2007.

IFC, a member of the World Bank Group, creates opportunity for people to escape poverty and improve their lives. We foster sustainable economic growth in developing countries by supporting private sector development, mobilizing private capital, and providing advisory and risk mitigation services to businesses and governments. Our new investments totaled $16.2 billion in fiscal 2008, a 34 percent increase over the previous year.

our ShareD ViSion is that people should have the

opportunity to escape poverty and improve their lives.

iFC: key FaCTS

Credit rating: Triple-A (Moodys, Standard & Poors) Portfolio: $25.4 billion, representing 1,410 investments in 116 countries (as of June 30, 2007) Total Staff: Approximately 3,100 (50 percent of whom are based outside of Washington, D.C.) number of Transactions Committed in Fiscal year 2007: 299 industry Coverage: Global financial markets; private equity and investment funds Global manufacturing and services; agribusiness; health and education Infrastructure; information and communication technologies; oil, gas, mining and chemicals; subnational finance

our Core ValueS are

Excellence Commitment Integrity Teamwork

SME Banking

oPPorTuniTieS in FinanCial markeTS

our PurPoSe is to

Promote open and competitive markets in developing countries Support companies and other private sector partners Generate productive jobs and deliver basic services Create opportunities for people to escape poverty and improve their lives

key Contacts

ghada Teima Program Manager, Specialist (Global) GTeima@ifc.org Paul rusten Principal Banking, Specialist (Global) PRusten@ifc.org

Bank muSCaT oman

objective and Client needs: Bank Muscat is the largest bank in Oman by total assets and market capitalization. The bank has been undergoing significant geographic expansion as well as increased diversification of its product offerings, especially in the SME lending area. IFC has partnered with Bank Muscat since 2006, providing both investments and advisory services. iFCs response and results: IFC committed $100 million in debt. It has helped Bank Muscat transform itself into a strong regional bank with adequate capitalization to support its expansion programs in Africa, the Middle East and North Africa, and South Asia. IFC also provided Bank Muscat with advisory services to help it develop and expand profitable SME lending operations, fostering SME lending in Oman. Development impact: As of December 31, 2007, the bank had 1,666 SME loan clients, worth a total of $161.1 million. The bank grew its SME portfolio by 40 percent in terms of number of loans and 221 percent in volume from 2006 to 2007. abdul razzak ali issa, Ceo, Bank muscat: In June 2006, in order to strategically position ourselves in the SME market, we signed an agreement with IFC to technically assist the bank to expand our SME business and customer base. This program included six modules and was successfully completed in May 2007. Many of the final recommendations have already been implemented.

iFC 2121 Pennsylvania Ave., NW Washington, D.C. 20433, USA ifc.org/gfm

ibragimov ikrom, Chairman of the Board, hamkorbank: The establishment and development of relations with IFC provided new business opportunities for Hamkorbank and its clients. Financial partnership with IFC served as a factor in the extension of the client base of OJSCB Hamkorbank, and it provided active work with small and medium enterprises, a major element of the banks strategy for development. We greatly appreciate the ability of IFC to share its skills and experiences with OJSCB Hamkorbank, through investment and advisory services.

We acknowledge support from our donors: netherlands

norway

2008

IFCs SME Banking Value Proposition

IFC is the leading investor in banks and other FIs in emerging markets. IFC offers both Investments and Advisory Services for FIs providing SME banking services to their clients.

Investment Services

Loans include senior, subordinated, and convertible loans and can be fixed or variable rate. Equity investments represent investment in share capital of SME banks, as a minority shareholder.

market segment can increase their access to financial services and generate more employment opportunities and income.

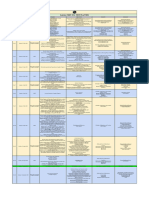

iFCs global investments in Financial intermediaries Providing Sme Banking

1,800 1,600 1,400 US$ Millions 1,200 1000 800 600 400 200 0

Advisory Services

As part of its development mission, IFC has positioned itself as a leader in providing advisory services that strengthen the capacity of FIs to downscale and adopt international best practices. In 2007, IFC launched the Global SME Banking Program. The program aims to have a broad and global impact on providing access to SME financial services in the developing world. Unmet demand exists in the area between micro and corporate banking, given that SMEs have largely remained an untapped market in most developing economies. IFC works to reduce the SME finance gap by providing instituion building services and disseminating of best practices to efficiently target the SME segment.

The Case for SME Banking

Small and medium enterprises (SMEs) are critical for the economic and social development of the emerging markets. They play a major role in creating jobs and generating income for lowincome people; they foster economic growth, social stability, and contribute to the development of a dynamic private sector. As such, access to financial services is vital in developing a vibrant SME sector in any economy. In many emerging markets, however, access to financial services for SMEs remains severely constrained. Most financial intermediaries (FIs) have hesitated to target this sector. Banks, which have traditionally served the corporate and large segments of the market, view SMEs as a challenge because of information asymmetry, lack of collateral, and the higher cost of serving smaller transactions. However, as corporate banking margins continue to shrink and increasing fiscal restraint lowers yields on government borrowings, banks have begun to assess the opportunities offered by SMEs. Providing banking services to this underserved SME

Quasi-equity investments include subordinated loans and income notes, which normally rank junior to loans in the event of a liquidation, and frequently are counted as Tier 2 capital for regulatory purposes. Risk management products include guarantees on cross-border bank loans, bond issues, and other debt service obligations, as well as guarantees on client undertakings, such as performance bonds.

role of Sme Banking in iFC access to Finance

Financial Infrastructure

GlOBAl SME BANkING PROGRAM ACTIVITIES

Promote SME banking by providing institution building services to FIs: Design an SME-focused organization and strategy; Segment clients and build a strong value proposition in product offering and brand; Standardise products and processes; Optimize delivery-cost of products and services through appropriate delivery channels; Create a strong sales culture; Implement independent and objective risk management systems, processes; Use credit scoring and rating tools for risk appraisal, underwriting, process streamlining, and risk-based pricing; and Leverage technology to reduce the cost of services. Develop best practice tools and standards to efficiently target the SME segment: IFC SME Banking CHECK toolkit: conducts a comprehensive assessment of FIs performance in more than 100 competencies; and The SME Banking Benchmarking Survey: is a web-based survey available to all banks in emerging markets interested in benchmarking themselves against SME banking practices of their peers. Build knowledge management and disseminate information Establish a core set of qualitative and quantitative benchmarks to promote SME Banking in emerging markets; Use SME Banking Benchmarking Survey results to monitor and disseminate information on the evolution of global SME banking operations and trends; and Organize local, regional, and international outreach events, and share and disseminate lessons learned about SME banking and best practices around the world.

Portfolio amounts of iFCs Sme Financial intermediaries Clients

700 600 500 $70,000 $60,000 $50,000 $40,000 $30,000 $20,000 $10,000 $0

Millions

0.1%

Corporate & Multinationals Large Businesses Medium Businesses Small Businesses Micro Businesses

0.9%

Banks Primary Target

FY00

FY01

FY02

FY03

FY04

FY05

FY06

FY07

FY08

Central and Eastern Europe South Asia Middle East and North Africa WORLD

East Asia and Pacific Southern Europe and Central Asia Latin America & Caribbean Sub-Saharan Africa

510%

20%

THE SME FINANCE GAP Micro Finance

6575%

Traditional banks typically target only a fragment of the market

LT Finance

IFC Ventures

Equipment Finance

Leasing

Increase access to finance in developing countries by building capacity of financial infrastructure, financial markets, and FIs.

Working Capital

Micro Finance Finance Informal/Smaller Formal/Larger

Sme Contribution to gDP and employment

THE SME BANkING OPPORTUNITy

The SME market is becoming increasingly attractive as competition increases for more established corporate clients.

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Korea South Africa India Philippines Egypt Morocco

SMEs provide a new target market and business development opportunities which diversify the banks portfolio. The SME market is large, with a potential for significant growth, and still largely underserved in most emerging markets. SMEs offer an opportunity for portfolio diversification as they are active in various industry sectors and geographic locations. An SME portfolio generates a stable income and requires less complex asset-liability management at the portfolio level. SMEs are integrated ino the rest of the economy, providing cross-selling opportunities.

Regional Presence - Global Impact

IFC operates in Central and Eastern Europe, Southern Europe & Central Asia, Latin America & the Caribbean, Middle East & North Africa, Sub-Saharan Africa, and South Asia. IFC SME banking advisory services focus on supporting FIs in more and less developed countries, with a focus on IDA countries and frontier regions.

IFC is the leading international investor in private sector banks and FIs in emerging markets. As a result of our investments and advisory services IFCs 121 SME banking clients provided $75 billion in financing to an

Thousands

400 300 200 100 0

GDP

Employment

estimated 818,168 small and medium enterprise owners.

IFCs outstanding portfolio in FIs was $9.9 billion, of which 55 percent was in SME FIs, as of June 30, 2008. As of beginning 2008, IFC had 86 SME banking advisory services projects, totaling $115 million, and representing 42

Small Loans

Number of Loans

Medium Loans

Volume (US$)

percent of total funds committed for access to finance projects.

Creating opportunity and developing employment drives IFCs work with FIs. Working with FIs to improve access to financial services for SMEs we leverage IFCs finance and knowledge to generate employment opportunities in emerging markets.

You might also like

- Metrobank Strama PaperDocument28 pagesMetrobank Strama PaperAnderei Acantilado67% (9)

- Metrobank - AnalysisDocument28 pagesMetrobank - AnalysisMeditacio Monto89% (27)

- Nclex Cheat SheetDocument6 pagesNclex Cheat SheetLeeAnn Marie100% (34)

- An Assessment of The Emirates NBD BankDocument25 pagesAn Assessment of The Emirates NBD BankHND Assignment Help100% (1)

- Case-Security Bank CorpDocument6 pagesCase-Security Bank CorpFernando VergaraNo ratings yet

- Cerenity SanitizerDocument14 pagesCerenity SanitizerAshwin KalraNo ratings yet

- JP Morgan AnalysisDocument4 pagesJP Morgan Analysishrushikesh keneNo ratings yet

- Uia UC1901 76146 7Document28 pagesUia UC1901 76146 7That Dude GageNo ratings yet

- Substructure Design & Intro Exercise TU DelftDocument62 pagesSubstructure Design & Intro Exercise TU DelftManish Shrivastava100% (1)

- Financing of SSIs in Developing CountriesDocument5 pagesFinancing of SSIs in Developing CountriesMd Ajmal malikNo ratings yet

- Chapter 1: Introduction: A. Company BackgroundDocument34 pagesChapter 1: Introduction: A. Company Backgroundwangyu roqueNo ratings yet

- Chapter 1: Introduction: A. Company BackgroundDocument30 pagesChapter 1: Introduction: A. Company Backgroundwangyu roqueNo ratings yet

- International Journal of Economics, Commerce and Management: United Kingdom Vol. II, Issue 6, 2014Document13 pagesInternational Journal of Economics, Commerce and Management: United Kingdom Vol. II, Issue 6, 2014PeterNo ratings yet

- The Future of Microfinance in IndiaDocument6 pagesThe Future of Microfinance in Indiaanushri2No ratings yet

- Performance Dynamics One BankDocument8 pagesPerformance Dynamics One BankZabed HussainNo ratings yet

- The Future of Microfinance in IndiaDocument3 pagesThe Future of Microfinance in IndiaSurbhi AgarwalNo ratings yet

- 08-11-24 Credit Scoring For SME LendingDocument36 pages08-11-24 Credit Scoring For SME LendingSimon MutekeNo ratings yet

- Introduction of BanksDocument4 pagesIntroduction of BanksNoman AnsariNo ratings yet

- Chapter One: 1.1. Back Ground of The StudyDocument46 pagesChapter One: 1.1. Back Ground of The StudyBobasa S AhmedNo ratings yet

- Metrobank Strama Paper, Group 3/M0531 Strategic Planning and Management: Group 3 Metropolitan Bank and Trust Company (METROBANK)Document28 pagesMetrobank Strama Paper, Group 3/M0531 Strategic Planning and Management: Group 3 Metropolitan Bank and Trust Company (METROBANK)sheila mae adayaNo ratings yet

- UNO Digital Bank Annual Report 2022Document65 pagesUNO Digital Bank Annual Report 2022tuando.bongbongNo ratings yet

- Small Industries Development Bank of India: Home Our Program Press & PublicationsDocument1 pageSmall Industries Development Bank of India: Home Our Program Press & PublicationsPraveen MorpakaNo ratings yet

- Global SME Finance Facility Progress Report 2012 2015Document42 pagesGlobal SME Finance Facility Progress Report 2012 2015Aarajita ParinNo ratings yet

- World Bank SME FinanceDocument8 pagesWorld Bank SME Financepaynow580No ratings yet

- Atif Bajwa InterviewDocument4 pagesAtif Bajwa Interviewtrillion5No ratings yet

- BCG Asean Digital Lending Can Turn The Dial On Financial Access For MsmesDocument14 pagesBCG Asean Digital Lending Can Turn The Dial On Financial Access For Msmesharsh.v.voraNo ratings yet

- Business Level Strategy of IFIC Bank MGT 490Document3 pagesBusiness Level Strategy of IFIC Bank MGT 490Shadman ShahadNo ratings yet

- An Analysis of Credit Management in The Nigerian Commercial Banks Chapter One To ThreeDocument44 pagesAn Analysis of Credit Management in The Nigerian Commercial Banks Chapter One To Threeabdulmalik saniNo ratings yet

- 2.5.3 Zenith Bank PLC HistoryDocument3 pages2.5.3 Zenith Bank PLC HistoryOyeleye TofunmiNo ratings yet

- IFC SME Banking Guide 2009Document80 pagesIFC SME Banking Guide 2009Chiemezie OhajiNo ratings yet

- Project of Commercial Banking: "Comparison of Islamic Bank and Conventional Bank Investment Activities"Document33 pagesProject of Commercial Banking: "Comparison of Islamic Bank and Conventional Bank Investment Activities"jannat2No ratings yet

- Factors Affecting Deposit MobilizationDocument13 pagesFactors Affecting Deposit MobilizationVu Minh ChauNo ratings yet

- Bus 424Document43 pagesBus 424davidechogaNo ratings yet

- Background of The StudyDocument4 pagesBackground of The Studymusing100% (1)

- Universal BankingDocument13 pagesUniversal BankingShrutikaKadamNo ratings yet

- SME Changemakers Asia PacificDocument4 pagesSME Changemakers Asia PacificHumphreyNo ratings yet

- 1.1 Origin of The Report: Prime Bank LimitedDocument93 pages1.1 Origin of The Report: Prime Bank LimitedAami TanimNo ratings yet

- Yes BankDocument2 pagesYes BankAmol KakdeNo ratings yet

- Yes Bank Case FinalDocument5 pagesYes Bank Case FinalSourav JainNo ratings yet

- Public BankDocument4 pagesPublic BankKhairul AslamNo ratings yet

- Internship Report On Global Ime Bank LimDocument32 pagesInternship Report On Global Ime Bank LimManju MaharaNo ratings yet

- Abstract The Objective of This Study Was To Examine The Factors Influence Credit Rationing by Commercial Banks in KenyaDocument8 pagesAbstract The Objective of This Study Was To Examine The Factors Influence Credit Rationing by Commercial Banks in KenyaMrxNo ratings yet

- IFIC Bank Full Review AssignmentDocument5 pagesIFIC Bank Full Review AssignmentJonaed Ashek Md. Robin100% (1)

- Financial Statement Analysis of Bank AsiDocument37 pagesFinancial Statement Analysis of Bank AsiFahim AlamNo ratings yet

- Swot AnalysisDocument6 pagesSwot Analysisbegaduhmetal100% (2)

- Kenya Digital RegsDocument6 pagesKenya Digital RegsThanasis DimasNo ratings yet

- Money and Capital Markets PresentationDocument29 pagesMoney and Capital Markets PresentationRashid MustahsanNo ratings yet

- Return On Assets RatioDocument21 pagesReturn On Assets RatioKaviya KaviNo ratings yet

- FinalDocument31 pagesFinalAniruddha RantuNo ratings yet

- METROBANKDocument28 pagesMETROBANKMa Teresa Angelyn100% (5)

- Bendigo Final ReportDocument26 pagesBendigo Final ReportHumayra Sharif0% (1)

- Summit Bank Final-1Document48 pagesSummit Bank Final-1ABDUL BASIT100% (2)

- Mummy Rodiah Report On Balogun Fulani Microfinance BankDocument26 pagesMummy Rodiah Report On Balogun Fulani Microfinance Bankmariamoyeniyi20No ratings yet

- Micro Finance: Mukesh Ranga Roll No. 078 GH BatchDocument14 pagesMicro Finance: Mukesh Ranga Roll No. 078 GH BatchMukesh KumarNo ratings yet

- Tutorial 5 AnswersDocument7 pagesTutorial 5 Answerskung siew houngNo ratings yet

- Chapter One: 1.1. Back Ground of The StudyDocument18 pagesChapter One: 1.1. Back Ground of The StudyReta TolesaNo ratings yet

- SIP SidbiDocument72 pagesSIP Sidbipalaksinghal100% (1)

- Swot AnalysisDocument7 pagesSwot AnalysisSikandar AkramNo ratings yet

- Annual Report 2021 202Document63 pagesAnnual Report 2021 202Datta KateNo ratings yet

- IndusInd Bank AnalysisDocument15 pagesIndusInd Bank AnalysisAvinash LoharNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Annual Report 2017 on EIB activity in Africa, the Caribbean and Pacific, and the overseas territoriesFrom EverandAnnual Report 2017 on EIB activity in Africa, the Caribbean and Pacific, and the overseas territoriesNo ratings yet

- Crane SafetyDocument166 pagesCrane Safetymordidomi100% (2)

- Luck-Key (2016)Document98 pagesLuck-Key (2016)samsung2k10No ratings yet

- Dominator 208 Mega IIIDocument31 pagesDominator 208 Mega IIIarmandsNo ratings yet

- Chemistry - Study of MatterDocument23 pagesChemistry - Study of MatterSachin KumarNo ratings yet

- Personal Profile: Jamia Mosque: I Have Done 2 Years of Voluntary Work in Central Jamia Mosque. in ThisDocument2 pagesPersonal Profile: Jamia Mosque: I Have Done 2 Years of Voluntary Work in Central Jamia Mosque. in ThisA.M NationNo ratings yet

- Talking To Teens About SextingDocument1 pageTalking To Teens About SextingActionNewsJaxNo ratings yet

- The Use of Chinese Taro (Xanthosoma Sagittifolium) As Source of BioplasticDocument24 pagesThe Use of Chinese Taro (Xanthosoma Sagittifolium) As Source of Bioplasticfantastic ladyNo ratings yet

- A Detailed Lesson Plan in Technology and Livelihood Education - Beauty Care (Nail Care)Document4 pagesA Detailed Lesson Plan in Technology and Livelihood Education - Beauty Care (Nail Care)Exequiel Macalisang Ramientos Jr.No ratings yet

- Nursing Consultation Applied To Hypertensive Clients: Application of Orem's Self-Care Theory AbstractsDocument16 pagesNursing Consultation Applied To Hypertensive Clients: Application of Orem's Self-Care Theory AbstractsRio RioNo ratings yet

- Application and Meter Selection: 1 Company NameDocument1 pageApplication and Meter Selection: 1 Company Namejammu_d_gr8No ratings yet

- Installation and Use Instructions: PatentedDocument32 pagesInstallation and Use Instructions: PatentedvizanteaNo ratings yet

- NTPC Project ReportDocument3 pagesNTPC Project Reportmeghshyam551No ratings yet

- Wendel Et Al. (2009) - Genetics and Genomics of CottonDocument20 pagesWendel Et Al. (2009) - Genetics and Genomics of CottonAna Luiza Atella de FreitasNo ratings yet

- Pickerlaza: A Website On Iot Based Garbage Collection SystemDocument20 pagesPickerlaza: A Website On Iot Based Garbage Collection SystemBeckyNo ratings yet

- Pdx8X Single and Dual Channel Din Rail Parking Detector User ManualDocument10 pagesPdx8X Single and Dual Channel Din Rail Parking Detector User ManualJose MorenoNo ratings yet

- Wrokbook For Science Week 2Document10 pagesWrokbook For Science Week 2Honeyjo NetteNo ratings yet

- LifeSaver Bottle Instruction Manual 1Document13 pagesLifeSaver Bottle Instruction Manual 1VladimirNo ratings yet

- Philips Wireless Phone Jack Model PH0900 (PX211 D Rev 2.2)Document29 pagesPhilips Wireless Phone Jack Model PH0900 (PX211 D Rev 2.2)chapicab6211No ratings yet

- Test Planner - Lakshya NEET 2024 - (Only PDFDocument2 pagesTest Planner - Lakshya NEET 2024 - (Only PDFdakshahirwar0708No ratings yet

- Paid Payback (091 120)Document30 pagesPaid Payback (091 120)sabaebrahimii83No ratings yet

- Malocclusion: Professor Nabeel ShamaaDocument14 pagesMalocclusion: Professor Nabeel ShamaaAhmed HegazyNo ratings yet

- Batteries PresentationDocument24 pagesBatteries PresentationGajendraPatelNo ratings yet

- Clinical Oncology AssignmentDocument10 pagesClinical Oncology Assignmentapi-635186395No ratings yet

- Bitter Kola Nut and Edulis Trees Production To ConsumptionDocument125 pagesBitter Kola Nut and Edulis Trees Production To Consumptionalkhwarizmi1968100% (1)

- U11 BMW X1 SAV Sales BrochureDocument32 pagesU11 BMW X1 SAV Sales BrochureJCNo ratings yet

- GB Syndrome and Other: Immune Mediated NeuropathiesDocument82 pagesGB Syndrome and Other: Immune Mediated NeuropathiesTeena ChandranNo ratings yet