Professional Documents

Culture Documents

Chap 14 1-2

Chap 14 1-2

Uploaded by

Buenaventura, Lara Jane T.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 14 1-2

Chap 14 1-2

Uploaded by

Buenaventura, Lara Jane T.Copyright:

Available Formats

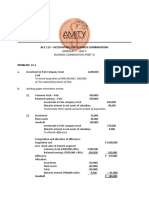

Chapter 14 – Consolidated Statement of Financial Position – Date of Acquisition Page 1 of 4

PROBLEM 14-1

On May 1, 2017, Polo Corporation paid P1,080,000 to stockholders of Solo Company for 90% of

Solo’s 100,000 outstanding shares of no-par common stock but with a fair value of P12 per

share. In addition, Polo Corporation paid acquisition-related costs of the combination totaling

P50,000 on that date. Book values and current values of Solo Company’s identifiable net assets

on May 1, 2017, were as follows:

Common stock P 400,000

Retained earnings 500,000

Total net assets at book value 900,000

Add: Difference between current fair value and book

value

Inventories 30,000

Property and equipment (net) 60,000

Total current fair value of identifiable net assets P 990,000

Required:

1. Prepare journal entries for Polo Corporation on May 1, 2017 to record the acquisition of

stock from Polo Company.

2. Prepare a working elimination entry for Polo Corporation and subsidiary on May 1, 2017.

SOLUTION:

1. Investment in Solo Company stock 1,080,000

Cash 1,080,000

To record acquisition of 90% of the outstanding shares of Solo.

Retained earnings – Polo Company 50,000

Cash 50,000

To record acquisition-related costs direct to retained earnings of Polo

Company.

Chapter 14 – Consolidated Statement of Financial Position – Date of Acquisition Page 2 of 4

2. Working paper elimination entries:

(1) Common stock – Solo 400,000

Retained earnings – Solo 500,000

Investment in Solo Company stock 810,000

Non-controlling interest 90,000

To eliminate Solo’s equity accounts at date of acquisition.

(2) Inventories 30,000

Property and Equipment 60,000

Goodwill 210,000

Investment in Solo Company stock 270,000

Non-controlling interest 30,000

To allocate excess

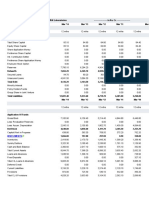

Determination and Allocation of Excess Schedule:

Total Parent (90%) NCI (10%)

Company fair value P1,200,000 P1,080,000 P120,000*

Less BV of interest acquired:

Common stock 400,000

Retained earnings 500,000

Total equity 900,000 P 900,000 P900,000

Interest acquired 90% 10%

Book value P 810,000 P 90,000

Excess P 300,000 P 270,000 P 30,000

Adjustments:

Inventory (30,000)

Plant assets (60,000)

Goodwill P 210,000

* (P1,080,000/90%) x 10% = P120,000

Chapter 14 – Consolidated Statement of Financial Position – Date of Acquisition Page 3 of 4

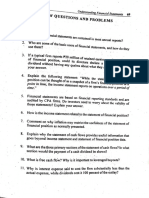

PROBLEM 14-2

The January 1, 2017 statement of financial position of Sotto Company at book and market

values are as follows:

Book Value Fair Value

Current assets P 800,000 P 750,000

Property and equipment (net) 900,000 1,000,000

Total assets P 1,700,000 P 1,750,000

Current liabilities P 300,000 P 300,000

Long-term liabilities 500,000 460,000

Common stock, P1 par 100,000

Additional paid-in capital 200,000

Retained earnings 600,000

Total liabilities and stockholders’ equity P 1,700,000

Pedro Company paid P950,000 in cash for 80% of Sotto Company’s common stock. Pedro

Company also paid P80,000 of professional fees to effect the combination. The fair value of the

NCI is assessed to be P230,000.

Required:

1. Prepare journal entry on Pedro Company’s books to record the acquisition of the Sotto

Company’s stock.

2. Prepare a determination and allocation of excess schedule.

3. Prepare the working paper elimination entries.

SOLUTION

1.

Investment in Sotto Company 950,000

Cash 950,000

To record acquisition of 80% stock of Sotto.

Retained earnings – Pedro Company 80,000

Cash 80,000

To record acquisition costs.

2. Price paid by the Parent Company P950,000

Non-controlling interest (NCI) 230,000

Total 1,180,000

Less: Book value of net assets 900,000

Excess 280,000

Allocation:

Current assets P 50,000

Property and equipment (100,000)

Long-term debt ( 40,000) ( 90,000)

Goodwill P190,000

Chapter 14 – Consolidated Statement of Financial Position – Date of Acquisition Page 4 of 4

3. Working paper elimination entries:

(1) Common stock – Sotto 100,000

APIC – Sotto 200,000

Retained earnings – Sotto 600,000

Investment in Sotto stock 720,000

Non-controlling interest 180,000

To eliminate equity accounts of Sotto at date ofacquisition.

(2) Property and equipment 100,000

Goodwill 190,000

Long-term debt 40,000

Current assets 50,000

Investment in Sotto stock 230,000

Non-controlling interest 50,000

To allocate excess

You might also like

- Hock Section A QuestionsDocument103 pagesHock Section A QuestionsMustafa AroNo ratings yet

- Chapter 10 - Common Stock ValuationDocument14 pagesChapter 10 - Common Stock ValuationNaweera Adnan100% (1)

- TAMAM - ISACA COBIT 5 Foundation - Principle1Document31 pagesTAMAM - ISACA COBIT 5 Foundation - Principle1Erdem EnustNo ratings yet

- MODULE-FinalTerm-FAR 3-Operating Segment, Interim Reporting & Events After Reporting PeriodDocument16 pagesMODULE-FinalTerm-FAR 3-Operating Segment, Interim Reporting & Events After Reporting PeriodJohn Mark FernandoNo ratings yet

- Famba 8e - SM - Mod 02 - 040220 1Document25 pagesFamba 8e - SM - Mod 02 - 040220 1Shady Mohsen MikhealNo ratings yet

- Installment SalesDocument2 pagesInstallment SalesNeil Christian LiwanagNo ratings yet

- MSN BalacesheetsDocument16 pagesMSN BalacesheetsnawazNo ratings yet

- Reminder: Use Your Official Answer Sheet: Universidad de ManilaDocument25 pagesReminder: Use Your Official Answer Sheet: Universidad de ManilaMarcellana ArianeNo ratings yet

- Long-Term Liabilities: Multiple ChoiceDocument28 pagesLong-Term Liabilities: Multiple ChoiceJulius Lester AbieraNo ratings yet

- Chapter 10 Installment Sales AccountingDocument13 pagesChapter 10 Installment Sales AccountingFaithful FighterNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument4 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Chapter 7 Other Valuation Concepts and TechniquesDocument10 pagesChapter 7 Other Valuation Concepts and TechniquesMaurice Agbayani100% (1)

- 3007 Effects of Changes in Foreign Currency RatesDocument7 pages3007 Effects of Changes in Foreign Currency RatesTatianaNo ratings yet

- ADV ACC TBch06Document21 pagesADV ACC TBch06hassan nassereddineNo ratings yet

- Ifrs 9 Debt Investment IllustrationDocument9 pagesIfrs 9 Debt Investment IllustrationVatchdemonNo ratings yet

- BIOLOGICAL ASSETS REVIEW MATERIALS DocxDocument7 pagesBIOLOGICAL ASSETS REVIEW MATERIALS Docxjek vinNo ratings yet

- Laura Taylor Wholesale Distributor WorksheetDocument3 pagesLaura Taylor Wholesale Distributor WorksheetHope Trinity EnriquezNo ratings yet

- 7106 - Biological AssetDocument2 pages7106 - Biological AssetGerardo YadawonNo ratings yet

- Discussion Material On Partnership Liquidation1Document4 pagesDiscussion Material On Partnership Liquidation1Ludovice XarinaNo ratings yet

- IAII FINAL EXAM Maual SET BDocument9 pagesIAII FINAL EXAM Maual SET BClara MacallingNo ratings yet

- Standard Unmodified Auditor ReportDocument3 pagesStandard Unmodified Auditor ReportRiz WanNo ratings yet

- Fin Man Case Study On Fs AnalysisDocument6 pagesFin Man Case Study On Fs AnalysisRechelleNo ratings yet

- 2comprehensive Case SamplingDocument3 pages2comprehensive Case SamplingLee TeukNo ratings yet

- Budget Problems-Homework Help1Document1 pageBudget Problems-Homework Help1Ryoma EchizenNo ratings yet

- Chapter 5 Review Questions and ProblemsDocument11 pagesChapter 5 Review Questions and ProblemsLars FriasNo ratings yet

- Rights and Remedies of The Government Under The NIRC: I. Power of The Bir To Obtain Information and Make An AssessmentDocument24 pagesRights and Remedies of The Government Under The NIRC: I. Power of The Bir To Obtain Information and Make An AssessmentPau SaulNo ratings yet

- Nobles Acct10 Tif 21Document205 pagesNobles Acct10 Tif 21Marqaz MarqazNo ratings yet

- Answer Key Chapter 20Document4 pagesAnswer Key Chapter 20NCTNo ratings yet

- Genesis' Trial Balance Reflected The FollowingDocument1 pageGenesis' Trial Balance Reflected The FollowingQueen ValleNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersHazel Pacheco100% (1)

- PDF Intermediate Accounting Volume 3 ValixDocument4 pagesPDF Intermediate Accounting Volume 3 ValixJosh Cruz CosNo ratings yet

- Business Combination at The Date of AcquisitionDocument2 pagesBusiness Combination at The Date of AcquisitionClaire CadornaNo ratings yet

- NOTESDocument53 pagesNOTESirahQNo ratings yet

- Chapter 8 Activity/Assignment: 1. On January 1, 20x1, The Biological Assets of Entity A Consist of Two 1-Year OldDocument1 pageChapter 8 Activity/Assignment: 1. On January 1, 20x1, The Biological Assets of Entity A Consist of Two 1-Year OldRandelle James FiestaNo ratings yet

- QUIZ1Document7 pagesQUIZ1Mikaela JeanNo ratings yet

- Corporate Liquidation (Integration) PDFDocument5 pagesCorporate Liquidation (Integration) PDFCatherine Simeon100% (1)

- Acc8fsconso Sdoa2019Document5 pagesAcc8fsconso Sdoa2019Sharmaine Clemencio0No ratings yet

- Tutorial Week 6Document7 pagesTutorial Week 6Mai Hoàng100% (1)

- Responsibility Accounting: Chapter Study ObjectivesDocument7 pagesResponsibility Accounting: Chapter Study ObjectivesLive LoveNo ratings yet

- TaxationDocument7 pagesTaxationDorothy ApolinarioNo ratings yet

- HEBEROLA SFExam 12Document22 pagesHEBEROLA SFExam 12Marjorie Joyce BarituaNo ratings yet

- Intacc 3Document102 pagesIntacc 3sofiaNo ratings yet

- Advanced Accounting Lupisan 3aDocument14 pagesAdvanced Accounting Lupisan 3aDaniel Tadeja0% (1)

- Financial InstrumentsDocument93 pagesFinancial InstrumentsLuisa Janelle BoquirenNo ratings yet

- Investment in Equity SecuritiesDocument42 pagesInvestment in Equity SecuritiesJhay AbabonNo ratings yet

- Auditing Concept Maps 2Document1 pageAuditing Concept Maps 2Jen RosalesNo ratings yet

- 6 AfarDocument24 pages6 AfarJM SonidoNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document11 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Kathrina RoxasNo ratings yet

- 2019 Vol 1 CH 1 AnswersDocument17 pages2019 Vol 1 CH 1 AnswersTatangNo ratings yet

- A Favorable Materials Price Variance Coupled With An Unfavorable Materials Usage Variance Would Most Likely Result FromDocument5 pagesA Favorable Materials Price Variance Coupled With An Unfavorable Materials Usage Variance Would Most Likely Result FromHey BeshywapNo ratings yet

- Quiz Installment Sales 2Document1 pageQuiz Installment Sales 2MARJORIE BAMBALANNo ratings yet

- NGA - JE ExercisesDocument3 pagesNGA - JE ExercisesShannise Dayne ChuaNo ratings yet

- Mowen ch10Document132 pagesMowen ch10KallistaNo ratings yet

- Understanding Formal Institutions - Politics, Laws and EconomicsDocument4 pagesUnderstanding Formal Institutions - Politics, Laws and EconomicsLeoncio BocoNo ratings yet

- 08 - Activity Based Costing and Balance ScorecardDocument4 pages08 - Activity Based Costing and Balance ScorecardMarielle CastañedaNo ratings yet

- Intangibles Assignment - Valix 2017Document3 pagesIntangibles Assignment - Valix 2017Shinny Jewel VingnoNo ratings yet

- Acct602 PQ2Document4 pagesAcct602 PQ2Sweet EmmeNo ratings yet

- TBCH 3Document59 pagesTBCH 3Minh Huy TrầnNo ratings yet

- Expenditures: V-Audit of Property, Plant and EquipmentDocument24 pagesExpenditures: V-Audit of Property, Plant and EquipmentKirstine DelegenciaNo ratings yet

- ACP 311-Accounting For Special Transactions: Installment LiquidationDocument28 pagesACP 311-Accounting For Special Transactions: Installment Liquidationcynthia reyesNo ratings yet

- Multinational CompaniesDocument3 pagesMultinational CompaniesKellNo ratings yet

- Economic Development Midterm ExaminationDocument4 pagesEconomic Development Midterm ExaminationHannagay BatallonesNo ratings yet

- Let's Analyze: Pacalna, Anifah BDocument2 pagesLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNo ratings yet

- Buscom 3Document4 pagesBuscom 3dmangiginNo ratings yet

- Acc 113 - Accounting For Business CombinationsDocument8 pagesAcc 113 - Accounting For Business CombinationsAlthea CagakitNo ratings yet

- Josie B. Aguila, Mbmba: Financial Accounting For IeDocument6 pagesJosie B. Aguila, Mbmba: Financial Accounting For IeCATHERINE FRANCE LALUCISNo ratings yet

- Chap 14 3-6Document4 pagesChap 14 3-6Buenaventura, Lara Jane T.No ratings yet

- Chap 13 - 1 To 5Document5 pagesChap 13 - 1 To 5Buenaventura, Lara Jane T.No ratings yet

- Chap 13 - 6 To 8Document2 pagesChap 13 - 6 To 8Buenaventura, Lara Jane T.No ratings yet

- Chap 13 - ProblemsDocument5 pagesChap 13 - ProblemsBuenaventura, Lara Jane T.No ratings yet

- Encore 1Document3 pagesEncore 1gsurawijaya75% (4)

- Financial Accounting Chapter 13Document26 pagesFinancial Accounting Chapter 13RNo ratings yet

- IntAcc-1 Accounting For ReceivablesDocument13 pagesIntAcc-1 Accounting For ReceivablesShekainah BNo ratings yet

- Holly Fashions Ratio Analysis Corporate PDFDocument6 pagesHolly Fashions Ratio Analysis Corporate PDFAgha Muhammad MujahidNo ratings yet

- 05 Activity 1Document1 page05 Activity 1Skuksy BillieNo ratings yet

- BM - FM II - CourseoutlineDocument26 pagesBM - FM II - CourseoutlineAtul Anand bj21135No ratings yet

- Beams Aa13e SM 01Document14 pagesBeams Aa13e SM 01jiajiaNo ratings yet

- Micheal Burry MSN Money Articles 2000Document3 pagesMicheal Burry MSN Money Articles 2000cts5131No ratings yet

- Audit Report UnqualifiedDocument19 pagesAudit Report Unqualifiedbona veronica viduyaNo ratings yet

- Chapter 6 Set 2 Residual Income ModelDocument20 pagesChapter 6 Set 2 Residual Income ModelNick HaldenNo ratings yet

- FIN3310 Chapter12Document29 pagesFIN3310 Chapter12Pure FaceNo ratings yet

- FA Balance SheetDocument15 pagesFA Balance SheetPrakash BhanushaliNo ratings yet

- Mindtree Model ReferenceDocument66 pagesMindtree Model Referencesaidutt sharma100% (1)

- CHP 13 Testbank 2Document15 pagesCHP 13 Testbank 2judyNo ratings yet

- Torrent PowerDocument8 pagesTorrent PowerSudhir SinghNo ratings yet

- Notepayable QuizDocument5 pagesNotepayable Quizkhalil rebatoNo ratings yet

- Accounting 2&3 PretestDocument11 pagesAccounting 2&3 Pretestelumba michael0% (1)

- FINANCE - A Study On Fundamental & Technical Analysis of SectorDocument114 pagesFINANCE - A Study On Fundamental & Technical Analysis of SectorNikita DhomkarNo ratings yet

- Chap 006Document71 pagesChap 006Aufa RadityatamaNo ratings yet

- Page 1 of 20 Chapter 6 - Accounting For PartnershipsDocument20 pagesPage 1 of 20 Chapter 6 - Accounting For PartnershipsELLAINE MA EBLACASNo ratings yet

- Financial Statements, Cash Flow, and Taxes: Answers To End-Of-Chapter QuestionsDocument3 pagesFinancial Statements, Cash Flow, and Taxes: Answers To End-Of-Chapter Questionstan lee hui100% (1)

- Intermediate Accounting I F R S Edition: Kieso, Weygandt, WarfieldDocument69 pagesIntermediate Accounting I F R S Edition: Kieso, Weygandt, WarfieldTito Imran100% (2)

- Desco Final Account AnalysisDocument26 pagesDesco Final Account AnalysiskmsakibNo ratings yet

- FIN305 FA12 Ch04Document39 pagesFIN305 FA12 Ch04banmaiixoNo ratings yet