Professional Documents

Culture Documents

Chap 13 - 1 To 5

Chap 13 - 1 To 5

Uploaded by

Buenaventura, Lara Jane T.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 13 - 1 To 5

Chap 13 - 1 To 5

Uploaded by

Buenaventura, Lara Jane T.Copyright:

Available Formats

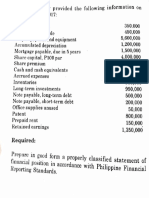

Chapter 13 – Business Combinations Page 1 of 5

PROBLEM 13-1

1. Record the acquisition on Big Corporation’s books. Provide support for your entry as

needed.

Books of Big Corporation

(a) To record acquisition of net assets of Small:

Accounts receivable 120,000

Inventories 140,000

Property, plant and equipment 300,000

Current liabilities 50,000

Gain on acquisition 10,000

Cash 500,000

(b) To record acquisition-related costs:

Acquisition expense 5,000

Cash 5,000

Computation of Income from Acquisition:

Price paid P500,000

Less: Fair value of net identifiable assets acquired:

Accounts receivable P120,000

Inventories 140,000

Property, plant and equipment 300,000

Current liabilities ( 50,000) 510,000

Gain on acquisition P( 10,000)

2. Record the sale on the books of Small Corporation and the subsequent total liquidation of

the corporation.

Books of Small Corporation

(a) To record the sale of net assets to Big:

Cash 500,000

Current liabilities 50,000

Accounts receivable 120,000

Inventories 100,000

Property, plant and equipment 280,000

Gain on sale of business 50,000*

*RE

(b) To record liquidation of the corporation:

Common stock 200,000

Retained earnings 300,000*

Cash 500,000

*Gain – P50,000 and RE – P250,000

Chapter 13 – Business Combinations Page 2 of 5

PROBLEM 13-2

(1) To record acquisition of net assets:

Cash and receivables 50,000

Inventory 200,000

Building and equipment 300,000

Goodwill 40,000

Accounts payable 50,000

Common stock, P10 par value 60,000

Additional paid-in capital 480,000

Computation of Goodwill

Price paid (6,000 shares x P90) P540,000

Less: fair value of net identifiable assets acquired

Total assets P550,000

Accounts payable ( 50,000) 500,000

Goodwill P 40,000

(2) To record acquisition-related costs:

Additional paid-in capital 25,000

Acquisition expenses 15,000

Cash 40,000

PROBLEM 13-3

(1) To record acquisition of net assets:

Cash 60,000

Accounts receivable 100,000

Inventory 115,000

Land 70,000

Building and equipment 350,000

Bond discount 20,000

Goodwill 95,000

Accounts payable 10,000

Bonds payable 200,000

Common stock, P10 par value* 120,000

Additional paid-in capital** 480,000

*P10 x 12,000 = P120,000

**P40 x 12,000 = P480,000

Computation of Goodwill

Purchase price (12,000 shares x P50) P600,000

Less: Fair value of net identifiable assets acquired

Total assets P695,000

Total liabilities ( 190,000) 505,000

Goodwill P 95,000

(2) To record acquisition-related costs:

Additional paid in capital 18,000

Acquisition expense 10,000

Cash 28,000

Chapter 13 – Business Combinations Page 3 of 5

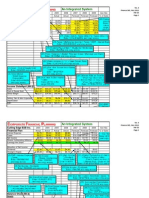

PROBLEM 13-4

Combined Statement of Financial Position

After acquisition

Based on P40/share Based on P20/share

Cash and receivables P 350,000 P 350,000

Inventory 645,000 645,000

Building and equipment 1,050,000 1,050,000

Accumulated depreciation (200,000) (200,000)

Goodwill __180,000 ________-

Total assets P2,025,000 P1,845,000

Accounts payable P 140,000 P 140,000

Bonds payable 485,000 485,000

Common stock P10 Par value 450,000 450,000

Additional paid-in capital 550,000 250,000

Retained earnings (including income from

acquisition) __400,000 __520,000

Total liabilities and stockholders’ equity P2,025,000 P1,845,000

Computation of Goodwill – Based on P40 per share:

Price paid (15,000 shares x P40) P600,000

Less: Fair value of net identifiable assets (P545,000 – P125,000) 420,000

Goodwill P180,000

Computation of Income from Acquisition – Based on P20 per share:

Price paid (15,000 shares x P20) P 300,000

Less: Fair value of net identifiable assets 420,000

Income from acquisition (added to retained earnings of Red) P (120,000)

Chapter 13 – Business Combinations Page 4 of 5

PROBLEM 13-5

1. Prepare all journal entries that Peter Industries should have entered on its books to record

the acquisition.

Books of Peter Industries:

(1) To record acquisition of net assets:

Cash 28,000

Accounts receivable 258,000

Inventory 395,000

Long-term investments 175,000

Land 100,000

Rolling stock 63,000

Plant and equipment 2,500,000

Patents 500,000

Special licenses 100,000

Discount on equipment trust notes 5,000

Discount on debentures 50,000

Goodwill 109,700

Allowance for bad debts 6,500

Current payables 137,200

Mortgage payables 500,000

Premium on mortgage payable 20,000

Equipment trust notes 100,000

Debenture payable 1,000,000

Common stock 180,000

APIC – common 2,340,000

Computation of Goodwill

Price paid (180,000 shares x P14) P2,520,000

Less: fair value of net identifiable assets acquired

Total assets P4,112,500

Total liabilities (1,702,200) 2,410,300

Goodwill P 109,700

(2) To record acquisition-related costs:

Additional paid in capital 42,000

Acquisition expenses 135,000

Cash 177,000

Chapter 13 – Business Combinations Page 5 of 5

2. Present all journal entries that should have been entered on the books of HCC to record the

combination and the distribution of the stock received.

Books of HCC:

Common stock (1,500 x P5) 7,500

APIC – Common 4,500

Treasury stock 12,000

To record retirement of treasury stock.

P7,500 = P5 x 1,500 shares

P4,500 = P12,000 – P7,500

Investment in stock – Peter (180,000 x P14) 2,520,000

Allowance for bad debts 6,500

Accumulated depreciation 614,000

Current payable 137,200

Mortgage payable 500,000

Equipment trust notes 100,000

Debentures payable 1,000,000

Discount on debentures 40,000

Cash 28,000

Accounts receivable 258,000

Inventory 381,000

Long-term investments 150,000

Land 55,000

Rolling stock 130,000

Plant and equipment 2,425,000

Patents 125,000

Special licenses 95,800

Gain on sale of assets and liabilities 1,189,900

To record sale of assets and liabilities to Peter.

Common stock 592,500

APIC – Common 495,500

APIC – Retirement of preferred 22,000

Retained earnings 1,410,000

Investment in stock – Peter 2,520,000

To record retirement of HCC stock and distribution of Peter Industries stock.

P592,500 = P600,000 - P7,500

P495,500 = P500,000 – P4,500

P1,410,000 = P220,000 + P1,189,900

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Session 1 Practice 3Document4 pagesSession 1 Practice 3yimin liuNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Advanced Accounting Vol 2 2014 Edition Baysa-LupisanDocument110 pagesAdvanced Accounting Vol 2 2014 Edition Baysa-LupisanIzzy B100% (4)

- AFAR TestbankDocument56 pagesAFAR TestbankDrama SubsNo ratings yet

- Yap - ACP312 - ULOb - Let's CheckDocument4 pagesYap - ACP312 - ULOb - Let's CheckJunzen Ralph YapNo ratings yet

- Far Quiz 2 Final W AnswersDocument4 pagesFar Quiz 2 Final W AnswersMarriz Bustaliño Tan78% (9)

- Depreciation Expense, Rp. 25.000.000Document12 pagesDepreciation Expense, Rp. 25.000.000Roni SinagaNo ratings yet

- Test Bank - Chapter12 Segment ReportingDocument32 pagesTest Bank - Chapter12 Segment ReportingAiko E. LaraNo ratings yet

- Chapter 14 Business CombinationDocument5 pagesChapter 14 Business CombinationAshNor Randy0% (1)

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- 04 Activity 1 BusComDocument3 pages04 Activity 1 BusComAngela Fye LlagasNo ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- Chap 13 - ProblemsDocument5 pagesChap 13 - ProblemsBuenaventura, Lara Jane T.No ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- ABC ReviewDocument21 pagesABC ReviewJr Reyes PedidaNo ratings yet

- Buscom 1Document4 pagesBuscom 1dmangiginNo ratings yet

- Advacc Buscom Prob IVDocument2 pagesAdvacc Buscom Prob IVEdward James SantiagoNo ratings yet

- Module 2 - Business CombinationsDocument4 pagesModule 2 - Business Combinations수지No ratings yet

- (LAB) Activity - Preparation of Financial Statements Using SpreadsheetDocument3 pages(LAB) Activity - Preparation of Financial Statements Using SpreadsheetJUVEN LOGAGAY0% (1)

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Activity Part 1 Prepartion of Financial StatementsDocument4 pagesActivity Part 1 Prepartion of Financial Statementsjrmsu-3No ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- S Man1 2008-2Document9 pagesS Man1 2008-2ExequielCamisaCrusperoNo ratings yet

- BUSCOM ActivityDocument14 pagesBUSCOM ActivityLerma MarianoNo ratings yet

- Josie B. Aguila, Mbmba: Financial Accounting For IeDocument6 pagesJosie B. Aguila, Mbmba: Financial Accounting For IeCATHERINE FRANCE LALUCISNo ratings yet

- 10 IFRS 3 Business CombinationDocument2 pages10 IFRS 3 Business CombinationDM BuenconsejoNo ratings yet

- Follow-Up Problem SubsequentDocument4 pagesFollow-Up Problem SubsequentasdasdaNo ratings yet

- A. The Following Account Balances Were Presented On December 31, 2017Document3 pagesA. The Following Account Balances Were Presented On December 31, 2017Shiela Mae Pon AnNo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersHazel Pacheco100% (1)

- Jessbel G. Mahilum - IA3-CD1 - Assignment4Document6 pagesJessbel G. Mahilum - IA3-CD1 - Assignment4Jessbel MahilumNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- Solution Chapter 14Document26 pagesSolution Chapter 14grace guiuanNo ratings yet

- BusCom Exercises AnswerDocument4 pagesBusCom Exercises AnswerVidgezxc LoriaNo ratings yet

- ACFrOgCXlqyBubUO 0k2 oqedP7h-nBYz6kyTwIOUtsM8YzGP85yKUDWiFtg8sxBlV4Hw82Zrv8Ha9zgsOOJOU6tLz838EivSxvzOqilLjimAlle6rnKpoa8Bur97ErTWtcl mZnrslLoC3IU KDocument2 pagesACFrOgCXlqyBubUO 0k2 oqedP7h-nBYz6kyTwIOUtsM8YzGP85yKUDWiFtg8sxBlV4Hw82Zrv8Ha9zgsOOJOU6tLz838EivSxvzOqilLjimAlle6rnKpoa8Bur97ErTWtcl mZnrslLoC3IU KStefanie Jane Royo PabalinasNo ratings yet

- Adv Acc 2 Sol Man 2008 BaysaDocument8 pagesAdv Acc 2 Sol Man 2008 BaysaNorman DelirioNo ratings yet

- Accum DepDocument13 pagesAccum Depconrad valixNo ratings yet

- ABC CH1 SeatworkDocument3 pagesABC CH1 SeatworkMaurice AgbayaniNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Multiple Choice ProblemsDocument5 pagesMultiple Choice ProblemsHannahbea LindoNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- Acctg 305 Prelim Exam (With Answers)Document5 pagesAcctg 305 Prelim Exam (With Answers)Michelle Joyce KuizonNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Chapter 15Document9 pagesChapter 15Coleen Joy Sebastian PagalingNo ratings yet

- 18mar24 - Business CombinationDocument16 pages18mar24 - Business Combinationmitha islandiNo ratings yet

- Describe and Illustrate The Acquisition Methods of Accounting For Business CombinationDocument5 pagesDescribe and Illustrate The Acquisition Methods of Accounting For Business CombinationAljenika Moncada GupiteoNo ratings yet

- Case 1: ABC Co Acquired The Net Assets of XYZ Co For P800,000. All The Assets and Liabilities BookDocument3 pagesCase 1: ABC Co Acquired The Net Assets of XYZ Co For P800,000. All The Assets and Liabilities BookkimkimNo ratings yet

- Chapter 1 - Multiple Choice Problem Answers AfarDocument13 pagesChapter 1 - Multiple Choice Problem Answers AfarChincel G. ANINo ratings yet

- Jawaban Latihan Soal AklDocument11 pagesJawaban Latihan Soal AklFauzi AbdillahNo ratings yet

- Chap 14 1-2Document4 pagesChap 14 1-2Buenaventura, Lara Jane T.No ratings yet

- Afar BuscombDocument22 pagesAfar BuscombMo Mindalano MandanganNo ratings yet

- Chapter9 MaDocument2 pagesChapter9 MaLele MaNo ratings yet

- Note 5: PPE: Acc. Dep. Book Value Acquisition CostDocument5 pagesNote 5: PPE: Acc. Dep. Book Value Acquisition CostSabel LagoNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923No ratings yet

- Multiple Choice Problems 9Document15 pagesMultiple Choice Problems 9Dieter LudwigNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Chap 14 3-6Document4 pagesChap 14 3-6Buenaventura, Lara Jane T.No ratings yet

- Chap 13 - 6 To 8Document2 pagesChap 13 - 6 To 8Buenaventura, Lara Jane T.No ratings yet

- Chap 13 - ProblemsDocument5 pagesChap 13 - ProblemsBuenaventura, Lara Jane T.No ratings yet

- Chap 14 1-2Document4 pagesChap 14 1-2Buenaventura, Lara Jane T.No ratings yet

- Financial Accounting (1) : SectionDocument17 pagesFinancial Accounting (1) : SectionAbdalrhman MahmoudNo ratings yet

- Chapter TwoDocument19 pagesChapter TwoTemesgen LealemNo ratings yet

- Revenue IAS 18Document7 pagesRevenue IAS 18Chota H MpukuNo ratings yet

- UNIT 19 - Accounting and Financial StatementsDocument6 pagesUNIT 19 - Accounting and Financial Statementsbaogon39No ratings yet

- Engineering Economics, Chapter 8Document23 pagesEngineering Economics, Chapter 8Bach Le NguyenNo ratings yet

- CFA Level 1 (Book-B)Document170 pagesCFA Level 1 (Book-B)butabutt100% (1)

- PAL Holdings, Inc.: CertificationDocument53 pagesPAL Holdings, Inc.: CertificationJerryJoshuaDiaz100% (1)

- 3 Joint Arrange. Ifrs 11Document6 pages3 Joint Arrange. Ifrs 11DM BuenconsejoNo ratings yet

- HCL Tech q3 2019 Investor ReleaseDocument23 pagesHCL Tech q3 2019 Investor ReleaseVarun SidanaNo ratings yet

- Module 5 MCQ Answers 2Document6 pagesModule 5 MCQ Answers 2Faker Playmaker100% (1)

- Artificial Flowers Import Business PlanDocument22 pagesArtificial Flowers Import Business Planapi-3774664No ratings yet

- Comprehensive Exam QuestionsDocument14 pagesComprehensive Exam QuestionsMuhammad Heickal PradinantaNo ratings yet

- Acounting Aacounting Aacounting Aacounting ADocument8 pagesAcounting Aacounting Aacounting Aacounting AFrankyLimNo ratings yet

- Module 1 - PGBP Handout PDF - 240124 - 204954Document42 pagesModule 1 - PGBP Handout PDF - 240124 - 204954jabeanonionNo ratings yet

- Revised Accounts Manual: Bharat Heavy Electricals Limited Regd. Office: BHEL House, Siri Fort, New Delhi: 110049Document180 pagesRevised Accounts Manual: Bharat Heavy Electricals Limited Regd. Office: BHEL House, Siri Fort, New Delhi: 110049chandrasekharNo ratings yet

- HW20Document18 pagesHW20kayteeminiNo ratings yet

- WCM PresentationDocument52 pagesWCM PresentationJeffrey S. RequisoNo ratings yet

- Knowledge - 18 - LAB0292 - Planned - Maintenance Field ServiceDocument75 pagesKnowledge - 18 - LAB0292 - Planned - Maintenance Field ServiceAlex AeronNo ratings yet

- 13 Sarbapriya Ray Final PaperDocument15 pages13 Sarbapriya Ray Final PaperiisteNo ratings yet

- Annual Report 2011-2012Document44 pagesAnnual Report 2011-2012snm1976No ratings yet

- Mercury Athletic Footwear Case (Work Sheet)Document16 pagesMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNo ratings yet

- Exceptional Service Grading Company: A Case Study On Employing Financial Ratio Analysis As A Basis For Business ExpansionDocument5 pagesExceptional Service Grading Company: A Case Study On Employing Financial Ratio Analysis As A Basis For Business ExpansionRyan S. AngelesNo ratings yet

- AP-C87-15 - Austroads Glossary of Terms (2015 Edition)Document181 pagesAP-C87-15 - Austroads Glossary of Terms (2015 Edition)Rita Moura Fortes0% (1)

- Translation Exposure Management PDFDocument13 pagesTranslation Exposure Management PDFpilotNo ratings yet

- FAR05-2.1 - Cash & Cash EquivalentsDocument7 pagesFAR05-2.1 - Cash & Cash EquivalentsJayNo ratings yet

- A15 Ipsas - 06Document32 pagesA15 Ipsas - 06Marius SteffyNo ratings yet

- A.Income Statement: Pre-Operation Year 1Document5 pagesA.Income Statement: Pre-Operation Year 1Benjie MariNo ratings yet