Professional Documents

Culture Documents

Midterms

Midterms

Uploaded by

Hans ValdeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Midterms

Midterms

Uploaded by

Hans ValdeCopyright:

Available Formats

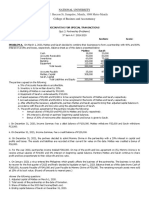

Republic of the Philippines Document Code: CBM-BF-026

UNIVERSITY OF ANTIQUE Revision No.: 00

Sibalom, Antique

Telefax No. (036) 543-8161 Effectivity Date: January 2016

E-mail: ua@antiquespride.edu.ph Page: 1 of 2

COLLEGE OF BUSINESS AND MANAGEMENT

cbm@antiquespride.edu.ph

MIDTERM EXAMINATION

ADVANCE ACCOUNTING I

TEST III – Long Problems. Sixty (60) points.

1. Sonny and Rey form a partnership. On January 1, 2018, Sonny invests a building worth P252,000 and

equipment valued at P116,000 as well as P132,000 in cash. Although Rey makes no tangible contribution to the

partnership, he will operate the business and be an equal partner in the beginning capital balances.

The partnership contract provided the following agreement:

Sonny will be credited annually with interest equal to 10% of the beginning capital balance for the year.

Sonny will also have added to his capital account 10% of partnership income each year(without regard

for the preceding interest figure) or P15,000, whichever is greater. All remaining income is credited to

Rey.

Neither partner is allowed to withdraw funds from the partnership during 2018. Thereafter, they can

each draw out of P20,000 annually or 10% of the beginning capital balance for the year, whichever is

greater.

A net loss of P 30,000 is reported by the partnership during the first year of its operation. On January 1, 2019,

Glenn becomes a third partner in this business by contributing P 125,000 cash to the partnership. Glenn receives

a 20% share of the business’ capital. The profit and loss agreement is altered as follows:

Sonny is still entitled to (1) interest on his beginning capital balance as well as (2) the share of

partnership income just specified.

Any remaining profit or loss will be split on a 6:4 basis between Rey and Glenn, respectively.

Partnership income for 2019 is reported as P 100,000. Each partner withdraws the full amount that is

allowed.

On January 2020, Glenn falls ill and sells his interest in the partnership (w/ the consent of the other two

partners) to Karen. Karen pays P 150,000 directly to Glenn. Net Income for 2020 is P 50,000 with partners again

taking their full drawing allowance.

On January 1, 2021, Karen elects to withdraw from the business for personal reasons. The partnership contract

contains a provision stating that any partner may leave the partnership at any time and its entitled to receive cash

in an amount equal to the recorded capital balance at that time plus 5%.

Required: (a) Prepare journal entries to record the previous transactions on the assumption that the GOODWILL

method is used. Drawings need not be recorded, though it should be included in the closing

entries.(round off all amounts to the nearest peso.) Twenty Seven (27) points.

(b) Prepare Statement of Financial Position. Eight (8) points.

2. Assume that the firm of S, J and T, SJT Merchandising decides to liquidate. All partnership assets are to be

converted into cash. S and J are insolvent while T is solvent. They share profits and losses 50%, 30%, 20%

respectively. A balance sheet is prepared on June 30, 2018 just before liquidation, showed the following

balance:

SJT Merchandising

Balance Sheet

June 30, 2018

Assets Liabilities and Partner’s Equity

Cash P 5,000 Accts. Payable P 44,000

Accounts Receivables P25,000 Advances from S 15,000

Less: All. for Doubtful Accts. 4,000 21,000 S, Capital 20,000

Advances to J 3,000 J, Capital 20,000

Merchandise Inventory 30,000 J, Drawing (5,000)

Goodwill 15,000 T, Capital 15,000

Equipment 41,000

Less: Accum. Dep’n. 6,000 35,000

Total Assets P 109,000 Total Liability and Capital P 109,000

Republic of the Philippines Document Code: CBM-BF-026

UNIVERSITY OF ANTIQUE Revision No.: 00

Sibalom, Antique

Telefax No. (036) 543-8161 Effectivity Date: January 2016

E-mail: ua@antiquespride.edu.ph Page: 2 of 2

The assets were realized as follow:

a. The accounts receivables were realized at P 12,000.

b. The merchandise inventory was sold for P13,000.

c. The equipment was sold for P 10,000.

Other information.

- Partner S has a positive personal net worth of P 8,000.

- Partner J has a negative personal net worth of P 3,000.

- Partner T has a positive personal net worth of P 15,000.

Required: (a) Prepare statement of liquidation. Ten (10) points.

(b) Prepare necessary journal Entries. Fifteen (15) points

-o-oo-o-oo-o-oo-o-o-o-oo-o-o-o-o-o-oo-o-o-o-o-oo-o-o-o-oo-o-oo-o-o-o-o-oo-o-o-o-o-oo-o-o-o-o-oo-o-o-oo-o-o-

o-

Prepared by: Checked and Verified by:

ALWIN B. PIANSAY, CPA NIMROD A. YBERA, CPA, MBA

Subject Instructor Program Head

Approved by:

CATHERINE C. VIESCA, CPA, MBA

Dean, CBA

You might also like

- (Afar) Week1 Compiled QuestionsDocument78 pages(Afar) Week1 Compiled QuestionsBeef Testosterone84% (25)

- Partnership Formation ActivityDocument8 pagesPartnership Formation ActivityShaira UntalanNo ratings yet

- Statement of Financial Capability For NotarizationDocument1 pageStatement of Financial Capability For NotarizationEdd Bautista55% (11)

- Estatement PDFDocument1 pageEstatement PDFRudy AlconcherNo ratings yet

- Resa Afar 2205 Quiz 1Document16 pagesResa Afar 2205 Quiz 1Rafael BautistaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Advnce - fin.Acc.&Repprac 2Document17 pagesAdvnce - fin.Acc.&Repprac 2Jerry Licayan0% (1)

- 1.4 Partnership Liquidation - 1Document4 pages1.4 Partnership Liquidation - 1Leane Marcoleta100% (2)

- Reviewer On Partnership Problems - Q2 PDFDocument3 pagesReviewer On Partnership Problems - Q2 PDFAdrian Montemayor33% (3)

- ADFINA 1 - Partnerhip - Luidation - Quizzer - 2016NDocument3 pagesADFINA 1 - Partnerhip - Luidation - Quizzer - 2016NKenneth Bryan Tegerero TegioNo ratings yet

- Acctg13 Midterm Exam TQ 2021 2022 2nd SemDocument6 pagesAcctg13 Midterm Exam TQ 2021 2022 2nd SemGarp BarrocaNo ratings yet

- Notre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong CityDocument15 pagesNotre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong Cityirishjade100% (1)

- St. Marry Inter CollegeDocument15 pagesSt. Marry Inter CollegeSTAR PRINTINGNo ratings yet

- Afar Mixauthors PDFDocument78 pagesAfar Mixauthors PDFGamers HubNo ratings yet

- Partnership CE W Control Ans PDFDocument10 pagesPartnership CE W Control Ans PDFRedNo ratings yet

- Partnership Liquidation Practice Problems - W CorrectionsDocument10 pagesPartnership Liquidation Practice Problems - W CorrectionsSarah BalisacanNo ratings yet

- Prequalifying ExaminationDocument7 pagesPrequalifying Examinationablay logeneNo ratings yet

- LiquidationDocument2 pagesLiquidationMikelle Justin RaizNo ratings yet

- Afar 01Document11 pagesAfar 01Raquel Villar DayaoNo ratings yet

- Chap 1 Part 4 - Installment Liquidation ProblemsDocument3 pagesChap 1 Part 4 - Installment Liquidation ProblemsLarpii Moname100% (1)

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoDocument5 pagesPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoLyca SorianoNo ratings yet

- AFARDocument41 pagesAFARAlican, JerhamelNo ratings yet

- 1st PREBOARD EXAMINATION - AFAR STUDENTS PDFDocument16 pages1st PREBOARD EXAMINATION - AFAR STUDENTS PDFAANo ratings yet

- PROBLEMsDocument3 pagesPROBLEMsHancel NageraNo ratings yet

- Disso and LiquiDocument9 pagesDisso and LiquiDexell Mar MotasNo ratings yet

- Sample Quesiton Paper Latest 11 4 2022 YOUTUBEDocument61 pagesSample Quesiton Paper Latest 11 4 2022 YOUTUBESourabh TiwariNo ratings yet

- Rev 1 - Prelim Examination - From Partnership Formation To Joint ArrangemeDocument6 pagesRev 1 - Prelim Examination - From Partnership Formation To Joint ArrangemeCM Lance100% (2)

- Advacc Quiz On PartnershipDocument10 pagesAdvacc Quiz On PartnershipLenie Lyn Pasion TorresNo ratings yet

- Class 12Document33 pagesClass 12vaibhav dangiNo ratings yet

- Wala LangDocument8 pagesWala LangMax Dela TorreNo ratings yet

- St. Scholasticas College: Leon Guinto, ManilaDocument13 pagesSt. Scholasticas College: Leon Guinto, Manilamaria evangelistaNo ratings yet

- Accountancy Previous QuestionsDocument4 pagesAccountancy Previous QuestionsmurthyNo ratings yet

- Advanced Financial Accounting and Reporting ExercisesDocument6 pagesAdvanced Financial Accounting and Reporting ExercisesKi LalaNo ratings yet

- Partnership Prof. Jon D. Inocentes, Cpa: UM Tagum College Arellano Street, Tagum City, 8100 PhilippinesDocument2 pagesPartnership Prof. Jon D. Inocentes, Cpa: UM Tagum College Arellano Street, Tagum City, 8100 PhilippinesJohn BryanNo ratings yet

- Problem On AdmissionDocument2 pagesProblem On AdmissionSam Rae LimNo ratings yet

- Riyadh Final PB Far 2019Document17 pagesRiyadh Final PB Far 2019jhaizonNo ratings yet

- Quiz 1 AFAR ReviewDocument7 pagesQuiz 1 AFAR ReviewPrankyJellyNo ratings yet

- QUIZ 02: Partnership Operations Name: - ID No.Document6 pagesQUIZ 02: Partnership Operations Name: - ID No.yoj cepilloNo ratings yet

- Accounting QuestionsDocument6 pagesAccounting QuestionsJohn Ace Dela RamaNo ratings yet

- PARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalDocument4 pagesPARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalErica AbegoniaNo ratings yet

- Comprehensive Review QuestionsDocument5 pagesComprehensive Review QuestionsJane Ruby JennieferNo ratings yet

- EXAM. MIDTERM. April 20, 2022Document15 pagesEXAM. MIDTERM. April 20, 2022Raziel Angelo AnsusNo ratings yet

- Prequalifying ExaminationDocument6 pagesPrequalifying ExaminationVincent Villalino LabrintoNo ratings yet

- Xii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021Document6 pagesXii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021mekavinashNo ratings yet

- Afar MCQ PracticeDocument79 pagesAfar MCQ PracticeAlysa dawn CabrestanteNo ratings yet

- Advacc Final Exam Answer KeyDocument7 pagesAdvacc Final Exam Answer KeyRIZLE SOGRADIELNo ratings yet

- Anas - Afar - Prelim Module - Ivisan - Bsa 4 - A B 2Document13 pagesAnas - Afar - Prelim Module - Ivisan - Bsa 4 - A B 2nisutrackerNo ratings yet

- Finals ProblemsDocument9 pagesFinals Problemsr3gjc.nfjpia2223No ratings yet

- Advanced Financial Accounting and Reporting: G.P. CostaDocument27 pagesAdvanced Financial Accounting and Reporting: G.P. CostaryanNo ratings yet

- Far - SfeDocument6 pagesFar - SfeAdrian ManongdoNo ratings yet

- Advacc Quiz On PartnershipDocument10 pagesAdvacc Quiz On PartnershipCzaeshel Edades0% (2)

- Advanced Financial Accounting and Reporting Accounting For PartnershipDocument6 pagesAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceNo ratings yet

- HO2 Partnership Dissolution and Liquidation RevisedDocument5 pagesHO2 Partnership Dissolution and Liquidation RevisedChristianAquinoNo ratings yet

- Print SW PartnershipDocument5 pagesPrint SW PartnershipMike MikeNo ratings yet

- 2nd Assign Topic2 AdvaccDocument2 pages2nd Assign Topic2 AdvaccStella SabaoanNo ratings yet

- PartnershipDocument10 pagesPartnershipOm JainNo ratings yet

- Basic Concepts of PartnershipDocument5 pagesBasic Concepts of PartnershipKyla DizonNo ratings yet

- Basic Concepts of PartnershipDocument7 pagesBasic Concepts of PartnershipKhim CortezNo ratings yet

- PartnershipDocument10 pagesPartnershipMark Joseph Urmeneta Fernando80% (5)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Child Labor Student MaterialsDocument9 pagesChild Labor Student MaterialsMerlyn ThelappillyNo ratings yet

- Think Like A FREAK (Abridgement)Document12 pagesThink Like A FREAK (Abridgement)Ron TurfordNo ratings yet

- IF1TB4 - 2024-Insurance, Legal and RegulatoryDocument276 pagesIF1TB4 - 2024-Insurance, Legal and Regulatorycorridor.insuranceNo ratings yet

- Dwnload Full Macroeconomics 6th Edition Williamson Solutions Manual PDFDocument36 pagesDwnload Full Macroeconomics 6th Edition Williamson Solutions Manual PDFhanhcharmainee29v100% (16)

- ASBI Grouted Post Tensioning SpecificationsDocument19 pagesASBI Grouted Post Tensioning Specificationselev lookNo ratings yet

- Generic Business Plan For Production of Straw PelletsDocument74 pagesGeneric Business Plan For Production of Straw PelletsARIF SAFI'INo ratings yet

- Ilnas-En Iso 21528-2:2017Document8 pagesIlnas-En Iso 21528-2:2017AristaNo ratings yet

- Chapter 1 TaxationDocument8 pagesChapter 1 TaxationSeid KassawNo ratings yet

- Dashboard Ence602Document314 pagesDashboard Ence602api-707678106No ratings yet

- BM 03N HP2 MarkschemeDocument19 pagesBM 03N HP2 MarkschemeMARIOLA ORTSNo ratings yet

- BOS Packet Love's Travel Center Rezoning and SUP RequestsDocument319 pagesBOS Packet Love's Travel Center Rezoning and SUP RequestsJanay ReeceNo ratings yet

- Multifamily Apartment ProformaDocument4 pagesMultifamily Apartment Proformaartsan3No ratings yet

- Module-2: Cost and Revenue, Profit FunctionsDocument37 pagesModule-2: Cost and Revenue, Profit FunctionsArpitha KagdasNo ratings yet

- If Globalization Is Truly Beneficial To All People Across The WorldDocument1 pageIf Globalization Is Truly Beneficial To All People Across The WorldNathaniel AzulNo ratings yet

- Versionfinalv3investment-Roadmap 1Document88 pagesVersionfinalv3investment-Roadmap 1Proexport ColombiaNo ratings yet

- World Economy: For Other Uses, SeeDocument1 pageWorld Economy: For Other Uses, Seerakeshk20No ratings yet

- Development Economics AssignmentDocument2 pagesDevelopment Economics Assignmentyedinkachaw shferawNo ratings yet

- Income Tax II Illustration Clubbing of Incomes PDFDocument1 pageIncome Tax II Illustration Clubbing of Incomes PDFSubramanian SenthilNo ratings yet

- Classification of ToolsDocument73 pagesClassification of ToolsNathaniel Pili De Jesus100% (1)

- Global Factor Premiums: Guido Baltussen Laurens Swinkels Pim Van VlietDocument70 pagesGlobal Factor Premiums: Guido Baltussen Laurens Swinkels Pim Van VlietTrialerNo ratings yet

- Rajiv Awas YojanaDocument8 pagesRajiv Awas YojanakausiniNo ratings yet

- Microfinance in Myanmar Sector AssessmentDocument54 pagesMicrofinance in Myanmar Sector AssessmentTHAN HANNo ratings yet

- A Contractors Interior Decorators / Architects and A C A O I A W I C of Berger Paints India LimitedDocument210 pagesA Contractors Interior Decorators / Architects and A C A O I A W I C of Berger Paints India LimitedDestiny WorldNo ratings yet

- Lease and Project Finance Exam 2022 S2Document4 pagesLease and Project Finance Exam 2022 S2bonaventure chipetaNo ratings yet

- Adobe Scan 13-Sep-2023Document4 pagesAdobe Scan 13-Sep-2023Yuvraj AlrejaNo ratings yet

- The Contemporary WorldDocument6 pagesThe Contemporary WorldRental SystemNo ratings yet

- The Shopping Centre Handbook 4.0Document31 pagesThe Shopping Centre Handbook 4.0apaceroNo ratings yet

- 2022 S1 2nd Sem Bookkeeping and Accounts Final ExamDocument18 pages2022 S1 2nd Sem Bookkeeping and Accounts Final ExamXuen Khun TanNo ratings yet