Professional Documents

Culture Documents

Company Case

Company Case

Uploaded by

Auramax EnterprisesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Case

Company Case

Uploaded by

Auramax EnterprisesCopyright:

Available Formats

CASE – MAYNARD COMPANY

Diane Maynard made the following request of a friend:

My bookkeeper has quit, and I need to see the balance sheets of my company. He has left behind a

book with the numbers already entered in it. Would you be willing to prepare balance sheets for

me? Also, any comments you care to make about the numbers would be appreciated. The Cash

account is healthy, which is a good sign, and he has told me that the net income in June was

$19,635.

The book contained a detailed record of transactions, and from it, the friend was able to copy off the

balances at the beginning of the month and at the end of the month as shown in Exhibit 1. Diane

Maynard owned all the stock of Maynard Company. At the end of June, Diane Maynard paid herself

an $11,700 dividend and used the money to repay her loan from the company.

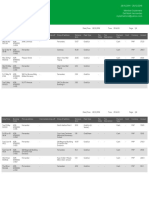

EXHIBIT 1 - Account Balances

June 1 June 30

Accounts payable $ 8,517 $ 21,315

Accounts receivable 21,798 26,505

Accrued wages payable 1,974 2,202

Accumulated depreciation on the building 156,000 157,950

Accumulated depreciation on equipment 5,304 5,928

Bank notes payable 8,385 29,250

Building 585,000 585,000

Capital stock 390,000 390,000

Cash 34,983 66,660

Equipment (at cost) 13,260 36,660

Land 89,700 89,700

Merchandise inventory 29,835 26,520

Note receivable, Diane Maynard 11,700 0

Other non-current assets 4,857 5,265

Other noncurrent liabilities 2,451 2,451

Prepaid insurance 3,150 2,826

Retained earnings 221,511 229,446

Supplies on hand 5,559 6,630

Taxes payable 5,700 7,224

Her friend replied, “A partial answer to that question is to look at an income statement for June. I

think I can find the data I need to prepare one for you.”

In addition to the data given in Exhibit 1 above, her friend found a record of cash receipts and

disbursements, which is summarized in Exhibit 2. She also learned that all accounts payable were to

vendors for the purchase of merchandise inventory and that cost of sales was $39,345 in June.

EXHIBIT 2

Cash Receipts and Disbursements

Month of June

Cash Receipts Cash Disbursements

Cash sales $44,420 Equipment purchased $23,400

Credit customers 21,798 Other assets purchased 408

Diane Maynard 11,700 Payments on accounts payable 8,517

Bank Loan 20,865 Cash purchases of merchandise 14,715

Total receipts $98,783 Cash purchase of supplies 1,671

Dividends 11,700

Wages paid 5,660

Utilities paid 900

Miscellaneous payments 135

Total disbursements $67,106

Reconciliation:

Cash balance, June 1 $ 34,983

Receipts 98,783

Subtotal $133,766

Disbursements 67,106

Cash balance, June 30 $ 66,660

You might also like

- Octane Service StationDocument8 pagesOctane Service StationKalyan Kumar83% (6)

- 2-1 Maynard Company (A)Document1 page2-1 Maynard Company (A)Tarry Berry75% (4)

- Tugas Pengantar Akuntansi-1Document23 pagesTugas Pengantar Akuntansi-1Wiedya fitrianaNo ratings yet

- Victoria Chemicals PLC: The Merseyside ProjectDocument15 pagesVictoria Chemicals PLC: The Merseyside ProjectAde AdeNo ratings yet

- Maynard Company (A) : EXHIBIT 1 Account BalancesDocument2 pagesMaynard Company (A) : EXHIBIT 1 Account Balancesriya lakhotiaNo ratings yet

- Introduction To AccountingDocument180 pagesIntroduction To Accountingmuzamilmf5No ratings yet

- Music Mart SolutionDocument6 pagesMusic Mart SolutionStranger Sinha50% (2)

- Orca Share Media1583067447855Document6 pagesOrca Share Media1583067447855Zoya Romelle Besmonte100% (1)

- Accounting Maynard CompanyDocument3 pagesAccounting Maynard CompanyAdit AdityaNo ratings yet

- Fca 1Document2 pagesFca 1AshirbadNo ratings yet

- Maynard CompanyDocument5 pagesMaynard CompanyNikitha Andrea SaldanhaNo ratings yet

- 'Vault Guide To The Top 25 Investment Management EmployersDocument449 pages'Vault Guide To The Top 25 Investment Management EmployersPatrick AdamsNo ratings yet

- Engineering Economy QuestionsDocument134 pagesEngineering Economy QuestionsJE Genobili100% (4)

- 8243907-Mid Term TemplateDocument6 pages8243907-Mid Term TemplateStephen dassNo ratings yet

- Case 3-1 PDFDocument3 pagesCase 3-1 PDFZereen Gail Nievera100% (2)

- Maynard Case 3 1 PDFDocument2 pagesMaynard Case 3 1 PDFTating Bootan Kaayo YangNo ratings yet

- Case - Maynard Company (A)Document2 pagesCase - Maynard Company (A)Sujay SaxenaNo ratings yet

- Maynard Company (A) Balance Sheet Asofjune1 AssetsDocument9 pagesMaynard Company (A) Balance Sheet Asofjune1 AssetsNeoNo ratings yet

- CASE Maynard (B)Document2 pagesCASE Maynard (B)johngay1987No ratings yet

- FADMDocument3 pagesFADMshreevarshashankarNo ratings yet

- Incomplete Records 1Document7 pagesIncomplete Records 1Khadejai LairdNo ratings yet

- Magesh FADM Mid TermDocument12 pagesMagesh FADM Mid TermshreevarshashankarNo ratings yet

- MHM 507 Midterm Exam OCTOBER 16, 2021: Answer The FollowingDocument3 pagesMHM 507 Midterm Exam OCTOBER 16, 2021: Answer The FollowingRenj CruzNo ratings yet

- Maynard Balance SheetDocument5 pagesMaynard Balance SheetanonymousNo ratings yet

- Accounting Exercises PDFDocument7 pagesAccounting Exercises PDFMoni TafechNo ratings yet

- 13 Single Entry and Incomplete Records Additional ExercisesDocument5 pages13 Single Entry and Incomplete Records Additional ExercisesAditya Hemani100% (1)

- Assets Asofjune1 As of June 30 Current AssetsDocument2 pagesAssets Asofjune1 As of June 30 Current AssetsFadhila Nurfida HanifNo ratings yet

- Case 21: Maynard Company (A) : Our Objective Is To Look at The Concept of Balance SheetDocument6 pagesCase 21: Maynard Company (A) : Our Objective Is To Look at The Concept of Balance SheetAranhav SinghNo ratings yet

- 1 - Accounting Cycle Overview Practice ProblemsDocument5 pages1 - Accounting Cycle Overview Practice ProblemsmikeNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- (Module 3) ProblemsDocument17 pages(Module 3) ProblemsArriane Dela CruzNo ratings yet

- Requirement 1: BALANCE SHEETDocument3 pagesRequirement 1: BALANCE SHEETAnnabeth BrionNo ratings yet

- Review QuestionsDocument9 pagesReview QuestionsGamaya EmmanuelNo ratings yet

- Projecct Accounting 2Document3 pagesProjecct Accounting 2Russell Von DomingoNo ratings yet

- Question 2 Water CorporationDocument7 pagesQuestion 2 Water Corporationyusuf pashaNo ratings yet

- Class 3 Statement of Cash Flows Learning Objectives: Financial Reporting and Analysis - Dr. Michael LeeDocument4 pagesClass 3 Statement of Cash Flows Learning Objectives: Financial Reporting and Analysis - Dr. Michael LeeKevin ChengNo ratings yet

- Cash Flow ExampleDocument2 pagesCash Flow ExampleAlhassan ShakirNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- Fa Atd 2 ExamDocument5 pagesFa Atd 2 ExamNelsonMoseMNo ratings yet

- Igcse - Final AccountsDocument4 pagesIgcse - Final AccountsMUSTHARI KHANNo ratings yet

- Merchandising Business Accounting Cycle 1Document14 pagesMerchandising Business Accounting Cycle 1Gela V.No ratings yet

- Cash CA NCA CLDocument8 pagesCash CA NCA CL15vinayNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- Final Exam - AccountingDocument5 pagesFinal Exam - Accountingtanvi virmaniNo ratings yet

- Test 1 (QP)Document2 pagesTest 1 (QP)Bushra AsgharNo ratings yet

- Acc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291Document201 pagesAcc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291290acc100% (2)

- Maynard A Balance SheetDocument3 pagesMaynard A Balance SheetFaisal Habibie YurzalNo ratings yet

- Midterm Exam-OlDocument8 pagesMidterm Exam-OlVip BigbangNo ratings yet

- Revision Questions - Final Exam - 4Document13 pagesRevision Questions - Final Exam - 4Vivian WongNo ratings yet

- Maynard Company: Balance SheetDocument4 pagesMaynard Company: Balance SheetDhence BasigaNo ratings yet

- Entrepreneurship Week 6 To 8Document10 pagesEntrepreneurship Week 6 To 8Rashid Pelegrino SaminiadaNo ratings yet

- CH 2 - HomeworkDocument5 pagesCH 2 - HomeworkAxel OngNo ratings yet

- 201 - 19-20 Practice FinalDocument21 pages201 - 19-20 Practice FinalRahadian ToramNo ratings yet

- Klausur WS2021-22-1Document6 pagesKlausur WS2021-22-1marynayarmak.stNo ratings yet

- Merchandising Accounting Cycle-Rev1 - 1Document33 pagesMerchandising Accounting Cycle-Rev1 - 1Hendra Setiyawan100% (4)

- Budgeted Balance SheetDocument3 pagesBudgeted Balance SheetIshanNo ratings yet

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- Current Liabilities and Warranties p2Document4 pagesCurrent Liabilities and Warranties p2James AngklaNo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- Cash Flow Excercise Questions-Set-2Document2 pagesCash Flow Excercise Questions-Set-2AgANo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Aegon Gtaa PresDocument23 pagesAegon Gtaa PresRohit ChandraNo ratings yet

- To Remove Genuin MessageDocument6 pagesTo Remove Genuin MessageAbdul BakiNo ratings yet

- BNPL As A New Financial Instrument & Its Impact On Consumer's Buying BehaviourDocument16 pagesBNPL As A New Financial Instrument & Its Impact On Consumer's Buying BehaviourAshish kujurNo ratings yet

- Allied Bank Internship ReportDocument174 pagesAllied Bank Internship ReportSohail AslamNo ratings yet

- Bank Recon and POC ProblemsDocument3 pagesBank Recon and POC ProblemsJanine IgdalinoNo ratings yet

- MTB Bank Iinternship ReportDocument52 pagesMTB Bank Iinternship ReportUmma HabibaNo ratings yet

- Addition by PurchaseDocument4 pagesAddition by PurchasesunshineNo ratings yet

- CCMA Lesson PlanDocument4 pagesCCMA Lesson Plan224akiNo ratings yet

- 1.1 Forex Key To CorrectionDocument4 pages1.1 Forex Key To Correctionalibanto.sherwinNo ratings yet

- Tutorial3 Sol ShortDocument4 pagesTutorial3 Sol ShortReza Al SaadNo ratings yet

- EE4209 - Lecture 3 - Economic and Financial Evaluation of Energy Sector ProjectsDocument20 pagesEE4209 - Lecture 3 - Economic and Financial Evaluation of Energy Sector ProjectsVindula LakshaniNo ratings yet

- ACCT10001 Assignment 1 Submission Sheet Part One 1361206Document8 pagesACCT10001 Assignment 1 Submission Sheet Part One 1361206jiazhuokNo ratings yet

- Engineering Economy 15th Edition Sullivan Solutions Manual Full Chapter PDFDocument77 pagesEngineering Economy 15th Edition Sullivan Solutions Manual Full Chapter PDFRobertFordicwr100% (18)

- The Investment Setting: True/False QuestionsDocument14 pagesThe Investment Setting: True/False Questionsjigglebots4695No ratings yet

- JP MorganDocument5 pagesJP Morgancar_hotmailNo ratings yet

- BBA Project ReportDocument67 pagesBBA Project ReportADIDEV TSNo ratings yet

- Literature Review On Adoption of Digital Payment SystemDocument7 pagesLiterature Review On Adoption of Digital Payment SystemNigin G KariattNo ratings yet

- Latih Soal Untuk Mhs Fin MGTDocument13 pagesLatih Soal Untuk Mhs Fin MGTnajNo ratings yet

- Result Gazette: University of JammuDocument504 pagesResult Gazette: University of Jammurahad60882No ratings yet

- Gmail - Rise in Windfall Tax, Vedanta To Raise Funds, & More - Groww DigestDocument6 pagesGmail - Rise in Windfall Tax, Vedanta To Raise Funds, & More - Groww DigestSUNIL SAININo ratings yet

- Mytaxi PH, Inc (008-479-980) 2/F, Rear Tower, Wilcon It Hub, Chino Roces Cor, Edsa, Bangkal Makati City, 1233 Manila, PhilippinesDocument4 pagesMytaxi PH, Inc (008-479-980) 2/F, Rear Tower, Wilcon It Hub, Chino Roces Cor, Edsa, Bangkal Makati City, 1233 Manila, PhilippinesDM HernandezNo ratings yet

- 007 PHD Chiara MonticoneDocument118 pages007 PHD Chiara MonticonePrince Adu OwusuNo ratings yet

- Inv S232093Document1 pageInv S232093KING MEDIANo ratings yet

- Introduction To Public Administration AB PDFDocument17 pagesIntroduction To Public Administration AB PDFDarpan AdvertismentNo ratings yet

- Education Loan AnalysisDocument16 pagesEducation Loan AnalysisAvinandan KumarNo ratings yet

- PSE Trading Participant SIPF and SCCP MemberDocument1 pagePSE Trading Participant SIPF and SCCP MemberAnnNo ratings yet

- Day To Day BankingDocument3 pagesDay To Day Bankingbalrajsingh715751No ratings yet