Professional Documents

Culture Documents

TR Nov 2021

TR Nov 2021

Uploaded by

Salifu AbdulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TR Nov 2021

TR Nov 2021

Uploaded by

Salifu AbdulCopyright:

Available Formats

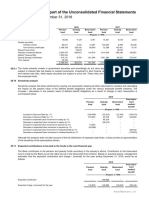

African Alliance Insurance Plc

54, Awolowo Road, Ikoyi

Liability Position as at 30 November 2021 (Estimate)

Conventional 6,013,618,959

Annuity 31,590,892,409

Individual DA 3,535,511,974

Group DA 129,929,642

Group Life - UPR 489,201,740

Group Life - IBNR 1,595,508,638

Additional Reserves 180,408,569

Total 43,535,071,930

Outstanding Claims (Indv & Group) 950,295,314

Prepaid Re 7,987,259

Notes

Conventional Reserves were calculated via a cashflow projection approach, taking into

account future office premiums, expenses and benefit payments. Future

cashflows were discounted back to the valuation date at the valuation rate

stated in the assumptions below.

Indv & Group DA Comprises of Investment linked policies, GAIIP, Esusu and Takaful

businesses. Reserving for these are based on account balances of policies

standing inforce as at the period under review.

Annuity Discounted cashflow method was used for reserving for annuity businesses.

Reserve is set equal to the present value of future annuity payments for each

annuitant assuming an average 20 years payment from inception of

contract, inclusive of guaranteed periods.

Group Life Reserving for Group Life business comprises of unexpired premium reserve

(UPR) net of an expense margin and where necessary for Incurred But Not

Reported Claims (IBNR) to make allowance for delay in claims reporting and

payment. The UPR represents the portion of premiums standing unused for

each scheme as at reporting date. IBNR is purely based on claims historical

assumptions

Assupmtions

Valuation Interest Rate

Conventional Annuity

10.40% Expected VIR for 2021 12.30%

Prudence Margin 1.00%

Less Tax 0.00%

Rate Adopted 11.30%

Additional Reserves

This is set aside to cater for expense over-run and data accuracy. 3% of total

Individual risks

You might also like

- Vehicle Lease To Own Agreement 1Document6 pagesVehicle Lease To Own Agreement 1Ravenn Miranda100% (1)

- Hca 500k TemporalDocument12 pagesHca 500k TemporalMiguel IgnacioNo ratings yet

- Prudential Assurance Malaysia Berhad Investment-Linked Sales IllustrationDocument13 pagesPrudential Assurance Malaysia Berhad Investment-Linked Sales Illustrationanon-310916100% (2)

- LyndonBasc 0894220504221237Document7 pagesLyndonBasc 0894220504221237LyndonNo ratings yet

- Montefiore Health System 2019 Financial StatementsDocument27 pagesMontefiore Health System 2019 Financial StatementsJonathan LaMantiaNo ratings yet

- Mount Sinai Hospital Audited Financial StatementsDocument62 pagesMount Sinai Hospital Audited Financial StatementsJonathan LaMantia100% (1)

- Bdo Peso Money Market Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 85.457 BillionDocument7 pagesBdo Peso Money Market Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 85.457 Billionk100% (1)

- Your Insurance Cards: FusionDocument4 pagesYour Insurance Cards: FusionDawn Lamb UmikerNo ratings yet

- BDRRM Fund Utilization FormDocument2 pagesBDRRM Fund Utilization FormBarangay LusongNo ratings yet

- Lusong Ldrrmfur Dec 2023Document1 pageLusong Ldrrmfur Dec 2023Ronnie ManaoNo ratings yet

- CandidateDocument2 pagesCandidateleelamrs48No ratings yet

- Montefiore Health System Q3 2019 Financial StatementsDocument25 pagesMontefiore Health System Q3 2019 Financial StatementsJonathan LaMantiaNo ratings yet

- Deposit Insurance System in BangladeshDocument2 pagesDeposit Insurance System in BangladeshSohel RanaNo ratings yet

- Insurance Stocks AnalysisDocument38 pagesInsurance Stocks AnalysisAnjaiah PittalaNo ratings yet

- Income Structure and Profitability in Life Insurance Industry in Nepal May 2014-With-cover-page-V2 InsuranceDocument12 pagesIncome Structure and Profitability in Life Insurance Industry in Nepal May 2014-With-cover-page-V2 InsuranceSagar SaudNo ratings yet

- BPI Global Equity Fund of Funds - September 2023 v2Document4 pagesBPI Global Equity Fund of Funds - September 2023 v2Ramon VinzonNo ratings yet

- MIPROV Actuarial Valuation 31 March 2019 VFDocument36 pagesMIPROV Actuarial Valuation 31 March 2019 VFHano Le RouxNo ratings yet

- SBI Life - MR - MuralidharanDocument36 pagesSBI Life - MR - MuralidharanPradipta TripathyNo ratings yet

- Insurance Regulations ParaguayDocument1 pageInsurance Regulations ParaguayMaria Esther PadovanNo ratings yet

- Sbi Life Insurance Co LTD Benefit Illustration For Sbi Life - Ewealth Insurance (Uin 111L100V02)Document2 pagesSbi Life Insurance Co LTD Benefit Illustration For Sbi Life - Ewealth Insurance (Uin 111L100V02)upasana9No ratings yet

- Candidate 1Document2 pagesCandidate 1Fascino WhiteNo ratings yet

- Annexure 3 Compensation FeeDocument3 pagesAnnexure 3 Compensation Feewanjariabhi6235No ratings yet

- AP Nafis Khairul IkhwanDocument32 pagesAP Nafis Khairul IkhwanMUHAMMAD SAFWAN AHMAD MUSLIMNo ratings yet

- Life InsuranceDocument10 pagesLife Insurancemegha_pawar_4No ratings yet

- Annexure 3 Compensation FeeDocument3 pagesAnnexure 3 Compensation FeeTech TipsNo ratings yet

- AP Uwais Khairul IkhwanDocument32 pagesAP Uwais Khairul IkhwanMUHAMMAD SAFWAN AHMAD MUSLIMNo ratings yet

- JD Nri RMDocument3 pagesJD Nri RMswarangiprabhu01No ratings yet

- Edelweiss Housing Finance LimitedDocument7 pagesEdelweiss Housing Finance LimitedDr. Ashwin Raja MBBS MSNo ratings yet

- Audit-Report-Sena KaylanDocument50 pagesAudit-Report-Sena KaylanSohag AMLNo ratings yet

- FAREASTLIF-Annual Report - 2014Document67 pagesFAREASTLIF-Annual Report - 2014Saram ShahNo ratings yet

- AP Khairul IkhwanDocument29 pagesAP Khairul IkhwanMUHAMMAD SAFWAN AHMAD MUSLIMNo ratings yet

- NYU Langone 2019 Audited Financial StatementsDocument46 pagesNYU Langone 2019 Audited Financial StatementsJonathan LaMantiaNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument5 pagesInstitute of Actuaries of India: ExaminationsWilson ManyongaNo ratings yet

- Amit JanaDocument1 pageAmit JanaPravin ThoratNo ratings yet

- State Life Endowment Plan Banca NewDocument2 pagesState Life Endowment Plan Banca Newzainhasan14No ratings yet

- New Group Gratuity Plan Shriram Life Insurance IndiaDocument2 pagesNew Group Gratuity Plan Shriram Life Insurance Indiadevesh mehtaNo ratings yet

- AlMeezan AnnualReport2023 MSFDocument9 pagesAlMeezan AnnualReport2023 MSFmrordinaryNo ratings yet

- SunlifeDocument11 pagesSunlifeAsisclo CastanedaNo ratings yet

- AP Anis FarhahDocument29 pagesAP Anis FarhahMUHAMMAD SAFWAN AHMAD MUSLIMNo ratings yet

- 2010 L 42 Valuation Basis (Health)Document18 pages2010 L 42 Valuation Basis (Health)VivekNo ratings yet

- Cba 2020 Annual Report Print 104 275 PDFDocument172 pagesCba 2020 Annual Report Print 104 275 PDFKelvin ChenNo ratings yet

- Blue ChipDocument1 pageBlue ChipUSERNo ratings yet

- Mount Sinai Beth Israel 2019 Audited Financial StatementsDocument48 pagesMount Sinai Beth Israel 2019 Audited Financial StatementsJonathan LaMantiaNo ratings yet

- St. Luke's Roosevelt 2019 Audited Financial StatementsDocument62 pagesSt. Luke's Roosevelt 2019 Audited Financial StatementsJonathan LaMantiaNo ratings yet

- AFS Licence No. 222605 ABN 31 003 146 290 GPO Box 4151 Sydney NSW 2001 Tel. +61-2-9324 3222 or 1800 023 043Document9 pagesAFS Licence No. 222605 ABN 31 003 146 290 GPO Box 4151 Sydney NSW 2001 Tel. +61-2-9324 3222 or 1800 023 043Ben BieberNo ratings yet

- GICB - Annual Report 2017 PDFDocument40 pagesGICB - Annual Report 2017 PDFÛbř ÖňNo ratings yet

- Financial Audit Manual Veranda, Malaybalay City, Bukidnon November 06-07,2019Document4 pagesFinancial Audit Manual Veranda, Malaybalay City, Bukidnon November 06-07,2019Lail PDNo ratings yet

- CP3 SolutionDocument4 pagesCP3 SolutionWilson ManyongaNo ratings yet

- MBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 3Document25 pagesMBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 3Jesse Rielle CarasNo ratings yet

- Security Analysis Portfolio Management: Sector - FMCGDocument8 pagesSecurity Analysis Portfolio Management: Sector - FMCGJay's GameplayNo ratings yet

- Curing of A Credit Impaired Financial Asset SlidesDocument27 pagesCuring of A Credit Impaired Financial Asset SlidesAsghar AliNo ratings yet

- UBL Annual Report 2018-123Document1 pageUBL Annual Report 2018-123IFRS LabNo ratings yet

- MSA 1 Winter 2021Document12 pagesMSA 1 Winter 2021gohar azizNo ratings yet

- EV and VNB MethodologyDocument2 pagesEV and VNB MethodologySaravanan BalakrishnanNo ratings yet

- Insurance and Float2Document24 pagesInsurance and Float2titoNo ratings yet

- Terrier Security Services (India) Private LimitedDocument7 pagesTerrier Security Services (India) Private Limitedgcgary87No ratings yet

- Bdo Esg Equity Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 117.841 MillionDocument4 pagesBdo Esg Equity Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 117.841 Millionfrancis280No ratings yet

- Ocean Pearl Hotels Private LimitedDocument7 pagesOcean Pearl Hotels Private LimitedAaaaNo ratings yet

- Value MultiplierDocument3 pagesValue MultiplierShahin AlamNo ratings yet

- U01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 131057O040720201037590899392 1593830302546Document9 pagesU01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 131057O040720201037590899392 1593830302546Rozel EncarnacionNo ratings yet

- Zuying. XueDocument9 pagesZuying. XueAbiot Asfiye GetanehNo ratings yet

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- Education Plan Proposal..Document1 pageEducation Plan Proposal..Salifu AbdulNo ratings yet

- LLL OVERVIEWOFOILPALMPRODUCTIONINNIGERIAeditedDocument11 pagesLLL OVERVIEWOFOILPALMPRODUCTIONINNIGERIAeditedSalifu AbdulNo ratings yet

- DIAMETICSDocument2 pagesDIAMETICSSalifu AbdulNo ratings yet

- 2518-Article Text-13065-1-10-20180626Document16 pages2518-Article Text-13065-1-10-20180626Salifu AbdulNo ratings yet

- Approval Memo...Document4 pagesApproval Memo...Salifu AbdulNo ratings yet

- NigeriaRe Notofications.Document4 pagesNigeriaRe Notofications.Salifu AbdulNo ratings yet

- AFRICARE NotificationsDocument3 pagesAFRICARE NotificationsSalifu AbdulNo ratings yet

- Summative Assignment Case Study 2021 22 2Document4 pagesSummative Assignment Case Study 2021 22 2Salifu AbdulNo ratings yet

- WAICARE Notifications.Document2 pagesWAICARE Notifications.Salifu AbdulNo ratings yet

- Disclosure FormDocument3 pagesDisclosure FormSalifu AbdulNo ratings yet

- Compensation Form 1.Document1 pageCompensation Form 1.Salifu AbdulNo ratings yet

- Wapic Smart LifeSavers PlanDocument8 pagesWapic Smart LifeSavers PlanSalifu AbdulNo ratings yet

- Individual Life q1 2022Document6 pagesIndividual Life q1 2022Salifu AbdulNo ratings yet

- F1 Visa GuidelinesDocument9 pagesF1 Visa GuidelinesMary Cruz ParralesNo ratings yet

- Avo 2374 10347066Document4 pagesAvo 2374 10347066MurugananthamjkNo ratings yet

- Tata AIG Motor Policy Schedule 3188 6301125574-00Document5 pagesTata AIG Motor Policy Schedule 3188 6301125574-00BOC ClaimsNo ratings yet

- Factors Influencing The Adoption of InsuranceDocument10 pagesFactors Influencing The Adoption of InsuranceArun Kumar PrajapatiNo ratings yet

- Mega Agent Rentals Georgia Property Management GuideDocument44 pagesMega Agent Rentals Georgia Property Management GuideCollier SweckerNo ratings yet

- Law of SuccessionDocument26 pagesLaw of SuccessionArif MusaNo ratings yet

- Status of Implementation of Prior Years' Audit RecommendationsDocument10 pagesStatus of Implementation of Prior Years' Audit RecommendationsJoy AcostaNo ratings yet

- Table of MeletDocument1 pageTable of MeletVim MalicayNo ratings yet

- Marine Insurance CasesDocument6 pagesMarine Insurance Casesnikol crisangNo ratings yet

- Honda Activa Policey - 21-22Document3 pagesHonda Activa Policey - 21-22MaegshNo ratings yet

- Vfis A&s RenewalDocument6 pagesVfis A&s RenewalmarNo ratings yet

- Cargill, Incorporated Terms and ConditionsDocument1 pageCargill, Incorporated Terms and ConditionsjramkiNo ratings yet

- HMRC Cover LetterDocument5 pagesHMRC Cover Letterckjoofsmd100% (1)

- Life Contingencies Study Note For CAS Exam SDocument14 pagesLife Contingencies Study Note For CAS Exam SJaswanth ChinnuNo ratings yet

- Pipe Conversion ChartDocument8 pagesPipe Conversion ChartSGNo ratings yet

- Financial Sector Presentation AnchalDocument20 pagesFinancial Sector Presentation AnchalPrashant Kumar100% (2)

- FIDIC Green BookDocument41 pagesFIDIC Green BookMoatazNo ratings yet

- Insurance Lesson Plan FEU Inst of LAw RevisedDocument9 pagesInsurance Lesson Plan FEU Inst of LAw RevisedMariline LeeNo ratings yet

- Contour Next Test Strips : Eligible Privately Insured or Cash PatientsDocument1 pageContour Next Test Strips : Eligible Privately Insured or Cash PatientsJit BNo ratings yet

- For HDFC ERGO General Insurance Company LTDDocument2 pagesFor HDFC ERGO General Insurance Company LTDNAVEEN H ENo ratings yet

- IDFC FIRST Bank Letter of Appointment Along With Model Terms and ConditionsDocument6 pagesIDFC FIRST Bank Letter of Appointment Along With Model Terms and ConditionsSidharth patraNo ratings yet

- Republic of The Philippines v. Sunlife Assurance Company of Canada, G.R. No. 158085, October 14Document10 pagesRepublic of The Philippines v. Sunlife Assurance Company of Canada, G.R. No. 158085, October 14Emerson NunezNo ratings yet

- Term and Conditions 2020Document2 pagesTerm and Conditions 2020ali.makrii makriNo ratings yet

- People Vs Lol-Lo and SarawDocument17 pagesPeople Vs Lol-Lo and Sarawnido12No ratings yet

- Past CAS Problems Exam 6U by PaperDocument3 pagesPast CAS Problems Exam 6U by PaperGagan SawhneyNo ratings yet

- Elite Life 2 One PagerDocument1 pageElite Life 2 One PagerFC KSKNo ratings yet

- Account Statement 010523 020523Document4 pagesAccount Statement 010523 020523pulkit sNo ratings yet

- Top 50 Insurance Interview Questions & Answers PDFDocument19 pagesTop 50 Insurance Interview Questions & Answers PDFgzalyNo ratings yet