Professional Documents

Culture Documents

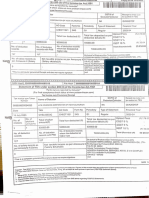

Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961

Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961

Uploaded by

suneet bansalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961

Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961

Uploaded by

suneet bansalCopyright:

Available Formats

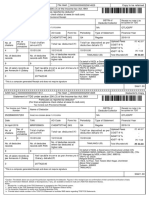

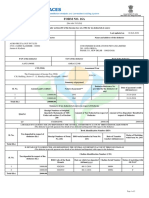

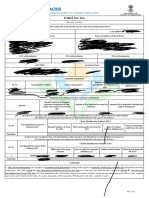

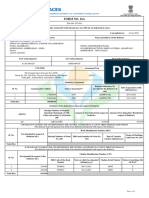

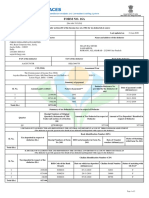

SAM Hash 00000000000000001813 File Hash 00000000000048136236 Copy to be retained

Statement of TDS under section 200 (3) of the Income-tax Act,1961

Particulars as reported by deductor*

(For final acceptance check status at www.tin-nsdl.com)

Tax Invoice cum Provisional Receipt

Tax Invoice cum GSTIN of Receipt no.(note i) (to

Name of Deductor be quoted on TDS

Token Number Deductor/Collector

621399600062102 BABY KOEL CHAIN & JEWELLERS PRIVATE LIMITED NA QVDKWGZF

Date TAN AO Code Form No Periodicity Type of Statement Financial Year

18 November 2022 DELB23584B DELW 793 26Q Q2 Regular 2022-23

Total challan Total tax deposited as per Upload Fees (`) 42.37

Total tax deducted (`)

amount(`) deductee details (`) CGST 9 % -

34002.00 33095.00 33095.00 SGST 9 % -

IGST 18 % (`) 7.63

No. of challans No. of challans unmatched DELHI (07)

Total (Rounded off) (`) 50.00

4 2 On behalf of NSDL e-Governance Infrastructure Limited (CIN

U72900MH1995PLC095642), (GSTIN: 27AAACN2082N1Z8), (TIN-

FC Managed by NSDL e-Gov) (SAC: 998319)

No. of deductee records TIN-FC ID: 62139

No. of deductee No. of deductee

where tax deducted at Religare Broking Limited

records records with PAN

higher rate S P Services A-214, Shop N-1, Gali No-1

Master Chamber, Shakarpur

44 44 - New Delhi - 110092

DELHI

*This is a computer generated Receipt and does not require signature

SAM 1.00

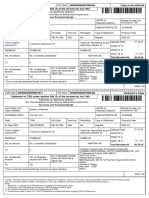

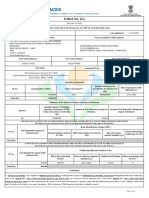

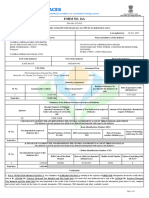

SAM Hash 00000000000000001813 File Hash 00000000000048136236 Deductor's Copy

Statement of TDS under section 200 (3) of the Income-tax Act,1961

Particulars as reported by deductor*

(For final acceptance check status at www.tin-nsdl.com)

Tax Invoice cum Provisional Receipt

Tax Invoice cum GSTIN of Receipt no.(note i) (to

Name of Deductor be quoted on TDS

Token Number Deductor/Collector

621399600062102 BABY KOEL CHAIN & JEWELLERS PRIVATE LIMITED NA QVDKWGZF

Date TAN AO Code Form No Periodicity Type of Statement Financial Year

18 November 2022 DELB23584B DELW 793 26Q Q2 Regular 2022-23

(`) 42.37

Total challan Total tax deposited as per Upload Fees

Total tax deducted (`)

amount(`) deductee details (`) CGST 9 % -

SGST 9 % -

34002.00 33095.00 33095.00

IGST 18 % (`) 7.63

No. of challans No. of challans unmatched DELHI (07)

(`) 50.00

Total (Rounded off)

4 2 On behalf of NSDL e-Governance Infrastructure Limited (CIN

U72900MH1995PLC095642), (GSTIN: 27AAACN2082N1Z8), (TIN-

FC Managed by NSDL e-Gov) (SAC: 998319)

No. of deductee records TIN-FC ID: 62139

No. of deductee No. of deductee

where tax deducted at Religare Broking Limited

records records with PAN

higher rate S P Services A-214, Shop N-1, Gali No-1

Master Chamber, Shakarpur

44 44 - New Delhi - 110092

DELHI

*This is a computer generated Receipt and does not require signature

SAM 1.00

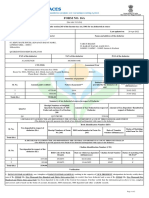

*Caution: The details above are as per the particulars reported by the deductor. Figures in this receipt is/are no confirmation of their correction/verification of data

from Tax Information Network. Details of discrepancies, if any, are available at www.tin-nsdl.com (TDS/TCS Statement Status).

Notes:

i. Receipt No. is valid only if the TDS Statement is accepted at the TIN Central system.

ii. Verify status of the TDS Statement through the TDS/TCS Statement Status facility.

iii. File correction Statement to rectify error including deductee PAN.

iv. Provide latest mobile number in the TDS/TCS Statement to facilitate SMS alerts regarding TDS/TCS Statements.

You might also like

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961aapka.kapil3758No ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961suneet bansalNo ratings yet

- Copy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961suneet bansalNo ratings yet

- 252289600057294Document1 page252289600057294Pricila MercyNo ratings yet

- 252289600057294Document1 page252289600057294Pricila MercyNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961krishnaNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961karvypandataNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961GST JINo ratings yet

- Ayfpv2618c Q1 2021-22Document2 pagesAyfpv2618c Q1 2021-22sandeep kumarNo ratings yet

- TDS BalamuruganDocument1 pageTDS Balamuruganbharani.mudomsNo ratings yet

- Aqxpa3351p Q2 2023-24Document3 pagesAqxpa3351p Q2 2023-24amrithavinilNo ratings yet

- Copy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961karvypandataNo ratings yet

- Akdpn3820e Q3 2023-24Document3 pagesAkdpn3820e Q3 2023-24truth.astrology0751No ratings yet

- Aadcp9992n Q3 2023-24Document3 pagesAadcp9992n Q3 2023-24Harikrishan BhattNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Dy ManagerNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToEr Sumit SiwatchNo ratings yet

- Tds Report 310387Document3 pagesTds Report 310387HimmatNo ratings yet

- Tds Report 310387Document3 pagesTds Report 310387HimmatNo ratings yet

- Tds Report 310387Document3 pagesTds Report 310387HimmatNo ratings yet

- TCS Ack. Q4 FY 1718Document1 pageTCS Ack. Q4 FY 1718Ravi kantNo ratings yet

- Tds Report 310387Document3 pagesTds Report 310387HimmatNo ratings yet

- Somya Amritanshu - Arcpa1206b - Q2 - Ay202223Document3 pagesSomya Amritanshu - Arcpa1206b - Q2 - Ay202223Sourabh PunshiNo ratings yet

- FSMPP1416G Q1 2023-24Document3 pagesFSMPP1416G Q1 2023-24Parvez AhmadNo ratings yet

- Hbupm1741l Q1 2023-24Document2 pagesHbupm1741l Q1 2023-24ProlayNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToDevasyrucNo ratings yet

- Somya Amritanshu - Arcpa1206b - Q3 - Ay202223Document2 pagesSomya Amritanshu - Arcpa1206b - Q3 - Ay202223Sourabh PunshiNo ratings yet

- Form 16a RSWM q2 Fy22-23 Sagar Mukesh SharmaDocument2 pagesForm 16a RSWM q2 Fy22-23 Sagar Mukesh SharmaSagar SharmaNo ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From Tovaibhav kharbandaNo ratings yet

- Aqxpa3351p Q4 2022-23Document3 pagesAqxpa3351p Q4 2022-23amrithavinilNo ratings yet

- Form16-2021-2022 Part ADocument2 pagesForm16-2021-2022 Part Athaarini doraiswamiNo ratings yet

- Form ADocument2 pagesForm Asky2flyboy@gmail.comNo ratings yet

- XSDRGBBJJJ NBGFCVHMM MMJHBFFCBHHH BBVVFFFVDocument2 pagesXSDRGBBJJJ NBGFCVHMM MMJHBFFCBHHH BBVVFFFVSagar SharmaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Aqxpa3351p Q1 2023-24Document3 pagesAqxpa3351p Q1 2023-24amrithavinilNo ratings yet

- Rashmi RanaDocument2 pagesRashmi RanaRashmi RanaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- FORM16Document11 pagesFORM16ganeshPVRMNo ratings yet

- Aqxpa3351p Q3 2021-22Document2 pagesAqxpa3351p Q3 2021-22amrithavinilNo ratings yet

- 468609600134045Document1 page468609600134045iraghavbsoniNo ratings yet

- Tds Report 310387Document3 pagesTds Report 310387HimmatNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToPrakash PandeyNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToPridex Medical Technologies LLNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMurthy KarumuriNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToSOUMYA RANJAN PATRANo ratings yet

- Copy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961karvypandataNo ratings yet

- QwertabacbDocument3 pagesQwertabacbNDKKMDBNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAman SinghNo ratings yet

- BFJPJ5437H 2019-20 SignedDocument5 pagesBFJPJ5437H 2019-20 SignedUjjwal JoshiNo ratings yet

- TNNHIS, Madurai, AC10481, M Mahalingam-1Document3 pagesTNNHIS, Madurai, AC10481, M Mahalingam-1yog eshNo ratings yet

- Aaacl4159l Q3 2024-25Document3 pagesAaacl4159l Q3 2024-25vbgrandvizagNo ratings yet

- Aaacl4159l Q2 2024-25Document3 pagesAaacl4159l Q2 2024-25vbgrandvizagNo ratings yet

- Qwertabacb PDFDocument3 pagesQwertabacb PDFNDKKMDBNo ratings yet

- Animesh Das - Form16 FY 21-22 - FY 2021 - 2022.Document7 pagesAnimesh Das - Form16 FY 21-22 - FY 2021 - 2022.Dass AniNo ratings yet

- 468609600147802Document1 page468609600147802iraghavbsoniNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Todaleep sharmaNo ratings yet

- Victor Singh - CWCPS5027H - Q1 - Ay202223 - 16aDocument2 pagesVictor Singh - CWCPS5027H - Q1 - Ay202223 - 16agitu sorgtNo ratings yet

- Prayag Pande - Ajypp0194m - Q1 - Ay202223 - 16aDocument2 pagesPrayag Pande - Ajypp0194m - Q1 - Ay202223 - 16agitu sorgtNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961suneet bansalNo ratings yet

- 27a RTKQ00058C 27Q Q4 202122Document1 page27a RTKQ00058C 27Q Q4 202122suneet bansalNo ratings yet

- Copy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961suneet bansalNo ratings yet

- Copy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961suneet bansalNo ratings yet

- TRACES Justification Report Generation Utility V3.0 2Document113 pagesTRACES Justification Report Generation Utility V3.0 2Chirag KhandelwalNo ratings yet

- WINRO154 BudgetLetterRequest - Semi MonthlyCashAssistanceBudgetCalculation - SNAPBudgetCalculationForCA&CA SSICases 585277954Document6 pagesWINRO154 BudgetLetterRequest - Semi MonthlyCashAssistanceBudgetCalculation - SNAPBudgetCalculationForCA&CA SSICases 585277954schwartzdaven7No ratings yet

- f1040s1 PDFDocument1 pagef1040s1 PDFCarlosNo ratings yet

- Rakesh M R S/O Ravindra M KDocument4 pagesRakesh M R S/O Ravindra M KNaveen KumarNo ratings yet

- LapKeu PT Mitra Energi Persada TBK 2019Q2Document6 pagesLapKeu PT Mitra Energi Persada TBK 2019Q2Aryanto AnggeNo ratings yet

- WelCome To E-PaySlip !!!!Document1 pageWelCome To E-PaySlip !!!!Muhammad Sufyan ImtiazNo ratings yet

- FA Student GuideDocument107 pagesFA Student GuideASHUTOSH UPADHYAYNo ratings yet

- Vidya PDFDocument1 pageVidya PDFVidyadhara sNo ratings yet

- Taxation Final DraftDocument9 pagesTaxation Final DraftYogesh KHANDELWALNo ratings yet

- Bir Ruling No. 108-93Document2 pagesBir Ruling No. 108-93saintkarriNo ratings yet

- Incomes Chargeable To Tax Under The Head "Profits and Gains of Business or Profession" (Section 28) - Attempt ReviewDocument5 pagesIncomes Chargeable To Tax Under The Head "Profits and Gains of Business or Profession" (Section 28) - Attempt Reviewaarishak786No ratings yet

- Ventura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Document7 pagesVentura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Mary VenturaNo ratings yet

- Amgen Financial AnalysisDocument2 pagesAmgen Financial AnalysisNiNo ratings yet

- Itrv Sarath 21-22Document1 pageItrv Sarath 21-22bindu mathaiNo ratings yet

- Fin 303 PDFDocument4 pagesFin 303 PDFSimanta KalitaNo ratings yet

- Business TransactionsDocument4 pagesBusiness TransactionsKuen Jianne Dayao67% (3)

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSubhendu NathNo ratings yet

- Republic of The Philippines Department of Finance Revenue Region No. 08 Revenue District Office No. 049 North MakatiDocument2 pagesRepublic of The Philippines Department of Finance Revenue Region No. 08 Revenue District Office No. 049 North MakatiHanabishi RekkaNo ratings yet

- Accounting For Governmental & Nonprofit Entities: Jacqueline L. Reck Suzanne L. LowensohnDocument51 pagesAccounting For Governmental & Nonprofit Entities: Jacqueline L. Reck Suzanne L. LowensohnHibaaq AxmedNo ratings yet

- Test Bank Other Percentage TaxDocument8 pagesTest Bank Other Percentage TaxJohn RellonNo ratings yet

- CBDT E-Payment Request FormDocument1 pageCBDT E-Payment Request FormAlicia Barnes67% (21)

- Group 4 ReportDocument13 pagesGroup 4 Reportnguyễnthùy dươngNo ratings yet

- Circular 9 2021Document3 pagesCircular 9 2021Camp Asst. to ADGP AdministrationNo ratings yet

- New York State Film Tax CreditDocument2 pagesNew York State Film Tax CreditIvan AraqueNo ratings yet

- Please Complete The Information Requested Below: COMPANY NAME: X2 Logics Staffing Solution, IncDocument2 pagesPlease Complete The Information Requested Below: COMPANY NAME: X2 Logics Staffing Solution, Incwasim riyazNo ratings yet

- Preparation of Financial Statement For PublicationDocument21 pagesPreparation of Financial Statement For PublicationRAUDAHNo ratings yet

- Renewal Premium Notice: Mr. Ganesh Vasant Karalkar Insured Name: MR - Ganesh Vasant KaralkarDocument1 pageRenewal Premium Notice: Mr. Ganesh Vasant Karalkar Insured Name: MR - Ganesh Vasant KaralkarGanesh KaralkarNo ratings yet

- Estates and TrustsDocument4 pagesEstates and TrustsXiaoyu KensameNo ratings yet

- CA FINAL - Question Bank - Nov 2019 KALPESH CLASSES PDFDocument1,093 pagesCA FINAL - Question Bank - Nov 2019 KALPESH CLASSES PDFparameshwaraNo ratings yet