Professional Documents

Culture Documents

MW Balt

MW Balt

Uploaded by

Anonymous Feglbx5Copyright:

Available Formats

You might also like

- Illinois Accessibility CodeDocument181 pagesIllinois Accessibility CodeBridgettJonesWakefield0% (1)

- 03b StepSmart 914511-XLS-EnG StudentDocument20 pages03b StepSmart 914511-XLS-EnG StudentShashikant ZarekarNo ratings yet

- NC 4-20Document21 pagesNC 4-20LandGuyNo ratings yet

- KlikBCA Individual JULI 2013Document2 pagesKlikBCA Individual JULI 2013Joshua SentosaNo ratings yet

- Q3:11 Baltimore: Transwestern OutlookDocument7 pagesQ3:11 Baltimore: Transwestern OutlookWilliam HarrisNo ratings yet

- Short Form Agency Transfer Property Spreadsheet by Category PL 11-9-12 PDFDocument4 pagesShort Form Agency Transfer Property Spreadsheet by Category PL 11-9-12 PDFRecordTrac - City of OaklandNo ratings yet

- 1900-2241 (Tab C Exs. 70-82) (PUBLIC)Document342 pages1900-2241 (Tab C Exs. 70-82) (PUBLIC)GriswoldNo ratings yet

- Jammu & Kashmir (01) : Housing ProfileDocument6 pagesJammu & Kashmir (01) : Housing ProfileLokakshi GandotraNo ratings yet

- p3 Trial Balance-CompleteDocument15 pagesp3 Trial Balance-CompleteAnnisaNo ratings yet

- Charlotte Web AMERICAS Market Beat Industrial 3page Q12012Document3 pagesCharlotte Web AMERICAS Market Beat Industrial 3page Q12012Anonymous Feglbx5No ratings yet

- Snapshot Q4 12Document1 pageSnapshot Q4 12Anonymous Feglbx5No ratings yet

- InvoiceDocument5 pagesInvoiceapi-214091549No ratings yet

- Annual Investment Plan 2011: Account Object of Expenditures Code Appropriation ObligationDocument3 pagesAnnual Investment Plan 2011: Account Object of Expenditures Code Appropriation Obligationbunso2012No ratings yet

- Sumona Chakraborty 2010Document6 pagesSumona Chakraborty 2010LoveSahilSharmaNo ratings yet

- Snapshot Q3 12Document1 pageSnapshot Q3 12Anonymous Feglbx5No ratings yet

- MarketView Snapshot - Boston Industrial 3Q12Document2 pagesMarketView Snapshot - Boston Industrial 3Q12Anonymous Feglbx5No ratings yet

- Campaign Contributions - Division of Elections - Florida Department of StateDocument6 pagesCampaign Contributions - Division of Elections - Florida Department of StateMatt Dixon TuNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- National Development Programme 2010-11 & 2011-12 (Ministry/Division-wise Summary)Document2 pagesNational Development Programme 2010-11 & 2011-12 (Ministry/Division-wise Summary)uetprince9647No ratings yet

- LLS-Chapter 3: Operating Decisions and The Income StatementDocument1 pageLLS-Chapter 3: Operating Decisions and The Income StatementchoivickyNo ratings yet

- Ansonia Final BudgetDocument1 pageAnsonia Final BudgetThe Valley IndyNo ratings yet

- NC Update 7-29Document18 pagesNC Update 7-29LandGuyNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- 20% IRA Utilization 1st Quarter 2011Document1 page20% IRA Utilization 1st Quarter 2011bunso2012100% (1)

- Single Family: Active Properties City Address Map BD BTH SQFT Lot SZ Year Date List Price $/SQFT Cdom Orig PriceDocument28 pagesSingle Family: Active Properties City Address Map BD BTH SQFT Lot SZ Year Date List Price $/SQFT Cdom Orig PriceLandGuyNo ratings yet

- Frank M Hull Financial Disclosure Report For 2010Document18 pagesFrank M Hull Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- City: Westport: Property SalesDocument4 pagesCity: Westport: Property SalesMargaret BlockNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- William H Albritton Financial Disclosure Report For 2010Document22 pagesWilliam H Albritton Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Site Phase Vendor Status Technology Site - Name BSC LAC RegionDocument21 pagesSite Phase Vendor Status Technology Site - Name BSC LAC RegionHayour HerkiinNo ratings yet

- White Flint Mall 120210 Sketch Plan SubmissionDocument41 pagesWhite Flint Mall 120210 Sketch Plan Submissiondal4596No ratings yet

- NC Update 2-24Document20 pagesNC Update 2-24LandGuyNo ratings yet

- Sample General Ledger With Trial BalanceDocument10 pagesSample General Ledger With Trial BalanceIriz Beleno0% (1)

- District Heat Pro FormaDocument8 pagesDistrict Heat Pro FormakeithmontpvtNo ratings yet

- Marketbeat: Industrial SnapshotDocument2 pagesMarketbeat: Industrial SnapshotAnonymous Feglbx5No ratings yet

- Howard County 3Q11Document3 pagesHoward County 3Q11William HarrisNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- ODS ArchitectureDocument6 pagesODS ArchitectureKishore DammavalamNo ratings yet

- ODS ArchitectureDocument6 pagesODS ArchitectureKishore DammavalamNo ratings yet

- Market Update November 2011Document2 pagesMarket Update November 2011maurashortNo ratings yet

- The Real Report Q3 Ending 2011, Bridge Commercial PropertiesDocument6 pagesThe Real Report Q3 Ending 2011, Bridge Commercial PropertiesScott W JohnstoneNo ratings yet

- 42pf9631d 10Document57 pages42pf9631d 10tiborambNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Monthly Operating Report Summary For Month 2012: WesternDocument9 pagesMonthly Operating Report Summary For Month 2012: WesternChapter 11 DocketsNo ratings yet

- Korea Facts and FiguresDocument1 pageKorea Facts and FiguresJohn CarpenterNo ratings yet

- Client Payment StatementDocument2 pagesClient Payment StatementAbu Ammar AsrafNo ratings yet

- NC 9-2Document9 pagesNC 9-2LandGuyNo ratings yet

- Financial Highlights: in This Annual Report $ Denotes US$Document2 pagesFinancial Highlights: in This Annual Report $ Denotes US$Harish PotnuriNo ratings yet

- Boho Omdraft 051618rDocument86 pagesBoho Omdraft 051618rmacconsaNo ratings yet

- City: Wilton: Property SalesDocument4 pagesCity: Wilton: Property SalesMargaret BlockNo ratings yet

- Presentation - Tyrone Square 8-15-14Document8 pagesPresentation - Tyrone Square 8-15-14api-260266139No ratings yet

- Richard J Holwell Financial Disclosure Report For 2010Document9 pagesRichard J Holwell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- 2011 Q2 Central London Offices JLLDocument16 pages2011 Q2 Central London Offices JLLpcharrisonNo ratings yet

- DormantDocument86 pagesDormantReechie TeasoonNo ratings yet

- Obama Care Contractor - CGI Federal - List of ContractsDocument12 pagesObama Care Contractor - CGI Federal - List of ContractsOK-SAFE, Inc.No ratings yet

- NorthernVA IND 3Q11Document2 pagesNorthernVA IND 3Q11Anonymous Feglbx5No ratings yet

- Barbara and Barrie Seid Foundation 363342443 2010 077d83fesearchableDocument20 pagesBarbara and Barrie Seid Foundation 363342443 2010 077d83fesearchablecmf8926No ratings yet

- Leonard I Garth Financial Disclosure Report For 2010Document8 pagesLeonard I Garth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- ValeportDocument3 pagesValeportAnonymous Feglbx5No ratings yet

- Houston's Office Market Is Finally On The MendDocument9 pagesHouston's Office Market Is Finally On The MendAnonymous Feglbx5No ratings yet

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocument6 pagesHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5No ratings yet

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocument7 pagesUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5No ratings yet

- Asl Marine Holdings LTDDocument28 pagesAsl Marine Holdings LTDAnonymous Feglbx5No ratings yet

- The Woodlands Office Submarket SnapshotDocument4 pagesThe Woodlands Office Submarket SnapshotAnonymous Feglbx5No ratings yet

- THRealEstate THINK-US Multifamily ResearchDocument10 pagesTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5No ratings yet

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocument9 pagesMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Greenville Americas Alliance MarketBeat Office Q32018Document1 pageGreenville Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Five Fast Facts - RIC Q3 2018Document1 pageFive Fast Facts - RIC Q3 2018Anonymous Feglbx5No ratings yet

MW Balt

MW Balt

Uploaded by

Anonymous Feglbx5Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MW Balt

MW Balt

Uploaded by

Anonymous Feglbx5Copyright:

Available Formats

D C O F FIC E 202.775.7000 VIE N NA OFFICE 703.821.

0040

B E THE S D A O FFIC E 301.571.0900 C O L U MB I A OFFICE 301.621.8800

July 2011

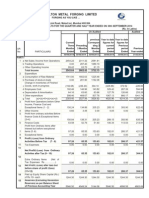

Office Space

Baltimore Metro Area

All Office Buildings

Buildings Built 1985 - Present

Total

Rentable SF 1

SF Available

Immediately 2

Direct

Vacancy

Rate

Baltimore County West

Baltimore County North

Baltimore County East

Baltimore CBD

10,611,476

15,028,812

2,205,631

17,891,713

1,029,313

1,803,457

326,433

2,522,732

9.7%

12.0%

14.8%

14.1%

9.8%

12.4%

16.2%

15.1%

5,248,810

5,958,921

539,943

8,604,903

Balance of Baltimore City

15,070,003

2,139,940

14.2%

14.4%

4,798,099

830,071

17.3%

(15,000)

15,000

13,292,258

1,145,773

10,810,129

5,823,039

2,944,257

94,823,091

1,701,409

299,047

1,708,000

582,304

488,747

12,601,383

12.8%

26.1%

15.8%

10.0%

16.6%

13.3%

13.0%

26.1%

16.1%

10.3%

17.0%

13.7%

7,599,101

542,178

6,754,687

1,847,418

1,202,645

43,096,705

1,018,280

87,833

763,280

199,521

357,186

5,592,510

13.4%

16.2%

11.3%

10.8%

29.7%

13.0%

178,779

235,000

372,700

1,021,979

66,000

(13,000)

(22,000)

6,000

59,000

163,000

39,000

42,000

(32,000)

58,000

107,000

142,000

Submarkets

Columbia4

Route 1 North

BWI

Anne Arundel South

Harford County5

TOTAL - Baltimore Metro

1

Vac. Rate

w/ Sublet

Space

Total

Rentable SF 3

SF Available

Immediately 2

Direct

Vacancy

Rate

SF Under

Construction or

Renovation

Q2 2011

Net Absorption

(SF)

First Half 2011

Net Absorption

(SF)

503,886

601,851

25,917

1,204,686

9.6%

10.1%

4.8%

14.0%

40,000

195,500

-

(31,000)

15,000

9,000

89,000

54,000

(195,000)

18,000

36,000

Includes buildings 15,000 SF RBA and greater. Does not include buildings under construction; does not include buildings owned by the government.

Does not include sublet space.

Includes buildings 50,000 SF RBA and greater built 1985-present, except for Baltimore CBD, which includes those buildings that are defined as Class A by CoStar and are 50,000 SF or greater.

4

9055 Sterling Drive delivered.

5

6180 Guardian Gateway Drive and 4696 Millenium Drive delivered.

3

Suburban Maryland

All Office Buildings

Buildings Built 1985 - Present

Total

Rentable SF 1

SF Available

Immediately 2

Direct

Vacancy

Rate

Bethesda/Chevy Chase

North Bethesda

Rockville

11,293,448

10,326,658

8,588,860

892,182

1,259,852

1,073,608

7.9%

12.2%

12.5%

9.4%

12.7%

12.6%

5,174,211

4,424,299

3,434,177

294,930

778,677

508,258

5.7%

17.6%

14.8%

358,440

-

11,000

103,000

(11,000)

(124,000)

86,000

North Rockville

Gaithersburg

Germantown

Kensington/Wheaton

Silver Spring

N. Silver Spring/Rt. 29

11,820,950

5,281,815

2,455,685

1,406,234

6,903,910

2,980,145

61,057,705

1,501,261

718,327

304,505

336,090

766,334

175,829

7,027,987

12.7%

13.6%

12.4%

23.9%

11.1%

5.9%

11.5%

14.3%

14.6%

13.6%

24.7%

11.8%

6.9%

12.5%

8,220,338

1,489,124

1,682,920

65,000

3,588,215

1,590,620

29,668,904

1,027,542

229,325

233,926

330,116

17,497

3,420,271

12.5%

15.4%

13.9%

0.0%

9.2%

1.1%

11.5%

575,000

194,400

1,127,840

106,000

(26,000)

(27,000)

(202,000)

(55,000)

(27,000)

(117,000)

71,000

(37,000)

49,000

(217,000)

(7,000)

(33,000)

(223,000)

TOTAL - Prince George's Co.

Frederick County

5,304,784

2,509,823

3,016,041

4,951,020

5,832,217

21,613,885

5,952,641

907,118

328,787

750,994

1,010,008

898,161

3,895,069

803,607

17.1%

13.1%

24.9%

20.4%

15.4%

18.0%

13.5%

17.1%

13.6%

25.1%

21.4%

16.0%

18.5%

13.7%

2,195,946

1,471,426

1,412,715

2,137,730

1,858,682

9,076,499

3,601,814

355,743

138,314

447,831

521,606

392,182

1,855,676

479,041

16.2%

9.4%

31.7%

24.4%

21.1%

20.4%

13.3%

268,762

268,762

-

5,000

(5,000)

(54,000)

(10,000)

(29,000)

(93,000)

65,000

5,000

(10,000)

(60,000)

(45,000)

(12,000)

(122,000)

71,000

TOTAL - Suburban Maryland

88,624,231

11,726,662

13.2%

14.0%

42,347,217

5,754,988

13.6%

1,396,602

(145,000)

(274,000)

Montg. Co. Submarkets

TOTAL - Montgomery Co.

Vac. Rate

w/ Sublet

Space

Total

Rentable SF 3

SF Available

Immediately 2

Direct

Vacancy

Rate

SF Under

Construction or

Renovation

Q2 2011

Net Absorption

(SF)

First Half 2011

Net Absorption

(SF)

Prince George's Co. Submarkets

Beltsville/Calverton/Coll. Pk.

Laurel

Greenbelt

Lanham/Landover/Largo

Bowie/Marlboro/South P.G.

Includes buildings 15,000 SF RBA and greater. Does not include buildings under construction; does not include buildings owned by the government.

2

Does not include sublet space.

3

Includes buildings 50,000 SF RBA and greater.

SOU RC E: D ELTA AS S O C I AT E S, R E S E A R C H A F F I L I AT E O F TR A NS WE S TE R N, BA S E D O N ITS P R O PR IE TA RY A NA LY S IS O F CO S TAR DATA.

D C O F FIC E 202.775.7000 VIE N NA OFFICE 703.821.0040

B E THE S D A O FFIC E 301.571.0900 C O L U MB I A OFFICE 301.621.8800

July 2011

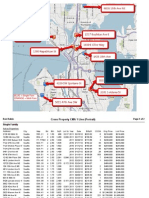

Submarket

Submarket

Harford County

Baltimore County East

Baltimore County North

Baltimore County West

Columbia

Route 1 North

BWI

Anne Arundel South

Baltimore City

TOTAL

Direct Avail. Space 2

Direct Vacancy Rate

Available Sublease Space

Vacancy Rate w/ Sublease Space

21,308,480

24,607,235

7,884,578

18,825,640

13,579,814

27,964,042

25,316,122

4,055,139

54,468,293

198,009,343

1,278,509

2,436,116

339,037

1,487,226

2,267,829

3,104,009

3,037,935

202,757

3,812,781

17,966,197

6.0%

9.9%

4.3%

7.9%

16.7%

11.1%

12.0%

5.0%

7.0%

9.1%

277,010

49,214

7,885

56,477

27,160

111,856

50,632

4,055

217,873

802,163

7.3%

10.1%

4.4%

8.2%

16.9%

11.5%

12.2%

5.1%

7.4%

9.5%

Q2 2011

Net Absorption (SF)

First Half 2011

Net Absorption (SF)

639,000

74,000

31,000

94,000

14,000

280,000

152,000

(8,000)

34,000

1,310,000

298,000

(123,000)

63,000

56,000

68,000

56,000

(253,000)

4,000

34,000

203,000

Space Under Construction

Space Under Renovation

30,000

211,600

241,600

Suburban Maryland

Submarket

Prince George's County

Montgomery County

Frederick County

TOTAL

Submarket

Prince George's County

Montgomery County

Frederick County

TOTAL

Total Inventory 1

Includes buildings 15,000 SF RBA and greater. Does not include buildings under construction; does not include buildings owned by the government.

Does not include sublet space.

Flex/Industrial Space

Baltimore Metro Area

Harford County

Baltimore County East

Baltimore County North

Baltimore County West

Columbia

Route 1 North

BWI

Anne Arundel South

Baltimore City

TOTAL

Total Inventory 1

Direct Avail. Space 2

Direct Vacancy Rate

Available Sublease Space

Vacancy Rate w/ Sublease Space

57,290,376

26,791,812

6,130,070

2,304,096

10.7%

8.6%

401,033

214,334

11.4%

9.4%

15,596,199

2,323,834

14.9%

265,135

16.6%

99,678,387

10,758,000

10.8%

880,503

11.7%

Q2 2011

Net Absorption (SF)

First Half 2011

Net Absorption (SF)

Space Under Construction

Space Under Renovation

(229,000)

(108,000)

79,000

(54,000)

142,346

-

(59,000)

(396,000)

(199,000)

(174,000)

370,000

512,346

Includes buildings 15,000 SF RBA and greater. Does not include buildings under construction; does not include buildings owned by the government.

Does not include sublet space.

SOU RC E: DELTA A S S O C I AT E S , R E S E A R C H A F F I L I ATE O F T R A NS WE S TE R N, BA S E D O N ITS P R O PR IE TA RY A NA LY S IS O F CO S TAR DATA.

D C O F FIC E 202.775.7000 VIE N NA OFFICE 703.821.0040

B E THE S D A O FFIC E 301.571.0900 C O L U MB I A OFFICE 301.621.8800

July 2011

Market Activity

Baltimore Metro Area: Office

LEASES

Tenant

Address

Morgan Stanley Smith Barney (Renewal)

2330 W. Joppa Road

Total Gross Leasing Activity Estimate - Through July 2011 (including renewals):

Square Feet

20,000

2,650,000

INVESTMENT SALES

No notable sales.

Baltimore Metro Area: Flex/Industrial

LEASES

Tenant

Address

IQ Solutions (Renewal)

Oceaneering, Inc.

350 Winmeyer Avenue

6090 Dorsey Road

Total Gross Leasing Activity Estimate - Through July 2011 (including renewals):

Square Feet

79,000

68,000

3,850,000

INVESTMENT SALES

Terreno Realty Corporation purchased 8730 Bollman Place for $7.5 million ($76/SF).

Suburban Maryland: Flex/Industrial and Office

LEASES

Tenant

Address

NIAID (Pre-lease)

JDA Software Group, Inc

Kirlin

5601 Fishers Lane (Office)

9713 Key West Avenue (Office)

75-79 Derwood Circle (Warehouse)

Total Gross Leasing Activity Estimate - Through July 2011 (including renewals):

Square Feet

491,000

26,000

21,000

4,600,000

INVESTMENT SALES

Cole Real Estate Investments purchased 3275 Bennett Creek Avenue (Office) for $38.2 million ($329/SF).

SOU RC E: DELTA A S S O C I AT E S , R E S E A R C H A F F I L I ATE O F T R A NS WE S TE R N, BA S E D O N ITS P R O PR IE TA RY A NA LY S IS O F CO S TAR DATA.

You might also like

- Illinois Accessibility CodeDocument181 pagesIllinois Accessibility CodeBridgettJonesWakefield0% (1)

- 03b StepSmart 914511-XLS-EnG StudentDocument20 pages03b StepSmart 914511-XLS-EnG StudentShashikant ZarekarNo ratings yet

- NC 4-20Document21 pagesNC 4-20LandGuyNo ratings yet

- KlikBCA Individual JULI 2013Document2 pagesKlikBCA Individual JULI 2013Joshua SentosaNo ratings yet

- Q3:11 Baltimore: Transwestern OutlookDocument7 pagesQ3:11 Baltimore: Transwestern OutlookWilliam HarrisNo ratings yet

- Short Form Agency Transfer Property Spreadsheet by Category PL 11-9-12 PDFDocument4 pagesShort Form Agency Transfer Property Spreadsheet by Category PL 11-9-12 PDFRecordTrac - City of OaklandNo ratings yet

- 1900-2241 (Tab C Exs. 70-82) (PUBLIC)Document342 pages1900-2241 (Tab C Exs. 70-82) (PUBLIC)GriswoldNo ratings yet

- Jammu & Kashmir (01) : Housing ProfileDocument6 pagesJammu & Kashmir (01) : Housing ProfileLokakshi GandotraNo ratings yet

- p3 Trial Balance-CompleteDocument15 pagesp3 Trial Balance-CompleteAnnisaNo ratings yet

- Charlotte Web AMERICAS Market Beat Industrial 3page Q12012Document3 pagesCharlotte Web AMERICAS Market Beat Industrial 3page Q12012Anonymous Feglbx5No ratings yet

- Snapshot Q4 12Document1 pageSnapshot Q4 12Anonymous Feglbx5No ratings yet

- InvoiceDocument5 pagesInvoiceapi-214091549No ratings yet

- Annual Investment Plan 2011: Account Object of Expenditures Code Appropriation ObligationDocument3 pagesAnnual Investment Plan 2011: Account Object of Expenditures Code Appropriation Obligationbunso2012No ratings yet

- Sumona Chakraborty 2010Document6 pagesSumona Chakraborty 2010LoveSahilSharmaNo ratings yet

- Snapshot Q3 12Document1 pageSnapshot Q3 12Anonymous Feglbx5No ratings yet

- MarketView Snapshot - Boston Industrial 3Q12Document2 pagesMarketView Snapshot - Boston Industrial 3Q12Anonymous Feglbx5No ratings yet

- Campaign Contributions - Division of Elections - Florida Department of StateDocument6 pagesCampaign Contributions - Division of Elections - Florida Department of StateMatt Dixon TuNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- National Development Programme 2010-11 & 2011-12 (Ministry/Division-wise Summary)Document2 pagesNational Development Programme 2010-11 & 2011-12 (Ministry/Division-wise Summary)uetprince9647No ratings yet

- LLS-Chapter 3: Operating Decisions and The Income StatementDocument1 pageLLS-Chapter 3: Operating Decisions and The Income StatementchoivickyNo ratings yet

- Ansonia Final BudgetDocument1 pageAnsonia Final BudgetThe Valley IndyNo ratings yet

- NC Update 7-29Document18 pagesNC Update 7-29LandGuyNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- 20% IRA Utilization 1st Quarter 2011Document1 page20% IRA Utilization 1st Quarter 2011bunso2012100% (1)

- Single Family: Active Properties City Address Map BD BTH SQFT Lot SZ Year Date List Price $/SQFT Cdom Orig PriceDocument28 pagesSingle Family: Active Properties City Address Map BD BTH SQFT Lot SZ Year Date List Price $/SQFT Cdom Orig PriceLandGuyNo ratings yet

- Frank M Hull Financial Disclosure Report For 2010Document18 pagesFrank M Hull Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- City: Westport: Property SalesDocument4 pagesCity: Westport: Property SalesMargaret BlockNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- William H Albritton Financial Disclosure Report For 2010Document22 pagesWilliam H Albritton Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Site Phase Vendor Status Technology Site - Name BSC LAC RegionDocument21 pagesSite Phase Vendor Status Technology Site - Name BSC LAC RegionHayour HerkiinNo ratings yet

- White Flint Mall 120210 Sketch Plan SubmissionDocument41 pagesWhite Flint Mall 120210 Sketch Plan Submissiondal4596No ratings yet

- NC Update 2-24Document20 pagesNC Update 2-24LandGuyNo ratings yet

- Sample General Ledger With Trial BalanceDocument10 pagesSample General Ledger With Trial BalanceIriz Beleno0% (1)

- District Heat Pro FormaDocument8 pagesDistrict Heat Pro FormakeithmontpvtNo ratings yet

- Marketbeat: Industrial SnapshotDocument2 pagesMarketbeat: Industrial SnapshotAnonymous Feglbx5No ratings yet

- Howard County 3Q11Document3 pagesHoward County 3Q11William HarrisNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- ODS ArchitectureDocument6 pagesODS ArchitectureKishore DammavalamNo ratings yet

- ODS ArchitectureDocument6 pagesODS ArchitectureKishore DammavalamNo ratings yet

- Market Update November 2011Document2 pagesMarket Update November 2011maurashortNo ratings yet

- The Real Report Q3 Ending 2011, Bridge Commercial PropertiesDocument6 pagesThe Real Report Q3 Ending 2011, Bridge Commercial PropertiesScott W JohnstoneNo ratings yet

- 42pf9631d 10Document57 pages42pf9631d 10tiborambNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Monthly Operating Report Summary For Month 2012: WesternDocument9 pagesMonthly Operating Report Summary For Month 2012: WesternChapter 11 DocketsNo ratings yet

- Korea Facts and FiguresDocument1 pageKorea Facts and FiguresJohn CarpenterNo ratings yet

- Client Payment StatementDocument2 pagesClient Payment StatementAbu Ammar AsrafNo ratings yet

- NC 9-2Document9 pagesNC 9-2LandGuyNo ratings yet

- Financial Highlights: in This Annual Report $ Denotes US$Document2 pagesFinancial Highlights: in This Annual Report $ Denotes US$Harish PotnuriNo ratings yet

- Boho Omdraft 051618rDocument86 pagesBoho Omdraft 051618rmacconsaNo ratings yet

- City: Wilton: Property SalesDocument4 pagesCity: Wilton: Property SalesMargaret BlockNo ratings yet

- Presentation - Tyrone Square 8-15-14Document8 pagesPresentation - Tyrone Square 8-15-14api-260266139No ratings yet

- Richard J Holwell Financial Disclosure Report For 2010Document9 pagesRichard J Holwell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- 2011 Q2 Central London Offices JLLDocument16 pages2011 Q2 Central London Offices JLLpcharrisonNo ratings yet

- DormantDocument86 pagesDormantReechie TeasoonNo ratings yet

- Obama Care Contractor - CGI Federal - List of ContractsDocument12 pagesObama Care Contractor - CGI Federal - List of ContractsOK-SAFE, Inc.No ratings yet

- NorthernVA IND 3Q11Document2 pagesNorthernVA IND 3Q11Anonymous Feglbx5No ratings yet

- Barbara and Barrie Seid Foundation 363342443 2010 077d83fesearchableDocument20 pagesBarbara and Barrie Seid Foundation 363342443 2010 077d83fesearchablecmf8926No ratings yet

- Leonard I Garth Financial Disclosure Report For 2010Document8 pagesLeonard I Garth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- ValeportDocument3 pagesValeportAnonymous Feglbx5No ratings yet

- Houston's Office Market Is Finally On The MendDocument9 pagesHouston's Office Market Is Finally On The MendAnonymous Feglbx5No ratings yet

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocument6 pagesHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5No ratings yet

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocument7 pagesUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5No ratings yet

- Asl Marine Holdings LTDDocument28 pagesAsl Marine Holdings LTDAnonymous Feglbx5No ratings yet

- The Woodlands Office Submarket SnapshotDocument4 pagesThe Woodlands Office Submarket SnapshotAnonymous Feglbx5No ratings yet

- THRealEstate THINK-US Multifamily ResearchDocument10 pagesTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5No ratings yet

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocument9 pagesMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Greenville Americas Alliance MarketBeat Office Q32018Document1 pageGreenville Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Five Fast Facts - RIC Q3 2018Document1 pageFive Fast Facts - RIC Q3 2018Anonymous Feglbx5No ratings yet