Professional Documents

Culture Documents

IATA Air - Passenger.market - Analysis Jun22

IATA Air - Passenger.market - Analysis Jun22

Uploaded by

pedroOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IATA Air - Passenger.market - Analysis Jun22

IATA Air - Passenger.market - Analysis Jun22

Uploaded by

pedroCopyright:

Available Formats

Air Passenger Market Analysis June 2022

Strong global recovery trend persists in June

• Global air passenger demand continued its strong recovery, with Revenue passenger kilometers (RPKs) rising by

76.2% in year-on-year (YoY) terms in June.

• International RPKs grew by 229.5% YoY and domestic RPKs increased by 5.2% YoY. Domestic traffic levels are now

18.6% below their pre-pandemic 2019 levels.

• The industry-wide passenger load factor was 82.4% in June, up 12.9 percentage points (pp) over the past year and

returning to above 80% for the first time since January 2020.

• Looking ahead, the re-opening of the Asia Pacific markets will provide renewed impetus to the global passenger

recovery while inflation and higher interest rates may eventually begin to dampen the pent-up demand for air travel.

Industry continues to reach for pre-pandemic levels Domestic air traffic volumes resilient, major

improvements in China

In June 2022, industry-wide revenue passenger-

kilometers (RPKs) grew by 76.2% YoY. The global Industry-wide domestic RPKs grew by a solid 5.2%

industry recovery is now well-entrenched and RPKs over the year to June, showing a tentative indication of

have now risen to 70.8% of 2019 levels (Chart 1). moving out of the clear sideways trend that has

prevailed over the past 9 months or so.

Chart 1: Global air passenger volumes (RPKs)

Compared with June 2019, global RPKs are still almost

20% lower (Chart 2).

Chart 2 – Domestic RPK growth (airline region of

registration basis), YoY% ch vs 2019

Jun 2022 May 2022

-18.6%

Industry -23.1%

-2.9%

-9.2%

Dom. Australia

-4.2%

Domestic Brazil -2.0%

-8.2%

Domestic USA -5.1%

-9.5%

Domestic India -4.6%

-22.5%

Domestic Japan

-28.3%

The industry-wide passenger load factor (PLF) Domestic China

-51.0%

-71.4%

returned to above 80% for the first time since January

-100% -80% -60% -40% -20% 0% 20% 40%

2020 and has increased by 12.9pp over the past year. Domestic revenue passenger-kilometres (% ch vs the same month in 2019)

Both the domestic and international PLFs are above Sources: IATA Economics, IATA Monthly Statistics

80%, with the latter increasing significantly – by almost

In China, domestic RPKs surged this month, increasing

30pp – over the past 12 months.

by 70.2%. After a period of strict Covid-related

lockdowns, China is gradually reopening to air travel.

Air Passenger Monthly Analysis – June 2022 1

Compared with June 2019, traffic levels within the Although the YoY growth rate has slowed in recent

country are still down 51.0%, although this represents months from an unsustainable pace, this more reflects

a significant improvement on the -71% outcome some very strong monthly gains in 2021 dropping out

observed last month. The experience in many other of the annual calculation, rather than a weakening of

countries is that domestic air travel demand rebounds the recovery.

sharply once restrictions are eased. While in its early

Across regions, the recovery in international RPKs has

stages, China so far appears to be following a similar

continued apace, alongside the reduction or removal

path in this regard.

of travel restrictions and the re-opening of markets.

US domestic traffic remained essentially unchanged in

Airlines based in Asia Pacific recorded the strongest

June compared with May, increasing by just 0.3%.

YoY growth rates for international RPKs this month, at

Compared with the same month in 2019, traffic

492.0%. This sharp uptake reflects the recent policy

volumes eased a little on this occasion to be 8.2%

decisions in countries including Japan and China to

below the June 2019 level, from a decline of around

re-open travel markets.

5% in May.

However, this international recovery is still in its early

In Brazil, domestic passenger volumes are up 37.6%

stages, with traffic levels still more than 70% lower

YoY in June, and are now just 4% below the level of

than their pre-pandemic 2019 levels. This is

2019. That said, the level of domestic RPKs has been

highlighted in the route area data shown in Chart 4,

trending broadly sideways for the past five months.

where the main Asia Pacific routes lag those of other

Contrasting fortunes were evident in India and Japan regions by some margin.

this month. For India, domestic RPKs increased by

Chart 4: Seasonally adjusted international RPKs,

264.4% YoY, but a decline in the monthly result saw

selected routes

the comparison with the 2019 level fall to -9%. In

Japan, the domestic market recovery continued in Seasonally adjusted international RPKs by route area, year-on-year %ch vs 2019

40%

Africa - Europe Africa - Asia

June, with traffic volumes up 146% YoY. Domestic Africa - Middle East Europe - Asia

Europe - Middle East Europe - North America

RPKs are 22.5% below their pre-pandemic level. 20% Europe - South America

Asia -SW Pacific

Asia - North America

ME-Asia

Middle East - North America Within Europe

The domestic market in Australia recorded a relatively 0%

modest 5.7% MoM increase in June. However, this

-20%

moves local traffic to within just 3% of its pre-

pandemic level. -40%

Insufficient data do not allow us to report on market -60%

developments for domestic Russia.

-80%

International traffic continues its strong recovery

-100%

International RPKs rose by 229.5% YoY in June.

Feb-20

Oct-20

Oct-21

Jan-20

Apr-20

Jun-20

Jul-20

Aug-20

Nov-20

Dec-20

Sep-20

Jan-21

Feb-21

Apr-21

Jul-21

Aug-21

Nov-21

Dec-21

Mar-20

May-20

Mar-21

May-21

Jun-21

Sep-21

Jan-22

Feb-22

Apr-22

Mar-22

May-22

Jun-22

sustaining the recent strong growth outcomes Source : IATA Economics, IATA Monthly Statistics

(Chart 3).

Airlines based in Europe recorded growth of 234.4% in

Chart 3: International RPK growth (airline region of international RPKs over the year to June. Traffic is

registration basis), %YoY currently around 20% below the 2019 level. The Within

Jun 2022 May 2022

Europe market remains one of the strongest

Industry 229.5%

performers at the route area level, with RPKs almost

325.6%

7% above the pre-pandemic level in seasonally

Asia Pacific 492.0%

456.0%

adjusted terms.

Middle East 246.5%

317.2%

Carriers in Latin and North America recorded YoY

234.4%

growth in international RPKs of 136.6% and 168.9%

Europe

411.4%

respectively. For North America, international RPKs

N. America 168.9%

203.0% are now 16.5% below their 2019 level, the best

L. America 136.6%

performing of all regions for this metric. International

180.5%

RPKs for the Latin American carriers are currently 27%

Africa 103.6%

134.9% below the pre-pandemic level.

0% 100% 200% 300% 400% 500%

International revenue passenger kilometres (% year-on-year)

600%

Strong outcomes on some of the key international

Sources: IATA Economics, IATA Monthly Statistics markets were sustained in June including:

Air Passenger Monthly Analysis – June 2022 2

• North America – Central America: 9.2% above Across regions, total industry capacity is 11-12%

the level of June 2019; below the pre-pandemic level in both North and Latin

America. Unsurprisingly, given the developments

• Middle East – North America: 21.9% above

noted above, the recovery in Asia Pacific lags that of

2019; and

the other regions, with capacity still 49% below the

• Europe – North America: 12.2% above 2019. level of 2019.

For Middle East airlines, the recovery in international Much of the added capacity is due to the recovery in

traffic also continues on a strong trend, with volumes international travel, where ASKs have increased by

up 246.5% YoY in June – a performance second only almost 120% over the past year. With the exception

to Asia Pacific. International RPKs are currently around of Africa (62%) and North America (95%), all other

25% below their level of June 2019. regions have more than doubled available

Airlines based in Africa recorded a doubling of international capacity over this period.

international RPKs over the year to June, with an In contrast, domestic ASKs have increased by a more

increase of 103.6%. In total, international RPKs have modest 2.3% YoY. Of the main domestic markets that

recovered to be around 35% below their 2019 level at we monitor, ASKs in India have increased by around

present. At a route area level, the performance of 180% and, despite recent developments, domestic

international traffic between Africa and neighboring China ASKs are down almost 40% YoY.

regions is approaching pre-pandemic levels:

Domestic forward bookings on the rise, slowdown for

• Africa – Europe: 4.6% below June 2019; and international

• Africa – Middle East: 10.4% below 2019. Looking through the volatility in the data, domestic

bookings have been trending upwards strongly since

Aligned recovery continues for Premium and

March.

Economy cabins

The performance of international bookings, however,

The broad recovery trends for traffic in the Premium

has been more mixed. International forward bookings

and Economy cabins remained aligned in June.

caught up to domestic sales for a period in May but

Economy RPKs – which include premium economy

have recently reversed course and have trended lower

(and account for 92% of total RPKs) – were at 65.1%

in recent weeks.

of their January 2020 levels in May 2022. Premium

RPKs – which capture travel in first and business class As these data are not seasonally adjusted, the recent

cabins – were at 66.8% of January 2020 traffic levels pull-back could reflect the natural correction following

in May (Chart 5). the seasonal peak purchase period for the summer

holiday season (Chart 6).

Chart 5: International RPKs by cabin class

Overall, the latest bookings data suggest that,

International RPKs, January 2020 = 100

120

notwithstanding high energy prices, disruptions

Share of int'l RPKs by class relating to labor and capacity constraints in some

100

(identical in 2019 and 2021)

Economy: 92%

markets, and various other pressures on the industry,

Premium: 8% consumers’ willingness to travel remains strong.

80

Chart 6: Passenger ticket sales (dom. vs. int’l), global,

60 YoY% ch vs 2019

Economy 100%

40

Premium Domestic

20 80%

0

60%

51%

50%

International

Source: IATA Monthly Statistics 40%

28%

Industry capacity increases with passenger traffic 20% 16%

Industry-wide available seat-kilometers (ASKs) grew

0%

by 48.5% over the year to June, continuing the

7-May-21

7-Jun-21

7-Aug-21

7-May-22

7-Mar-22

7-Jun-22

7-Feb-21

7-Mar-21

7-Sep-21

7-Oct-21

7-Feb-22

7-Apr-21

7-Apr-22

7-Jan-21

7-Jul-21

7-Nov-21

7-Dec-21

7-Jul-22

7-Jan-22

recovery in global capacity. However, capacity is still

down around 28% compared with the level of 2019. Source: IATA Economics, DDS

Air Passenger Monthly Analysis – June 2022 3

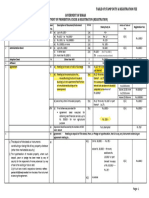

Air passenger market in detail - June 2022

World June 2022 (% year-on-year) % year-to-date

share 1 RPK ASK PLF (%-pt)2 PLF (level)3 RPK ASK PLF (%-pt)2 PLF (level)3

TOTAL MARKET 100.0% 76.2% 48.5% 12.9% 82.4% 82.9% 52.3% 12.5% 74.6%

Africa 1.9% 97.1% 62.0% 13.2% 74.3% 81.7% 49.3% 12.2% 68.2%

Asia Pacific 27.5% 33.7% 18.9% 8.1% 72.9% 3.5% 0.5% 1.9% 65.6%

Europe 25.0% 155.1% 96.1% 19.9% 86.0% 217.0% 140.0% 18.5% 76.2%

Latin America 6.5% 74.0% 67.2% 3.2% 81.7% 99.1% 81.0% 7.3% 80.3%

Middle East 6.6% 216.8% 89.3% 31.1% 77.2% 213.9% 87.1% 28.5% 70.6%

North America 32.6% 39.2% 26.4% 8.2% 89.1% 74.5% 44.7% 13.8% 81.0%

International 37.7% 229.5% 118.4% 28.1% 83.4% 264.3% 128.3% 27.3% 73.0%

Africa 1.5% 103.6% 61.9% 15.2% 74.2% 88.3% 48.9% 14.0% 67.1%

Asia Pacific 3.1% 492.0% 138.9% 45.8% 76.7% 280.7% 89.8% 31.5% 62.7%

Europe 18.7% 234.4% 134.5% 25.8% 86.3% 339.5% 189.2% 25.8% 75.6%

Latin America 2.1% 136.6% 107.4% 10.3% 83.3% 193.2% 134.7% 16.0% 80.5%

Middle East 6.0% 246.5% 102.4% 32.4% 78.0% 240.2% 97.1% 29.8% 70.8%

North America 6.2% 168.9% 95.0% 24.1% 87.7% 198.1% 93.1% 26.6% 75.6%

Domestic 62.3% 5.2% 2.3% 2.2% 81.1% 14.0% 7.1% 4.7% 76.6%

Dom. Australia4 0.8% 78.6% 43.5% 15.9% 80.8% 41.0% 28.6% 6.4% 72.7%

Domestic Brazil4 1.9% 37.6% 47.3% -5.4% 75.4% 59.7% 58.1% 0.8% 78.6%

Dom. China P.R.4 17.8% -45.0% -37.6% -8.9% 65.9% -48.2% -39.8% -10.2% 62.8%

Domestic India4 2.2% 264.4% 179.8% 19.0% 81.8% 67.3% 38.2% 13.9% 80.0%

Domestic Japan4 1.1% 146.4% 79.7% 15.7% 58.2% 83.1% 56.4% 7.6% 52.2%

Domestic US4 25.6% 8.7% 4.1% 3.9% 89.8% 46.9% 28.2% 10.6% 83.4%

1 2 3

% of industry RPKs in 2021 Year-on-year change in load factor Load factor level

4

Note: the seven domestic passenger markets for w hich broken-dow n data are available account for approximately 54% of global total RPKs and 86% of total domestic RPKs

Note: The total industry and regional grow th rates are based on a constant sample of airlines combining reported data and estimates for missing observations. Airline traffic is allocated

according to the region in w hich the carrier is registrated; it should not be considered as regional traffic.

Air passenger market - 2022 vs. 2019

World June 2022 (% ch vs the same month in 2019)

share

1

RPK ASK PLF (%-pt)2 PLF (level)3

TOTAL MARKET 100.0% -29.2% -27.5% -2.0% 82.4%

Africa 1.9% -31.4% -34.3% 3.2% 74.3%

Asia Pacific 27.5% -54.6% -48.8% -9.3% 72.9%

Europe 25.0% -18.7% -17.3% -1.4% 86.0%

Latin America 6.5% -13.8% -12.1% -1.6% 81.7%

Middle East 6.6% -25.5% -26.2% 0.8% 77.2%

North America 32.6% -11.2% -11.4% 0.2% 89.1%

1 2 3

% of industry RPKs in 2021 Change in load factor vs same month in 2019 Load factor level

World June 2022 (% ch vs the same month in 2019) World June 2022 (% ch vs the same month in 2019)

share 1 RPK ASK PLF (%-pt)2 PLF (level)3 share 1 RPK ASK PLF (%-pt)2 PLF (level)3

International 37.7% -35.0% -34.8% -0.3% 83.4% Domestic 62.3% -18.6% -13.9% -4.6% 81.1%

Africa 1.5% -34.7% -37.6% 3.3% 74.2% Dom. Australia 0.8% -2.9% -5.9% 2.5% 80.8%

Asia Pacific 3.1% -70.2% -68.4% -4.7% 76.7% Domestic Brazil 1.9% -4.2% 3.8% -6.3% 75.4%

Europe 18.7% -20.4% -19.0% -1.5% 86.3% Dom. China P.R. 17.8% -51.0% -37.0% -18.8% 65.9%

Latin America 2.1% -27.0% -26.5% -0.7% 83.3% Domestic India 2.2% -9.5% -0.9% -7.7% 81.8%

Middle East 6.0% -25.7% -27.1% 1.6% 78.0% Domestic Japan 1.1% -22.5% -5.2% -13.1% 58.2%

North America 6.2% -16.5% -16.3% -0.2% 87.7% Domestic US 25.6% -8.2% -8.4% 0.2% 89.8%

1 2 3

% of industry RPKs in 2021 Change in load factor vs same month in 2019 Load factor level 1

% of industry RPKs in 2021 2

Change in load factor vs same month in 2019 3

Load factor level

IATA Economics

economics@iata.org

4 August 2022

Get the data IATA Economics Consulting

Access data related to this briefing through IATA’s Monthly Statistics To find out more about our tailored economics consulting

publication: solutions, visit:

www.iata.org/monthly-traffic-statistics www.iata.org/consulting

Terms and Conditions for the use of this IATA Economics Report and its contents can be found here: www.iata.org/economics-terms

By using this IATA Economics Report and its contents in any manner, you agree that the IATA Economics Report Terms and Conditions

apply to you and agree to abide by them. If you do not accept these Terms and Conditions, do not use this report.

Air Passenger Monthly Analysis – June 2022 4

You might also like

- Kantar Worldpanel Division FMCG Monitor Full Year 2020 EN FinalDocument10 pagesKantar Worldpanel Division FMCG Monitor Full Year 2020 EN FinalvinhtamledangNo ratings yet

- Inventory ManagementDocument25 pagesInventory Managementmba abhi50% (2)

- Advertising Age - Hispanic Fact PackDocument31 pagesAdvertising Age - Hispanic Fact Packdrummestudcom0% (1)

- OnlyDocument4 pagesOnlydio prabowoNo ratings yet

- Air Passenger Market Analysis: Domestic Air Travel Is The Driver of RecoveryDocument4 pagesAir Passenger Market Analysis: Domestic Air Travel Is The Driver of RecoveryJuan ArcilaNo ratings yet

- Outlook of Global Airline Industry 2021Document6 pagesOutlook of Global Airline Industry 2021Raja Churchill DassNo ratings yet

- The State of The Economy - DR Salami UpdatedDocument21 pagesThe State of The Economy - DR Salami UpdatedEfosa AigbeNo ratings yet

- Performance Review: Fourth-Quarter 2021Document16 pagesPerformance Review: Fourth-Quarter 2021ZerohedgeNo ratings yet

- 2024.3 - CEVA - GL - Air - Market Update - ENDocument12 pages2024.3 - CEVA - GL - Air - Market Update - ENno TengoNo ratings yet

- India Market Strategy: FY23 Budget: The Struggle To Spend ProductivelyDocument34 pagesIndia Market Strategy: FY23 Budget: The Struggle To Spend ProductivelyVi KiNo ratings yet

- ReQ Real Estate Quarterly HighlightsDocument8 pagesReQ Real Estate Quarterly HighlightsVaibhav RaghuvanshiNo ratings yet

- Pax Forecast Infographic 2020 FinalDocument1 pagePax Forecast Infographic 2020 Finallibardo silvaNo ratings yet

- National Output Income ExpenDocument40 pagesNational Output Income ExpenImanthi AnuradhaNo ratings yet

- DescargaDocument4 pagesDescargaJorge Ignacio Ramos OlguinNo ratings yet

- Air Cargo Market Analysis: Air Cargo Volumes Reached An All-Time High in MarchDocument4 pagesAir Cargo Market Analysis: Air Cargo Volumes Reached An All-Time High in MarchJuan ArcilaNo ratings yet

- Covid India 210112202540Document33 pagesCovid India 210112202540agrinmathurNo ratings yet

- SER 2021 Chapter 04Document4 pagesSER 2021 Chapter 04IPNo ratings yet

- RED WorkforceDocument22 pagesRED WorkforcereiiNo ratings yet

- 2023-06 2022 Phil Eco PerformanceDocument2 pages2023-06 2022 Phil Eco PerformanceDaincy Pearl MarianoNo ratings yet

- Executive Summary-2020 State of LogisticsDocument10 pagesExecutive Summary-2020 State of LogisticspharssNo ratings yet

- Deloitte Ghana Budget Snapshot 2024Document12 pagesDeloitte Ghana Budget Snapshot 2024ThomasMuneneNo ratings yet

- Inflation Sticky IIP Zooms On Base Effect 1657806344Document5 pagesInflation Sticky IIP Zooms On Base Effect 1657806344Grace StylesNo ratings yet

- Pidilite Industries (PIDIND) : High Raw Material Prices Hit MarginDocument10 pagesPidilite Industries (PIDIND) : High Raw Material Prices Hit MarginSiddhant SinghNo ratings yet

- IATA Air Passenger Market Analysis July 2022Document4 pagesIATA Air Passenger Market Analysis July 2022scorpion2001glaNo ratings yet

- Viet Nam Market Pulse - Shared by WorldLine Technology-1Document21 pagesViet Nam Market Pulse - Shared by WorldLine Technology-1CHIÊM HÀNo ratings yet

- Performance Review: First-Quarter 2022Document12 pagesPerformance Review: First-Quarter 2022ZerohedgeNo ratings yet

- Monthly Chartbook 6 Jan 23Document53 pagesMonthly Chartbook 6 Jan 23avinash sharmaNo ratings yet

- EricssonDocument47 pagesEricssonRafa Borges100% (1)

- Air Freight Monthly Analysis - December 2021Document4 pagesAir Freight Monthly Analysis - December 2021Mohammad SamirNo ratings yet

- What COVID-19 Did To European Aviation in 2020, and Outlook 2021Document12 pagesWhat COVID-19 Did To European Aviation in 2020, and Outlook 2021Satrio AditomoNo ratings yet

- Pak Ado April 2024Document6 pagesPak Ado April 2024Kanwal MunawarNo ratings yet

- Budget Insights 2019-20Document5 pagesBudget Insights 2019-20MahiUddinNo ratings yet

- Investor Digest: Equity Research - 18 May 2020Document15 pagesInvestor Digest: Equity Research - 18 May 2020helmy muktiNo ratings yet

- Ramkrishna-Forgings-Limited 159 QuarterUpdate PDFDocument4 pagesRamkrishna-Forgings-Limited 159 QuarterUpdate PDFhamsNo ratings yet

- Nepal Macroeconomic Update 202209 PDFDocument30 pagesNepal Macroeconomic Update 202209 PDFRajendra NeupaneNo ratings yet

- MacroeconomicSituationReport2ndFY2021 22 PDFDocument24 pagesMacroeconomicSituationReport2ndFY2021 22 PDFsha ve3No ratings yet

- India International Trade Investment Website June 2022Document18 pagesIndia International Trade Investment Website June 2022vinay jodNo ratings yet

- V.. R L 'F": Scrip Symbol: NSE-DABUR, BSE Scrip Code: 500096Document23 pagesV.. R L 'F": Scrip Symbol: NSE-DABUR, BSE Scrip Code: 500096arti guptaNo ratings yet

- Outlook On Indian Economy and Automobile IndustryDocument38 pagesOutlook On Indian Economy and Automobile IndustryVishwasNo ratings yet

- 2022-Q4 Vehicle Pricing Index-TransUnionDocument9 pages2022-Q4 Vehicle Pricing Index-TransUnionsygmacorpNo ratings yet

- Ssi Securities Corporation 1Q2020 Performance Updates: April 2020Document20 pagesSsi Securities Corporation 1Q2020 Performance Updates: April 2020Hoàng HiệpNo ratings yet

- Singapore EconomyDocument11 pagesSingapore EconomyK60 Nguyễn Thúy HoàNo ratings yet

- Report On NIA Q2 2021Document24 pagesReport On NIA Q2 2021sarah jane lomaNo ratings yet

- Pes04 FiscalDocument22 pagesPes04 FiscalJason JhonNo ratings yet

- Economic Performance of The Airline Industry: Key PointsDocument5 pagesEconomic Performance of The Airline Industry: Key PointsAlex SanchoNo ratings yet

- Press Presentation q1 Fy21Document13 pagesPress Presentation q1 Fy21Pharma researchNo ratings yet

- OMT 2021 BarometroDocument32 pagesOMT 2021 BarometroCarmelita Morales MendozaNo ratings yet

- Page 5Document1 pagePage 5Nguyen ThuNo ratings yet

- Budget FY23 Focusing Fiscal Consolidation: June 12, 2022Document18 pagesBudget FY23 Focusing Fiscal Consolidation: June 12, 2022NAUROZ KHANNo ratings yet

- Results-Presentation 2019Document32 pagesResults-Presentation 2019Shahin AlamNo ratings yet

- Summary of Proposed National Budget FY2023-24Document15 pagesSummary of Proposed National Budget FY2023-24Zaki Al FahadNo ratings yet

- CS Lviii 33 19082023Document2 pagesCS Lviii 33 19082023ram917722No ratings yet

- 3768investor Presentation Q2 2021Document40 pages3768investor Presentation Q2 2021timphamNo ratings yet

- Fibank Albania Annual Report 2019 083685f7fdDocument141 pagesFibank Albania Annual Report 2019 083685f7fdKarolina MusagalliuNo ratings yet

- Global Mid-Year Forecast: JUNE 2021Document20 pagesGlobal Mid-Year Forecast: JUNE 2021Daiany Costa100% (1)

- Kearney-Resilience Tested-2020 - State of LogisticsDocument72 pagesKearney-Resilience Tested-2020 - State of LogisticspharssNo ratings yet

- Straetgy - PWC - The Outlook For Travel by SegmentDocument23 pagesStraetgy - PWC - The Outlook For Travel by SegmentDavidSeowNo ratings yet

- Qb23q3 en Ch2Document5 pagesQb23q3 en Ch2milvibesupplyNo ratings yet

- Bangladesh - A Compelling Growth StoryDocument38 pagesBangladesh - A Compelling Growth StoryiamnahidNo ratings yet

- Jakarta Res 2q19Document5 pagesJakarta Res 2q19Golden Tree RealtyNo ratings yet

- Airline Industry Economic Performance Jun19 Report PDFDocument6 pagesAirline Industry Economic Performance Jun19 Report PDFFahad MohamedNo ratings yet

- sw-1629711171-NATIONAL ROAD SAFETY POLICYDocument108 pagessw-1629711171-NATIONAL ROAD SAFETY POLICYpedroNo ratings yet

- Session4 Railways Victor Shange Infrabuild Africa Feb22 2Document39 pagesSession4 Railways Victor Shange Infrabuild Africa Feb22 2pedroNo ratings yet

- NCoS Act 2019Document36 pagesNCoS Act 2019pedroNo ratings yet

- Session4 Railways Mucemi Gakuru Infrabuild Africa Feb22 1Document16 pagesSession4 Railways Mucemi Gakuru Infrabuild Africa Feb22 1pedroNo ratings yet

- Session3 Roads KURA Silas Kinoti Infrabuild Africa Feb22Document44 pagesSession3 Roads KURA Silas Kinoti Infrabuild Africa Feb22pedroNo ratings yet

- Session1 ConstructionTrends Gituro Wainaina Infrabuild Africa Feb22Document13 pagesSession1 ConstructionTrends Gituro Wainaina Infrabuild Africa Feb22pedroNo ratings yet

- Generic Non-Solicitation AgreementDocument8 pagesGeneric Non-Solicitation AgreementToby LarsenNo ratings yet

- Oikos Cases 2005 Mountain InstituteDocument22 pagesOikos Cases 2005 Mountain InstituteabdelNo ratings yet

- Bihar Stamp Duty and Registration Charges BiharDocument1 pageBihar Stamp Duty and Registration Charges BiharAkshansh NegiNo ratings yet

- Course Outline A402Document2 pagesCourse Outline A402mmekkaellaNo ratings yet

- Cameron Harper Resume Fashion MerchDocument1 pageCameron Harper Resume Fashion Merchapi-519497901No ratings yet

- 6 Customizing Asset AccountingDocument33 pages6 Customizing Asset AccountingChirag SolankiNo ratings yet

- Chapter 15 MonopolyDocument40 pagesChapter 15 MonopolyThanh Nguyen100% (2)

- James A. Davies ResumeDocument1 pageJames A. Davies ResumeJimmy DaviesNo ratings yet

- Jacopo Targa - URBAN COMMONS - 02octDocument30 pagesJacopo Targa - URBAN COMMONS - 02octLe Petit GardenNo ratings yet

- Job Order Costing HandoutsDocument8 pagesJob Order Costing HandoutsHannah Jane Arevalo LafuenteNo ratings yet

- Contract II Notes PDFDocument3 pagesContract II Notes PDFSiddharth Jain PatniNo ratings yet

- Putri Yuanita: SachikoDocument1 pagePutri Yuanita: SachikoBobby AndreasNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Anuj KumarNo ratings yet

- Financial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFDocument67 pagesFinancial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFphongtuanfhep4u100% (12)

- Business Plan-GROUP 4Document8 pagesBusiness Plan-GROUP 4Christine Joy Mendigorin100% (2)

- Cost 1-72Document72 pagesCost 1-72Junaid AhmedNo ratings yet

- Form B Address ChangeDocument4 pagesForm B Address ChangeANAND KADAMNo ratings yet

- Good Governance and Social Responsibilities: Purok Spring, Brgy. Morales, City of Koronadal Tel Number 877-2051/0228-1996Document13 pagesGood Governance and Social Responsibilities: Purok Spring, Brgy. Morales, City of Koronadal Tel Number 877-2051/0228-1996mark david sabellaNo ratings yet

- Firm Size, Business Sector and Quality of Accounting Information SystemDocument8 pagesFirm Size, Business Sector and Quality of Accounting Information SystemHoàng AnhNo ratings yet

- Manifestation of Global Trends in Hotel Industries in Baguio City As Perceived by Hotel GuestsDocument15 pagesManifestation of Global Trends in Hotel Industries in Baguio City As Perceived by Hotel GuestsIJAR JOURNALNo ratings yet

- Brand Audit of VodafoneDocument14 pagesBrand Audit of VodafoneSamarth .Rajiv. WaghNo ratings yet

- Apr 24Document8 pagesApr 24Mobilkamu JakartaNo ratings yet

- What Is The Software Development Life CycleDocument3 pagesWhat Is The Software Development Life CycleRizwan AhmadNo ratings yet

- Mercantile Law I llb2 Course OutlineDocument11 pagesMercantile Law I llb2 Course Outlinerobert TibaruhaNo ratings yet

- Pyramid Power. The Millennium ScienceDocument95 pagesPyramid Power. The Millennium ScienceRich McAdamNo ratings yet

- Major Influences On Pricing DecisionsDocument6 pagesMajor Influences On Pricing DecisionsAlief PramestiaNo ratings yet

- What Is An 8D ReportDocument2 pagesWhat Is An 8D ReportKó ChitNo ratings yet

- Dyal Singh Evening College: Submitted by Imran Roll No. 28D Bcom (Prog)Document7 pagesDyal Singh Evening College: Submitted by Imran Roll No. 28D Bcom (Prog)Muskan mehta D 31No ratings yet